Global Aquaponics Market By Equipment (Pumps and Valves, Grow Light, Aeration Systems, Water Heaters, Others), By Facility Type (Greenhouse, Building Based Indoor Farms, Others), By Produce (Fish, Fruits and Vegetables, Others), By Application (Commercial, Home Production, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: June 2025

- Report ID: 150738

- Number of Pages: 245

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

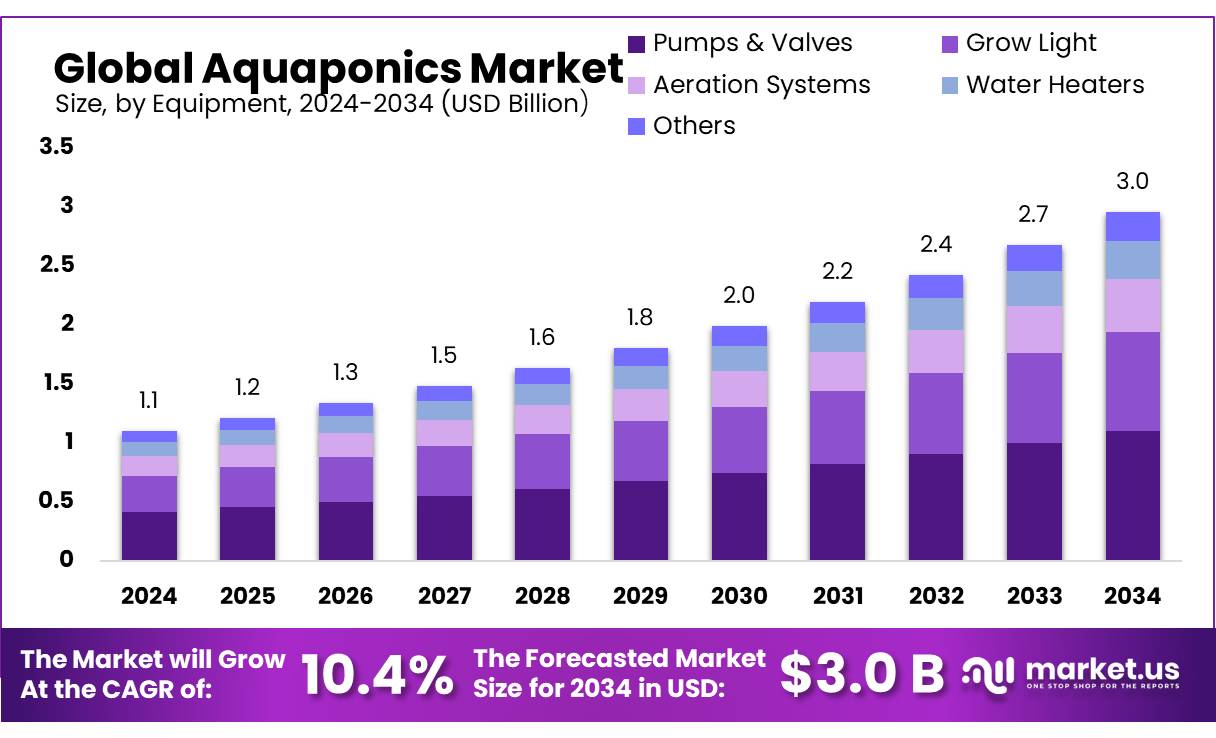

The Global Aquaponics Market size is expected to be worth around USD 3.0 Billion by 2034, from USD 1.1 Billion in 2024, growing at a CAGR of 10.4% during the forecast period from 2025 to 2034.

Aquaponics, an integrated system combining aquaculture (raising aquatic animals) and hydroponics (cultivating plants in water), has emerged as a promising sustainable agriculture model. This closed-loop ecosystem leverages the symbiotic relationship between fish and plants, enabling efficient nutrient recycling and significant water savings. As global food security concerns intensify due to climate change and soil degradation, aquaponics offers an ecologically sound alternative.

According to the Food and Agriculture Organization (FAO), global agricultural water use accounts for nearly 70% of total freshwater withdrawals, while aquaponics systems can reduce water usage by up to 90%, making them an attractive solution for arid regions and urban agriculture initiatives.

Government interventions, such as the Pradhan Mantri Matsya Sampada Yojana (PMMSY), launched in July 2019, allocated ₹3,737 crore to modernize fisheries and boost infrastructure; targets include enhancing inland fish production to 700,000 t and creating 5.5 million employment opportunities.

For example, the U.S. Department of Agriculture (USDA) has been funding controlled environment agriculture (CEA) projects, including aquaponics systems, under its Specialty Crop Block Grant Program. In 2023, USDA allocated over US$72 million in funding to support sustainable agriculture and innovation.

