Global Geochemical Services Market Size, Share and Industry Analysis Report By Type (Laboratory-based, Infiled-based), By Service Type (Sample Preparation, Mixed Acid Digest, Hydrogeochemistry, Fire Assay, X-ray Fluorescence, Aqua Regia Digest, Others), By Technology (Machine Learning, Natural Language Processing (NLP), Data Analytics, Others), By End-user (Mineral and Mining, Oil and Gas, Archaeological Survey, Others), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

- Published date: Oct 2024

- Report ID: 129969

- Number of Pages: 300

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

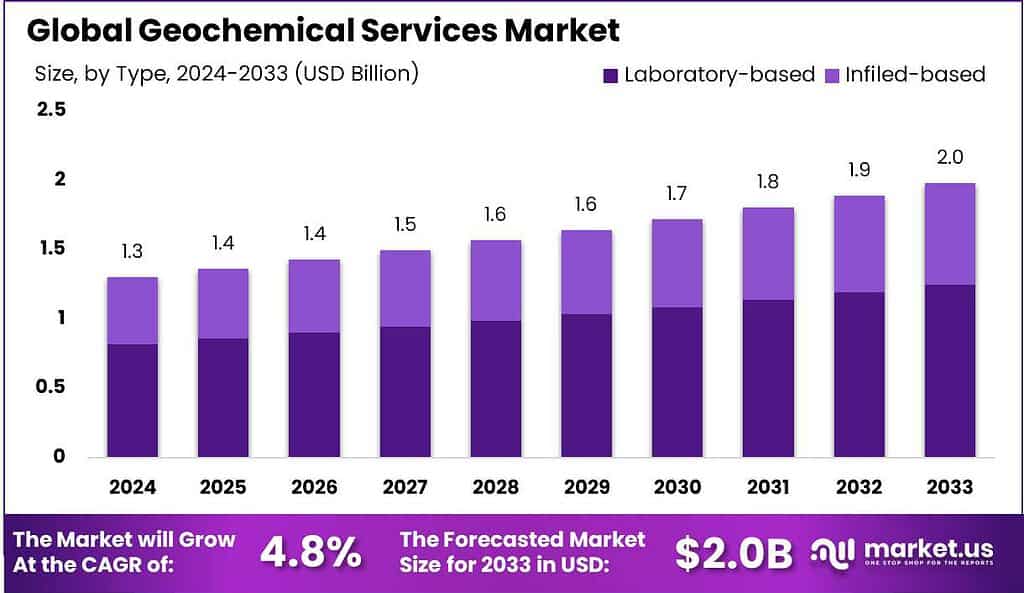

The Global Geochemical Services Market size is expected to be worth around USD 2.0 Billion by 2033, from USD 1.3 Billion in 2023, growing at a CAGR of 4.8% during the forecast period from 2024 to 2033. In contrast, the largest and fastest-growing market is the Asia Pacific region, which holds a significant 37.2% market share valued at USD 0.4 billion.

The Geochemical Services Market encompasses a spectrum of specialized analytical techniques employed to assess earth materials’ chemical properties and composition. These services involve collecting samples from soil, water, and rocks, and employing advanced analytical techniques to detect and quantify mineral deposits, assess environmental contamination, and support resource management decisions.

Regionally, the Asia Pacific market emerges as a dominant player, commanding over 37.2% of the global market share. This is largely attributed to the heightened demand for minerals in countries like China and India, which are pivotal in global supply chains. The strategic importance of this region is underscored by its vast mineral reserves and the extensive industrial activities that require regular geochemical assessments.

For instance, in April 2020, the Canadian government unveiled its “Economic Response Plan,” a COVID-19 aid package. The Canadian prime minister announced a total of USD 1.9 billion in public investment to revive the nation’s oil and gas sector.

The provinces of Alberta, Saskatchewan, British Columbia, and Saskatchewan’s administration all receive approximately USD 1.3 billion in funding to clean up inactive hydrocarbon assets. Additionally, the new Emissions Reduction Fund will lend USD 560 million to oil and gas companies so they can monitor dangerous emissions like methane from both onshore and offshore wells.

Numerous countries in the Asia-Pacific region, such as Singapore, Malaysia, Australia, and India, have started making investments in the mining industry. As per the India Brand Equity Foundation (IBEF), India’s mining output in 2019 amounted to 729.10 million tons. India produces ninety-five different types of minerals fifty-five minor, four fuel-related, three atomic, twenty-three non-metallic, and ten metallic. This factor is anticipated to propel the global market share for geochemical services during the estimated year.

