Global Arm Microcontrollers Market Size, Share, Industry Analysis Report By Product (80-120 Pins, Less than 80 Pins, More than 120 Pins), By Application (Automotive, Industrial, Consumer Electronics, Telecommunication, Medical, Other Applications), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: August 2025

- Report ID: 156493

- Number of Pages: 334

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

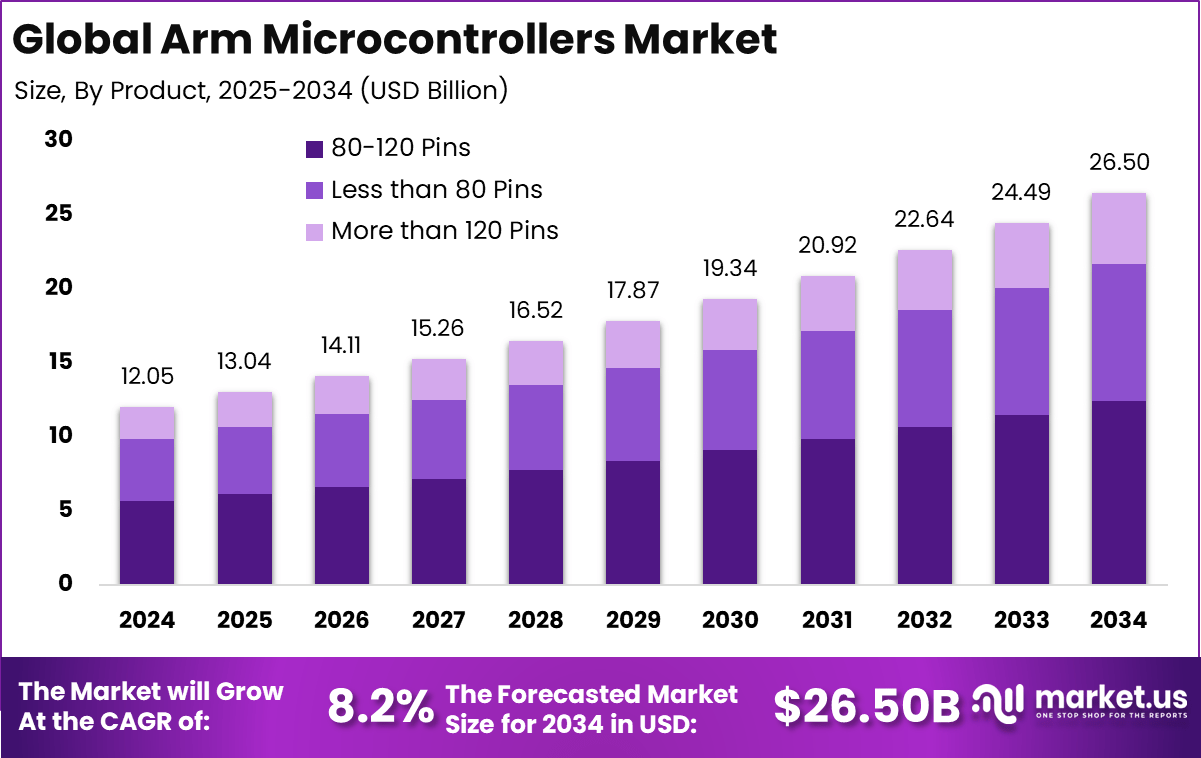

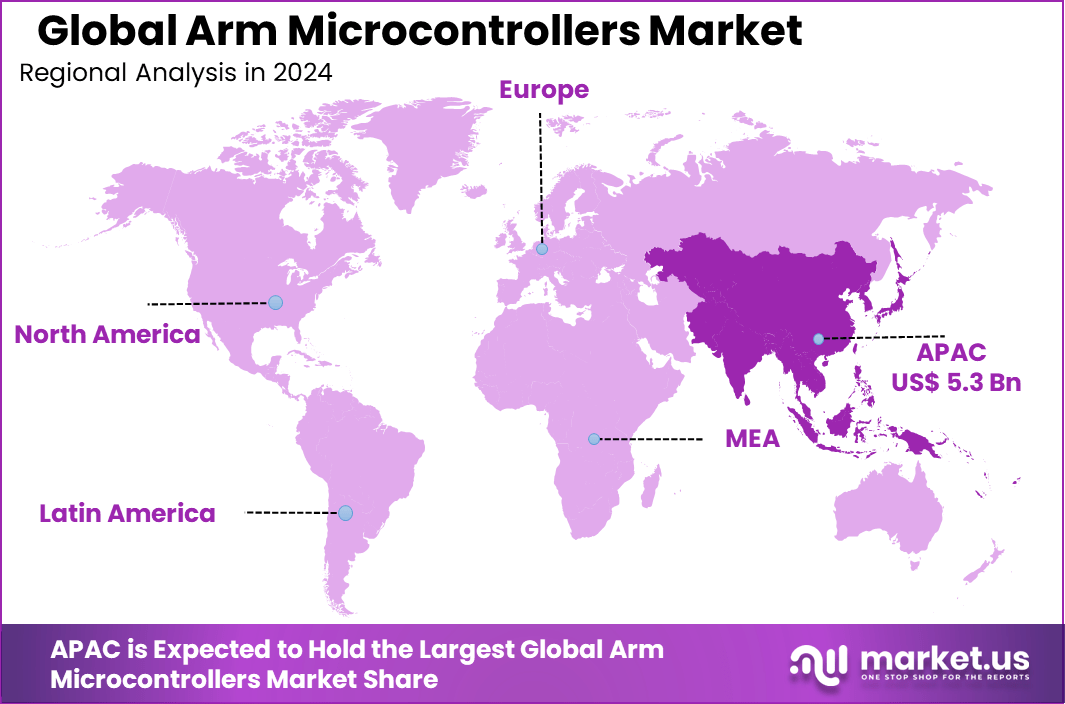

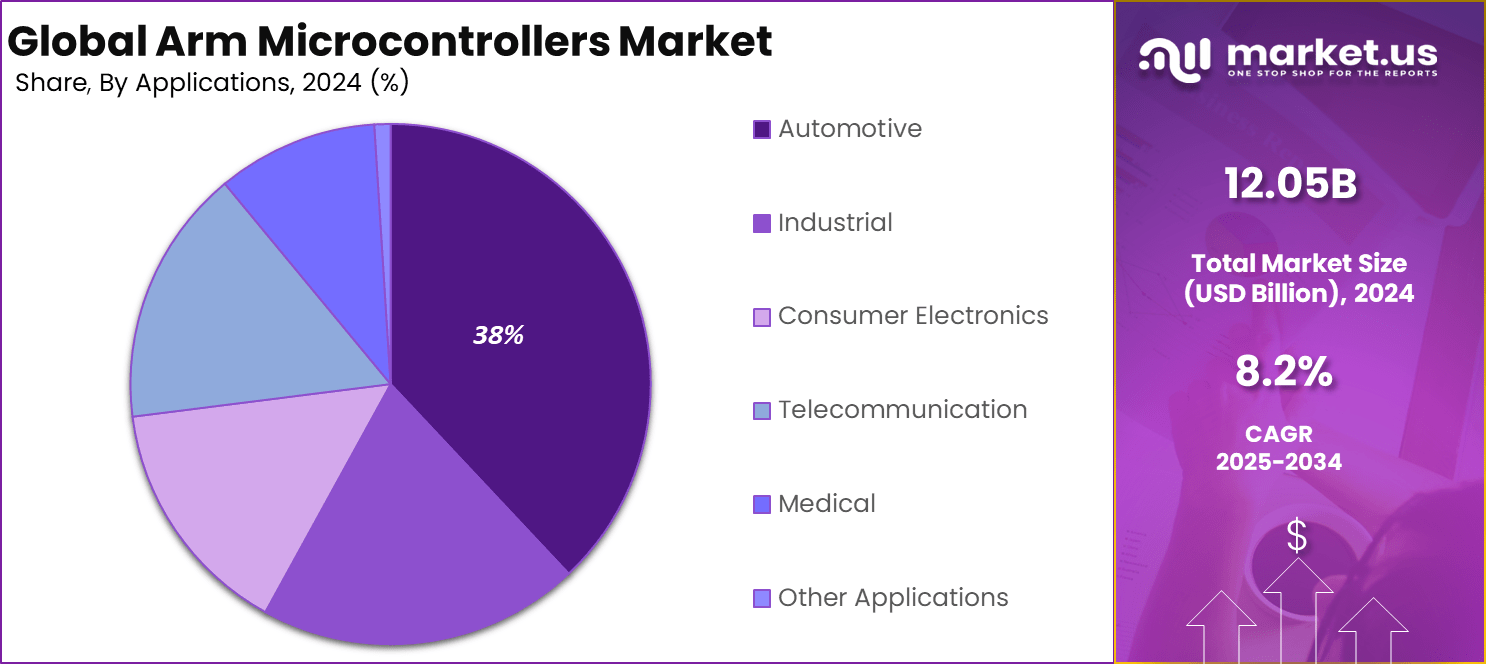

The Global Arm Microcontrollers Market size is expected to be worth around USD 26.50 billion by 2034, from USD 12.05 billion in 2024, growing at a CAGR of 8.2% during the forecast period from 2025 to 2034. In 2024, Asia-Pacific held a dominant market position, capturing more than a 44.3% share, holding USD 5.3 billion in revenue.

The ARM microcontrollers market is shaped by the rising need for efficient and reliable embedded systems across various industries. ARM microcontrollers are the core processing units in many electronic devices, offering high performance with low power consumption, making them essential for applications ranging from consumer electronics to automotive and industrial automation.

