Global Construction Machinery Market Size, Share, Growth Analysis By Product (Excavators, Loaders, Hoisting Machinery, Road Machinery, Concrete Machinery, Piling Machinery, Others), By Propulsion Type (ICE, Electric, CNG/LNG), By Share of Replacement (Replacement, New Purchase) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Sep 2025

- Report ID: 157658

- Number of Pages: 220

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

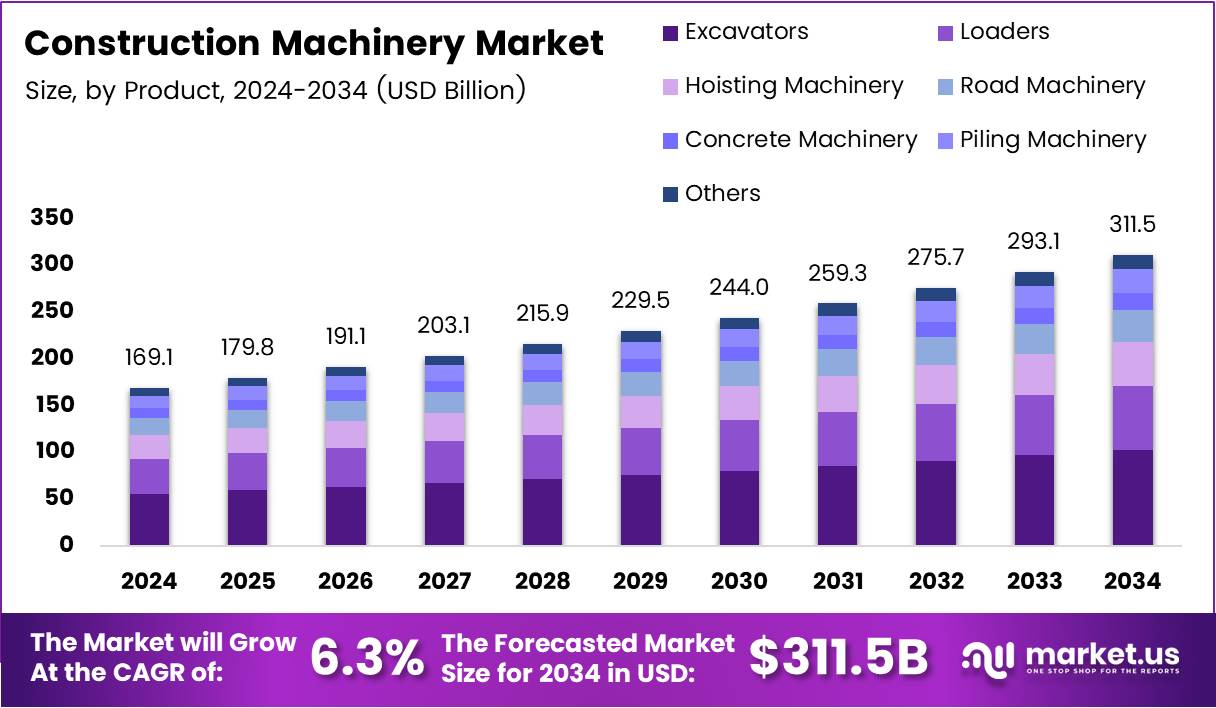

The Global Construction Machinery Market size is expected to be worth around USD 311.5 Billion by 2034, from USD 169.1 Billion in 2024, growing at a CAGR of 6.3% during the forecast period from 2025 to 2034.

The construction machinery market plays a pivotal role in the global infrastructure development sector. It encompasses various types of heavy equipment used in construction, such as excavators, cranes, loaders, and bulldozers. These machines are essential for large-scale projects, contributing significantly to improving productivity and reducing manual labor in construction activities.

In recent years, the market has experienced steady growth due to rising urbanization and increasing demand for infrastructure development. The surge in construction activities, particularly in emerging economies, has further boosted the demand for construction machinery. Moreover, technological advancements, such as the integration of automation and artificial intelligence, are expected to enhance machine efficiency, offering new growth prospects.

