Global Butyl Rubber Market By Products (Regular Butyl, Bromo Butyl, Chloro Butyl), By Application (Tires and Lubes, Adhesives, Sealants, Stoppers, Industrial and Medical Gloves, Others), By End-use (Automotive, Pharmaceutical, Consumer, Construction, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: July 2025

- Report ID: 151878

- Number of Pages: 366

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

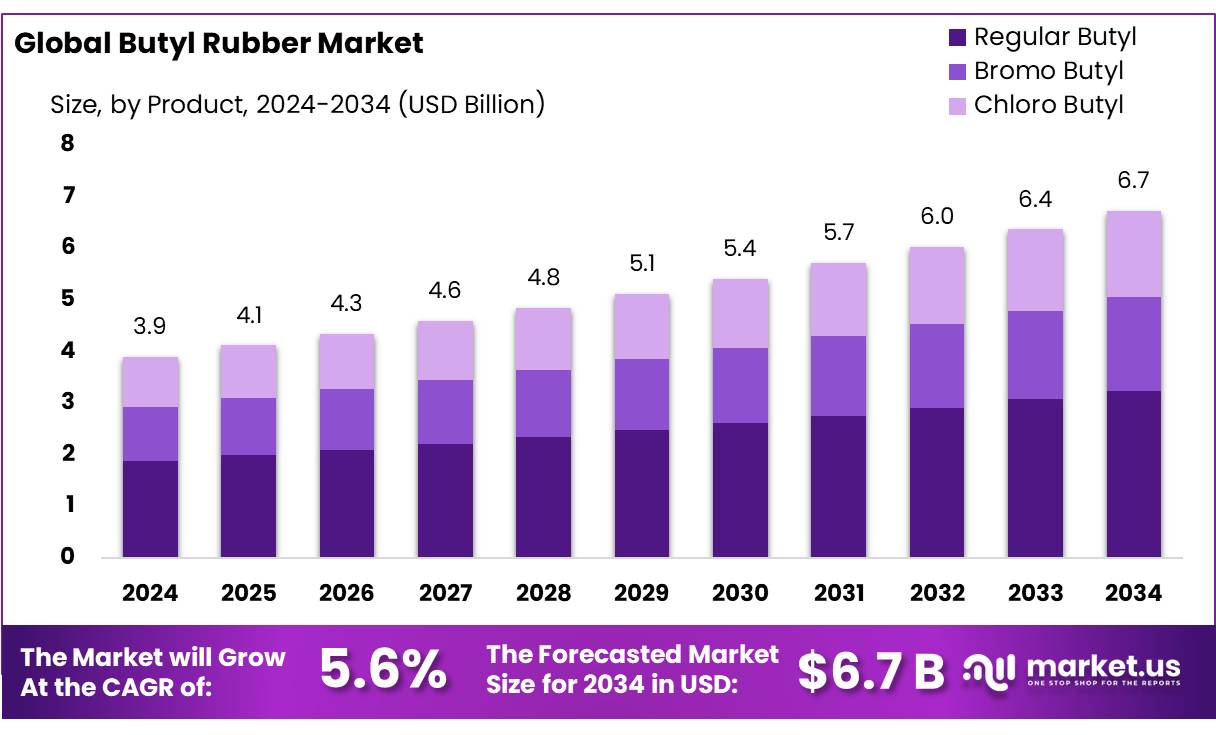

The Global Butyl Rubber Market size is expected to be worth around USD 6.7 Billion by 2034, from USD 3.9 Billion in 2024, growing at a CAGR of 5.6% during the forecast period from 2025 to 2034.

Butyl rubber concentrates are specialized synthetic elastomers derived from the copolymerization of approximately 98% isobutylene with 2% isoprene. This combination yields a product characterized by low gas permeability, high resilience, and superior resistance to heat, ozone, and chemicals, making it indispensable in multiple high-performance applications, including tire inner liners, industrial sealants, pharmaceutical closures, and insulation materials

Demand is primarily propelled by the automotive sector, where butyl rubber’s low air permeability and heat resistance offer significant performance advantages in tire and inner-liner systems. Nearly halobutyl variants are now standard for tubeless tire inner-lining due to improved curing rates and bonding with natural rubber.

