Global Biogas Upgrading Market Size, Share and Future Trends Analysis Report By Technology (Pressure Swing Adsorption (PSA), Membrane Separation, Water Scrubbing, Chemical Absorption, Cryogenic Distillation), By Feedstock Type (Agricultural Residues, Animal Manure, Food Waste, Sewage Sludge, Others), By End Use (Energy Generation, Transportation Fuel, Agriculture, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: June 2025

- Report ID: 150051

- Number of Pages: 333

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

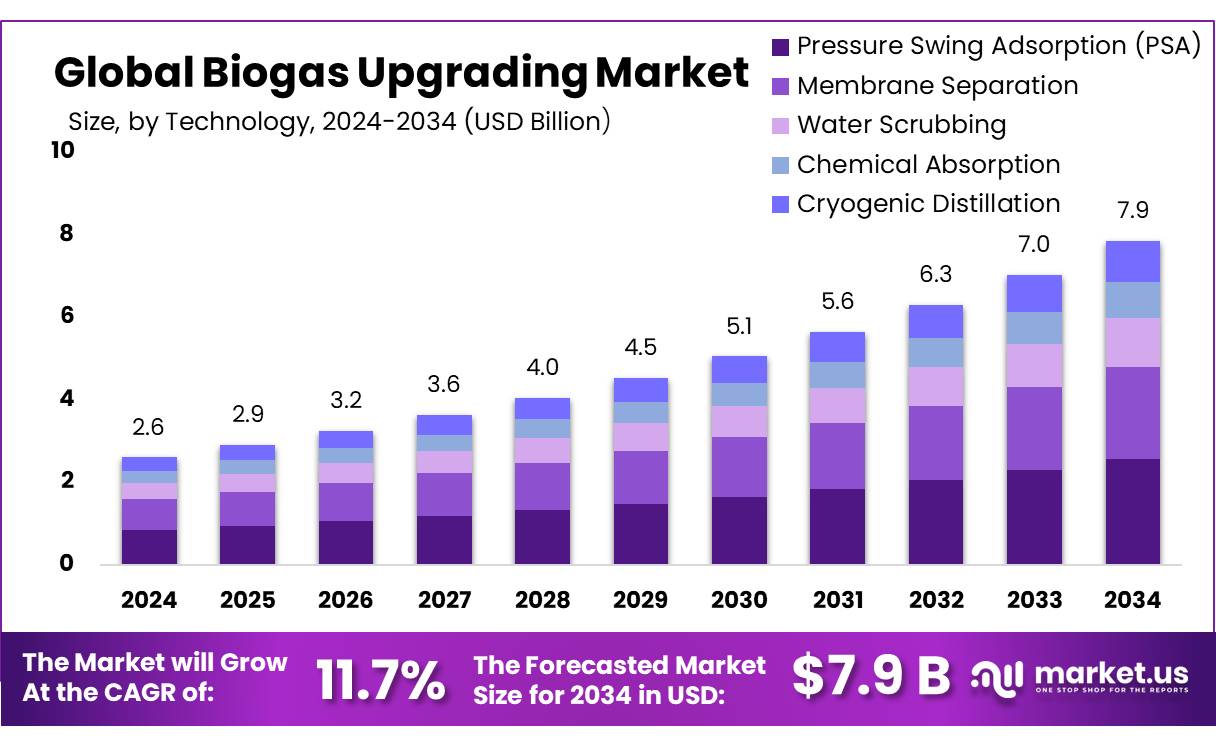

The Global Biogas Upgrading Market size is expected to be worth around USD 7.9 Billion by 2034, from USD 2.6 Billion in 2024, growing at a CAGR of 11.7% during the forecast period from 2025 to 2034.

The biogas upgrading sector, particularly focusing on cellulose-based feedstocks, is experiencing significant growth driven by global energy transitions, environmental mandates, and technological advancements. Biogas upgrading involves purifying raw biogas—produced through anaerobic digestion of organic materials such as agricultural residues, municipal solid waste, and wastewater—into biomethane, a renewable and cleaner alternative to fossil fuels. Cellulose-rich materials, including crop residues and forestry waste, serve as abundant and sustainable feedstocks for biogas production.