Key Takeaways

- The Global Geochemical Services Market size is expected to be worth around USD 2.0 Billion by 2033, from USD 1.3 Billion in 2023, growing at a CAGR of 4.8% during the forecast period from 2024 to 2033.

- Laboratory-based geochemical services dominated the market with a 62.5% share due to their precision and reliability.

- Sample Preparation dominated the Geochemical Services Market with a 28.4% share.

- Machine Learning dominated the Geochemical Services Market’s Technology segment with a 34.5% share.

- Mineral & Mining dominated the Geochemical Services Market with a 54.6% share.

- Asia Pacific leads the Geochemical Services market with 37.2%, valued at USD 0.4 billion.

By Type Analysis

Laboratory-based geochemical services dominated the market with a 62.5% share due to their precision and reliability.

In 2023, Laboratory-based held a dominant market position in the By Type segment of the Geochemical Services Market, capturing more than a 62.5% share. This substantial market share can be attributed to the advanced analytical capabilities and accuracy provided by laboratory environments, which are essential for geochemical analysis in mining, oil and gas exploration, and environmental monitoring.

Laboratory-based services offer comprehensive data analysis, utilizing sophisticated equipment and techniques to detect and quantify mineral deposits and assess environmental contamination. This method’s precision and reliability underpin its preferential adoption across diverse industries.

Conversely, infield-based services, while essential for immediate results and on-site decision-making, accounted for a lesser share of the market. These services are primarily utilized for rapid sample analysis directly at the exploration or extraction site, facilitating quick responses to geological findings.

By Service Type Analysis

Sample Preparation dominated the Geochemical Services Market with a 28.4% share.

In 2023, Sample Preparation held a dominant market position in the By Service Type segment of the Geochemical Services Market, capturing more than 28.4% share. This segment is critical as it encompasses the initial steps in geochemical analysis, which involve the preparation of samples to ensure accurate, consistent analytical results across various testing methods. Following closely are Mixed Acid Digest and Hydrogeochemistry, which are essential for the dissolution of mineral phases in samples and the analysis of dissolved ions and elements in waters, respectively.

Fire Assay, another significant service, is traditionally used for determining the precious metals content in mineral deposits through fusion and cupellation. This method’s accuracy and reliability make it indispensable in the quantification of gold and other precious metals. X-ray Fluorescence offers a rapid, non-destructive means of elemental analysis, pivotal for real-time decision-making in mining operations.

Aqua Regia Digest, utilized for dissolving metals not fully digested by other weaker acids, and Other specialized services, including trace element techniques and isotope analysis, also play crucial roles. These methods cater to specific needs such as detailed geochemical mapping and age dating of geological samples, highlighting the diversity and specialization within the Geochemical Services Market.

Each service type, by addressing particular aspects of geochemical testing, collectively contributes to a comprehensive understanding and utilization of geochemical data in environmental assessment, resource exploration, and mining operations.

By Technology Analysis

Machine Learning dominated the Geochemical Services Market’s Technology segment with a 34.5% share.

In 2023, Machine Learning held a dominant market position in the By Technology segment of the Geochemical Services Market, capturing more than a 34.5% share. This technology outperformed others due to its advanced capabilities in analyzing complex geological data, thereby enhancing mineral exploration accuracy and efficiency.

Following closely, Natural Language Processing (NLP) also demonstrated substantial market penetration, as it facilitated the interpretation and automation of textual data from geological reports and research papers. This integration is pivotal in identifying potential mineral deposits and geological formations.

Data Analytics, as another significant contributor, leveraged statistical tools to interpret vast datasets, aiding in predictive modelling and risk assessment within the geochemical sector. Its application helps firms in decision-making processes by providing deeper insights into mineral composition and distribution patterns.

By End-user Analysis

Mineral & Mining dominated the Geochemical Services Market with a 54.6% share.

In 2023, Mineral & Mining held a dominant market position in the By End-user segment of the Geochemical Services Market, capturing more than 54.6% share. This segment’s prominence can be attributed to increased demand for minerals and metals driven by rapid advancements in technology and electrification of vehicles, which require extensive mineral resources. As the primary consumers of geochemical services, mining companies rely heavily on these services for exploration and environmental monitoring, further bolstering the sector’s growth.

The Oil & Gas sector also leverages geochemical services, particularly in upstream activities to enhance the efficiency of exploration and production operations. Geochemical analysis aids in understanding the composition of hydrocarbons, thus optimizing drilling strategies and reducing operational risks.

Additionally, the Archaeological Survey segment utilizes geochemical services to analyze soil samples and sediments, helping to map ancient human activities and environmental changes over time. This application underscores the versatility of geochemical services beyond industrial uses, contributing to historical and cultural research.

