Global Biomass Power Market Size, Share, And Business Benefits By Technology (Combustion, Gasification, Anaerobic Digestion), By Feedstock (Solid Biofuel, Liquid Biofuel, Biogas), By End Use (Industrial, Commercial, Residential), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: June 2025

- Report ID: 150090

- Number of Pages: 199

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

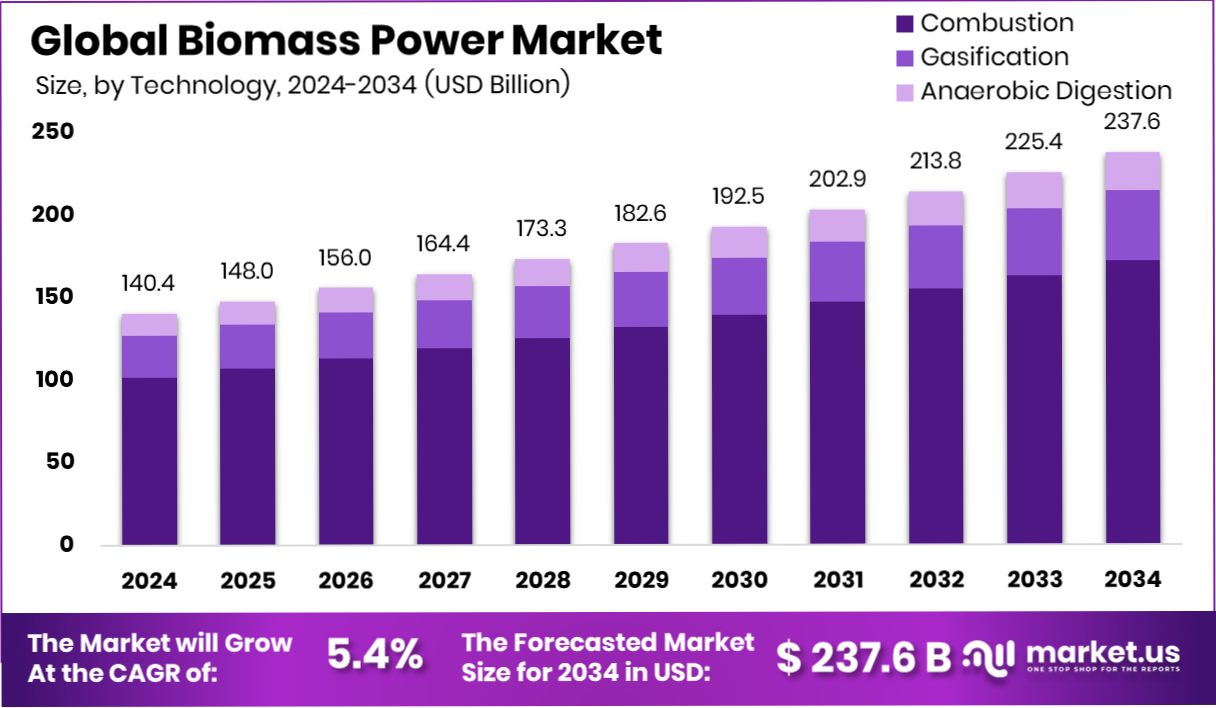

Global Biomass Power Market is expected to be worth around USD 237.6 billion by 2034, up from USD 140.4 billion in 2024, and grow at a CAGR of 5.4% from 2025 to 2034. Strong policy support in Europe drives biomass power growth to USD 64.3 billion.

Biomass power refers to the generation of electricity using organic materials such as wood chips, agricultural residues, animal manure, and even municipal solid waste. These materials are burned or converted into biogas through processes like combustion, gasification, or anaerobic digestion to produce steam or gas, which then drives turbines to generate electricity.

The biomass power market includes all activities related to the production and distribution of electricity generated from biomass sources. This encompasses biomass feedstock procurement, power plant construction, grid integration, and utility-scale as well as decentralized biomass systems. It also includes policy frameworks, financing mechanisms, and trade of biomass fuel. The market plays a vital role in clean energy strategies, especially in rural electrification, waste management, and climate mitigation plans across both developed and developing economies.

