Global Automotive Sheet Metal Components Market By Material Type (Steel and Aluminum), By Distribution Channel (OEM and Aftermarket), By Vehicle Type (Passenger Cars and Commercial Vehicles), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Jan 2026

- Report ID: 175231

- Number of Pages: 352

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

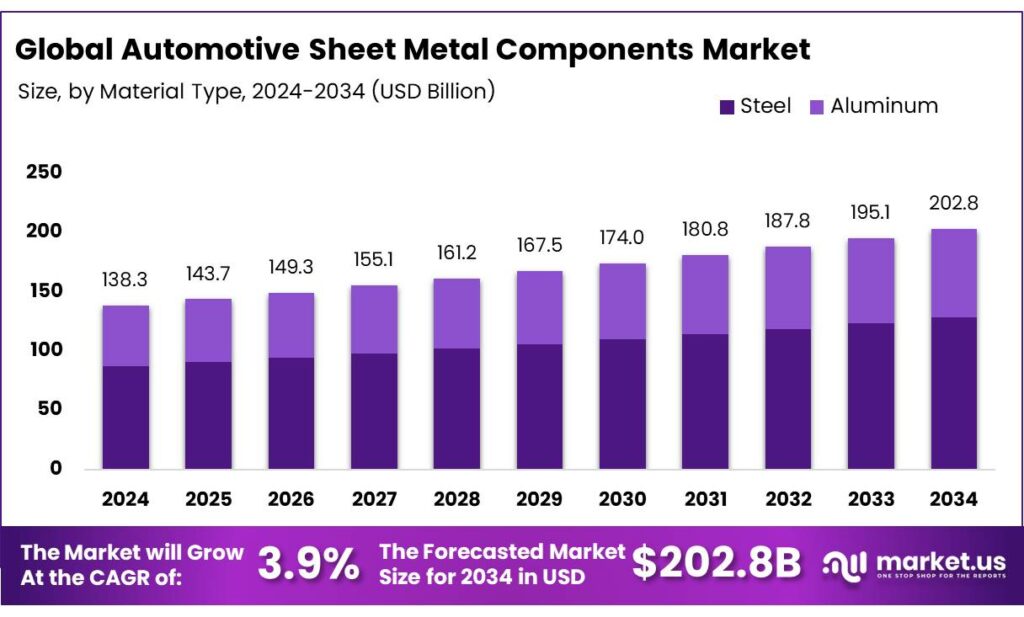

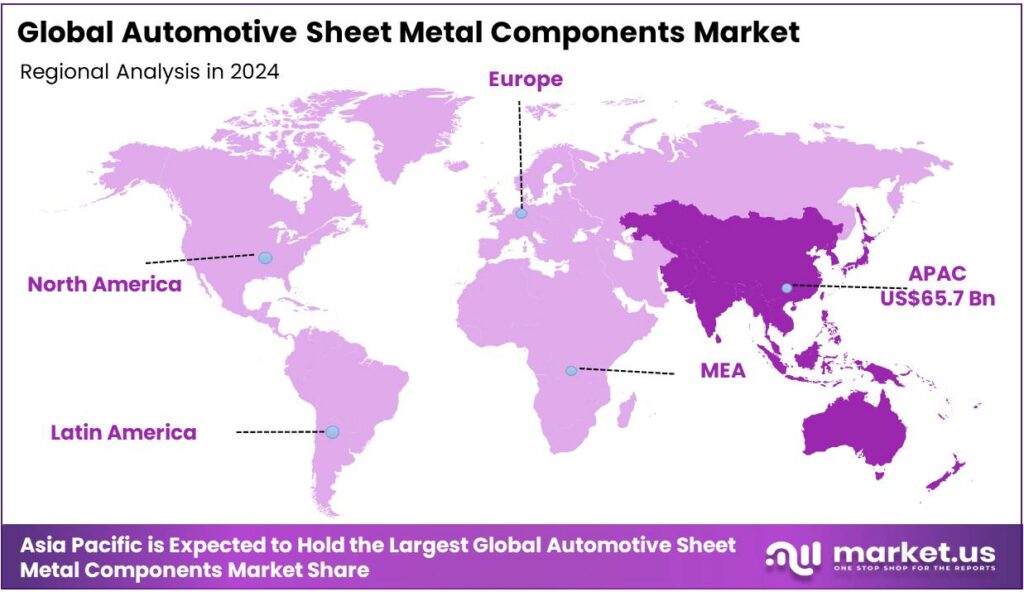

Global Automotive Sheet Metal Components Market size is expected to be worth around USD 202.8 Billion by 2034, from USD 138.3 Billion in 2024, growing at a CAGR of 3.9% during the forecast period from 2025 to 2034. In 2024 Asia Pacific held a dominant market position, capturing more than a 47.5% share, holding USD 500.0 Million in revenue.

