Global Bone Densitometers Market By Product Type (Central Bone Densitometers and Peripheral Bone Densitometers), By Technology (Dual-Energy X-Ray Absorptiometry (DXA/DEXA), Quantitative Computed Tomography (QCT), Quantitative Ultrasound (QUS), Radiographic Absorptiometry (RA), Single Energy X-Ray Absorptiometry (SEXA) and Others), By Application (Osteoporosis and Osteopenia Diagnosis, Cystic Fibrosis Diagnosis, Chronic Kidney Diseases Diagnosis, Rheumatoid Arthritis Diagnosis and Body Composition Measurement), By End-User (Hospitals, Diagnostic Imaging Centers, Specialty Clinics and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Jan 2026

- Report ID: 173343

- Number of Pages: 386

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

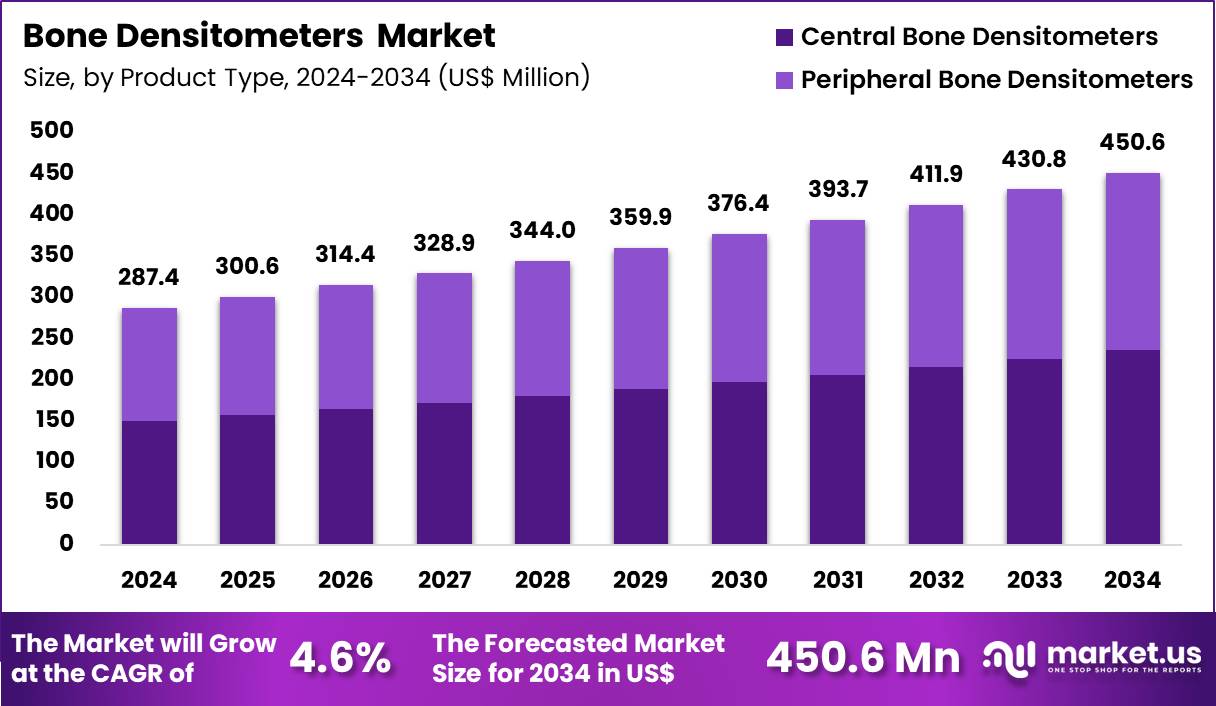

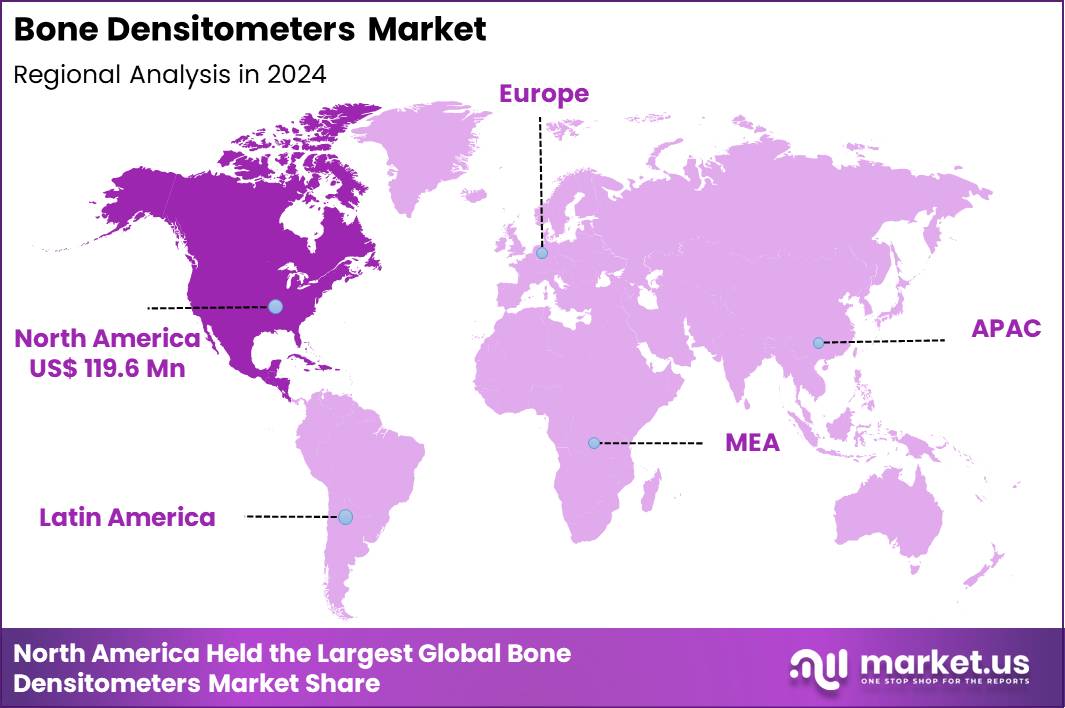

The Global Bone Densitometers Market size is expected to be worth around US$ 450.6 Million by 2034 from US$ 287.4 Million in 2024, growing at a CAGR of 4.6% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 41.6% share with a revenue of US$ 119.6 Million.

Rising prevalence of osteoporosis and related bone disorders compels healthcare providers to adopt bone densitometers that deliver precise measurements of bone mineral density for effective risk assessment and intervention. Clinicians increasingly utilize dual-energy X-ray absorptiometry systems to diagnose osteoporosis and osteopenia in postmenopausal women and elderly patients, guiding preventive strategies to reduce fragility fractures. These devices support fracture risk evaluation by quantifying bone loss in high-risk populations, including individuals with rheumatoid arthritis or chronic kidney disease.

Radiologists employ bone densitometers for body composition analysis, assessing lean mass, fat distribution, and visceral adiposity in obesity management and metabolic health evaluations. These tools facilitate monitoring in cystic fibrosis care, tracking bone health complications associated with chronic respiratory conditions.

Across 2024, several leading US-based imaging providers entered into collaborations with artificial intelligence diagnostics specialists to incorporate automated bone mineral density reporting into clinical workflows. These partnerships focused on reducing manual interpretation requirements, enabling real-time analytical outputs, and improving operational efficiency within radiology departments by easing the workload on imaging professionals.

Manufacturers pursue opportunities to integrate artificial intelligence algorithms that automate vertebral fracture detection and enhance diagnostic precision in osteoporosis screening programs. Developers engineer portable peripheral densitometers that enable point-of-care assessments in primary care settings, expanding access for early intervention in at-risk geriatric populations. These advancements broaden applications in sports medicine, where clinicians monitor bone density in athletes to prevent stress fractures and optimize performance.