Governments worldwide are investing heavily in infrastructure development, which directly benefits the construction machinery market. Many governments are focusing on building resilient infrastructure, particularly in urban areas, which drives demand for specialized machinery. Furthermore, government regulations around safety standards and environmental concerns have led to innovations in the market, pushing manufacturers to design more efficient, eco-friendly machines.

In addition, there is a growing preference among construction companies to own rather than rent machinery. According to a survey, approximately 73.5% of construction companies prefer owning equipment, citing better control over fleet and asset management. This trend towards ownership is expected to continue, especially as companies look to optimize their operational costs.

Market statistics also show that sales in construction machinery are rising steadily. In June 2025, construction machinery sales hit 8,560 units, reflecting a 55.04% growth. This surge highlights the recovery of the construction industry, following previous slowdowns. Such growth is driven by increased construction activities, particularly in residential, commercial, and infrastructural projects.

The market’s prospects look promising, driven by both growing demand and technological advancements. Companies that can adapt to shifting regulations and invest in sustainable practices are well-positioned to lead the market in the coming years. As the construction industry continues to expand, the construction machinery market will remain a critical component of global infrastructure development.

Key Takeaways

- Global Construction Machinery Market size is projected to reach USD 311.5 Billion by 2034, growing at a CAGR of 6.3% from 2025 to 2034.

- Excavators dominate the By Product Analysis segment with a 35.3% market share in 2024.

- Internal Combustion Engine (ICE) leads the By Propulsion Type Analysis segment with a 67.9% share in 2024.

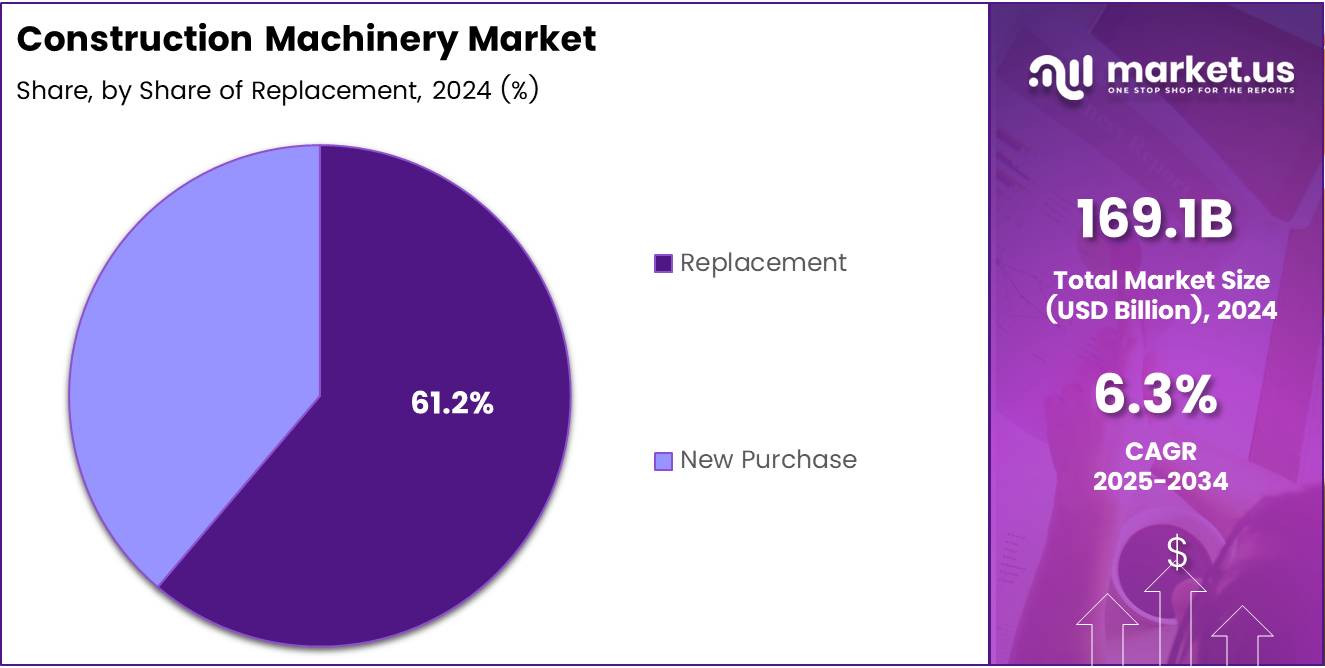

- Replacement segment holds the highest share in By Share of Replacement Analysis with 61.2% in 2024.

