Global Brazed Plate Heat Exchanger Market Size, Share and Report Analysis By Product (Single Circuit, Multi Circuit), By Application (Evaporator, Condenser, Economizer), By End-use (HVAC-R, Chemical And Petrochemical, Food And Beverage, Power Generation, Heavy Industry, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Jan 2026

- Report ID: 175199

- Number of Pages: 321

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

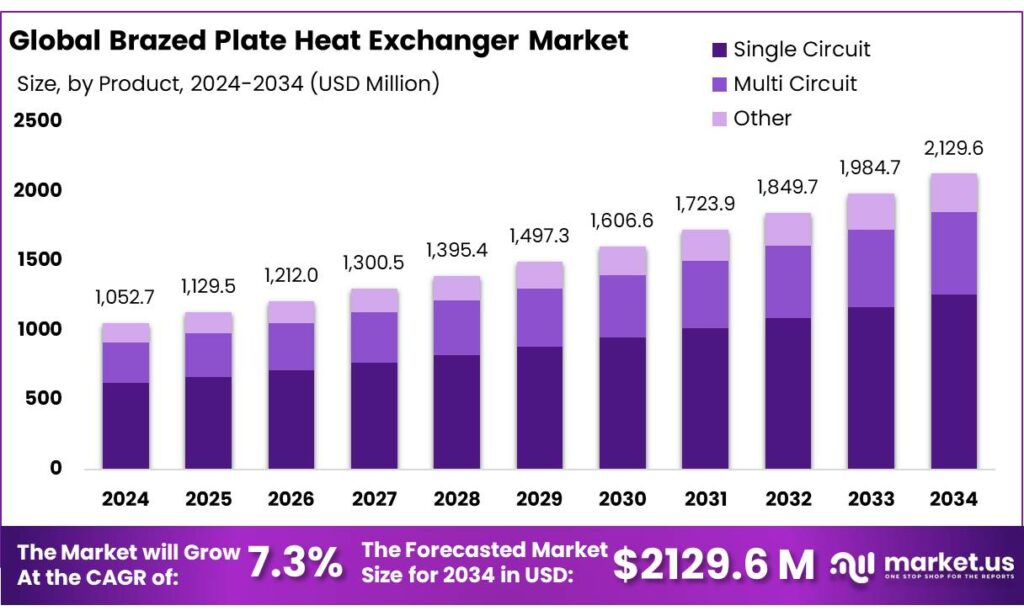

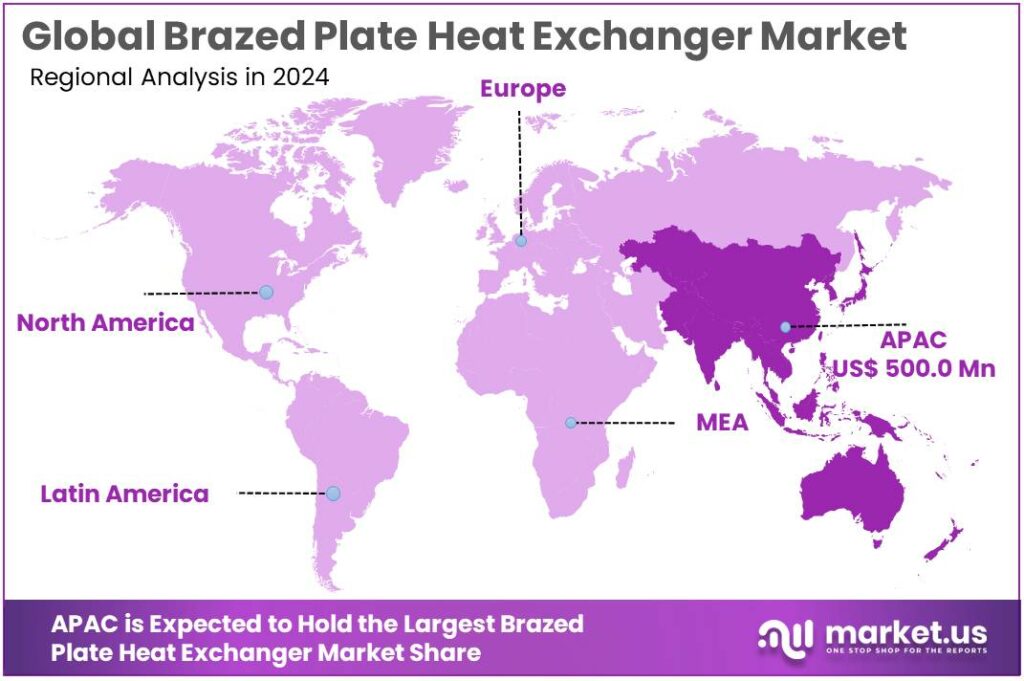

Global Brazed Plate Heat Exchanger Market size is expected to be worth around USD 2129.6 Million by 2034, from USD 1052.7 Million in 2024, growing at a CAGR of 7.3% during the forecast period from 2025 to 2034. In 2024 Asia Pacific held a dominant market position, capturing more than a 47.5% share, holding USD 500.0 Million in revenue.

Brazed plate heat exchangers (BPHEs) are compact, all-metal heat exchangers made by stacking thin corrugated stainless-steel plates and vacuum-brazing them. The brazed construction eliminates gaskets, so the unit stays tight under temperature cycling and high pressures, while the corrugations create turbulence that boosts heat transfer. Typical industrial ranges are wide: for example, Alfa Laval’s CBM line states design temperatures from -196°C to 225°C and maximum design pressure of 51 bar, supporting both cryogenic and high-temperature duties.

Key driving factors include energy-cost pressure and policy-driven efficiency upgrades. The IEA notes that approximately 72% of industrial process heat demand is below 200°C, which strengthens the business case for compact heat recovery, heat pumps, and upgraded thermal systems—areas where BPHEs are commonly specified. Regulations are also accelerating equipment refresh: the EU’s F-gas Regulation (EU) 2024/573 was adopted on 7 Feb 2024 and applied from 11 Mar 2024, tightening the transition away from high-GWP refrigerants and pushing OEMs toward redesigned refrigeration/heat-pump architectures.

