Global Cocktail Syrups Market Size, Share, And Enhanced Productivity By Product (Fruit, Herbs and Seasonings, Vanilla, Others), By Flavor (Sweet, Salty, Sour, Mint), By Distribution Channel (Online, Offline), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: January 2026

- Report ID: 174293

- Number of Pages: 362

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

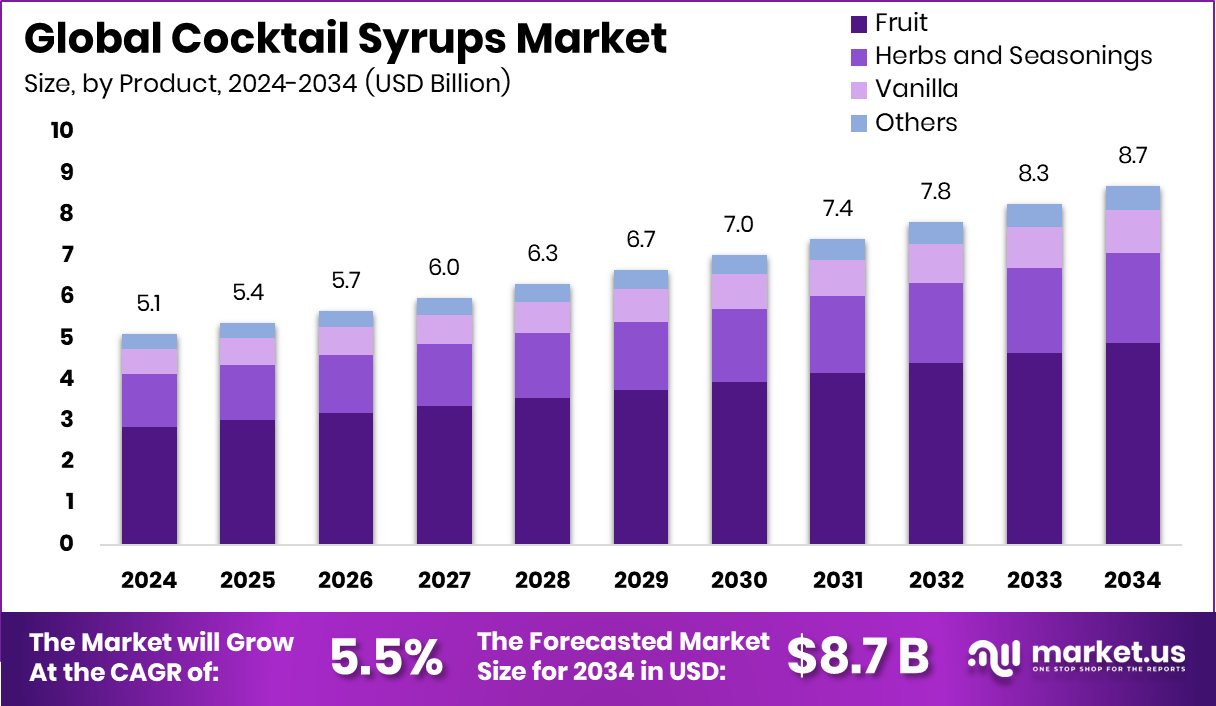

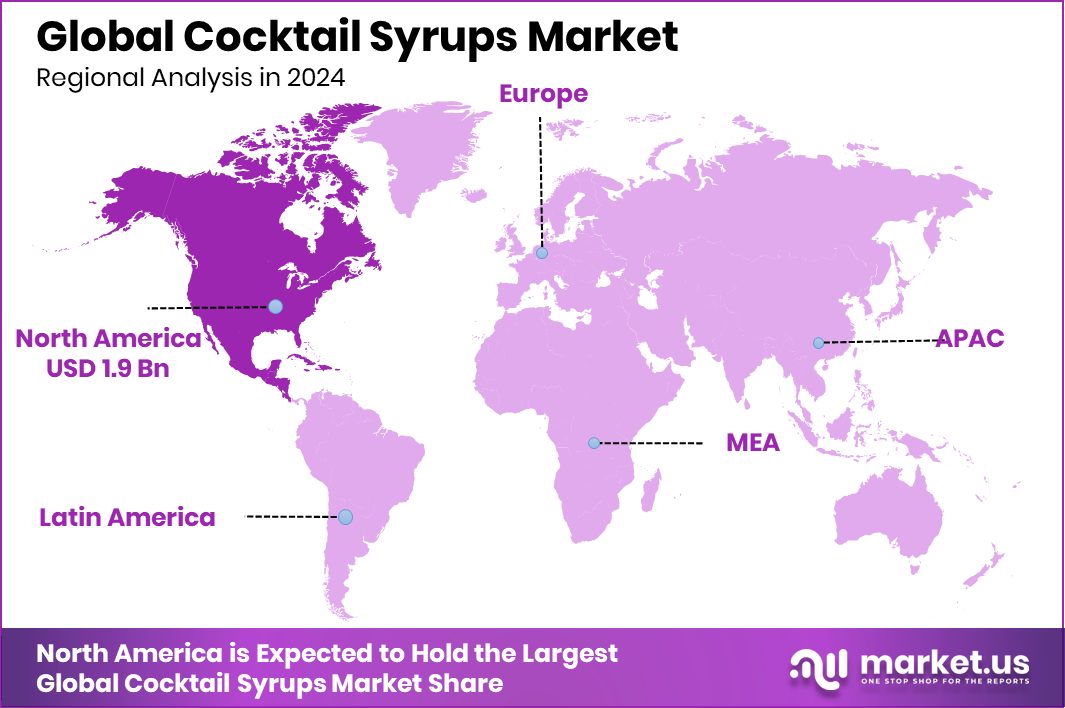

The Global Cocktail Syrups Market is expected to be worth around USD 8.7 billion by 2034, up from USD 5.1 billion in 2024, and is projected to grow at a CAGR of 5.5% from 2025 to 2034. North America dominates the cocktail syrups industry at 37.4% share, worth USD 1.9 Bn overall region.

Cocktail syrups are concentrated liquid sweeteners infused with flavors such as fruits, herbs, spices, or botanicals. They are used to add sweetness, aroma, and balance to cocktails and mocktails without complex preparation. Because they dissolve easily and offer a consistent taste, they are widely used in bars, cafés, restaurants, and at home for mixing. Their role has expanded beyond alcohol-based drinks into lemonades, iced teas, and creative non-alcoholic beverages.

The Cocktail Syrups Market represents the commercial production and sale of these flavored syrups across on-trade and off-trade channels. It covers products used by professional mixologists as well as home consumers seeking convenience and flavor control. The market reflects broader lifestyle shifts toward experiential drinks, premium ingredients, and customization, making cocktail syrups a core component of modern beverage culture.

