Global Apple Seed Oil Market Size, Share, And Business Benefits By Nature (Conventional, Organic), By Extraction Process (Solvent Extraction, Cold-pressed), By Distribution Channel (Supermarket/Hypermarket, Specialty Stores, Modern Grocery Retail stores, E-Retail, Others), By End-Use (Personal Care and Cosmetics, Skincare, Hair Care, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: August 2025

- Report ID: 156412

- Number of Pages: 321

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

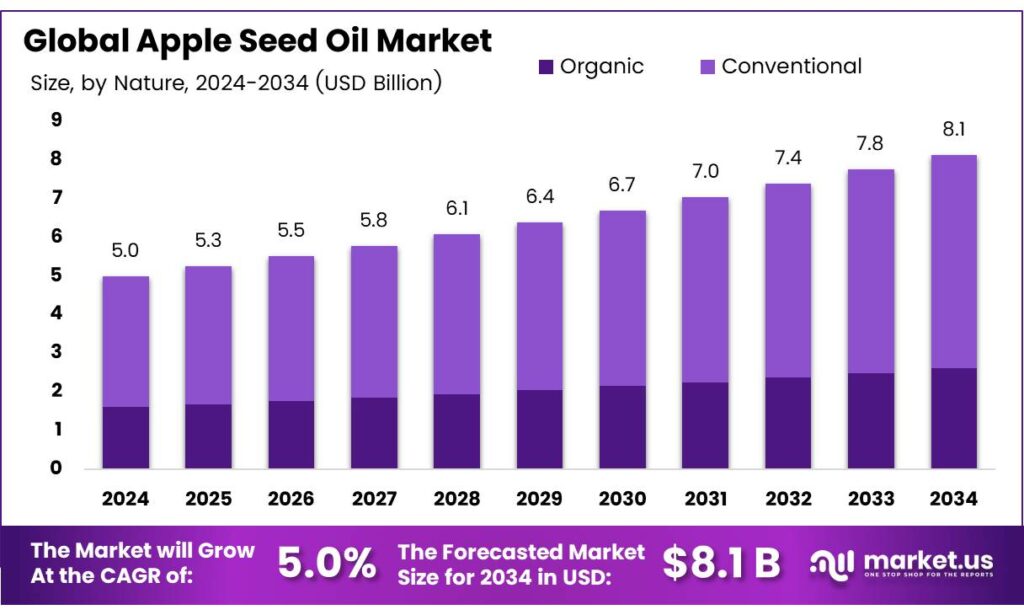

The Global Apple Seed Oil Market size is expected to be worth around USD 8.1 billion by 2034, from USD 5.0 billion in 2024, growing at a CAGR of 5.0% during the forecast period from 2025 to 2034.

The Apple Seed Oil Market is emerging as a promising sector within the natural oils and nutraceuticals industry, driven by the increasing demand for plant-based ingredients in cosmetics, pharmaceuticals, and functional foods. Apple seed oil is valued for its rich composition of linoleic acid, oleic acid, and vitamin E, which make it a sought-after ingredient in skincare formulations and dietary supplements.

Apple seed oil was extracted using supercritical fluid extraction (SFE) and Soxhlet techniques to compare their efficacy. In the SFE process, the impact of experimental variables, pressure 10–30 MPa, temperature 40–60 °C, and carbon dioxide flow rate (1–8L/h) on oil yield, antioxidant activity, and total phenolic content was evaluated using a central composite design. The experimental data were analyzed and fitted to a second-order polynomial equation through regression analysis.

The optimal SFE conditions were determined to be 24 MPa, 40 °C, and a carbon dioxide flow rate of 1 L/h for 140 minutes, yielding a maximum oil extraction of 20.5 ± 1.5%. In comparison, Soxhlet extraction produced a slightly higher yield of 22.5 ± 2.5% (w/w). Both extraction methods resulted in oils rich in linoleic acid, a key fatty acid. However, the SFE-derived oil contained a higher linoleic acid content (63.76 ± 4.96 g/100 g oil) compared to the Soxhlet-extracted oil (49.03 ± 3.85 g/100 g oil).

