Global Glass Manufacturing Market By Product (Container Glass, Flat Glass, Fiber Glass, and Other Products), By Manufacturing Process(Float Process, Blown Process, Pressing and Casting, Drawing Process, Others), By Application (Packaging, Construction, Transportation, Electrical and electronics, Telecommunication, and Other Applications), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2024-2033

- Published date: Dec 2024

- Report ID: 103675

- Number of Pages: 281

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

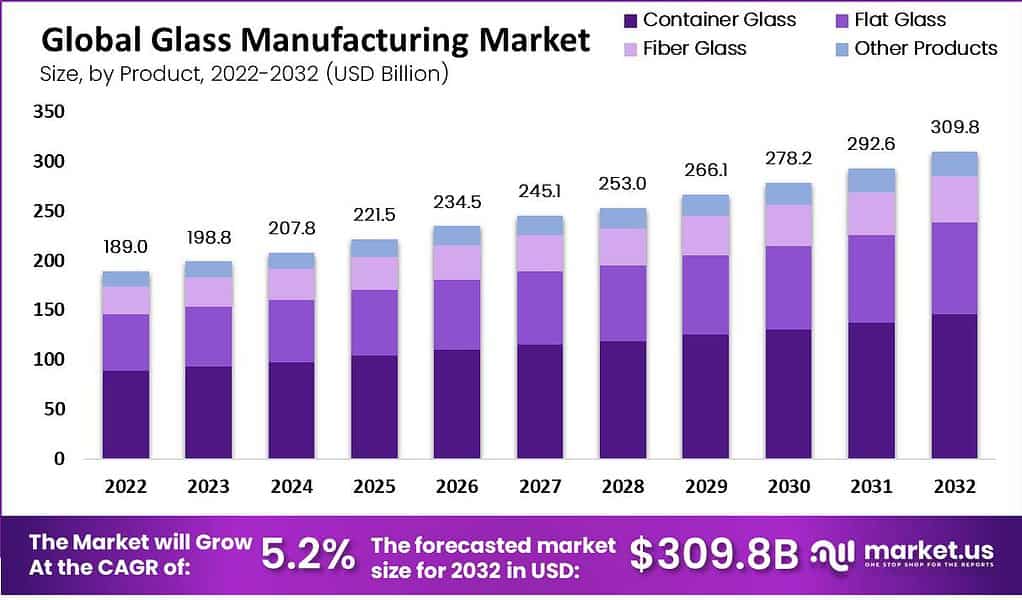

The global Glass Manufacturing Market size is expected to be worth around USD 309.8 billion by 2033, from USD 189 billion in 2023, growing at a CAGR of 5.2% during the forecast period from 2023 to 2033.

The glass manufacturing market is a dynamic sector pivotal to various industries, including construction, automotive, and packaging. This market’s growth is propelled by global urbanization and infrastructure expansion, especially in emerging economies where modern, sustainable building techniques are increasingly in demand.

Glass is integral in these developments due to its transparency, recyclability, and resistance to environmental factors, which make it a versatile choice for applications ranging from architectural facades to vehicle windows and food packaging.

In the construction industry, glass plays a critical role in enhancing the energy efficiency of buildings. Innovations such as low-emissivity (low-E) glass coatings significantly reduce heat transfer, aligning with global initiatives to create more energy-efficient and sustainable buildings.

The automotive sector relies on high-quality glass for safety and aesthetic enhancements, using laminated and tempered glass to ensure durability and clarity in windshields and sunroofs. In the realm of packaging, glass’s inert properties prevent contamination and preserve the quality and flavor of food and beverages, making it a preferred material for eco-conscious consumers and manufacturers.

Governments across the globe are promoting environmental sustainability in glass production by enforcing recycling regulations and supporting the development of green technologies. The European Union, for instance, targets a recycling rate of over 75% for glass packaging, driving advancements in recycling practices and technologies. These regulatory frameworks not only support sustainability but also foster innovation within the industry.