Market growth is supported by innovation across adjacent food and beverage spaces. For example, beverage startups continue to attract capital, such as Cann, which raised USD 27 million to expand into Canada, signaling investor confidence in functional and alternative drinks. Similarly, Vanilla closed USD 35 million in funding, highlighting demand for flavor-driven products that also influence syrup innovation.

Demand is rising as consumers seek sustainable, clean-label, and premium drink ingredients. This is reinforced by investments like Notpla, which secured £20 million to scale plastic-free solutions, aligning with eco-conscious beverage consumption. Recognition programs such as the Scottish EDGE Awards, where 35 winners shared £1.5 million, further show strong support for food and drink innovation ecosystems.

Future opportunities lie in functional, plant-based, and locally sourced syrups. Public and private funding continues to encourage innovation, including a USD 600,000 USDA grant awarded to JUA Technologies International for solar-powered food processing, and broader agri-food investments such as Liberation Labs’ USD 50.5 million raise, alongside OCELL’s USD 10 million and Pluri’s lab-grown cocoa acquisition, all of which indirectly strengthen ingredient supply chains relevant to cocktail syrups.

Key Takeaways

- The Global Cocktail Syrups Market is expected to be worth around USD 8.7 billion by 2034, up from USD 5.1 billion in 2024, and is projected to grow at a CAGR of 5.5% from 2025 to 2034.

- In 2024, fruit syrups captured 56.2% share, reflecting strong consumer preference for familiar flavors globally.

