Global 5-Hydroxymethylfurfural Market Size, Share Analysis Report By Grade (Industrial Grade, Food Grade), By Purity (≥ 99%, ≥ 95%, ≥ 80%), By End-use (Chemical Industry, Flavor and Fragrance Industry, Pharmaceutical Industry, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Sep 2025

- Report ID: 159985

- Number of Pages: 331

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

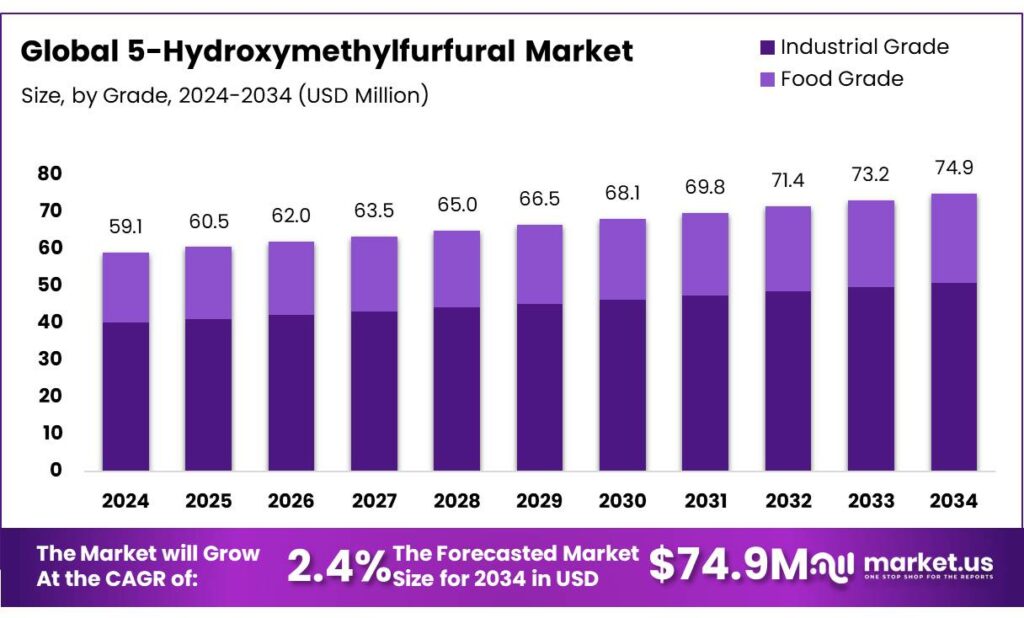

The Global 5-Hydroxymethylfurfural Market size is expected to be worth around USD 74.9 Million by 2034, from USD 59.1 Million in 2024, growing at a CAGR of 2.4% during the forecast period from 2025 to 2034.

In 2024–2025, 5-hydroxymethylfurfural (5-HMF) was established as a versatile biomass-derived platform chemical produced by the acid-catalysed dehydration of hexose sugars. The compound has been deployed as an intermediate for production of 2,5-furandicarboxylic acid (FDCA) (a precursor for polyethylene-furanoate bioplastics), specialty solvents, pharmaceutical intermediates and resin modifiers. Demand has been driven by interest in renewable feedstocks and by the requirement for petroleum-alternatives in high-value specialty chemicals; multiple downstream value chains have been identified where HMF derivatives provide performance or sustainability advantages.

The industrial landscape has been characterised by small-to-pilot scale commercial activity and by pronounced scale-up challenges. A first small commercial HMF plant in Switzerland was reported with a capacity of approximately 300 tonnes HMF per year, demonstrating that commercial production has been technically feasible but limited in scale. Other reviews and production surveys have reported smaller semi-commercial capacities linked to single-company plants, indicating variability in reported capacities and the existence of niche supply. These discrepancies have been associated with differences in plant definitions and with proprietary production routes.

Key driving factors have been the shift toward bio-based chemicals, technological advances in catalytic dehydration and upgrading, and public R&D funding targeted at biomass conversion. Public programs have been significant: for example, U.S. Department of Energy peer-review materials document catalytic-upgrading investments in the order of tens of millions of dollars (reported program investment value ≈ $45,920,419 in the reviewed portfolio), which has been applied to platform chemical conversion research that includes HMF pathways. Such funding has been instrumental in de-risking catalytic technologies and in supporting lab-to-pilot scale demonstrations.

