Global Corn Powder Market Size, Share Report By Type (Yellow Corn Powder, White Corn Powder, Sweet Corn Powder, Others), By Form (Powder, Granules, Others), By Application (Bakery and Confectionary, Snacks, Pharmaceuticals, Others), By Distribution Channel (Supermarkets, Convenience Stores, Online Store, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Aug 2025

- Report ID: 154402

- Number of Pages: 339

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

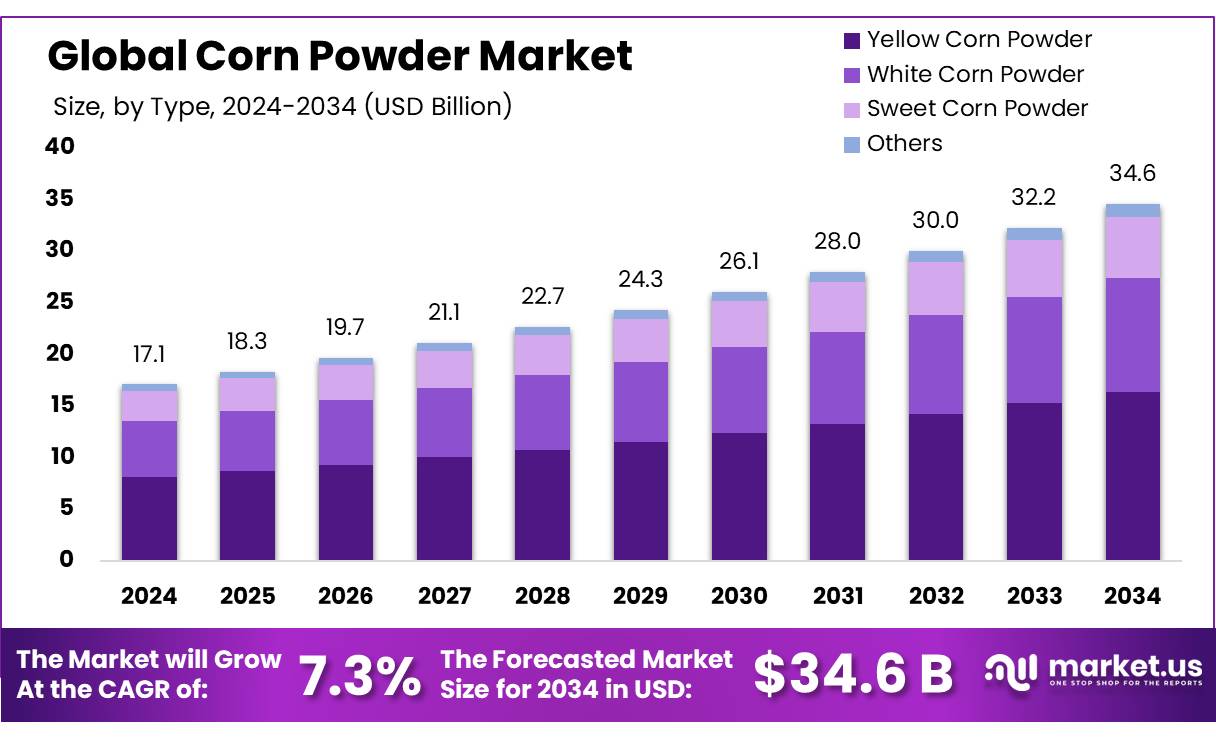

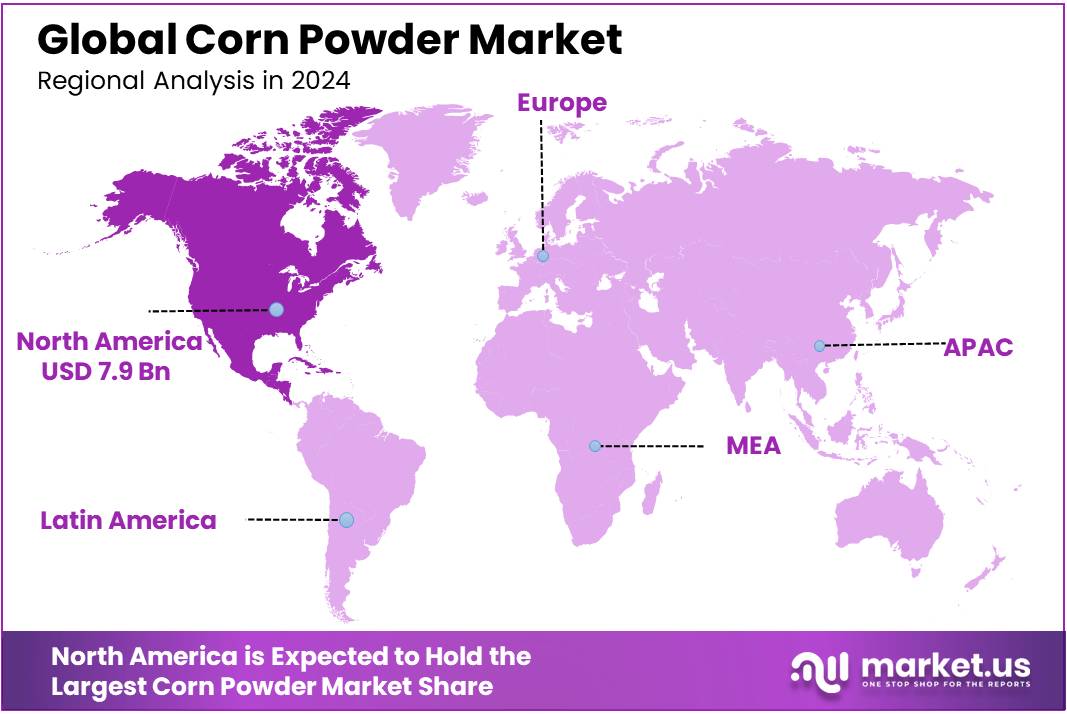

The Global Corn Powder Market size is expected to be worth around USD 34.6 Billion by 2034, from USD 17.1 Billion in 2024, growing at a CAGR of 7.3% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 46.30% share, holding USD 7.9 Billion in revenue.

Corn powder concentrates, derived from maize, serve as vital ingredients in various sectors, including food processing, animal feed, and industrial applications. In India, the corn market has witnessed significant growth, with production reaching approximately 42.28 million metric tons in the 2024/25 period, marking a 15% increase over the previous year’s average. This surge is attributed to favorable climatic conditions and the adoption of high-yielding maize varieties.

