Global Amorphous Core Transformers Market Size, Share, And Business Benefits By Type (Distribution Transformers, Power Transformers, Instrument Transformers), By Voltage Range (Medium Voltage, Low Voltage, High Voltage), By Phase (Three Phase, Single Phase), By Application (Industrial, Commercial, Residential, Utilities), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: November 2025

- Report ID: 164534

- Number of Pages: 321

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

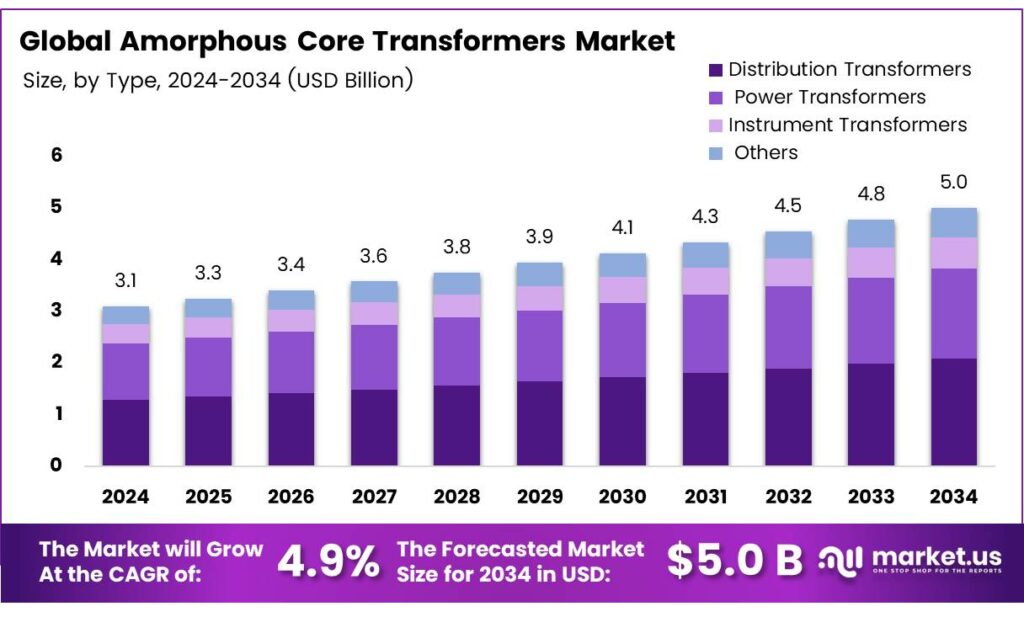

The Global Amorphous Core Transformers Market size is expected to be worth around USD 5.0 Billion by 2034, from USD 3.1 Billion in 2024, growing at a CAGR of 4.9% during the forecast period from 2025 to 2034.

Amorphous Core Transformers (AMT) represent a highly energy-efficient advancement in electrical grid technology. These transformers utilize amorphous metal, also known as metallic glass, as the core material instead of conventional silicon steel. The disordered atomic structure of amorphous metals contrasts sharply with the uniform crystalline composition found in traditional silicon steel laminations, which are stacked to form the core in standard transformers.

In amorphous core transformers, a ribbon of this amorphous metal is wound into a rectangular structure, enhancing resistance to short-circuit stresses. This design contributes to remarkable efficiency gains, with stand-by (idle) losses reduced by up to 70% and on-load (working) losses by up to 30% compared to traditional models. The lower operating temperatures in amorphous steel cores further minimize CO2 emissions, making these transformers significantly more environmentally friendly and recyclable.

- Amorphous metal alloys, with a saturation flux density of 1.56 T and working flux up to 1.4 T, feature a density of 7.18 g/cc, ultra-thin 0.025 mm ribbons, and an 86% lamination factor, yielding core losses of just 0.1–0.2 W/kg. Available in widths of 142 mm, 170 mm, and 213 mm, they require annealing at 340–360 °C for optimal magnetic properties. Amorphous metal transformers deliver up to 70% lower losses through high permeability and minimal hysteresis and eddy currents, generating less heat, better overload capacity, and enhanced reliability.

