Global Buttermilk Powder Market Size, Share, And Business Benefits By Nature (Organic, Conventional), By Application (Bakery and Confectionery, Soups and Sauces, Dairy Products, Others), By End-use (Foodservice, Household), By Distribution Channel (Hypermarkets and Supermarkets, Convenience stores, Online, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: September 2025

- Report ID: 159235

- Number of Pages: 217

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

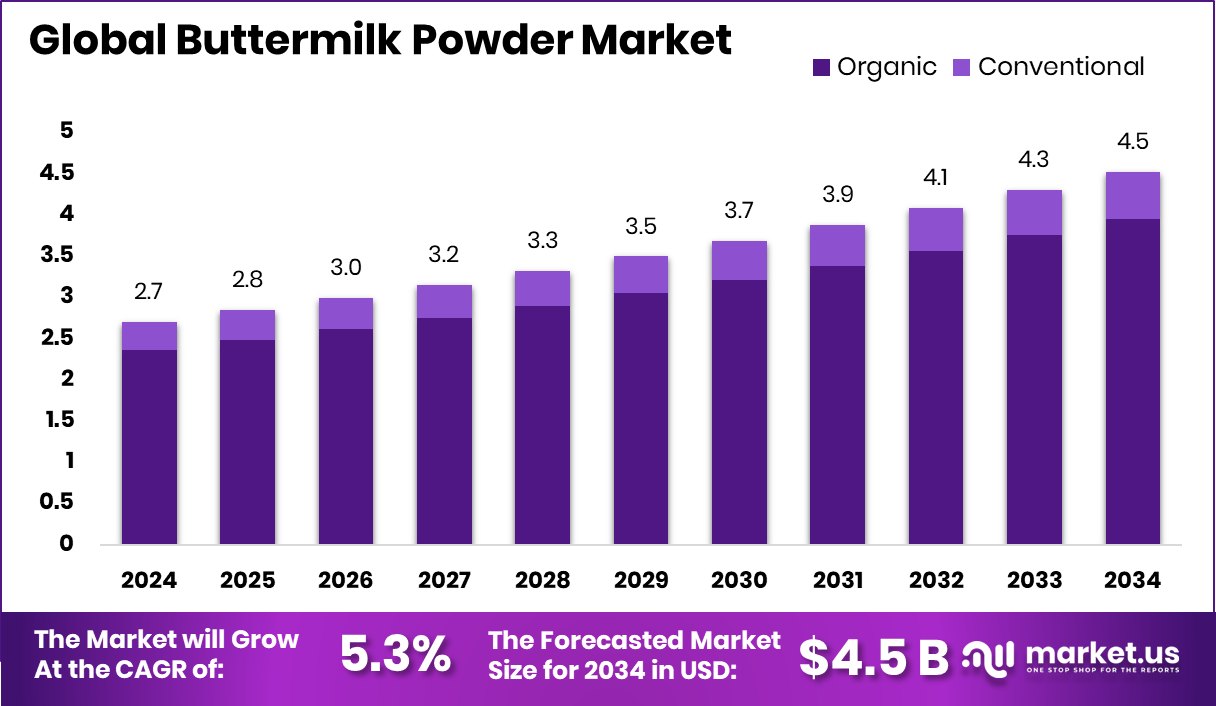

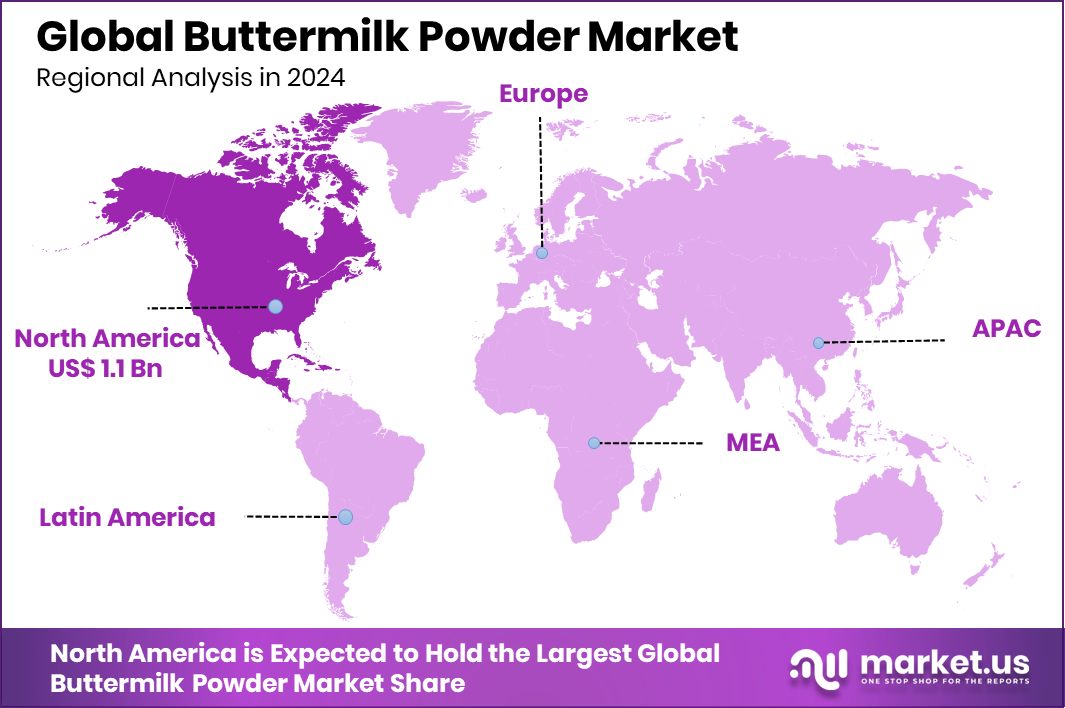

The Global Buttermilk Powder Market is expected to be worth around USD 4.5 billion by 2034, up from USD 2.7 billion in 2024, and is projected to grow at a CAGR of 5.3% from 2025 to 2034. North America led the Buttermilk Powder Market at 42.8% share, achieving a USD 1.1 Bn valuation.

Buttermilk powder is a dehydrated form of buttermilk, produced by removing the moisture from liquid buttermilk. This process results in a shelf-stable product that retains the nutritional benefits and tangy flavor of fresh buttermilk. It’s widely used in the food industry, particularly in bakery products, dairy items, and snacks, due to its convenience and long shelf life.

The rapid expansion of the food processing industry has significantly contributed to the growth of the buttermilk powder market. As consumers increasingly seek convenient and shelf-stable dairy products, buttermilk powder serves as an ideal ingredient, offering both flavor and nutritional benefits without the need for refrigeration. Additionally, advancements in spray drying technology have enhanced the production efficiency and quality of buttermilk powder, further driving market growth.