Government initiatives play a pivotal role in fostering the growth of the butyl rubber industry. The establishment of Reliance Sibur Elastomers Private Limited, a joint venture between Reliance Industries and SIBUR, has significantly bolstered domestic production capabilities. Located in Jamnagar, Gujarat, this facility boasts an annual production capacity of 120,000 metric tonnes of butyl rubber, aiming to reduce India’s dependency on imports. Furthermore, the Indian government’s allocation of INR 18,000 crores to enhance public bus transportation infrastructure is expected to stimulate demand for butyl rubber in the automotive sector.

Several government initiatives underpin the resilience and expansion of the sector. The Government of India under the 12th Five-Year Plan increased planting subsidy for natural rubber cultivation to INR 25,000 per ha in traditional regions and INR 35,000 per ha in non traditional areas. Furthermore, policy frameworks such as Make in India and Atmanirbhar Bharat have incentivized synthetic rubber production, with over INR 4,000 crore invested in facilities such as Reliance-Sibur Elastomers Pvt. Ltd.

Key Takeaways

- Butyl Rubber Market size is expected to be worth around USD 6.7 Billion by 2034, from USD 3.9 Billion in 2024, growing at a CAGR of 5.6%.

- Regular Butyl held a dominant market position, capturing more than a 48.2% share of the global butyl rubber market.

- Tires & Tubes held a dominant market position, capturing more than a 59.7% share of the global butyl rubber market.

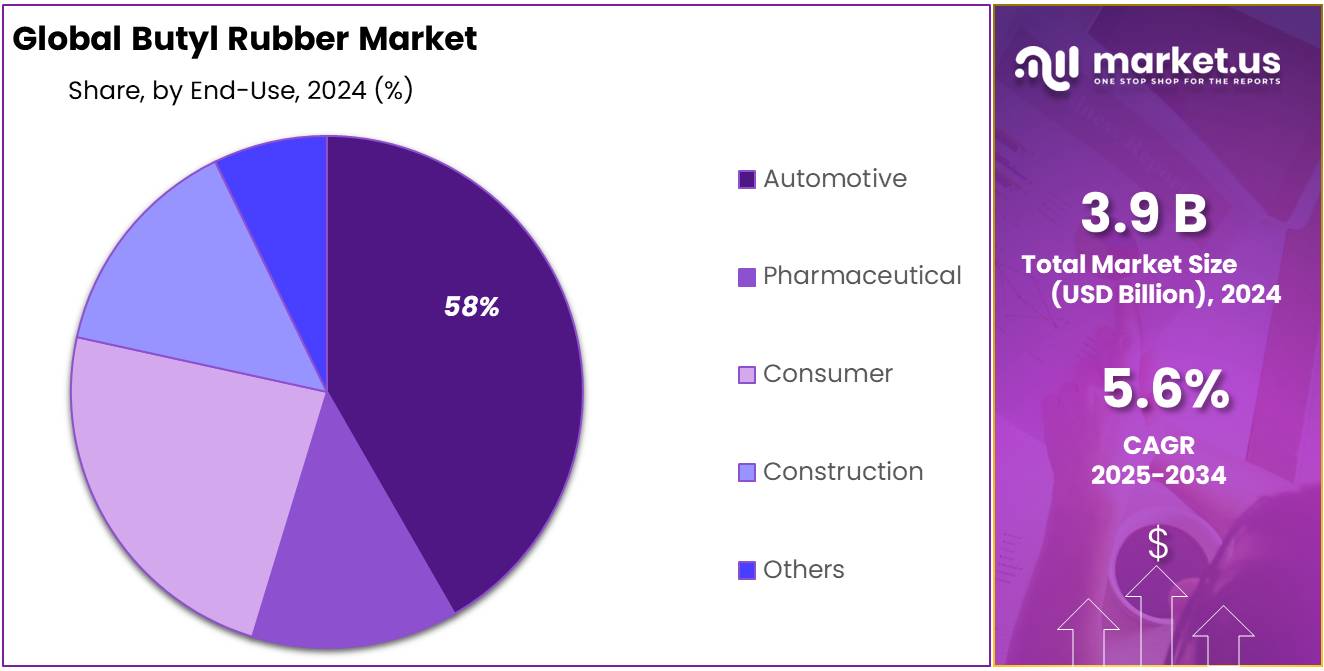

- Automotive held a dominant market position, capturing more than a 58.9% share in the global butyl rubber market.

