Global Banana Puree Market Size, Share, And Business Benefits By Nature (Organic, Conventional), By End-use (Food and Beverage Industry (Infant Food, Dairy and Desserts, Dressings and Sauces, Beverages, Bakery and Snacks, Others), Foodservice Industry, Household/Retail), By Distribution Channel (Business to Business, Business to Consumer (Hypermarkets/Supermarkets, Convenience Stores, Online Retail, Others)), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: May 2023

- Report ID: 148420

- Number of Pages: 339

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

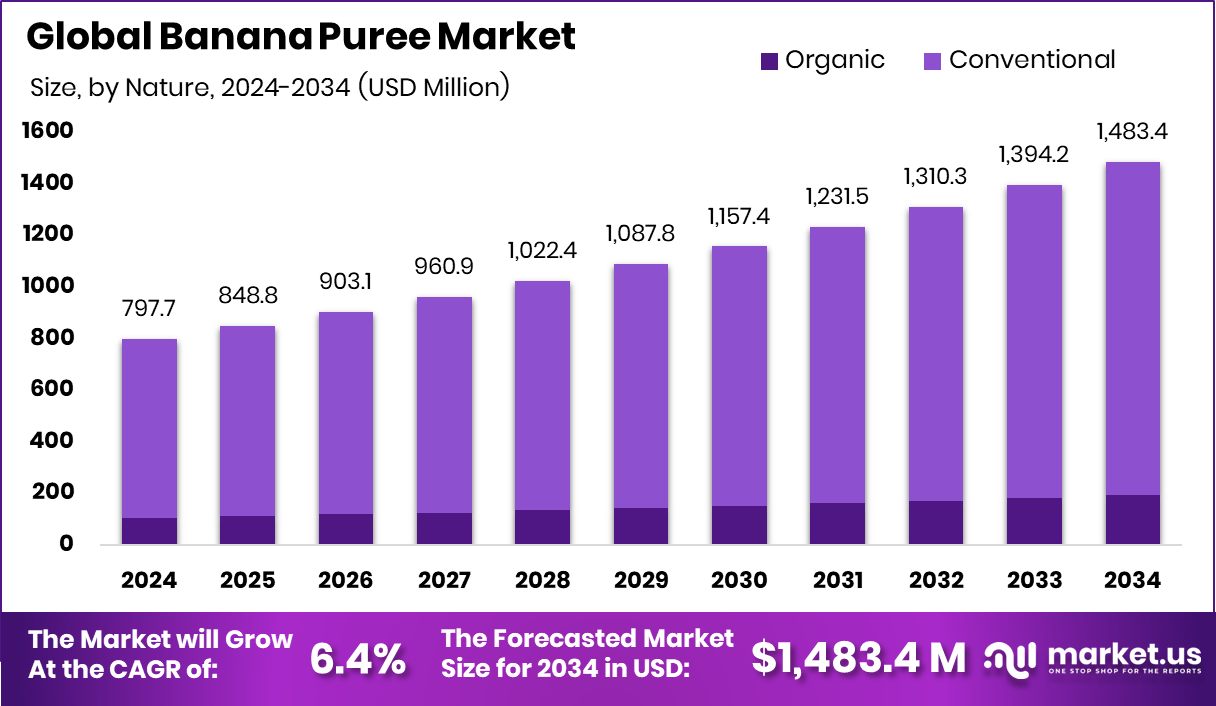

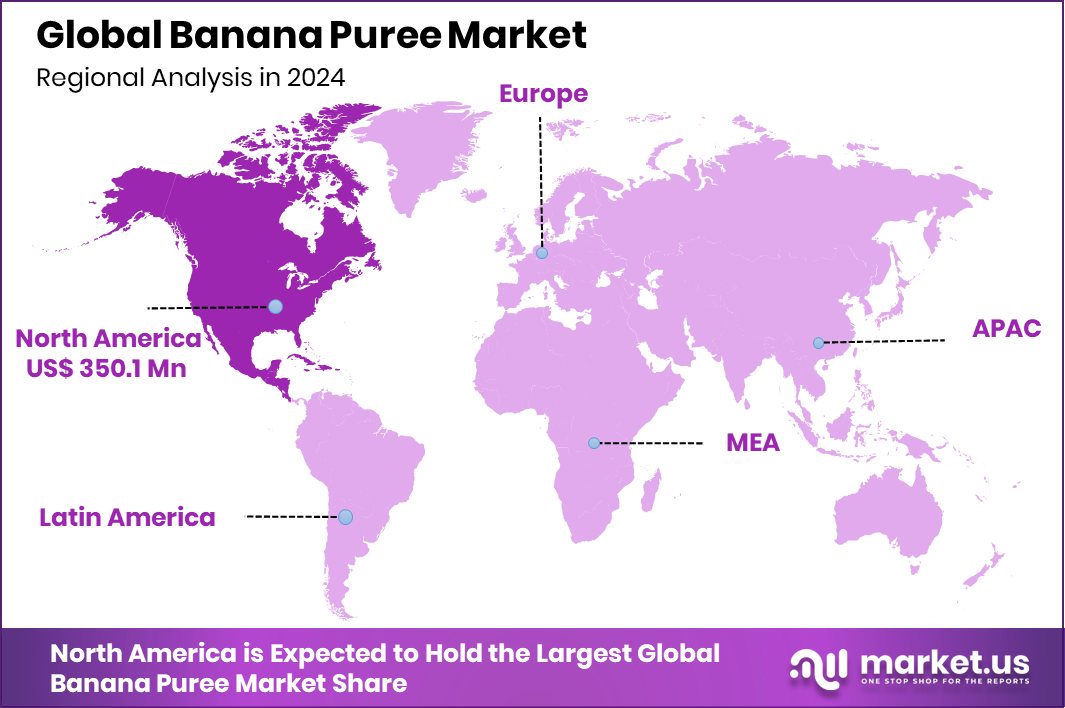

Global Banana Puree Market is expected to be worth around USD 1,483.4 Million by 2034, up from USD 797.7 Million in 2024, and grow at a CAGR of 6.4% from 2025 to 2034. Increasing demand for baby food products drives the growth of the Banana Puree Market in North America, valued at USD 350.1 million.

Banana puree is a smooth, creamy product made by blending ripe bananas into a thick, pulp-like consistency. It is commonly used as a natural sweetener, flavor enhancer, and thickening agent in baby foods, bakery products, beverages, and desserts. The puree retains the natural taste, aroma, and nutrients of bananas, making it a versatile ingredient in both processed and homemade foods. According to an industry report, in Europe alone, 6 billion kg of bananas are imported every year.