In the United States, the biogas industry is also expanding. As of 2024, there are over 2,300 operational biogas plants, with investments in new biogas systems growing by $3 billion, marking a 40% increase compared to the previous year. The U.S. Environmental Protection Agency (EPA) has identified more than 2,000 sites producing biogas, with the potential for an additional 11,000 systems.

Government initiatives are significantly influencing the biogas sector’s growth. The Sustainable Alternative Towards Affordable Transportation (SATAT) scheme aims to establish 5,000 compressed biogas plants by 2023, producing 15 million tons of biogas annually. Additionally, the GOBARdhan (Galvanizing Organic Bio-Agro Resources Dhan) scheme focuses on converting organic waste into biogas, promoting a circular economy. The Indian Biogas Association has proposed integrating these initiatives into a unified national mission to streamline efforts and scale up biogas deployment.

The global potential for biogas production remains largely untapped. According to the World Biogas Association, only 1.6–2.2% of the potential of anaerobic digestion technology is currently utilized. This indicates substantial opportunities for expansion, particularly in converting cellulose-rich waste into renewable energy. Advancements in biogas upgrading technologies, coupled with supportive government policies and increasing environmental awareness, are expected to drive significant growth in this sector.

India is actively promoting biogas production through various government initiatives. The Sustainable Alternative Towards Affordable Transportation (SATAT) scheme aims to establish 5,000 compressed biogas (CBG) plants, targeting the production of 15 million tons of biogas annually. Additionally, the GOBARDhan initiative focuses on managing cattle dung and solid waste to produce biogas, thereby improving sanitation and generating energy. The Indian Biogas Association has proposed integrating these initiatives into a unified national mission to streamline efforts and enhance efficiency.

Key Takeaways

- Biogas Upgrading Market size is expected to be worth around USD 7.9 Billion by 2034, from USD 2.6 Billion in 2024, growing at a CAGR of 11.7%.

- Pressure Swing Adsorption (PSA) held a dominant market position, capturing more than a 32.7% share of the global biogas upgrading market.

- Agricultural Residues held a dominant market position, capturing more than a 29.5% share of the global biogas upgrading market.