Growth of the corn powder concentrate sector is driven by multiple factors. First, the government’s ethanol blending programme has elevated corn demand: in 2024, an estimated 3.5 million tonnes of corn produced 1.35 billion litres of ethanol, almost four times the previous year, as India targets a 20% ethanol blending mix by 2025–26.

Second, import liberalisation measures were introduced to stabilise supply and pricing: the Government permitted 500,000 tonnes of corn imports under concessional duty via tariff‑rate quotas in mid‑2024 to restrain price inflation facing poultry and feed sectors. Third, rising demand from poultry, starch, pharmaceutical and personal care industries continues to bolster industrial consumption of corn powder concentrates given their utility as binders and texturizers.

In January 2024, the Indian government revised its ethanol procurement policy, prioritizing corn over sugarcane for ethanol production. This shift aims to achieve a 20% ethanol blending target in gasoline by 2025–26, up from the current 13%. To meet this ambitious goal, the country plans to increase ethanol production to 10 billion liters annually, requiring approximately 8 million tons of corn. In the 2024–25 season, around 3.5 million tons of corn were utilized to produce 1.35 billion liters of ethanol, indicating a fourfold increase from the previous year.

Key Takeaways

- Corn Powder Market size is expected to be worth around USD 34.6 Billion by 2034, from USD 17.1 Billion in 2024, growing at a CAGR of 7.3%.

