Global Cerium Market By Type (Cerium Oxide, Cerium Metal, Cerium Fluoride, Cerium Nitrate, Cerium Hydrate, and Others), By Applications (Glass Polishing, Catalysts, Alloys and Metallurgy, IR Optics, and Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034.

- Published date: October 2025

- Report ID: 151050

- Number of Pages: 245

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overviews

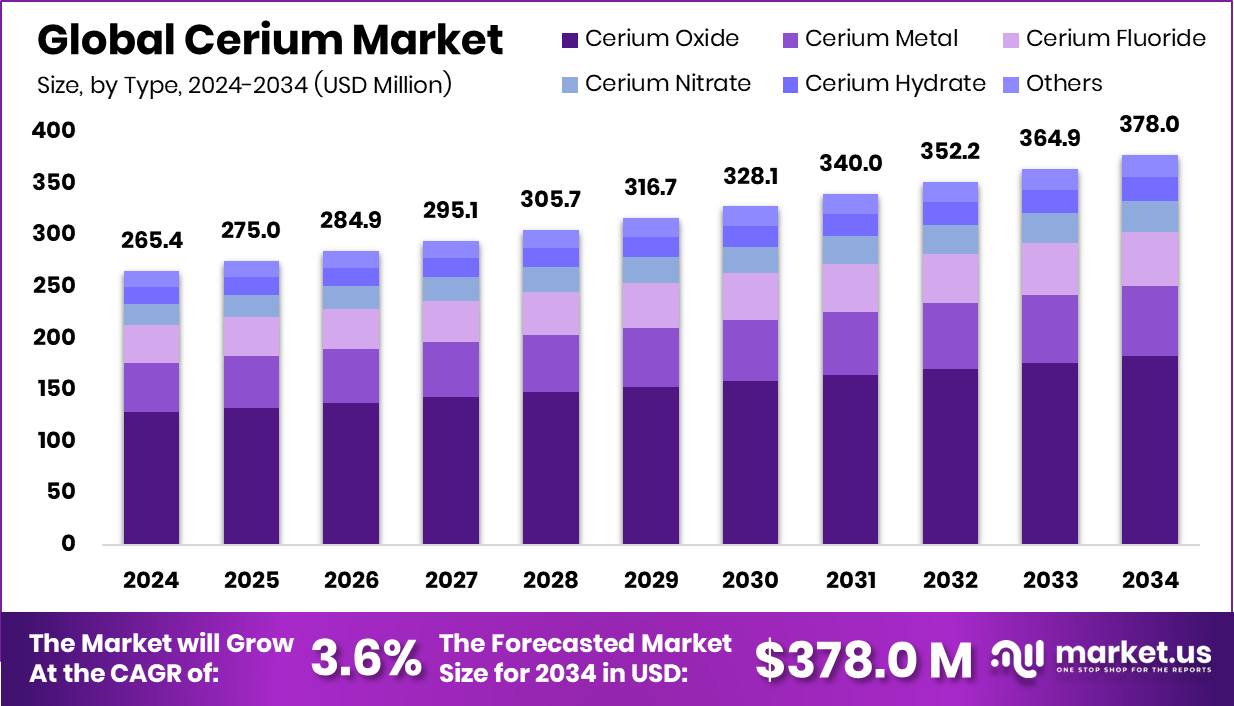

In 2024, the Global Cerium Market was valued at US$265.4 million, and between 2025 and 2034, it is estimated to register a CAGR of 3.6%, reaching approximately US$378.0 million by 2034.

Cerium is the most abundant of the rare earth elements. It is a reactive, grey metal and a member of the lanthanoid group of the periodic table. Additionally, it is the 25th most abundant element within the Earth’s crust. Cerium tarnishes if it is exposed to air and is a highly reactive metal that will burn if scratched with a knife. Additionally, it reacts rapidly with water and dissolves in acids. Due to its reactivity, it is stored in light mineral oil to protect it against oxidation.

Cerium is extracted from the ores Bastnasite and Monazite, and its annual world production is about 24,000 mt. 50-75% of rare-earth content in bastnasite ores is typically made up by lanthanum and cerium, the two most abundant rare-earth elements.

The major driver of the market is its application in glass polishing and as an additive in the ceramic sector. Lanthanum and cerium together account for more than 70% of such ore bodies, but account for less than 10% of the total REEs market value. Due to this, there are rising concerns about the resource management of cerium.

To combat this oversupply, several organizations and government institutions are readily studying the applications of cerium across different countries. As advancements take place, cerium and its compounds are gaining traction in the battery as well as alloy industries.