However, handling amorphous transformers requires caution due to the brittle nature of the material, which is prone to mechanical stress. They should avoid locations with vibrations, as this can cause irreparable fragmentation and performance degradation. Additional considerations include potential infrastructure issues like short-circuits or step-loads, where the rectangular core exhibits lower resistance to faults and overloads compared to traditional designs.

Key Takeaways

- The Global Amorphous Core Transformers market is projected to grow from USD 3.1 billion in 2024 to USD 5.0 billion by 2034 at a 4.9% CAGR.

- Distribution transformers dominated by type in 2024, with 49.3% share for efficient local voltage step-down.

- The medium voltage segment led by voltage range in 202,4, with 44.5% share, operating between 1kV and 36kV.

- Three-phase transformers held a 69.8% share by phase in 2024, preferred for balanced heavy-load power in factories and utilities.

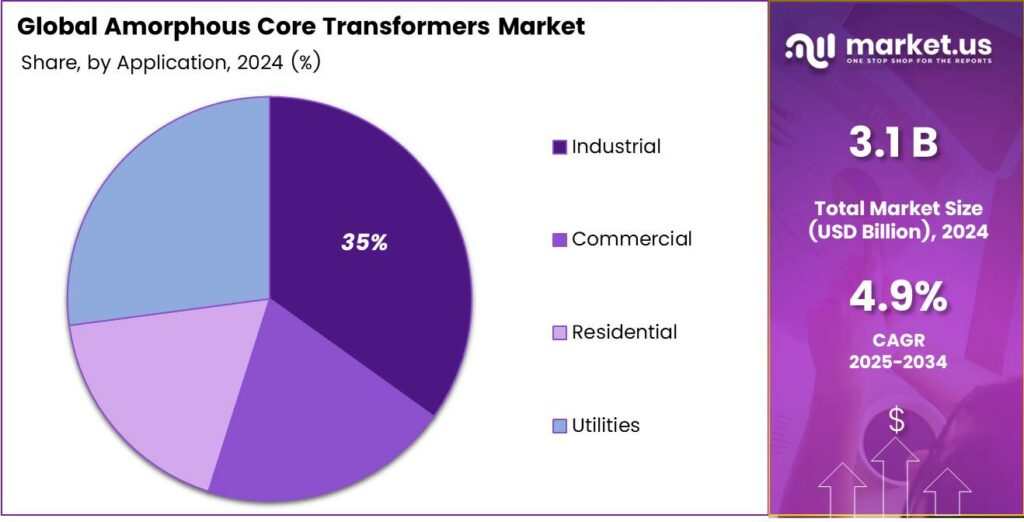

- Industrial applications dominated in 2024 with a 34.9% share, powering manufacturing plants efficiently.