Cooling and refrigeration are an equally important pull factor—especially for food supply chains. The International Institute of Refrigeration (IIR) estimates the refrigeration sector accounts for about 20% of global electricity consumption and 7.5% of global CO₂ emissions, which keeps efficiency improvements high on the agenda for plant owners. In food cold chains, FAO highlights that inadequate refrigeration contributes to the loss of 526 million tons of food production, around 12% of the global total—making reliable, efficient heat-transfer hardware a practical lever for reducing spoilage and operating cost.

On the supplier side, leading thermal-technology companies continue to prioritize food and industrial heat-transfer platforms. For example, Alfa Laval reported Food & Water Division net sales of SEK 25,742 million in 2024, signaling sustained spending by customers in hygienic processing and thermal systems. Danfoss also shows the scale of investment in efficiency-enabling hardware: it reported EUR 9.7 billion sales in 2024 and EUR 488 million in R&D, reflecting ongoing product development across heat-transfer and cooling/heating solutions used in industrial and food facilities.

Government and regulatory signals further reinforce BPHE adoption. In Europe, the updated F-gas Regulation (EU) 2024/573 was adopted on 7 February 2024 and began applying on 11 March 2024, accelerating the shift toward lower-GWP refrigerants and higher system efficiency—changes that often require redesigned heat-exchanger networks to maintain performance. In the U.S., DOE’s Industrial Efficiency and Decarbonization efforts include a $38 million cross-sector funding opportunity (FY24) to advance industrial energy-efficiency technologies, and DOE funding selections explicitly target improved heat-exchanger effectiveness and higher heat-transfer rates—an indicator of policy-backed innovation that can flow into next-generation compact exchangers.

Key Takeaways

- Brazed Plate Heat Exchanger Market size is expected to be worth around USD 2129.6 Million by 2034, from USD 1052.7 Million in 2024, growing at a CAGR of 7.3%

- Single Circuit held a dominant market position, capturing more than a 59.8% share.

