Clinical Chemistry Analyzers Market By Product Type (Reagents, Analyzers, and Others), By Test Type (Liver Panels, Thyroid Function Panels, Electrolyte Panels, Lipid Profiles, and Others), By End-user (Hospital, Diagnostic Laboratories, and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Jan 2025

- Report ID: 138309

- Number of Pages: 266

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

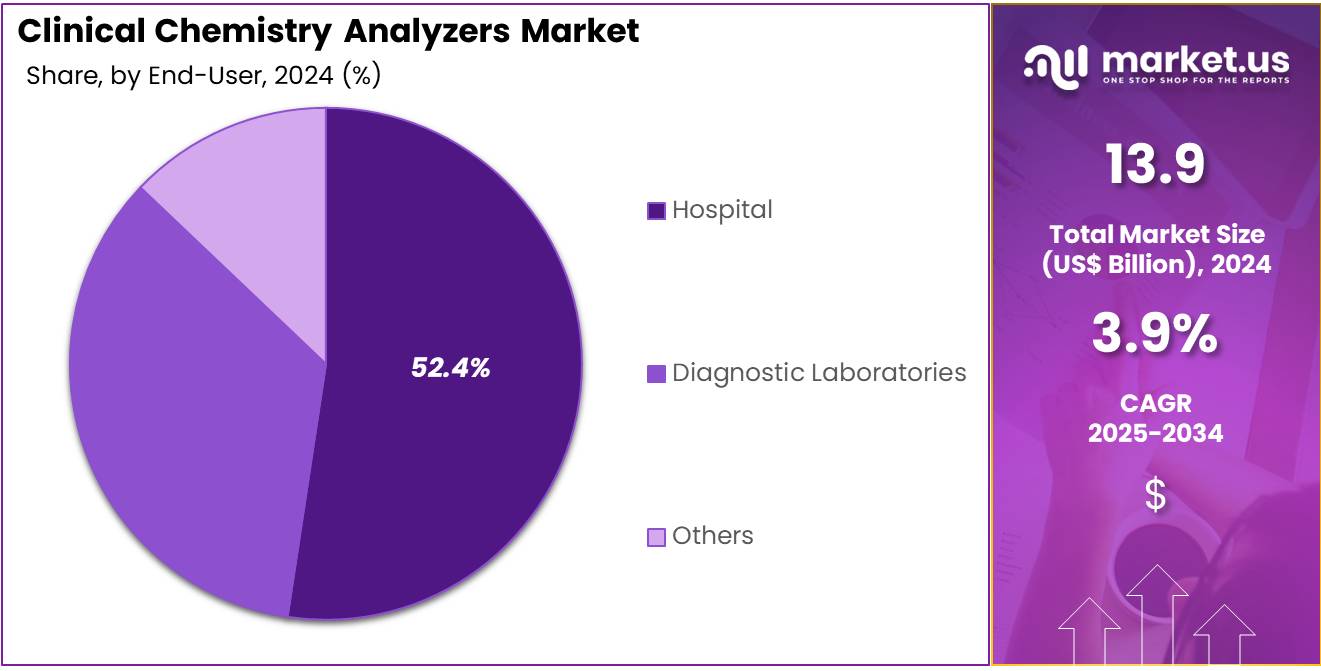

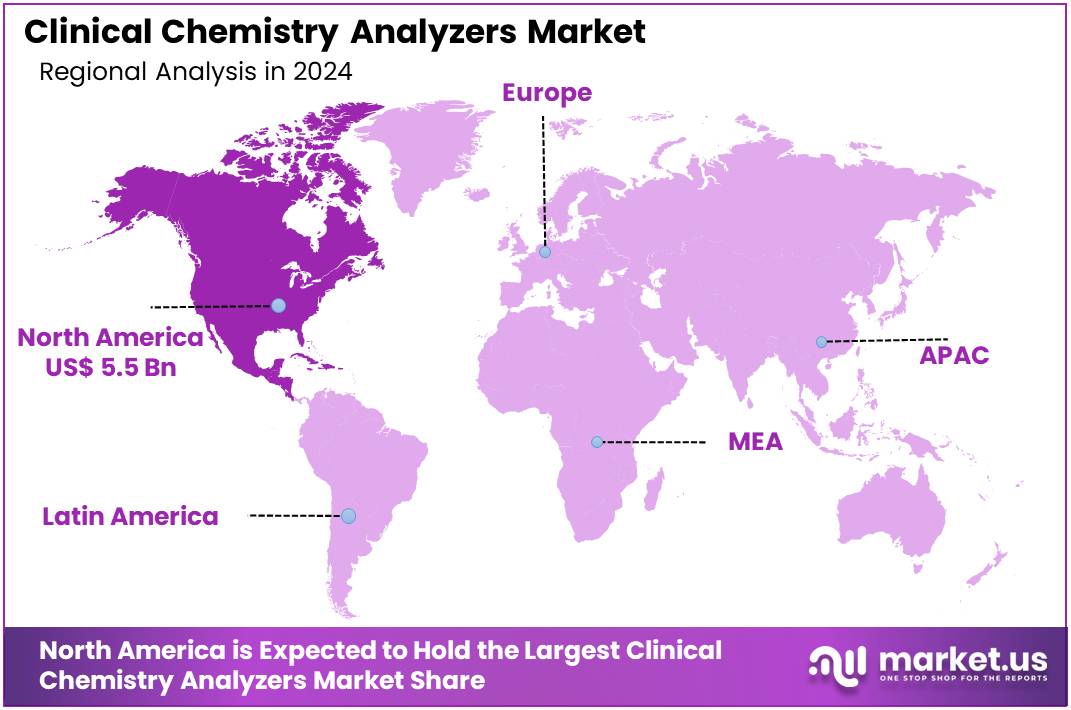

The Global Clinical Chemistry Analyzers Market Size is expected to be worth around US$ 20.4 Billion by 2034, from US$ 13.9 Billion in 2024, growing at a CAGR of 3.9% during the forecast period from 2025 to 2034. North America held a dominant market position, capturing more than a 39.6% share and holds US$ 5.5 Billion market value for the year.

Growing demand for faster, more accurate diagnostic testing is driving the expansion of the clinical chemistry analyzers market. Clinical chemistry analyzers play a pivotal role in the healthcare sector by automating the analysis of blood, urine, and other body fluids to detect various conditions, including diabetes, cardiovascular diseases, and kidney disorders. These analyzers are critical in clinical laboratories for performing a wide range of tests such as liver and kidney function tests, lipid profiles, and electrolytes.

The increasing prevalence of chronic diseases and the rising need for early disease detection are fueling demand for clinical chemistry analyzers. In May 2022, Mindray launched the BS-600M, a sophisticated chemistry analyzer aimed at enhancing the productivity and efficiency of medium-volume laboratories. Designed for high reliability, the BS-600M optimizes workflows and improves the overall performance of laboratory operations, demonstrating the market’s push toward automation and efficiency.