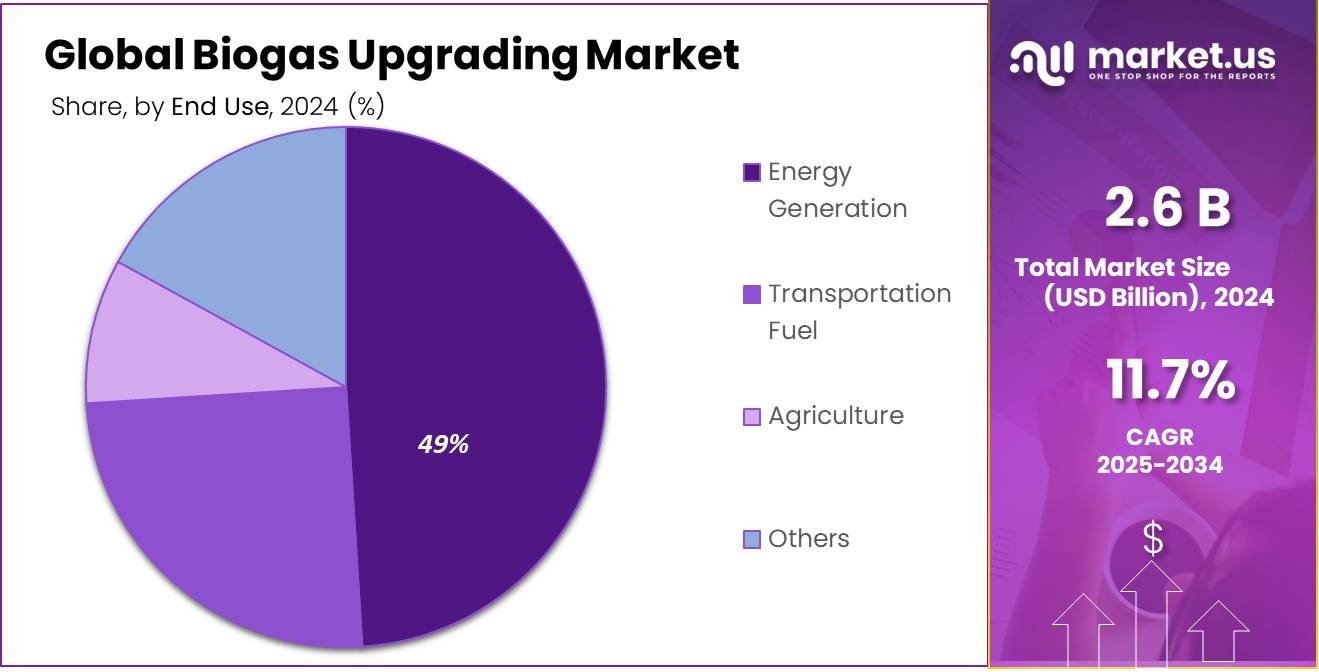

- Energy Generation held a dominant market position, capturing more than a 49.9% share of the biogas upgrading market.

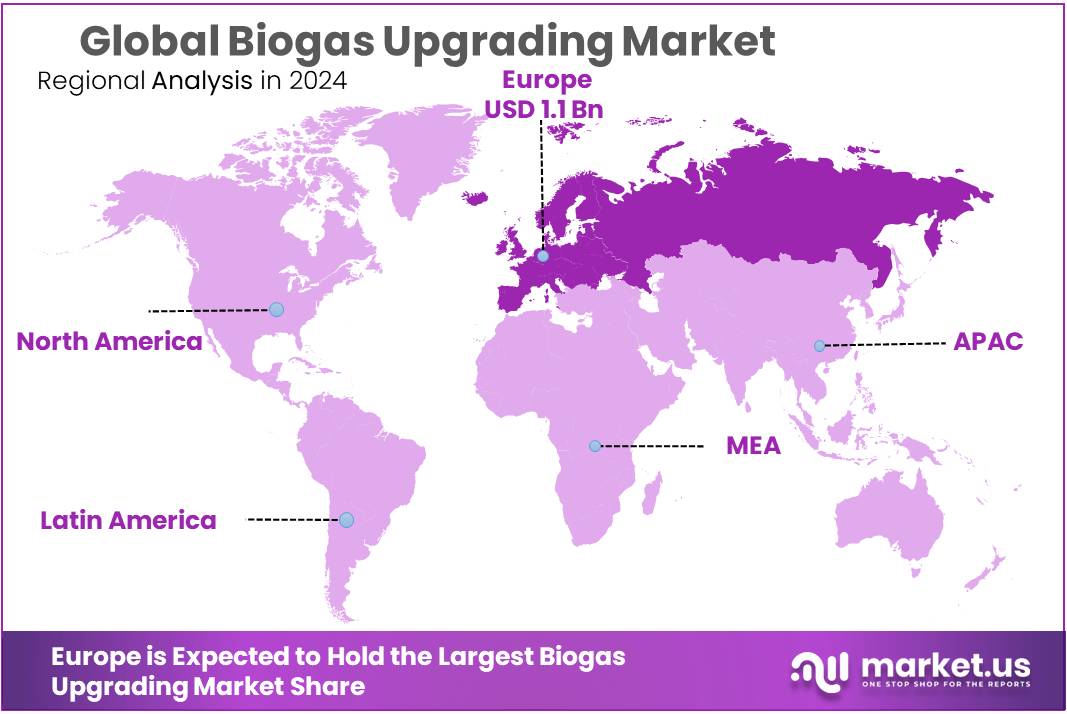

- Europe solidified its leadership in the global biogas upgrading market, capturing a dominant 44.8% share, equivalent to approximately USD 1.1 billion.

By Technology

Pressure Swing Adsorption (PSA) leads with 32.7% market share in 2024 due to its operational simplicity and low energy demand.

