Global Bioabsorbable Stents Market By Biomaterial (Polymer Based Bioabsorbable Stents and Metal Based Bioabsorbable Stents), By Absorption Rate (Fast Resorbing and Slower Resorbing), By Application (Coronary Artery Disease (CAD) and Peripheral Artery Disease (PAD)), By End-User (Hospitals and Cardiac Centers), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 172155

- Number of Pages: 371

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

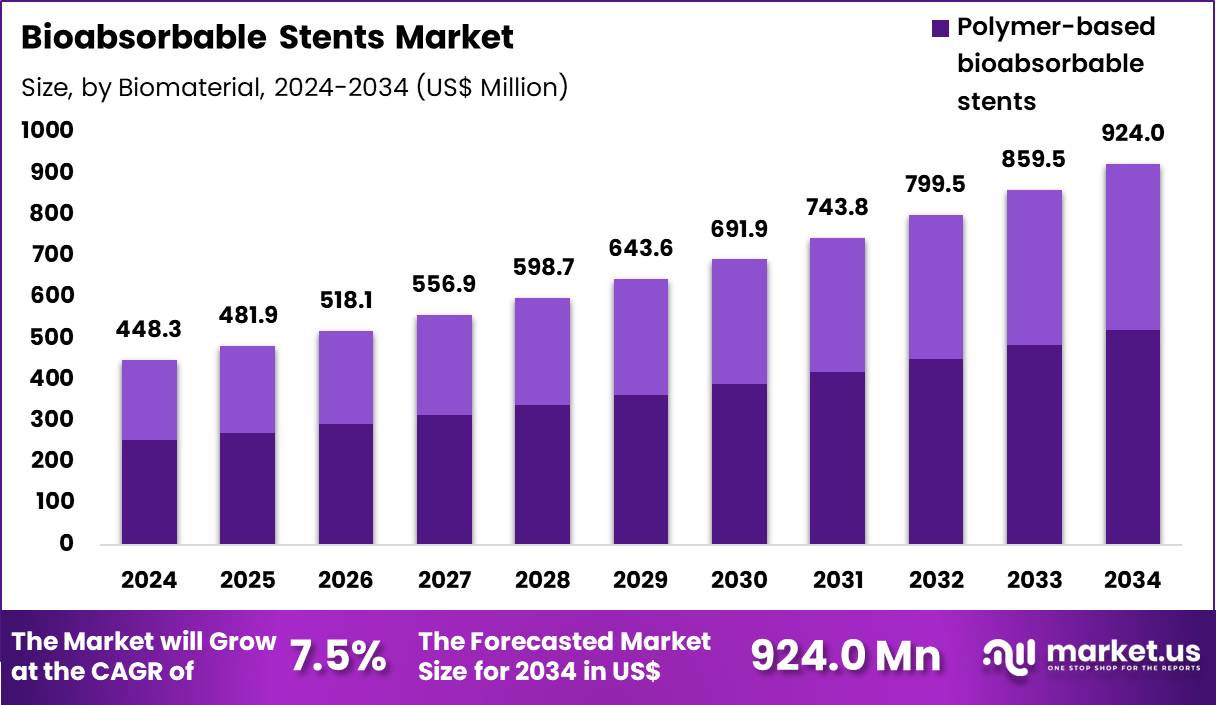

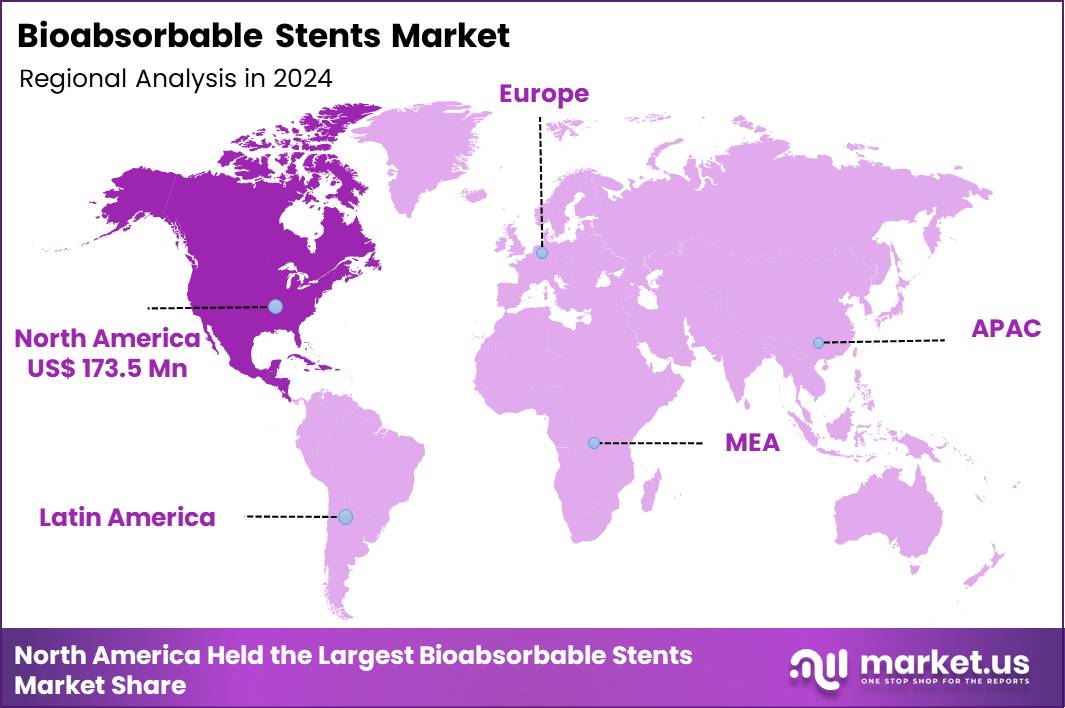

The Global Bioabsorbable Stents Market size is expected to be worth around US$ 924.0 Million by 2034 from US$ 448.3 Million in 2024, growing at a CAGR of 7.5% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 38.7% share with a revenue of US$ 173.5 Million.

Growing prevalence of cardiovascular diseases drives demand for bioabsorbable stents that eliminate long-term complications associated with permanent metallic implants. Interventional cardiologists increasingly select these devices to restore vessel patency while allowing natural healing and vasomotion recovery in patients undergoing percutaneous interventions.

Manufacturers advance polymer- and magnesium-based scaffolds to provide temporary structural support without inducing chronic inflammation or thrombosis risks. These stents address limitations of traditional options by fully degrading after fulfilling their mechanical role. In November 2023, Kaneka’s strategic acquisition of Japan Medical Device Technology reshaped competitive dynamics within the Bioabsorbable Stents Market by strengthening capabilities in magnesium based scaffold development.

This consolidation enhances material science innovation, improves production scalability, and accelerates the commercialization of next generation bioabsorbable stents designed for improved strength and controlled resorption profiles. Such strategic moves underscore how industry consolidation propels advancements in treating coronary artery disease through fully resorbable technologies.

Manufacturers pursue opportunities to expand bioabsorbable stents into peripheral artery disease management, particularly below-the-knee lesions where permanent implants heighten risks of chronic limb-threatening ischemia. Developers engineer thinner struts and drug-eluting coatings to improve endothelialization and reduce restenosis in complex vascular anatomies. These devices enable clinicians to treat critical limb ischemia by providing scaffold support during healing followed by complete absorption.

Opportunities also arise in neurovascular interventions, where bioabsorbable scaffolds minimize foreign body reactions in delicate cerebral vessels. Companies capitalize on hybrid polymer-metal compositions to enhance radial strength for broader applicability in peripheral vascular reconstructions. Firms invest in tailored resorption profiles that align with tissue recovery timelines across diverse arterial beds.

