Global Automotive Alternator & Starter Motor Market By Product (Alternator, Starter Motor), By Vehicle Type (Commercial Vehicle, Off-road Vehicle, Passenger vehicle), By Sales Channel (OEM, Aftermarket), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Feb 2025

- Report ID: 139839

- Number of Pages: 384

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

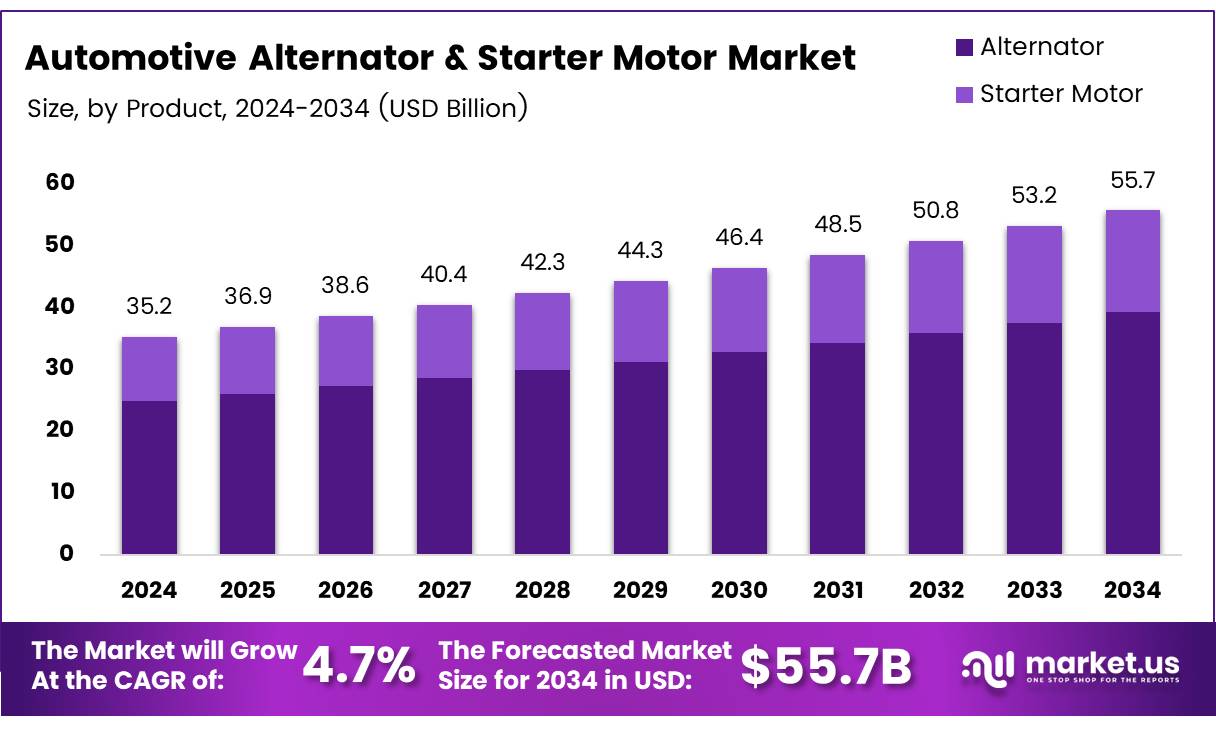

The Global Automotive Alternator & Starter Motor Market size is expected to be worth around USD 55.7 Billion by 2034, from USD 35.2 Billion in 2024, growing at a CAGR of 4.7% during the forecast period from 2025 to 2034.

The Automotive Alternator and Starter Motor market plays a crucial role in ensuring the optimal functioning of modern vehicles. Alternators generate electricity to charge the vehicle’s battery and power various electrical systems, while starter motors are responsible for initiating engine start-up. These components are integral to both conventional internal combustion engine (ICE) vehicles and emerging electric vehicle (EV) technologies.

As automotive manufacturers shift toward more energy-efficient and sustainable models, the demand for high-performance alternators and starter motors continues to rise. The market is also supported by increasing vehicle production, technological advancements in components, and the rising number of light commercial vehicles globally.