The banana puree market refers to the global trade and consumption of processed banana products in puree form. It includes various product types, such as organic, conventional, and baby food-grade puree. The market is driven by the growing demand for natural, clean-label ingredients in the food and beverage industry. Additionally, banana puree is increasingly used in baby foods due to its nutritional content, easy digestibility, and natural sweetness.

The banana puree market is experiencing growth due to the increasing preference for natural and organic ingredients. Consumers are increasingly shifting towards plant-based products, and banana puree fits well into this trend as a natural sweetener and thickener. Additionally, the rise in health-conscious consumers seeking nutrient-dense foods is boosting demand for banana puree, which is rich in vitamins, potassium, and dietary fiber.

Demand for banana puree is being driven by the rising popularity of smoothies, health drinks, and plant-based snacks. With consumers becoming more health-conscious, the use of natural fruit purees as an alternative to synthetic additives has gained traction. Additionally, banana puree serves as a natural sweetener in bakery products, confectioneries, and dairy-based desserts, further expanding its application scope.

Key Takeaways

- Global Banana Puree Market is expected to be worth around USD 1,483.4 Million by 2034, up from USD 797.7 Million in 2024, and grow at a CAGR of 6.4% from 2025 to 2034.

- In 2024, conventional banana puree maintained its dominance, capturing 87.3% market share, driven by affordability.