Automotive sheet metal components are parts for vehicles, such as body panels, chassis, brackets, and fuel tanks, made by cutting, bending, stamping, and joining flat metal sheets to provide structure, function, and aesthetics, forming the fundamental skeleton and safety structure of cars, trucks, and other automobiles.

Sheet metal is classified based on its thickness, ranging from 0.5 mm to 6 mm, approximately 0.02 to 0.25 inches. Material with a thickness less than this range is referred to as foil, while material exceeding this thickness is classified as plate. The thickness of the sheet is a critical factor, as it influences the design and manufacturing process of the component.

Its market is primarily driven by the demand for lightweight, durable, and cost-effective materials to meet stringent regulations for vehicle efficiency and emissions reduction. While steel remains the dominant material due to its affordability and strength, the adoption of aluminum is on the rise for lightweight applications, especially in high-performance and electric vehicles.

- According to the European Automobile Manufacturers’ Association (ACEA), in 2024, global car sales reached 74.6 million units, marking a 2.5% increase compared to 2023. As the sales and registration of vehicles increase, there is a consistent demand for raw materials for the manufacturing of vehicles, such as sheet metal components.

Geopolitical tensions have impacted metal prices and disrupted supply chains, posing challenges for manufacturers. Furthermore, the Asia Pacific region leads the market, with countries like China, Japan, and India being key producers of both vehicles and sheet metal components. Most components are sold to OEMs due to the high volume and integration required in vehicle manufacturing, while aftermarket sales remain secondary. Additionally, innovations such as additive manufacturing play a larger role in component design and production, offering more flexibility and efficiency in meeting market needs.

- According to the ACEA, in 2023, over 70 million units of passenger vehicles were produced compared to about 18 million units of commercial vehicles that were produced in the same year. Passenger cars make up the majority of the global vehicle production, leading to a higher demand for automotive components, including sheet metal components.

Key Takeaways

- The global automotive sheet metal components market was valued at USD 138.3 billion in 2024.

- The global automotive sheet metal components market is projected to grow at a CAGR of 3.9% and is estimated to reach USD 202.8 billion by 2034.

- On the basis of material type, automotive sheet metal components made by steel dominated the market, constituting 63.2% of the total market share.

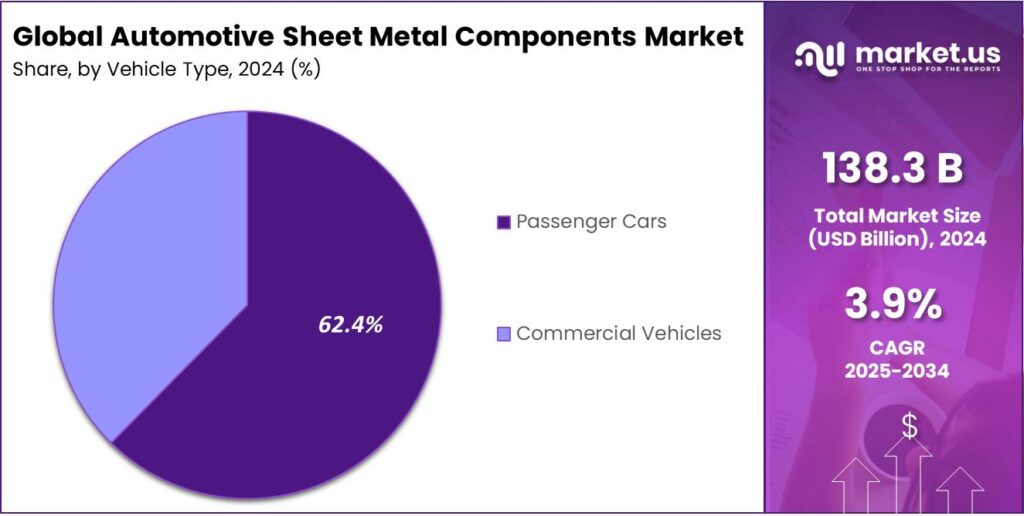

- Based on the vehicle type, most automotive sheet metal components are utilized for passenger vehicles, with a substantial market share of around 62.4%.