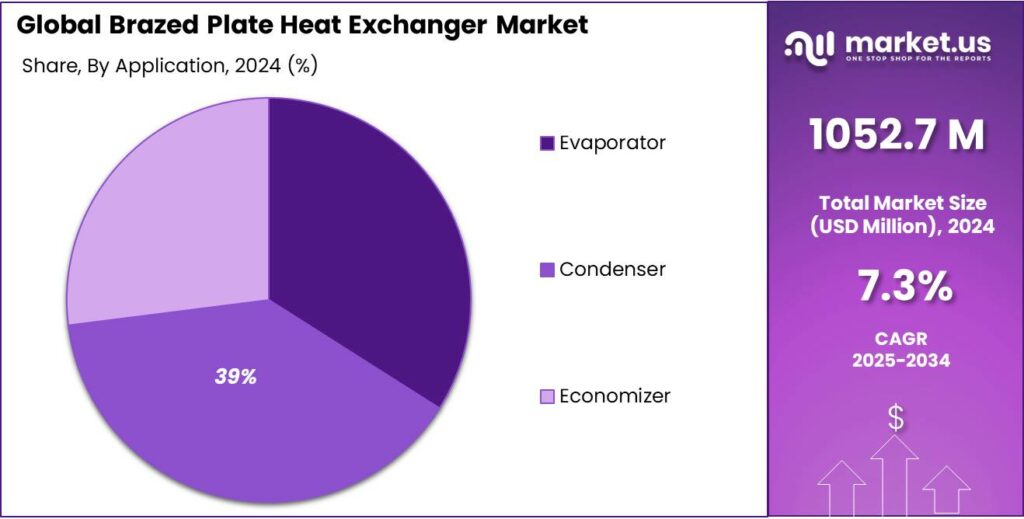

- Condenser held a dominant market position, capturing more than a 39.1% share.

- HVAC-R held a dominant market position, capturing more than a 45.4% share.

- Asia Pacific held a dominant market position, capturing 47.5% share and reaching USD 500.0 Mn.

By Product Analysis

Single Circuit Brazed Plate Heat Exchangers lead with a strong 59.8% share in 2024, supported by steady industrial demand.

In 2024, Single Circuit held a dominant market position, capturing more than a 59.8% share, largely because industries increasingly choose compact and energy-efficient heat transfer solutions. Their simple flow path design makes them easier to install, maintain, and integrate into both new and existing systems. Sectors like HVAC, food processing, chemicals, and district heating continued to rely on single-circuit units due to their reliability and cost-effective operation. In 2024, manufacturers saw consistent orders from commercial heating projects and small-capacity industrial applications, reinforcing the strong demand for these systems.

By Application Analysis

Condenser applications lead the market with a strong 39.1% share in 2024, driven by rising cooling and HVAC demand.

In 2024, Condenser held a dominant market position, capturing more than a 39.1% share, mainly because brazed plate heat exchangers are widely used in systems that require efficient condensation under compact footprints. Their ability to manage high pressures, deliver rapid heat transfer, and operate reliably with modern refrigerants makes them essential in commercial chillers, heat pumps, and industrial cooling units. The ongoing shift toward low-GWP refrigerant technologies also supported their adoption, as brazed plate designs handle varying refrigerant properties more effectively than traditional condenser types.

By End-use Analysis

HVAC-R leads the market with a solid 45.4% share in 2024, supported by the rising need for efficient heating and cooling systems.

In 2024, HVAC-R held a dominant market position, capturing more than a 45.4% share, driven by the growing demand for compact, energy-efficient heat management solutions across residential, commercial, and light-industrial buildings. Brazed plate heat exchangers are widely chosen in HVAC-R systems because they deliver strong thermal performance, maintain stable operation under varying load conditions, and work well with modern low-GWP refrigerants. Their small size and ease of integration make them ideal for heat pumps, chillers, boilers, refrigeration racks, and district cooling units, all of which saw higher installation activity throughout 2024.

Key Market Segments

By Product

- Single Circuit

- Multi Circuit

By Application

- Evaporator

- Condenser

- Economizer

By End-use

- HVAC-R

- Chemical & Petrochemical

- Food & Beverage

- Power Generation

- Heavy Industry

- Others

Emerging Trends

Natural refrigerants and heat recovery are reshaping food cooling, lifting BPHE demand

A major latest trend for the brazed plate heat exchanger (BPHE) market is the rapid shift in food refrigeration toward natural refrigerants (especially CO₂) and heat-recovery-ready system designs. In Europe’s food retail, this transition is no longer niche: as of December 2024, about 90,700 food retail stores were using transcritical CO₂ systems—76,200 with centralized racks and 14,500 with condensing units—and overall store penetration reached 30%.

What’s pushing this trend is not just energy cost—it’s also regulation and replacement cycles. The EU’s revised F-gas framework (Regulation (EU) 2024/573) was adopted on 7 February 2024 and started to apply on 11 March 2024, increasing pressure to move away from high-GWP refrigerants in equipment that relies on them. In practical terms, many supermarkets and cold facilities are using this compliance window to replace aging HFC systems rather than keep investing in legacy platforms.