The demand for buttermilk powder is primarily driven by its versatility and functional properties. In the bakery sector, it enhances the texture and moisture retention of products like cakes and bread. In dairy products, it imparts a creamy consistency and tangy flavor. Moreover, the growing preference for clean-label and natural ingredients among consumers has bolstered the demand for buttermilk powder as a wholesome additive in various food products.

There is a significant opportunity in the development of organic and non-GMO buttermilk powder variants to cater to the rising health-conscious consumer base. Furthermore, the expansion of e-commerce platforms presents a new avenue for reaching a broader audience, allowing manufacturers to tap into markets previously inaccessible through traditional retail channels. Innovative packaging solutions that extend shelf life and preserve product quality also offer opportunities for differentiation in the competitive market.

The Indian government has recognized the importance of the dairy sector and has implemented initiatives to support its growth. Programs like the Dairy Processing & Infrastructure Development Fund (DIDF), established with a corpus of ₹8,004 crore, aim to modernize dairy infrastructure and promote value-added dairy products. Such support is instrumental in enhancing the production capabilities of buttermilk powder and ensuring its availability in the market.

Key Takeaways

- The Global Buttermilk Powder Market is expected to be worth around USD 4.5 billion by 2034, up from USD 2.7 billion in 2024, and is projected to grow at a CAGR of 5.3% from 2025 to 2034.

- The buttermilk powder market is dominated by organic products, accounting for 87.3% of sales.

- Bakery and confectionery applications lead the buttermilk powder market, representing 42.5% of usage globally.

- Foodservice remains the largest end-use segment in the buttermilk powder market, covering 68.9% of demand.