- Yellow Corn Powder held a dominant market position, capturing more than a 47.4% share in the Corn Powder Market.

- Powder held a dominant market position, capturing more than a 73.1% share in the Corn Powder Market.

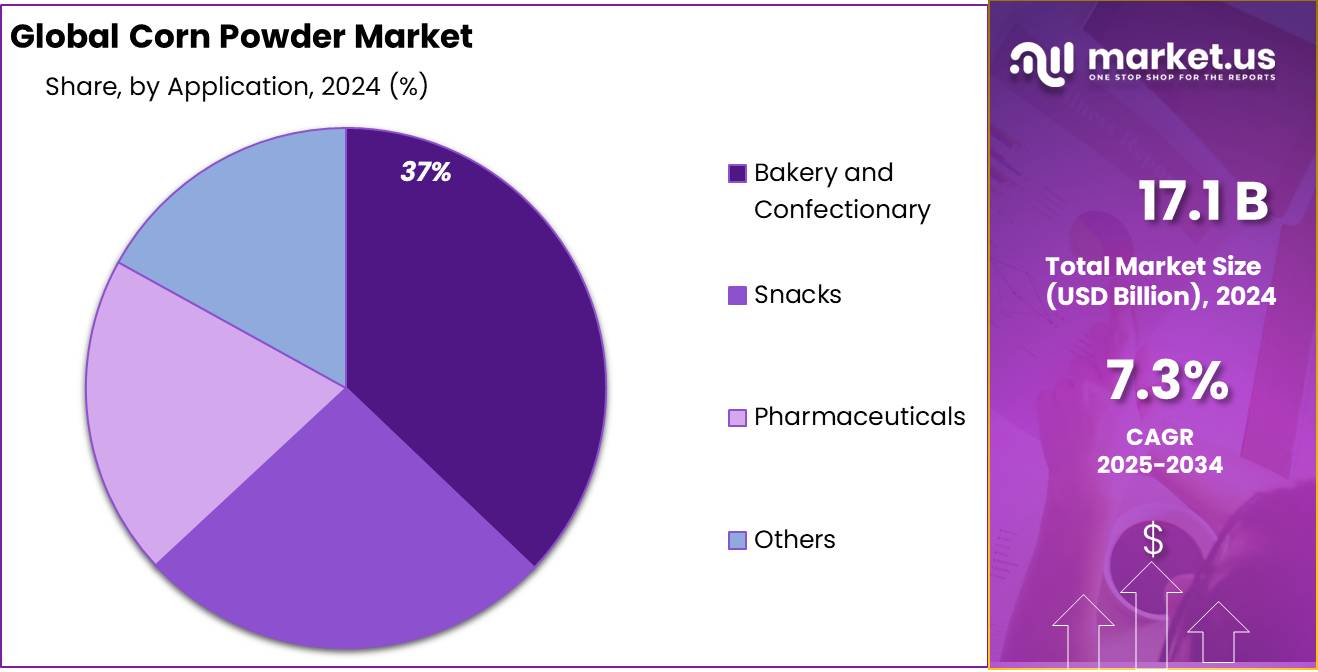

- Confectionery held a dominant market position, capturing more than a 37.2% share in the Corn Powder Market.

- Supermarkets held a dominant market position, capturing more than a 42.6% share in the Corn Powder Market.

- North America stands as a formidable leader in the global corn powder market, commanding a substantial 46.30% share, valued at approximately USD 7.9 billion

By Type Analysis

Yellow Corn Powder dominates with 47.4% share due to its wide use in food and feed applications.

In 2024, Yellow Corn Powder held a dominant market position, capturing more than a 47.4% share in the Corn Powder Market by type. This strong market presence is mainly due to its versatile use across food, beverage, and animal feed industries. Yellow corn powder is commonly preferred in baking mixes, snack coatings, breakfast cereals, and thickening agents because of its mild flavor, bright color, and high starch content. Its wide acceptance in poultry and livestock feed also contributes significantly to demand, especially in developing countries where cost-effective and energy-rich feed ingredients are essential.

