Global Automotive Upholstery Market Size, Share, Growth Analysis By Materials (Automotive Textiles, Leather, Plastics, Smart Fabrics, Synthetic Leather, Thermoplastic Polymers), By Fabric Type (Woven, Non-woven), By Vehicle Type (Passenger Cars, Commercial Vehicles), By Application (Seat Covers, Carpets, Dashboards, Roof Liners, Sun Visors, Trunk Liners), By Sales Channel (OEM, Aftermarket), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 172588

- Number of Pages: 275

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

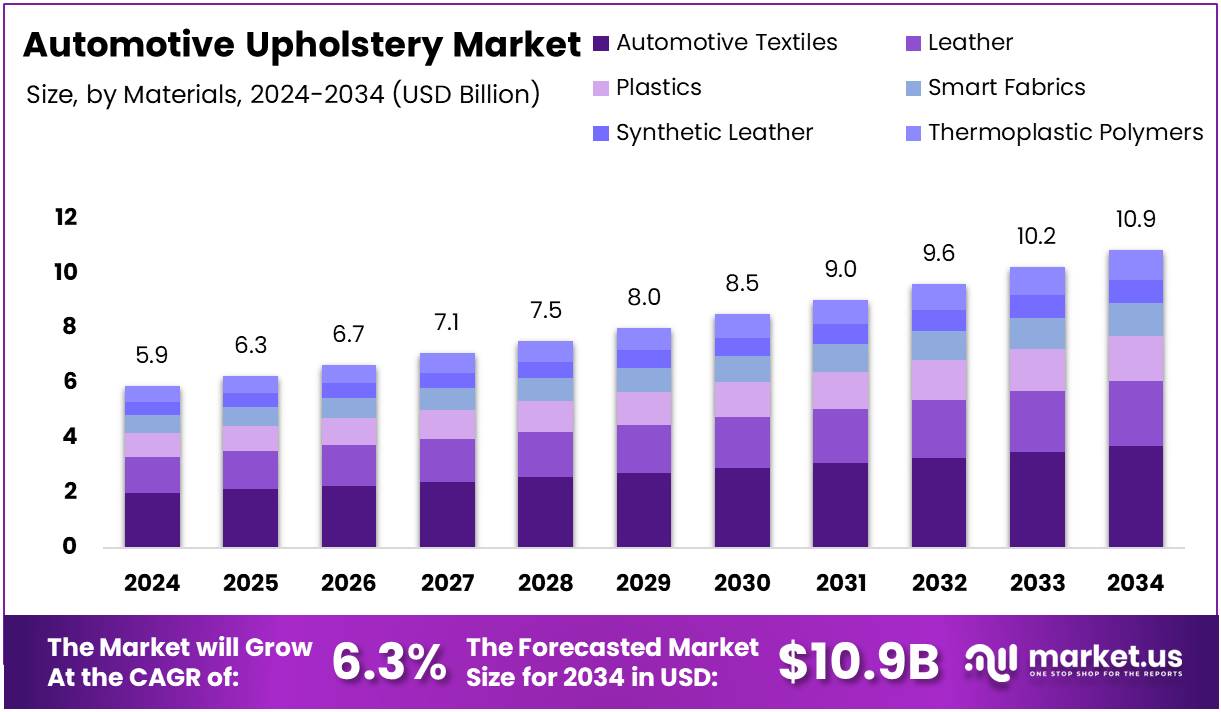

The Global Automotive Upholstery Market size is expected to be worth around USD 10.9 Billion by 2034, from USD 5.9 Billion in 2024, growing at a CAGR of 6.3% during the forecast period from 2025 to 2034.

The Automotive Upholstery Market encompasses interior fabric materials, leather, synthetic coverings, and trim components used in vehicle seats, dashboards, door panels, and headliners. This sector serves passenger cars, commercial vehicles, and luxury automobiles globally. Market dynamics reflect evolving consumer preferences toward comfort, aesthetics, and durability. Moreover, technological advancements drive innovation in material science and manufacturing processes consistently.

Currently, the market demonstrates robust expansion driven by increasing vehicle production and rising consumer spending on premium interiors. Electric vehicle proliferation accelerates demand for lightweight, eco-friendly upholstery solutions that enhance energy efficiency. Subsequently, manufacturers invest heavily in developing sustainable alternatives to traditional materials. This transition creates substantial opportunities for companies specializing in recycled fabrics and bio-based synthetics throughout established markets.