Government initiatives play a significant role in promoting the adoption of 5-HMF. In the European Union, the Horizon Europe program awarded Avantium N.V. a €200,000 grant to support the large-scale production of 5-HMF, highlighting the region’s commitment to green chemistry and sustainability. Similarly, in the United States, over 18 states, including California and New Jersey, have enacted incentives to support the use of biomass-derived chemicals, contributing to a 14% growth in 5-HMF-based production capacity in 2024

Key Takeaways

- 5-Hydroxymethylfurfural Market size is expected to be worth around USD 74.9 Million by 2034, from USD 59.1 Million in 2024, growing at a CAGR of 2.4%.

- Industrial Grade held a dominant market position, capturing more than a 68.3% share.

- ≥ 95% held a dominant market position, capturing more than a 46.9% share.

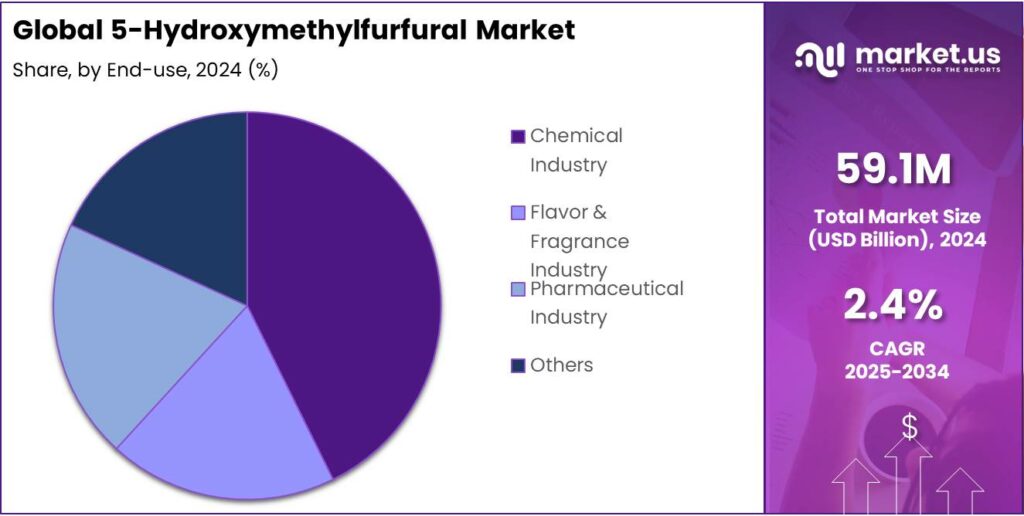

- Chemical Industry held a dominant market position, capturing more than a 44.7% share.