According to Study, unit sales in the Light Commercial Vehicles market are projected to reach 29.53 million vehicles in 2025. Additionally, France recorded the highest number of light commercial vehicle (LCV) sales in 2023, with approximately 378,000 vehicles sold. This growth in vehicle production directly correlates with a higher demand for critical components like alternators and starter motors.

Furthermore, the average lifespan of a starter motor, which ranges from 100,000 to 150,000 miles, as reported by eBay, highlights the need for consistent replacement and maintenance of these components in the aftermarket segment, thereby sustaining long-term market growth.

The Automotive Alternator and Starter Motor market is poised for substantial growth, driven by several factors. Rising global vehicle sales, particularly in emerging markets, are expected to boost demand for these components.

According to Deloitte, global air passenger traffic was up 11.9% year-to-date as of August 2024, with total capacity also increasing by 12%. This recovery in air travel could indirectly impact the automotive sector, including the demand for alternators and starter motors in commercial fleets that support air travel logistics and transportation.

Furthermore, governmental investment in infrastructure and the push for stricter emissions regulations are fostering innovation in the automotive space, especially for electric and hybrid vehicles.

As vehicle electrification continues, manufacturers are increasingly focusing on efficient and lightweight alternators and starter motors, thereby opening avenues for technological innovations and market expansion. With the increasing regulatory focus on environmental sustainability, particularly in Europe and North America, stricter emission standards are likely to drive innovation in vehicle components, including alternators and starter motors.

Key Takeaways

- The global automotive alternator & starter motor market is projected to reach USD 55.7 billion by 2034, growing at a CAGR of 4.7% from 2025 to 2034.

- In 2024, commercial vehicles held an 80.2% share of the market, driven by light and heavy commercial vehicle adoption.