The glass manufacturing market is highly globalized, with significant production and export volumes originating from major hubs like China. This international aspect is influenced by regional demands, logistical costs, and varying trade policies, which shape the flow and availability of glass products worldwide.

The industry is witnessing substantial investments in developing smart glass technologies that adapt their optical properties under different environmental stimuli. These advancements are finding applications in various sectors, from automotive, where they are used in sunroofs that automatically tint in bright sunlight, to smart buildings, which utilize responsive windows to optimize internal temperature and light.

Key Takeaways

- Glass Manufacturing Market size is expected to be worth around USD 309.8 billion by 2033, from USD 189 billion in 2023, growing at a CAGR of 5.2%

- flat glass held a dominant market position, capturing more than a 46.3% share.

- Float Process held a dominant market position, capturing more than a 54.5% share.

- construction held a dominant market position, capturing more than a 44.3% share.

By Product Analysis

In 2023, flat glass held a dominant market position, capturing more than a 46.3% share of the overall glass manufacturing market. Flat glass is extensively used in construction and automotive industries for windows, facades, and windshields due to its transparency and durability. The demand is driven by the ongoing construction of commercial and residential buildings and advancements in automotive safety and design.

Container glass, which is primarily used for bottling and packaging in the food and beverage industry, also represents a significant segment. This type of glass is favored for its inert properties that ensure there is no interaction between the glass and its contents, preserving the quality and extending the shelf life of products. The push towards sustainable packaging solutions further increases the demand for recyclable glass containers.

Fiberglass, another key product segment, is widely utilized in insulation for residential and commercial buildings, as well as in various industrial applications. Its thermal and acoustic insulating properties, combined with its strength and lightweight nature, make it a popular choice in the construction sector and automotive parts manufacturing.

By Manufacturing Process

In 2023, the Float Process held a dominant market position, capturing more than a 54.5% share of the glass manufacturing market. This method is highly favored for producing flat glass due to its ability to create smooth, uniform glass sheets, which are extensively used in the construction and automotive industries for windows and windshields. The float process is renowned for its efficiency and cost-effectiveness, making it the preferred technique for large-scale glass production.

The Blown Process, another traditional method in glass manufacturing, is primarily used for making container glass, including bottles and jars. This technique involves blowing air into molten glass to form the desired shapes and is cherished for the unique aesthetic qualities it can impart, making it ideal for specialty and decorative items.

Pressing and Casting are used for creating glass objects that require precise shapes and dimensions, such as glassware and optical components. This method allows for a high degree of control over the thickness and details of the glass, making it suitable for complex designs.

The Drawing Process is employed in the production of fiber glass and certain types of window glass. This process involves drawing molten glass through dies to form fibers or sheets, known for producing consistent thickness, and is crucial in applications requiring high tensile strength and flexibility.