Recent trends highlight the growing adoption of integrated, high-throughput, and user-friendly analyzers that enable laboratories to perform a higher volume of tests with greater accuracy and reduced turnaround times. Additionally, advancements in reagent technology and the increasing focus on personalized medicine present significant opportunities for the market. As clinical laboratories continue to enhance their diagnostic capabilities, the clinical chemistry analyzers market is poised for sustained growth.

Key Takeaways

- In 2024, the market for clinical chemistry analyzers generated a revenue of US$ 13.9 billion, with a CAGR of 3.9%, and is expected to reach US$ 20.4 billion by the year 2033.

- The product type segment is divided into reagents, analyzers, and others, with analyzers taking the lead in 2024 with a market share of 46.8%.

- Considering test type, the market is divided into liver panels, thyroid function panels, electrolyte panels, lipid profiles, and others. Among these, liver panels held a significant share of 34.7%.

- Furthermore, concerning the end-user segment, the market is segregated into hospital, diagnostic laboratories, and others. The hospital sector stands out as the dominant player, holding the largest revenue share of 52.4% in the clinical chemistry analyzers market.

- North America led the market by securing a market share of 39.6% in 2024.

Product Type Analysis

In 2024, the analyzers segment dominated the market, holding a 46.8% share due to the rising need for accurate diagnostic tools. These devices are critical in testing blood, urine, and other bodily fluids. Their ability to deliver fast, accurate results is crucial for diagnosing a range of health conditions. This necessity drives their continued adoption in medical settings.

