Cell Sorting Market By Product Type (Reagents & Consumables, Cell Sorters, and Services), By Technology (Fluorescence-based Droplet Cell Sorting (Jet-in-air Cell Sorting, and Cuvette-based Cell Sorting), MEMS - Microfluidics, and Magnetic-activated Cell Sorting), By Application (Research Applications (Stem Cell Research, Immunology & Cancer Research, Drug Discovery, and Others), and Clinical Applications), By End-user (Research Institutions, Medical Schools & Academic Institutions, Pharmaceutical & Biotechnology Companies, and Hospitals & Clinical Testing Laboratories), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Sep 2025

- Report ID: 159023

- Number of Pages: 344

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

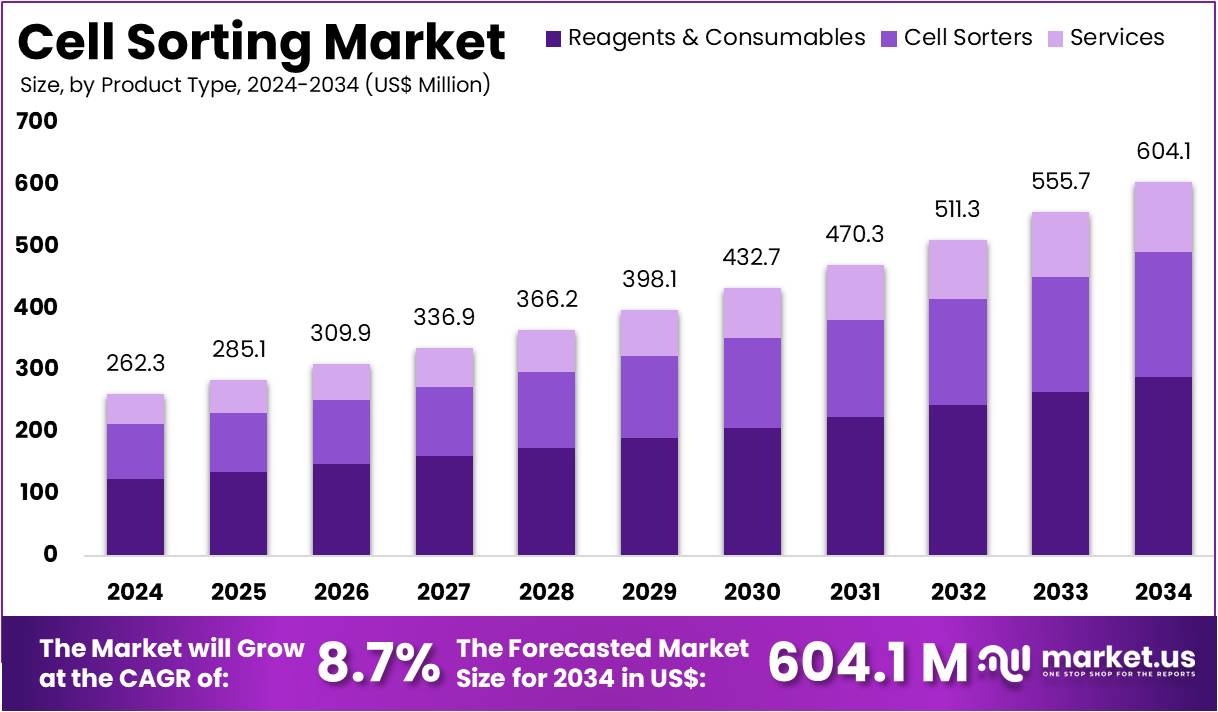

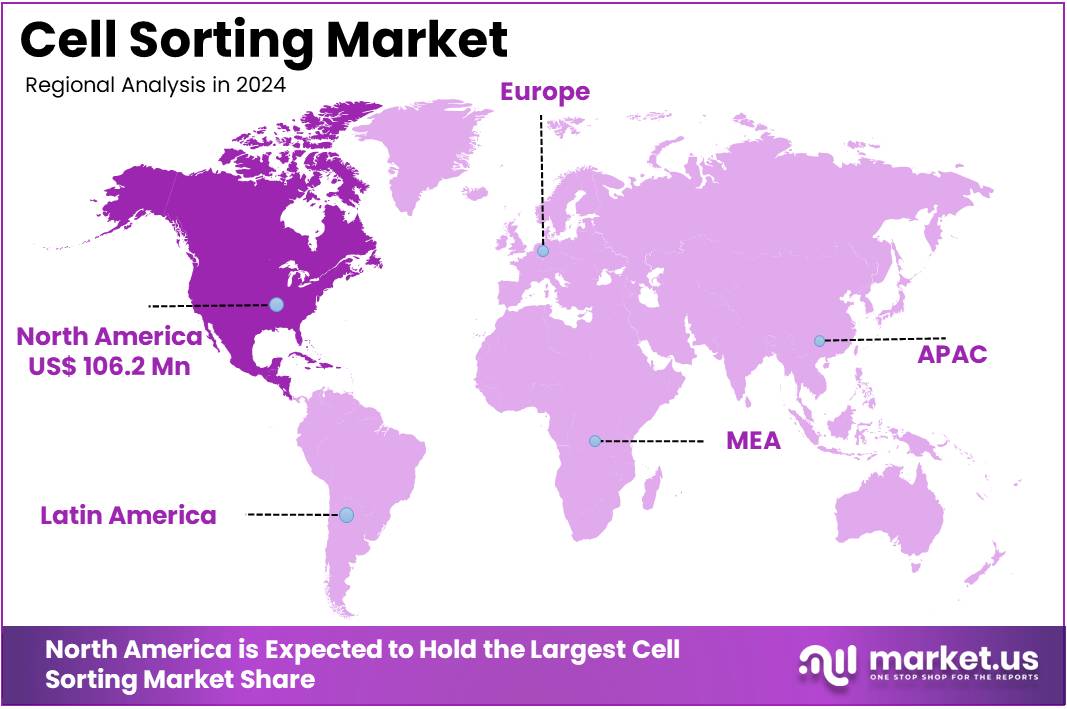

The Cell Sorting Market Size is expected to be worth around US$ 604.1 million by 2034 from US$ 262.3 million in 2024, growing at a CAGR of 8.7% during the forecast period 2025 to 2034. North America held a dominant market position, capturing more than a 40.5% share and holds US$ 106.2 Million market value for the year.

Rising research and development in fields like immunology, oncology, and stem cell biology is a primary driver of the cell sorting market. Cell sorters are indispensable tools that enable researchers to isolate and purify specific cell populations from complex mixtures with high precision, which is critical for therapeutic development and diagnostics.

The Centers for Disease Control and Prevention (CDC) reports that cancer affects millions of people annually, and cell sorting technologies are crucial for understanding tumor heterogeneity and developing targeted immunotherapies like CAR-T cell therapy. This strong link between cell sorting and cutting-edge medical research ensures a consistent demand for advanced sorting equipment across academic and clinical settings.