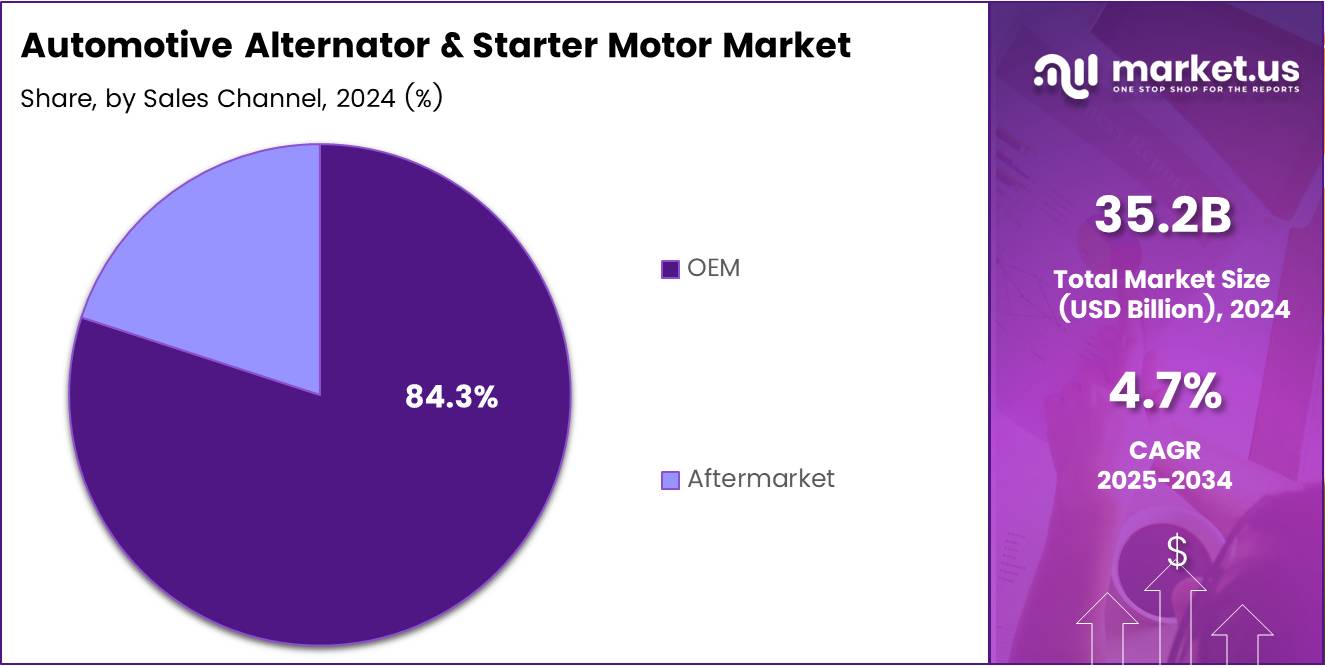

- OEMs dominated the sales channel segment in 2024 with an 84.3% market share.

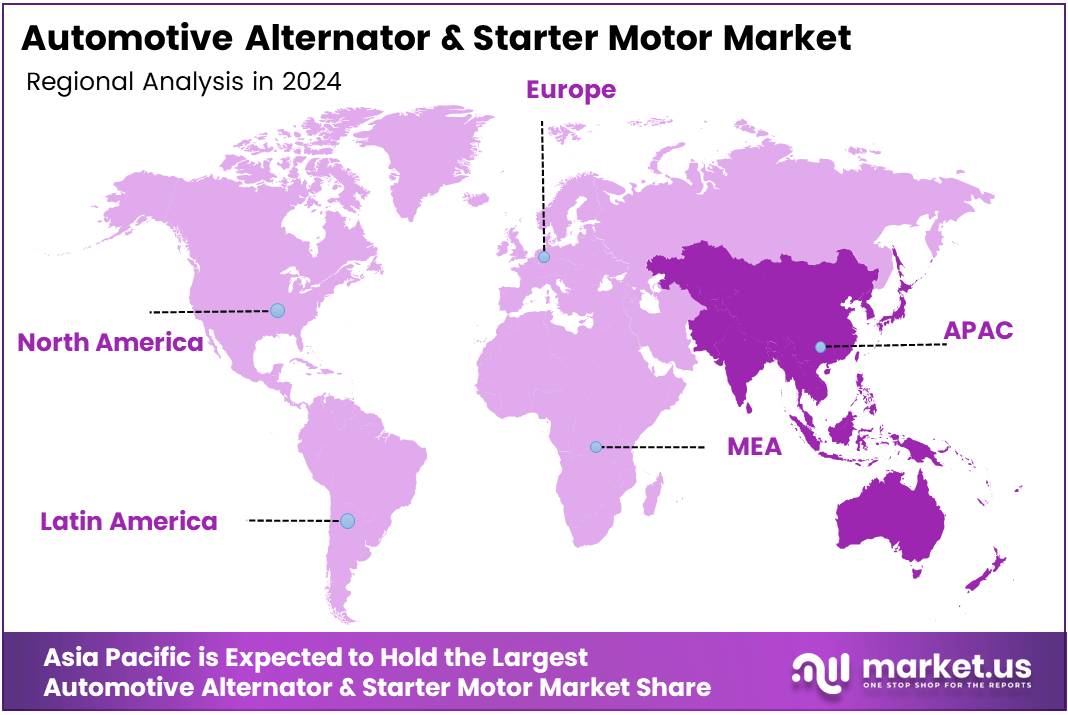

- The Asia Pacific region leads the global market, driven by industrialization and high vehicle production in China, India, and Japan.

Vehicle Type Analysis

Commercial Vehicles Lead with 80.2% Share in Automotive Alternator & Starter Motor Market in 2024

In 2024, Commercial Vehicles dominated the Automotive Alternator & Starter Motor Market with a significant 80.2% share, driven by the widespread adoption of both light commercial vehicles (LCVs) and heavy commercial vehicles (HCVs).

This sector benefits from the increasing demand for robust and reliable electrical systems to support the growing global logistics and transportation industries. LCVs, which are used for goods transportation in urban and suburban areas, and HCVs, essential for long-haul freight, both rely heavily on high-performance alternators and starter motors to ensure operational efficiency and vehicle longevity.

The Off-road Vehicle segment, including Agricultural Tractors & Equipment and Construction & Mining Equipment, held a smaller yet significant portion of the market. The demand for these vehicles, especially in emerging markets where agriculture and infrastructure development are key drivers of economic growth, contributes to steady demand for high-durability automotive components.