The increasing prevalence of chronic diseases like diabetes, cardiovascular disorders, and liver disease fuels the demand for clinical chemistry analyzers. These conditions require reliable testing solutions to manage and monitor effectively. As such, the market for analyzers is expected to grow, supported by the need for precise diagnostic capabilities.

Technological advancements are enhancing analyzers further. Automation and the integration of artificial intelligence are set to improve accuracy and efficiency. These innovations promise to elevate the capabilities of analyzers, making them more appealing to healthcare providers. The push for high-throughput, reliable testing methods will likely increase their utilization in laboratories and healthcare facilities.

Test Type Analysis

The liver panels held a significant share of 34.7% due to the increasing prevalence of liver diseases such as hepatitis, cirrhosis, and liver cancer. Liver panels, which test for various liver function markers like ALT, AST, and bilirubin, are expected to see rising demand as healthcare providers focus on early diagnosis and monitoring of liver health.

The growing awareness of the importance of liver health, especially in high-risk populations such as those with obesity or excessive alcohol consumption, is likely to further contribute to the growth of this segment. Moreover, advancements in panel testing, such as the development of more comprehensive liver function tests, are expected to enhance diagnostic capabilities and drive market expansion.

End-User Analysis

The hospital segment had a tremendous growth rate, with a revenue share of 52.4% owing to the increasing need for diagnostic tests and the expanding focus on preventive healthcare in hospital settings. Hospitals are expected to remain the primary end-users of clinical chemistry analyzers due to their central role in diagnosing and monitoring a wide range of diseases. As the number of hospital admissions continues to rise and the demand for diagnostic testing services increases, the adoption of advanced chemistry analyzers is projected to grow.

Additionally, the growing focus on improving patient outcomes and reducing diagnostic errors is likely to contribute to the continued use of clinical chemistry analyzers in hospitals. As technological advancements improve the efficiency and accuracy of testing, hospitals will increasingly rely on these systems for comprehensive disease management and early diagnosis.

Key Market Segments

By Product Type

- Reagents

- Analyzers

- Others

By Test Type

- Liver Panels

- Thyroid Function Panels

- Electrolyte Panels

- Lipid Profiles

- Others

By End-user

- Hospital

- Diagnostic Laboratories

- Others

Drivers

Rise in Technological Advancements Driving the Clinical Chemistry Analyzers Market

Rising technological advancements are anticipated to drive the clinical chemistry analyzers market significantly. In April 2022, Sysmex Europe launched the XQ-320, a three-part differential automated hematology analyzer with advanced technology and user-friendly features. Innovations like this enhance diagnostic accuracy and operational efficiency, meeting the growing demand for precise and rapid clinical testing. Integration of artificial intelligence and machine learning in analyzers optimizes data analysis and minimizes manual errors.

Laboratories adopt automated systems to handle high workloads efficiently, especially in centralized and reference labs. Compact and portable analyzers cater to point-of-care applications, expanding market reach. Companies increasingly focus on modular systems that offer flexibility for scaling operations. Advanced connectivity features support seamless data integration with laboratory information systems, improving workflow management.

Rising prevalence of chronic diseases amplifies the demand for reliable diagnostic tools, further boosting market growth. Collaboration between manufacturers and healthcare institutions accelerates the adoption of next-generation analyzers. These trends emphasize the transformative role of technology in advancing the capabilities of clinical chemistry analyzers.

Restraints

High Costs Are Restraining the Clinical Chemistry Analyzers Market

High costs associated with clinical chemistry analyzers are restraining the market. Advanced systems equipped with automation and integrated technologies demand significant investment, making them unaffordable for smaller laboratories. Maintenance expenses and the high cost of consumables such as reagents further increase operational costs.

Limited budgets in public healthcare facilities, especially in low-income countries, restrict access to these systems. Inconsistent reimbursement policies for diagnostic testing add financial pressure on healthcare providers. Training personnel to operate sophisticated analyzers requires additional resources, which can be challenging for smaller institutions.

Developing regions often face supply chain issues, increasing costs and limiting the availability of these devices. Addressing these barriers requires cost-efficient solutions and strategies to make analyzers accessible to a wider range of healthcare facilities.