Furthermore, government regulations significantly influence market trajectories by mandating stricter environmental standards and emissions controls. Various administrations implement policies promoting circular economy principles within automotive manufacturing. Consequently, automakers prioritize suppliers offering compliant, sustainable upholstery materials that meet evolving legislative requirements. These regulatory frameworks simultaneously challenge traditional producers while empowering innovative material developers across multiple regions.

Investment patterns reveal substantial capital allocation toward research and development of advanced upholstery technologies. Manufacturers explore antimicrobial treatments, temperature-regulating fabrics, and integrated sensor systems within seating materials. Additionally, partnerships between automotive OEMs and textile innovators accelerate commercialization of next-generation interior solutions. This collaborative approach enhances product differentiation and strengthens competitive positioning within increasingly crowded market segments.

Consumer behavior analysis indicates decisive shifts toward sustainability and functionality in purchasing decisions. Research shows 57% of respondents value sustainable materials, preferring faux leather over genuine leather alternatives. Performance characteristics equally matter, as car users find water- and dirt-repellent surfaces highly appealing: 74% in China and 70% in the U.S. express strong preference for such features. These statistics underscore the growing importance of combining environmental consciousness with practical durability expectations among modern vehicle buyers globally.

Key Takeaways

- The Global Automotive Upholstery Market is projected to reach USD 10.9 Billion by 2034, growing from USD 5.9 Billion in 2024 at a 6.3% CAGR.

- Automotive Textiles lead the materials segment with a 34.7% share due to comfort, breathability, and cost-effectiveness.

- Woven fabrics dominate the fabric type segment with 64.4% market share for strength, versatility, and durability.

- Passenger Cars hold the largest vehicle type share at 74.8% driven by high production and diverse consumer demand.