In 2024, Pressure Swing Adsorption (PSA) held a dominant market position, capturing more than a 32.7% share of the global biogas upgrading market. PSA technology has gained popularity because it operates without the use of solvents, which reduces both energy costs and environmental impact. It is particularly preferred in small-to-medium scale biogas plants due to its modular setup and ease of operation.

This method separates carbon dioxide from methane by using pressure differences across molecular sieves, achieving biomethane concentrations of over 96%. As more countries push for decentralized renewable energy systems, especially in rural and semi-urban regions, PSA systems are being adopted in both agricultural and municipal biogas projects. While no major fluctuations are expected in 2025, PSA is anticipated to maintain its lead, especially in European and Asian installations, due to strong policy support and continued investment in renewable natural gas (RNG) infrastructure.

By Feedstock Type

Agricultural Residues lead the feedstock segment with 29.5% in 2024, driven by their abundance and low processing cost.

In 2024, Agricultural Residues held a dominant market position, capturing more than a 29.5% share of the global biogas upgrading market by feedstock type. This dominance is primarily due to the wide availability of crop leftovers like wheat straw, corn stalks, and rice husks, which are often underutilized and low-cost. Farmers and rural cooperatives are increasingly adopting biogas systems that convert this organic waste into valuable biomethane, creating both energy and income.

Since these residues do not compete with food supply chains, they are seen as a sustainable and circular source for renewable energy. Government-backed programs in countries like India and Germany are also encouraging biogas production from agricultural inputs to cut emissions and reduce waste burning. Looking into 2025, the share of agricultural residues is expected to remain strong, especially with expanding infrastructure in Asia and Europe to process this feedstock efficiently and at scale.

By End Use

Energy Generation dominates biogas upgrading use with 49.9% share in 2024, powered by rising demand for clean electricity and heat.

In 2024, Energy Generation held a dominant market position, capturing more than a 49.9% share of the biogas upgrading market by end use. This strong lead reflects the global shift toward cleaner power sources, as upgraded biogas (biomethane) is increasingly used in combined heat and power (CHP) systems and injected into national gas grids. Countries across Europe, such as Germany and the Netherlands, have prioritized biomethane for local electricity production to reduce dependency on fossil fuels.

The flexibility of using biomethane for both electricity and heating needs—especially in rural areas—makes it an attractive alternative. As electricity demand continues to grow and nations work to meet net-zero targets, the role of biogas in energy generation is set to stay critical. In 2025, this segment is expected to maintain its leadership, supported by new grid-injection projects and renewable energy mandates.

Key Market Segments

By Technology

- Pressure Swing Adsorption (PSA)

- Membrane Separation

- Water Scrubbing

- Chemical Absorption

- Cryogenic Distillation

By Feedstock Type

- Agricultural Residues

- Animal Manure

- Food Waste

- Sewage Sludge

- Others

By End Use

- Energy Generation

- Transportation Fuel

- Agriculture

- Others

Drivers

Government Support and Policy Incentives Are Driving Biogas Upgrading Growth

One of the key drivers behind the growth of the biogas upgrading market is the increasing support from governments and the implementation of favorable policies. These measures are encouraging the adoption of biogas technologies by providing financial incentives, setting renewable energy targets, and streamlining regulatory frameworks.

In India, the government has launched several initiatives to promote biogas production and utilization. The Sustainable Alternative Towards Affordable Transportation (SATAT) scheme aims to establish 5,000 compressed biogas (CBG) plants by 2023, producing 15 million tons of biogas annually. Additionally, the GOBARdhan (Galvanizing Organic Bio-Agro Resources Dhan) scheme focuses on converting organic waste into biogas, promoting a circular economy. The Indian Biogas Association has proposed integrating these initiatives into a unified national mission to streamline efforts and scale up biogas deployment.

Europe is also witnessing significant growth in the biogas sector, driven by strong policy support and environmental regulations. The European Union has set an annual biomethane production target of 35 billion cubic meters (bcm) by 2030. In June 2024, the EU achieved 5.2 bcm, up more than a third from the previous year.