Several driving factors are accelerating the adoption of Aquaponics, with its ability to function independently of traditional agricultural inputs, offers a robust alternative. Furthermore, government-led climate resilience programs, such as the European Union’s Farm to Fork Strategy and India’s Paramparagat Krishi Vikas Yojana (PKVY), promote natural and integrated farming systems, indirectly supporting aquaponics expansion. In India, PKVY received an allocation of INR 450 crore in FY 2023–24 to promote sustainable farming.

Key Takeaways

- Aquaponics Market size is expected to be worth around USD 3.0 Billion by 2034, from USD 1.1 Billion in 2024, growing at a CAGR of 10.4%.

- Pumps & Valves held a dominant market position, capturing more than a 37.3% share in the global aquaponics equipment market.

- Greenhouse held a dominant market position, capturing more than a 49.4% share in the global aquaponics market.

- Fish held a dominant market position, capturing more than a 56.6% share in the aquaponics market.

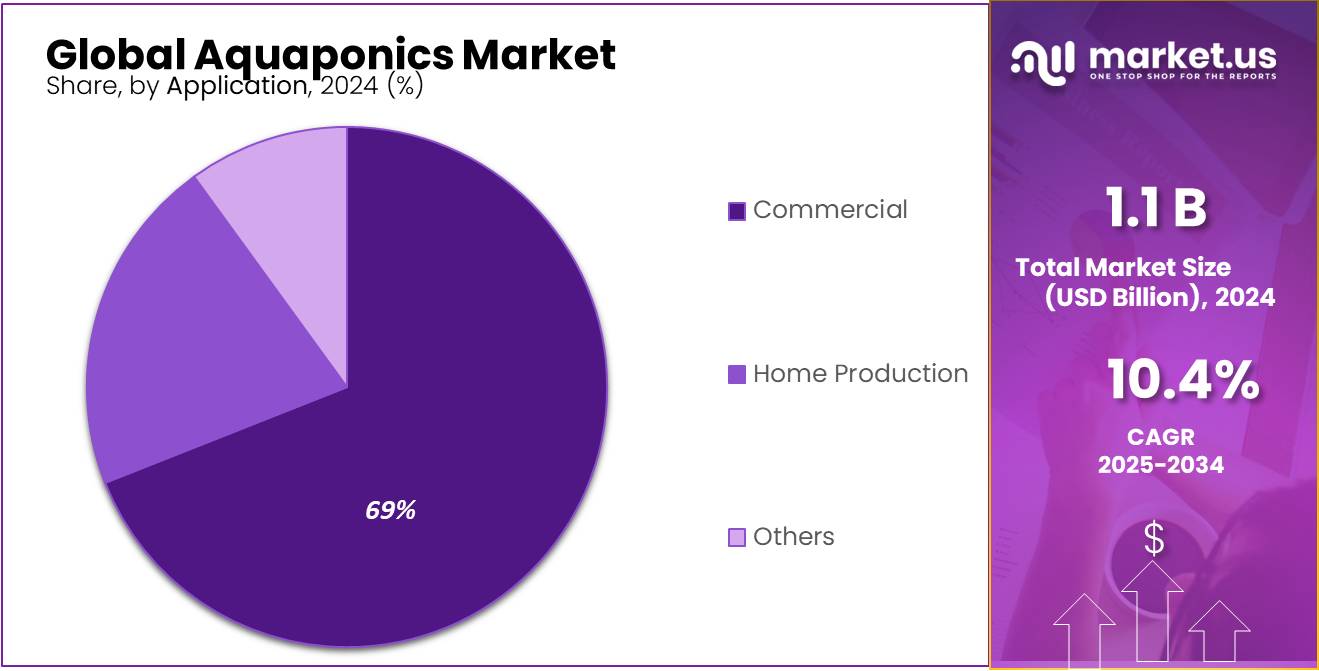

- Commercial held a dominant market position, capturing more than a 69.9% share of the global aquaponics market.