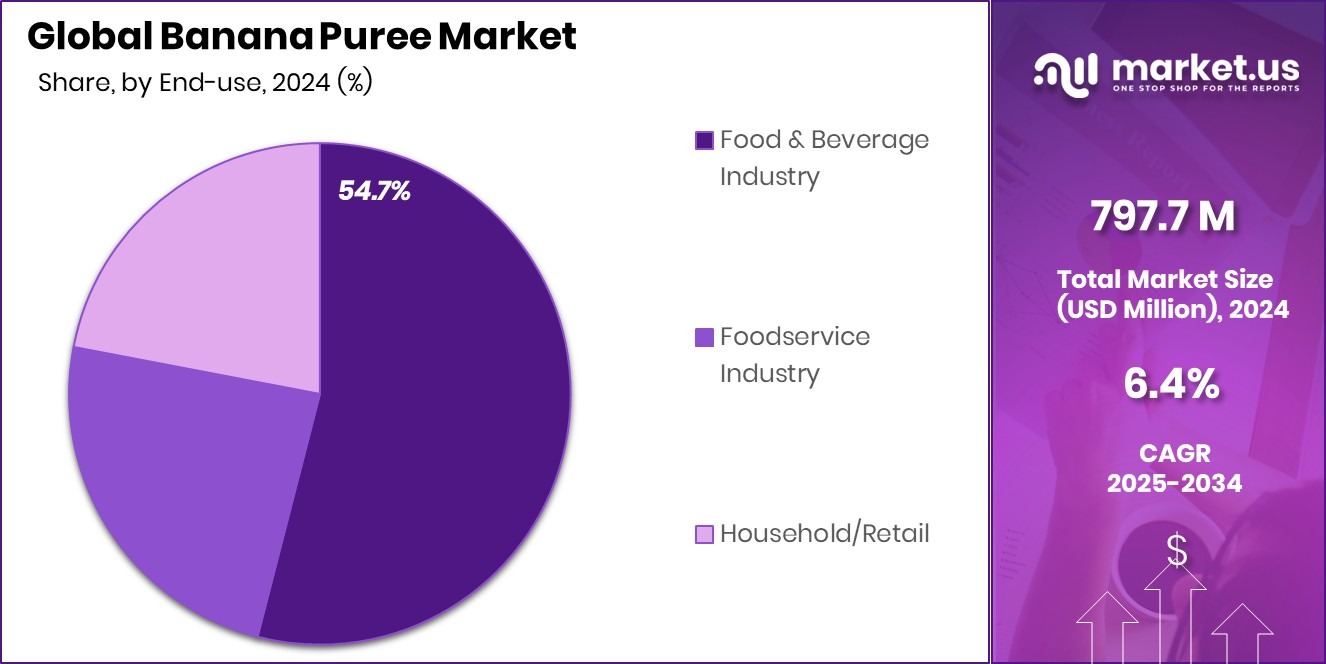

- The food and beverage industry commanded 54.7% of the banana puree market, fueled by product demand.

- Business-to-business distribution accounted for 78.1% of banana puree sales, driven by bulk purchasing agreements.

- The Banana Puree Market in North America reached USD 350.1 million in 2024.

By Nature Analysis

Conventional banana puree accounted for 87.3%, reflecting its widespread consumer preference.

In 2024, Conventional held a dominant market position in the By Nature segment of the Banana Puree Market, capturing a substantial 87.3% share. The extensive utilization of conventional banana puree across various applications, including baby food, beverages, and bakery products, underpins its commanding market presence.

The high adoption rate is driven by cost-effectiveness and widespread availability, particularly in emerging markets where cost-sensitive consumers prefer conventional products over organic variants. Additionally, the steady supply chain and established processing infrastructure for conventional bananas further strengthen its market penetration. Manufacturers in the segment are leveraging economies of scale, resulting in competitive pricing that maintains consumer demand.

The conventional segment’s dominance is also supported by robust distribution networks in key regions, ensuring consistent product availability to industrial users and retailers. As the market progresses, the conventional segment is likely to retain its leading position, bolstered by continued demand for banana-based ingredients in the food and beverage industry, particularly in regions with growing population bases and expanding food processing sectors.

By End-use Analysis

The food and beverage industry captured a 54.7% share, driven by product versatility.

In 2024, Food and Beverage Industry held a dominant market position in the By End-use segment of the Banana Puree Market, accounting for a 54.7% share. The segment’s leadership is driven by the extensive use of banana puree in manufacturing baby food, beverages, smoothies, and bakery products. The growing demand for natural and fruit-based ingredients in the food and beverage sector has fueled the adoption of banana puree as a natural sweetener and flavor enhancer.

Additionally, the rising consumer inclination toward healthy and organic food products has further accelerated the segment’s growth. The food and beverage industry continues to leverage banana puree due to its rich nutrient profile, making it a preferred choice for infant nutrition and health-oriented product lines. With major manufacturers integrating banana puree into their formulations to enhance taste and texture, the segment is expected to maintain its market dominance.