The same trend is moving beyond supermarkets into industrial food and cold-chain sites. As of December 2024, ATMOsphere estimates 4,900 European industrial sites were using transcritical CO₂ refrigeration—up 48% from 3,300 a year earlier—and these sites represented 5.1% of the 95,600 total transcritical CO₂ sites in Europe. Food processing plants care about reliability and temperature stability, but they also increasingly care about waste-heat reuse, because it lowers operating cost and supports sustainability reporting.

Drivers

Cutting food loss is pushing efficient cooling upgrades

In 2024, one major driver for the Brazed Plate Heat Exchanger (BPHE) market is the urgent push to reduce food loss by improving cold-chain and food-processing refrigeration efficiency. The scale of the problem is clear: FAO estimates 13.2% of food is lost in the supply chain after harvest and before retail, and UNEP’s 2024 statistics cited by FAO add that 19% is wasted at retail, food service, and households. When food companies and logistics operators try to protect value in storage, chilling, freezing, and transport, they typically invest in tighter temperature control, faster pull-down times, and better energy use—exactly where BPHEs fit well because they transfer heat quickly in a compact footprint.

In 2024, government-backed food infrastructure spending is also translating into real equipment demand. In India, the Ministry of Food Processing Industries reported 1,217 approved food processing projects with a total project cost of ₹31,308.24 crore, including grants/subsidy of ₹8,698.18 crore, and ₹22,610.06 crore of attracted private investment. It also notes 651 completed projects creating preservation infrastructure of 48.91 LMT/annum and processing infrastructure of 183.523 LMT/annum.

In 2025, the same “save energy while tightening temperature control” trend strengthens because cooling loads keep rising and operators are under pressure to cut operating costs. The International Energy Agency notes that energy demand for space cooling has grown at about 4% per year since 2000, and residential AC units in operation reached more than 1.5 billion in 2022—a signal of how quickly cooling-linked infrastructure is scaling.

Regulation is the final accelerator, especially in 2024–2025. Europe’s updated F-gas framework—Regulation (EU) 2024/573, adopted 7 February 2024 and applicable from 11 March 2024—tightens requirements for fluorinated gases and equipment that contains or relies on them. This pushes system redesign, refrigerant transitions, and higher-efficiency component choices.

Restraints

High upfront cost and weak cold-chain infrastructure slow down BPHE adoption in food systems

One of the major restraining factors for the Brazed Plate Heat Exchanger (BPHE) market, especially in food processing and cold-chain operations, is the high initial cost combined with insufficient refrigeration infrastructure in key parts of the food supply chain. While BPHEs deliver strong efficiency and compact performance, many food processors and cold-chain operators hesitate to invest in upgraded heat-exchange solutions because large system upgrades require substantial capital outlay.

To understand why this matters, consider the scale of food loss and waste that occurs when refrigeration systems are inadequate. Globally, about one-third of all food produced for human consumption is lost or wasted each year, which equals roughly 1.3 billion tonnes of food annually and nearly USD 940 billion in economic losses according to the Food and Agriculture Organization (FAO) of the United Nations. In India, a significant food market and processor, there are only 5,386 stand-alone cold storage facilities with a total capacity of about 23.6 million metric tons — a figure that falls far short of what’s needed to handle perishable output.

Government programs attempt to fill some of the gaps. In India, the Ministry of Food Processing Industries (MoFPI) has supported cold-chain infrastructure through initiatives such as cold storage projects and schemes like Pradhan Mantri Kisan SAMPADA Yojana (PMKSY), which has helped establish 399 cold chain projects along with various food parks and agro clusters. However, these programs often focus on building storage capacity rather than retrofitting existing refrigeration equipment with more efficient components like BPHEs.

Opportunity

Cold-chain expansion and food-waste targets open a big BPHE opportunity

A clear growth opportunity for the Brazed Plate Heat Exchanger (BPHE) market is the fast build-out and modernization of cold-chain + food processing refrigeration, driven by food-loss reduction targets and rising demand for reliable cooling. The need is measurable: the UN’s food-loss and waste work highlights that 13.2% of food is lost between harvest and retail, and 19% is wasted at retail, food service, and households. UNEP’s Food Waste Index 2024 also reports about 1.05 billion tonnes of food waste in 2022 across retail, food service, and households.

In 2024, the opportunity is strongest where governments and institutions are actively funding food processing capacity and preservation infrastructure. India is a good example of this momentum. As of 30 June 2024, government updates and industry summaries around PMKSY-linked programs cite scale in food infrastructure approvals, including 399 cold chain projects approved under PMKSY.