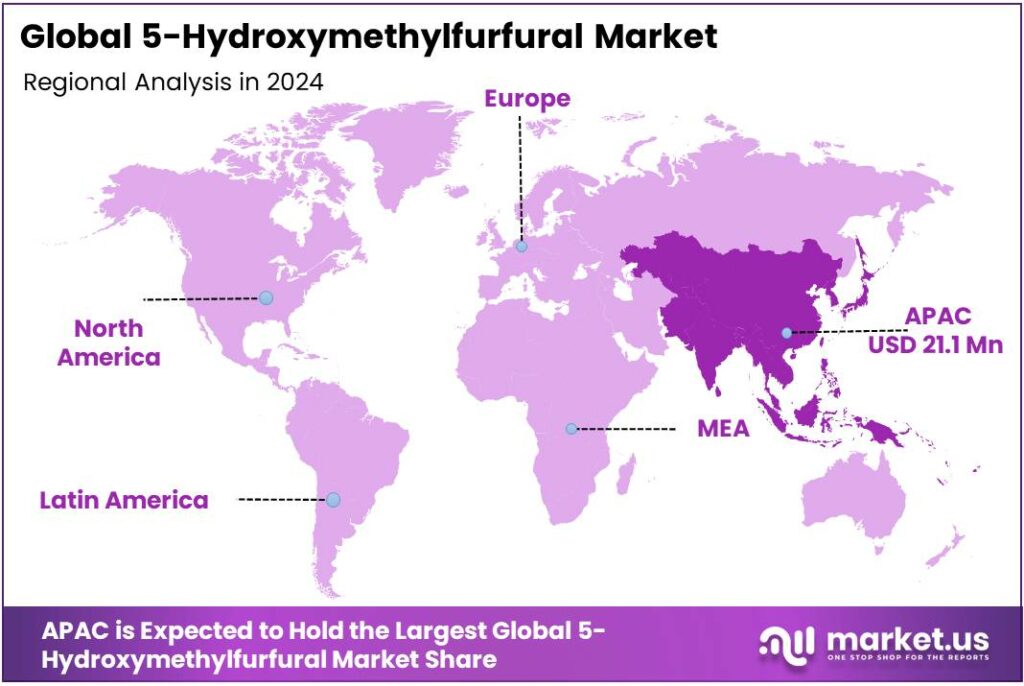

- Asia Pacific emerged as the leading regional market for 5-Hydroxymethylfurfural (5-HMF), holding a 35.8% share valued at USD 21.1 million.

By Grade Analysis

Industrial Grade leads with 68.3% share in 2024 driven by large-scale chemical applications

In 2024, Industrial Grade held a dominant market position, capturing more than a 68.3% share. This strong dominance was supported by its extensive use in bulk chemical production, particularly in applications such as resins, polymers, solvents, and bio-based fuels. Industrial Grade 5-Hydroxymethylfurfural (5-HMF) is preferred by manufacturers due to its cost-effectiveness and ability to meet the requirements of large-volume processing industries. The material’s role as a key intermediate in the synthesis of bio-based chemicals further strengthened its demand across the industrial segment.

Moving into 2025, the preference for Industrial Grade remains high as governments and industries continue to invest in green chemistry and sustainable raw materials. With 5-HMF being an important bio-based building block, its industrial applications in furandicarboxylic acid (FDCA) and polyethylene furanoate (PEF) production are drawing wider adoption from packaging and plastics industries. The cost advantage of Industrial Grade over higher-purity variants also supports its large-scale usage, especially in markets where high-purity levels are not essential. This consistent reliance is expected to maintain the strong market share of Industrial Grade in 2025, positioning it as the backbone of the global 5-HMF demand.

By Purity Analysis

≥ 95% purity dominates with 46.9% share in 2024 supported by demand in fine chemical and pharma applications

In 2024, ≥ 95% held a dominant market position, capturing more than a 46.9% share. This segment gained prominence as high-purity 5-Hydroxymethylfurfural (5-HMF) is increasingly used in pharmaceuticals, food additives, and specialty chemicals where stringent quality standards are required. Its superior purity level allows it to serve as a reliable intermediate in fine chemical synthesis and in applications where trace impurities cannot be tolerated. The rising interest in bio-based, high-performance materials further added to the adoption of ≥ 95% purity 5-HMF, as industries aim to improve quality while aligning with green chemistry initiatives.

By 2025, the ≥ 95% purity category continues to hold a strong position as pharmaceutical and nutraceutical industries expand their reliance on bio-derived compounds. With regulatory bodies emphasizing purity and safety, demand for high-quality 5-HMF remains steady. This consistent requirement ensures that ≥ 95% purity retains its leading share, supported by ongoing research and product development efforts in advanced materials and health-related applications.

By End-use Analysis

Chemical Industry dominates with 44.7% share in 2024 driven by strong demand for bio-based intermediates

In 2024, Chemical Industry held a dominant market position, capturing more than a 44.7% share. The segment benefited from the rising demand for 5-Hydroxymethylfurfural (5-HMF) as a key bio-based intermediate in the production of resins, solvents, and specialty polymers. Its application in the synthesis of furandicarboxylic acid (FDCA), which is used to produce polyethylene furanoate (PEF), further strengthened its role in replacing petroleum-based feedstocks with sustainable alternatives. The chemical sector’s move toward circular and green production models also contributed to the steady adoption of 5-HMF at an industrial scale.