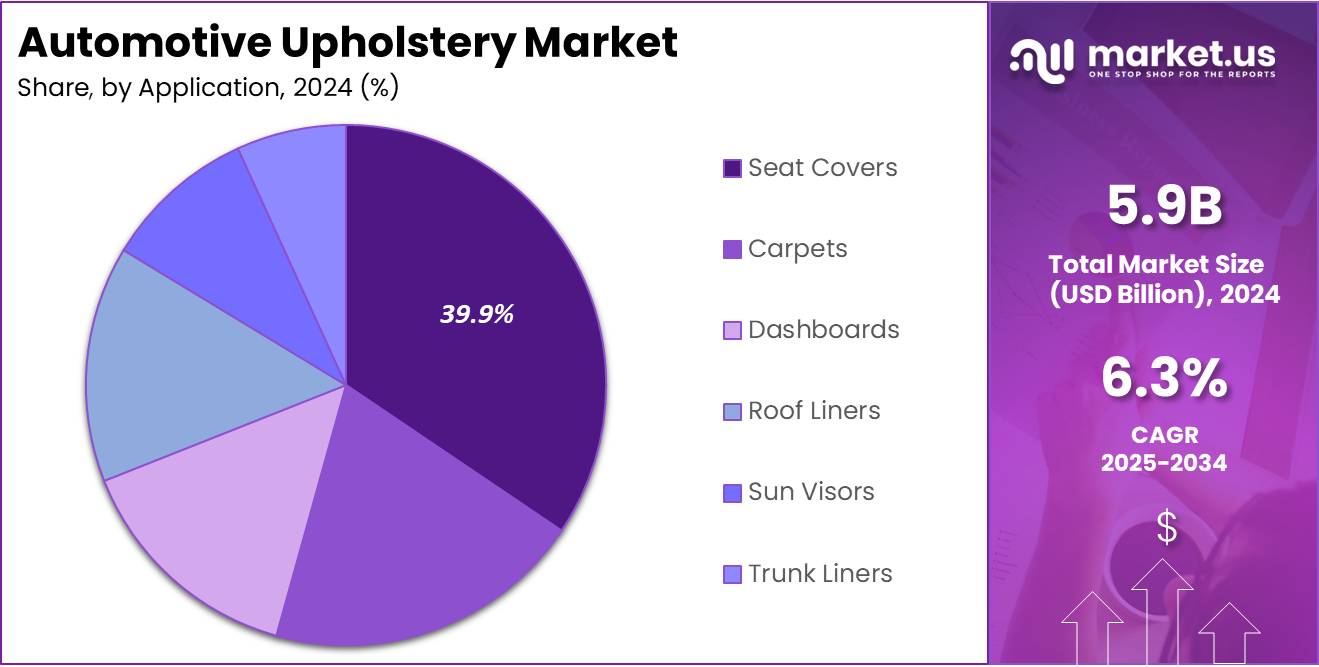

- Seat Covers are the largest application segment with 39.9% market share due to high surface area and direct passenger interaction.

- OEM channels dominate sales with 69.2% share, benefiting from integrated supply chains and bulk orders.

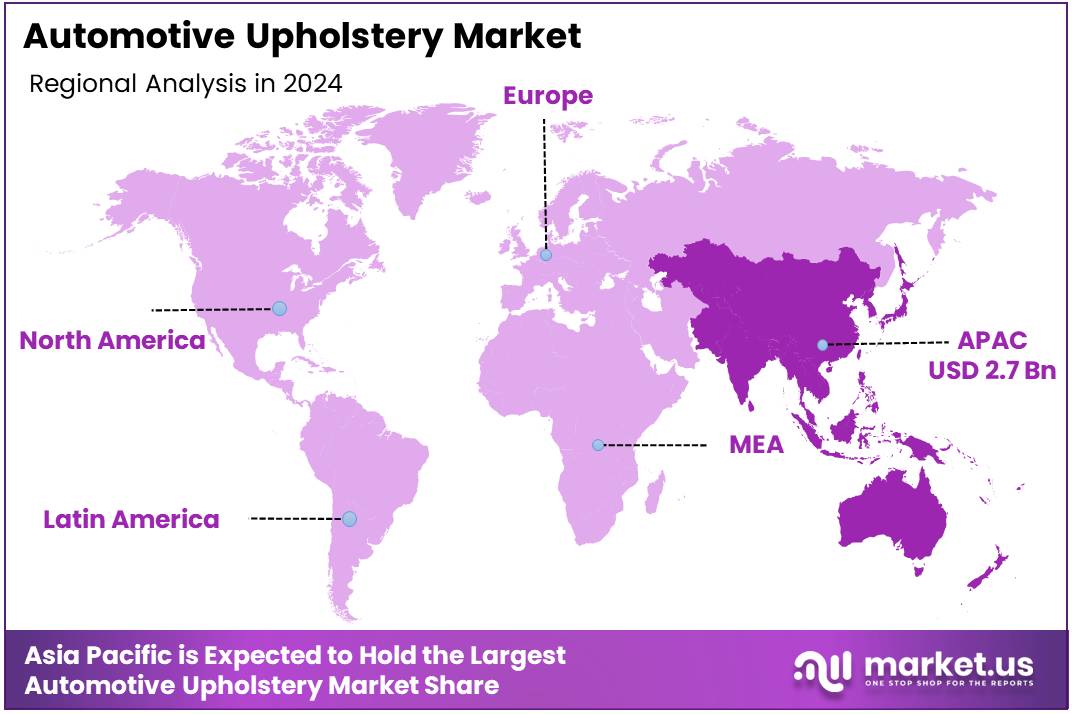

- Asia Pacific leads regional demand with 45.8% share, valued at USD 2.7 Billion, driven by China, India, Japan, and South Korea.

Materials Analysis

Automotive Textiles dominates with 34.7% due to its superior comfort, breathability, and cost-effectiveness in mass-market vehicles.

Automotive Textiles lead the materials segment with a 34.7% market share, driven by their exceptional balance of comfort, durability, and affordability. These fabrics offer excellent breathability and moisture management, making them ideal for everyday driving conditions. Manufacturers prefer automotive textiles for their versatility in design, ease of maintenance, and ability to meet diverse consumer preferences across various vehicle segments.

Leather remains a premium choice in automotive upholstery, particularly favored in luxury and high-end vehicle segments. Its natural aesthetic appeal, luxurious feel, and long-lasting durability justify the higher price point. Leather upholstery enhances vehicle interiors with sophisticated styling while offering relatively easy cleaning and maintenance, making it a status symbol among discerning automotive consumers.