Developers introduce next-generation magnesium alloy scaffolds that deliver superior radial strength and predictable degradation compared to earlier polymer-only designs. Clinicians adopt ultra-thin strut configurations to facilitate faster vessel healing and lower thrombosis rates in coronary applications. Industry players integrate advanced drug-eluting mechanisms with bioabsorbable platforms to prevent neointimal hyperplasia effectively.

Researchers refine composite materials combining polymers and metals for optimized mechanical performance and biocompatibility. Market innovators prioritize scaffolds that restore native vessel function post-absorption in both coronary and peripheral settings. Ongoing trials validate expanded indications for bioabsorbable technologies in challenging anatomies, building physician confidence in transient vascular support solutions.

Key Takeaways

- In 2024, the market generated a revenue of US$ 448.3 million, with a CAGR of 7.5%, and is expected to reach US$ 924.0 million by the year 2034.

- The biomaterial segment is divided into polymer based bioabsorbable stents and metal based bioabsorbable stents, with polymer‑based bioabsorbable stents taking the lead in 2024 with a market share of 56.4%.

- Considering absorption rate, the market is divided into fast resorbing and slower resorbing. Among these, slower‑resorbing held a significant share of 58.1%.

- Furthermore, concerning the application segment, the market is segregated into coronary artery disease (CAD) and peripheral artery disease (PAD). The coronary artery disease (CAD)sector stands out as the dominant player, holding the largest revenue share of 72.1% in the market.

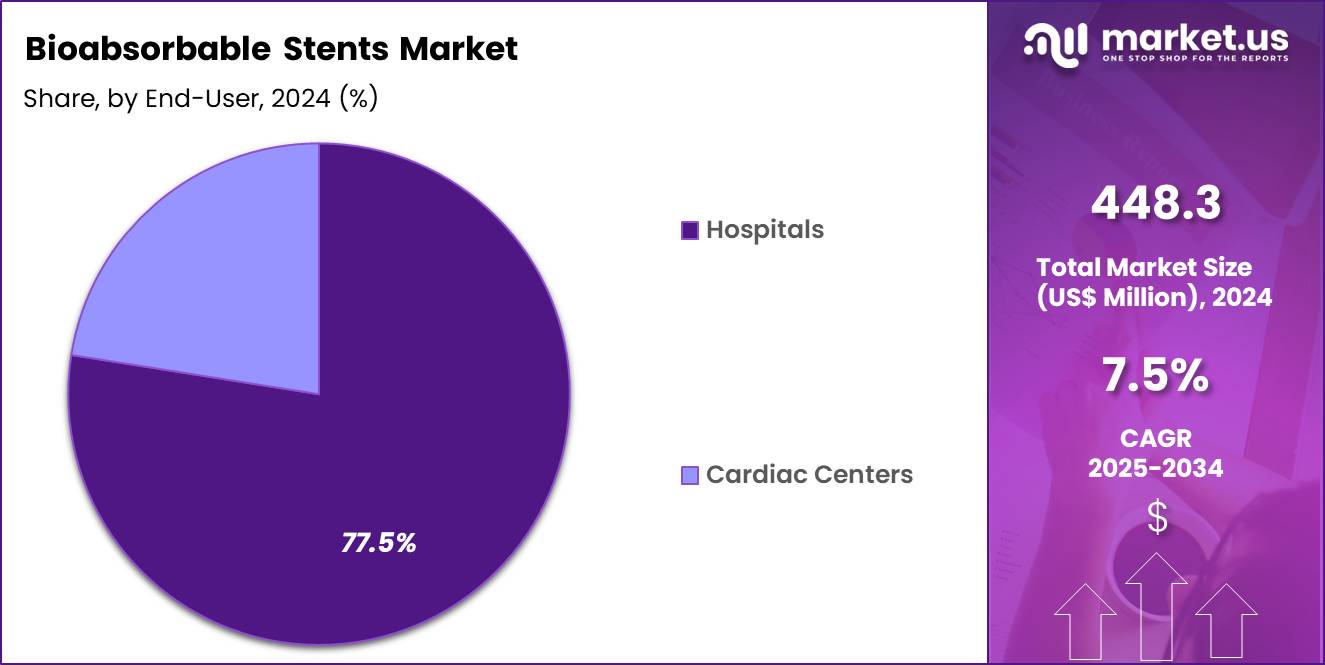

- The end-user segment is segregated into hospitals and cardiac centers, with the hospitals segment leading the market, holding a revenue share of 77.5%.