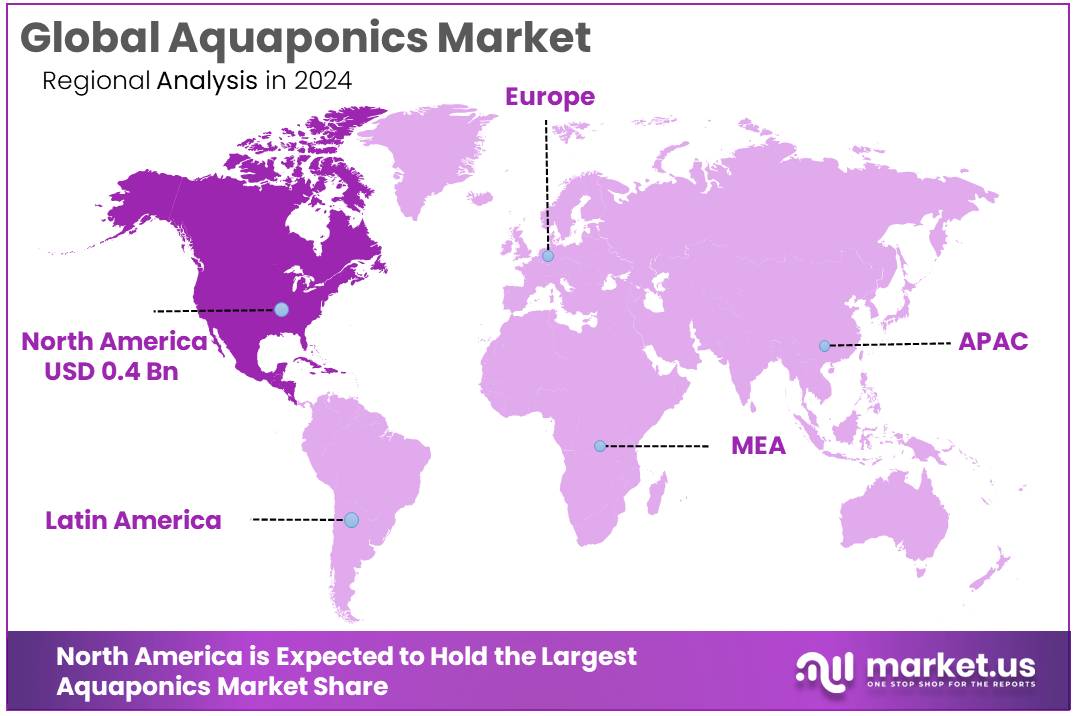

- North America stands as the dominant region in the global aquaponics market, capturing approximately 42.4% of the market share in 2023. With a regional market value of around USD 0.4 billion.

By Equipment

Pumps & Valves lead Aquaponics Equipment Market with 37.3% share in 2024 due to their essential role in system flow control.

In 2024, Pumps & Valves held a dominant market position, capturing more than a 37.3% share in the global aquaponics equipment market. These components are critical in maintaining water circulation between fish tanks and plant beds, ensuring nutrient flow, oxygen distribution, and system balance. The strong demand is driven by the essential function pumps play in both small-scale urban units and larger commercial systems, while valves help regulate pressure and flow to maintain system efficiency. Their mechanical reliability and integration with smart control systems have further boosted adoption, particularly as precision farming and automated aquaponics setups continue to expand in 2025.

By Facility Type

Greenhouse dominates Aquaponics Facility Market with 49.4% in 2024, driven by its climate control and year-round production benefits.

In 2024, Greenhouse held a dominant market position, capturing more than a 49.4% share in the global aquaponics market by facility type. The ability of greenhouses to offer controlled temperature, humidity, and light conditions makes them highly suitable for aquaponic farming, especially in regions with variable climates. This environment helps optimize plant growth and fish health while reducing the risk of external contamination. In 2025, the trend is expected to continue as greenhouse-based systems allow for consistent, high-yield production and better integration with vertical farming setups, making them a preferred choice for both commercial and educational aquaponics installations.

By Produce

Fish leads Aquaponics Produce Market with 56.6% in 2024, owing to its strong demand and continuous nutrient supply in systems.

In 2024, Fish held a dominant market position, capturing more than a 56.6% share in the aquaponics market by produce type. Fish are the core of any aquaponic system, providing the nutrient-rich waste that supports plant growth through natural biofiltration. Their continuous presence ensures a steady nutrient cycle, making them essential for the system’s sustainability. Popular species such as tilapia, catfish, and trout are widely cultivated due to their resilience and market demand. As of 2025, the focus on sustainable protein sources and rising interest in local aquaculture has further strengthened the role of fish in aquaponics setups, especially in urban and semi-commercial farming models.

By Application

Commercial Aquaponics leads with 69.9% share in 2024, driven by large-scale food production and urban farming demand.

In 2024, Commercial held a dominant market position, capturing more than a 69.9% share of the global aquaponics market. This strong lead reflects the growing use of aquaponics systems by commercial growers, agri-tech companies, and urban farming ventures to produce fresh vegetables, herbs, and fish in integrated environments. Businesses are investing in aquaponics to meet rising consumer demand for pesticide-free produce and sustainably farmed fish, particularly in urban and peri-urban areas.