Restraints

High Capital Costs and Infrastructure Challenges Restrain Biogas Upgrading Market Growth

One of the significant barriers hindering the widespread adoption of biogas upgrading technologies is the substantial initial capital investment required. Establishing a biogas upgrading facility involves considerable expenses related to land acquisition, equipment procurement, engineering, and construction. These high upfront costs can deter potential investors and project developers, especially in regions where financial incentives and subsidies are limited.

In developing countries, the challenge is further exacerbated by widespread poverty and limited access to financing. High investment costs, coupled with economic constraints, make it difficult for these regions to implement biogas technologies effectively. This situation underscores the need for targeted financial support and policy interventions to make biogas upgrading more accessible and economically viable in these areas.

Moreover, the complexity of regulatory frameworks and the need for compliance with environmental standards can slow down project approvals and increase costs. Navigating these regulatory landscapes requires specialized knowledge and resources, which can be a barrier for smaller organizations or those new to the biogas sector.

To overcome these challenges, it is essential to implement supportive policies and provide financial incentives that can offset the high initial costs associated with biogas upgrading. This includes offering subsidies, tax credits, and low-interest loans to project developers. Additionally, streamlining regulatory processes and providing technical assistance can help reduce the complexity and cost of compliance, making biogas upgrading projects more feasible and attractive to investors.

Opportunity

Government Initiatives Fuel Growth in Biogas Upgrading Market

One of the significant growth opportunities in the biogas upgrading market is the increasing support from governments worldwide. These initiatives aim to promote renewable energy sources, reduce greenhouse gas emissions, and manage organic waste effectively.

In India, the government has launched several programs to boost biogas production and utilization. The Sustainable Alternative Towards Affordable Transportation (SATAT) initiative aims to establish 5,000 compressed biogas (CBG) plants by 2023, producing 15 million tons of biogas annually. Additionally, the GOBARdhan (Galvanizing Organic Bio-Agro Resources Dhan) scheme focuses on converting organic waste into biogas, promoting a circular economy. The Indian Biogas Association has proposed integrating these initiatives into a unified national mission to streamline efforts and scale up biogas deployment.

In the United States, the biogas industry has seen substantial growth, with $1.8 billion invested in new projects in 2023 alone. This investment led to nearly 100 new projects coming online, and the trend is expected to continue, with more than 100 new projects projected for 2024. These developments are driven by the need to manage millions of tons of organic waste and reduce methane emissions.

Europe is also witnessing significant advancements in the biogas sector. The European Union has set an annual biomethane production target of 35 billion cubic meters (bcm) by 2030. In June 2024, the EU achieved 5.2 bcm, up more than a third from the previous year.

Trends

Integration of Biogas Upgrading with Power-to-X Technologies: A Promising Trend

A significant emerging trend in the biogas upgrading market is the integration of Power-to-X (PtX) technologies, particularly the production of hydrogen and e-methanol. This approach leverages the carbon dioxide (CO₂) captured during biogas upgrading processes, combining it with renewable hydrogen to synthesize e-methanol, a versatile fuel and chemical feedstock.

A study by Alamia et al. (2024) explores the optimization of hydrogen and e-methanol production through PtX integration in biogas plants. The research indicates that such integration can create an internal market for energy and materials, interfacing effectively with external energy systems. The study found that methanol production costs could be reduced to below €650 per ton, and hydrogen production costs to below €3 per kg, making the process economically viable. Furthermore, the integration allows for over 90% CO2 recovery, significantly enhancing the sustainability of biogas operations.

This trend aligns with broader energy strategies, such as the European Union’s focus on developing hydrogen and electrofuels infrastructure to achieve net-zero emissions. By utilizing renewable CO₂ from biogas plants, PtX hubs can contribute to the production of renewable fuels of non-biological origin (RFNBOs), supporting the EU’s Renewable Energy Directive targets.

Regional Analysis

Europe Commands 44.8% of Global Biogas Upgrading Market in 2024, Valued at $1.1 Billion

In 2024, Europe solidified its leadership in the global biogas upgrading market, capturing a dominant 44.8% share, equivalent to approximately $1.1 billion. This commanding position is underpinned by the European Union’s strategic emphasis on renewable energy and its commitment to reducing greenhouse gas emissions.