- Among the distribution channels, 67.5% of the automotive sheet metal components are sold to OEMs.

- In 2024, the Asia Pacific was the most dominant region in the automotive sheet metal components market, accounting for 47.5% of the total global consumption.

Material Type Analysis

Steel Automotive Sheet Metal Components are a Prominent Segment in the Market.

The automotive sheet metal components market is segmented based on material type into steel and aluminum. The steel automotive sheet metal components led the market, comprising 63.2% of the market share. Steel is more commonly used to manufacture automotive sheet metal components than aluminum due to its cost-effectiveness, superior strength, and ease of processing. Steel is often less expensive than aluminum, making it a more attractive option for mass production, particularly for automakers seeking to balance cost and performance.

Additionally, it provides higher strength, which is crucial for ensuring the structural integrity and safety of vehicles. Similarly, steel is easier to form and weld compared to aluminum, which requires more specialized techniques. The availability of high-strength steel alloys allows manufacturers to achieve weight reduction without compromising on safety or durability. While aluminum offers advantages such as reduced weight, steel remains the preferred choice for most automotive sheet metal components due to its combination of performance and affordability.

Vehicle Type Analysis

Passenger Cars Utilize Most Automotive Sheet Metal Components.

On the basis of vehicle type, the automotive sheet metal components market is segmented into passenger cars and commercial vehicles. The passenger cars held a major share in the automotive sheet metal components market, comprising 62.4% of the market share, due to differences in design requirements, production volumes, and cost considerations. Passenger vehicles typically emphasize aesthetics, fuel efficiency, and comfort, which require precise, lightweight, and often complex sheet metal components, such as body panels, doors, and hoods.

In contrast, commercial vehicles prioritize durability, load-bearing capacity, and functionality over aesthetics, often using heavier, thicker, and more utilitarian materials such as reinforced steel or composite materials for parts like chassis and cargo beds. Moreover, passenger vehicles account for higher production volumes, which makes the use of advanced sheet metal technologies more economically feasible. Commercial vehicles, with their larger size and lower production numbers, have different manufacturing needs that don’t demand as many intricate or lightweight components.

Distribution Channel Analysis

OEMs Held a Major Share of the Automotive Sheet Metal Components Market.

Based on the distribution channels, the automotive sheet metal components market is segmented into OEM and aftermarket. Among the applications of the automotive sheet metal components, 67.5% of the components are sold to OEMs as they require high volumes of parts for the initial assembly of vehicles. OEMs need consistent quality, precise fit, and reliable performance to meet strict safety and regulatory standards, which sheet metal components must adhere to.

Additionally, the design and manufacturing of these components are closely integrated with the vehicle’s overall engineering, making them essential for the production process. On the contrary, aftermarket parts are often used for repairs, replacements, or customization, often after the vehicle has been in use. The demand for aftermarket components is relatively lower and more fragmented compared to OEMs, which rely on a steady supply of parts for large-scale vehicle production.

Key Market Segments

By Material Type

- Steel

- Aluminum

By Vehicle Type

- Passenger Cars

- Hatchback

- Sedan

- SUV

- Others

- Commercial Vehicles

- Light Duty

- Heavy Duty

By Distribution Channel

- OEM

- Aftermarket

Drivers

Regulatory Frameworks Drive the Automotive Sheet Metal Components Market.

Regulatory frameworks aimed at reducing carbon emissions and improving fuel efficiency are significantly driving the demand for lightweight components in the automotive industry, particularly sheet metal components. Governments worldwide have introduced stringent emissions standards, such as the European Union’s Euro 6 regulations and the U.S. Corporate Average Fuel Economy (CAFE) standards, which require automakers to reduce the weight of vehicles and improve fuel efficiency to meet these targets.

- The proposed End-of-Life Vehicles (ELV) Regulation in the European Union would require vehicles to be designed for high reusability (85%) and recoverability (95%), promoting materials that are easier to recycle and recover, such as aluminum, advanced steels, and composites.

The regulatory push has led to a greater reliance on advanced sheet metal components, which are used in the production of vehicle bodies, chassis, and other key parts. Automakers, including Ford and BMW, are increasingly incorporating high-strength steel and aluminum to meet regulatory requirements while maintaining vehicle safety.

Consequently, the automotive industry has made significant progress in reducing vehicle weight, with studies showing that every 10% reduction in vehicle weight can result in a 6-8% improvement in fuel economy, contributing directly to emissions reduction goals set by governments.