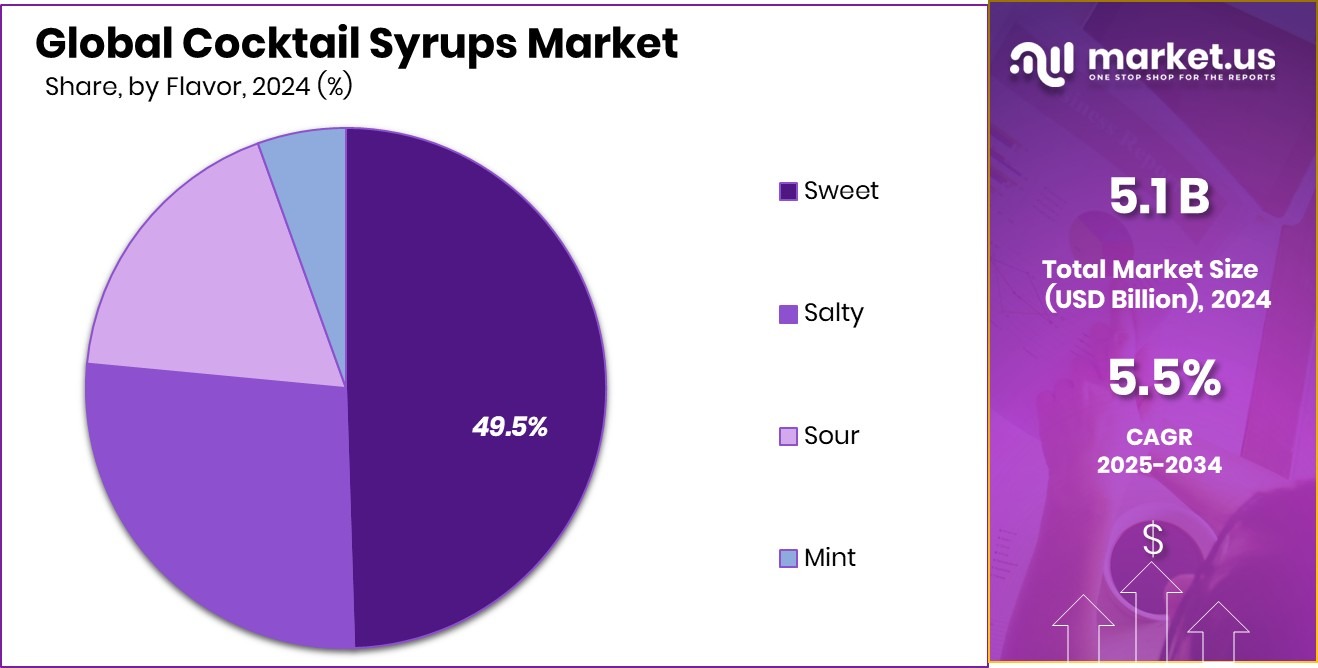

- In 2024, sweet variants held 49.5% share, driven by broad acceptance among diverse consumers globally.

- In 2024, offline distribution accounted for 67.3% share, reflecting strong store-based purchasing behavior globally today.

- North America accounts for 37.4% of the cocktail syrups market, reaching a USD 1.9 Bn value region.

By Product Analysis

In the cocktail syrups market, fruit products dominated demand with 56.2%.

In 2024, the Cocktail Syrups Market witnessed strong demand for fruit-based variants, with the fruit segment holding a dominant share of 56.2%. This leadership is driven by the widespread use of fruit syrups such as strawberry, mango, lime, and cranberry in both alcoholic and non-alcoholic cocktails. Bars, cafés, and home consumers increasingly prefer fruit syrups because they deliver consistent taste, vibrant color, and easy blending compared to fresh fruit.

Additionally, fruit syrups support menu standardization for hospitality operators, reducing preparation time and ingredient wastage. Rising consumer interest in tropical and exotic fruit flavors, along with growing mocktail consumption, has further strengthened the position of fruit-based cocktail syrups across global on-trade and off-trade channels.

By Flavor Analysis

In the cocktail syrups market, sweet flavors captured demand at 49.5%.