Furthermore, increased product launches in the beverage sector, particularly smoothies and ready-to-drink fruit-based beverages, are likely to reinforce the Food and Beverage Industry’s leading position in the Banana Puree Market, sustaining its substantial market share in the coming years.

By Distribution Channel Analysis

Business-to-business distribution led with 78.1%, emphasizing bulk demand from manufacturers.

In 2024, Business to Business held a dominant market position in the By Distribution Channel segment of the Banana Puree Market, securing a commanding 78.1% share. The extensive use of banana puree as a key ingredient in food processing industries, including baby food, beverages, and bakery products, underscores the segment’s substantial market share.

Food manufacturers and beverage producers prefer bulk purchases of banana puree for its cost-effectiveness and consistent quality, driving the B2B channel’s prominence. Additionally, the demand from large-scale food processors and contract manufacturers has significantly contributed to the segment’s expansion. The B2B segment benefits from established supply agreements with puree producers, ensuring a steady flow of raw materials for production.

Furthermore, the rising inclination toward natural and fruit-based ingredients in processed foods has bolstered the demand for banana puree among industrial users, further solidifying the B2B channel’s market dominance. As the trend of incorporating fruit puree in health-focused food products continues to rise, the Business-to-Business distribution channel is anticipated to maintain its leading market position, propelled by growing demand from beverage companies, confectionery manufacturers, and infant nutrition brands in key regions.

Key Market Segments

By Nature

- Organic

- Conventional

By End-use

- Food and Beverage Industry

- Infant Food

- Dairy and Desserts

- Dressings and Sauces

- Beverages

- Bakery and Snacks

- Others

- Foodservice Industry

- Household/Retail

By Distribution Channel

- Business to Business

- Business to Consumer

- Hypermarkets/Supermarkets

- Convenience Stores

- Online Retail

- Others

Driving Factors

Rising Demand for Natural Sweeteners in Beverages

The increasing consumer preference for natural and healthy food products is significantly driving the demand for banana puree in the beverage sector. Manufacturers are increasingly incorporating banana puree as a natural sweetener in smoothies, juices, and flavored drinks to align with the health-conscious trend.

Additionally, the puree’s rich nutrient profile, including essential vitamins and minerals, makes it an ideal ingredient for fortified beverages targeted at health-focused consumers. The growing shift away from artificial sweeteners and additives further supports the use of banana puree in beverage formulations.

As beverage producers innovate with new fruit-based product lines, the demand for banana puree as a natural sweetening agent is expected to witness robust growth in the coming years.

Restraining Factors

Fluctuating Banana Prices Impacting Production Costs

The volatile pricing of raw bananas is a significant restraining factor affecting the banana puree market. Seasonal variations, climatic changes, and supply chain disruptions contribute to unpredictable banana prices, directly impacting production costs for puree manufacturers.

When banana prices surge, producers face challenges in maintaining stable pricing for their products, potentially affecting profit margins. Additionally, supply shortages during unfavorable weather conditions can further strain production processes, leading to delays and increased operational costs.

Small and medium-sized manufacturers, in particular, struggle to absorb these cost fluctuations, making it difficult to sustain competitive pricing. As banana prices continue to fluctuate, the overall market dynamics for banana puree remain susceptible to economic and environmental factors.

Growth Opportunity

Growing Demand for Natural Baby Food Products

The rising preference for natural and organic baby food products is creating a significant growth opportunity in the banana puree market. With increasing health consciousness among parents, demand for chemical-free and nutrient-dense baby food is surging globally. Banana puree, rich in essential vitamins and minerals, is gaining popularity as a primary ingredient in infant food formulations.

Additionally, manufacturers are focusing on sustainable sourcing and clean-label certifications to meet the growing consumer demand for transparency and quality. This trend is particularly evident in regions like North America and Europe, where organic baby food products are experiencing substantial growth, providing lucrative prospects for banana puree producers.

Latest Trends

Rising Demand for Organic and Clean-Label Banana Puree

In 2025, a major trend in the banana puree market is the increasing demand for organic and clean-label products. Consumers are becoming more health-conscious and prefer foods without artificial additives or preservatives. Banana puree, being naturally sweet and nutritious, fits well into this preference. It’s widely used in baby foods, smoothies, and baked goods, making it a popular choice for those seeking healthier options.