Restraints

Fluctuating Metal Costs Amidst International Tensions Might Hinder the Growth of the Automotive Sheet Metal Components Market.

Fluctuating metal costs, driven by international tensions and supply chain disruptions, pose a significant challenge to the growth of the automotive sheet metal components market. The geopolitical instability, particularly the trade conflicts between major economies such as the U.S. and China, and the ongoing conflict in Ukraine, has caused volatility in metal prices.

For instance, the price of aluminum, a key material used in automotive sheet metal components, saw significant spikes following the imposition of tariffs on imports from Russia, one of the world’s largest aluminum producers. Similarly, the U.S. Department of Commerce’s Section 232 tariffs on steel and aluminum imports have contributed to price increases, with steel prices in the U.S. rising by over 60%.

The price surges increase production costs for automakers, particularly those reliant on large volumes of steel and aluminum for vehicle bodies and structural components. This uncertainty may deter investment in new production technologies or lead to cost-cutting measures that impact the quality or innovation of automotive sheet metal components. While the market continues to adapt, these external pressures underscore the vulnerability of the automotive supply chain to global tensions.

Opportunity

Rising Vehicle Sales Create Opportunities in the Automotive Sheet Metal Components Market.

Rising vehicle sales, particularly in emerging markets, are creating significant opportunities for the automotive sheet metal components market. As global automotive production continues to recover, automakers are scaling up production to meet growing consumer demand.

- According to the International Organization of Motor Vehicle Manufacturers (OICA), global vehicle production reached around 92.5 million units in 2024, signaling a strong recovery and subsequent growth in vehicle sales.

This growth is especially prominent in regions such as Asia-Pacific, where countries like China and India are seeing a surge in vehicle sales due to expanding middle-class populations and improved purchasing power. These increasing sales volumes create a higher demand for automotive components, especially sheet metal parts, which are essential for manufacturing vehicle bodies, doors, roofs, and chassis.

Consequently, manufacturers are investing in advanced technologies and automation to meet the increasing demand for these components, while focusing on lightweight materials to comply with regulatory standards. As vehicle sales grow, the demand for cost-efficient, durable, and high-performance sheet metal components becomes more critical, offering ample opportunities for suppliers and manufacturers in the industry.

Trends

Adoption of Additive Manufacturing for Automotive Sheet Metal Components.

The adoption of additive manufacturing (AM), or 3D printing, for automotive sheet metal components is gaining momentum as automakers seek to enhance design flexibility, reduce production costs, and speed up prototyping. This trend is particularly evident in companies, such as Ford and BMW, which have started integrating 3D printing technologies to produce more complex, lightweight sheet metal parts.

For instance, in February 2023, Ford inaugurated a 3D printing center in Germany to increase efficiency and quality in production processes. The facility is able to produce a wide variety of plastic and metal components, from components weighing 30 grams to 15 kilograms. Additive manufacturing enables the creation of intricate designs, which are costly to achieve using traditional methods such as stamping or casting, offering improved material efficiency and reduced waste.

Moreover, the technology supports the shift toward low-volume, custom production, catering to specific customer requirements for niche vehicle models. Additionally, it provides a reduction in tooling costs, which can be a significant expense in traditional manufacturing processes.

Furthermore, several government organizations, including the U.S. Department of Energy, have highlighted the benefits of additive manufacturing in achieving higher efficiency and sustainability in automotive production. As the technology continues to evolve, it is expected to play an increasingly vital role in the manufacturing of sheet metal components, particularly in the electric vehicle (EV) sector, where weight reduction and part consolidation are essential for improving efficiency.

Geopolitical Impact Analysis

Geopolitical Tensions Have Led to Disruption in the Production of Automotive Sheet Metal Components.

The geopolitical tensions have had a profound impact on the automotive sheet metal components market, with disruptions in supply chains, rising material costs, and shifting trade policies. For instance, the conflict in Ukraine has led to a sharp increase in the cost of raw materials, particularly steel and aluminum, as Russia and Ukraine are key suppliers of these metals.

After the war, the European Union and the U.S. imposed sanctions that further complicated the flow of these materials, pushing prices higher. This has placed considerable pressure on automotive manufacturers, many of whom were previously struggling with the effects of the global semiconductor shortage and supply chain bottlenecks.

Additionally, trade tensions between China and the U.S. have exacerbated challenges in sourcing components, as both countries rely on each other for various automotive parts, including sheet metal. This has led to delays and increased lead times, ultimately affecting vehicle production rates.