By flavor profile, sweet cocktail syrups accounted for a leading market share of 49.5% in 2024. Sweet syrups remain the foundation of classic and contemporary cocktails, balancing acidity and bitterness while enhancing overall mouthfeel. Popular sweet profiles such as vanilla, caramel, grenadine, and honey-based syrups are widely used across spirits, coffee cocktails, and dessert drinks.

The growth of ready-to-mix beverages and at-home cocktail culture has also increased demand for sweet syrups, as they are easy to use for beginners. Moreover, sweet flavors appeal to a broad consumer base, including younger adults and first-time cocktail consumers, supporting their sustained dominance in the Cocktail Syrups Market.

By Distribution Channel Analysis

In the cocktail syrups market, offline channels led distribution with 67.3%.

From a distribution perspective, offline channels dominated the Cocktail Syrups Market with a share of 67.3% in 2024. Supermarkets, liquor stores, specialty beverage shops, and horeca suppliers remain the primary purchasing points for cocktail syrups due to immediate product availability and brand visibility.

Professional buyers, such as bars and restaurants, prefer offline procurement to ensure consistent supply and quality verification. In addition, in-store promotions and bulk purchasing options encourage higher volumes through offline retail. While online sales are expanding, especially for premium and niche syrups, offline distribution continues to lead due to strong relationships with hospitality operators and established retail networks worldwide.

Key Market Segments

By Product

- Fruit

- Herbs and Seasonings

- Vanilla

- Others

By Flavor

- Sweet

- Salty

- Sour

- Mint

By Distribution Channel

- Online

- Offline

Driving Factors

Rising Digital Engagement Drives Social Drinking Culture

One major driving factor for the Cocktail Syrups Market is the growing influence of digital entertainment and social engagement on drinking habits. Interactive platforms and mobile apps encourage social connections, celebrations, and shared experiences, which often extend to food and beverages. This behavior supports experimentation with cocktails and flavored drinks at home.

A relevant example is Plain Vanilla Games, the maker of the trivia app QuizUp, which raised USD 22 million to expand user engagement. Such funding highlights how digital communities shape lifestyle trends. As people socialize more through games, quizzes, and online gatherings, interest in easy-to-use cocktail syrups increases, helping users recreate bar-style drinks during casual social moments without complex preparation.

Restraining Factors

Rising Ingredient Costs Limit Pricing Flexibility

A key restraining factor for the Cocktail Syrups Market is the rising cost of specialty ingredients and fermentation-based inputs. Many syrups rely on natural extracts, sugars, and bio-derived components, which can face supply and cost pressure. Innovation in biotech ingredients, while promising, often remains expensive at early stages.

For instance, Anomaly Bio from Singapore raised USD 2.6 million in pre-seed funding to develop advanced biological solutions. While such investments support long-term ingredient innovation, short-term costs can be high. These pressures make it difficult for syrup producers to maintain affordable pricing, especially in price-sensitive markets, which can slow adoption among small cafés and home consumers.

Growth Opportunity

Advanced Processing Technologies Unlock New Flavor Opportunities

A strong growth opportunity for the Cocktail Syrups Market lies in adopting advanced processing and precision technologies that improve flavor extraction and consistency. Investments in high-performance systems show how technology can enhance reliability and scalability. A parallel example is Vanilla UAS, which received a USD 30 million investment to strengthen advanced operational capabilities.

While focused on defense technology, this highlights how funding into precision systems can inspire similar advancements in food and beverage processing. For cocktail syrups, better control over temperature, purity, and blending can enable cleaner flavors, longer shelf life, and customized profiles, opening doors to premium and functional syrup segments.

Latest Trends

Biomanufacturing Shapes Next-Generation Natural Ingredients

One of the latest trends influencing the Cocktail Syrups Market is the shift toward biomanufacturing for producing natural proteins, enzymes, and flavor-related ingredients. This approach supports sustainability and reduces reliance on traditional agricultural inputs. A clear signal of this trend is Future Fields, which raised USD 8 million in Series A funding to expand its fruit fly-based production platform.

Such developments show how alternative manufacturing methods are gaining traction. For cocktail syrups, this trend supports the future use of bio-produced flavor enhancers and stabilizers, helping brands meet clean-label expectations while maintaining taste consistency and supply reliability.