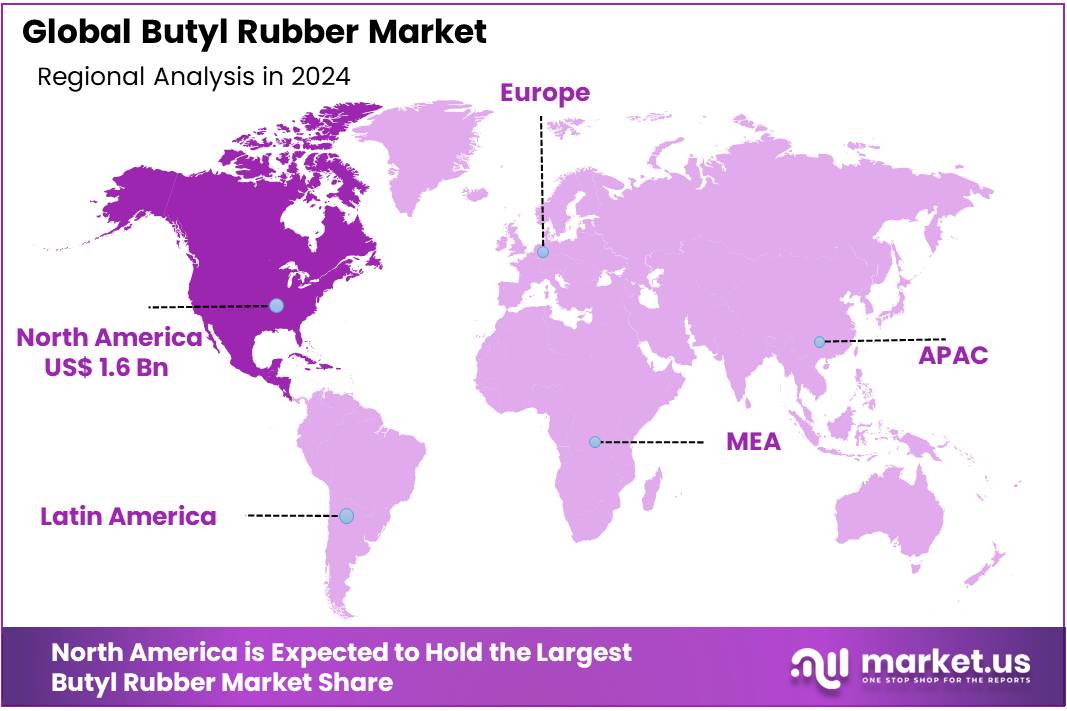

- North America emerged as the dominant region in the butyl rubber market, registering a substantial 43.2% market share—equivalent to approximately USD 1.6 billion.

By Products

Regular Butyl dominates with 48.2% share in 2024 due to its versatile sealing and air-retention properties.

In 2024, Regular Butyl held a dominant market position, capturing more than a 48.2% share of the global butyl rubber market. This strong performance is largely attributed to its excellent impermeability to air and moisture, which makes it ideal for tire inner liners, sealants, and various industrial applications. Regular Butyl continues to be the preferred choice in the automotive industry due to its durability, low gas permeability, and strong resistance to heat and chemicals.

These characteristics not only support tire efficiency but also extend product life, making it a reliable and cost-effective solution for manufacturers. As industries such as construction, pharmaceuticals, and adhesives seek consistent sealing performance, the demand for Regular Butyl has remained steady through 2024 and is expected to maintain momentum in 2025. Its broad compatibility with manufacturing processes and low maintenance needs further solidify its role as a key product segment within the butyl rubber market.

By Application

Tires & Tubes lead with 59.7% share in 2024 as demand rises in automotive and transport sectors.