Regional Analysis

Asia Pacific Held the Largest Share of the Global Automotive Sheet Metal Components Market.

In 2024, the Asia Pacific dominated the global automotive sheet metal components market, holding about 47.5% of the total global consumption, driven by the region’s robust automotive manufacturing sector, particularly in countries such as China, Japan, and India. Moreover, the region benefits from low labor costs, well-established supply chains, and increasing investments in technology, which continue to bolster its dominance in the market.

- According to the OICA, in 2024, the Asia Pacific region represented about 59.4% of the total global vehicle production.

- China, as the world’s largest automotive producer, is home to major players like BYD, which accounts for a significant portion of global vehicle production. In 2024, China produced over 31 million vehicles, with a substantial amount of sheet metal components used in vehicle assembly.

- Japan, accounting for 8.2 million vehicle units in 2024, and home to major automakers such as Toyota and Honda, contributes heavily to the demand for sheet metal parts, with a focus on lightweight, high-strength materials to improve vehicle efficiency.

- India’s growing automotive industry, with over 6 million vehicle production in 2024, driven by rising domestic demand and increasing exports, is a key factor, as it becomes a hub for cost-effective sheet metal component production.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

To gain a competitive edge in the automotive sheet metal components market, manufacturers focus on investing in advanced manufacturing technologies, such as automation, robotics, and additive manufacturing, to improve production efficiency, reduce costs, and enhance component precision.

Additionally, manufacturers prioritize the development of lightweight, high-strength materials, such as advanced steel alloys and aluminum, to meet evolving regulatory standards and consumer demands for fuel-efficient vehicles.

Furthermore, they emphasize collaboration with OEMs for early-stage design integration to ensure that parts are optimized for assembly and performance. Similarly, these players are focusing on sustainability initiatives, such as recycling and reducing material waste. Moreover, manufacturers expand their geographic presence in emerging markets like the Asia-Pacific to tap into growing vehicle production volumes and capitalize on lower production costs.

The Major Players in The Industry

- NIPPON STEEL CORPORATION

- Nucor Corporation

- Magna International

- Novelis

- Norsk Hydro ASA

- Arconic Corporation

- The Craemer Group

- Omax Autos

- Frank Dudley

- Jobro Sheet Metal Technology AB

- Approved Sheet Metal

- JFE Steel Corporation

- Paul Craemer GmbH

- Aleris International Inc.

- Amada Co., Ltd.

- Frank Dudley Ltd.

- Other Key Players

Key Development

- In August 2025, Nippon Steel, a Japanese giant in the steel industry, announced to invest US$11 billion in its acquired U.S. Steel, aiming to revitalize the ailing American steel industry.

- In November 2025, General Motors announced to invest US$250 million in its Parma Metal Center to support the production of sheet metal stampings and assemblies for vehicles.

Report Scope

Report Features Description Market Value (2024) US$138.3 Bn Forecast Revenue (2034) US$202.8 Bn CAGR (2025-2034) 3.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Material Type (Steel and Aluminum), By Distribution Channel (OEM and Aftermarket), By Vehicle Type (Passenger Cars and Commercial Vehicles) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC– China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America– Brazil, Mexico & Rest of Latin America; Middle East & Africa– GCC, South Africa, & Rest of MEA Competitive Landscape Nippon Steel Corporation, Nucor Corporation, Magna International, Novelis, Norsk Hydro ASA, Arconic Corporation, The Craemer Group, Omax Autos, Frank Dudley, Jobro Sheet Metal Technology AB, Approved Sheet Metal, JFE Steel Corporation, Paul Craemer GmbH, Aleris International Inc., Amada Co. Ltd., Frank Dudley Ltd., and Other Players. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)  Automotive Sheet Metal Components MarketPublished date: Jan 2026add_shopping_cartBuy Now get_appDownload Sample

Automotive Sheet Metal Components MarketPublished date: Jan 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- NIPPON STEEL CORPORATION

- Nucor Corporation

- Magna International

- Novelis

- Norsk Hydro ASA

- Arconic Corporation

- The Craemer Group

- Omax Autos

- Frank Dudley

- Jobro Sheet Metal Technology AB

- Approved Sheet Metal

- JFE Steel Corporation

- Paul Craemer GmbH

- Aleris International Inc.

- Amada Co., Ltd.

- Frank Dudley Ltd.

- Other Key Players