Opportunities emerge in combining densitometry with body composition metrics for comprehensive evaluations in bariatric surgery candidates, supporting pre- and post-operative metabolic assessments. Companies advance pediatric-specific protocols that accommodate smaller anatomies while maintaining accuracy in growth-related bone health monitoring. Firms invest in low-dose technologies that minimize radiation exposure, facilitating repeated scans in long-term endocrine disorder management.

Industry innovators deploy machine learning-enhanced software that predicts fracture probability with greater accuracy, streamlining workflow integration in high-volume orthopedic and rheumatology practices. Developers refine quantitative ultrasound alternatives for radiation-free screening, offering complementary options in community health initiatives.

Market participants prioritize seamless electronic health record connectivity to support longitudinal tracking of bone density trends in chronic disease cohorts. Companies emphasize user-friendly interfaces that accelerate training for technologists, improving throughput in busy diagnostic centers. Ongoing refinements focus on hybrid systems combining axial and peripheral capabilities, delivering versatile solutions across osteoporosis diagnosis, body composition studies, and fracture risk stratification.

Key Takeaways

- In 2024, the market generated a revenue of US$ 287.4 Million, with a CAGR of 4.6%, and is expected to reach US$ 450.6 Million by the year 2034.

- The product type segment is divided into central bone densitometers and peripheral bone densitometers, with central bone densitometers taking the lead in 2024 with a market share of 52.3%.

- Considering technology, the market is divided into dual-energy x-ray absorptiometry (DXA/DEXA), quantitative computed tomography (QCT), quantitative ultrasound (QUS), radiographic absorptiometry (RA), single energy x-ray absorptiometry (SEXA) and others. Among these, dual-energy x-ray absorptiometry (dxa/dexa)held a significant share of 41.8%.

- Furthermore, concerning the application segment, the market is segregated into osteoporosis and osteopenia diagnosis, cystic fibrosis diagnosis, chronic kidney diseases diagnosis, rheumatoid arthritis diagnosis and body composition measurement. The osteoporosis and osteopenia diagnosis sector stands out as the dominant player, holding the largest revenue share of 34.4% in the market.