On the other hand, the Passenger Vehicle segment, though substantial, faces slower growth compared to commercial and off-road vehicle segments. Advances in electric and hybrid vehicle technologies are influencing the evolving demand for starter motors and alternators, which are crucial in traditional internal combustion engines but may see less demand in electric vehicles moving forward.

Sales Channel Analysis

OEM Dominates with 84.3% Share in Automotive Alternator & Starter Motor Market in 2024

In 2024, OEM (Original Equipment Manufacturer) dominated the Automotive Alternator & Starter Motor Market in the By Sales Channel Analysis segment, holding a substantial 84.3% share.

This dominance can be attributed to the strong demand from vehicle manufacturers who require high-quality, durable alternators and starter motors for new vehicle production. OEMs supply these components directly to automotive manufacturers, ensuring compatibility and performance with the latest models, thus meeting the stringent requirements of vehicle manufacturers globally.

The Aftermarket segment, while considerably smaller in comparison, continues to see steady growth, driven by the need for replacement and repair parts. As vehicles age, the demand for aftermarket alternators and starter motors increases, especially in regions where vehicle maintenance is a significant part of the automotive ecosystem. The aftermarket sector benefits from a growing number of independent repair shops, online retailers, and the increasing trend of vehicle ownership longevity.

Despite the steady growth of the aftermarket, OEM’s dominant position remains intact, as new vehicle production and strict industry standards require high-performance components that OEMs are best positioned to supply.

However, the aftermarket continues to be a vital source of revenue, particularly for aging vehicle fleets and in regions with a high number of vehicles in operation.

Key Market Segments

By Product

- Alternator

- Starter Motor

By Vehicle Type

- Commercial Vehicle

- Light Commercial Vehicle

- Heavy Commercial Vehicle

- Off-road Vehicle

- Agricultural Tractors & Equipment

- Construction & Mining Equipment

- Passenger vehicle

By Sales Channel

- OEM

- Aftermarket

Drivers

Growth in Automotive Production Drives Demand for Starter Motors

The automotive alternator and starter motor market is significantly influenced by the rising global production of vehicles. As more cars are manufactured worldwide, the demand for starter motors increases, as they are essential components in nearly every internal combustion engine vehicle.

This surge in vehicle production is primarily driven by factors like higher consumer demand, technological advancements, and enhanced production capabilities of automotive manufacturers.

Additionally, emerging economies, particularly in regions like Asia-Pacific, are experiencing rapid urbanization and an improvement in living standards, which further boosts vehicle sales. As more consumers purchase vehicles, the need for starter motors continues to grow. Another key factor contributing to the market’s expansion is the rise of electric vehicles (EVs), including hybrid and fully electric models.

These vehicles require specialized starter motors, creating new growth opportunities. Furthermore, the growing focus on fuel efficiency in the automotive sector has led to innovations in starter motor technology, pushing manufacturers to develop high-performance motors that reduce energy consumption and improve overall vehicle efficiency. As automakers strive to meet these demands, the automotive alternator and starter motor market is poised for continued growth.

Restraints

Substitute Technologies Limit Demand for Traditional Starter Motors

One of the key restraints in the automotive alternator and starter motor market is the rise of alternative starting systems, particularly in hybrid and electric vehicles. These vehicles often use different technologies, such as power electronics or high-voltage battery systems, which can reduce or eliminate the need for traditional internal combustion engine (ICE) starter motors.

As more consumers and manufacturers shift toward electric vehicles (EVs), the demand for conventional starter motors decreases, especially in markets focused on clean energy solutions.

Additionally, developments in other automotive power sources, like supercapacitors, are also emerging as potential alternatives. Supercapacitors, for example, store and discharge energy more quickly than traditional batteries, offering an energy-efficient solution for starting engines without relying on a starter motor.

This could put pressure on the demand for traditional starter motors, especially if these alternatives become more widely adopted. As these technologies improve, there is a growing risk that they may replace conventional starter motors in some vehicle segments, slowing down the growth of the traditional starter motor market.