The European Biogas Association reported that biogas production in Europe reached 22 billion cubic meters (bcm) in 2023, marking a significant contribution to the region’s renewable energy mix. This growth trajectory is supported by substantial investments, with €27 billion earmarked for the biomethane sector by 2030. The potential for expansion is considerable, with projections indicating that the sector could deliver up to 101 bcm of biomethane to the European Union by 2040, effectively covering more than 80% of the EU’s gas consumption at that time.

Technological advancements are also playing a crucial role in Europe’s biogas upgrading market. Membrane separation has become the most common technology used in countries like France and Switzerland, while chemical scrubbers dominate in Denmark. Sweden and Germany have the highest shares of water scrubbers. These technologies enhance the efficiency and cost-effectiveness of biogas purification processes, contributing to the sector’s growth.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

EnviTec Biogas AG, headquartered in Germany, is a global leader in biogas plant construction and upgrading technologies. Since its inception in 2002, the company has completed over 700 biogas projects across 18 countries. Their EnviThan upgrading system is renowned for its compact, modular design, facilitating efficient deployment and operation. EnviTec’s portfolio encompasses anaerobic digestion, gas upgrading, ammonia stripping, bio-LCO₂, and bio-LNG solutions, catering to diverse renewable energy needs.

Founded in 1967 in Canada, Xebec Adsorption Inc. specializes in gas purification and filtration solutions. The company has designed and serviced over 9,000 adsorption units globally, with more than 250 Fast Cycle Pressure Swing Adsorption (PSA) systems deployed. Xebec’s technologies are pivotal in transforming raw biogas into high-purity renewable natural gas, supporting the global shift towards sustainable energy sources.

Greenlane Renewables, based in Canada, is a pioneer in biogas upgrading, offering a comprehensive suite of technologies including water wash, PSA, and membrane separation. With over 145 systems installed in 19 countries, Greenlane’s solutions are instrumental in converting organic waste into clean, low-carbon renewable natural gas, suitable for grid injection or vehicle fuel.

Top Key Players in the Market

- EnviTec Biogas

- Xebec Adsorption

- Greenlane Renewables

- Ecovia Renewables

- DMT Environmental Technology

- Veolia Environnement

- Biogas Nord

- Biofuel Systems

- Air Products and Chemicals

- Hobas

- Methanation Technology

- Wartsila

- CNG Services

- Gazasia

- Sustainable Energy Group

Recent Developments

In 2024 EnviTec Biogas AG, reported revenues of €337.7 million and employed approximately 690 people. EnviTec has constructed over 700 biogas and gas upgrading plants across 18 countries, demonstrating its global reach and expertise.

In 2024, Ecovia Renewables raised $2.05 million in a seed funding round, bringing their total funding to approximately $11.9 million over eight rounds from six investors.

Report Scope

Report Features Description Market Value (2024) USD 2.6 Bn Forecast Revenue (2034) USD 7.9 Bn CAGR (2025-2034) 11.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Technology (Pressure Swing Adsorption (PSA), Membrane Separation, Water Scrubbing, Chemical Absorption, Cryogenic Distillation), By Feedstock Type (Agricultural Residues, Animal Manure, Food Waste, Sewage Sludge, Others), By End Use (Energy Generation, Transportation Fuel, Agriculture, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape EnviTec Biogas, Xebec Adsorption, Greenlane Renewables, Ecovia Renewables, DMT Environmental Technology, Veolia Environnement, Biogas Nord, Biofuel Systems, Air Products and Chemicals, Hobas, Methanation Technology, Wartsila, CNG Services, Gazasia, Sustainable Energy Group Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- EnviTec Biogas

- Xebec Adsorption

- Greenlane Renewables

- Ecovia Renewables

- DMT Environmental Technology

- Veolia Environnement

- Biogas Nord

- Biofuel Systems

- Air Products and Chemicals

- Hobas

- Methanation Technology

- Wartsila

- CNG Services

- Gazasia

- Sustainable Energy Group