In 2024, Tires & Tubes held a dominant market position, capturing more than a 59.7% share of the global butyl rubber market. This strong performance is mainly driven by the growing use of butyl rubber in tire inner liners and inner tubes, thanks to its exceptional air retention, elasticity, and heat resistance. The automotive industry’s continued growth, particularly in emerging markets, has led to a sharp increase in tire production, further boosting the demand for butyl rubber. Commercial vehicles, passenger cars, and two-wheelers increasingly rely on butyl-based components to improve fuel efficiency and ensure long-term durability.

In 2025, this trend is expected to continue, with steady investments in mobility infrastructure and rising vehicle ownership across Asia-Pacific and Latin America. Moreover, the shift toward tubeless tires in both personal and commercial transport segments is reinforcing the relevance of butyl rubber in this application. Its performance under extreme weather and road conditions makes it a reliable material, keeping Tires & Tubes the most significant and steady-growing segment in the overall market.

By End-use

Automotive dominates with 58.9% share in 2024 due to strong demand for durable and airtight materials in vehicles.

In 2024, Automotive held a dominant market position, capturing more than a 58.9% share in the global butyl rubber market. This dominance comes from the material’s widespread use in vehicle components such as tire inner liners, tubes, gaskets, hoses, and seals. Butyl rubber is especially valued in the automotive industry for its ability to resist air, moisture, and heat—key features that help extend tire life, reduce maintenance, and improve fuel efficiency. As global vehicle production continues to climb, especially in Asia-Pacific and Latin America, the demand for reliable rubber materials like butyl has risen sharply.

In 2025, this trend is likely to strengthen, with more carmakers focusing on performance and safety standards that require advanced rubber solutions. Additionally, the increasing popularity of electric vehicles, which demand high-performance sealing systems for battery packs and thermal insulation, further supports the segment’s growth. Automotive manufacturers prefer butyl rubber because of its long-lasting performance under extreme driving conditions, ensuring both safety and comfort. As the need for durable and airtight materials grows across vehicle platforms, the Automotive segment is set to remain the largest end-use sector in the butyl rubber market.

Key Market Segments

By Products

- Regular Butyl

- Bromo Butyl

- Chloro Butyl

By Application

- Tires & Lubes

- Adhesives, Sealants, Stoppers

- Industrial & Medical Gloves

- Others

By End-use

- Automotive

- Pharmaceutical

- Consumer

- Construction

- Others

Drivers

Strong Growth in Food & Beverage Packaging Driving Butyl Rubber Adoption

Butyl rubber, with its excellent barrier properties against air, moisture, and gases, stands out as an ideal material for food-grade closures, liners, and seals. Its non-toxic nature and low permeability ensure food freshness, thereby preventing spoilage and extending shelf life. Manufacturers of beverages, dairy products, and packaged foods increasingly choose butyl-based seals to meet stringent regulatory and quality standards enforced by authorities such as the Food Safety and Standards Authority of India (FSSAI).

Government-backed initiatives are also reinforcing this trend. The Indian Institute of Packaging (IIP), operating under the Ministry of Commerce, has enhanced its focus on packaging standards and education with a nationwide certificate program launched in 2024. Furthermore, the ‘Ecomark’ certification—upgraded in 2024 under the LiFE mission—encourages manufacturers to adopt sustainable and eco-friendly packaging materials, covering plastic products and packaging materials among its categories. Such regulations are prompting food companies to integrate higher-grade sealing materials, including butyl rubber, to achieve compliance and environmental recognition.

The rising importance of cold-chain logistics adds further impetus. The National Centre for Cold-chain Development (NCCD) indicates that 18%–40% of perishable food is lost annually in India due to inadequate packaging. To address this loss, improved sealing and insulation—where butyl rubber plays a pivotal role—are being prioritized in refrigerated transport and storage solutions. Corresponding subsidies and grants, part of government efforts to boost cold chain infrastructure, are indirectly stimulating demand for material components like butyl rubber.

