Global Blended Cement Market Size, Share, And Business Benefits By Type (Portland Pozzolana Cement (PPC), Portland Slag Cement (PSC), Composite cement, Other), By Application (Precast Construction, Cast-in-place Construction), By End user industry (Building Construction, Infrastructure), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: April 2025

- Report ID: 146827

- Number of Pages: 352

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

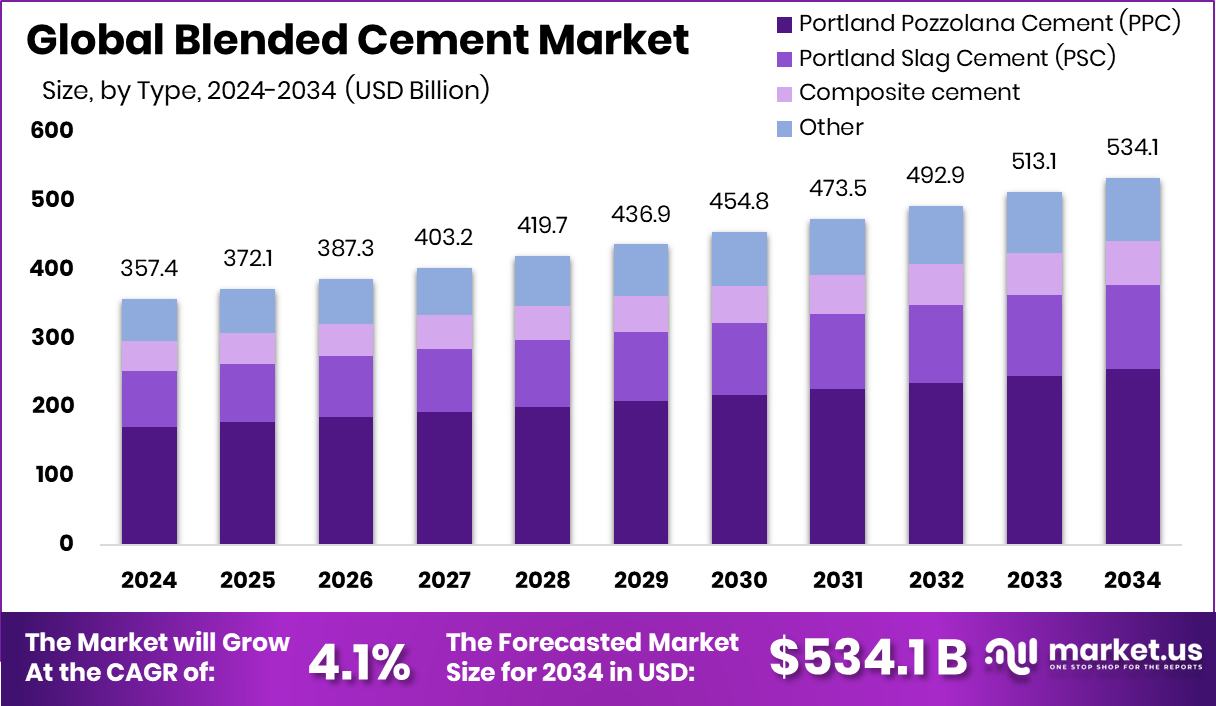

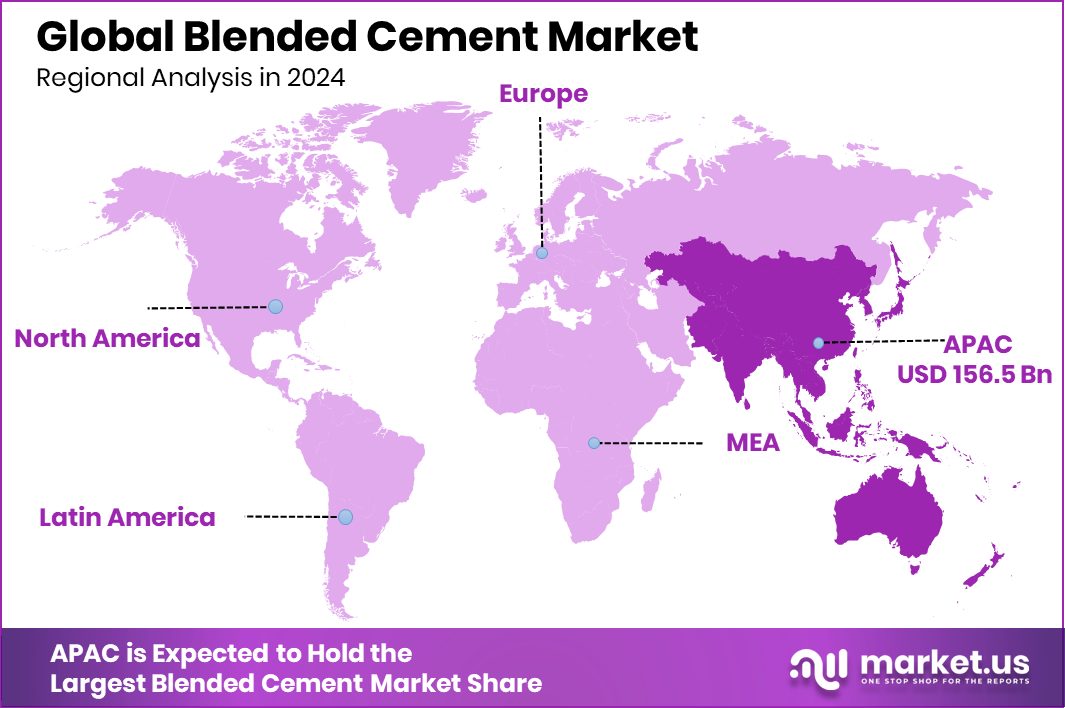

Global Blended Cement Market is expected to be worth around USD 534.1 billion by 2034, up from USD 357.4 billion in 2024, and grow at a CAGR of 4.1% from 2025 to 2034. Blended cement demand in Asia-Pacific reached USD 156.5 billion, capturing a 43.8% share.

Blended cement, a composite material combining Ordinary Portland Cement (OPC) with supplementary cementitious materials (SCMs) like fly ash, slag, and silica fume, has gained prominence in India’s construction sector. This blend not only enhances durability and workability but also reduces the environmental footprint by lowering CO₂ emissions associated with traditional cement production.

India stands as the second-largest cement producer globally, with a total production of approximately 360 million tonnes in 2021–22, up from 300 million tonnes in the previous year. The country’s cement industry comprises around 150 integrated large cement plants, 116 grinding units, 62 mini cement plants, and 5 clinkerization units. Despite this vast infrastructure, the per capita cement consumption in India is about 195 kg, significantly lower than the global average of 500 kg, indicating substantial growth potential.

The production of blended cement is intrinsically linked to the availability of limestone, the primary raw material. In 2021–22, India produced approximately 392 million tonnes of limestone, with about 97% classified as cement grade. Rajasthan emerged as the leading producer, accounting for 22% of the total production. The consumption of limestone by the cement industry was about 308.66 million tonnes in 2019–20, representing 94% of the total limestone consumption in the country.

Several factors are driving the growth of blended cement in India. Government initiatives like the Housing for All and Smart Cities Mission are propelling infrastructure development, thereby increasing cement demand. Additionally, the emphasis on sustainable construction practices is encouraging the adoption of blended cement, which utilizes industrial by-products like fly ash and slag, reducing environmental impact. The Ministry of Mines has also facilitated the auctioning of 74 limestone blocks up to 2022–23, ensuring a steady supply of raw materials for cement production.

Key Takeaways

- Global Blended Cement Market is expected to be worth around USD 534.1 billion by 2034, up from USD 357.4 billion in 2024, and grow at a CAGR of 4.1% from 2025 to 2034.

- Portland Pozzolana Cement dominated the market in 2024 with a 47.8% share due to sustainability.

- Cast-in-place construction held a 67.5% market share, benefiting from on-site flexibility and cost-efficiency.