Looking ahead to 2025, the Chemical Industry continues to lead end-use adoption as manufacturers increasingly prioritize renewable raw materials. The ability of 5-HMF to support high-volume applications while aligning with regulatory frameworks promoting bio-based products ensures its ongoing demand. This consistent reliance places the chemical sector as the anchor of the 5-HMF market, sustaining its dominance through both performance and sustainability-driven growth.

Key Market Segments

By Grade

- Industrial Grade

- Food Grade

By Purity

- ≥ 99%

- ≥ 95%

- ≥ 80%

By End-use

- Chemical Industry

- Flavor & Fragrance Industry

- Pharmaceutical Industry

- Others

Emerging Trends

Emergence of faster, more sensitive, green analytical techniques for 5-HMF monitoring

A clear and important recent trend in the 5-HMF field is the shift toward developing rapid, high-throughput, and environmentally friendly analytical methods to detect 5-HMF in foods and complex matrices. As regulatory scrutiny, consumer safety concerns, and the drive for more precise food quality control increase, researchers are increasingly focused on new instrument methods and sensing technologies that are faster, cheaper, more sensitive, and less wasteful.

One of the standout recent advances came in 2025, when a research team introduced a MALDI-MS (matrix-assisted laser desorption/ionization mass spectrometry) method with in situ derivatization for 5-HMF detection. This method achieved a detection limit of 0.347 mg/kg with good accuracy and linearity. Compared to older approaches, it offers both speed and lower reagent use, aligning well with green analytical chemistry principles.

Another example is the use of photoelectric (photoelectrochemical) sensing approaches. A 2024 study reported a hollow TiO₂-based sensor with an ultra-low detection limit—down to 0.001 nanomolar (nM)—for 5-HMF in relevant sample media. Such sensors are attractive because they can be compact, inexpensive, and suitable for on-site or point-of-sample use.

In the broader literature, authors have documented rising interest in methods combining spectrometric, chromatographic, electrochemical, or hybrid techniques. For instance, a bibliometric analysis of 5-HMF detection in honey noted that the number of publications peaked in 2024, with the trend shifting toward methods that are “fast, accurate, precise, cheap, portable and environment friendly.” Moreover, a 2025 review on HMF detection in honey highlights that chromatographic (e.g. LC, HPLC) and spectrometric approaches remain dominant but are being improved for speed and lower sample prep burden.

Drivers

Regulatory pressure from food safety agencies to limit 5-HMF levels in food products

One of the major driving forces pushing interest and attention toward 5-hydroxymethylfurfural (5-HMF) in food science and industry is the regulatory scrutiny it faces from food safety authorities around the world. Because 5-HMF can form during heating, storage, and processing of sugar-rich foods, regulators have begun imposing limits or monitoring requirements to ensure that consumption stays within safe bounds.

For example, the Codex Alimentarius, which is a global reference standard developed by FAO/WHO, sets a maximum limit for HMF in honey at 40 mg per kg (with a relaxed limit of 80 mg per kg for honeys from tropical regions) to protect consumers and maintain honey quality. In many European countries, the EU Honey Directive and food safety rules align with these limits.

Because honey is one of the few foodstuffs where HMF limits are formally codified, it has become a benchmark: if a regulatory body monitors HMF in honey, it’s more likely to evaluate its presence in other processed foods, such as fruit syrups, juices, baked goods, caramel products, and more. Research literature already reports that in various processed foods, the HMF content can be quite elevated—for instance, some balsamic vinegars showed HMF levels much higher than honey limits.

This regulatory focus forces food companies, ingredient suppliers, and processing technology developers to pay attention: they must control heat treatments, storage conditions, and raw material quality to stay compliant. Failing to meet limits can lead to product recalls, reputational damage, or trade barriers—especially when exporting to markets with strict food safety rules.

In practical terms, food producers increasingly invest in low-temperature processing, shorter processing time, enzyme or catalyst approaches to limit HMF formation, or adopt analytical testing methods with high sensitivity for instance, detection limits for HMF down to ~0.347 mg/kg have been achieved in research testing methods. They also often monitor storage duration and temperature to avoid further accumulation of HMF over shelf life.