In 2025, the opportunity broadens as policy focus shifts from “build capacity” to “improve efficiency and reliability.” For example, a Government of India press release states that 52 projects were approved under PMKSY component schemes from January 2024 to June 2025. Each new or upgraded processing unit increases demand for compact heat exchangers in refrigeration and utility systems, especially where producers want quicker installation, lower maintenance complexity, and predictable performance.

The IEA notes that energy demand for space cooling has risen around 4% per year since 2000, and residential AC units in operation reached more than 1.5 billion in 2022. While this is not “food only,” it matters directly for the food cold-chain because the same suppliers, refrigerant platforms, compressors, and condenser technologies often serve commercial refrigeration and industrial cooling.

Regional Insights

Asia Pacific dominates the Brazed Plate Heat Exchanger market with 47.5% share, valued at USD 0.5 Bn, backed by fast-growing cooling demand.

Asia Pacific leads the Brazed Plate Heat Exchanger (BPHE) market because the region is scaling up HVAC, industrial refrigeration, and cold-chain networks at the same time. In 2024, Asia Pacific held a dominant market position, capturing 47.5% share and reaching USD 0.5 Bn, supported by heavy demand for compact, high-efficiency heat transfer equipment used in chillers, heat pumps, and refrigeration packs.

A clear regional signal is India’s cooling-driven power stress: the IEA reported that in India, each 1°C rise in outdoor temperature in 2024 was associated with a 7 GW increase in peak electricity demand, showing how quickly cooling loads are rising and why energy-efficient components matter.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Danfoss is a key BPHE supplier to HVAC-R and cooling system makers, with strong reach in compressors, controls, and heat exchangers that bundle well in refrigeration packages. In 2024, Danfoss reported sales of EUR 9.7 billion and operational EBITA of EUR 1,097 million. Headcount was 39,360 employees, reflecting its large footprint across manufacturing and application engineering.

SWEP International AB is a specialist brand in brazed plate technology, widely used in heat pumps, chillers, and industrial cooling where compactness matters. Its Sustainability Report 2024 describes SWEP as having over 1,100 employees. The same report notes it is part of Dover Corporation, which it describes as having annual revenue of over USD 7 billion, providing financial backing and global reach.

Xylem Inc. participates via thermal and process solutions used in water, industrial, and building applications where efficient heat transfer reduces energy load. Xylem reported $8.6 billion revenue in 2024 and stated it has about 23,000 employees worldwide. That scale helps it support large customer programs, aftermarket service, and engineered packages that can include plate heat exchanger solutions.

Top Key Players Outlook

- Alfa Laval

- Danfoss

- Kelvion Holding GmbH

- SWEP International AB

- Xylem Inc.

- API Heat Transfer

- AIC

- Hisaka Works, Ltd.

- Charts Industries, Inc.

- Mersen Corporate Services SAS

Recent Industry Developments

Moving into 2025, Danfoss reported H1 2025 sales of EUR 4,788 million and operational EBITA of EUR 509 million, which signals continued demand even in a more volatile order environment—important for BPHE volumes tied to OEM production cycles in heat pumps, refrigeration packs, and HVAC equipment.

In 2024, Xylem reported revenue of $8.6 billion and about 23,000 employees, showing the scale to support global OEM programs and project delivery.

Report Scope

Report Features Description Market Value (2024) USD 1052.7 Mn Forecast Revenue (2034) USD 2129.6 Mn CAGR (2025-2034) 7.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Single Circuit, Multi Circuit), By Application (Evaporator, Condenser, Economizer), By End-use (HVAC-R, Chemical And Petrochemical, Food And Beverage, Power Generation, Heavy Industry, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Alfa Laval, Danfoss, Kelvion Holding GmbH, SWEP International AB, Xylem Inc., API Heat Transfer, AIC, Hisaka Works, Ltd., Charts Industries, Inc., Mersen Corporate Services SAS Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Brazed Plate Heat Exchanger MarketPublished date: Jan 2026add_shopping_cartBuy Now get_appDownload Sample

Brazed Plate Heat Exchanger MarketPublished date: Jan 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Alfa Laval

- Danfoss

- Kelvion Holding GmbH

- SWEP International AB

- Xylem Inc.

- API Heat Transfer

- AIC

- Hisaka Works, Ltd.

- Charts Industries, Inc.

- Mersen Corporate Services SAS