Global Ammunition Market Size, Share, Statistics Analysis Report By Product (Bullets, Aerial Bombs, Grenades, Others), By Caliber (Small Caliber (5.56 mm, 7.62 mm, 9 mm, Others), Medium Caliber (23 mm, 30 mm, Others), Large Caliber (VSHORAD, 122 mm, Others, Others)), By End Use (Civil & Commercial, (Sports, Hunting, Self Defense), Defense (Military, Law Enforcement), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: February 2025

- Report ID: 139746

- Number of Pages: 213

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

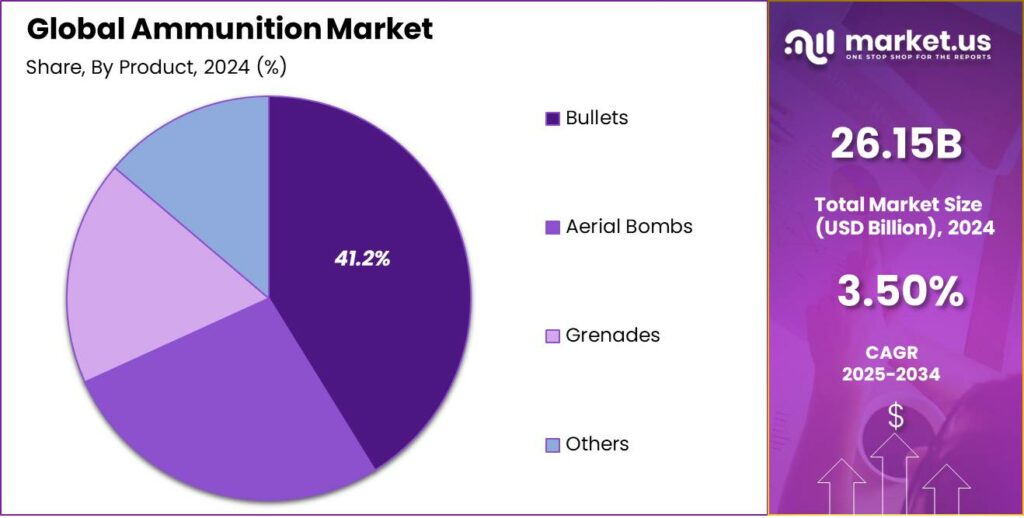

The Global Ammunition Market size is expected to be worth around USD 36.9 Billion By 2034, from USD 26.15 Billion in 2024, growing at a CAGR of 3.50% during the forecast period from 2025 to 2034. In 2024, the Asia-Pacific region dominated the global ammunition market, holding 38.1% of the share with revenues of USD 9.9 billion. The China ammunition market is projected to reach USD 4.1 billion with a CAGR of 3.50%.

The ammunition market is propelled by several key factors. Notably, increasing geopolitical tensions, the modernization of military and law enforcement agencies, and rising defense budgets globally contribute significantly to market expansion. The technological advancement in ammunition, including the development of smart ammunition systems, enhances the effectiveness and capabilities of ammunition, providing a considerable push to the market growth.

The demand for ammunition is robust, driven primarily by the defense sector, which accounts for the lion’s share of the market. This demand is spurred by rising global security concerns, including increased cross-border conflicts and terrorism. Opportunities in the market are abundant with the advent of more sophisticated technology, such as guided systems and smart munitions, which are expected to offer significant growth potential in the coming years.

Additionally, technological advancements in ammunition manufacturing, aiming for more efficient, reliable, and accurate ammunition, also propel the market growth. Ongoing global efforts to enhance law enforcement capabilities necessitate regular procurement and upgrading of ammunition, further stimulating market expansion.

The ammunition market is witnessing several emerging trends. There’s a growing emphasis on precision and reduced collateral damage, which is leading to the adoption of smart munitions and precision-guided systems. This trend is prevalent in military applications and in law enforcement scenarios where precision is critical to minimize public harm.

Technological advancements are significantly reshaping the ammunition market. Developments include the creation of lighter, more durable materials, and the integration of technologies such as Artificial Intelligence (AI) and the Internet of Things (IoT), which enhance the capabilities of ammunition through improved targeting and performance metrics.

Key Takeaways

- The Global Ammunition Market size is projected to reach USD 36.9 billion by 2034, growing from USD 26.15 billion in 2024, at a CAGR of 3.50% during the forecast period from 2025 to 2034.

- In 2024, the Bullets segment held a dominant market position, accounting for more than 41.2% of the global ammunition market share.