Restraints

Raw Material Price Instability Restricts Butyl Rubber Growth

However, shifting prices for key feedstocks such as isobutylene, isoprene, and petroleum-derived intermediates can abruptly inflate production expenses. According to industry observations, uncertainty in oil prices—used in synthesising these feedstocks—adds risk to operational budgets and often discourages manufacturers from expanding capacity or investing in R&D.

The cost impact extends beyond butyl rubber to indirectly affect the food packaging sector, where butyl-based sealing solutions are often used. For example, nitrile butadiene rubber (NBR), a related synthetic material, saw a 20% surge in price during mid-2024. While this increase did not involve butyl rubber directly, it signals potential price escalations across rubber supply chains—a reality that packaging firms and food manufacturers may need to absorb. Higher rubber prices can reduce margins for producers of food packaging closures, seals, and liners that use butyl compounds.

Government responses have aimed to stabilise such cost fluctuations, but their effects remain moderate. In India, the Food Safety and Standards Authority of India (FSSAI), operating under the Food Safety and Standards Act of 2006, oversees packaging material standards to ensure safety and compliance . Though these regulations strengthen consumer protection, they entail added certification processes and testing requirements.

Consequently, manufacturers face increased regulatory compliance expenditure that compounds the burden of raw material cost volatility. Packaging firms are obliged to invest in certified testing facilities, documentation, and audits per FSSAI mandates—expenses that are not easily passed on to end consumers.

Opportunity

Rising Cold-Chain Demand Opens New Butyl Rubber Markets

The rapid growth of India’s cold-chain infrastructure is offering a significant growth opportunity for butyl rubber, especially in the food and beverage sector. According to the Food and Agriculture Organization of the United Nations, approximately 1.3 billion tonnes of food—about one-third of all food produced globally—is wasted each year, largely due to poor temperature control during storage and transport. This stark figure underlines the urgent need for improved packaging and sealing materials in cold-chain logistics.

Butyl rubber’s superior gas-barrier and moisture-resistant properties make it ideally suited for sealing applications in cold-chain packaging—such as liners, closures, seals, and gaskets—helping to preserve product quality, reduce spoilage, and extend shelf life. These applications address waste reduction directly, aligning with sustainability goals and cost-saving mandates across the supply chain.

The Indian government has recognized the critical importance of cold-chain infrastructure. The Ministry of Food Processing Industries has sanctioned over 250 cold-chain projects under the Pradhan Mantri Kisan SAMPADA Yojana, with an overall outlay of INR 6,000 crore to strengthen storage and logistics facilities. Additionally, the National Centre for Cold chain Development (NCCD)—a nodal body under the Ministry of Agriculture—has championed policies encouraging public private partnerships, providing grants, subsidies, and technical standards to improve sealing materials and packaging systems.

Trends

Surge in Coated Butyl Rubber Stoppers Opens New Pharmacy & Food Packaging Channels

A key trend shaping the butyl rubber market is the rising demand for coated butyl rubber stoppers in pharmaceutical and food-grade applications. In 2024, the Asia Pacific coated butyl rubber stopper market was valued at USD 1.2 billion, reflecting its growing adoption in vaccine, injectable, and food packaging sectors. This uptake is driven by global health priorities and stringent hygiene standards.

Government and regulatory bodies are reinforcing this shift. The Food Safety and Standards Authority of India (FSSAI) upgraded packaging material regulations under its 2018-2025 framework, mandating compliance with mechanical, chemical, and thermal safety tests. Moreover, in April 2025, FSSAI officially approved recycled PET (rPET) for food-grade packaging—evidence of growing focus on material safety and sustainable compliance. Coated butyl rubber, with its inert profile, aligns well with these standards and may pair with new PET-based systems, making it an appealing choice for manufacturers.

Regional Analysis

North America leads with a 43.2% share (USD 1.6 billion) in 2024, driven by strong automotive and pharmaceutical demand.

In 2024, North America emerged as the dominant region in the butyl rubber market, registering a substantial 43.2% market share—equivalent to approximately USD 1.6 billion. This leading position is supported by two major pillars: the well-established automotive sector and extensive pharmaceutical infrastructure. Butyl rubber’s superior air-tight, chemical-resistant, and weather-proof qualities make it a preferred material for tire inner liners, gaskets, sealants, and pharmaceutical vial stoppers—applications where performance integrity is critical.