Restraints

High toxicity uncertainty and limited safety thresholds

One major restraining factor in the adoption or broader use of 5-hydroxymethylfurfural (5-HMF) in food and related industries is the scientific uncertainty around its toxicity at low doses, combined with the lack of well-defined regulatory safety thresholds. Because 5-HMF forms as a heat-induced product in many foods, food processors might hesitate to use or intentionally produce it when the health risks are not firmly established.

- Toxicological studies in animals show some cause for caution. In rodent experiments, the no observed adverse effect levels (NOAELs) for 5-HMF lie in the range of 80–100 mg per kg body weight per day. But extrapolating these results to humans involves uncertainties due to metabolic differences, long-term exposures, and possible formation of more toxic metabolites like 5-sulfooxymethylfurfural (SMF).

Because of these uncertainties, regulatory bodies use cautious approaches, which restrain usage. For example, EFSA (the European Food Safety Authority) published a Scientific Opinion that classifies 5-HMF (and related substances) under the CONTAM panel of contaminants in the food chain, and points out that existing data are insufficient to fully quantify risk for all populations. The opinion mentions that while acute toxicity is considered low, potential chronic, genotoxic or carcinogenic effects are not ruled out.

A further burden is that dietary exposure estimates for humans vary. Some reviews place the average daily intake of 5-HMF between 4 and 30 mg per person per day. There is also another estimate showing a lower bound of 30–150 mg/day as possible in high consumers of heated or processed foods. Because of such variability, authorities cannot reliably set a “safe” threshold applying to all populations.

Another restraining aspect is that regulatory frameworks in many countries don’t yet explicitly regulate 5-HMF in foods (except for certain products like honey). Without regulatory clarity, industries are nervous about investing in processes or formulations that might later be disallowed or heavily restricted. In contrast, when regulations are clear (with numerical limits), industry can plan compliance. Because 5-HMF still sits in a gray zone in many jurisdictions, that ambiguity slows adoption or use.

Opportunity

Rising demand for bio-based chemicals as a green alternative

One of the most promising growth opportunities for 5-hydroxymethylfurfural (5-HMF) is its role as a versatile platform chemical in the green chemistry and bioeconomy sectors. Because it can be derived from biomass (sugars, cellulose) and then converted into a wide range of valuable downstream products (such as biofuels, bioplastics, platform monomers, solvents, polymers, flavor precursors), 5-HMF is viewed as a building block in the shift away from petroleum-based feedstocks.

In recent years, governments and research agencies have encouraged investment into biomass valorization and “platform molecules” to promote sustainability. For example, the U.S. Department of Energy has highlighted that the U.S. could triple its biomass production and produce 60 billion gallons of low-greenhouse gas liquid fuels while still meeting other demands. This suggests the raw biomass supply is expected to expand significantly, creating feedstock availability for 5-HMF production processes.

From a commercial perspective, even at relatively early stages, one small commercial 5-HMF plant has been operating in Switzerland with a capacity of 300 tonnes HMF per year since 2014. That shows that scaling is already feasible at modest levels—and further scaling offers opportunity.

Research is also progressively advancing to make 5-HMF production more efficient, lower cost, and more sustainable. A recent study demonstrates continuous conversion of glucose to 5-HMF using a biphasic microreactor with Lewis acid catalysts, which could reduce energy and separation costs. Meanwhile, a 2025 paper describes the use of simple microwave‐assisted dehydration of sucrose into HMF, offering a more cost-friendly route. These innovations lower barriers to commercial uptake.

From the policy side, many governments are pushing bioeconomy and circular economy agendas. Though not always specific to 5-HMF, such policies create a favorable ecosystem for molecules like 5-HMF. For instance, mandates or incentives for biofuels, mandates for renewable chemical content, carbon credits for lower-emission processes, and grants for biorefinery development all help indirectly. In the U.S., the DOE’s biomass targets and strategy to scale biofuels (60 billion gallons) send signals to chemical sectors.