Plastics serve critical functional roles in automotive interiors, particularly for dashboards, door panels, and trim components. Their moldability, lightweight properties, and resistance to wear make them indispensable in modern vehicle manufacturing. Plastics offer cost-effective solutions while enabling complex design integrations and enhanced safety features through impact-resistant formulations.

Smart Fabrics represent the emerging innovation frontier, incorporating technologies like temperature regulation, stain resistance, and health monitoring capabilities. Though currently niche, these advanced materials attract tech-savvy consumers seeking enhanced comfort and connectivity in their vehicles, positioning themselves as the future of automotive upholstery materials.

Synthetic Leather bridges the gap between affordability and premium aesthetics, offering leather-like appearance without the environmental and cost concerns. Its improved manufacturing techniques deliver enhanced durability and easier maintenance, appealing to environmentally conscious consumers and mid-range vehicle manufacturers seeking upscale interior finishes at competitive prices.

Thermoplastic Polymers provide exceptional flexibility and recyclability in automotive applications. These materials excel in creating seamless, integrated interior components while supporting sustainability initiatives through their recyclable nature. Their resistance to chemicals and UV radiation ensures long-term performance in demanding automotive environments.

Fabric Type Analysis

Woven dominates with 64.4% due to its superior strength, aesthetic versatility, and traditional manufacturing excellence.

Woven fabrics command a 64.4% market share, attributed to their inherent strength, dimensional stability, and refined appearance. The interlacing pattern creates robust materials that withstand constant use and abrasion in automotive environments. Woven textiles offer manufacturers extensive design possibilities through varied weaving patterns, colors, and textures, enabling differentiation across vehicle models while maintaining structural integrity and longevity.

Non-woven fabrics provide cost-effective alternatives with simplified manufacturing processes and lightweight characteristics. These materials excel in applications requiring bulk, insulation, or sound absorption properties, such as roof liners and trunk carpets. Non-woven fabrics deliver functional benefits including enhanced filtration capabilities and moldability, making them increasingly relevant in specific automotive interior applications where traditional woven structures aren’t essential.

Vehicle Type Analysis

Passenger Cars dominates with 74.8% due to high production volumes and diverse consumer demand across global markets.

Passenger Cars hold a commanding 74.8% market share, reflecting their ubiquity in global automotive production and sales. The segment encompasses sedans, hatchbacks, SUVs, and crossovers, all requiring extensive upholstery across seats, interiors, and trim components. Rising middle-class populations, urbanization trends, and personal mobility preferences drive continuous demand for passenger vehicle upholstery across economy, mid-range, and luxury segments globally.

Commercial Vehicles require specialized upholstery solutions emphasizing durability, easy maintenance, and functional design over aesthetic appeal. This segment includes trucks, buses, vans, and fleet vehicles subjected to intensive daily use and varied operating conditions. Commercial upholstery prioritizes materials resistant to heavy wear, stains, and frequent cleaning while meeting safety regulations and providing adequate driver comfort during extended operational hours.

Application Analysis

Seat Covers dominates with 39.9% due to being the largest surface area requiring upholstery and direct passenger contact.

Seat Covers represent the largest application segment with 39.9% market share, as seats constitute the most visible and tactile upholstery component in vehicles. Consumers prioritize seat comfort, aesthetics, and durability since they directly impact driving and riding experiences. Manufacturers invest significantly in seat upholstery materials and designs to differentiate their offerings, justify premium pricing, and enhance overall vehicle appeal.

Carpets provide essential flooring coverage throughout vehicle interiors, contributing to acoustic insulation, thermal comfort, and aesthetic cohesion. Automotive carpets require materials that resist moisture, stains, and wear from foot traffic while maintaining appearance over extended periods. Their functionality extends beyond decoration to include safety aspects through proper anchoring and fire-resistance properties mandated by automotive standards.

Dashboards demand specialized upholstery materials combining aesthetic appeal with functional requirements like UV resistance, low glare, and airbag deployment compatibility. Dashboard coverings must withstand extreme temperature variations and direct sunlight exposure while maintaining structural integrity and visual consistency. Premium soft-touch materials increasingly define dashboard upholstery trends, enhancing perceived quality and tactile experiences in modern vehicle interiors.