Growing technological advancements and a shift toward high-parameter analysis are key trends shaping the market. Manufacturers are developing next-generation instruments that can analyze more cellular markers simultaneously, providing researchers with deeper insights into cellular populations. For example, in October 2023, Sony launched the FP7000 Spectral Cell Sorter, an advanced instrument capable of handling six lasers and 182 detectors. This enables detailed cellular analysis across diverse research panels, accelerating discoveries in immunology and molecular biology. The drive toward high-throughput and multi-parameter analysis is crucial for applications such as single-cell genomics, where the heterogeneity of individual cells in a population is a focus.

Increasing strategic partnerships and research funding are creating significant opportunities for market expansion. Governments and private entities are investing heavily in projects that rely on cell sorting to advance biomedical science. The National Institutes of Health (NIH) has funded multiple initiatives aimed at advancing single-cell analysis technologies, underscoring the importance of these tools in uncovering fundamental biological principles. Moreover, with over 3,700 cell and gene therapies in clinical and preclinical development as of early 2023, according to a report from the National Center for Biotechnology Information, the need for robust cell sorting capabilities will continue to grow. This robust funding and active pipeline of cell-based therapies ensures sustained market growth.

Key Takeaways

- In 2024, the market generated a revenue of US$ 262.3 million, with a CAGR of 8.7%, and is expected to reach US$ 604.1 million by the year 2034.

- The product type segment is divided into reagents & consumables, cell sorters, and services, with reagents & consumables taking the lead in 2023 with a market share of 47.8%.