One of the key growth drivers for the biomass power market is the global push for low-carbon energy alternatives. Countries are increasingly investing in biomass projects to meet carbon neutrality targets and reduce dependence on fossil fuels. Additionally, supportive government policies, such as feed-in tariffs and renewable energy incentives, are boosting the installation of biomass-based plants.

The rising demand for sustainable waste disposal methods is encouraging industries and municipalities to adopt biomass-based solutions. Biomass power offers dual benefits—energy generation and waste reduction, which makes it an attractive option for circular economy models. In regions with strong agricultural economies, the availability of biomass feedstock is abundant, ensuring a consistent supply and lowering operational risks for power generation.

Key Takeaways

- Global Biomass Power Market is expected to be worth around USD 237.6 billion by 2034, up from USD 140.4 billion in 2024, and grow at a CAGR of 5.4% from 2025 to 2034.

- In 2024, Combustion technology dominated the Biomass Power Market with a 72.4% global share.

- Solid Biofuel led the feedstock segment in the Biomass Power Market, capturing 67.3% share.

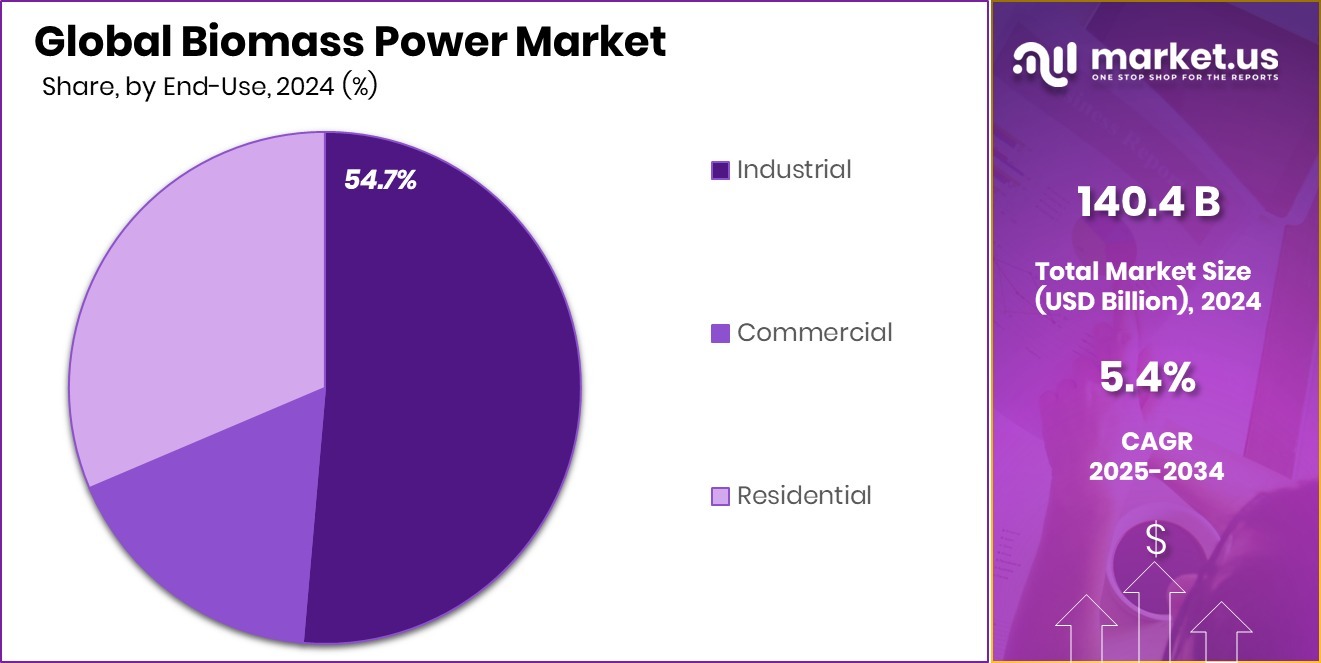

- Industrial end-use held a strong position in the Biomass Power Market with a 54.7% share globally.