By Form Analysis

Powder form leads the market with 73.1% share owing to its convenience and long shelf life.

In 2024, Powder held a dominant market position, capturing more than a 73.1% share in the Corn Powder Market by form. This leading position is largely driven by the powder’s ease of storage, longer shelf stability, and flexibility in various applications such as food processing, bakery mixes, sauces, and feed formulations. The powdered form allows for easy blending, uniform texture, and consistent quality in industrial usage, making it a preferred choice across both small-scale and large-scale food manufacturers.

By Application Analysis

Confectionery dominates with 37.2% share due to its high usage in candies, chocolates, and sweet fillings.

In 2024, Confectionery held a dominant market position, capturing more than a 37.2% share in the Corn Powder Market by application. This strong foothold is mainly attributed to the wide use of corn powder as a thickening, binding, and stabilizing agent in products like toffees, chocolates, gummies, and various sweet coatings. Its smooth texture and neutral taste make it ideal for enhancing consistency and improving shelf life in confectionery goods. The increasing demand for processed and packaged sweets, especially in urban areas, has further pushed the usage of corn powder in this segment.

By Distribution Channel Analysis

Supermarkets lead with 42.6% share due to wide product availability and strong consumer footfall.

In 2024, Supermarkets held a dominant market position, capturing more than a 42.6% share in the Corn Powder Market by distribution channel. This dominance is largely driven by the extensive shelf space, organized product display, and the ability to offer a variety of corn powder brands and packaging sizes under one roof. Consumers prefer supermarkets for their convenience, promotions, and trust in product quality, especially when buying everyday essentials like corn powder. In urban and semi-urban areas, the growing number of supermarket chains and retail outlets has made it easier for households to access packaged food ingredients, boosting sales through this channel.

Key Market Segments

By Type

- Yellow Corn Powder

- White Corn Powder

- Sweet Corn Powder

- Others

By Form

- Powder

- Granules

- Others

By Application

- Bakery and Confectionary

- Snacks

- Pharmaceuticals

- Others

By Distribution Channel

- Supermarkets

- Convenience Stores

- Online Store

- Others

Emerging Trends

Emerging Trends in the Corn Powder Concentrate Industry

A notable trend is the increasing demand for gluten-free and plant-based products. Consumers are becoming more health-conscious, leading to a surge in the popularity of corn-based ingredients in various food applications.

For instance, the corn powder market size in the food and beverages application segment was valued at USD 13.8 billion in 2023, owing to its extensive use in bakery items, snacks, soups, sauces, and traditional foods like tortillas and tamales. This growth is further supported by the rising adoption of clean-label products among health-conscious consumers.

Government initiatives are also playing a pivotal role in shaping the industry’s landscape. In 2024, the Indian government granted duty concessions for limited imports of corn under the tariff-rate quota (TRQ), allowing 500,000 metric tons of corn to be imported at reduced duties. This move aims to stabilize domestic corn prices, which have been rising due to strong demand from the poultry and ethanol industries. The concessional imports are managed by cooperatives and state-run companies such as the National Dairy Development Board (NDDB), the National Agricultural Cooperative Marketing Federation of India Ltd (NAFED), and the National Cooperative Dairy Federation (NCDF).

These trends indicate a dynamic shift in the corn powder concentrate industry, with increased consumer demand for healthier options and proactive government measures to ensure market stability. Stakeholders in the industry are encouraged to align with these trends to capitalize on emerging opportunities and contribute to the sector’s growth.