This market growth is closely tied to advancements in semiconductor technology and the increasing complexity of connected devices, which demand sophisticated control capabilities. ARM microcontrollers provide a versatile and scalable solution, adaptable for numerous use cases while also benefiting from a robust global developer ecosystem.

The top driving factors behind the market include the widespread adoption of the Internet of Things (IoT), smart appliances, and automotive electronics. As more devices connect to networks, there is a growing demand for microcontrollers that can efficiently manage communication and data processing while maintaining energy efficiency to extend battery life.

According to Market.us, the AI Microcontroller Market is projected to grow from USD 6.1 billion in 2024 to around USD 24.7 billion by 2034, at a CAGR of 14.7% during 2025–2034. In 2024, APAC dominated the market with more than 34.7% share, generating about USD 2.1 billion revenue.

in parallel, The Next-gen Microcontrollers Market is expected to expand from USD 3.20 billion in 2024 to nearly USD 17.32 billion by 2034, advancing at a CAGR of 18.4% over the forecast period. APAC led this market as well in 2024, securing over 35.7% share and recording USD 1.1 billion revenue.

Additionally, the automotive industry’s shift toward electric and autonomous vehicles requires microcontrollers that support advanced driver assistance systems and real-time processing. Industry 4.0 trends, focusing on automation and data analytics, further bolster demand for ARM microcontrollers in industrial environments, where precision control and connectivity are critical.

For instance, in December 2024, Edge Impulse and STMicroelectronics launched a new microcontroller designed for next-generation edge AI applications. This collaboration resulted in the development of an ARM-based microcontroller optimized for machine learning at the edge, enabling real-time processing of AI models directly on devices.

Key Takeaway

- In 2024, the 80-120 Pins segment dominated with a 47% share, highlighting its wide usage across industrial and automotive applications.

- The Automotive segment held the largest end-use share at 38%, driven by demand for microcontrollers in advanced driver-assistance systems (ADAS), EVs, and in-vehicle electronics.