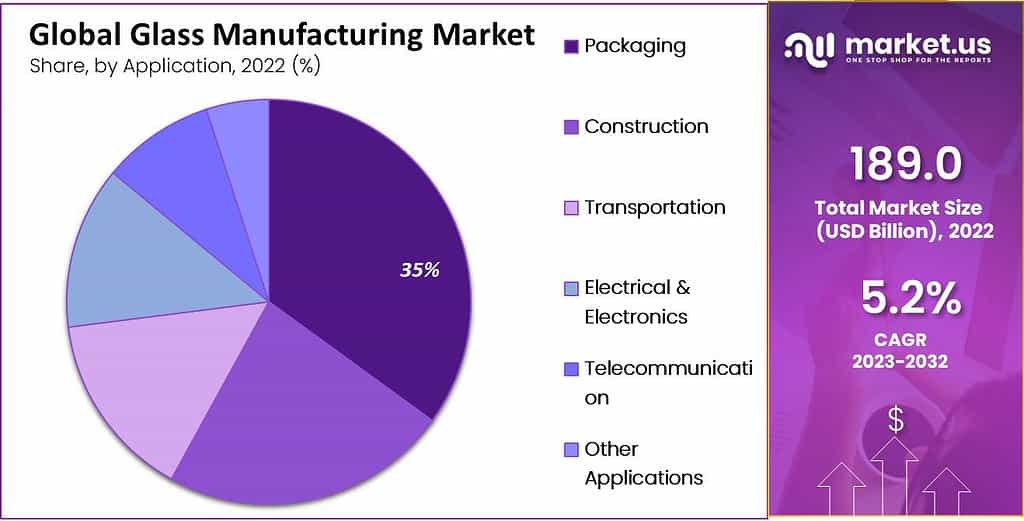

By Application Analysis

In 2023, construction held a dominant market position, capturing more than a 44.3% share of the glass manufacturing market. Glass is extensively utilized in the construction industry for applications such as windows, doors, facades, and interior partitions due to its transparency, insulation properties, and aesthetic appeal. The increasing emphasis on energy-efficient buildings has further amplified the demand for advanced glass solutions that provide superior insulation and solar control.

Packaging follows as another significant application, where glass is primarily used for food and beverage containers. This segment leverages glass for its non-reactive and recyclable properties, ensuring that products are preserved safely without affecting their taste or quality. The drive towards sustainable packaging solutions continues to support the demand for glass in this sector.

In transportation, glass is crucial for automotive and aerospace applications, where safety and durability are paramount. Glass used in vehicle windshields, windows, and sunroofs is specially treated to enhance visibility and resistance to impacts, contributing to passenger safety and comfort.

The electrical and electronics segment utilizes glass in a variety of products such as display panels, insulators, and fiber optics. This sector demands glass that offers high clarity, durability, and precise optical characteristics to ensure the efficient functioning of electronic devices and systems.

Telecommunication is another area where glass is vital, especially in the form of fiber optic cables. Glass fibers are essential for high-speed data transmission, playing a crucial role in the infrastructure of global communications networks. The ongoing expansion of broadband and telecommunications networks drives the demand for high-quality glass fibers.

Key Market Segments

Based on Product

- Container Glass

- Flat Glass

- Fiber Glass

- Other Products

By Manufacturing Process

- Float Process

- Blown Process

- Pressing and Casting

- Drawing Process

- Others

Based on Application

- Packaging

- Construction

- Transportation

- Electrical & Electronics

- Telecommunication

- Other Applications

Driving Factors

Surge in Construction and Infrastructure Development

One of the primary driving factors for the glass manufacturing market is the significant growth in global construction and infrastructure development. The increasing demand for residential and commercial buildings equipped with energy-efficient glass products is propelling the glass industry forward.

The worldwide construction industry is experiencing a robust expansion, with an expected compound annual growth rate (CAGR) of around 4% over the next decade. Emerging economies in Asia, Africa, and Latin America are witnessing substantial urbanization and infrastructure projects, driving the demand for various glass products used in building applications such as windows, facades, and interior partitions.

Governments around the world are implementing stricter regulations aimed at reducing energy consumption in buildings. For instance, the European Union has set ambitious targets under the Energy Performance of Buildings Directive (EPBD) to increase the energy efficiency of buildings, which directly boosts the demand for energy-efficient glass products.

In the United States, the Department of Energy (DOE) has been proactive in promoting the use of energy-efficient materials in construction through various incentives and standards, significantly influencing the glass market.

Technological advancements in glass manufacturing, such as the development of low-emissivity (low-E) glass and smart glass, are revolutionizing the construction sector. These technologies enhance the insulation properties of glass and contribute to the sustainability of buildings, aligning with global green building initiatives.

The market for smart glass, capable of changing its light transmission properties based on external conditions, is particularly poised for growth, with projections suggesting a CAGR of over 12% in the next five years.

The push towards sustainability has led to increased recycling and reuse of glass, supported by government policies and industry initiatives. For example, the Glass Recycling Coalition in the U.S. works towards enhancing the recycling rates of glass, thus supporting the circular economy in the glass manufacturing industry.

European countries have also seen significant investments in glass recycling facilities, driven by both regulatory pressures and corporate responsibility commitments.

Substantial investments in infrastructure development, including transportation and public amenities, also involve extensive use of glass, thereby supporting the growth of the glass manufacturing market. Government-funded projects in roadways, airports, and urban transit systems frequently incorporate large quantities of glass, further expanding its market.