Drivers

Government Support and Policy Initiatives Driving the Growth of Corn Powder Concentrates

In the 2024-25 agricultural year, India achieved record maize production, with the Ministry of Agriculture and Farmers’ Welfare reporting an estimated 42.3 million metric tons, marking a significant increase from previous years. This surge in production is attributed to the government’s strategic initiatives, including the National Food Security Mission (NFSM) and the Rashtriya Krishi Vikas Yojana (RKVY), which have been instrumental in promoting maize cultivation through the adoption of high-yielding hybrid seeds and improved agricultural practices. These efforts aim to increase maize productivity from the current 3.5 metric tons per hectare to 6 metric tons per hectare by encouraging mechanization and the use of advanced farming techniques.

The government’s commitment to maize cultivation is further demonstrated by the establishment of a dedicated procurement plan for maize intended for ethanol production. In December 2023, the Indian government announced an innovative program to guarantee the purchase of maize for ethanol production, anticipating reduced sugar production in key states like Maharashtra and Karnataka. This proactive step aims to counteract potential decreases in ethanol production due to declining sugar output, thereby stabilizing the maize market and ensuring consistent demand for maize-based products.

In states like Uttar Pradesh, the government has set a Minimum Support Price (MSP) of ₹2,225 per quintal for maize in the 2024-25 season, with procurement running from June 15 to July 31. This MSP ensures that farmers receive fair compensation for their produce, encouraging increased maize cultivation and providing a stable supply for processing industries.

Furthermore, the establishment of a regional office by the Agriculture and Processed Food Products Export Development Authority (APEDA) in Patna aims to enhance agricultural exports from Bihar, a major maize-producing state. This initiative is expected to boost farmers’ incomes by promoting agriculture as a commercial enterprise through the adoption of export standards.

Restraints

Supply Chain Challenges and Infrastructure Gaps

One of the significant challenges hindering the growth of the corn powder concentrate industry in India is the underdeveloped supply chain infrastructure, particularly concerning post-harvest handling, storage, and transportation. Despite being one of the largest producers of maize globally, India faces substantial losses due to inefficiencies in its agricultural supply chain. Estimates suggest that approximately 18% to 40% of horticultural produce is lost annually due to inadequate infrastructure.

The lack of cold storage facilities exacerbates these losses, especially for perishable commodities like maize. The National Centre for Cold-chain Development (NCCD) has highlighted that food and agricultural losses in India amount to USD 8 to 15 billion annually due to insufficient cold-chain infrastructure. This deficiency not only affects the quality and quantity of maize available for processing into corn powder concentrates but also leads to increased costs for manufacturers.

Additionally, logistical challenges such as poor road connectivity, inadequate transportation facilities, and lack of efficient warehousing systems contribute to delays and increased costs in the supply chain. These issues are particularly pronounced in rural areas, where maize is predominantly cultivated. The Food Corporation of India (FCI) and other agencies have been criticized for inefficiencies in handling and storing grains, further compounding the problem .

While the government has recognized these challenges and has been working towards improving infrastructure, the pace of development remains slow. Initiatives like the National Food Security Mission (NFSM) and the Rashtriya Krishi Vikas Yojana (RKVY) aim to enhance agricultural productivity and infrastructure. However, the focus has often been on staple crops like rice and wheat, with maize receiving comparatively less attention.

Opportunity

Government Initiatives Fueling Growth in Corn Powder Concentrates

A significant growth opportunity for the corn powder concentrate industry in India lies in the government’s strategic push for biofuel production, particularly corn-based ethanol. This initiative not only addresses energy sustainability but also bolsters the demand for corn, thereby benefiting the corn powder sector.

In January 2024, the Indian government revised its ethanol procurement policy, prioritizing corn over sugarcane for ethanol production. This shift aims to achieve a 20% ethanol blending target in gasoline by 2025–26, up from the current 13%. To meet this ambitious goal, the country plans to increase ethanol production to 10 billion liters annually, requiring approximately 8 million tons of corn. In the 2024–25 season, around 3.5 million tons of corn were utilized to produce 1.35 billion liters of ethanol, indicating a fourfold increase from the previous year.