Moreover, North America’s advanced medical and healthcare supply chains underpin the need for high-quality butyl rubber in sterile packaging and closures. The region’s pharmaceutical stoppers and seals segment has grown steadily, reflecting investments in research, clinical trials, and drug manufacturing. Government support—such as US incentives for electric vehicles totaling USD 13 billion in plant conversion loans—has further strengthened butyl usage in automotive and battery sealing systems.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Arlanxeo, a leading synthetic rubber producer headquartered in the Netherlands, is a joint venture between Saudi Aramco and LANXESS. It plays a major role in the global butyl rubber market through its advanced bromobutyl and chlorobutyl rubber products. The company focuses on innovation and sustainability, catering to the automotive, pharmaceutical, and industrial sectors. Its strong R&D capabilities and global production footprint allow it to meet growing demand across North America, Europe, and Asia-Pacific efficiently and competitively.

China Petrochemical Corporation, commonly known as Sinopec, is one of the world’s largest integrated energy and chemical companies. It is a key player in China’s synthetic rubber industry, including butyl rubber, serving domestic automotive and packaging markets. Through its subsidiary Sinopec Baling Petrochemical, the company has scaled up butyl rubber production to support the country’s industrial self-reliance goals. Sinopec benefits from state-backed investments and policy incentives, strengthening its position in both domestic supply and export markets.

ENEOS Corporation, headquartered in Japan, is a significant contributor to the butyl rubber industry through its petrochemical business segment. Known for its high-purity and specialty-grade synthetic rubbers, ENEOS supports sectors such as automotive, medical packaging, and industrial components. Its production is closely aligned with Japan’s focus on high-performance materials and quality standards. As Japan pushes for eco-friendly and value-added materials, ENEOS continues to invest in efficient manufacturing and R&D to maintain its competitive edge in Asia.

Top Key Players in the Market

- Arlanxeo

- China Petrochemical Corporation

- ENEOS Corporation

- Exxon Mobil Corporation

- Formosa Synthetic Rubber

- Huntsman International LLC.

- JSR Corporation

- Kiran Rubber Industries

- LANXESS

- Reliance Industries Limited

- SABIC

- SIBUR Holding

- The Goodyear Tire & Rubber Company

- Timco Rubber

- Veolia

Recent Developments

In February 2024, ExxonMobil’s affiliate expanded its Kashima plant in Japan by 10,000 tonnes per year, reinforcing its ability to meet rising demand for halobutyl grades.

In 2024 Formosa Synthetic Rubber Corporation, operated a plant in Ningbo, China, with an annual production capacity of 100,000 metric tons of butyl rubber. This facility primarily produces regular butyl rubber, which is widely used in tire manufacturing, medical closures, and sealants.

Report Scope

Report Features Description Market Value (2024) USD 3.9 Bn Forecast Revenue (2034) USD 6.7 Bn CAGR (2025-2034) 5.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Products (Regular Butyl, Bromo Butyl, Chloro Butyl), By Application (Tires and Lubes, Adhesives, Sealants, Stoppers, Industrial and Medical Gloves, Others), By End-use (Automotive, Pharmaceutical, Consumer, Construction, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Arlanxeo, China Petrochemical Corporation, ENEOS Corporation, Exxon Mobil Corporation, Formosa Synthetic Rubber, Huntsman International LLC., JSR Corporation, Kiran Rubber Industries, LANXESS, Reliance Industries Limited, SABIC, SIBUR Holding, The Goodyear Tire & Rubber Company, Timco Rubber, Veolia Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Arlanxeo

- China Petrochemical Corporation

- ENEOS Corporation

- Exxon Mobil Corporation

- Formosa Synthetic Rubber

- Huntsman International LLC.

- JSR Corporation

- Kiran Rubber Industries

- LANXESS

- Reliance Industries Limited

- SABIC

- SIBUR Holding

- The Goodyear Tire & Rubber Company

- Timco Rubber

- Veolia