Despite the higher unsaturated fatty acid content in the SFE oil, it exhibited greater oxidative stability, with an induction time of 21.4 ± 1.2 hours, compared to 12.1 ± 1.1 hours for the Soxhlet oil. The most abundant phenolic compound in the extracts was phloridzin, with SFE oil containing 2.96 ± 0.046 μg/g seed and Soxhlet oil containing 1.56 ± 0.026 μg/g seed. Notably, amygdalin, an antinutrient commonly found in seeds, was absent in the SFE oil, highlighting a potential advantage of the SFE method.

Key Takeaways

- The Global Apple Seed Oil Market is expected to grow from USD 5.0 billion in 2024 to USD 8.1 billion by 2034, at a CAGR of 5.0%.

- The conventional segment held a 68.2% market share in 2024 due to cost-effectiveness and large-scale production.

- Solvent Extraction dominated with a 59.4% share in 2024, favored for high yield and low cost in industrial production.

- Supermarkets/Hypermarkets led distribution with a 32.7% share in 2024, offering accessibility and variety.

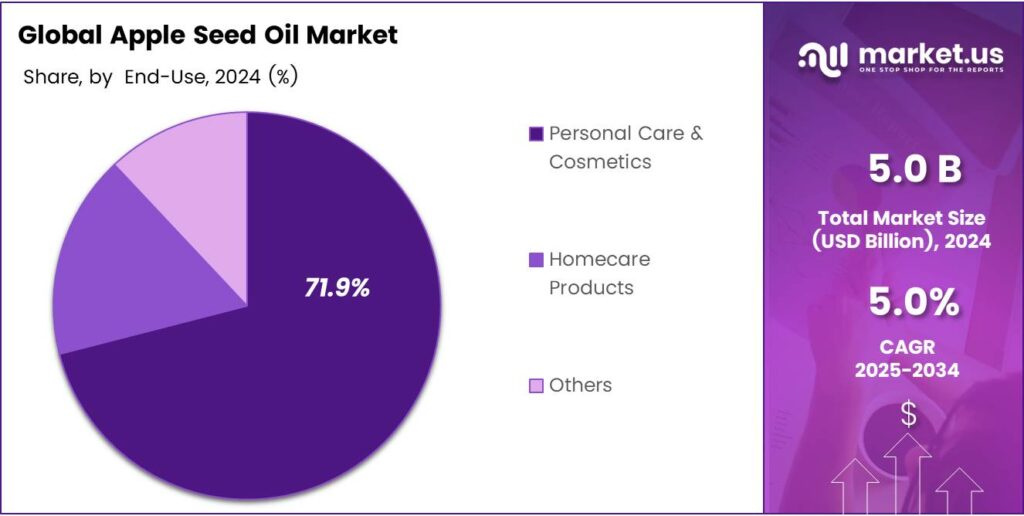

- Personal Care and Cosmetics captured a 71.9% share in 2024, driven by use in skincare and haircare products.