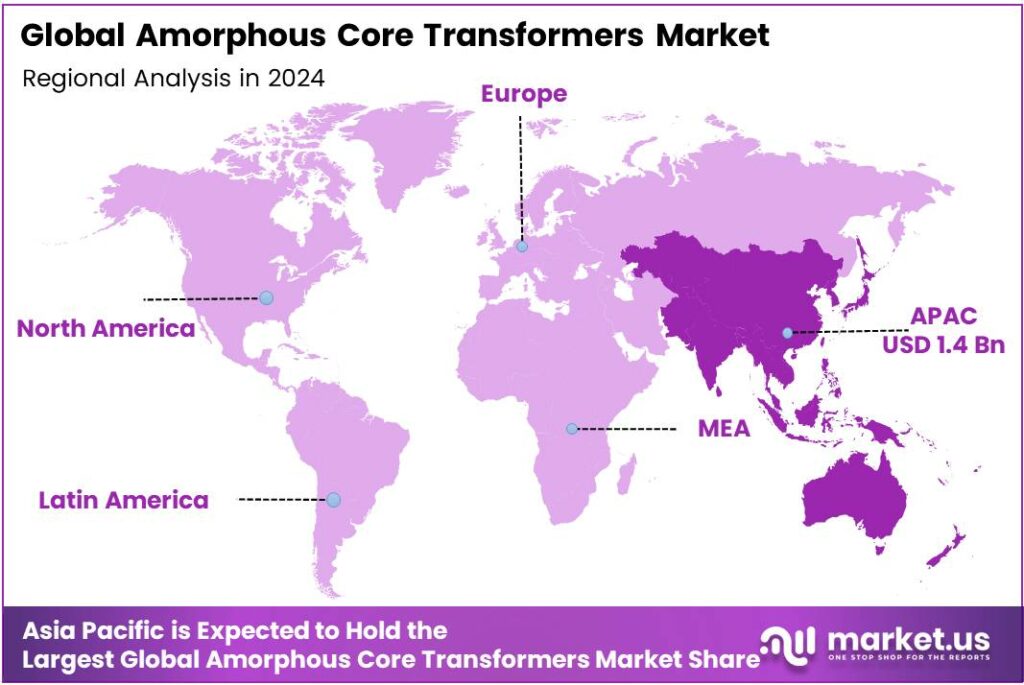

- Asia-Pacific captured 45.3% market share in 2024, USD 1.4 billion, driven by industrial growth, electricity demand, and energy efficiency policies.

By Type

Distribution Transformers dominate with 49.3% due to their essential role in efficient power delivery.

In 2024, Distribution Transformers held a dominant market position in the By Type Analysis segment of the Amorphous Core Transformers Market, with a 49.3% share. These transformers efficiently step down voltage for local distribution. They reduce energy losses significantly in urban and rural grids. Industries prefer them for reliability and cost savings. Thus, they lead the segment amid rising energy demands.

Power Transformers play a key role in transmitting high-voltage electricity over long distances. They handle bulk power efficiently with amorphous cores. Utilities adopt them to minimize transmission losses. Their integration boosts grid stability. Consequently, they gain traction in expanding power networks worldwide.

Instrument Transformers measure and protect electrical systems accurately. Amorphous cores enhance their precision and efficiency. They suit metering and relay applications. Engineers value their low losses for consistent performance. Hence, they support modern smart grid initiatives effectively.

By Voltage Range

Medium Voltage leads with 44.5% owing to balanced efficiency in urban applications.

In 2024, Medium Voltage held a dominant market position in the By Voltage Range Analysis segment of the Amorphous Core Transformers Market, with a 44.5% share. These transformers operate between 1kV and 36kV ideally. They cut losses in distribution networks. Cities rely on them for a stable supply. Therefore, they dominate amid urbanization trends.

Low-voltage transformers serve household and small-scale needs below 1kV. Amorphous cores ensure minimal idle losses here. They promote energy savings in residential setups. Users appreciate their eco-friendly design. As a result, they support sustainable home electrification.

High Voltage units manage over 36kV for long-haul transmission. Their amorphous construction lowers heat and emissions. Power plants favor them for durability. This drives adoption in renewable integrations. Overall, they strengthen high-capacity grids.

By Phase Analysis

Three-phase commands 69.8% for superior power handling in industries.

In 2024, Three Phase held a dominant market position in the By Phase Analysis segment of the Amorphous Core Transformers Market, with a 69.8% share. These deliver balanced power for heavy loads efficiently. Factories and utilities prefer them for seamless operation. They reduce vibrations and noise, too. Thus, they prevail in commercial infrastructures.

Single-phase transformers cater to lighter, individual loads like homes. Amorphous cores optimize their compact size and efficiency. They minimize copper usage effectively. Homeowners benefit from lower bills. Consequently, they fit well in decentralized energy systems.

By Application

Industrial takes a 34.9% lead, driven by heavy energy demands.

In 2024, Industrial held a dominant market position in the By Application Analysis segment of the Amorphous Core Transformers Market, with a 34.9% share. These transformers power manufacturing plants with high efficiency. They slash operational costs notably. Industries embrace them for green compliance. Hence, they spearhead sustainable production.

Commercial applications include offices and retail spaces. Amorphous designs ensure a reliable supply amid peak hours. They have lower cooling needs, too. Businesses gain from reduced downtime. Therefore, they enhance urban commercial viability. Residential setups use them for safe, efficient home power. Low losses promote energy conservation daily. Families enjoy quieter operations. This fosters eco-conscious living.