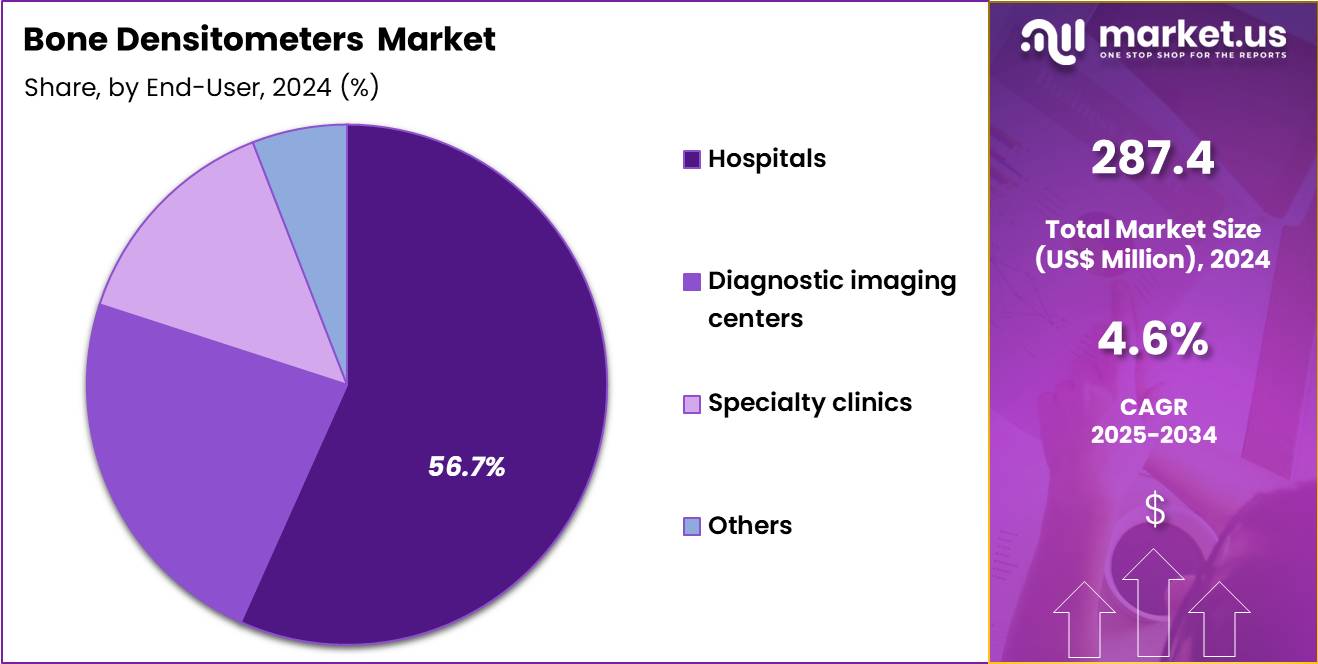

- The end-user segment is segregated into hospitals, diagnostic imaging centers, specialty clinics and others, with the hospitals segment leading the market, holding a revenue share of 56.7%.

- North America led the market by securing a market share of 41.6% in 2024.

Product Type Analysis

Central bone densitometers accounted for 52.3% of the bone densitometers market, reflecting their comprehensive assessment capability for clinically relevant skeletal sites. Clinicians rely on central systems to measure bone mineral density at the hip and spine, which directly correlates with fracture risk. Higher diagnostic accuracy strengthens confidence in treatment decisions.

Aging populations increase screening volumes for osteoporosis management. Central devices support standardized reporting aligned with clinical guidelines. Integration with hospital imaging infrastructure improves workflow efficiency.

Technological enhancements improve scan speed and patient comfort. Reimbursement structures often favor central assessments for definitive diagnosis. Growing emphasis on early intervention increases routine screening demand. This segment is projected to sustain dominance due to diagnostic precision and strong clinical acceptance.

Technology Analysis

Dual-energy X-ray absorptiometry accounted for 41.8% of the bone densitometers market, driven by its status as the clinical reference standard for bone density measurement. DXA provides high precision with low radiation exposure, which supports repeated monitoring. Clinical guidelines consistently recommend DXA for osteoporosis diagnosis and fracture risk assessment.

Improved software analytics enhance diagnostic confidence and reporting clarity. Compatibility with body composition analysis expands clinical utility. Widespread clinician familiarity accelerates adoption across care settings. Technological upgrades improve throughput and image quality. Cost effectiveness compared to advanced imaging supports broader deployment. Regulatory and reimbursement alignment reinforce market penetration. This segment is anticipated to remain dominant due to accuracy, safety, and guideline endorsement.

Application Analysis

Osteoporosis and osteopenia diagnosis represented 34.4% of the bone densitometers market, reflecting the growing burden of age-related bone disorders. Rising life expectancy increases the population at risk for low bone density. Preventive healthcare strategies emphasize early detection to reduce fracture incidence.

Public health awareness programs encourage routine screening among postmenopausal women and older adults. Clinicians prioritize bone density assessment to guide pharmacological intervention. Fracture prevention initiatives drive diagnostic demand. I

mproved access to screening expands testing volumes. Chronic disease management programs integrate bone health monitoring. Insurance coverage supports routine diagnostic evaluations. This application segment is likely to grow steadily due to expanding screening and prevention efforts.

End-User Analysis

Hospitals held 56.7% of the bone densitometers market, reflecting their role as primary centers for diagnostic imaging and chronic disease management. Hospitals manage high patient volumes requiring bone health evaluation. Integrated care pathways support routine screening and follow-up. Availability of multidisciplinary teams strengthens diagnostic decision-making.

Capital investment capacity enables acquisition of advanced densitometry systems. Inpatient and outpatient services sustain consistent utilization rates. Teaching hospitals promote guideline-based osteoporosis screening. Centralized data management improves longitudinal patient monitoring. Emergency fracture care increases downstream screening demand. Consequently, hospitals are expected to remain the dominant end-user due to scale, infrastructure, and comprehensive care delivery.