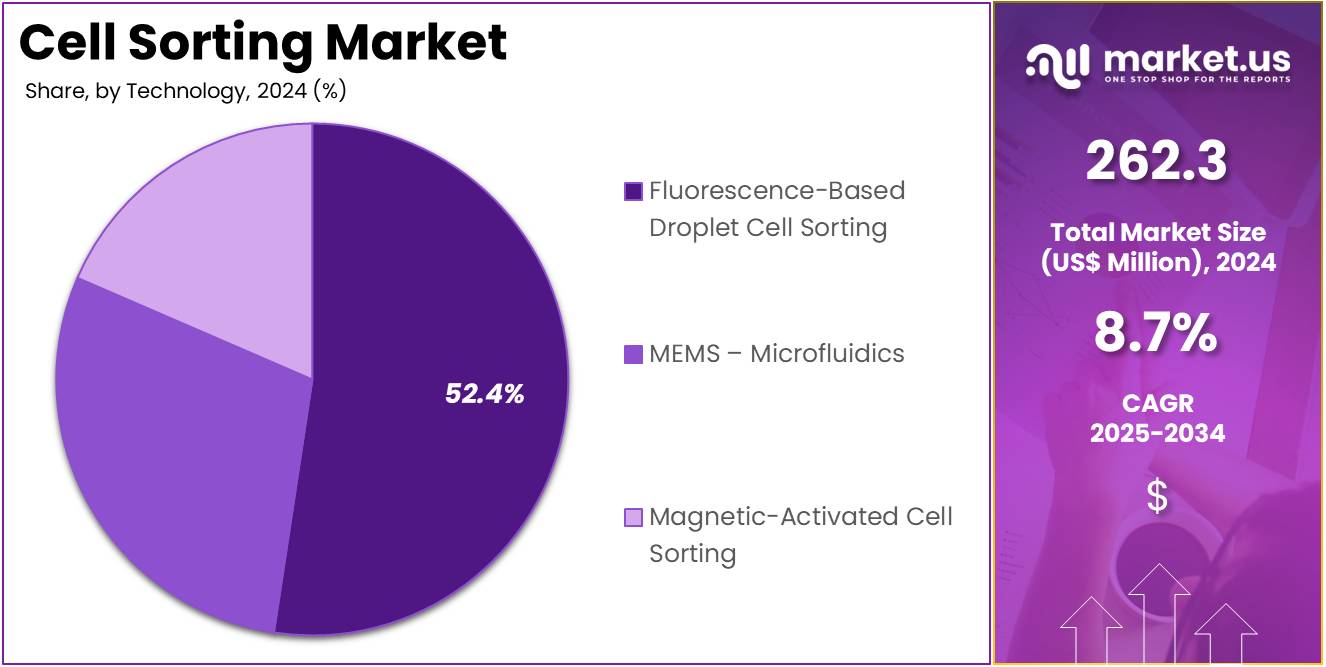

- Considering technology, the market is divided into fluorescence-based droplet cell sorting, MEMS – microfluidics, and magnetic-activated cell sorting. Among these, fluorescence-based droplet cell sorting held a significant share of 52.4%.

- Furthermore, concerning the application segment, the market is segregated into research applications and clinical applications. The research applications sector stands out as the dominant player, holding the largest revenue share of 58.2% in the market.

- The end-user segment is segregated into research institutions, medical schools & academic institutions, pharmaceutical & biotechnology companies, and hospitals & clinical testing laboratories, with the research institutions segment leading the market, holding a revenue share of 49.6%.

- North America led the market by securing a market share of 40.5% in 2023.

Product Type Analysis

Reagents and consumables dominate with a 47.8% share due to their essential role in cell sorting protocols. Research laboratories are anticipated to drive demand for antibodies, staining dyes, and buffer solutions. Consumables such as tubes and microplates are projected to witness recurring purchases. Companies like BD Biosciences and Thermo Fisher Scientific are expected to expand reagent portfolios. Increasing research funding is likely to support high reagent consumption. Fluorescence-tagged antibodies are projected to fuel adoption. High reproducibility in experiments is likely to encourage consistent reagent use.

Laboratories are anticipated to invest in quality-certified consumables. Expansion of single-cell research is expected to increase reagent demand. Integration with automated workflows is projected to improve efficiency. Academic collaborations are likely to promote standardized reagents. Advanced consumables for rare cell isolation are expected to grow. Training and technical support from manufacturers are projected to enhance adoption. Reagents tailored for multi-parameter analysis are likely to increase. Stringent quality standards are anticipated to ensure regulatory compliance. Overall, reagents and consumables are projected to grow due to consistent demand, high research activity, and technological integration.