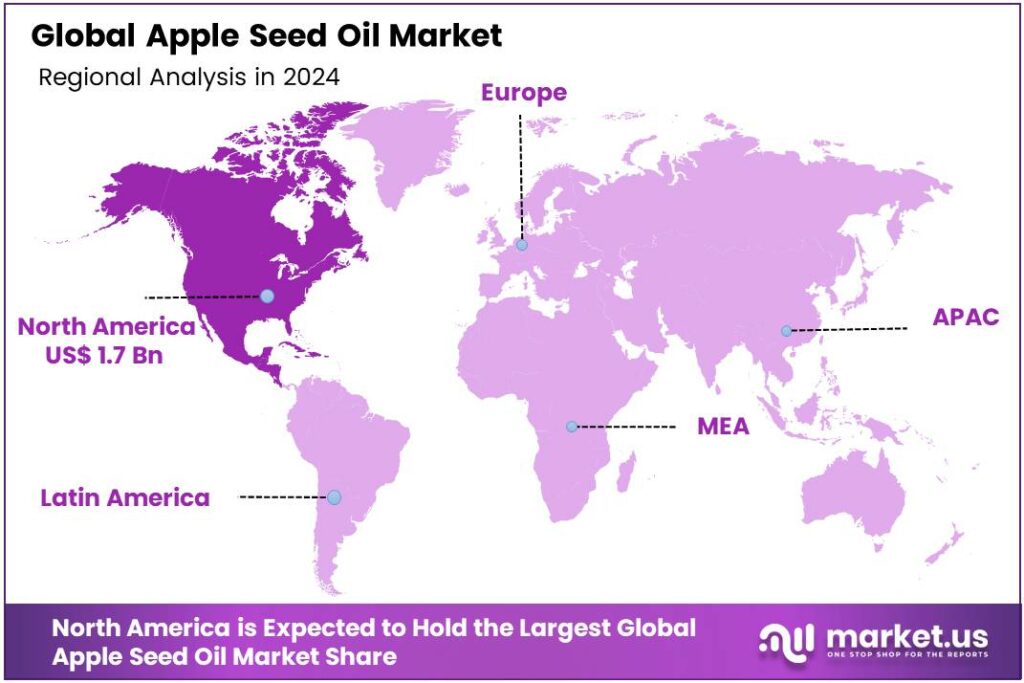

- North America accounted for 34.7% of market revenue in 2024, approximately USD 1.7 billion, led by diverse applications.

Analyst Viewpoint

The Apple Seed Oil Market is gaining traction as a niche yet promising investment opportunity, driven by growing consumer demand for natural and sustainable products. With the global trend toward clean beauty and wellness, apple seed oil’s rich profile of antioxidants, essential fatty acids, and vitamins makes it a sought-after ingredient in cosmetics, skincare, and even nutraceuticals.

However, the market remains small compared to mainstream oils like coconut or olive, and its growth depends on overcoming supply chain challenges, such as limited apple seed availability as a byproduct of fruit processing. Investors can find opportunities in sustainable extraction technologies, like supercritical CO2 methods, which enhance oil purity and yield, potentially offering higher margins for premium products.

The regulatory environment, especially in cosmetics, is stringent, with the EU enforcing strict safety standards that necessitate costly compliance measures. Still, for investors willing to navigate these challenges, the apple seed oil market offers a unique opportunity to tap into the growing demand for natural, plant-based solutions, particularly in regions like Asia-Pacific, where rising disposable incomes are fueling interest in premium wellness products.

By Nature

Conventional Apple Seed Oil dominates with 68.2% market share

In 2024, Conventional held a dominant market position, capturing more than a 68.2% share in the global apple seed oil market. The conventional segment has been widely accepted across industries due to its large-scale production, cost-effectiveness, and easy availability when compared with organic variants.

Food and cosmetic manufacturers continue to prefer conventional apple seed oil as it offers consistent quality and stable pricing, making it the primary choice for bulk applications. The dominance of conventional apple seed oil is expected to continue as demand from personal care, nutraceutical, and food processing industries rises.

Consumers in emerging economies are still more inclined toward affordable natural oils, and this trend directly supports the growth of the conventional segment. Additionally, its extensive use in skincare and haircare products, owing to its rich content of antioxidants and fatty acids, ensures that manufacturers continue to rely on conventional production methods to meet rising demand.

By the Extraction Process

Solvent Extraction leads with a 59.4% share in 2024

In 2024, Solvent Extraction held a dominant market position, capturing more than a 59.4% share in the global apple seed oil market. This process is widely used by manufacturers because it ensures maximum oil yield from apple seeds at a comparatively lower cost, making it highly suitable for large-scale industrial production. The method is particularly favored in food and cosmetic applications where consistent output and efficiency are essential.

The solvent extraction segment is expected to maintain its leadership as producers continue to rely on this process for bulk supply to meet the growing demand across nutraceuticals, personal care, and food industries. The cost-effectiveness of solvent extraction, along with its ability to handle mass volumes of seeds, positions it as the most practical and commercially viable choice compared with other extraction methods.

By Distribution Channel

Supermarket/Hypermarket captures 32.7% share in 2024

In 2024, Supermarket/Hypermarket held a dominant market position, capturing more than a 32.7% share in the global apple seed oil market. These retail formats remain the most preferred choice for consumers as they provide easy access, a wide product variety, and competitive pricing under one roof.

Shoppers trust supermarkets and hypermarkets for purchasing edible oils and personal care oils due to quality assurance, brand availability, and attractive discounts. The dominance of this channel is expected to continue as urbanization and lifestyle changes drive higher footfall in modern retail outlets.