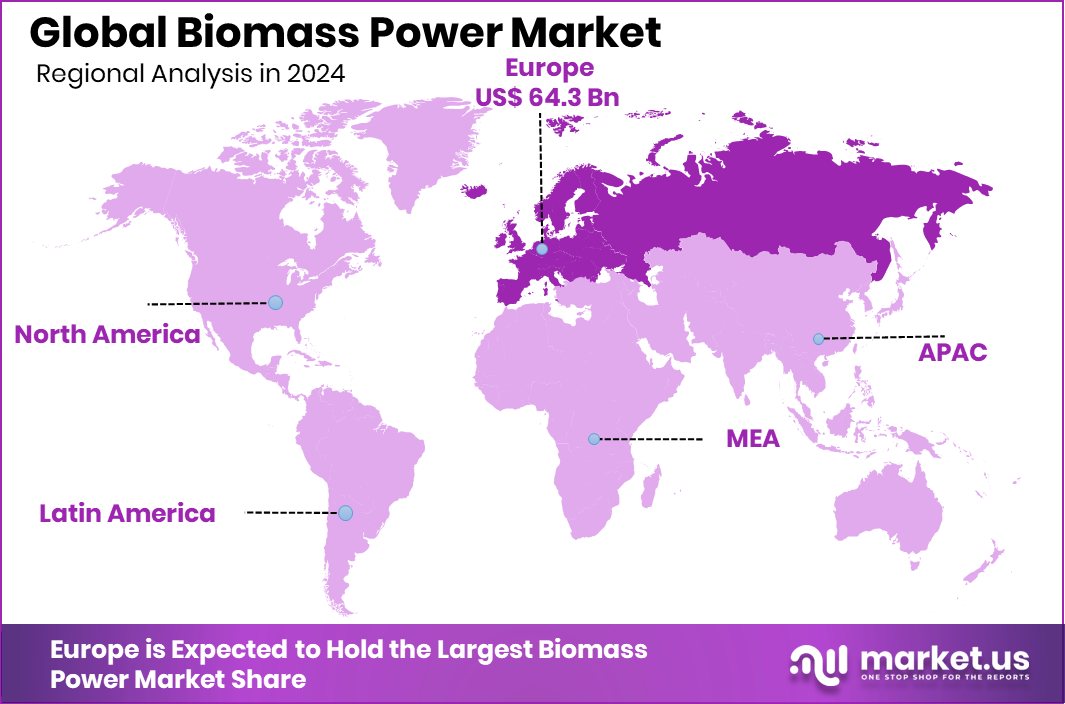

- The Biomass Power market value in Europe reached a total of USD 64.3 billion.

By Technology Analysis

In 2024, Combustion held a 72.4% share in the Biomass Power Market technology.

In 2024, Combustion held a dominant market position in By Technology segment of the Biomass Power Market, with a 72.4% share. This dominance is attributed to the wide-scale adoption of direct combustion systems due to their technical simplicity, cost-effectiveness, and long-standing operational reliability.

Combustion technology remains the most established method for converting biomass into energy, especially for utility-scale and industrial applications. It enables efficient energy recovery from a wide variety of biomass feedstocks, including wood chips, agricultural waste, and municipal solid waste.

The widespread infrastructure support and regulatory familiarity with combustion systems further reinforced their market leadership in 2024. In rural areas and regions with abundant biomass resources, combustion-based plants are preferred due to lower capital requirements compared to more advanced technologies.

Additionally, the ability to retrofit existing coal-fired power stations with biomass combustion systems contributed to its strong market penetration. With ongoing governmental support for renewable energy projects and emission-reduction commitments, combustion technology continued to receive policy and financial incentives, helping it maintain its significant share in the market.

By Feedstock Analysis

Solid Biofuel contributed a 67.3% share by feedstock in the Biomass Power Market.

In 2024, Solid Biofuel held a dominant market position in the By Feedstock segment of the Biomass Power Market, with a 72.4% share. This strong market hold is primarily driven by the high availability, lower processing costs, and energy efficiency associated with solid biomass forms such as wood chips, pellets, sawdust, and agricultural residues. Solid biofuels are easy to transport, store, and combust, making them highly suitable for both small- and large-scale biomass power plants.