Technology Analysis

Fluorescence-based droplet cell sorting leads with a 52.4% share due to high precision and multi-parameter analysis capabilities. Laboratories are projected to adopt droplet-based systems for single-cell research. The technology is anticipated to improve detection sensitivity. Companies such as Sony Biotechnology and BD Biosciences are likely to innovate with faster sorting speeds. Integration with fluorescent antibodies is projected to enhance specificity. High throughput and reduced sample loss are expected to drive adoption. Academic and pharmaceutical labs are likely to favor this technology for immunology studies.

Automated droplet sorting is anticipated to optimize workflow efficiency. Clinical research collaborations are projected to increase utilization. Multi-color analysis is likely to expand application scope. Reagent compatibility is anticipated to attract researchers. System miniaturization and portability are projected to encourage adoption.

Fluorescence-based systems are likely to enhance data reproducibility. Single-cell sequencing integration is projected to fuel market growth. Training programs by manufacturers are anticipated to support widespread use. Overall, this technology is expected to dominate due to precision, versatility, and ongoing innovation.

Application Analysis

Research applications dominate with a 58.2% share as single-cell and multi-omics studies accelerate globally. Academic and industrial laboratories are projected to drive growth. Cell sorting is anticipated to enhance studies in immunology, stem cell biology, and cancer research. Funding from NIH, EU Horizon, and similar programs is likely to support expansion. Pharmaceutical R&D is projected to adopt sorting for drug discovery. Integration with flow cytometry and genomics is expected to improve efficiency. Preclinical studies are anticipated to increase reliance on precise cell separation.

Lab collaborations are projected to expand application breadth. Customized reagents and workflows are likely to support specific research needs. High demand for live cell isolation is anticipated to fuel adoption. Publications highlighting novel findings are expected to boost awareness. Single-cell RNA sequencing integration is projected to accelerate usage. Cross-institutional projects are likely to standardize methods. Overall, research applications are expected to grow due to scientific innovation, funding, and technology integration.

End-User Analysis

Research institutions lead end-users with a 49.6% share driven by continuous investment in life sciences. Universities and government labs are projected to expand facilities. Institutions are anticipated to adopt cell sorting for high-throughput and single-cell studies. Funding from bodies such as the NIH and Wellcome Trust is likely to support growth. Core facilities are projected to increase access to advanced sorters. Institutional collaborations are expected to optimize resource utilization. Training programs are likely to improve technical adoption.

Research institutions are projected to prioritize high-precision technologies. Integration with academic projects in genomics and immunology is anticipated to drive demand. Reagents and consumables procurement is likely to grow steadily. Expansion of multi-disciplinary labs is expected to enhance adoption. Peer-reviewed studies are projected to validate methods. Institutions are likely to implement quality control standards. Overall, research institutions are expected to dominate due to consistent funding, academic priorities, and high throughput needs.

Key Market Segments

By Product Type

- Reagents & Consumables

- Cell Sorters

- Services

By Technology

- Fluorescence-based Droplet Cell Sorting

- Jet-in-air Cell Sorting

- Cuvette-based Cell Sorting

- MEMS – Microfluidics

- Magnetic-activated Cell Sorting

By Application

- Research Applications

- Stem Cell Research

- Immunology & Cancer Research

- Drug Discovery

- Others

- Clinical Applications

By End-user

- Research Institutions

- Medical Schools & Academic Institutions

- Pharmaceutical & Biotechnology Companies

- Hospitals & Clinical Testing Laboratories

Drivers

The increasing prevalence of chronic diseases and cancer research initiatives are driving the market

The cell sorting market is experiencing significant growth, primarily driven by the escalating number of research initiatives focused on chronic diseases and cancer. Researchers are increasingly relying on cell sorting technologies to isolate specific cell populations for in-depth study, drug development, and disease diagnostics. These technologies are crucial for understanding the complex cellular mechanisms underlying various conditions, from autoimmune disorders to malignant tumors.

The demand for precise and efficient cell isolation is a fundamental requirement for advancing personalized medicine and developing targeted therapies. The National Cancer Institute (NCI)’s annual report to the nation on cancer for 2024 highlights this trend, with federal funding for cancer research and prevention reaching US$7.3 billion in fiscal year 2023. This substantial and consistent government investment in life sciences research provides a strong financial impetus for the development and adoption of advanced cell sorting instruments.