- In 2024, the Large Caliber segment also held a dominant position, capturing more than 49.3% of the market share in the ammunition industry.

- The Defense segment was the leading sector in the global ammunition market in 2024, securing more than 86.7% of the total market share.

- In 2024, the Asia-Pacific region dominated the global ammunition market, contributing more than 38.1% of the total share, with revenues reaching USD 9.9 billion.

- The China ammunition market is expected to be valued at USD 4.1 billion in 2024, with a projected CAGR of 3.50%.

China Ammunition Market

The ammunition market in China is expected to reach a valuation of USD 4.1 billion by the year 2024. It is anticipated to grow at a compound annual growth rate (CAGR) of 3.50%. This growth can be attributed to several factors, including increasing defense expenditures by the Chinese government and advancements in military technology. Additionally, the regional security situation in Asia-Pacific is prompting higher investments in ammunition and ballistic capabilities.

Furthermore, the expansion of the market is also being driven by the development of indigenous weapon systems and the modernization of the Chinese military forces. China’s focus on enhancing its air and naval capabilities is likely to increase the demand for specialized ammunition types, including smart, guided, precision munitions, and anti-aircraft systems.

In 2024, Asia-Pacific held a dominant market position in the global ammunition market, capturing more than a 38.1% share with revenues reaching USD 9.9 billion. This substantial market share can be attributed to several strategic and economic factors.

The region is characterized by an increased focus on military modernization and enhanced defense capabilities in countries such as China, India, and South Korea. These nations are significantly boosting their defense budgets in response to growing regional tensions and the need to maintain sovereignty over territorial disputes.

The Asia-Pacific region is witnessing a rise in the domestic production of ammunition, driven by national policies aimed at reducing dependence on foreign arms imports. Governments are actively promoting local arms manufacturing through partnerships and technology transfer agreements with established global defense firms.

Additionally, the region’s geopolitical dynamics, including border disputes and maritime security challenges, particularly in the South China Sea and along the India-China border, have led to an uptick in demand for ammunition and related military equipment. The ongoing modernization of armed forces, including the shift towards more advanced warfare technologies, is further driving the growth of the ammunition market in Asia-Pacific.

Product Analysis

In 2024, the Bullets segment held a dominant market position, capturing more than a 41.2% share of the global ammunition market. This segment’s leadership is attributed primarily to the widespread use of bullets in both military and civilian applications.

Bullets are the key component in small arms ammunition, used extensively by military forces worldwide for defense, training, and combat purposes. In the civilian sector, the rising popularity of shooting sports and personal safety concerns drive substantial demand for various types of bullets, from handgun rounds to rifle cartridges.

The dominance of the Bullets segment is also reinforced by ongoing innovations in bullet design and manufacturing. Advances in materials science have led to the development of more effective and safer ammunition, which includes lead-free and frangible bullets, enhancing their appeal across both law enforcement and civilian markets.

Furthermore, the regulatory environment significantly influences the Bullets segment. In many regions, there are stringent controls over more destructive types of ammunition, such as grenades and aerial bombs, while regulations for bullets are relatively more relaxed.

Caliber Analysis

In 2024, the Large Caliber segment held a dominant market position within the ammunition industry, capturing more than 49.3% of the market share. This leadership stems from several critical factors such as demand for large-caliber ammunition in military and defense sectors.

Large caliber munitions, which include categories like VSHORAD (Very Short Range Air Defense systems) and 122 mm artillery shells, are pivotal in modern military operations. Their significant share is primarily driven by their indispensable role in heavy artillery and air defense systems, which are crucial for national security measures.

Another contributor to the dominance of the large caliber segment is the continual technological advancement that characterizes its development. Innovations such as precision-guidance technology and enhanced explosive materials have made large caliber ammunition more effective, thereby increasing its desirability for modern warfare.

Government investments in large caliber ammunition reflect its strategic importance, often tied to defense modernization efforts. With global tensions rising, the demand for reliable and powerful ammunition grows, further boosting its market share.

End Use Analysis

In 2024, the Defense segment held a dominant market position in the global ammunition market, capturing more than an 86.7% share. This significant portion of the market can be primarily attributed to heightened global security threats and increased defense expenditures by countries around the world.

Nations are investing heavily in military capabilities to ensure national security, address regional conflicts, and participate in international peacekeeping missions, which in turn drives the demand for ammunition in military and law enforcement applications.