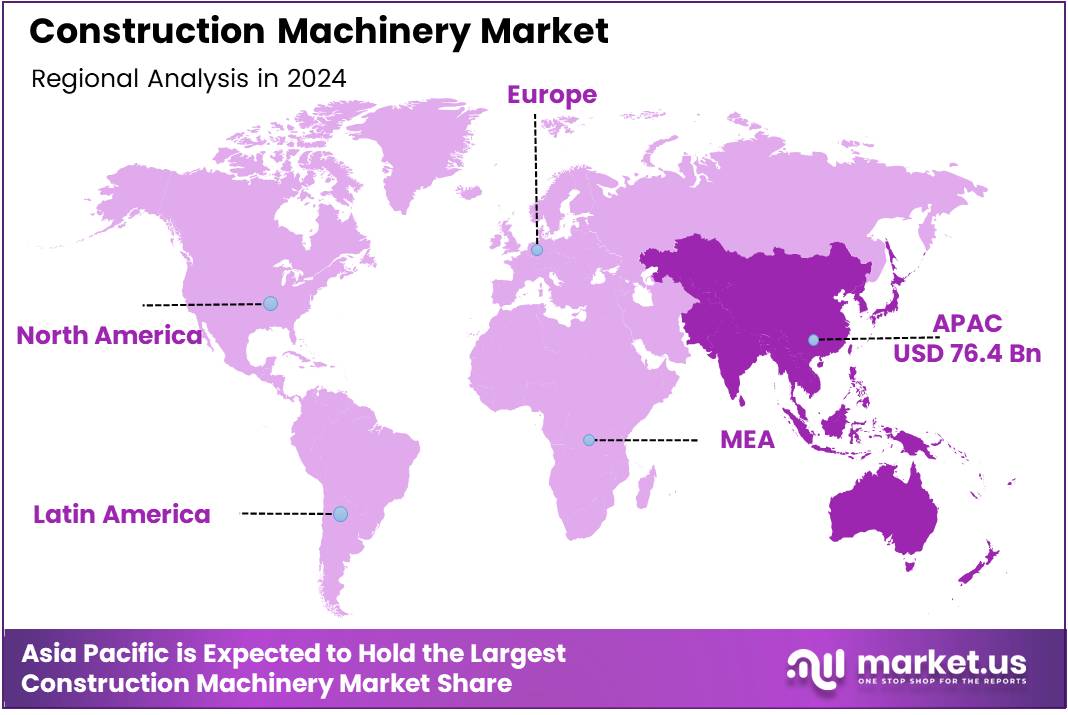

- Asia Pacific dominates the global market with 45.2% share, valued at USD 76.4 billion in 2024.

Product Analysis

Excavators dominate with 35.3% due to their versatility and widespread construction applications.

In 2024, Excavators held a dominant market position in By Product Analysis segment of Construction Machinery Market, with a 35.3% share. The excavator segment’s leadership stems from its critical role in various construction activities including earthmoving, demolition, and material handling operations. These machines offer exceptional versatility across residential, commercial, and infrastructure projects.

Loaders represent the second-largest segment, driven by their efficiency in material transportation and loading operations. The segment benefits from increasing urbanization and infrastructure development projects globally. Hoisting Machinery maintains steady demand due to high-rise construction activities and industrial applications requiring heavy lifting capabilities.

Road Machinery experiences consistent growth linked to government investments in road infrastructure and maintenance projects. Concrete Machinery shows robust performance supported by commercial construction boom and residential development activities.

Piling Machinery serves specialized foundation work requirements in large-scale construction projects. The Others category encompasses specialized equipment catering to niche construction applications and emerging technological innovations in the construction machinery sector.