- North America led the market by securing a market share of 38.7% in 2024.

Biomaterial Analysis

Polymer based bioabsorbable stents, holding 56.4%, are expected to dominate because they provide controlled degradation while maintaining sufficient radial strength during the critical vessel healing period. Cardiologists increasingly favor polymer platforms due to their flexibility, improved deliverability, and reduced long-term foreign body presence compared with permanent metallic implants.

Advances in polymer chemistry enhance mechanical integrity and predictability of resorption, improving clinical confidence. Growing focus on restoring natural vessel physiology after intervention strengthens preference for polymer-based designs. Clinical studies highlighting reduced late-stage complications support wider adoption in routine practice.

Manufacturers continue optimizing scaffold architecture to balance support and resorption timing. Regulatory pathways for polymer systems mature steadily, supporting commercialization. These drivers keep polymer based bioabsorbable stents anticipated to remain the leading biomaterial segment.

Absorption Rate Analysis

Slower resorbing stents, holding 58.1%, are projected to dominate because they provide prolonged vessel scaffolding during endothelial healing and plaque stabilization. Clinicians prioritize sustained mechanical support to reduce early recoil and restenosis risks in complex lesions. Slower degradation profiles align better with biological healing timelines, improving long-term vessel patency. Research demonstrates that extended support reduces adverse remodeling during the vulnerable post-implantation phase.

Device developers tailor polymer compositions to achieve predictable, gradual resorption without inflammatory response. Increasing treatment of high-risk patients strengthens demand for reliable, longer-support solutions. Clinical preference for stability over rapid disappearance drives adoption. These factors keep slower resorbing stents expected to lead the absorption rate segment.

Application Analysis

Coronary artery disease (CAD), holding 72.1%, is expected to dominate because CAD remains the most prevalent indication requiring interventional stent placement worldwide. Rising incidence of lifestyle-related cardiovascular risk factors expands the patient pool requiring revascularization. Bioabsorbable stents offer a compelling alternative by supporting arteries temporarily and then allowing natural vessel function restoration.

Interventional cardiology guidelines increasingly explore bioresorbable options for selected CAD cases. Technological improvements reduce early failure concerns, encouraging broader clinical acceptance. Hospitals and cardiac centers expand CAD treatment volumes, reinforcing device utilization. Patient demand for advanced, long-term friendly implants supports adoption. These trends keep CAD anticipated to remain the dominant application.

End-User Analysis

Hospitals, holding 77.5%, are projected to dominate because complex coronary interventions predominantly occur in hospital-based catheterization laboratories. Hospitals maintain advanced imaging, surgical backup, and multidisciplinary teams essential for bioabsorbable stent deployment. Increasing cardiovascular admissions drive procedural volume growth in tertiary and secondary hospitals.

Training programs and clinical trials primarily operate within hospital settings, accelerating technology diffusion. Hospitals standardize procurement of advanced stent systems to improve outcomes and competitiveness. Reimbursement structures favor inpatient and hospital-led interventional care. Expanding cardiac care infrastructure globally strengthens hospital dominance. These drivers keep hospitals expected to remain the leading end-user segment in the bioabsorbable stents market.

Key Market Segments

By Biomaterial

- Polymer‑based bioabsorbable stents

- Metal‑based bioabsorbable stents

By Absorption Rate

- Fast‑resorbing

- Slower‑resorbing

By Application

- Coronary Artery Disease (CAD)

- Peripheral Artery Disease (PAD)

By End-User

- Hospitals

- Cardiac Centers

Drivers

Rising Prevalence of Coronary Heart Disease is Driving the Market

The increasing burden of coronary heart disease worldwide necessitates advanced interventional treatments, including the development and potential adoption of bioabsorbable stents. This condition remains the most common form of heart disease, contributing significantly to mortality and morbidity. Patients with coronary artery disease often require revascularization procedures to restore blood flow.