Restraints

The high cost of instrumentation and operational complexity are restraining the market

A significant restraint on the cell sorting market is the substantial capital expenditure required to acquire advanced instruments and the subsequent operational costs. High-end cell sorters, which offer superior speed and purity, can be prohibitively expensive for smaller academic labs, emerging biotechnology companies, and institutions with limited budgets. The cost of the instrument itself is only one part of the equation, as ongoing expenses for consumables, specialized reagents, and maintenance contracts add to the total cost of ownership.

Furthermore, these sophisticated machines require highly skilled operators with specialized training to run the instruments, perform quality control, and analyze the data correctly. According to the Bureau of Labor Statistics (BLS), the median annual wage for medical and clinical laboratory technologists and technicians was US$ 61,890 in May 2024, a figure that illustrates the considerable cost of employing specialized personnel. This combination of high equipment costs and the need for skilled labor creates a considerable barrier to entry and market adoption.

Opportunities

The expansion into regenerative medicine and stem cell therapies is creating growth opportunities

The cell sorting market is presented with significant opportunities through its increasing integration into emerging therapeutic fields, particularly regenerative medicine and stem cell therapies. These cutting-edge treatments require the isolation of specific cell types, such as mesenchymal stem cells or hematopoietic stem cells, from a heterogeneous population for clinical application. Cell sorters enable the precise purification of these cells to a high degree of purity and viability, a critical step for ensuring the safety and efficacy of the final therapeutic product.

The number of clinical trials in this space is a clear indicator of this growing opportunity. The US National Library of Medicine’s ClinicalTrials.gov database shows a significant increase in the number of actively recruiting and completed clinical studies for stem cell-based therapies. For example, as of June 2024, there were over 2,000 registered clinical trials in the US utilizing stem cells, highlighting the immense research and commercial focus on this field, which directly translates to a greater demand for cell sorting technologies.

Impact of Macroeconomic / Geopolitical Factors

The cell sorting market is facing macroeconomic and geopolitical factors that challenge its supply chain stability and research funding. US government support for this sector is robust; for example, the National Institutes of Health (NIH) allocated over US$1.7 billion to cellular therapy research in 2024, reflecting a strong commitment to scientific innovation.

However, geopolitical tensions add significant costs. While tariffs on specific cell sorters vary, the US has imposed a 25% duty on imported laboratory instruments from China. This directly increases the procurement cost for research institutions and private labs. Despite these headwinds, the market’s fundamental drivers remain strong.

ClinicalTrials.gov, the world’s largest clinical trial registry, recorded over 2,200 new cell-based therapy studies in 2024 alone, signaling sustained demand for advanced cell analysis tools. This continued investment in cutting-edge research, coupled with manufacturers’ efforts to diversify their supplier networks, ensures the sector’s long-term prosperity.

Latest Trends

The development of microfluidics-based and miniaturized sorters is a recent trend

A significant trend in 2024 is the accelerated development and commercialization of microfluidics-based and miniaturized cell sorting devices. Traditional cell sorters are large, expensive, and require a dedicated lab space, but the new generation of instruments is changing this paradigm. These technologies leverage microfluidic chips to perform sorting in a compact, benchtop format, making them more accessible and affordable for a wider range of laboratories. This innovation is expanding the use of cell sorting beyond large research institutions and into smaller academic labs and even point-of-care settings.

The rapid pace of innovation is reflected in intellectual property filings. A review of the US Patent and Trademark Office (USPTO)’s public search database for 2023 and 2024 reveals a noticeable increase in the number of patents issued for technologies related to microfluidic cell sorting and lab-on-a-chip devices. This trend signifies a major shift toward decentralized, high-throughput, and user-friendly cell sorting, which is poised to democratize access to this critical technology.

Regional Analysis

North America is leading the Cell Sorting Market

The North American cell sorting market held a significant 40.5% share of the global market in 2024. This leadership is directly attributed to the region’s highly advanced biomedical research ecosystem, robust government funding, and a high prevalence of chronic diseases. Public funding from sources like the National Institutes of Health (NIH) has been a powerful catalyst, with the organization allocating a budget of approximately US$47.7 billion in 2023 to support a wide range of biomedical research, a significant portion of which involves cellular analysis. This sustained investment fosters innovation and drives the adoption of new, sophisticated cell sorting technologies.