Key Market Segments

By Product Type

- Central Bone Densitometers

- Peripheral Bone Densitometers

By Technology

- Dual-Energy X-Ray Absorptiometry (DXA/DEXA)

- Quantitative Computed Tomography (QCT)

- Quantitative Ultrasound (QUS)

- Radiographic Absorptiometry (RA)

- Single Energy X-Ray Absorptiometry (SEXA)

- Others

By Application

- Osteoporosis and Osteopenia Diagnosis

- Cystic Fibrosis Diagnosis

- Chronic Kidney Diseases Diagnosis

- Rheumatoid Arthritis Diagnosis

- Body Composition Measurement

By End-User

- Hospitals

- Diagnostic imaging centers

- Specialty clinics

- Others

Drivers

Rising prevalence of osteoporosis is driving the market

The bone densitometers market is substantially driven by the rising prevalence of osteoporosis, a condition characterized by reduced bone density that necessitates diagnostic screening for early intervention and management. Healthcare providers increasingly utilize bone densitometers to assess bone mineral density in at-risk populations, facilitating timely treatment to prevent fractures. Regulatory agencies promote screening guidelines that emphasize the role of densitometers in osteoporosis care, supporting market expansion.

Pharmaceutical companies develop therapies that require accurate diagnosis via densitometers to monitor efficacy in affected patients. Clinical protocols integrate densitometer results to guide personalized treatment plans for osteoporosis management. Global health organizations track osteoporosis trends to inform policy on diagnostic tool accessibility.

Academic research on bone health contributes to innovations in densitometer technologies for precise measurements. Patient education campaigns raise awareness, boosting demand for screening services using densitometers. Economic burdens from osteoporosis-related fractures further justify investment in diagnostic equipment. According to a cross-sectional study published by the National Institutes of Health in 2024, the prevalence of osteoporosis was 10.4% among the surveyed population, with a median age of 56.0 years.

Restraints

High costs of advanced bone densitometer systems are restraining the market

The bone densitometers market is restrained by the high costs of advanced systems, which include substantial capital investment for dual-energy X-ray absorptiometry machines and ongoing maintenance expenses. Smaller healthcare facilities struggle to afford these devices, limiting market penetration in resource-constrained settings. Regulatory compliance for calibration and quality assurance adds to financial burdens, deterring adoption.

Pharmaceutical collaborations are challenged by cost-sharing models for diagnostic equipment in clinical trials. Clinical practices in rural areas opt for alternative screening methods due to budget constraints. Global disparities in healthcare funding exacerbate access issues for high-end densitometers.

Academic institutions face funding limitations for research-grade devices, slowing technological advancements. Patient screening programs are impacted by cost-related barriers to widespread implementation. Economic analyses highlight the need for affordable alternatives to mitigate market restraints. These factors collectively hinder broader deployment and innovation in bone densitometer technologies.

Opportunities

Expansion of screening programs for older adults is creating growth opportunities

The bone densitometers market offers growth opportunities through the expansion of screening programs for older adults, where densitometers play a key role in identifying low bone mass and osteoporosis risk. Healthcare initiatives target this demographic to prevent fractures, driving demand for accessible densitometer solutions. Regulatory frameworks endorse population-based screening, facilitating market entry for portable and efficient devices.

Pharmaceutical firms can partner with programs to integrate densitometers into preventive care protocols. Clinical research focuses on validating densitometer use in longitudinal studies for aging populations. Global health policies prioritize bone health in elderly care, broadening applications for densitometers. Academic collaborations refine screening algorithms to enhance densitometer utility. Patient-centered approaches benefit from programs enabling early intervention with densitometer-guided treatments.

Economic incentives from reduced healthcare costs support investment in screening infrastructure. According to the Centers for Disease Control and Prevention’s FastStats on osteoporosis, the percent of women age 50 and older with osteoporosis of the femur neck or lumbar spine is 20.4%, underscoring the need for expanded screening.