Restraining Factors

High Energy Consumption and Environmental Concerns

A significant restraining factor for the glass manufacturing market is the high energy consumption required during the production process and the associated environmental concerns. Glass production is energy-intensive, involving the melting of raw materials at high temperatures, which leads to substantial CO2 emissions and other pollutants.

The process of manufacturing glass typically involves heating raw materials to temperatures up to 1700°C, making it one of the most energy-intensive industries. The energy used in this process primarily comes from non-renewable sources, contributing significantly to the industry’s carbon footprint.

According to industry analyses, the glass manufacturing sector is among the top energy-consuming industries globally, with significant implications for operational costs and environmental impact.

Stringent environmental regulations aimed at reducing industrial emissions are increasingly impacting the glass manufacturing industry. In regions like the European Union and North America, strict guidelines on emissions and energy usage compel manufacturers to invest in cleaner, but often more expensive, technologies.

The European Union’s Industrial Emissions Directive (IED) and the U.S. Environmental Protection Agency’s (EPA) regulations under the Clean Air Act mandate specific emission reductions for pollutants like NOx, SOx, and particulate matter, which are prevalent in glass production.

Adhering to these environmental regulations requires significant capital investment in pollution control technologies and the modernization of facilities to enhance energy efficiency. These upgrades, while beneficial in the long term, present substantial short-term financial challenges to manufacturers.

The cost of implementing environmentally friendly technologies can be prohibitive, particularly for smaller manufacturers, potentially limiting their competitive edge in the global market.

The global shift towards sustainability and reduced carbon emissions is prompting a reevaluation of production processes across industries. In the glass manufacturing sector, there is a growing pressure to transition to renewable energy sources and improve recycling rates to reduce the reliance on raw, energy-intensive materials.

Innovations such as the development of low-energy melting technologies and the increased use of recycled glass (cullet) in production processes are being explored as ways to mitigate environmental impact, but these require time and financial investment to become widely implemented.

Volatility in energy prices and disruptions in the supply chain further exacerbate the challenges faced by the glass manufacturing industry. Fluctuations in the cost of natural gas and other fuels can significantly affect production costs, impacting the overall profitability and sustainability of operations.

Growth Opportunities

Expansion in Energy-Efficient and Smart Glass Technologies

A significant growth opportunity for the glass manufacturing market lies in the burgeoning demand for energy-efficient and smart glass technologies. These technologies are increasingly sought after in both the construction and automotive industries, driven by global initiatives to reduce energy consumption and enhance building and vehicle functionalities.

As governments worldwide intensify efforts to reduce energy consumption, the push for energy-efficient buildings is growing. Glass plays a pivotal role in these initiatives due to its ability to significantly influence the energy performance of buildings. For instance, the use of low-emissivity (low-E) glass in windows can reduce energy loss by up to 50%, according to the U.S. Department of Energy (DOE).

The global market for energy-efficient windows is projected to grow substantially, with a notable increase in the adoption of advanced glass solutions that offer better insulation and solar heat gain control.

Smart glass or electrochromic glass, which can change its light transmission properties based on external conditions, is seeing a surge in demand. This type of glass reduces the need for air conditioning and artificial lighting, making it highly attractive for modern, sustainable building designs.

The market for smart glass is anticipated to expand at a robust CAGR, driven by applications in smart buildings and vehicles that leverage its ability to improve comfort, privacy, and energy efficiency.

Several regulatory frameworks and government incentives are promoting the adoption of energy-efficient and smart glass technologies. For example, the European Union’s directives on energy efficiency are mandating the incorporation of advanced glass in new and renovated buildings.

In the United States, tax credits and rebates are available for homeowners who install energy-efficient windows, further stimulating market growth.

In the automotive sector, the rise of electric vehicles (EVs) and increased focus on fuel efficiency are driving the adoption of advanced glass technologies. Smart glass helps reduce the energy consumption of EVs by minimizing the need for climate control systems, thereby extending battery life and vehicle range.