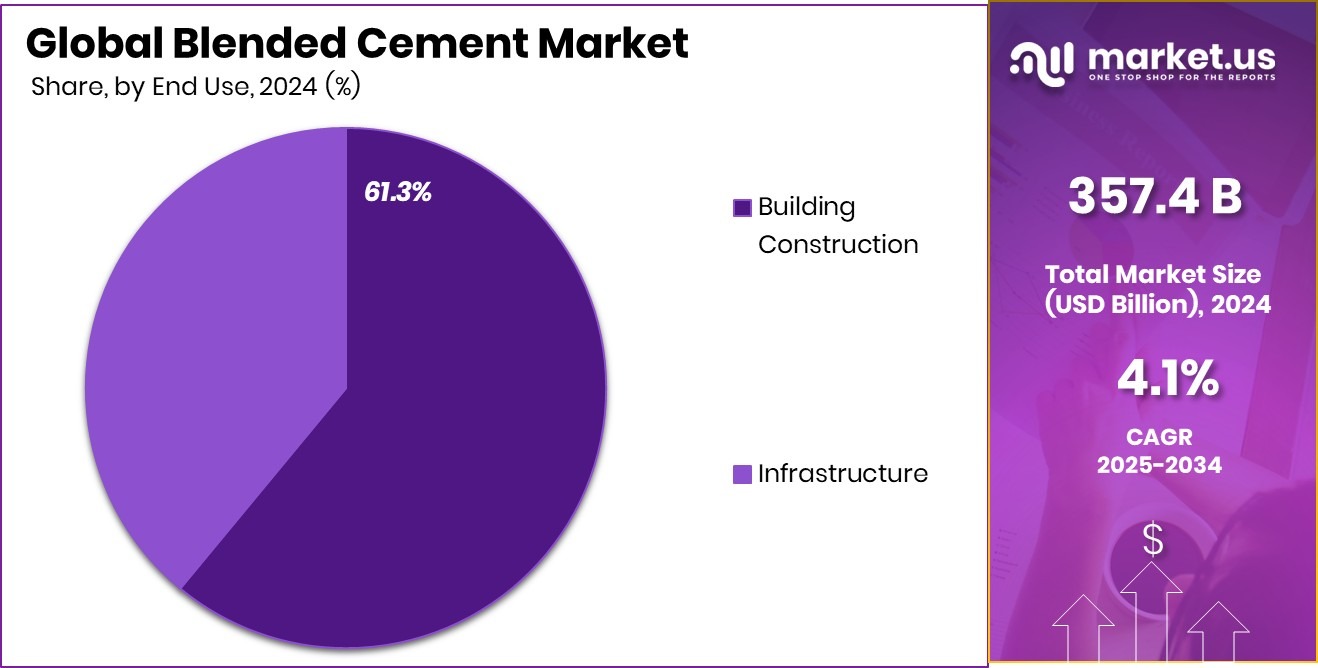

- The building construction sector contributed 61.3% of the demand, driven by housing and commercial infrastructure growth.

- In 2024, Asia-Pacific held the dominant share of 43.8%, leading globally.

By Type Analysis

Portland Pozzolana Cement dominates the market with 47.8% due to environmental benefits.

In 2024, Portland Pozzolana Cement (PPC) held a dominant market position in the By Type segment of the Blended Cement Market, with a 47.8% share. This segment’s lead is attributed to PPC’s long-term durability, low heat of hydration, and its suitability for mass concrete work such as dams, foundations, and large structures. Its composition—blending pozzolanic materials like fly ash or calcined clay with Portland cement—enhances strength and resistance to chemical attack, making it a preferred choice in infrastructure development.

The growing demand for eco-friendly materials has also driven the preference for PPC, as it utilizes industrial by-products and reduces the overall carbon footprint of construction. Government regulations promoting sustainable construction practices have further propelled PPC usage, especially in public infrastructure and urban development projects. Additionally, PPC’s cost-effectiveness in comparison to traditional cement types has increased its adoption in both rural and urban settings.

With nearly half the market share at 47.8%, PPC continues to dominate in terms of volume and application breadth, particularly in developing economies where price sensitivity and environmental compliance are major factors. The segment’s robust position is expected to remain steady as builders prioritize long-term structural performance and sustainable practices in cement usage.

By Application Analysis

Cast-in-place construction leads with 67.5% usage due to better structural performance.

In 2024, Cast-in-place Construction held a dominant market position in the By Application segment of the Blended Cement Market, with a 67.5% share. This significant share reflects the strong reliance on on-site concrete pouring techniques in both residential and commercial construction projects. Cast-in-place methods offer flexibility in design, structural integrity, and better resistance to environmental stressors, making them a preferred choice for large-scale construction.

Blended cement, particularly in cast-in-place applications, enhances workability and long-term strength while also addressing sustainability concerns. The segment’s dominance can be attributed to its cost efficiency, adaptability to varied architectural requirements, and suitability for a wide range of infrastructure works such as bridges, tunnels, roads, and high-rise buildings. Moreover, contractors favor cast-in-place techniques when using blended cement like Portland Pozzolana Cement (PPC), due to its improved durability and reduced permeability.

With 67.5% of the application share, cast-in-place construction continues to be the backbone of the cement consumption landscape, especially in regions witnessing urban expansion and government-backed infrastructure initiatives. Its market position is reinforced by the ongoing shift toward environmentally responsible construction practices and the need for long-lasting, scalable concrete solutions across sectors.