These systems help reduce water usage by up to 90% compared to traditional farming, while offering year-round crop production with minimal land footprint. The scalability and operational efficiency of commercial setups also attract investment from supermarkets, restaurants, and hospitality sectors seeking localized food sourcing.

Key Market Segments

By Equipment

- Pumps & Valves

- Grow Light

- Aeration Systems

- Water Heaters

- Others

By Facility Type

- Greenhouse

- Building Based Indoor Farms

- Others

By Produce

- Fish

- Fruits & Vegetables

- Others

By Application

- Commercial

- Home Production

- Others

Drivers

Growing Demand for Water-Efficient Farming Systems

One of the biggest driving forces behind the rising interest in aquaponics is the urgent need for water-efficient farming methods. With the world facing increasing water scarcity and drought-like conditions in several regions, traditional agriculture is becoming unsustainable.

According to the Food and Agriculture Organization (FAO), agriculture alone consumes nearly 70% of the world’s freshwater supply. This is a serious concern as global water demand is projected to increase by 55% by 2050, while many freshwater sources are already stressed.

Aquaponics offers a solution by using up to 90% less water than conventional soil-based farming. This is possible because water in aquaponic systems is continuously recycled—plants absorb nutrients from fish waste, and in return, they help purify the water, which is then returned to the fish tanks. This closed-loop system ensures minimal water loss, making it ideal for regions facing drought, water restrictions, or poor-quality soil. For instance, many farmers in arid parts of Africa and the Middle East have started turning to aquaponics because of its high productivity and low water requirement.

Governments and organizations are starting to recognize this potential. In 2022, the United States Department of Agriculture (USDA) supported various urban farming projects, including aquaponics, through its Urban Agriculture and Innovative Production (UAIP) grants. These grants encourage sustainable models that reduce water use and carbon emissions in food production.

Restraints

High Initial Setup Costs and Technical Complexity

One of the key challenges holding back the wider adoption of aquaponics is the high initial investment required to set up a functional system. Unlike traditional farming, aquaponics needs a carefully balanced environment where water quality, temperature, lighting, and pH levels must all be regulated. This involves costs for tanks, grow beds, water pumps, aeration systems, sensors, and in many cases, climate control infrastructure—especially for commercial or urban indoor farms. For many small farmers or startups, these upfront costs can be overwhelming.

According to the Food and Agriculture Organization (FAO), small-scale aquaponic systems for household use may cost anywhere between US$500 and US$5,000 depending on size and automation level. However, setting up a medium to large-scale commercial system can run into tens of thousands of dollars, particularly when combined with energy-efficient technologies and automation tools.

Moreover, aquaponics requires a good understanding of both aquaculture and hydroponics. Farmers need to be skilled in managing fish health, plant nutrition, biofiltration, and system maintenance. Any imbalance can lead to system failure—fish may die, plants may wilt, and the entire cycle can collapse. In areas with limited access to trained personnel or extension services, this complexity becomes a significant barrier.

Opportunity

Integration of IoT and Smart Farming Technologies

One of the most exciting growth opportunities for the aquaponics market lies in the rapid adoption of IoT (Internet of Things) and smart-precision farming methods. These technologies elevate aquaponics from a traditional, labor-intensive method to a high-tech, efficient system that even small and medium enterprises can operate effectively. Studies show that soilless farming techniques—like hydroponics, aeroponics, and aquaponics—stand to gain significantly from real-time monitoring, automated nutrient and water regulation, and data-driven decision-making.

By equipping systems with sensors that track pH, temperature, oxygen levels, and nutrient concentrations, farmers can promptly correct imbalances—preventing crop loss and improving yields. Real-time data creates a feedback loop that not only enhances system resilience but also empowers even novice growers to manage complex ecosystems.

Governments are beginning to offer support. In the U.S., for instance, a $10 million USDA grant was awarded to Purdue University for developing sustainable seafood production—including indoor systems like aquaponics—for communities in the Midwest. This funding not only backs technological research, but also helps commercialize aquaponics models that are inclusive and scalable.

Trends

Rise of Automated, Smart Aquaponics Systems

One of the most exciting trends in aquaponics today is the move toward fully automated, smart systems powered by IoT sensors and robotics. It’s becoming more common to see fish tanks and plant beds that monitor themselves around the clock—checking pH, temperature, oxygen levels, and nutrient balance—and make small adjustments automatically.

Globally, aquaculture production has grown by about 54% between 2011 and 2022. The FAO now aims to lift aquaculture output by another 35% by 2030 to meet rising food demand—and aquaponics, with its built-in closed-loop efficiency, fits right into that goal. This “smart” farming is far from science fiction: sensors detect nutrient levels, pumps regulate flow, and lights adjust based on plant needs—all managed remotely via apps or computer dashboards.