Key Takeaways

- The global cerium market was valued at US$265.4 million in 2024.

- The global cerium market is projected to grow at a CAGR of 3.6% and is estimated to reach US$378.0 million by 2034.

- Based on types, cerium oxide dominated the market in 2024, comprising about 48.4% share of the total global market.

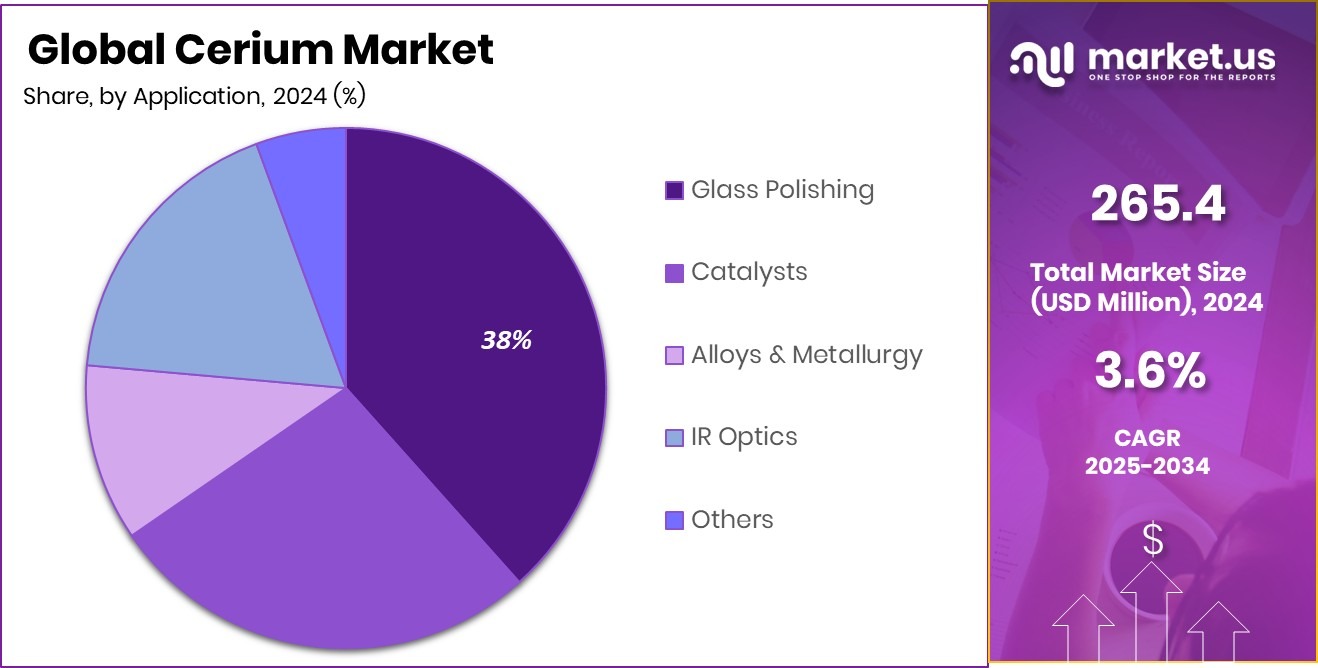

- Among the applications of cerium, the glass polishing industry dominated the market in 2024, accounting for around 38.4% of the market share.