By End User Industry Analysis

Building construction uses 61.3% blended cement, driven by housing and urban expansion.

In 2024, Building Construction held a dominant market position in End end-user industry segment of the Blended Cement Market, with a 61.3% share. This substantial share reflects the extensive use of blended cement in residential, commercial, and institutional building projects, driven by the material’s strength, durability, and environmental benefits. Builders are increasingly choosing blended cement formulations such as Portland Pozzolana Cement (PPC) for their superior resistance to sulfate attacks and lower heat generation during curing, which are ideal for vertical structures.

The dominance of the building construction sector also stems from rising global urbanization and rapid housing development, especially in emerging economies. Government-led affordable housing schemes and urban infrastructure expansion have further supported demand for cost-efficient, sustainable cement types. The use of blended cement in building construction is also favored for its role in enhancing indoor air quality and long-term energy savings by reducing heat transfer through concrete walls.

Capturing 61.3% of the end-user segment, building construction leads due to the balance it offers between performance and sustainability. This preference is expected to strengthen as cities grow denser and regulations around green building certifications become stricter, positioning blended cement as a reliable and compliant solution in mainstream construction activities.

Key Market Segments

By Type

- Portland Pozzolana Cement (PPC)

- Portland Slag Cement (PSC)

- Composite cement

- Other

By Application

- Precast Construction

- Cast-in-place Construction

By End user industry

- Building Construction

- Infrastructure

Driving Factors

Rising Green Construction Demand Boosts Blended Cement Use

One of the main driving forces behind the blended cement market is the growing global demand for green and sustainable construction. Governments and builders are shifting toward low-carbon construction materials to reduce the environmental impact of infrastructure and real estate development.

Blended cement, which includes materials like fly ash, slag, and pozzolana, significantly lowers CO₂ emissions compared to traditional ordinary Portland cement. As a result, it has become a preferred choice in both residential and commercial projects.

In India, the Bureau of Energy Efficiency promotes the use of blended cement to support its climate goals. This increasing eco-consciousness and government backing are pushing the market upward, especially in emerging economies aiming for sustainable urban development.

Restraining Factors

Low Early Strength Slows Blended Cement Adoption

A key restraining factor in the blended cement market is its lower early strength compared to traditional cement. Many construction projects—especially those needing fast turnaround times—rely on materials that gain strength quickly to speed up project timelines. Blended cement, although more sustainable and cost-effective in the long term, tends to take more time to develop its full strength.

This delay can slow down construction schedules and increase project costs in time-sensitive developments. As a result, builders often hesitate to use it in high-speed construction projects. Until improved formulations are widely adopted, this early strength limitation remains a challenge, especially in regions where rapid urban development is crucial and project deadlines are tight.

Growth Opportunity

Emerging Markets Drive Blended Cement Growth

A major opportunity for the blended cement market lies in the rapid infrastructure development across emerging economies, particularly in regions like Asia-Pacific, Africa, and Latin America.

Countries such as India, Vietnam, and Nigeria are experiencing significant urbanization, leading to increased demand for sustainable and durable construction materials. Blended cement, known for its environmental benefits and cost-effectiveness, is becoming a preferred choice in these regions.

In India, for instance, the government’s focus on infrastructure projects like “Smart Cities” and “Housing for All” initiatives is propelling the demand for blended cement. Additionally, the use of blended cement contributes to reduced CO₂ emissions, aligning with global sustainability goals.

Latest Trends

Innovative Cement Technologies Transforming Blended Market”

A significant trend in the blended cement market is the adoption of advanced technologies aimed at reducing carbon emissions and enhancing sustainability. Companies are exploring methods like “micronizing,” which involves finely grinding clinker and combining it with chemical admixtures. This process allows for a reduction in clinker content without compromising strength, leading to lower CO₂ emissions and cost savings .

Additionally, the development of energetically modified cements (EMCs) is gaining traction. EMCs are produced through mechanical processes without the need for high-temperature kilns, resulting in no toxic emissions during production. These innovations not only address environmental concerns but also offer improved durability and resistance in construction applications.

The integration of such technologies signifies a shift towards more sustainable practices in the cement industry, aligning with global efforts to reduce the environmental impact of construction materials. As these methods become more widespread, they are expected to play a crucial role in the future growth and development of the blended cement market.