The dominance of solid biofuel also stems from its established supply chains in regions rich in forestry and agriculture. Power producers continue to prefer solid feedstocks due to their consistent energy yield and ease of handling in conventional combustion-based systems. Moreover, solid biofuel’s compatibility with existing infrastructure further supports its market position, especially in retrofitted coal-fired facilities where solid fuel input remains structurally optimal.

Government policies promoting renewable energy and rural waste-to-energy initiatives have also enhanced the uptake of solid biofuels. Many countries are encouraging the collection and use of agricultural residues that would otherwise be burned in open fields, adding both environmental and economic value.

By End Use Analysis

The industrial segment led end-use with a 54.7% share in the Biomass Power Market.

In 2024, Industrial held a dominant market position in the By End Use segment of the Biomass Power Market, with a 54.7% share. This leadership is largely due to the increasing adoption of biomass power in industrial facilities seeking sustainable and cost-effective energy solutions. Industries with high thermal energy requirements, such as pulp and paper, cement, food processing, and chemicals, are increasingly integrating biomass-based systems to reduce reliance on fossil fuels and lower their carbon footprint.

The ability of biomass power to deliver both electricity and process heat through cogeneration makes it particularly attractive for industrial use. Many manufacturing units are also utilizing in-house biomass waste, like husks, shells, and residues, as a fuel source, enhancing energy efficiency and reducing operational costs. The 54.7% share highlights the strong alignment between biomass energy and industrial sustainability goals.

Additionally, regulatory pressures and energy security concerns are prompting industries to diversify their energy mix, with biomass emerging as a stable, locally sourced alternative. Governments offering tax benefits and renewable energy credits have further incentivized industrial players to invest in biomass power systems.

Key Market Segments

By Technology

- Combustion

- Gasification

- Anaerobic Digestion

By Feedstock

- Solid Biofuel

- Liquid Biofuel

- Biogas

By End Use

- Industrial

- Commercial

- Residential

Driving Factors

Government Support Boosting Renewable Biomass Power Adoption

One of the biggest driving factors for the biomass power market is strong government support. Many countries are creating policies to reduce carbon emissions and promote clean energy. To support this, they are offering subsidies, tax benefits, and incentives to encourage biomass energy projects.

These policies make it easier and more affordable for companies to invest in biomass power plants. In rural areas, governments are also helping build small-scale biomass units to improve electricity access. National renewable energy targets and emission control regulations are pushing more industries to switch to biomass from coal or diesel.

Restraining Factors

High Installation Costs Limit Biomass Power Expansion

A major challenge for the biomass power market is its high initial setup cost. Building a biomass power plant requires expensive equipment, such as boilers, turbines, and emission control systems. In addition, preparing and storing feedstock like wood chips or agricultural waste adds to the overall cost. For many small businesses or rural communities, these expenses can be too high without financial support.

Also, setting up a consistent supply chain for biomass fuel can be complicated and costly in remote areas. Even though biomass power is a clean energy option, the heavy investment needed at the start often discourages investors and developers from choosing it, especially when cheaper energy alternatives are available in the market.

Growth Opportunity

Rising Agricultural Waste Unlocks Biomass Opportunity

One big growth opportunity for the biomass power market is the increasing availability of agricultural waste. Every year, farms generate large amounts of crop residues like husks, straw, and shells that often go unused or are burned in open fields. Instead of letting this waste cause pollution, it can be collected and used to generate electricity.

Countries with strong farming sectors, especially in Asia and Africa, have huge potential to turn this waste into clean energy. Using agricultural waste not only helps reduce emissions but also creates income opportunities for farmers. As governments and industries look for affordable and local energy sources, this growing supply of agricultural byproducts can become a valuable fuel for biomass power plants.

Latest Trends

Hybrid Biomass Systems Gaining More Industry Attention

A key trend in the biomass power market is the growing use of hybrid systems. These systems combine biomass with other renewable sources like solar or wind to produce more stable and efficient energy. Since solar and wind depend on weather, combining them with biomass helps maintain a steady power supply, especially in off-grid or remote areas.

Industries are showing interest in hybrid setups because they reduce fuel use, improve reliability, and lower overall energy costs. Some hybrid plants also use waste heat from biomass to boost efficiency. As technology becomes more advanced and affordable, more companies and governments are exploring these smart energy solutions to meet both environmental goals and energy needs effectively.