Key Market Segments

By Type

- Distribution Transformers

- Power Transformers

- Instrument Transformers

- Others

By Voltage Range

- Medium Voltage

- Low Voltage

- High Voltage

By Phase

- Three Phase

- Single Phase

By Application

- Industrial

- Commercial

- Residential

- Utilities

Emerging Trends

Policy push toward ultra-low-loss distribution cores

A clear trend is taking shape: utilities are moving to ultra-low-loss transformer cores, often amorphous, for cutting no-load losses as grids electrify and standards tighten. Two forces are driving it. First, electricity demand is rising faster again. The IEA estimates global electricity consumption grew 4.3% in 2024, with robust growth expected to continue pressure which magnifies every watt lost in the network.

- Second, regulators now hard-wire efficiency into new equipment. In the United States, the Department of Energy finalized updated efficiency standards for distribution transformers. DOE projects these rules will save $14 billion on energy bills over 30 years and avoid 85 million metric tons of CO₂, while noting that a portion of the market will meet the levels with amorphous alloy cores.

In Europe, the Ecodesign framework has already lowered losses in newly sold transformers; Commission analysis shows losses for units sold were 17% lower than they would have been without the rules. Planning horizons are also stretching. New NREL work suggests U.S. distribution transformer capacity may need to increase, reflecting electrification and the replacement of aging assets.

Drivers

Significant Reduction in No-Load Losses

One of the central reasons utilities and grid operators are increasingly choosing amorphous core transformers is the dramatic reduction in no-load losses. No-load losses (also called core losses) occur even when a transformer isn’t supplying any load — the core continues to magnetize and demagnetize, drawing energy simply by being connected to the system.

The distribution transformers often operate at low load factors, spending a lot of time lightly loaded or idle, and these losses accumulate year after year. The U.S. Department of Energy (DOE) states that amorphous-steel cores tend to reduce no-load losses by over 60 percent compared to conventional grain-oriented silicon steel cores.

- Another study underlines that in practical deployment, amorphous core transformers reduce no-load losses by 50–70 percent relative to a typical baseline transformer. From an industry commentary: up to 70% reduction in no-load losses has been observed when switching from traditional CRGO cores to amorphous core designs.

Restraints

Higher Up-Front Cost Burden

One of the major restraints when it comes to adopting amorphous-core transformers is their higher initial cost compared to conventional grain-oriented silicon steel units. A detailed study by Bonneville Power Administration (BPA) – a respected U.S. energy‐efficiency agency – noted that early generation amorphous core liquid-immersed distribution transformers carried an incremental cost in the order of 20% to 30% above conventional transformers.

Even though the lifetime energy savings (due to lower no-load losses) can compensate, the extra capital required can deter decision-makers, especially in regions or utilities under budget pressure, or where energy cost savings are less compelling. The lack of immediate payback can make the technology less attractive for utilities focused on short-term budgets rather than total life-cycle cost.

- The procurement specifications and public-tender rounds are still designed around the lowest first cost rather than the lowest life-cycle cost. If the decision models don’t adequately value the future savings from reduced losses, the premium of 10-30% can tip the balance in favour of conventional designs. Furthermore, the higher cost is partly due to the more complex manufacturing of amorphous alloy cores.

Opportunity

Policy mandates and electrification are pulling ACTs forward

A powerful growth engine for amorphous-core transformers (ACTs) is the tightening of efficiency standards, just as electricity demand accelerates with electrification. In April 2024, the U.S. Department of Energy issued amended energy-conservation standards for distribution transformers, explicitly targeting lower losses and finding the new levels technologically feasible and economically justified.

- These rules drive utilities toward low-loss designs where amorphous metal cores excel by setting binding national baselines that manufacturers must meet. At the same time, the DOE’s final rule arrived alongside public statements that implementation would expand domestic availability of amorphous-metal core units by 10%–25%, signaling policy-backed supply growth that further enables adoption.

Global demand trends compound this policy pull. The International Energy Agency reports that electricity consumption grew, with robust growth expected to continue as transport, buildings, and industry electrify. More than 80% of generation growth was covered by low-emissions sources, raising the value of wringing out network losses so clean power reaches end-users.

Regional Analysis

Asia-Pacific leads with a 45.3% share and a USD 1.4 Billion market value.