Impact of Macroeconomic / Geopolitical Factors

Global economic recoveries prompt heightened allocations to diagnostic infrastructure, spurring uptake of bone densitometers in hospitals and clinics across developed nations. Enterprises harness demographic trends like expanding elderly cohorts to drive product innovations and capture untapped segments. Nonetheless, rampant inflation escalates raw material outlays, pressuring vendors to navigate tighter financial constraints in volatile regions.

International rivalries in manufacturing hubs obstruct seamless component flows, extending lead times for equipment assembly worldwide. Leaders counteract these challenges via proactive supplier vetting and regional hub establishments, cultivating greater operational agility. Prevailing US tariffs, enforcing a 10% baseline on imported imaging tools from overseas origins, amplify sourcing burdens for reliant importers.

Indigenous manufacturers exploit this landscape to bolster production scales, igniting job growth and tech localization efforts. Cutting-edge integrations of AI and compact designs ultimately invigorate the sector’s momentum, promising widespread accessibility and robust expansion ahead.

Latest Trends

Integration of AI in bone densitometer analysis is a recent trend

In 2024, the bone densitometers market has exhibited a prominent trend toward the integration of artificial intelligence in analysis, which enhances diagnostic accuracy and automates fracture risk assessments. Manufacturers incorporate AI algorithms to process densitometer scans, providing detailed insights into bone structure beyond traditional measurements. Healthcare providers adopt AI-enabled systems to streamline workflows and improve patient throughput in screening settings.

Regulatory reviews accommodate AI innovations with evidence of improved precision in osteoporosis detection. Clinical applications benefit from AI tools that predict long-term bone health outcomes. Academic studies evaluate AI performance in diverse populations for equitable diagnostic capabilities. Global distribution expands access to AI-integrated densitometers in advanced healthcare facilities.

Patient care advances with AI facilitating personalized risk profiles from densitometer data. Ethical protocols ensure AI transparency in clinical decision-making. According to a DelveInsight analysis published in 2025, AI integration is among the newer innovations driving the bone densitometers market forward.

Regional Analysis

North America is leading the Bone Densitometers Market

In 2024, North America held a 41.6% share of the global bone densitometers market, driven by increasing awareness of osteoporosis risks and the expansion of preventive screening programs in primary care and specialized clinics. Healthcare providers integrated dual-energy X-ray absorptiometry systems into routine assessments for postmenopausal women and elderly men, supported by updated guidelines emphasizing early detection to mitigate fracture risks.

Technological advancements in peripheral devices and portable units facilitated broader deployment in ambulatory settings, improving accessibility in rural areas. Aging populations and rising incidence of metabolic disorders heightened demand for high-resolution scanners that enable precise trabecular bone evaluation. Insurance reimbursements expanded coverage for diagnostic procedures, encouraging adoption in community hospitals amid value-based care models.

Collaborative initiatives between medical societies and manufacturers refined software algorithms for automated fracture risk prediction, enhancing clinical decision-making. Supply chain stability ensured consistent availability of calibrated equipment compliant with radiation safety standards. The Centers for Disease Control and Prevention reported that osteoporosis affects approximately 10 million Americans aged 50 and older.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Stakeholders project steady advancement in bone densitometry technologies across Asia Pacific over the forecast period, as governments intensify efforts to combat skeletal health challenges amid rapid demographic aging. Clinicians deploy central dual-energy systems in urban hospitals, optimizing osteoporosis screening for high-risk postmenopausal cohorts.

National health authorities subsidize peripheral devices for community clinics, enabling early identification of low bone mass in rural populations facing nutritional deficiencies. Biotech innovators customize portable scanners with enhanced image processing, tailoring them to regional body compositions in diverse ethnic groups. Regional consortia conduct validation studies on trabecular bone score integration, supporting fracture risk assessments in diabetes-associated osteoporosis.