Consequently, automakers are facing a dilemma of balancing the demand for traditional components while integrating newer, more advanced technologies, creating uncertainty for the future of the starter motor market.

Growth Factors

Technological Advancements Open New Growth Opportunities for Starter Motors

The automotive alternator and starter motor market has several growth opportunities, particularly with the integration of smart systems and advancements in motor efficiency.

The rise of connected and smart automotive systems, such as Internet of Things (IoT) integration and advanced diagnostics, offers new avenues for starter motor manufacturers. By incorporating these technologies, starter motors can provide better performance monitoring and predictive maintenance, enhancing vehicle reliability and reducing downtime.

Additionally, there is significant potential for growth in the development of high-efficiency starter motors. As automakers focus on improving fuel efficiency and reducing emissions, more power-saving and energy-efficient starter motors are in demand, especially in the context of hybrid and electric vehicles. Another promising opportunity lies in the increasing demand for commercial vehicles, such as trucks, buses, and delivery vehicles.

These vehicles typically require more durable and powerful starter motors, creating a strong market for suppliers who can meet these needs. Lastly, the growing automotive service industry presents opportunities for manufacturers to expand their presence in after-sales services, including repairs, maintenance, and retrofitting.

With the automotive aftermarket growing steadily, starter motor companies can capitalize on the demand for replacement parts and maintenance solutions, building long-term customer relationships and increasing their market share in the service sector.

Emerging Trends

Shift Toward Autonomous Vehicles Boosts Demand for Advanced Starter Motors

Several key trends are shaping the automotive alternator and starter motor market, with technological advancements playing a central role. One of the most notable trends is the shift towards autonomous vehicles. As these vehicles rely heavily on advanced electrical systems and power management technologies, the demand for more sophisticated starter motors is increasing.

These motors need to support the growing complexity of electrical components that autonomous vehicles require. Another important trend is the use of lightweight materials in starter motors. By reducing the weight of these components, automakers can improve overall vehicle efficiency and fuel economy, contributing to a larger focus on materials like aluminum or composites.

Additionally, the integration of starter motors with advanced power management systems is becoming more common. These systems help optimize energy use across various components, enhancing overall vehicle performance and energy efficiency. Lastly, the growing adoption of brushless DC (BLDC) motors in automotive applications is another key trend.

BLDC motors offer advantages such as higher efficiency, greater durability, and reduced maintenance needs, making them an attractive option for manufacturers. As the market continues to evolve with these trends, starter motor manufacturers are adapting by developing more efficient, durable, and high-performance products that meet the needs of modern vehicles, from autonomous cars to energy-efficient hybrids.

Regional Analysis

Asia Pacific Leads the Market Due to Rapid Automotive Production and EV Growth

The Asia Pacific region dominates the global automotive alternator and starter motor market, accounting for the largest market share. This is due to rapid industrialization and high vehicle production, particularly in China, India, and Japan.

The region also benefits from a burgeoning electric vehicle (EV) market, with significant investments in EV infrastructure and growing consumer demand for fuel-efficient vehicles. Asia Pacific is expected to continue its dominance, with the highest growth forecasted, driven by both traditional and electric vehicle manufacturing.

Regional Mentions:

North America holds a notable position in the market, driven by strong automotive manufacturing in the U.S. and Canada. The increasing adoption of electric and hybrid vehicles further contributes to the demand for advanced alternators and starter motors. The region’s stable vehicle ownership and high standards for automotive quality ensure continued growth, though at a more moderate pace compared to Asia Pacific.

In Europe, automotive alternator and starter motor sales are supported by a strong automotive industry, especially in Germany, France, and the UK. Europe’s stringent environmental regulations are propelling the shift toward electric and hybrid vehicles, which drives demand for efficient automotive components. The region’s focus on premium vehicles and technological advancements in starter motors further fuels the market growth.

Middle East & Africa presents a slower growth rate, with lower vehicle production volumes. However, increasing automotive output in countries like South Africa and the United Arab Emirates, combined with growing vehicle sales, will offer opportunities for market expansion. The automotive industry is gradually modernizing, which will positively impact the alternator and starter motor market in the long term.