Regional Analysis

North America’s cocktail syrups market leads with 37.4% share, valued at USD 1.9 Bn.

In the global Cocktail Syrups Market, North America emerged as the dominating region, accounting for 37.4% of overall demand and valued at USD 1.9 Bn, supported by a mature cocktail culture, high consumption across bars and restaurants, and strong at-home mixing trends. The region benefits from the wide availability of flavored syrups through established offline retail and horeca channels, reinforcing steady volume demand.

Europe follows with stable market performance, driven by long-standing café traditions, premium cocktail menus, and consistent use of syrups in both alcoholic and non-alcoholic beverages across hospitality settings. Asia Pacific shows growing market momentum, supported by rising urbanization, expanding café chains, and increasing interest in mocktails and Western-style beverages among younger consumers.

In the Middle East & Africa, demand is shaped largely by non-alcoholic cocktail syrups, fueled by strong consumption of flavored drinks in hotels, cafés, and social venues. Meanwhile, Latin America reflects steady adoption, supported by vibrant foodservice culture and the use of fruit-based syrups in traditional and contemporary mixed beverages.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, Kerry Group PLC plays a strategic role in the global Cocktail Syrups Market through its deep expertise in taste science and flavor formulation. The company’s strength lies in developing consistent, scalable flavor solutions that meet evolving consumer preferences for balanced sweetness, fruit-forward profiles, and premium sensory experiences. Its strong focus on innovation enables beverage brands and foodservice operators to maintain uniform taste quality across large volumes, which is critical for commercial cocktail applications.

Liber & Co. is viewed as a premium, craft-focused player that appeals strongly to bartenders and mixology-driven establishments. The company emphasizes small-batch production, natural ingredients, and classic cocktail authenticity, which aligns well with the rising demand for artisanal and high-quality syrups. From an analyst perspective, Liber & Co.’s positioning supports higher value perception and strong brand loyalty within niche but influential on-trade segments.

Meanwhile, MONIN remains a cornerstone of the Cocktail Syrups Market due to its broad flavor portfolio and strong presence across both professional and home-use channels. Its ability to cater to diverse applications, including cocktails, mocktails, and café beverages, supports consistent global demand. Analysts see MONIN’s versatility and accessibility as key drivers sustaining its relevance across changing consumption patterns in 2024.

Top Key Players in the Market

- Kerry Group PLC

- Liber & Co.

- MONIN

- The Simple Syrup Co.

- ADM WILD Europe GmbH & Co. KG

- Bristol Syrup Company

- Döhler

- Toschi Vignola s.r.l.

- Giffard

- ODK

Recent Developments

- In March 2024, Döhler Ventures formed a partnership with Vertosa, a company focused on infusion technology for beverage ingredients. Through this collaboration, Döhler will help co-develop natural ingredients and blends that can be used in innovative beverage products.

- In February 2024, industry event coverage mentioned that Bristol Syrup Company was preparing several new cocktail-focused syrups for release later in the year. The team was also active in supporting bar partners in the UK with drinks and menu work, such as bar takeovers, signaling product activity, and market engagement.

- In February 2024, Toschi Vignola presented a new line of syrups for drinks and sweets at the Gulfood trade show in Dubai. These new drink syrups are designed to expand the company’s portfolio in beverage applications, including cocktails, mocktails, and other fruit-flavored drinks. Toschi’s syrups are known fortheir fruit-based quality and mixology use

Report Scope

Report Features Description Market Value (2024) USD 5.1 Billion Forecast Revenue (2034) USD 8.7 Billion CAGR (2025-2034) 5.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Fruit, Herbs and Seasonings, Vanilla, Others), By Flavor (Sweet, Salty, Sour, Mint), By Distribution Channel (Online, Offline) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Kerry Group PLC, Liber & Co., MONIN, The Simple Syrup Co., ADM WILD Europe GmbH & Co. KG, Bristol Syrup Company, Döhler, Toschi Vignola s.r.l., Giffard, ODK Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Kerry Group PLC

- Liber & Co.

- MONIN

- The Simple Syrup Co.

- ADM WILD Europe GmbH & Co. KG

- Bristol Syrup Company

- Döhler

- Toschi Vignola s.r.l.

- Giffard

- ODK