Regional Insights

Asia Pacific leads with 35.8% share valued at USD 21.1 million in 2024

In 2024, Asia Pacific emerged as the leading regional market for 5-Hydroxymethylfurfural (5-HMF), holding a 35.8% share valued at USD 21.1 million. The region’s dominance is strongly linked to its expanding chemical, pharmaceutical, and packaging industries, particularly in countries such as China, Japan, South Korea, and India. China has positioned itself as a key hub for bio-based chemical production, supported by national strategies to reduce dependence on fossil-based inputs. The Ministry of Industry and Information Technology (MIIT) of China has been actively promoting bio-based and green materials, which has directly fueled the demand for high-volume intermediates such as 5-HMF.

Japan and South Korea are also contributing to regional growth through their advancements in specialty chemicals, food additives, and polymer industries. Japan’s push toward developing sustainable packaging alternatives, particularly polyethylene furanoate (PEF) derived from 5-HMF, is opening new opportunities. Similarly, India’s government-led initiatives such as “Make in India” and growing investments in bio-economy projects are creating favorable conditions for the adoption of bio-based intermediates. The increasing demand from the pharmaceutical sector in India and China for high-purity 5-HMF further strengthens the region’s position.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Zhejiang Sugar Energy is a more recent entrant (established ~2017) that focuses on bio-based materials including 5-HMF. They have scaled from a 100-ton line to a 1,000-ton capacity and aim for 2,000 tons/year in 5-HMF. Their product chain integrates upstream sugars and downstream furan derivatives (FDCA, etc.), positioning them as a vertically integrated bio-refinery player.

Japan’s TCI is a long-standing specialty chemicals provider (founded 1946) with a portfolio of ~30,000+ organic reagents and custom synthesis services. Their product catalog includes stabilized 5-HMF (≥95 % purity) for research and industrial use. TCI’s global presence and reputation in labs gives them access to researchers and niche buyers who need high-grade intermediates.

Swiss firm AVA Biochem is a leader in producing high-purity 5-HMF via a patented water-based conversion of industrial sugars. They target multiple end markets such as biopolymers, adhesives, resins, packaging and aim to replace formaldehyde-based chemistries. Their collaboration with Michelin highlights ambitions for commercial scale expansion.

Top Key Players Outlook

- AVA Biochem AG

- Robinson Brothers Limited

- Xuzhou Ruisai Technology Industrial Co Ltd.

- Zhejiang Sugar Energy Technology Co. Ltd

- Tokyo Chemical Industry Co.Ltd. (TCI)

- Anhui Sunsing Chemicals Co.Ltd.

Recent Industry Developments

In 2024 Zhejiang Sugar Energy Technology Co., Ltd., was operating a pilot production line of 1,000 tonnes/year capacity of 5-HMF, using a “Full Mixed-Flow Continuous Production Process” which they have optimized to reduce costs.

In 2024, AVA Biochem is planning expansion: the company aims to build a larger industrial plant with a production capacity of 6,500 tonnes/year of 5-HMF. This would require roughly 13,000 tonnes/year of sugar feedstock (first‐generation sugars like sugar beet or corn) to run.

Report Scope

Report Features Description Market Value (2024) USD 59.1 Mn Forecast Revenue (2034) USD 74.9 Mn CAGR (2025-2034) 2.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Grade (Industrial Grade, Food Grade), By Purity (≥ 99%, ≥ 95%, ≥ 80%), By End-use (Chemical Industry, Flavor and Fragrance Industry, Pharmaceutical Industry, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape AVA Biochem AG, Robinson Brothers Limited, Xuzhou Ruisai Technology Industrial Co Ltd., Zhejiang Sugar Energy Technology Co. Ltd, Tokyo Chemical Industry Co.Ltd. (TCI), Anhui Sunsing Chemicals Co.Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  5-Hydroxymethylfurfural MarketPublished date: Sep 2025add_shopping_cartBuy Now get_appDownload Sample

5-Hydroxymethylfurfural MarketPublished date: Sep 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- AVA Biochem AG

- Robinson Brothers Limited

- Xuzhou Ruisai Technology Industrial Co Ltd.

- Zhejiang Sugar Energy Technology Co. Ltd

- Tokyo Chemical Industry Co.Ltd. (TCI)

- Anhui Sunsing Chemicals Co.Ltd.