Roof Liners serve both functional and aesthetic purposes, providing thermal insulation, sound dampening, and finished interior appearance. These components require lightweight materials that adhere reliably to roof structures while maintaining sag resistance over time. Roof liner upholstery must integrate seamlessly with lighting fixtures, grab handles, and safety features without compromising structural integrity or visual appeal.

Sun Visors represent smaller but essential upholstered components requiring materials that resist UV degradation, maintain flexibility, and provide adequate glare protection. These accessories must integrate smoothly with vanity mirrors, lighting, and mounting mechanisms while matching overall interior design themes. Quality upholstery on sun visors contributes to perceived craftsmanship and attention to detail in vehicle finishing.

Trunk Liners emphasize durability and functionality, protecting cargo areas from spills, scratches, and general wear while facilitating easy cleaning. These applications require robust materials resistant to chemical exposure, mechanical damage, and environmental factors. Trunk upholstery balances practical utility with aesthetic considerations, ensuring cohesive interior design while meeting demanding cargo-hauling requirements across diverse vehicle types.

Sales Channel Analysis

OEM dominates with 69.2% due to integrated supply chains, bulk ordering, and direct manufacturer relationships.

OEM (Original Equipment Manufacturer) channels command a 69.2% market share, driven by automotive manufacturers’ preference for direct supplier relationships ensuring quality control, customization, and seamless production integration. OEM upholstery is designed and installed during vehicle manufacturing, meeting exact specifications and warranty requirements.

Aftermarket channels serve replacement, customization, and upgrade needs after initial vehicle purchase, addressing wear-and-tear, damage, or aesthetic modification desires. This segment appeals to consumers seeking personalization, premium material upgrades, or cost-effective repair solutions outside dealership networks.

Key Market Segments

By Materials

- Automotive Textiles

- Leather

- Plastics

- Smart Fabrics

- Synthetic Leather

- Thermoplastic Polymers

By Fabric Type

- Woven

- Non-woven

By Vehicle Type

- Passenger Cars

- Commercial Vehicles

By Application

- Seat Covers

- Carpets

- Dashboards

- Roof Liners

- Sun Visors

- Trunk Liners

By Sales Channel

- OEM

- Aftermarket

Drivers

Increasing Demand for Premium Automotive Upholstery Drives Market Growth

The automotive upholstery market is experiencing robust growth driven by rising consumer expectations for premium interior experiences. Modern car buyers increasingly prioritize cabin comfort and luxury, pushing manufacturers to invest in high-quality upholstery materials that offer superior tactile feel and visual appeal.

Vehicle production volumes continue to climb globally, particularly in developing economies, creating sustained demand for original equipment manufacturer upholstery solutions. This production surge compels automakers to adopt advanced materials including leather, synthetic fabrics, and engineered textiles that meet durability and aesthetic standards.

Manufacturers are responding to consumer preferences by incorporating sophisticated upholstery designs that enhance interior aesthetics. The cabin experience has become a key differentiator in vehicle purchasing decisions, with buyers willing to pay premium prices for enhanced comfort features. This trend encourages continuous innovation in fabric technology and design approaches.

The shift toward advanced upholstery materials supports both functional and emotional needs of consumers. OEM adoption of next-generation fabrics, memory foams, and climate-responsive materials reflects the industry’s commitment to delivering exceptional interior environments that elevate the overall driving experience and strengthen brand positioning.

Restraints

Stringent Environmental Regulations Restrain Market Expansion

The automotive upholstery market faces significant challenges from increasingly strict environmental and emission regulations worldwide. Governments are implementing tougher standards on volatile organic compound emissions from interior materials, forcing manufacturers to reformulate traditional upholstery products. This regulatory pressure increases production costs and extends development timelines as companies work to ensure compliance.

Manufacturing processes for automotive upholstery must now meet stringent sustainability criteria, limiting the use of certain chemicals and treatments historically employed in fabric production. These restrictions can compromise material performance characteristics while adding complexity to supply chain management and quality control procedures.

Another critical restraint involves the limited long-term performance validation of sustainable upholstery materials. While eco-friendly alternatives gain traction, insufficient data exists regarding their durability, colorfastness, and wear resistance over extended vehicle lifecycles. This uncertainty makes automotive manufacturers hesitant to fully commit to these materials for large-scale production.