Consumers prefer to physically check packaging, authenticity, and product quality before purchase, which further strengthens the role of supermarkets and hypermarkets in this segment. The visibility and promotional offers available in these stores also make them a popular choice compared to online or specialty channels.

By End-Use

Personal Care and Cosmetics dominate with a 71.9% share in 2024

In 2024, Personal Care and Cosmetics held a dominant market position, capturing more than a 71.9% share in the global apple seed oil market. This dominance is driven by the growing use of apple seed oil in skincare, haircare, and cosmetic formulations.

The oil’s rich antioxidant profile, along with essential fatty acids and vitamin E, makes it highly valuable in products targeting anti-aging, skin hydration, and hair nourishment. Consumers are increasingly seeking natural and plant-based ingredients, which has further strengthened their use in premium cosmetic ranges.

The personal care and cosmetics segment is expected to maintain its leading role as the global demand for clean-label beauty products continues to grow. Rising consumer awareness about the harmful effects of synthetic ingredients is encouraging brands to incorporate safe, natural oils like apple seed oil.

Key Market Segments

By Nature

- Conventional

- Organic

By Extraction Process

- Solvent Extraction

- Cold-pressed

By Distribution Channel

- Supermarket/Hypermarket

- Specialty Stores

- Modern Grocery Retail Stores

- E-Retail

- Others

By End-Use

- Personal Care and Cosmetics

- Skincare

- Hair Care

- Others

- Homecare Products

- Others

Drivers

Rich in Heart-Healthy Unsaturated Fatty Acids

Apple seed oil stands out because it’s packed with unsaturated fatty acids, especially linoleic acid and oleic acid. These good fats support heart health, help maintain healthy cholesterol levels, and nourish our cells from the inside out. For instance, a peer-reviewed study showed that apple seed oil typically contains about 50.7 – 51.4 g of linoleic acid per 100 g of oil, and around 37.5 – 38.6 g of oleic acid per 100 g.

On the practical side, there’s a smart, eco-friendly angle too. Scientists in Poland studied the apple‑juice industry and found that about 3.4 million tons of apples are used for juice each year, producing approximately 850,000 tons of leftover pulp. Of this dried apple pomace, about 4–7 % comes from apple seeds, yielding enough to produce 3.5–5 million liters of apple seed oil each year if processed, just in Poland’s case.

Restraints

Presence of Cyanogenic Compound (Amygdalin) in Apple Seed Oil

One important concern about apple seed oil comes from a naturally occurring compound called amygdalin, which belongs to a family of substances known as cyanogenic glycosides. In plain words, that means if too much of it gets into your body, it can break down into cyanide, a known poison.

Here’s what experts have found: typical apple seeds contain around 2.5 mg of amygdalin per gram of seed. That might sound like a lot, but the good news is that when seeds are cold-pressed into oil, only a tiny fraction of that makes its way into the oil itself.

Based on how apricot seeds behave, researchers estimate apple seed oil might contain as little as 0.01 mg per gram of oil. Apple seed oil does carry amygdalin, but at remarkably low levels. That small amount is seen as not harmful. In fact, there’s some early research suggesting it might even offer beneficial effects at that scale.

Opportunity

Waste-to-Wealth Transformation from Apple Pomace

The mountain of apple leftover skins, pulp, and seeds is left behind when juice is made. Year after year, this pile grows, and waking up to its hidden potential is what’s really fueling the rise of apple seed oil. The world generates about 4 million metric tons of apple pomace annually, which is a lot of post-juice leftovers just waiting to be turned into something useful.

Experts point out that nearly 25–30 % of an apple’s mass ends up as pomace when juice is extracted. Now, here’s where the spark lies: part of that pomace, about 2–4 % is actually seeds. If we scale this globally, considering Poland is about 5 % of global apple output, we could be looking at around 70–100million liters of apple seed oil per year

Trends

Turning Apple Pomace Seeds into Valuable Oil

Apple processing often leaves behind a lot of leftovers, which we call pomace, which includes peels, cores, and seeds. These byproducts usually go to waste. But now, thanks to a growing push for eco-friendly food systems, farmers and producers are seeing seeds as a hidden gem: a chance to squeeze out healthy oil instead of throwing them away.