Opportunities

Rapid Production Expansion as an Opportunity for the Clinical Chemistry Analyzers Market

In September 2023, HORIBA UK enhanced its product offerings with the launch of the POINTE G6PD Assay Kit, designed to streamline screening for Glucose-6-phosphate dehydrogenase (G6PD) deficiency. This development emphasizes the importance of scalable production in meeting the growing demands of the market. Manufacturers are increasingly investing in expanded production capabilities to cater to the rising need for efficient diagnostic tools, particularly in chronic disease management.

The trend toward automation in manufacturing processes is gaining traction, which ensures consistent quality while allowing for faster production turnaround times. This shift is crucial as it aids manufacturers in keeping pace with the escalating demand for clinical chemistry analyzers. Automated systems also reduce human error, enhancing the reliability of diagnostic tools.

Strategic collaborations are becoming vital as manufacturers partner with suppliers to secure a steady flow of consumables and accessories. These partnerships are essential for maintaining uninterrupted operations of clinical chemistry analyzers. Ensuring the availability of necessary components helps in smooth and efficient analyzer functionality, which is critical for ongoing diagnostic processes.

Expanding global distribution networks is another key strategy for manufacturers. By broadening their reach, companies can provide advanced diagnostic solutions to even the most remote regions. This expansion is often supported by funding and infrastructure investments from both governments and private organizations, highlighting a collective effort to improve access to critical health diagnostics worldwide.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic and geopolitical factors have a significant impact on the clinical chemistry analyzers market. On the positive side, increasing healthcare spending globally, particularly in emerging markets, drives the demand for advanced diagnostic tools, including biochemical analyzers. As healthcare systems strive for greater efficiency, the adoption of automated systems accelerates, supporting market growth.

However, economic downturns and budget constraints can lead to reduced healthcare investments, limiting the availability of these devices in resource-limited settings. Geopolitical factors, such as trade disputes and regulatory hurdles, may disrupt the supply chain for essential components and increase production costs.

Additionally, regulatory variations across different regions can affect market access and slow the introduction of new technologies. Despite these challenges, the growing focus on precision medicine and early disease detection ensures continued demand for high-quality diagnostic tools, providing a positive outlook for the market’s growth.

Trends

Surge in Mergers and Acquisitions Driving the Clinical Chemistry Analyzers Market

Rising mergers and acquisitions are significantly driving the clinical chemistry analyzers market. High levels of consolidation among key players are expected to enhance technological capabilities, expand product portfolios, and improve market competitiveness. These collaborations enable companies to integrate complementary technologies and accelerate innovation in diagnostic tools.

In July 2023, Canon Medical Systems acquired Minaris Medical and its subsidiaries, aiming to expand its presence in the in vitro diagnostics sector. This acquisition is set to enhance Canon Medical’s capabilities by combining Minaris Medical’s expertise in reagent technology with Canon’s advanced automated biochemical analyzers. As the trend of mergers and acquisitions continues, the market is anticipated to benefit from strengthened product offerings and expanded reach, further driving growth and innovation in the sector.

Regional Analysis

North America is leading the Clinical chemistry analyzers Market

North America dominated the market with the highest revenue share of 39.6% owing to advancements in diagnostic technology, increasing demand for accurate and efficient laboratory testing, and rising healthcare expenditures. The growing prevalence of chronic diseases, such as diabetes, cardiovascular conditions, and liver diseases, has driven the need for precise and reliable diagnostic tools to monitor and manage these conditions.

In July 2023, Siemens Healthineers obtained FDA clearance for the Atellica CI Analyzer, making it available in key international markets, including North America. This introduction is anticipated to drive regional market expansion by offering an innovative and dependable solution for clinical diagnostics, particularly for high-volume testing environments.

The Atellica CI Analyzer, known for its speed, accuracy, and ease of use, is expected to enhance testing efficiency and improve patient outcomes, making it a critical addition to healthcare facilities. With increasing investments in healthcare infrastructure and rising demand for personalized and preventive care, the clinical chemistry analyzers market in North America is expected to continue expanding in 2023 and beyond.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

The clinical chemistry analyzers market in Asia Pacific is anticipated to grow rapidly, driven by the rising incidence of chronic diseases and the expansion of healthcare access. This region, including key countries like China, India, and Japan, is experiencing a significant modernization and expansion of healthcare systems. The increasing focus on early disease detection and the demand for high-quality diagnostic services are central to driving this market’s growth.