In the U.S., the USDA’s Urban Agriculture and Innovative Production (UAIP) grants fund indoor farms including aquaponic setups. The 2025 UAIP program encourages projects in urban food deserts and supports tech-based farms, showing official confidence in automation and sustainable production. Meanwhile, studies report that only around 31% of commercial aquaponics systems are currently profitable—but automation bridges that gap by reducing labor costs and preventing crop losses.

Regional Analysis

North America stands as the dominant region in the global aquaponics market, capturing approximately 42.4% of the market share in 2023. With a regional market value of around USD 0.4 billion in 2023, it clearly outpaces other regions.

Canada and Mexico contribute meaningfully within the region, with Canada emerging as one of the fastest-growing markets. North America’s dominance is rooted in technological leadership—automated systems, precision sensors, and climate-controlled greenhouses—supported by robust infrastructure, research institutions, and funding mechanisms. The result: a mature market ripe with innovation and commercial viability.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Nelson and Pade, based in Wisconsin, is one of the most recognized names in the aquaponics industry. The company specializes in Clear Flow Aquaponic Systems®, offering commercial, educational, and residential solutions. They also operate a training center and consulting service, supporting clients in over 30 countries. By 2024, they have expanded their influence in North America through partnerships with schools, NGOs, and startups focused on sustainable food production and education-driven aquaponics implementation.

Pentair PAES is a leading global supplier of aquaculture equipment, water filtration, and aquaponics solutions. Headquartered in Florida, the company offers advanced RAS (Recirculating Aquaculture Systems) and integrated aquaponics kits. By 2024, Pentair has positioned itself as a technological innovator, serving both large-scale commercial farms and research institutions. Its robust distribution network and investment in automation and IoT-based monitoring tools have strengthened its role in scaling up efficient aquaponic production worldwide.

The Aquaponic Source, based in Colorado, focuses on home-scale and educational aquaponics systems. It provides complete kits, nutrients, water testing kits, and extensive learning resources. The company has been instrumental in making aquaponics accessible to schools and hobbyists. In 2024, The Aquaponic Source continues to support small growers with user-friendly designs and virtual education programs, especially within U.S. suburban and school-based sustainability initiatives.

Top Key Players in the Market

- Nelson and Pade Aquaponics

- Pentair Aquatic Eco-System, Inc. (PAES)

- The Aquaponic Source

- Hydrofarm Holdings Group, Inc.

- Practical Aquaponics (Pty)Ltd

- Greenlife Aquaponics

- Backyard Aquaponics Pty Ltd

- My Aquaponics

- Aquaponic Lynx LLC

- Portable Farms Aquaponics Systems

- aquaponik manufactory GmbH

- Aponic Ltd

Recent Developments

In 2024, Pentair Aquatic Eco Systems (PAES), a division of Pentair plc, recorded full-year sales of approximately USD 4.1billion, with fourth-quarter revenue at USD 973 million.

In 2024, Nelson and Pade Aquaponics continued to strengthen its role in the global aquaponics industry with annual revenues reaching approximately USD 2.4 million, supported by a dedicated team of around 69 employees.

Report Scope

Report Features Description Market Value (2024) USD 1.1 Bn Forecast Revenue (2034) USD 3.0 Bn CAGR (2025-2034) 10.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Equipment (Pumps and Valves, Grow Light, Aeration Systems, Water Heaters, Others), By Facility Type (Greenhouse, Building Based Indoor Farms, Others), By Produce (Fish, Fruits and Vegetables, Others), By Application (Commercial, Home Production, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Nelson and Pade Aquaponics, Pentair Aquatic Eco-System, Inc. (PAES), The Aquaponic Source, Hydrofarm Holdings Group, Inc., Practical Aquaponics (Pty)Ltd, Greenlife Aquaponics, Backyard Aquaponics Pty Ltd, My Aquaponics, Aquaponic Lynx LLC, Portable Farms Aquaponics Systems, aquaponik manufactory GmbH, Aponic Ltd Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Nelson and Pade Aquaponics

- Pentair Aquatic Eco-System, Inc. (PAES)

- The Aquaponic Source

- Hydrofarm Holdings Group, Inc.

- Practical Aquaponics (Pty)Ltd

- Greenlife Aquaponics

- Backyard Aquaponics Pty Ltd

- My Aquaponics

- Aquaponic Lynx LLC

- Portable Farms Aquaponics Systems

- aquaponik manufactory GmbH

- Aponic Ltd