Propulsion Type Analysis

ICE dominates with 67.9% due to its widespread availability and cost-effectiveness.

In 2024, ICE held a dominant market position in By Propulsion Type Analysis segment of Construction Machinery Market, with a 67.9% share. Internal Combustion Engine technology continues to lead the construction machinery market due to its proven reliability, established infrastructure, and competitive operational costs. ICE-powered equipment offers superior power output and operational flexibility across diverse working conditions.

Electric propulsion systems are gaining momentum driven by environmental regulations and sustainability initiatives. The segment benefits from technological advancements in battery technology and charging infrastructure development. Electric machinery offers reduced operational noise, lower maintenance requirements, and zero on-site emissions, making it attractive for urban construction projects.

CNG/LNG propulsion represents an emerging alternative fuel segment, appealing to operators seeking cleaner alternatives to traditional diesel engines. This segment shows promise in regions with abundant natural gas resources and supportive government policies.

The technology offers reduced emissions compared to conventional ICE while maintaining familiar operational characteristics. Growing environmental consciousness and regulatory pressures are gradually shifting market preferences toward cleaner propulsion technologies, though ICE maintains dominance due to established supply chains and lower upfront costs.

Replacement dominates with 61.2% due to its widespread availability and cost-effectiveness.

In 2024, Replacement held a dominant market position in By Share of Replacement Analysis segment of Construction Machinery Market, with a 61.2% share. The replacement segment’s dominance reflects the mature nature of construction equipment markets where existing machinery reaches end-of-life cycles and requires renewal. Replacement demand is driven by equipment depreciation, technological obsolescence, and maintenance cost escalation.

Construction companies prioritize replacing aging equipment to maintain operational efficiency and comply with evolving emission standards. The replacement cycle typically ranges from five to ten years depending on equipment utilization intensity and maintenance practices. Fleet renewal decisions are influenced by technological advancements offering improved fuel efficiency, enhanced productivity features, and reduced operating costs.

New Purchase segment represents expansion-driven demand from growing construction activities and market entry by new contractors. This segment benefits from infrastructure development projects, urbanization trends, and economic growth in emerging markets.

New purchases often involve advanced machinery with latest technological features, though the higher initial investment makes replacement the preferred option for many established operators. The replacement segment’s strength indicates market maturity and provides stable demand patterns for equipment manufacturers.

Key Market Segments

By Product

- Excavators

- Loaders

- Hoisting Machinery

- Road Machinery

- Concrete Machinery

- Piling Machinery

- Others

By Propulsion Type

- ICE

- Electric

- CNG/LNG

By Share of Replacement

- Replacement

- New Purchase

Drivers

Increasing Infrastructure Development in Emerging Economies Drives Market Growth

The construction machinery market is experiencing strong growth due to several key factors. Emerging countries like India, China, and Brazil are investing heavily in building new roads, bridges, and airports. This creates a huge demand for excavators, bulldozers, and cranes.

Cities around the world are growing rapidly, with more people moving from rural areas to urban centers. This urbanization trend requires new housing, office buildings, and smart city infrastructure. Governments are launching ambitious smart city projects that need advanced construction equipment to build modern transportation systems and digital infrastructure.

The residential and commercial construction sectors are also booming. New apartment complexes, shopping centers, and office towers require specialized machinery for efficient construction. Energy-efficient and sustainable construction equipment is becoming increasingly popular as companies focus on reducing their environmental impact and operating costs.

These sustainable machines help construction companies meet environmental regulations while saving money on fuel and maintenance. The combination of infrastructure growth, urbanization, and sustainability requirements creates a strong foundation for continued market expansion in the construction machinery sector.

Restraints

Fluctuating Raw Material Prices Create Market Challenges

The construction machinery market faces several significant challenges that can slow growth and impact profitability. Raw material prices, especially steel and aluminum, change frequently due to global supply chain issues and economic uncertainty. When these materials become expensive, machinery manufacturers must either absorb higher costs or pass them to customers through higher prices.