Improvements in diagnostic technologies and rising public health awareness are enhancing the demand for advanced laboratory equipment in Asia Pacific. Government initiatives aimed at bolstering healthcare infrastructure are also contributing to the market expansion. These factors together are expected to boost the adoption of clinical chemistry analyzers, vital for accurate health assessments.

The market is further propelled by the growing prevalence of metabolic disorders and infectious diseases, alongside an aging population. The shift towards automated and high-throughput clinical chemistry analyzers is streamlining testing processes and enhancing diagnostic accuracy. With ongoing technological advancements, the clinical chemistry analyzers market in this region is poised for considerable growth in the foreseeable future.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the clinical chemistry analyzers market focus on developing high-throughput systems and automated solutions to improve efficiency and accuracy in diagnostic laboratories. Companies invest in R&D to expand assay menus, catering to a wide range of clinical applications, including metabolic, renal, and liver function tests. Collaborations with healthcare institutions and diagnostic centers drive the adoption of advanced technologies.

Geographic expansion into emerging markets with increasing investments in healthcare infrastructure supports market growth. Many players also emphasize user-friendly designs and cost-effective solutions to meet the needs of diverse healthcare settings. Abbott Laboratories is a leading company in this market, offering innovative products like the ARCHITECT and Alinity series of clinical chemistry systems.

The company focuses on combining advanced technology with reliability to deliver precise and efficient diagnostic solutions. Abbott’s global presence and commitment to healthcare innovation solidify its position as a key player in the diagnostics industry.

Top Key Players in the Clinical chemistry analyzers Market

- Thermo Fisher Scientific

- Siemens Healthineers AG

- QuidelOrtho Corporation

- Horiba, Ltd.

- Hoffmann-La Roche Ltd

- ELITech Group

- Danaher Corporation (Beckman Coulter)

- Abbott

Recent Developments

- In July 2023, Beckman Coulter Diagnostics received FDA clearance for the DxC 500 AU Chemistry Analyzer, a fully automated system tailored for small-to-medium-sized laboratories. With standardized assays and Six Sigma performance, the analyzer enhances clinical decision-making, improving patient outcomes through greater efficiency and reliability in diagnostic testing.

- In March 2023, Thermo Fisher Scientific completed its acquisition of The Binding Site Group for £2.3 billion (USD 2.8 billion). This strategic acquisition strengthens Thermo Fisher’s Specialty Diagnostics division, particularly expanding its capabilities in oncology testing, with a focus on multiple myeloma.

- In May 2023, Siemens Healthineers unveiled the Atellica HEMA 570 and 580 Analyzers, optimized for high-throughput hematology testing. These state-of-the-art systems integrate intuitive interfaces, multi-analyzer automation, and rules-based testing to enhance laboratory efficiency and provide swift, reliable results for healthcare providers and patients alike.

Report Scope

Report Features Description Market Value (2024) US$ 13.9 Billion Forecast Revenue (2034) US$ 20.4 Billion CAGR (2025-2034) 3.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Reagents, Analyzers, and Others), By Test Type (Liver Panels, Thyroid Function Panels, Electrolyte Panels, Lipid Profiles, and Others), By End-user (Hospital, Diagnostic Laboratories, and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Thermo Fisher Scientific, Siemens Healthineers AG, QuidelOrtho Corporation, Horiba, Ltd., F. Hoffmann-La Roche Ltd, ELITech Group, Danaher Corporation (Beckman Coulter), and Abbott. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Clinical Chemistry Analyzers MarketPublished date: Jan 2025add_shopping_cartBuy Now get_appDownload Sample

Clinical Chemistry Analyzers MarketPublished date: Jan 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Thermo Fisher Scientific

- Siemens Healthineers AG

- QuidelOrtho Corporation

- Horiba, Ltd.

- Hoffmann-La Roche Ltd

- ELITech Group

- Danaher Corporation (Beckman Coulter)

- Abbott