In 2024, Asia-Pacific held a dominant position in the global amorphous core transformers market, capturing a substantial 45.3% share valued at around USD 1.4 billion. The region’s leadership is primarily driven by rapid industrial expansion, surging electricity demand, and strong government commitments toward improving energy efficiency.

Countries such as China, India, Japan, and South Korea are witnessing continuous grid modernization and rural electrification initiatives, creating a consistent need for energy-efficient distribution transformers. China’s policy under its Dual Carbon Goals has accelerated the deployment of amorphous core transformers across smart grid projects and renewable energy integration networks.

The International Energy Agency (IEA) notes that Asia-Pacific accounts for global electricity consumption growth, reinforcing the region’s crucial role in power infrastructure expansion. Japan and South Korea, with established industrial bases, continue replacing aging transformer fleets with low-loss amorphous models to comply with stricter energy-performance standards.

Asia-Pacific’s dominance in the amorphous core transformer landscape reflects the convergence of policy-driven efficiency mandates, infrastructure modernization, and rising electricity consumption, positioning the region as the pivotal growth engine of this market in the coming decade.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Hitachi ABB Power Grids is a dominant force, leveraging its extensive legacy in power technologies. It excels in providing high-voltage amorphous core transformers for complex grid applications, including renewable integration and smart grid projects. The company’s global reach and strong R&D focus allow it to set industry benchmarks for efficiency and reliability.

Siemens AG is a pivotal player, integrating amorphous core technology into its comprehensive energy portfolio. The company emphasizes digitalization and smart infrastructure, offering transformers with enhanced monitoring capabilities. Its global manufacturing and service network ensures widespread availability and support. Siemens targets diverse sectors from utilities to industrial manufacturing, promoting its products as key to achieving sustainability and energy efficiency goals.

Schneider Electric strengthens its market position by embedding amorphous core transformers within its broader EcoStruxure platform for energy management. This strategy focuses on providing complete, efficient, and digitally connected solutions for commercial and industrial buildings. The company emphasizes lifecycle cost savings and reduced carbon footprint, appealing directly to sustainability-conscious clients.

Top Key Players in the Market

- Hitachi ABB Power Grids

- Siemens AG

- Schneider Electric SE

- Mitsubishi Electric Corporation

- Toshiba Corporation

- Eaton Corporation

- Hyosung Heavy Industries

- Howard Industries

- Wilson Transformer Company

- Vijai Electricals Limited

Recent Developments

- In 2025, Hitachi Energy revealed U.S. manufacturing investment for a new large power transformer facility in South Boston, Virginia. This state-of-the-art plant will create high-paying jobs and produce transformers optimized for modern grids, incorporating energy-efficient technologies to reduce losses and support decarbonization.

- In 2025, Siemens Energy is advancing energy-efficient transformer production amid rising U.S. electricity demands, with a strong emphasis on domestic manufacturing to cut lead times and enhance grid resilience. The company is building a new power transformer factory in Charlotte, North Carolina—the first such U.S. facility for Siemens.

Report Scope

Report Features Description Market Value (2024) USD 3.1 Billion Forecast Revenue (2034) USD 5.0 Billion CAGR (2025-2034) 4.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Distribution Transformers, Power Transformers, Instrument Transformers, Others), By Voltage Range (Medium Voltage, Low Voltage, High Voltage), By Phase (Three Phase, Single Phase), By Application (Industrial, Commercial, Residential, Utilities) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Hitachi ABB Power Grids, Siemens AG, Schneider Electric SE, Mitsubishi Electric Corporation, Toshiba Corporation, Eaton Corporation, Hyosung Heavy Industries, Howard Industries, Wilson Transformer Company, Vijai Electricals Limited Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)  Amorphous Core Transformers MarketPublished date: November 2025add_shopping_cartBuy Now get_appDownload Sample

Amorphous Core Transformers MarketPublished date: November 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Hitachi ABB Power Grids

- Siemens AG

- Schneider Electric SE

- Mitsubishi Electric Corporation

- Toshiba Corporation

- Eaton Corporation

- Hyosung Heavy Industries

- Howard Industries

- Wilson Transformer Company

- Vijai Electricals Limited