Key Market Segments

By Type

- Laboratory-based

- Infiled-based

By Service Type

- Sample Preparation

- Mixed Acid Digest

- Hydrogeochemistry

- Fire Assay

- X-ray Fluorescence

- Aqua Regia Digest

- Others

By Technology

- Machine Learning

- Natural Language Processing (NLP)

- Data Analytics

- Others

By End-user

- Mineral & Mining

- Oil & Gas

- Archaeological Survey

- Others

Driving factors

Increased Demand from the Mining Sector

The Geochemical Services Market is experiencing significant growth due to the escalated demand from the mining sector. As industries seek to identify and quantify mineral deposits more efficiently, geochemical services are increasingly utilized to provide critical data that enhances exploration strategies and operational decision-making.

This sector, often seen as the backbone of geochemical services, drives demand for analyses that ensure resource extraction is economically viable and environmentally responsible. The integration of advanced geochemical testing and analysis techniques has further propelled this demand, aligning with the industry’s need for precision in identifying ore boundaries and compositions.

Environmental Regulations

Environmental regulations are playing a crucial role in shaping the Geochemical Services Market. Stricter global standards aimed at reducing environmental impact and promoting sustainable mining and exploration practices have mandated the need for comprehensive geochemical studies. These regulations necessitate detailed assessments of soil, water, and air quality before, during, and after extraction processes, fostering a consistent demand for geochemical services.

The intersection of increased environmental scrutiny and the requirement for regulatory compliance feeds into the expansion of geochemical services, ensuring that projects adhere to environmental safety standards.

Sustainable Development Initiatives

Sustainable development initiatives, often aligned with environmental regulations, significantly influence the Geochemical Services Market. These initiatives encourage the adoption of practices that minimize ecological disruption and promote the long-term sustainability of natural resources.

Geochemical services are integral to these efforts, providing essential data that helps companies align with sustainable practices and meet corporate social responsibility objectives. This shift towards sustainability not only broadens the scope of services required but also integrates geochemical expertise in the planning and monitoring stages of projects, enhancing market growth.

Rising Investment in Oil & Gas Exploration

The resurgence of global investment in oil and gas exploration is a potent catalyst for growth in the Geochemical Services Market. As energy companies expand their search for new oil and gas reserves, the need for detailed geochemical data becomes paramount. This data aids in pinpointing potential extraction sites, assessing reservoir quality, and monitoring environmental compliance. The confluence of high energy demand and the technological advancements in geochemical services underpins the enhanced accuracy and efficiency of exploration activities, thus driving the market’s expansion.

Urbanization and Infrastructure Development

Urbanization and infrastructure development are critical drivers for the Geochemical Services Market. The expansion of cities and the development of infrastructural projects like roads, bridges, and public facilities heighten the need for geological assessments that ensure structural integrity and environmental compliance.

Geochemical services contribute to these projects by analyzing soil and rock properties, which are essential for safe construction practices and sustainable urban planning. The continuous growth in urban areas worldwide, especially in emerging economies, necessitates ongoing support from geochemical services, fueling further market growth.

Restraining Factors

High Costs of Services: Limiting Market Accessibility

The high costs associated with geochemical services significantly restrain market growth by limiting accessibility to a broader client base. These services often involve sophisticated analytical techniques and equipment, along with specialized personnel, which contribute to higher operational and labor costs. Such expenses can deter smaller entities or regions with limited financial resources from utilizing these services, thereby narrowing the market. This factor fundamentally affects the market’s expansion by restricting its penetration into potentially lucrative but financially sensitive sectors.

Availability of Cheaper Alternatives: Intensifying Competitive Pressures

Cheaper alternatives to traditional geochemical services, such as basic geochemical testing kits or software-based simulations, present a substantial challenge. These alternatives appeal to cost-conscious consumers and small-scale projects, offering a significant price advantage over comprehensive geochemical analysis.

The rise of these alternatives fuels competitive pressure, forcing established players to either innovate or reduce prices, potentially eroding profit margins and affecting the overall market growth. This dynamic illustrates a direct correlation between the proliferation of cost-effective substitutes and the suppression of market expansion for higher-end services.

Economic Factors: Cyclical and External Impacts

Economic downturns and fluctuations in commodity prices can have a profound impact on investment in sectors like mining and oil & gas, which are major users of geochemical services. During economic recessions or periods of low commodity prices, companies may reduce exploration and production budgets, leading to decreased demand for geochemical analysis. This sensitivity to economic cycles places inherent volatility within the geochemical services market, making its growth prospects susceptible to broader economic conditions.