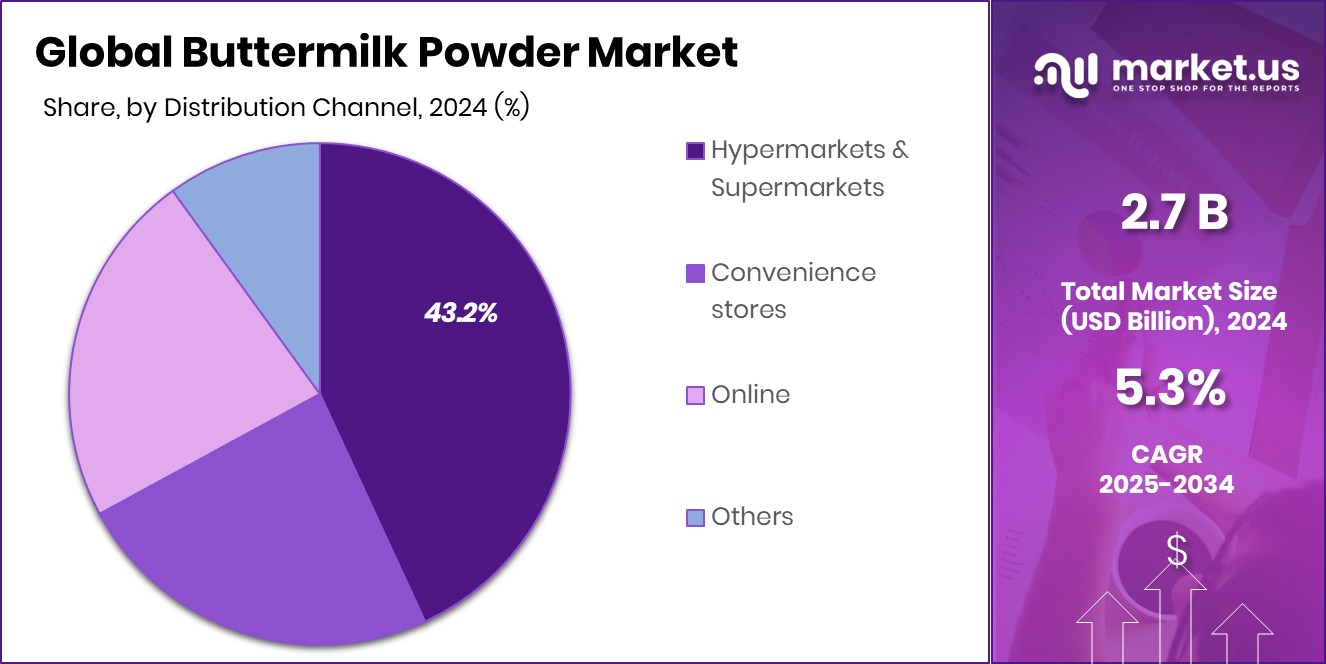

- Hypermarkets and supermarkets drive buttermilk powder market growth, contributing 43.2% of overall distribution sales.

- Strong demand in North America, with a 42.8% share, pushed the Buttermilk Powder Market to USD 1.1 Bn.

By Nature Analysis

The buttermilk powder market shows an 87.3% share in the organic product segment.

In 2024, Organic held a dominant market position in the By Nature segment of the Buttermilk Powder Market, with an 87.3% share. This strong preference for organic buttermilk powder reflects the growing consumer inclination towards natural and clean-label food products that are perceived as healthier and safer.

Organic buttermilk powder is widely used in bakery products, dairy items, and snacks due to its nutritional benefits and consistent quality. The high adoption rate is also supported by increased awareness about the harmful effects of additives and synthetic ingredients. Government initiatives promoting organic farming and value-added dairy products have further strengthened the market for organic buttermilk powder, making it the preferred choice among manufacturers and consumers alike.

By Application Analysis

Bakery and confectionery applications account for 42.5% of the buttermilk powder market.

In 2024, Bakery and Confectionery held a dominant market position in the By Application segment of the Buttermilk Powder Market, with a 42.5% share. The widespread use of buttermilk powder in this segment is driven by its ability to enhance texture, flavor, and moisture retention in baked goods such as cakes, bread, and pastries.

Manufacturers prefer it for its consistent quality, long shelf life, and ease of use compared to liquid buttermilk. Growing consumer demand for indulgent and freshly baked products has further fueled its adoption in the bakery and confectionery sector. Additionally, government support for dairy value addition and infrastructure development has enabled producers to supply high-quality buttermilk powder, strengthening its dominance in this application segment.

By End-use Analysis

Foodservice end-use dominates with 68.9% in the buttermilk powder market growth.

In 2024, Foodservice held a dominant market position in the by-end-use segment of the Buttermilk Powder Market, with a 68.9% share. The high adoption in foodservice is attributed to the product’s convenience, long shelf life, and ease of storage, making it ideal for restaurants, cafes, and catering services.