Bioabsorbable stents offer theoretical long-term advantages by eliminating permanent implants after vessel healing. Clinical interest persists in these devices despite past setbacks with earlier generations. According to data from the Centers for Disease Control and Prevention, coronary heart disease caused 371,506 deaths in the United States in 2022.

The same source indicates that approximately 1 in 20 adults aged 20 and older have coronary artery disease. The American Heart Association’s 2025 statistical update confirms these mortality figures for 2022. Rising risk factors such as obesity and diabetes exacerbate this prevalence. Consequently, the demand for innovative stenting solutions continues to motivate research and market interest in bioabsorbable technologies.

Restraints

Lack of FDA Approval for Coronary Applications is Restraining the Market

The absence of United States Food and Drug Administration approval for bioabsorbable stents in coronary arteries significantly limits their commercial availability in the largest healthcare market. Earlier polymeric devices faced scrutiny over long-term safety outcomes, leading to market withdrawals. Permanent metallic drug-eluting stents dominate clinical practice due to established efficacy and regulatory clearance.

Physicians in the United States currently lack access to approved coronary bioresorbable options for routine use. This regulatory gap stems from stringent requirements for demonstrating non-inferiority to existing standards. No coronary bioresorbable stent received FDA approval between 2022 and 2024.

In contrast, approvals during this period focused on permanent stents or bioresorbable devices for peripheral arteries. Reimbursement and guideline integration favor approved technologies. Institutional protocols prioritize devices with robust post-marketing data. As a result, market growth remains constrained in regions requiring FDA clearance.

Opportunities

CE Mark Approval for Next-Generation Magnesium-Based Scaffolds is Creating Growth Opportunities

Regulatory clearance in Europe for advanced bioresorbable magnesium scaffolds expands treatment options for coronary lesions in select patients. These third-generation devices incorporate improvements in mechanical strength and resorption profiles. The Freesolve resorbable magnesium scaffold from Biotronik received CE mark approval on February 13, 2024. This approval enables commercialization across European Union member states.

Enhanced radial support and faster resorption distinguish it from prior iterations. Interventional cardiologists gain access to a metallic bioresorbable alternative to permanent implants. Clinical registries support its use in de novo lesions. Expanded indications potentially include complex anatomies over time. Manufacturer investments in physician training facilitate adoption. Overall, this development broadens the European market for bioabsorbable coronary interventions.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic forces invigorate the bioabsorbable stents market as escalating healthcare budgets and surging cardiovascular disease rates worldwide prompt interventional cardiologists to embrace dissolvable scaffolds for reduced long-term complications in coronary procedures. Executives at leading firms strategically unveil next-generation polymer-based designs, harnessing momentum from aging demographics and preventive cardiology trends to broaden adoption in high-growth regions.

Lingering inflation and global economic headwinds, however, inflate expenses for raw biomaterials and clinical trials, leading hospitals to trim elective interventions and postpone device acquisitions amid fiscal pressures. Geopolitical strains, notably U.S.-China trade clashes and regional instabilities, routinely sever supply routes for critical alloys and manufacturing inputs, spawning delays and operational risks for producers with heavy overseas dependencies.

Current U.S. tariffs, featuring a 10 percent baseline on imported medical devices alongside steeper duties up to 25 percent on Chinese-origin products, amplify procurement outlays for American distributors and erode pricing competitiveness in domestic channels. These tariffs also provoke counter-tariffs from key partners that curtail U.S. exports of innovative stents and impede multinational regulatory alignments.

Still, the tariff regime galvanizes substantial capital toward North American fabrication centers and onshoring tactics, forging durable supply architectures that will accelerate technological leaps and secure robust market vitality for the long term.