Ongoing technological advancements in glass manufacturing, such as the development of triple and quadruple-pane windows, are enhancing the thermal and acoustic properties of glass. These innovations not only improve the product offering but also align with increasing environmental consciousness among consumers.

Major players in the glass industry are investing heavily in research and development to pioneer new glass technologies and improve manufacturing processes, ensuring they meet the evolving demands of the market.

Latest Trends

Adoption of Recycled Glass and Sustainability Initiatives

A major trend in the glass manufacturing industry is the increasing adoption of recycled glass, known as cullet, in production processes. This shift is largely driven by growing environmental awareness and the need to reduce the carbon footprint of glass production. Using recycled glass not only conserves raw materials but also significantly decreases energy consumption during the manufacturing process.

The use of recycled glass in manufacturing significantly reduces energy consumption. According to industry sources, for every 10% of cullet used in the production process, there is approximately a 2-3% energy saving, as melting recycled glass requires less energy compared to raw materials. This is because cullet melts at a lower temperature.

Furthermore, using recycled glass reduces the demand for raw materials like silica sand, soda ash, and limestone, which are the primary components of glass. This not only preserves natural resources but also lessens the environmental impact associated with their extraction.

Governments worldwide are implementing policies and regulations that encourage the use of recycled materials. In the European Union, stringent recycling targets and directives aim to increase recycling rates across various materials, including glass. The EU’s target for glass packaging recycling is set to reach and maintain a rate of 75%.

In the United States, the Environmental Protection Agency (EPA) supports and promotes glass recycling through various programs and guidelines that encourage municipalities and businesses to incorporate recycled materials in their operations.

Consumer demand for sustainable products is influencing manufacturers to adopt greener practices. There is a growing preference among consumers for products packaged in recycled glass because of its lower environmental impact compared to new glass or other packaging materials like plastic.

This consumer trend is pushing beverage companies, food producers, and other industries to use recycled glass packaging to align with market expectations and enhance their brand image as environmentally responsible.

Advances in technology are improving the efficiency and effectiveness of glass recycling. New sorting and processing technologies are enabling higher purity and quality of recycled glass, making it suitable for a broader range of applications, including those requiring high clarity and strength.

Investment in better collection and sorting facilities is also on the rise, driven by both private and public funding aimed at enhancing the recycling infrastructure.

There is an increasing collaboration among countries, industries, and organizations to improve glass recycling rates globally. Major glass manufacturers and consumer goods companies are committing to higher usage rates of recycled content in their products, supported by global initiatives to reduce waste and improve recycling rates.