Buttermilk powder enhances the taste, texture, and consistency of a wide range of dishes, including baked goods, sauces, and beverages, which aligns with the demand for high-quality and consistent food preparation in commercial kitchens. Additionally, government initiatives supporting the dairy sector and value-added products have enabled foodservice operators to access reliable, high-quality buttermilk powder, further consolidating its dominant position in this end-use segment.

By Distribution Channel Analysis

Hypermarkets and supermarkets hold a 43.2% share in the buttermilk powder market distribution.

In 2024, Hypermarkets and Supermarkets held a dominant market position in the By Distribution Channel segment of the buttermilk powder market, with a 43.2% share. The strong presence of buttermilk powder in these retail outlets is driven by the convenience of one-stop shopping, wide product visibility, and the ability to reach a large consumer base. Retailers benefit from organized supply chains and attractive shelf placements, which help in promoting premium and value-added dairy products like buttermilk powder.

Growing consumer preference for ready-to-use and shelf-stable ingredients has further strengthened this channel. Additionally, government programs supporting dairy infrastructure and organized retail expansion have enabled better distribution and availability, reinforcing the dominance of hypermarkets and supermarkets in this segment.

Key Market Segments

By Nature

- Organic

- Conventional

By Application

- Bakery and Confectionery

- Soups and Sauces

- Dairy Products

- Others

By End-use

- Foodservice

- Household

By Distribution Channel

- Hypermarkets and Supermarkets

- Convenience stores

- Online

- Others

Driving Factors

Government Support Boosts Dairy Processing Infrastructure

The Indian government’s commitment to enhancing the dairy sector is evident through substantial funding initiatives aimed at modernizing dairy processing infrastructure. In 2024, the Dairy Processing and Infrastructure Development Fund (DIDF) was merged with the Animal Husbandry Infrastructure Development Fund (AHIDF), creating a unified scheme with an extended budget of ₹29,110.25 crore for the period 2024–2026. This consolidation aims to streamline financial support for the development of dairy processing facilities, including those producing value-added products like buttermilk powder.

Additionally, the Revised National Program for Dairy Development (NPDD) received an additional budget of ₹1,000 crore, bringing the total to ₹2,790 crore for the 15th Finance Commission period (2021–2026). This program focuses on improving milk procurement, processing capacity, and quality control, thereby enhancing the overall dairy supply chain.

These government initiatives provide dairy cooperatives and farmers with access to low-interest loans and grants, facilitating the establishment and modernization of dairy processing units. Such support is crucial for scaling up the production of value-added dairy products, including buttermilk powder, thereby strengthening the dairy sector’s contribution to the economy.

Restraining Factors

High Production Costs Limit Buttermilk Powder Growth

The production of buttermilk powder involves complex processes such as pasteurization, homogenization, and spray drying, which require significant investment in specialized equipment and skilled labor. These high production costs make it challenging for smaller manufacturers to compete, limiting the expansion of the market. Additionally, maintaining product quality and shelf stability demands continuous monitoring and energy-intensive processes, further adding to expenses.

Fluctuating raw milk prices can also increase operational costs, affecting profit margins. While consumer demand is rising, the financial burden of producing high-quality buttermilk powder can slow market growth. Without adequate support or subsidies, some producers may struggle to scale operations or enter new markets, restraining the overall development of the buttermilk powder industry.

Growth Opportunity

Rising Health Trends Boost Buttermilk Powder Demand

The growing focus on health and wellness presents a major growth opportunity for the buttermilk powder market. Consumers are increasingly seeking natural, nutrient-rich ingredients to include in their diets, and buttermilk powder fits this demand with its protein content, probiotics, and ease of use in cooking and baking. The trend towards home-prepared and clean-label foods is also driving adoption, as seen in investments like Buttermilk Home selling for $31.5 million, Awake Chocolate securing $5.8 million, and Win-Win raising $4 million for cocoa-free chocolate collaborations with Martin Braun-Gruppe.

These investments highlight consumer interest in innovative, health-focused products that incorporate dairy ingredients. With government schemes supporting dairy infrastructure and value-added product development, manufacturers can expand production and introduce new buttermilk-based offerings to meet rising consumer demand.

Latest Trends

Clean-Label and Natural Ingredients Drive Demand

A significant trend in the buttermilk powder market is the growing consumer preference for clean-label and natural ingredients. As people become more health-conscious, they seek products with minimal processing and recognizable components. Buttermilk powder, being a natural dairy product without artificial additives, aligns well with this demand.