Pharmaceutical partnerships promote combined screening with anti-resorptive therapies, addressing treatment adherence in aging workforces. Policy frameworks incentivize equipment upgrades, bridging gaps in underserved provinces. The World Health Organization estimates that osteoporosis contributes to 8.9 million fractures annually in the Western Pacific Region.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the Bone Densitometers market drive growth by advancing low-dose imaging technology, faster scan times, and improved diagnostic accuracy to support osteoporosis screening and fracture risk assessment. Companies expand adoption by integrating densitometry systems with hospital IT infrastructure and clinical decision tools that streamline reporting for physicians.

Commercial strategies emphasize partnerships with hospitals, diagnostic centers, and preventive health programs to embed routine bone health screening into standard care pathways. Innovation priorities include portable systems, AI-assisted analysis, and expanded body composition capabilities that increase clinical utility beyond bone density alone.

Market expansion focuses on aging populations and regions strengthening preventive healthcare and women’s health initiatives. Hologic operates as a leading company through its strong DXA technology portfolio, global installed base, and continued investment in imaging innovation that supports early diagnosis and long-term bone health management.

Top Key Players

- DMS Imaging

- Hologic Inc.

- GE Healthcare

- Trivitron Healthcare

- Xingaoyi Medical Equipment Co. Ltd

- Swissray International, Inc.

- OsteoSys Corp

- Medonica Co. Ltd

- Scanflex Healthcare AB

- Eurotec Medical Systems Srl

- BeamMed

- Mednova Medical

- Unigamma

- Nanoomtech Co., Ltd.

- L’Accessorio Nucleare S.R.L

- Osteometer MediTech

- Furuno Electric Co. Ltd.

Recent Developments

- In July 2024, a Class 2 recall was issued in the United States for certain models of a Horizon X-ray bone densitometer after technical concerns were identified that could affect diagnostic accuracy. The action underscored the high level of regulatory oversight applied to bone densitometry equipment and highlighted the importance of ongoing system monitoring, calibration, and maintenance in precision imaging environments.

- During 2025, major software enhancements were introduced for Lunar bone densitometry systems, integrating artificial intelligence to automate fracture risk evaluation. The addition of AI-driven analysis improved both the speed and consistency of dual-energy X-ray absorptiometry scans, supporting more accurate osteoporosis risk assessment and aiding clinicians in faster clinical decision-making.

Report Scope

Report Features Description Market Value (2024) US$ 287.4 Million Forecast Revenue (2034) US$ 450.6 Million CAGR (2025-2034) 4.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Central Bone Densitometers and Peripheral Bone Densitometers), By Technology (Dual-Energy X-Ray Absorptiometry (DXA/DEXA), Quantitative Computed Tomography (QCT), Quantitative Ultrasound (QUS), Radiographic Absorptiometry (RA), Single Energy X-Ray Absorptiometry (SEXA) and Others), By Application (Osteoporosis and Osteopenia Diagnosis, Cystic Fibrosis Diagnosis, Chronic Kidney Diseases Diagnosis, Rheumatoid Arthritis Diagnosis and Body Composition Measurement), By End-User (Hospitals, Diagnostic Imaging Centers, Specialty Clinics and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape DMS Imaging, Hologic Inc., GE Healthcare, Trivitron Healthcare, Xingaoyi Medical Equipment Co. Ltd, Swissray International, Inc., OsteoSys Corp, Medonica Co. Ltd, Scanflex Healthcare AB, Eurotec Medical Systems Srl, BeamMed, Mednova Medical, Unigamma, Nanoomtech Co., Ltd., L’Accessorio Nucleare S.R.L, Osteometer MediTech, Furuno Electric Co. Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- DMS Imaging

- Hologic Inc.

- GE Healthcare

- Trivitron Healthcare

- Xingaoyi Medical Equipment Co. Ltd

- Swissray International, Inc.

- OsteoSys Corp

- Medonica Co. Ltd

- Scanflex Healthcare AB

- Eurotec Medical Systems Srl

- BeamMed

- Mednova Medical

- Unigamma

- Nanoomtech Co., Ltd.

- L’Accessorio Nucleare S.R.L

- Osteometer MediTech

- Furuno Electric Co. Ltd.