The increasing incidence of geopolitical tensions and the need for national and regional security have led countries to modernize their armed forces. This modernization includes the procurement of advanced weaponry and the corresponding ammunition to ensure that the military and law enforcement agencies are equipped with the latest technology.

Moreover, the defense sector’s focus on maintaining a robust law enforcement and military presence requires continuous replenishment of ammunition supplies. Training exercises, patrol duties, and actual combat operations contribute to the regular consumption of ammunition, thereby sustaining the segment’s growth.

Key Market Segments

By Product

- Bullets

- Aerial Bombs

- Grenades

- Others

By Caliber

- Small Caliber

5.56 mm

7.62 mm

9 mm

Others - Medium Caliber

23 mm

30 mm

Others - Large Caliber

VSHORAD

122 mm

Others - Others

By End Use

- Civil & Commercial

Sports

Hunting

Self Defense - Defense

Military

Law Enforcement

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver

Increasing Global Security Concerns

The global ammunition market is primarily driven by escalating security concerns across nations, which manifest through regional conflicts, terrorism, and geopolitical tensions. As countries strive to enhance their military capabilities in response to these threats, the demand for various types of ammunition is increasing significantly.

This uptrend is further bolstered by the modernization efforts of military forces worldwide, incorporating advanced weaponry systems and technologies. Additionally, strategic partnerships and alliances among nations are enhancing global defense capabilities, fostering shared intelligence, and facilitating joint training exercises that improve operational effectiveness and interoperability.

Restraint

Regulatory and Environmental Challenges

The ammunition market faces significant constraints due to strict government regulations on production, distribution, and use for public safety. Growing environmental concerns are pushing manufacturers to develop eco-friendly alternatives, which may impact production capabilities and market trends.

Additionally, environmental concerns over the ecological impacts of ammunition production and disposal prompt the need for non-toxic and environmentally friendly ammunition solutions. These regulatory and ecological pressures pose significant hurdles for market growth, as manufacturers must comply with these evolving standards while maintaining production efficiency.

Opportunity

Technological Advancements in Ammunition

Opportunities abound in the ammunition market with the advent of technological innovations such as smart munitions and improved materials that enhance the performance and safety of ammunition. Also, the growing demand for advanced defense systems in both military and civilian sectors is fueling investment in next-generation ammunition solutions.

These advancements are revolutionizing not only military engagements but also expanding the market into civilian sectors such as self-defense and recreational shooting. The ongoing development of precision-guided munitions, which reduce collateral damage and increase operational success rates, represents a significant growth avenue for industry players.

Challenge

Economic Fluctuations and Market Competition

The global ammunition market faces challenges from economic fluctuations, affecting defense spending and procurement. Supply chain disruptions, caused by geopolitical tensions or natural disasters, can also delay production and delivery, adding to market instability.

Moreover, the intense competition among established players who dominate the market with advanced technological capabilities and strong governmental relationships makes it difficult for new entrants to gain a foothold. Maintaining competitiveness in this technologically driven and tightly regulated market requires continuous innovation and adaptation to shifting global defense needs and economic conditions.

Emerging Trends

One significant development is the shift towards environmentally friendly ammunition. Manufacturers are increasingly producing lead-free bullets and biodegradable casings to minimize environmental impact. This move not only addresses ecological concerns but also aligns with stricter environmental regulations.

Technological advancements are also playing a crucial role. The emergence of smart bullets, which offer self-guiding capabilities, aims to enhance accuracy and reduce unintended damage during operations. Additionally, the development of polymer-cased ammunition is gaining traction.

Another trend is the focus on precision-guided munitions (PGMs). These advanced weapons are designed to hit specific targets with high accuracy, thereby increasing effectiveness and minimizing collateral damage. Also,there’s a growing emphasis on increasing ammunition production capacities.

Business Benefits

The adoption of eco-friendly ammunition opens new market opportunities, especially among environmentally conscious consumers and organizations. Companies that prioritize sustainable practices can enhance their brand reputation and meet the growing demand for green products.

Investing in advanced technologies like smart bullets and polymer-cased ammunition can lead to a competitive edge. These innovations not only improve product performance but also cater to the modern military’s need for lightweight and efficient solutions.

Expanding production capacities ensures that businesses can meet both current and future demands. With the global security environment prompting nations to strengthen their defenses, companies capable of scaling up production swiftly are better positioned to secure substantial contracts.

Key Player Analysis

The Ammunition industry is driven by several leading players that shape the market dynamics through innovation, technology, and strategic growth.