Its versatility in various applications, from bakery items to beverages, further enhances its appeal. Manufacturers are responding by emphasizing the purity and simplicity of their buttermilk powder offerings, catering to the clean-label trend. This shift not only meets consumer expectations but also opens new market opportunities for producers who prioritize transparency and quality in their products.

Regional Analysis

In 2024, North America held a 42.8% share of the Buttermilk Powder Market, worth USD 1.1 Bn.

In 2024, the regional landscape for the Buttermilk Powder Market shows distinct demand patterns across North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America. North America is the dominating region, holding 42.8% of the market and valued at USD 1.1 Bn, driven by strong foodservice demand, advanced cold chain and processing infrastructure, and robust retail penetration.

Europe demonstrates steady adoption through bakery and dairy reformulation trends, supported by stringent food safety standards and growing consumer interest in clean-label ingredients.

Asia Pacific exhibits rapid uptake as urbanization, expanding quick-service restaurants, and rising disposable incomes boost demand for shelf-stable dairy ingredients and localized value-added formulations.

Middle East & Africa see niche growth driven by foodservice expansion and import-led supply chains, while Latin America’s market is supported by traditional dairy consumption and rising industrialization of food processing. Across regions, two common enablers are increased product innovation—such as powdered ingredient blends for convenience—and improving logistics that reduce wastage and extend reach.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Agropur is a significant player in the North American dairy industry, processing over 6.6 billion liters of milk annually across its 32 plants. This extensive processing capacity supports its production of buttermilk powder, catering to the growing demand for dairy ingredients in various food applications

Fonterra Co-operative Group Limited, based in New Zealand, operates one of the largest dairy processing sites globally at Whareroa, processing up to 12.5 million liters of milk per day. This facility contributes significantly to Fonterra’s production of buttermilk powder, which is utilized in products like evaporated and UHT milks, enhancing their heat stability and emulsifying properties

Dairy Farmers of America (DFA) is a leading dairy cooperative in the United States, with a vast manufacturing network strategically located near its farmer-owners. This proximity ensures a steady supply of high-quality milk for its buttermilk powder production, which is essential for applications in baking, sauces, and dressings.

Top Key Players in the Market

- Agropur

- Fonterra Co-operative Group Limited

- Dairy Farmers of America, Inc.

- Arla Foods Ingredients Group P/S

- North Cork Creameries Ltd

- NOW Foods

- NUMIDIA BV

- California Dairies, Inc

- Valio Oy

- UELZENA eG

Recent Developments

- In August 2025, DFA acquired W&W Dairy, a company based in Monroe, Wisconsin. This acquisition includes the W&W Dairy business, its licensed brands, and the manufacturing facility in Monroe, which produces a variety of Hispanic cheese products, including queso fresco, cotija, queso blanco, quesadilla, panela, and para freir. This move allows DFA to diversify its product offerings and enhance its presence in the Hispanic cheese market.

- In September 2024, Fonterra announced an investment of approximately $150 million in a new cool store at its Whareroa site in Taranaki. This facility is expected to enhance the company’s storage and distribution capabilities, supporting the efficient delivery of its dairy products, including buttermilk powder, to global markets.

Report Scope

Report Features Description Market Value (2024) USD 2.7 Billion Forecast Revenue (2034) USD 4.5 Billion CAGR (2025-2034) 5.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Nature (Organic, Conventional), By Application (Bakery and Confectionery, Soups and Sauces, Dairy Products, Others), By End-use (Foodservice, Household), By Distribution Channel (Hypermarkets and Supermarkets, Convenience stores, Online, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Agropur, Fonterra Co-operative Group Limited, Dairy Farmers of America, Inc., Arla Foods Ingredients Group P/S, North Cork Creameries Ltd, NOW Foods, NUMIDIA BV, California Dairies, Inc, Valio Oy, UELZENA eG Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Buttermilk Powder MarketPublished date: September 2025add_shopping_cartBuy Now get_appDownload Sample

Buttermilk Powder MarketPublished date: September 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Agropur

- Fonterra Co-operative Group Limited

- Dairy Farmers of America, Inc.

- Arla Foods Ingredients Group P/S

- North Cork Creameries Ltd

- NOW Foods

- NUMIDIA BV

- California Dairies, Inc

- Valio Oy

- UELZENA eG