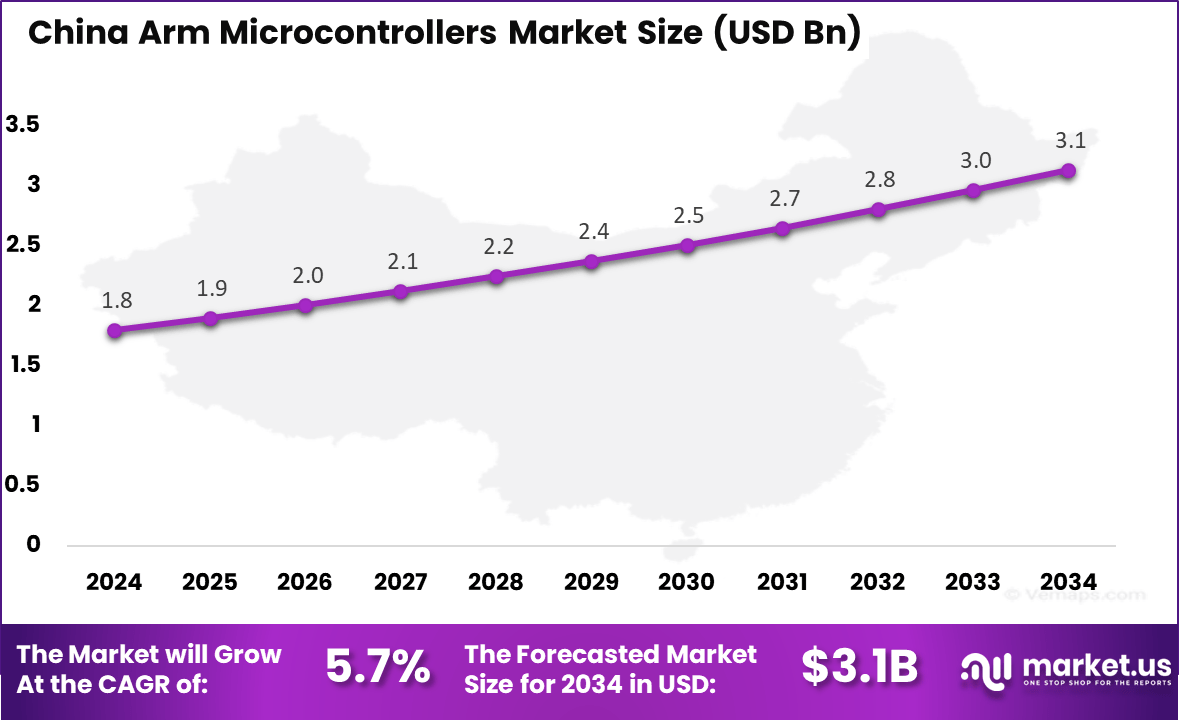

- The China Arm Microcontrollers Market was valued at USD 1.8 Billion in 2024, with a projected CAGR of 5.7%, underscoring its role as a key manufacturing and consumer hub.

- Asia-Pacific led the global market, accounting for 44.3% share in 2024, supported by strong electronics production, automotive innovation, and IoT adoption.

China Market Size

The market for Arm Microcontrollers within China is growing tremendously and is currently valued at USD 1.8 billion, the market has a projected CAGR of 5.7%. The market is growing due to the rapid technological advancements and increasing demand for smart devices, IoT applications, and automotive electronics.

As China continues to lead in the manufacturing and adoption of next-gen technologies, they are favored for its energy efficiency, scalability, and performance. The government’s push for digital transformation and the rise of industries such as smart cities, autonomous vehicles, and industrial automation further drive the demand for ARM microcontrollers, strengthening their market presence in the region.

For instance, in August 2024, Gigadevice Semiconductor, a leading Chinese semiconductor company, expanded its ARM microcontroller product roadmap through ARM Total Access. This collaboration enables Gigadevice to leverage ARM’s comprehensive resources and tools, accelerating the development of advanced ARM-based MCUs.

In 2024, Asia-Pacific held a dominant market position in the Global Arm Microcontrollers Market, capturing more than a 44.3% share, holding USD 5.3 billion in revenue. The dominance is due to the region’s rapid industrialization, significant investments in electronics manufacturing, and the growing demand for IoT devices.

Countries like China, Japan, and South Korea are key players in the semiconductor and microcontroller industries, driving innovations in automotive, consumer electronics, and industrial automation. Additionally, the region benefits from cost-effective manufacturing and a robust supply chain, which further strengthens its position in the global market.

For instance, in January 2025, STMicroelectronics unveiled its new STM32 microcontrollers designed to accelerate AI at the edge. These ARM-based microcontrollers are specifically optimized for edge AI applications, enabling real-time processing of machine learning models directly on devices, without the need for cloud infrastructure.

Segment by Product

The 80-120 pins segment holds a significant 47% share of the ARM microcontrollers market, making it the largest product category. This segment’s popularity is largely attributed to its well-balanced feature set that combines moderate pin count with high performance and versatility.

ARM microcontrollers within this range are designed to support applications requiring advanced processing and real-time control capabilities, while maintaining cost efficiency and ease of integration. They cater particularly well to markets where multiple peripheral connections and LCD support are necessary, such as healthcare devices, consumer electronics, and home appliances.

These microcontrollers are widely adopted due to their support for complex functionalities without the complexity or cost of microcontrollers with more than 120 pins. Specifically, they offer benefits like low power consumption which is crucial for battery-operated devices, and integrated peripheral connectivity that reduces CPU workload and system complexity.

The adaptability of 80-120 pin microcontrollers allows them to be used across various technological applications, driving their sustained demand in the global market and positioning them for steady growth through the forecast period.

Segment by Application

The automotive segment commands a substantial 38% share of the ARM microcontrollers market, reflecting its critical role as a key driver of market growth. The increasing incorporation of electronics in vehicles – including advanced driver assistance systems (ADAS), infotainment, telematics, and electric vehicle (EV) controls – has elevated the reliance on ARM-based microcontrollers.