BAE Systems is a global defense and aerospace giant, and a major player in the ammunition market. The company is known for its expertise in creating high-quality, reliable ammunition for various defense systems, including artillery and small arms. BAE’s innovative approach, combined with its experience in defense technologies, allows them to meet the growing needs of military customers worldwide.

Rheinmetall Defense, a division of the German multinational Rheinmetall Group, is a leader in ammunition and defense systems. The company excels in providing high-performance ammunition, with a specialization in precision-guided munitions. Rheinmetall’s advanced research and development capabilities enable them to introduce innovative products that enhance military effectiveness.

Nexter KNDS Group, a key player in the global defense sector, is part of the KNDS Group, a European leader in military technology. Nexter is known for designing and manufacturing a wide range of ammunition, including that used in large-caliber artillery and tank systems.

Top Key Players in the Market

- BAE Systems, Inc.

- Rheinmetall Defense

- Nexter KNDS Group

- Hanwha Corporation

- ST Engineering

- Northrop Grumman Corporation

- FN Herstal

- Olin Corporation

- General Dynamics Corporation

- Remington Arms Company LLC

- Vista Outdoor Operations LLC

- Other Major Players

Top Opportunities Awaiting for Players

The ammunition market is poised for substantial growth and transformation, offering several key opportunities for industry players.

- Increased Defense Expenditure: As global defense budgets continue to rise, driven by heightened geopolitical tensions and the modernization of military forces, there is significant demand for new and advanced ammunition types. This trend is bolstered by the need for nations to enhance their military capabilities in response to both traditional and emerging threats.

- Technological Advancements: The ammunition industry is seeing rapid innovation, particularly in the development of non-lethal ammunition, smart munitions, and environmentally friendly components. Companies investing in these technologies are likely to gain competitive advantages, tapping into new market segments and meeting evolving regulatory and consumer demands.

- Rising Demand in Emerging Markets: Countries in Asia-Pacific and the Middle East are increasing their defense outlays and modernizing their armed forces, which presents lucrative opportunities for ammunition manufacturers. The growth in these regions is supported by ongoing regional tensions and an increasing focus on domestic defense manufacturing capabilities.

- Diversification into Non-Lethal and Specialized Ammunition: With a growing global emphasis on human rights and law enforcement reform, there is an increasing market for non-lethal ammunition options, such as rubber bullets and tear gas. These products are particularly relevant for law enforcement agencies aiming to manage civil unrest with minimal casualties.

- Partnerships and Expansion in International Markets: There is a substantial opportunity for companies to expand their global footprint through strategic alliances, partnerships, and direct investment in manufacturing facilities in high-growth markets. Such expansions can help companies leverage local market insights, reduce operational costs, and navigate regulatory landscapes more effectively.

Recent Developments

- In February 2024, Rheinmetall announced a €300 million investment to build a new ammunition plant in northern Germany with an annual capacity for 200,000 artillery shells and 1,900 metric tons of explosives.

- In October 2024, Hanwha is developing a wheeled artillery system using the same 155mm gun as the K9 and incorporating autonomous technology.

- In December 2024, the U.S. Army awarded BAE Systems a contract to develop a 155mm self-propelled cannon prototype, called the Multi-Domain Artillery Cannon (MDAC). It is designed to counter threats like drones and cruise missiles using hypervelocity ammunition.

Report Scope

Report Features Description Market Value (2024) USD 26.15 Bn Forecast Revenue (2034) USD 36.9 Bn CAGR (2025-2034) 3.50% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product (Bullets, Aerial Bombs, Grenades, Others), By Caliber (Small Caliber (5.56 mm, 7.62 mm, 9 mm, Others), Medium Caliber (23 mm, 30 mm, Others), Large Caliber (VSHORAD, 122 mm, Others, Others), By End Use (Civil & Commercial, (Sports, Hunting, Self Defense), Defense (Military, Law Enforcement) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape BAE Systems, Inc., Rheinmetall Defense, Nexter KNDS Group, Hanwha Corporation, ST Engineering, Northrop Grumman Corporation, FN Herstal, Olin Corporation, General Dynamics Corporation, Remington Arms Company LLC, Vista Outdoor Operations LLC, Other Major Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- BAE Systems, Inc.

- Rheinmetall Defense

- Nexter KNDS Group

- Hanwha Corporation

- ST Engineering

- Northrop Grumman Corporation

- FN Herstal

- Olin Corporation

- General Dynamics Corporation

- Remington Arms Company LLC

- Vista Outdoor Operations LLC

- Other Major Players