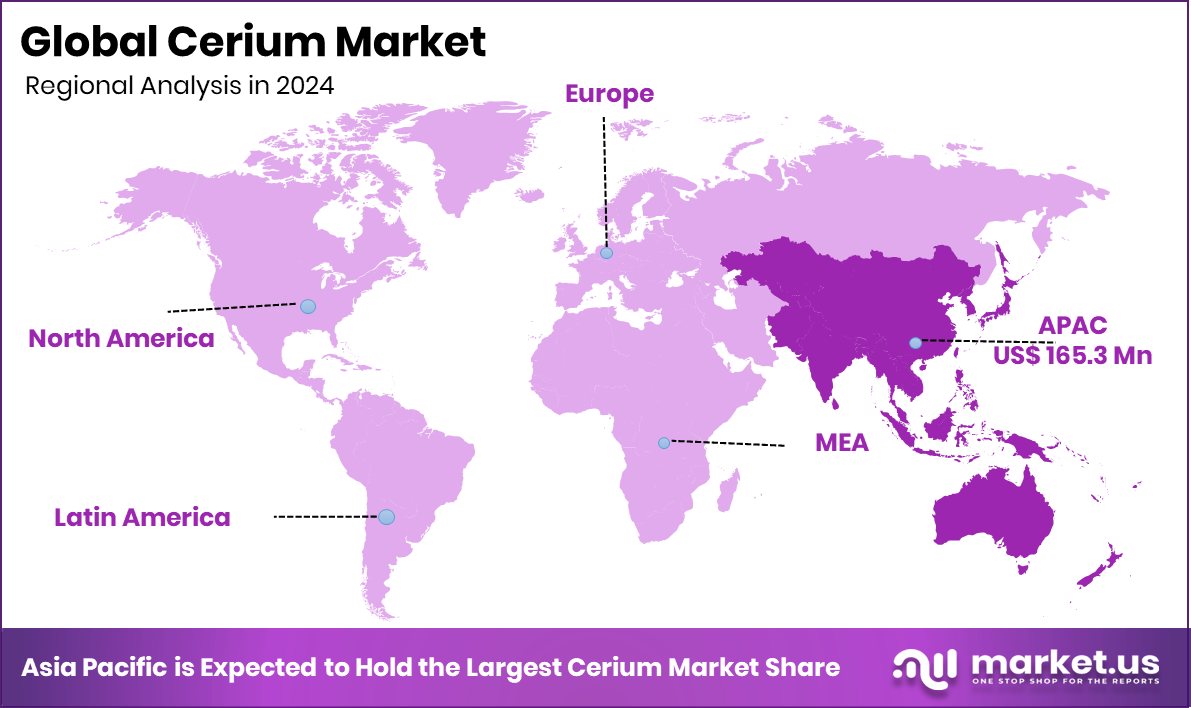

- Asia Pacific was the largest market for cerium in 2024, accounting for around 62.3% of the total global consumption.

Type Analysis

Cerium Oxide Dominated the Market Due to Its Chemical Properties.

On the basis of type, the cerium market is segmented into cerium oxide, cerium metal, cerium fluoride, cerium nitrate, cerium hydrate, and others. Cerium oxide dominated the market in 2024 with a market share of 48.4%. Cerium oxide is preferred over cerium metal and other compounds because its oxide structure provides superior catalytic activity, oxygen storage capacity, polishing capabilities, and stability. The oxide structure of cerium (CeO2) possesses a remarkable ability to store and release oxygen, a key feature for its use in automotive catalysts and other oxidation/reduction processes.

Its unique combination of properties makes it useful in a wide array of applications, including gas sensors, adsorbents, biomedical devices, and as a glass additive to prevent discoloration. While versatile, pure cerium metal is highly reactive and less stable, making it less suitable for applications requiring controlled redox behavior or high thermal stability.

Application Analysis

In 2024, the Glass Polishing Sector Emerged as the Leading Consumer within the Cerium Market.

In 2024, the glass polishing industry emerged as the largest end-use sector for cerium, accounting for nearly 38.4% of the product’s total market share, outperforming sectors such as catalysts, alloys & metallurgy, and IR optics. Most cerium is used in glass polishing because cerium oxide offers superior performance in achieving high-quality, scratch-free finishes on glass surfaces.

Its fine abrasive properties and chemical reactivity allow it to not only polish but also slightly etch the glass, resulting in a smoother and clearer finish compared to traditional abrasives such as iron oxide. This makes it essential for manufacturing precision glass products such as camera lenses, mirrors, LCD panels, and optical instruments. While cerium is also valuable in catalysts, alloys, and infrared optics, these applications use smaller quantities, making glass polishing the dominant end-use due to both volume and efficiency.

Key Market Segments

By Type

- Cerium Oxide

- Cerium Metal

- Cerium Fluoride

- Cerium Nitrate

- Cerium Hydrate

- Others

By Application

- Glass Polishing

- Catalysts

- Alloys and Metallurgy

- IR Optics

- Others

Drivers

Demand for Cerium from the Glass and Ceramic Industry Drives the Market.

The cerium market is significantly driven by strong demand from the glass and ceramics industry due to cerium’s unique chemical and physical properties. Cerium oxide (CeO₂), commonly known as ceria, is extensively used as a polishing agent for glass products, including optical lenses, mirrors, and flat-panel displays. It offers superior polishing performance compared to traditional materials, such as iron oxide, owing to its high polishing efficiency and ability to achieve ultra-smooth surfaces without scratching.

In the ceramics sector, cerium compounds are used as additives to enhance color, thermal stability, and mechanical strength, particularly in high-performance and specialty ceramics. The construction and automotive sectors, both major consumers of glass and ceramics, contribute to this growing demand.

For instance, the widespread use of tempered and laminated glass in buildings and vehicles boosts the need for cerium-based polishing agents. Additionally, the global push toward renewable energy has increased the production of solar panels, further supporting cerium consumption for glass surface treatment.