Supply chain disruptions have become a major concern, especially after recent global events. Delays in getting essential components can halt production lines and create equipment shortages. This affects construction projects that depend on timely machinery delivery.

Another critical challenge is the shortage of skilled workers who can operate complex construction machinery. Many experienced operators are retiring, and fewer young workers are entering the field. Training new operators takes time and money, creating bottlenecks in project execution.

The learning curve for modern construction equipment is steep, requiring specialized training programs and certifications. Companies must invest heavily in operator education to ensure safe and efficient machinery use. These workforce challenges can limit market growth even when demand for construction projects remains strong.

Growth Factors

Expansion of Rental Equipment Services Creates New Growth Opportunities

The construction machinery market is discovering exciting new growth opportunities that could reshape the industry. Equipment rental services are expanding rapidly as construction companies prefer renting over buying expensive machinery. This trend allows smaller contractors to access high-quality equipment without large upfront investments.

Internet of Things (IoT) technology integration offers tremendous potential for machinery monitoring and maintenance. Smart sensors can track equipment performance, predict maintenance needs, and optimize fuel consumption. This technology helps construction companies reduce downtime and operating costs significantly.

Autonomous and semi-autonomous construction machinery represents the future of the industry. These machines can work with minimal human intervention, improving safety and productivity on construction sites. Early adopters are seeing substantial benefits in terms of precision and efficiency.

Government support through incentives and funding programs is creating additional market opportunities. Many countries offer tax breaks and subsidies for companies that invest in modern, environmentally friendly construction equipment. Infrastructure spending packages provide steady demand for construction machinery across various sectors.

Emerging Trends

Increasing Adoption of Electric Construction Machines Shapes Market Trends

The construction machinery market is experiencing significant transformation through emerging technology trends. Electric and hybrid construction machines are gaining popularity as companies seek to reduce emissions and operating costs. These environmentally friendly alternatives offer quieter operation and lower maintenance requirements compared to traditional diesel-powered equipment.

Artificial intelligence integration is revolutionizing machine optimization and performance monitoring. AI systems can analyze equipment usage patterns, predict optimal operating conditions, and automatically adjust machine settings for maximum efficiency. This technology helps construction companies maximize productivity while minimizing fuel consumption and wear.

Drones and robotics are becoming essential tools for construction site monitoring and surveying. These technologies provide real-time data about project progress, site conditions, and safety hazards. Construction managers can make better decisions and identify potential problems before they become costly issues.

Safety standards and worker protection systems are receiving increased attention as the industry focuses on reducing workplace accidents. Modern construction machinery includes advanced safety features like collision avoidance systems, operator assistance technology, and improved visibility designs.

Regional Analysis

Asia Pacific Dominates the Construction Machinery Market with a Market Share of 45.2%, Valued at USD 76.4 Billion

Asia Pacific holds a dominant position in the global construction machinery market, capturing 45.2% of the market share, valued at USD 76.4 billion. The growth of this region is primarily driven by rapid urbanization and increasing infrastructure development projects.

The region’s substantial market share reflects its pivotal role in construction activities, particularly in countries like China and India, where major construction projects are underway. Moreover, government investments in large-scale infrastructure, such as roads, bridges, and residential buildings, continue to propel the demand for construction machinery.

North America Construction Machinery Market Trends

North America holds a significant market share, supported by the robust construction industry in the US and Canada. With continuous investment in infrastructure, housing, and commercial projects, the demand for advanced construction machinery is expected to rise. This region also benefits from the adoption of automation and digital technologies, improving construction efficiency and safety standards.

Europe Construction Machinery Market Trends

Europe’s construction machinery market is witnessing growth driven by stringent environmental regulations and the push for sustainable construction methods. The demand for energy-efficient and eco-friendly machinery has seen an upward trend, as countries like Germany, France, and the UK focus on infrastructure renovation and green building projects. The region’s emphasis on smart cities further drives machinery requirements.

Middle East and Africa Construction Machinery Market Trends

The Middle East and Africa construction machinery market is growing steadily, fueled by the extensive construction of commercial, residential, and industrial projects. The region, especially the UAE and Saudi Arabia, continues to invest in infrastructure development, with large-scale projects such as smart cities and industrial parks. The demand for heavy-duty machinery is increasing in line with ambitious construction goals.