Latin America shows steady but moderate growth in the automotive alternator and starter motor market. The region’s automotive sector is expanding, particularly in countries like Brazil and Mexico, where vehicle production is rising. However, economic instability in certain parts of Latin America limits rapid growth, though increasing vehicle demand will support the market in the coming years.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The global automotive alternator and starter motor market is poised for continued growth in 2024, driven by technological advancements, shifting consumer demands, and the transition toward electric vehicles (EVs). Key players such as Robert Bosch GmbH, Cummins Inc., and DENSO CORPORATION are likely to remain at the forefront due to their extensive product portfolios and innovation capabilities.

Robert Bosch GmbH, with its strong market presence, continues to lead in terms of product development, particularly in fuel-efficient and electric vehicle applications. Bosch’s commitment to green technology and its expertise in both traditional and electric automotive components place it as a pivotal player in the evolving market.

Prestolite Electric and BBB Industries are notable for their aftermarket solutions, providing high-quality alternators and starters for a wide range of vehicles. They remain competitive by focusing on cost-effective solutions and expanding their global distribution networks.

Cummins Inc., traditionally known for its heavy-duty vehicle systems, is also increasingly active in the electric and hybrid vehicle space. Their growing emphasis on electrified powertrains and advanced motor technologies is expected to contribute significantly to their market position.

DENSO CORPORATION, Hitachi Astemo, and Valeo are expected to drive innovation in electric starter motors and alternators for hybrid and fully electric vehicles, areas where demand is expanding rapidly. Their focus on efficiency, lightweight designs, and reduced energy consumption will be key to maintaining competitiveness in the face of changing automotive trends.

With the rise of electric mobility, Mitsuba Corp., HELLA GmbH, and Broad-Ocean Technologies are making strides in developing cutting-edge starter and alternator solutions tailored to EVs and hybrid vehicles, ensuring their roles in shaping the future of the automotive powertrain landscape.

Top Key Players in the Market

- Robert Bosch GmbH

- Prestolite Electric Incorporated.

- Cummins Inc

- BBB Industries

- DENSO CORPORATION

- Hitachi Astemo, Ltd.

- Mitsuba Corp.

- HELLA GmbH & Co. KGaA

- Valeo

- Broad-Ocean Technologies

Recent Developments

- In August 2024, IPU Group Ltd announced the sale of its Engine Starting Division to an international conglomerate, marking a strategic shift in the company’s portfolio and focus. This divestment is expected to streamline operations and boost future growth prospects in core business areas.

- In December 2024, Lucas TVS significantly expanded its product offerings, enhancing its global presence through strategic partnerships and a broadened distribution network. The move is poised to strengthen the brand’s position in the automotive and industrial sectors worldwide.

- In January 2025, Euler Motors successfully raised up to USD 20 million in debt funding from responsAbility Investments to accelerate the development and manufacturing of its electric commercial vehicles. This funding will help the company scale production and expand its market reach.

Report Scope

Report Features Description Market Value (2024) USD 35.2 Billion Forecast Revenue (2034) USD 55.7 Billion CAGR (2025-2034) 4.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Alternator, Starter Motor), By Vehicle Type (Commercial Vehicle, Off-road Vehicle, Passenger vehicle), By Sales Channel (OEM, Aftermarket) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Robert Bosch GmbH, Prestolite Electric Incorporated., Cummins Inc, BBB Industries, DENSO CORPORATION, Hitachi Astemo, Ltd., Mitsuba Corp., HELLA GmbH & Co. KGaA, Valeo, Broad-Ocean Technologies Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Automotive Alternator & Starter Motor MarketPublished date: Feb 2025add_shopping_cartBuy Now get_appDownload Sample

Automotive Alternator & Starter Motor MarketPublished date: Feb 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Robert Bosch GmbH

- Prestolite Electric Incorporated.

- Cummins Inc

- BBB Industries

- DENSO CORPORATION

- Hitachi Astemo, Ltd.

- Mitsuba Corp.

- HELLA GmbH & Co. KGaA

- Valeo

- Broad-Ocean Technologies