Latest Trends

Release of Three-Year Follow-Up Data from the BIOMAG-I Trial in 2025 Represents a Recent Trend

Long-term clinical evidence for next-generation resorbable magnesium scaffolds demonstrates sustained safety and performance, encouraging further investigation. The BIOMAG-I first-in-human trial evaluated the Freesolve scaffold from Biotronik. Three-year follow-up results, presented on May 21, 2025, reported no new target lesion failure events between the two-year and three-year marks. This absence of additional adverse events highlights vascular restoration potential.

Low rates of scaffold thrombosis and revascularization persisted throughout the period. Optical coherence tomography previously confirmed complete resorption by 12 months in earlier analyses. These findings build on prior 12-month and 24-month data showing favorable outcomes. Randomized controlled trials now compare it against contemporary drug-eluting stents. Positive extended results reinforce interest in metallic bioresorbable platforms. The trend signals maturing evidence for this technology class in coronary applications.

Regional Analysis

North America is leading the Bioabsorbable Stents Market

In 2024, North America held a 38.7% share of the global bioabsorbable stents market, driven by escalating adoption of fully resorbable vascular scaffolds in interventional cardiology practices. Cardiothoracic centers increasingly favor magnesium- and polymer-based scaffolds that dissolve post-endothelialization, mitigating long-term risks of in-stent restenosis and thrombosis associated with permanent metallic implants. Accelerated Food and Drug Administration clearances for next-generation platforms with refined strut profiles enhance radial strength, supporting deployment in complex bifurcations and calcified lesions.

Multicenter registries funded by the National Heart, Lung, and Blood Institute validate superior vessel patency rates, encouraging guideline integrations for younger patients with diffuse atherosclerosis. Reimbursement expansions under Centers for Medicare & Medicaid Services facilitate elective procedures in community hospitals, broadening procedural volumes amid rising coronary interventions. Device engineers optimize elution kinetics for anti-proliferative agents, aligning with personalized antithrombotic regimens to curtail dual antiplatelet therapy durations.

Cross-disciplinary consortia advance imaging modalities like optical coherence tomography, refining implantation precision for optimal scaffold apposition. These advancements collectively elevate therapeutic paradigms, addressing persistent challenges in durable revascularization outcomes. The American Heart Association reported that coronary heart disease remained the leading cause of cardiovascular mortality in the United States in 2022.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Stakeholders project considerable expansion in bioabsorbable stent utilization across Asia Pacific throughout the forecast period, as epidemiological transitions amplify ischemic burdens. Cardiology divisions in China and Australia procure advanced PLLA-based scaffolds, tailoring resorption profiles to high-burden multivessel disease prevalent in diabetic subpopulations. Medtech innovators formulate hybrid constructs incorporating iron alloys, suiting humid climates while ensuring mechanical integrity during arterial remodeling phases.

Professional assemblies via the Asian Pacific Society of Cardiology disseminate procedural benchmarks, equipping interventionalists in Vietnam with volumetric intravascular ultrasound for lesion preparation. Growing middle-class cohorts in Indonesia prioritize transient implants, minimizing late-stage complications in smoking-attributed vasculopathies. Regulatory convergences expedite biosafety evaluations, enabling manufacturers in South Korea to commercialize thinner-strut variants for small-vessel applications.

Training symposia mentor fellows on bioresorption monitoring via non-invasive computed tomography angiography, fostering confidence in extended follow-up protocols. These measures capitalize on infrastructural leaps, priming equitable access to restorative coronary solutions. The World Health Organization noted that cardiovascular diseases accounted for substantial mortality in the Western Pacific Region, with ischemic heart disease as a primary contributor in recent assessments.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the bioabsorbable stents market pursue growth by advancing polymer and magnesium-based scaffold technologies that improve radial strength, controlled resorption, and long-term vessel healing outcomes. Companies in the bioabsorbable stents market strengthen clinical adoption through large-scale trials and real-world evidence programs that address safety, restenosis, and thrombosis concerns among interventional cardiologists.