Latin America Construction Machinery Market Trends

Latin America is witnessing moderate growth in its construction machinery market, driven by infrastructure projects in Brazil and Mexico. Government initiatives to enhance transportation networks and the construction of new urban centers support machinery demand. However, market growth is somewhat constrained by economic fluctuations and political instability in some regions.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Construction Machinery Company Insights

In 2024, Caterpillar, Inc. continues to hold a strong presence in the global construction machinery market, focusing on the production of high-performance construction equipment. The company is expected to leverage its extensive dealer network and innovative technologies, ensuring sustained demand for its machines across various sectors, including mining, construction, and infrastructure.

CNH Industrial America LLC. is positioned as a key player with its diverse portfolio of construction machinery. The company’s products, such as backhoe loaders and excavators, are anticipated to witness increasing adoption due to their robust performance and fuel efficiency. CNH Industrial’s focus on innovation is expected to maintain its competitive edge in North America and other global markets.

Deere & Company is set to further solidify its role in the market with a range of advanced, environmentally friendly construction equipment. Known for its high-quality machinery, Deere’s commitment to sustainability and technological integration is projected to continue driving its success in both developed and emerging markets.

Doosan Corporation has made substantial strides in the construction machinery industry, particularly with its excavators and wheel loaders. With a focus on enhancing machine durability and user-friendly features, Doosan is expected to maintain its strong position in Asia and expand its footprint in Western markets as well.

These companies, along with others in the sector, are expected to continue driving innovation, focusing on enhancing operational efficiencies and environmental sustainability, which will shape the future of the construction machinery market.

Top Key Players in the Market

- Caterpillar, Inc

- CNH Industrial America LLC.

- Deere & Company

- Doosan Corporation

- Escorts Limited

- Hitachi Construction Machinery Co., Ltd.

- Hyundai Construction Equipment Co., Ltd.

- J C Bamford Excavators Ltd.

- Komatsu Ltd.

- KUBOTA Corporation

Recent Developments

- In Sep 2025, the Indian government is set to introduce a Rs 13,000-crore incentive plan aimed at boosting the construction equipment sector, providing substantial financial support to industry players and fostering growth within the sector.

- In Dec 2024, Pai Machines strengthened its market position by acquiring L&T Construction Equipment Facilities, reinforcing its footprint in the construction machinery industry.

- In Nov 2024, Hitachi Construction Machinery’s subsidiary, H-E Parts, is set to acquire Brake Supply Inc, strengthening its capabilities in the North American market and expanding its product offerings in the construction machinery segment.

- In Jun 2025, Volvo CE made a significant move by acquiring Swecon, marking a major investment in its European retail business, a step expected to enhance its market reach and operational efficiency across Europe.

Report Scope

Report Features Description Market Value (2024) USD 169.1 Billion Forecast Revenue (2034) USD 311.5 Billion CAGR (2025-2034) 6.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Excavators, Loaders, Hoisting Machinery, Road Machinery, Concrete Machinery, Piling Machinery, Others), By Propulsion Type (ICE, Electric, CNG/LNG), By Share of Replacement (Replacement, New Purchase) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Caterpillar, Inc, CNH Industrial America LLC., Deere & Company, Doosan Corporation, Escorts Limited, Hitachi Construction Machinery Co., Ltd., Hyundai Construction Equipment Co., Ltd., J C Bamford Excavators Ltd., Komatsu Ltd., KUBOTA Corporation Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Construction Machinery MarketPublished date: Sep 2025add_shopping_cartBuy Now get_appDownload Sample

Construction Machinery MarketPublished date: Sep 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Caterpillar, Inc

- CNH Industrial America LLC.

- Deere & Company

- Doosan Corporation

- Escorts Limited

- Hitachi Construction Machinery Co., Ltd.

- Hyundai Construction Equipment Co., Ltd.

- J C Bamford Excavators Ltd.

- Komatsu Ltd.

- KUBOTA Corporation