Furthermore, the substantial burden of chronic diseases, such as cancer, fuels a critical need for precise diagnostics and targeted therapeutics. The International Agency for Research on Cancer (IARC) reported that in 2022, Northern America had an estimated 2.67 million new cancer cases, creating a large and consistent demand for instruments that isolate specific cell populations for both research and clinical applications.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

The Asia Pacific region is expected to experience significant growth, driven by increasing government investment and advancements in biotechnology. Several governments across the region are actively prioritizing life sciences research and development, a trend that is likely to fuel the demand for sophisticated laboratory tools. For example, in 2024, India’s government sanctioned US$120 million to boost biotech-associated manufacturing and employment, as per recent reports. This type of strategic funding supports research and clinical applications where advanced cell analysis is crucial.

Similarly, China is estimated to lead the region with escalating R&D, where a report indicates Chinese biotechs developed over 600 first-in-class drug candidates between 2022 and 2024. These innovations, particularly in oncology and immunology, require high-precision equipment to isolate specific cell populations. In a parallel development, Japan is also a key player, with a strong focus on regenerative medicine and stem cell research. Sony, a key player in the sector, expanded its microfluidics-based cell sorter offerings in 2024 for clinical and research use, specifically targeting these applications. Such developments are anticipated to boost the market growth in this region during the forecast period.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the cell sorting market are driving growth by leveraging technological advancements like machine learning and artificial intelligence to automate processes and improve data analysis. They are also actively engaged in strategic collaborations, mergers, and acquisitions to expand their portfolios and gain access to new technologies, such as microfluidics and single-cell genomics platforms.

Companies further focus on developing user-friendly, benchtop systems that make the technology more accessible to a wider range of laboratories, thereby expanding their customer base. This combination of innovation and business development is crucial for maintaining a competitive edge in this dynamic field.

Becton, Dickinson and Company (BD) has established a dominant position in the sector through its Biosciences segment. The company’s business model is centered on a deep commitment to scientific innovation, providing a comprehensive portfolio of instruments and reagents for research and clinical applications.

BD’s strategy involves continuously investing in its R&D pipeline to develop high-throughput and multi-parameter systems, such as the BD FACSymphony, while also leveraging its global distribution network to ensure widespread product availability. The company’s focus on creating integrated, end-to-end solutions for its customers has solidified its role as a foundational partner in the life sciences and diagnostics sectors.

Recent Developments

- In August 2024: Bio-Rad Laboratories named Jon DiVincenzo as President and COO, succeeding Andy Last upon his retirement. DiVincenzo’s extensive experience in life sciences and clinical diagnostics is expected to drive operational efficiency and support strategic growth initiatives across the company’s global operations.

- In April 2024: BD introduced the FACSDiscover S8 Cell Sorter, a high-performance platform that allows researchers to identify and separate specific cell populations with precision. The system is designed to streamline complex laboratory workflows and enhance the accuracy of biological analyses worldwide.

Top Key Players in the Cell Sorting Market

- Union Biometrica, Inc.

- uFluidix

- Thermo Fisher Scientific Inc.

- Sony Group Corporation

- On-chip Biotechnologies Co., Ltd.

- Miltenyi Biotec

- Danaher Corporation

- Cytonome/ST, LLC

- Bio-Rad Laboratories, Inc.

- BD

Report Scope

Report Features Description Market Value (2024) US$ 262.3 million Forecast Revenue (2034) US$ 604.1 million CAGR (2025-2034) 8.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Reagents & Consumables, Cell Sorters, and Services), By Technology (Fluorescence-based Droplet Cell Sorting (Jet-in-air Cell Sorting, and Cuvette-based Cell Sorting), MEMS – Microfluidics, and Magnetic-activated Cell Sorting), By Application (Research Applications (Stem Cell Research, Immunology & Cancer Research, Drug Discovery, and Others), and Clinical Applications), By End-user (Research Institutions, Medical Schools & Academic Institutions, Pharmaceutical & Biotechnology Companies, and Hospitals & Clinical Testing Laboratories) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Union Biometrica, Inc., uFluidix, Thermo Fisher Scientific Inc., Sony Group Corporation, On-chip Biotechnologies Co., Ltd., Miltenyi Biotec, Danaher Corporation, Cytonome/ST, LLC, Bio-Rad Laboratories, Inc., BD. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Union Biometrica, Inc.

- uFluidix

- Thermo Fisher Scientific Inc.

- Sony Group Corporation

- On-chip Biotechnologies Co., Ltd.

- Miltenyi Biotec

- Danaher Corporation

- Cytonome/ST, LLC

- Bio-Rad Laboratories, Inc.

- BD