Manufacturers are responding by producing organic banana puree, ensuring the use of bananas grown without synthetic pesticides or fertilizers. This shift not only meets consumer demand but also promotes sustainable farming practices. As awareness grows, the market for organic banana puree is expected to expand further, offering opportunities for producers and benefiting health-conscious consumers worldwide.

Regional Analysis

North America led the Banana Puree Market in 2024, capturing 43.9% share.

In 2024, North America dominated the Banana Puree Market, holding a significant 43.9% market share valued at USD 350.1 million. The region’s dominance is driven by the rising demand for natural and organic baby food products, particularly in the United States and Canada.

Europe follows closely, with increasing consumption of banana puree in bakery and confectionery applications. In the Asia Pacific region, the growing awareness of healthy food alternatives is fueling market growth, supported by expanding retail networks and rising disposable incomes.

The Middle East & Africa region is witnessing steady demand, primarily driven by the expanding food processing sector. Meanwhile, Latin America presents growth opportunities due to its substantial banana production, positioning it as a crucial raw material supplier for global banana puree manufacturers.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, Döhler GmbH leveraged its strong market presence and extensive product portfolio to solidify its position in the global Banana Puree Market. The company’s focus on innovative product formulations aimed at beverage and baby food applications has driven consistent demand, particularly in Europe and North America. By integrating advanced processing techniques, Döhler has managed to maintain superior quality standards, fostering long-term client relationships and expanding its distribution network.

FructaCR S.A., strategically positioned in Costa Rica, capitalized on its proximity to key banana-producing regions, ensuring a steady supply of high-quality banana puree. The company’s vertically integrated supply chain has enabled cost-effective production and facilitated swift exports to major markets, including the U.S. and Europe. Additionally, FructaCR’s emphasis on sustainable sourcing and organic product lines has resonated with health-conscious consumers, further enhancing its market share.

Grünewald Fruchtsaft GmbH, recognized for its premium fruit puree offerings, maintained a competitive edge by focusing on diversified product applications, including smoothies, bakery fillings, and baby food. The company’s investment in state-of-the-art processing facilities in Germany has not only elevated product quality but also bolstered its capacity to meet increasing demand in the European market.

Top Key Players in the Market

- Antigua Processors S.A.

- ARGANA Beteiligungs AG

- Ariza B.V.

- Dennick Fruitsource

- Döhler GmbH

- Fenix S.A

- FructaCR S.A.

- Grünewald Fruchtsaft GmbH

- Hiltfields Ltd.

- Jain Farm Fresh Foods Ltd.

- Kerr Concentrates

- Kiril Mischeff

- LaFruitière du Val Evel

- Newberry International Produce Limited

- Riviana Foods Pty Ltd.

Recent Developments

- In May 2025, Riviana Foods Pty Ltd., based in Melbourne, Australia, specializes in manufacturing and distributing a wide range of food and beverage products. Their portfolio includes rice, canned fruits, condiments, and purees under various brands like Fehlbergs, Admiral, Always Fresh, and Palms.

Report Scope

Report Features Description Market Value (2024) USD 797.7 Million Forecast Revenue (2034) USD 1,483.4 Million CAGR (2025-2034) 6.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Nature (Organic, Conventional), By End-use (Food and Beverage Industry (Infant Food, Dairy and Desserts, Dressings and Sauces, Beverages, Bakery and Snacks, Others), Foodservice Industry, Household/Retail), By Distribution Channel (Business to Business, Business to Consumer (Hypermarkets/Supermarkets, Convenience Stores, Online Retail, Others)) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Antigua Processors S.A., ARGANA Beteiligungs AG, Ariza B.V., Dennick Fruitsource, Döhler GmbH, Fenix S.A, FructaCR S.A., Grünewald Fruchtsaft GmbH, Hiltfields Ltd., Jain Farm Fresh Foods Ltd., Kerr Concentrates, Kiril Mischeff, LaFruitière du Val Evel, Newberry International Produce Limited, Riviana Foods Pty Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Antigua Processors S.A.

- ARGANA Beteiligungs AG

- Ariza B.V.

- Dennick Fruitsource

- Döhler GmbH

- Fenix S.A

- FructaCR S.A.

- Grünewald Fruchtsaft GmbH

- Hiltfields Ltd.

- Jain Farm Fresh Foods Ltd.

- Kerr Concentrates

- Kiril Mischeff

- LaFruitière du Val Evel

- Newberry International Produce Limited

- Riviana Foods Pty Ltd.