Restraints

Increasing Concerns on Cerium Resource Management Might Be a Significant Challenge in the Cerium Market.

Lanthanum and cerium, both classified as light rare earth elements, are among the most abundant in rare earth ore deposits, collectively making up over 70% of the composition in many deposits. Despite their abundance, their industrial value remains relatively low compared to heavier rare earth elements such as dysprosium or terbium, leading to a market imbalance. Cerium alone can constitute up to 50% of the total rare earth content in certain ores.

However, its lower demand in high-tech applications has led to a surplus, raising concerns about efficient resource utilization. For instance, while neodymium is heavily used in permanent magnets for electric vehicles and wind turbines, cerium is primarily used in polishing powders and catalytic converters, markets that do not scale proportionally with its supply.

As a result, large volumes of cerium are often stockpiled or underutilized, prompting growing interest in developing new applications, particularly in energy storage technologies, to balance its extraction with consumption.

Opportunity

Application of Cerium in the Battery Industry Creates Opportunities in the Market.

The application of cerium in the battery industry is creating promising opportunities in the cerium market. Cerium is increasingly used in nickel-metal hydride (NiMH) batteries, which are widely utilized in hybrid vehicles and portable electronic devices. Cerium’s ability to improve electrode stability and increase battery lifespan makes it a valuable component in energy storage technologies. For instance, in NiMH batteries, mischmetal, a mixture of rare earth elements including cerium, enhances performance and reduces degradation over repeated charge cycles.

Additionally, in zinc-cerium (Zn-Ce) batteries, which are rechargeable hybrid flow batteries, positive cerium and negative zinc electrolytes are circulated in separate reservoirs. Similarly, aqueous cerium ion batteries (ACIBs) aim to fully utilize cerium’s redox capabilities for energy storage. In the battery sector, NiMH and lithium-ion batteries use cerium on a commercial level, and the use of cerium in Zn-Ce and ACIB batteries is in the research and development phase, showcasing the potential of cerium in the future of batteries.

Trends

Demand for Cerium-Based Alloys.

There is growing demand for cerium-based alloys across various industrial sectors due to their unique properties, such as improved strength, corrosion resistance, and high-temperature stability. In the automotive industry, cerium is used in aluminum alloys to produce lightweight components that help reduce vehicle weight and improve fuel efficiency. Additionally, cerium-containing alloys exhibit better oxidation resistance, making them ideal for exhaust systems and engine parts.

In aerospace, magnesium-cerium alloys are valued for their strength-to-weight ratio and thermal stability, which are critical for aircraft structures and engine components. Moreover, in the metallurgy sector, cerium is used in ferrocerium, commonly known as flint, for lighter ignition systems, owing to its pyrophoric properties.

Furthermore, cerium acts as a deoxidizer and desulfurizer in steelmaking, enhancing the quality and durability of specialty steels. These versatile applications across transportation, defense, and manufacturing highlight the increasing reliance on cerium-based alloys to meet performance and environmental standards in modern engineering.

Geopolitical Impact Analysis

Geopolitical Tensions Leading to Supply Chain Disruptions in the Cerium Market.

Geopolitical tensions have a significant impact on the cerium market, primarily due to the concentration of rare earth element (REE) production in a few key regions. China is the world’s largest producer with an estimated 210,000 tonnes of mined REEs and 175,000 tonnes of refined REEs in 2022, accounting for 70% of global mined production and 87% of global refined production. This heavy reliance makes the global cerium supply chain vulnerable to political and trade disputes. For instance, in past years, export restrictions imposed by China during diplomatic disputes with countries such as Japan and the United States led to sharp price fluctuations and supply shortages.

Western countries are increasingly recognizing the strategic importance of cerium and other REEs, leading to efforts to diversify supply chains and invest in domestic production and recycling. However, these measures take time to develop, leaving the market exposed to short-term geopolitical risks and uncertainty. To combat these vulnerabilities, the Quad Alliance (U.S., India, Japan, and Australia) has collaborated in rare earth supply chains to counterbalance China. Similarly, the EU is exploring partnerships with African and Latin American producers.

Regional Analysis

Asia Pacific was the Largest Market for Cerium in 2024.

Asia Pacific held the major share of the global cerium market, valued at around US$165.3 million, commanding an estimated 62.3% of the total revenue share. The region has emerged as the largest market for cerium, driven by the region’s dominant role in both the production and consumption of rare earth elements. China, in particular, produces over 68% of the world’s cerium. The country is not only the world’s leading producer of cerium but also a major consumer, owing to its extensive manufacturing base across industries such as electronics, automotive, glass, and renewable energy.