This isn’t just about numbers, it’s about smart, kind choices. Turning waste into something useful helps fight food waste and supports a healthier planet. So the emerging factor isn’t a new gadget or trendy ingredient, it’s a shift in how we see waste itself.

Apple pomace is no longer trash; its seeds are resources. Companies and small producers can all take part: gathering seeds, pressing them gently, and turning what used to be bin-bound into something nourishing and sustainable.

Regional Analysis

North America holds a 34.7% share, valued at USD 1.7 billion

North America stands as the powerhouse in the global apple seed oil market, contributing approximately 34.7 % of total revenue, equating to about USD 1.7 billion. This commanding share is fueled by strong demand across personal care, cosmetics, dietary supplements, and pharmaceutical applications.

Asia‑Pacific is emerging as the fastest-growing region, supported by expanding middle-class populations, rising disposable incomes, and increasing awareness of natural wellness products. The region benefits from abundant apple production, particularly in countries like China and India, which creates a robust supply chain for apple seed oil.

Europe represents a mature market with steady growth. Key markets such as Germany and France are known for their exacting cosmetic ingredient standards and strong consumer preference for eco‑friendly and organic products. Regulatory rigor enhances trust in apple seed oil’s safety and quality, particularly in high-end and clean‑label formulations.

Latin America and the Middle East & Africa (MEA) account for smaller but gradually expanding shares. While their combined revenue contribution, these markets are gaining traction thanks to rising interest in natural ingredients and emerging applications in the personal care and wellness sectors.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Nature’s Way Products is a prominent player in the apple seed oil market, leveraging its strong reputation in natural wellness. The company focuses on high-quality, cold-pressed extraction to preserve the oil’s nutritional integrity, rich in antioxidants and essential fatty acids.

Organic Pure Oil Inc. specializes in producing certified organic, unrefined apple seed oil. The company emphasizes purity and sustainable sourcing directly from organic orchards. By avoiding chemicals and using minimal processing, it caters to the growing demand for clean-label, eco-conscious beauty and nutritional products.

Ramona Cosmaceuticals Pvt Ltd operates at the intersection of cosmetics and pharmaceuticals, offering apple seed oil for advanced skincare applications. The company highlights the oil’s clinical benefits, such as anti-aging and moisturizing properties, targeting the cosmeceutical industry.

Top Key Players in the Market

- Nature’s Way Products

- Organic Pure Oil Inc

- Ramona Cosmaceuticals Pvt Ltd

- SUYASH AYURVEDA

- The Kerfoot Group

- Herboil Chem

- H&B OIL CENTER COMPANY

- Leven Rose

Recent Developments

- In 2024, Nature’s Way has been recognized for its commitment to high-quality, naturally sourced ingredients, particularly in the dietary supplements and natural products sector. While specific updates on apple seed oil are limited, the company continues to emphasize organic certification and ethical sourcing practices.

- In 2024, Organic Pure Oil Inc. is noted for its portfolio of organic oils, including apple seed oil, which is marketed for its use in cosmetics and personal care products. The company emphasizes cold-pressed extraction methods to maintain the oil’s nutritional integrity.

Report Scope

Report Features Description Market Value (2024) USD 5.0 Billion Forecast Revenue (2034) USD 8.1 Billion CAGR (2025-2034) 5.0% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Nature (Conventional, Organic), By Extraction Process (Solvent Extraction, Cold-pressed), By Distribution Channel (Supermarket/Hypermarket, Specialty Stores, Modern Grocery Retail stores, E-Retail, Others), By End-Use (Personal Care and Cosmetics, Skincare, Hair Care, Others, Homecare Products, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Nature’s Way Products, Organic Pure Oil Inc, Ramona Cosmaceuticals Pvt Ltd, SUYASH AYURVEDA, The Kerfoot Group, Herboil Chem, H&B OIL CENTER COMPANY, Leven Rose Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)

-

-

- Nature's Way Products

- Organic Pure Oil Inc

- Ramona Cosmaceuticals Pvt Ltd

- SUYASH AYURVEDA

- The Kerfoot Group

- Herboil Chem

- H&B OIL CENTER COMPANY

- Leven Rose