The absence of comprehensive testing standards for bio-based and recycled upholstery materials creates additional market friction. Without proven performance histories, automakers face potential warranty risks and customer satisfaction issues, slowing the widespread adoption of sustainable upholstery solutions despite environmental pressures.

Growth Factors

Rapid Expansion of Electric Vehicles Creates Growth Opportunities

The automotive upholstery market stands at the threshold of significant expansion driven by the electric and autonomous vehicle revolution. These next-generation vehicles require reimagined interior spaces with innovative upholstery solutions that accommodate new seating configurations, enhanced comfort features, and technology integration points unavailable in traditional automobiles.

Electric vehicle manufacturers are prioritizing sustainable, eco-friendly upholstery materials that align with their environmental brand positioning. This shift opens substantial opportunities for suppliers developing vegan leather, bio-based fabrics, and recycled textile solutions that deliver premium aesthetics without environmental compromise.

Emerging automotive markets across Asia-Pacific, Latin America, and Africa present tremendous growth potential as middle-class populations expand and vehicle ownership rates increase. These regions demonstrate growing appetite for vehicles with enhanced interior features, creating demand for diverse upholstery options across multiple price segments.

The rising adoption of plant-based and sustainable materials reflects broader consumer consciousness about environmental impact. Manufacturers investing in circular economy approaches and renewable material sources position themselves advantageously as regulatory frameworks increasingly favor sustainable production methods. This convergence of consumer demand, regulatory support, and technological advancement creates a favorable environment for market expansion.

Emerging Trends

Growing Use of Smart Upholstery Drives Market Innovation

The automotive upholstery market is witnessing transformative trends centered on technology integration and sustainability. Smart, connected upholstery incorporating sensors and heating elements represents a significant innovation direction. These intelligent fabrics monitor occupant health metrics, adjust temperature automatically, and enhance safety through integrated detection systems that improve overall cabin functionality.

Recycled and sustainable interior materials are gaining substantial market traction as environmental awareness influences purchasing decisions. Manufacturers increasingly utilize post-consumer plastics, reclaimed ocean materials, and agricultural waste to create high-performance upholstery that reduces environmental footprint while maintaining aesthetic appeal and durability standards.

The demand for customizable upholstery designs reflects consumer desire for personalization in vehicle interiors. Automakers now offer expanded color palettes, texture options, and bespoke finishes that allow buyers to create unique cabin environments matching individual preferences. This customization trend extends beyond luxury segments into mainstream vehicle categories.

Digitalization enables precise pattern matching and rapid prototyping of upholstery designs, accelerating development cycles and reducing waste. Advanced manufacturing techniques including 3D knitting and digital printing facilitate small-batch production runs economically, supporting the customization movement while addressing sustainability concerns through efficient material utilization and reduced inventory requirements.

Regional Analysis

Asia Pacific Dominates the Automotive Upholstery Market with a Market Share of 45.8%, Valued at USD 2.7 Billion

Asia Pacific commands the automotive upholstery market with a dominant position, accounting for 45.8% of the global market share and valued at USD 2.7 billion. This leadership is primarily driven by the region’s robust automotive manufacturing sector, particularly in China, India, Japan, and South Korea. The expanding middle-class population, rising disposable incomes, and increasing preference for premium vehicles have significantly boosted demand for advanced upholstery materials.

North America Automotive Upholstery Market Trends

North America represents a significant market characterized by high consumer expectations for quality and comfort in vehicle interiors. The region’s growth is fueled by strong presence of premium vehicle manufacturers and increasing demand for customized and sustainable upholstery solutions. Advanced material technologies, including eco-friendly fabrics and vegan leather alternatives, are gaining substantial traction, with the United States remaining the primary contributor to regional growth.

Europe Automotive Upholstery Market Trends

Europe maintains a prominent position driven by the region’s automotive excellence and stringent quality standards. The market emphasizes sustainability with increasing adoption of bio-based and recycled materials in vehicle interiors. European consumers demonstrate strong preferences for premium upholstery options, with the region’s aggressive push toward electric vehicles creating opportunities for innovative lightweight upholstery solutions.