Regional Analysis

Asia-Pacific led the Blended Cement Market with 43.8%, worth USD 156.5 billion.

In 2024, the Asia-Pacific region held a dominant position in the global Blended Cement Market, capturing 43.8% of the total market share and reaching a valuation of USD 156.5 billion. This leading position was supported by strong infrastructure development across emerging economies such as India, China, and Southeast Asian countries, where rapid urbanization and government-led construction initiatives are accelerating the use of sustainable building materials like blended cement.

In contrast, North America and Europe continued to reflect steady growth, driven by environmental regulations and the growing preference for low-carbon cement alternatives in green construction. While both regions maintained notable market presence, they did not match the scale of consumption seen in Asia-Pacific.

The Middle East & Africa region showed moderate adoption, supported by urban infrastructure projects in the Gulf Cooperation Council (GCC) countries, yet lagged in overall volume compared to Asia-Pacific. Similarly, Latin America demonstrated potential, particularly in countries like Brazil and Mexico, where infrastructural investments are increasing, though still on a smaller scale.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, Ambuja Cements Ltd continued reinforcing its position in the global blended cement market through sustainability-focused production and strategic resource optimization. The company emphasized increasing its use of fly ash and slag to reduce clinker consumption, aligning with India’s decarbonization targets. Its operational efficiency, supported by the use of waste heat recovery systems and green logistics, helped boost blended cement output while minimizing emissions.

Buzzi Unicem SpA, headquartered in Italy, expanded its influence in the European and North American blended cement sectors. The company focused on integrating supplementary cementitious materials, particularly ground granulated blast-furnace slag (GGBS), in its product mix to meet stringent EU environmental standards. In 2024, Buzzi accelerated investments in carbon capture and storage (CCS) technologies, aiming to future-proof its blended cement manufacturing and meet sustainability commitments under the European Green Deal.

Cement Australia maintained a stronghold in the Oceania region by expanding production capacity and leveraging locally sourced pozzolanic materials. The company’s strategic partnerships with infrastructure developers and its tailored blended cement solutions—optimized for durability and cost-efficiency in coastal construction—helped drive sales in 2024. Cement Australia’s commitment to circular economy practices, including the use of industrial by-products like fly ash from domestic power stations, aligned with Australia’s sustainable construction goals, reinforcing its position in the market.

Top Key Players in the Market

- Ambuja Cements Ltd

- Buzzi Unicem SpA

- Cement Australia

- CEMEX S.A.B DE C.V.

- Cimpor

- CRH Plc

- Dalmia Bharat Limited

- Dyckerhoff

- Heidelberg

- Holcim

- Lafarge

- RMC

- St. Marys Cement

- Taiheiyo

- UltraTech Cement Limited

- Zuari Cements

Recent Developments

- In January 2025, Buzzi Unicem sold its Fanna cement plant in Italy to Alpacem Italia. This move is part of the company’s strategy to restructure its production facilities in Italy. The sale allows Buzzi Unicem to focus more on sustainable and innovative cement products, including blended cements.

- In December 2024, Cement Australia, a joint venture between Heidelberg Materials and Holcim Australia, announced plans to acquire the cementitious division of the Buckeridge Group of Companies (BGC) in Perth for approximately US$800 million. This acquisition includes a cement grinding unit with significant capacities, as well as operations in cement, concrete, quarry, asphalt, transport, and a materials technology centre.

Report Scope

Report Features Description Market Value (2024) USD 357.4 Billion Forecast Revenue (2034) USD 534.1 Billion CAGR (2025-2034) 4.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Portland Pozzolana Cement (PPC), Portland Slag Cement (PSC), Composite cement, Other), By Application (Precast Construction, Cast-in-place Construction), By End user industry (Building Construction, Infrastructure) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Ambuja Cements Ltd, Buzzi Unicem SpA, Cement Australia, CEMEX S.A.B DE C.V., Cimpor, CRH Plc, Dalmia Bharat Limited, Dyckerhoff, Heidelberg, Holcim, Lafarge, RMC, St. Marys Cement, Taiheiyo, UltraTech Cement Limited, Zuari Cements Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Ambuja Cements Ltd

- Buzzi Unicem SpA

- Cement Australia

- CEMEX S.A.B DE C.V.

- Cimpor

- CRH Plc

- Dalmia Bharat Limited

- Dyckerhoff

- Heidelberg

- Holcim

- Lafarge

- RMC

- St. Marys Cement

- Taiheiyo

- UltraTech Cement Limited

- Zuari Cements