Additionally, the demand for cerium oxide in glass polishing and ceramics is especially strong in countries such as China, Japan, and South Korea, where precision glass products and electronics are produced at large scales. Additionally, the growing adoption of hybrid and electric vehicles in the region supports the use of cerium in battery and alloy applications. Furthermore, India has expanded its rare earth processing capabilities and increased the usage of cerium in the metal and chemical sectors. The presence of key end-use industries, coupled with an abundant supply of raw materials, continues to reinforce Asia Pacific’s leadership in the global cerium market.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

There are several major players in the Cerium market, such as Avalon Advanced Materials, American Elements, Central Drug House, China Northern Rare Earth (Group) High-Tech, Chrome Star Chemical Works, Indian Platinum, Lynas Corporation, Mitsui Mining & Smelting, Shepherd Chemical Company, Sichuan Wonaixi New Material Technology, Star Earth Minerals Private Limited, Yiyang Hongyuan Rare Earth, IREL (India) Limited, Canada Rare Earth Corporation, and Nanografi Advanced Materials.

China Northern Rare Earth is a major player in the global rare earth market, including cerium. The company integrates scientific research, development, production, sales, and export of rare earth products in domestic and international markets.

Lynas Corp. is the world’s second-largest producer of separated rare earths, operating the Mt Weld mine in Australia and a processing plant in Malaysia. The company is recognized as a leading supplier of sustainable rare earth materials, holding a unique position as the only significant producer of separated rare earths outside of China.

IREL (India) Limited is an Indian government-owned enterprise under the Department of Atomic Energy that mines and processes rare earth minerals from beach sands, including monazite. At its Rare Earth Metal and Titanium Theme Park in Bhopal, IREL operates facilities to demonstrate the production of cerium metal and other high-purity rare earth metals, promoting their use in domestic industries.

Top Key Players in the Market

- Avalon Advanced Materials

- American Elements

- Central Drug House

- China Northern Rare Earth (Group) High-Tech Co., Ltd

- Chrome Star Chemical Works

- Indian Platinum Pvt. Ltd.

- Lynas Corporation

- Mitsui Mining & Smelting Co., Ltd.

- Shepherd Chemical Company

- Sichuan Wonaixi New Material Technology Co., Ltd.

- Star Earth Minerals Private Limited

- Yiyang Hongyuan Rare Earth Co., Ltd.

- IREL (India) Limited

- Canada Rare Earth Corporation

- Nanografi Advanced Materials

- Other Key Players

Recent Developments

- In January 2025, China Northern Rare Earth announced that the company invested 153 million yuan of its own funds to jointly establish Northern Jinlong (Baotou) Rare Earth, with its associate company, Fujian Jinlong Rare Earth, to construct a 5,000 mt rare earth oxide separation production line.

- In June 2025, IREL (India), the Indian government-run Miniratna PSU, began production of rare earth magnets and metals such as Samarium-Cobalt, Cerium, and Lanthanum, aiming to reduce India’s reliance on Chinese supplies.

Report Scope

Report Features Description Market Value (2024) USD 265.4 Million Forecast Revenue (2034) USD 378.0 Million CAGR (2025-2034) 3.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Cerium Oxide, Cerium Metal, Cerium Fluoride, Cerium Nitrate, Cerium Hydrate, Others), By Applications (Glass Polishing, Catalysts, Alloys & Metallurgy, IR Optics, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Avalon Advanced Materials, American Elements, Central Drug House, China Northern Rare Earth (Group) High-Tech, Chrome Star Chemical Works, Indian Platinum, Lynas Corporation, Mitsui Mining & Smelting Co., Ltd., Shepherd Chemical Company, Sichuan Wonaixi New Material Technology Co., Ltd., Star Earth Minerals Private Limited, Yiyang Hongyuan Rare Earth Co., Ltd., IREL (India) Limited, Canada Rare Earth Corporation, Nanografi Advanced Materials, Other Key Players. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Avalon Advanced Materials

- American Elements

- Central Drug House

- China Northern Rare Earth (Group) High-Tech Co., Ltd

- Chrome Star Chemical Works

- Indian Platinum Pvt. Ltd.

- Lynas Corporation

- Mitsui Mining & Smelting Co., Ltd.

- Shepherd Chemical Company

- Sichuan Wonaixi New Material Technology Co., Ltd.

- Star Earth Minerals Private Limited

- Yiyang Hongyuan Rare Earth Co., Ltd.

- IREL (India) Limited

- Canada Rare Earth Corporation

- Nanografi Advanced Materials

- Other Key Players