Regional Analysis

Europe led the Biomass Power Market in 2024 with a 45.8% market share.

In 2024, Europe held the dominant position in the global Biomass Power Market, accounting for 45.8% of the market share, valued at USD 64.3 billion. The region’s leadership can be attributed to well-established renewable energy policies, widespread adoption of biomass-based combined heat and power (CHP) plants, and strong government incentives supporting decarbonization.

Countries such as Germany, Sweden, and Finland have invested significantly in sustainable biomass infrastructure, ensuring a consistent supply of feedstock and high-efficiency power systems.

North America followed with steady growth supported by favorable bioenergy regulations and a growing shift toward replacing coal-fired power with renewable alternatives. Asia Pacific showed notable development, primarily driven by increasing energy demand, agricultural residue availability, and rising rural electrification programs.

The Middle East & Africa region is gradually entering the biomass energy space, with pilot-scale projects aimed at improving waste management and local energy generation. Latin America, rich in forestry and agricultural resources, is exploring biomass potential, especially in Brazil and Argentina.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, Mitsubishi Heavy Industries, Ltd. continued to demonstrate strong involvement in the biomass power sector through its engineering expertise and turnkey plant solutions. The company’s capabilities in providing biomass-fired boilers and integrated systems have made it a reliable partner in both domestic and international markets. Mitsubishi’s focus on advancing boiler efficiency and emissions control aligns well with tightening global environmental regulations, reinforcing its strategic importance in biomass power projects that demand technical precision and long-term reliability.

Suez, with its deep roots in environmental services and waste management, plays a critical role in the biomass power landscape, particularly through its waste-to-energy operations. In 2024, Suez maintained its position by converting organic and municipal waste into bioenergy across multiple facilities. Its circular economy model, which includes waste collection, processing, and energy recovery, positions it as a key enabler of sustainable biomass practices.

Xcel Energy Inc., a U.S.-based utility, continued to incorporate biomass into its diversified renewable energy mix in 2024. Its ongoing efforts to reduce carbon emissions and transition to cleaner sources have supported biomass projects in select service areas. Xcel’s strategy emphasizes grid reliability, and biomass plays a supportive role in providing dispatchable power.

Top Key Players in the Market

- Mitsubishi Heavy Industries, Ltd.

- Suez

- Xcel Energy Inc.

- Ramboll Group A/S

- Babcock & Wilcox Enterprises, Inc.

- Ørsted A/S

- Ameresco

- General Electric

- Veolia

- Vattenfall

Recent Developments

- In February 2025, Xcel Energy received approval from the Minnesota Public Utilities Commission for its Upper Midwest Energy Plan, aiming to exceed 80% carbon emissions reductions by 2030. The plan includes significant investments in renewable energy sources such as wind and solar power, as well as battery energy storage systems.

- In June 2024, B&W began work on converting a former coal-fired power plant in Filer City, Michigan, into a Bioenergy with Carbon Capture and Storage (BECCS) facility. This project employs B&W’s SolveBright™ technology to capture up to 550,000 tons of CO₂ annually, aiming to produce net-negative greenhouse gas emissions by using sustainable biomass as fuel.

Report Scope

Report Features Description Market Value (2024) USD 237.6 Billion Forecast Revenue (2034) USD 140.4 Billion CAGR (2025-2034) 5.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Technology (Combustion, Gasification, Anaerobic Digestion), By Feedstock (Solid Biofuel, Liquid Biofuel, Biogas), By End Use (Industrial, Commercial, Residential) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Mitsubishi Heavy Industries, Ltd., Suez, Xcel Energy Inc., Ramboll Group A/S, Babcock & Wilcox Enterprises, Inc., Ørsted A/S, Ameresco, General Electric, Veolia, Vattenfall Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Mitsubishi Heavy Industries, Ltd.

- Suez

- Xcel Energy Inc.

- Ramboll Group A/S

- Babcock & Wilcox Enterprises, Inc.

- Ørsted A/S

- Ameresco

- General Electric

- Veolia

- Vattenfall