These microcontrollers provide the essential processing power, scalability, and real-time responsiveness demanded by modern automotive systems. Their energy-efficient design also aligns well with the automotive industry’s shift towards electric and hybrid vehicles. Automotive applications benefit from the ARM microcontrollers’ ability to handle complex computations, safety-critical operations, and connectivity requirements.

As vehicle technologies evolve to embrace automation and connectivity, the microcontrollers serve as the backbone for multiple control units within a car, enhancing safety, performance, and user experience. The ongoing trends in autonomous driving and vehicle-to-everything (V2X) communication further underscore the growing need for high-performance ARM microcontrollers in automotive systems, supporting market expansion over the coming years.

For instance, in September 2024, Renesas introduced its RH850 automotive microcontrollers, designed to enhance the performance and safety of next-generation vehicles. These MCUs are optimized for automotive applications, including advanced driver assistance systems (ADAS), electric vehicles, and infotainment systems.

Key Market Segments

By Product

- 80-120 Pins

- Less than 80 Pins

- More than 120 Pins

By Application

- Automotive

- Industrial

- Consumer Electronics

- Telecommunication

- Medical

- Other Applications

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Drivers

Proliferation of IoT Devices

Growing Demand from IoT and Automotive Sectors

The ARM microcontroller market is gaining strong momentum, driven mainly by the growing Internet of Things ecosystem. Billions of connected devices require efficient, low-power processors capable of handling edge-level data processing. ARM-based designs are preferred because they balance energy efficiency and performance, allowing smart devices to perform complex functions while maintaining long battery life.

The automotive sector has emerged as another powerful driver of demand. Advanced driver-assistance systems, electric vehicles, and modern infotainment systems all rely on ARM microcontrollers to deliver reliable real-time processing. Their scalability and security features make them essential for handling the complexity of connected and autonomous vehicle technologies.

Recent industry developments highlight this trend. In April 2025, Farnell expanded its offering by including NXP Semiconductors’ microcontrollers and FRDM development boards. This step strengthens support for developers building IoT applications requiring high performance with low energy consumption. The move reflects the continuing rise in demand for ARM-based solutions, positioning them as a cornerstone in both IoT and automotive innovation.

Restraint

Supply Chain Disruptions and Competitive Pressure

Despite positive growth projections, the ARM microcontroller market faces significant restraints, with supply chain disruptions being a major concern. The ongoing global semiconductor shortage impacts production timelines and component availability, inflating costs and creating delays. These disruptions challenge manufacturers and their ability to meet growing demand across sectors, especially at a time when timely delivery is crucial.

Additionally, intense competition from alternative microcontroller architectures poses a restraint to ARM’s market dominance. Emerging platforms like RISC-V offer open-source and customizable options, attracting certain developers and companies looking for cost-effective or specialized solutions. This competition puts pressure on ARM suppliers to innovate while balancing pricing strategies to maintain profitability

For instance, in January 2025, an article on Electropages highlighted the growing cybersecurity concerns surrounding ARM microcontrollers, specifically focusing on vulnerabilities in the RP2350 microcontroller. As microcontrollers become integral to various IoT devices, the increasing complexity of their security challenges presents significant risks.

Opportunities

AI and Machine Learning Integration at the Edge

A significant opportunity lies in the integration of artificial intelligence (AI) and machine learning (ML) capabilities within ARM microcontrollers. Incorporating AI/ML at the edge allows devices to perform intelligent data processing without relying on cloud connectivity, reducing latency and improving privacy. This trend opens up new applications across healthcare, industrial automation, smart homes, and automotive sectors, where real-time decision-making is valuable.

With rising demand for intelligent embedded systems, ARM-based microcontrollers equipped with neural processing units and optimized software frameworks are poised to capture a growing share of this emerging market. Companies investing in AI-enabled microcontrollers can differentiate their products and tap into high-growth verticals driven by AI adoption at the device level.

For instance, in March 2025, a breakthrough in microcontroller technology was reported, highlighting the development of the world’s smallest microcontroller, which could revolutionize wearable tech and medicine. This tiny ARM-based microcontroller offers incredible potential for health monitoring devices and wearable technology, thanks to its ultra-low power consumption and compact design.