Middle East and Africa Automotive Upholstery Market Trends

The Middle East and Africa market is witnessing steady growth, propelled by expanding automotive sales in GCC countries and emerging African economies. The region’s hot climatic conditions drive demand for materials with superior heat resistance and UV protection. Luxury vehicle segments dominate in Middle Eastern markets, while African markets experience gradual growth supported by increasing vehicle affordability and local automotive assembly plants.

Latin America Automotive Upholstery Market Trends

Latin America’s market demonstrates moderate growth, primarily driven by Brazil and Mexico as major automotive manufacturing hubs. The market is characterized by demand for cost-effective upholstery solutions that balance quality with affordability, catering to compact and mid-size vehicle segments. The region is witnessing gradual shifts toward improved interior quality standards as manufacturers focus on enhancing vehicle value propositions.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Automotive Upholstery Company Insights

The global Automotive Upholstery Market in 2024 is characterized by intense competition among established manufacturers who are continuously innovating to meet evolving consumer preferences and stringent regulatory requirements. These industry leaders are focusing on sustainable materials, advanced technologies, and enhanced comfort features to maintain their competitive edge in an increasingly dynamic market landscape.

Adient plc maintains its position as a dominant force in automotive seating and upholstery solutions, leveraging its global manufacturing footprint and strong relationships with major automakers to deliver innovative seating systems that prioritize comfort, safety, and design aesthetics. The company’s emphasis on lightweight materials and sustainable production processes aligns well with the industry’s shift toward eco-friendly solutions.

Lear Corporation continues to strengthen its market presence through its comprehensive portfolio of automotive seating and electrical systems, demonstrating particular expertise in integrating smart technologies into upholstery solutions that enhance the overall vehicle experience. Their strategic investments in research and development enable them to stay ahead of emerging trends in vehicle interiors.

Toyota Boshoku Corporation brings decades of automotive interior expertise to the market, offering high-quality upholstery solutions that reflect Japanese manufacturing excellence and attention to detail. The company’s focus on comfort engineering and material innovation has established it as a preferred supplier for premium automotive applications.

Forvia, formed through strategic consolidation, represents a significant player in automotive interiors and upholstery, combining extensive technical capabilities with a commitment to sustainable mobility solutions. Their integrated approach to interior systems allows for cohesive design and functionality across multiple vehicle platforms, serving diverse customer needs globally.

Top Key Players in the Market

- Adient plc

- Antolin

- Asahi Kasei Corporation

- Forvia

- Lear Corp.

- Morbern

- Murtra Nonwovens

- Seiren Co., Ltd

- SUMINOE Co., Ltd.

- Toyota Boshoku Corporation

- Woodbridge

Recent Developments

- In Oct 2025, Axent Capital Partners acquired the German automotive interior parts supplier Eissmann Group. The deal strengthens Axent’s presence in the European automotive interiors market and expands its product portfolio.

- In Oct 2024, Gruppo Mastrotto completed the acquisition of Portuguese leather supplier Coindu. This move enhances Mastrotto’s footprint in Europe and supports its growth strategy in sustainable leather solutions.

- In Sept 2024, Volkswagen entered into a partnership with Revoltech to develop a hemp-based leather alternative for car interiors. The collaboration focuses on innovation in sustainable materials for automotive interiors.

Report Scope

Report Features Description Market Value (2024) USD 5.9 Billion Forecast Revenue (2034) USD 10.9 Billion CAGR (2025-2034) 6.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Materials (Automotive Textiles, Leather, Plastics, Smart Fabrics, Synthetic Leather, Thermoplastic Polymers), By Fabric Type (Woven, Non-woven), By Vehicle Type (Passenger Cars, Commercial Vehicles), By Application (Seat Covers, Carpets, Dashboards, Roof Liners, Sun Visors, Trunk Liners), By Sales Channel (OEM, Aftermarket) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Adient plc, Antolin, Asahi Kasei Corporation, Forvia, Lear Corp., Morbern, Murtra Nonwovens, Seiren Co., Ltd, SUMINOE Co., Ltd., Toyota Boshoku Corporation, Woodbridge Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Automotive Upholstery MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample

Automotive Upholstery MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Adient plc

- Antolin

- Asahi Kasei Corporation

- Forvia

- Lear Corp.

- Morbern

- Murtra Nonwovens

- Seiren Co., Ltd

- SUMINOE Co., Ltd.

- Toyota Boshoku Corporation

- Woodbridge