This surge in ethanol demand has transformed India from a net corn exporter to a net importer. In 2024, imports reached 1 million tons, primarily from Myanmar and Ukraine, while exports dwindled to 450,000 tons. The poultry and starch industries, which traditionally consumed a significant portion of domestically produced corn, now compete with ethanol producers for limited supplies, leading to increased corn prices.

Regional Insights

North America stands as a formidable leader in the global corn powder market, commanding a substantial 46.30% share, valued at approximately USD 7.9 billion in 2024. This dominance is primarily attributed to the United States, the world’s largest producer of corn, with an annual output exceeding 15 billion bushels. The vast production capacity ensures a steady supply of raw materials for corn powder manufacturing, catering to both domestic consumption and export demands. In 2024, the U.S. corn powder market alone reached USD 7 billion, with projections indicating a 6.8% annual growth rate through 2032 .

The expansive application of corn powder across various sectors further solidifies North America’s market leadership. In the food and beverage industry, corn powder serves as a versatile ingredient in products ranging from bakery items to snacks and sauces. The increasing consumer preference for gluten-free and plant-based diets has further propelled its demand. Additionally, the pharmaceutical and biofuel industries utilize corn powder for applications such as excipients in drug formulations and as a feedstock for ethanol production, respectively.

Government policies have played a pivotal role in fostering this growth. Subsidies and incentives for corn farming, coupled with advancements in agricultural technology, have enhanced yield and quality. Furthermore, initiatives promoting renewable energy have bolstered the demand for corn-based ethanol, indirectly supporting the corn powder sector. The integration of sustainable practices and innovation continues to drive the market’s expansion in the region.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

BASF SE, a global leader in chemical and agricultural solutions, plays a significant role in the corn powder market. The company offers a wide range of ingredients, including corn-based products, used in food and beverage formulations. BASF’s focus on sustainability and innovative technologies helps improve production efficiency and product quality, supporting its strong presence in the corn powder industry. Their solutions cater to diverse applications, including food, pharmaceuticals, and biofuels.

Bonn Group is a leading producer of a wide range of food products, including corn flour and powder concentrates. Known for its innovative approach to food production, the company offers high-quality corn powder for various applications, including snacks, bakery products, and sauces. Bonn Group’s commitment to quality, consumer satisfaction, and sustainability has helped solidify its position in the corn powder market, particularly in the North American region.

Cargill Inc. is a major global player in the agribusiness and food industry, providing a diverse portfolio of corn-based products, including corn powder. The company’s expertise in food ingredients and animal feed supplements has contributed significantly to the demand for corn powder across multiple sectors. Cargill’s innovation-driven approach ensures that it meets evolving consumer preferences, such as the growing demand for gluten-free and plant-based products, while maintaining sustainability across its operations.

Top Key Players Outlook

- BASF SE

- Bonn Group

- Cargill Inc.

- Crown Bakeries

- Grain Millers

- Ingredion

- ADM

- Tate Lyle

- Agrana Beteiligungs

- Grain Processing Corporation

Recent Industry Developments

In 2024, BASF’s Agricultural Solutions division reported sales of €9.8 billion, with a substantial portion attributed to corn-related products.

Report Scope

Report Features Description Market Value (2024) USD 17.1 Bn Forecast Revenue (2034) USD 34.6 Bn CAGR (2025-2034) 7.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Yellow Corn Powder, White Corn Powder, Sweet Corn Powder, Others), By Form (Powder, Granules, Others), By Application (Bakery and Confectionary, Snacks, Pharmaceuticals, Others), By Distribution Channel (Supermarkets, Convenience Stores, Online Store, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape BASF SE, Bonn Group, Cargill Inc., Crown Bakeries, Grain Millers, Ingredion, ADM, Tate Lyle, Agrana Beteiligungs, Grain Processing Corporation Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- BASF SE

- Bonn Group

- Cargill Inc.

- Crown Bakeries

- Grain Millers

- Ingredion

- ADM

- Tate Lyle

- Agrana Beteiligungs

- Grain Processing Corporation