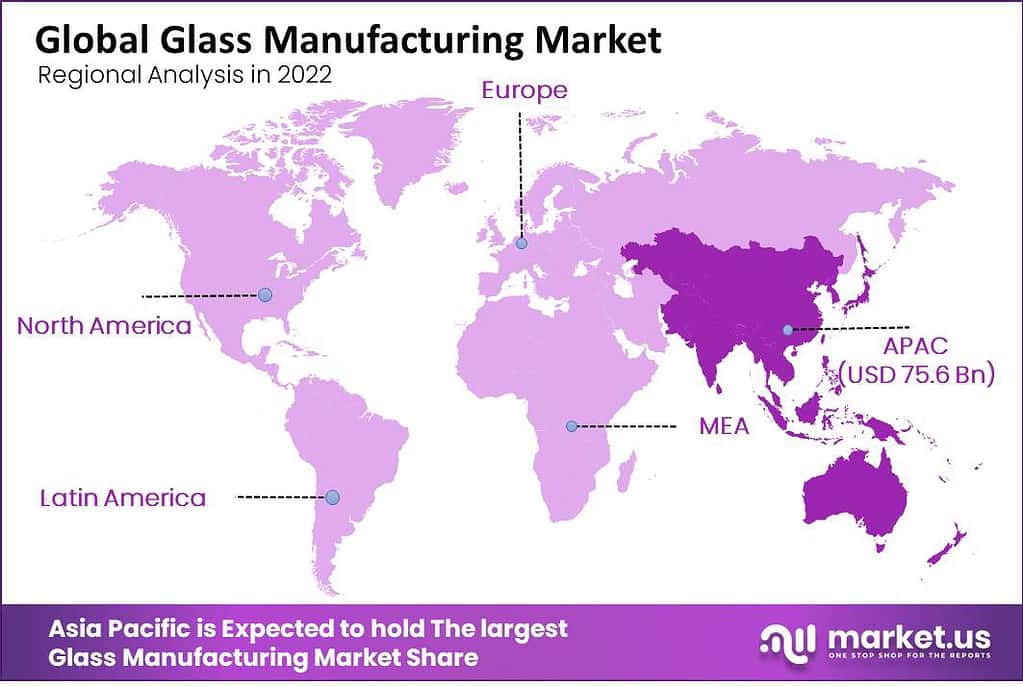

Regional Analysis

Asia Pacific is the Dominant Region in the Global Glass Manufacturing Market

Asia Pacific is anticipated to be the most dominant region in the global glass manufacturing market with the largest market share of 41% and is projected to register a CAGR of 5.8% during the forecast period.

Asia-Pacific leads the market primarily owing to the growth of the construction industry in China & India and the increasing demand for glass-based products.

North America will register a revenue-based CAGR of 5.3% during the forecast period. Demand for products is driven by increasing investments in the food & beverage, pharmaceutical, and construction industries.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

The fragmented market and the growing product demand have led to cutthroat competition in the glass manufacturing industry. Companies have adopted a number of strategies to increase their market presence which include mergers & acquisitions. They also use partnerships, collaborations, and new product launches.

Market players are focusing their efforts on the differentiation of the manufacturing process & innovation in products. In September 2021, Gerresheimer a French company announced that it would use hybrid technology to melt glass in its Lohr plant. The company plans to overcome CO2 emissions in the manufacturing of glass tubes & containers by using this technology.

Market Key Players

- 3B – the fiberglass company

- AGC Inc.

- AGI glaspac

- Amcor

- Central Glass Co. Ltd.

- Fuyao Glass Industry Group Co. Ltd.

- Guardian Industries

- Heinz Glass

- Koa Glass

- Nihon Yamamura

- Nippon Sheet Glass Co., Ltd.

- NSG Co., Ltd

- O-I Glass Inc.

- Owens Illinois Inc.

- Saint Gobain

- Vitro

Recent Developments

- In March 2022, Saint-Gobain will inaugurate its new float-glass facility & integrated window line worth INR 500 crores (USD 62.5 million) in Chennai, India. The company is a leader in India for building materials & sustainable construction. It also expects the country to experience sustained high growth.

- In 2022, Vitro, a key player in the glass manufacturing market revealed that Solarban low-E, solar control glasses were used for four of the top ten green building projects selected by the AIA Committee.

Report Scope

Report Features Description Market Value (2022) USD 189 Bn Forecast Revenue (2032) USD 309.8 Bn CAGR (2023-2032) 5.2% Base Year for Estimation 2023 Historic Period 2020-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product (Container Glass, Flat Glass, Fiber Glass, and Other Products), By Manufacturing Process(Float Process, Blown Process, Pressing and Casting, Drawing Process, Others), By Application (Packaging, Construction, Transportation, Electrical and electronics, Telecommunication, and Other Applications) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape 3B – the fiberglass company, AGC Inc., AGI glaspac, Amcor, Central Glass Co. Ltd., Fuyao Glass Industry Group Co. Ltd., Guardian Industries, Heinz Glass, Koa Glass, Nihon Yamamura, Nippon Sheet Glass Co., Ltd., NSG Co., Ltd, O-I Glass Inc., Owens Illinois Inc., Saint Gobain, Vitro Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- AGC Inc.

- Fuyao Glass Industry Group Co. Ltd.

- Guardian Industries

- Saint-Gobain

- O-I Glass Inc.

- AGI glaspac

- Nihon Yamaura Glass Co., Ltd.

- Vitro

- 3B- the fiberglass company

- Other Key Players