Challenges

Security Concerns and Industry Fragmentation

Increasing interconnectedness and data exchange raise serious security challenges for ARM microcontroller platforms. As more devices become connected to the internet and critical infrastructures, vulnerabilities in embedded systems present risks ranging from data breaches to operational failures. Ensuring robust hardware- and software-level security within ARM microcontrollers is essential but complex, requiring ongoing innovation and investment.

Another challenge is the highly fragmented competitive landscape. While ARM dominates, numerous established and emerging players vie for market share with different architectures, features, and pricing models. This fragmentation sustains intense rivalry, which can slow standardization and interoperability, potentially confusing end-users and increasing development costs for OEMs who must support multiple platforms.

For instance, in March 2025, NXP Semiconductors unveiled its new S32K5 microcontroller family, designed to advance zonal Software-Defined Vehicle (SDV) architectures and extend the NXP CoreRide platform. This release highlights the rapid technological advancements in the ARM microcontroller space, where the need for high-performance, flexible, and scalable solutions is growing.

Latest Trends

A significant trend in the ARM microcontroller market is the integration of AI capabilities directly into microcontrollers. These AI microcontrollers are designed to process machine learning tasks at the edge, enabling real-time data analysis and decision-making without the need for cloud processing.

With applications ranging from smart homes to industrial automation and wearable devices, AI-powered microcontrollers improve efficiency, reduce latency, and enhance functionality. Companies like STMicroelectronics and NXP are leading this innovation, driving the adoption of AI in embedded systems.

For instance, in February 2025, Mouser Electronics began shipping STMicroelectronics STM32N6 edge AI microcontrollers, designed for automotive and robotics applications. These microcontrollers bring advanced artificial intelligence capabilities directly to the edge, enabling real-time processing and decision-making without relying on cloud infrastructure.

Key Players Analysis

In the Arm microcontrollers market, companies such as ZiLOG, Maxim Integrated, Renesas, and Toshiba have established themselves as influential players. Their focus remains on providing reliable and cost-efficient solutions for industrial, automotive, and consumer electronics applications. Renesas, in particular, is recognized for its large product portfolio supporting both performance and power efficiency.

Another group of leaders includes Silicon Laboratories, Infineon, Texas Instruments, and Nuvoton Technology. Their strategies are centered on integrating connectivity features such as Bluetooth, Wi-Fi, and IoT compatibility. Infineon and Texas Instruments are widely adopted in energy management and industrial automation due to their emphasis on performance stability and security features.

The segment is further strengthened by Analog Devices, STMicroelectronics, NXP, Cypress Semiconductor, and Microchip, along with several other contributors. These firms focus on innovations in mixed-signal processing, automotive safety, and secure communication. STMicroelectronics and NXP are highly competitive in automotive electronics, while Microchip maintains strong traction in consumer and industrial applications.

Top Key Players in the Market

- ZiLOG

- Maxim Integrated

- Renesas

- Toshiba

- Silicon Laboratories

- Infineon

- Texas Instruments

- Nuvoton Technology

- Analog Devices Inc.

- STMicroelectronics

- NXP

- Cypress Semiconductor

- Microchip

- Other Key Players

Recent Developments

- In December 2024, STMicroelectronics launched the STM32N6 series, ARM-based microcontrollers designed for edge AI and machine learning applications, enabling local image and audio processing.

- In April 2024, Nuvoton launched the NuMicro MA35D0 series, high-performance microprocessors designed for industrial edge and IoT applications, enhancing processing capabilities in smart infrastructure.

Report Scope

Report Features Description Market Value (2024) USD 12.05 Bn Forecast Revenue (2034) USD 26.50 Bn CAGR(2025-2034) 8.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Product (80-120 Pins, Less than 80 Pins, More than 120 Pins), By Application (Automotive, Industrial, Consumer Electronics, Telecommunication, Medical, Other Applications) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape ZiLOG, Maxim Integrated, Renesas, Toshiba, Silicon Laboratories, Infineon, Texas Instruments, Nuvoton Technology, Analog Devices Inc., STMicroelectronics, NXP, Cypress Semiconductor, Microchip, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Arm Microcontrollers MarketPublished date: August 2025add_shopping_cartBuy Now get_appDownload Sample

Arm Microcontrollers MarketPublished date: August 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- ZiLOG

- Maxim Integrated

- Renesas

- Toshiba

- Silicon Laboratories

- Infineon

- Texas Instruments

- Nuvoton Technology

- Analog Devices Inc.

- STMicroelectronics

- NXP

- Cypress Semiconductor

- Microchip

- Other Key Players