Commercial strategies in the bioabsorbable stents market emphasize targeted penetration of high-volume cath labs and teaching hospitals where next-generation cardiovascular therapies gain early acceptance. Product teams focus on delivery-system refinement and imaging compatibility to support precise deployment and procedural confidence.

Market leaders also drive expansion by aligning with regulatory bodies and reimbursement frameworks in regions with growing coronary artery disease prevalence. Abbott Laboratories represents a key participant in the bioabsorbable stents market, leveraging its deep cardiovascular device portfolio, global clinical trial expertise, and strong relationships with cardiology centers to advance scaffold-based coronary intervention solutions worldwide.

Top Key Players

- Abbott Laboratories

- Boston Scientific Corporation

- Biotronik SE & Co. KG

- REVA Medical, LLC

- Elixir Medical Corporation

- MicroPort Scientific Corporation

- Meril Life Sciences Pvt. Ltd

- Terumo Corporation

- Biosensors International Group

- Lifetech Scientific

- Kyoto Medical Planning Co., Ltd.

- Arterial Remodeling Technologies

- Arterius Limited

- Lepu Medical Technology Co., Ltd.

- Amaranth Medical

Recent Developments

- In April 2024, Abbott’s regulatory clearance for the Esprit BTK resorbable scaffold marked a meaningful shift in the Bioabsorbable Stents Market by demonstrating that temporary scaffolding can be clinically viable in challenging below the knee vascular conditions. This development supports wider physician acceptance of bioresorbable devices in peripheral interventions, expands treatment options for chronic limb ischemia, and reinforces confidence among regulators and payers in next generation scaffold technologies.

- In March 2024, Biotronik’s Freesolve scaffold gaining Breakthrough Device status highlighted the growing clinical priority of bioabsorbable solutions in coronary care. This recognition strengthens the Bioabsorbable Stents Market by accelerating innovation pathways, attracting hospital level trial participation, and signaling that resorbable scaffolds are increasingly viewed as long term alternatives to permanent metallic implants in complex coronary procedures.

- In February 2024, the completion of patient enrollment for MicroPort’s BIOSOLVE IV study advanced the Bioabsorbable Stents Market by moving comparative clinical validation closer to real world practice. By directly benchmarking bioabsorbable scaffolds against established drug eluting stents in complex lesions, this progress supports future adoption decisions, reimbursement confidence, and broader integration into interventional cardiology workflows.

Report Scope

Report Features Description Market Value (2024) US$ 448.3 Million Forecast Revenue (2034) US$ 924.0 Million CAGR (2025-2034) 7.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Biomaterial (Polymer Based Bioabsorbable Stents and Metal Based Bioabsorbable Stents), By Absorption Rate (Fast Resorbing and Slower Resorbing), By Application (Coronary Artery Disease (CAD) and Peripheral Artery Disease (PAD)), By End-User (Hospitals and Cardiac Centers) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Abbott Laboratories, Boston Scientific Corporation, Biotronik SE & Co. KG, REVA Medical, LLC, Elixir Medical Corporation, MicroPort Scientific Corporation, Meril Life Sciences Pvt. Ltd, Terumo Corporation, Biosensors International Group, Lifetech Scientific, Kyoto Medical Planning Co., Ltd., Arterial Remodeling Technologies, Arterius Limited, Lepu Medical Technology Co., Ltd., Amaranth Medical Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Bioabsorbable Stents MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample

Bioabsorbable Stents MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Abbott Laboratories

- Boston Scientific Corporation

- Biotronik SE & Co. KG

- REVA Medical, LLC

- Elixir Medical Corporation

- MicroPort Scientific Corporation

- Meril Life Sciences Pvt. Ltd

- Terumo Corporation

- Biosensors International Group

- Lifetech Scientific

- Kyoto Medical Planning Co., Ltd.

- Arterial Remodeling Technologies

- Arterius Limited

- Lepu Medical Technology Co., Ltd.

- Amaranth Medical