Public Perception and Opposition: Shaping Market Dynamics

Public perception and opposition to certain industries, such as mining and hydrocarbon extraction, can also pose significant challenges to the geochemical services market. Increased environmental awareness and opposition to projects perceived as harmful to the environment can delay or cancel projects, directly reducing demand for geochemical services.

This factor is increasingly influential as community engagement and environmental stewardship become central to project approval processes. The impact of public sentiment on industry activities highlights the interconnectedness of socio-political factors and market viability.

Growth Opportunity

Growth in Oil & Gas Exploration

The global geochemical services market is poised for significant expansion driven primarily by the increasing activities in oil and gas exploration. As energy companies continue to seek new reserves to meet global energy demands, the demand for geochemical services that can provide detailed analysis and data to optimize exploration efforts is expected to rise sharply. This trend is indicative of a broader industry movement towards extensive geological surveys and strategic exploration initiatives, which are fundamental to securing viable energy sources.

Increased Investment in Research and Development

Another pivotal factor contributing to the growth of the geochemical services market is the heightened investment in research and development (R&D). Companies within this sector are progressively investing in advanced technologies and methodologies to enhance the accuracy and efficiency of geochemical analyses.

These investments not only improve the quality of data but also reduce operational costs and timelines, making geochemical services more attractive to a broader range of industries, including mining and environmental science.

Focus on Sustainability

Sustainability concerns are also reshaping the geochemical services market. There is an increasing demand for services that can offer environmental assessments and ensure compliance with international environmental standards. This focus on sustainability is driving the adoption of innovative geochemical techniques that are less invasive and more environmentally friendly.

As industries worldwide intensify their efforts to minimize environmental impact, geochemical service providers that can offer sustainable and compliant solutions are likely to experience substantial growth.

Latest Trends

Technological Advancements

The Geochemical Services Market is expected to witness significant growth, driven by technological advancements. Enhanced analytical tools and techniques, such as X-ray fluorescence (XRF) and mass spectrometry, are becoming more sophisticated, offering faster and more accurate geochemical data. These advancements facilitate deeper insights into mineral exploration and environmental assessments, potentially reducing operational costs and increasing efficiency for clients across various sectors.

Laboratory vs. In-field Services

The distinction between laboratory and in-field services is becoming increasingly pronounced. In-field services are anticipated to gain traction, attributed to the development of portable technologies that allow for real-time data collection and analysis. This shift is poised to offer substantial benefits, including the immediate application of findings to operational processes and reduced turnaround times for projects. Conversely, laboratory services continue to play a crucial role, especially in complex analyses requiring controlled conditions and high accuracy levels.

Diverse Applications

Diverse applications of geochemical services are expanding into new industries, such as renewable energy and agriculture, alongside traditional sectors like oil and gas and mining. This trend is underpinned by a growing emphasis on sustainable practices and the need for more precise environmental monitoring. The application of geochemical services in these areas is expected to uncover new opportunities and drive market expansion as industries seek to comply with regulatory standards and improve their environmental impact assessments.

Regional Analysis

Asia Pacific leads the Geochemical Services market with 37.2%, valued at USD 0.4 billion.

The Geochemical Services market exhibits variegated growth dynamics across global regions, attributed to diverse industrial activities and regulatory landscapes. In North America, the market is driven by stringent environmental regulations and a robust oil & gas sector, leading to increased demand for geochemical testing to monitor environmental compliance and optimize resource extraction.

Europe follows a similar trajectory, with additional emphasis on sustainability and renewable energy projects necessitating comprehensive soil and mineral analyses.

Conversely, the Asia Pacific region, commanding a dominant 37.2% market share valued at USD 0.4 billion, stands as the largest and fastest-growing market. This is spurred by rapid industrialization, urbanization, and the expanding mining activities in countries like China, India, and Australia. The need for geochemical services in these nations is further amplified by government initiatives toward resource conservation and environmental protection.

In the Middle East & Africa, the market growth is closely tied to the oil & gas industry, where geochemical services are critical for exploration and environmental monitoring. Latin America, with its rich mineral reserves, sees a steady demand driven by the mining sector, particularly in countries such as Brazil and Chile, which are heavily investing in exploration and production activities.

This regional segmentation highlights the pivotal role geochemical services play in supporting industrial and environmental objectives, positioning the Asia Pacific as the clear leader in this sector.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of the Middle East & Africa

Key Players Analysis

In the global geochemical services market exhibits robust competitive dynamics with a spectrum of key players strategically positioned to capitalize on industry growth. These companies, which range from specialized laboratories to integrated service providers, play a pivotal role in supporting exploration, environmental studies, and resource development.

Actlabs Group and Activation Laboratories Ltd. stand out for their comprehensive analytical and testing services, which are vital in the early stages of mineral exploration. Their innovative approaches in geochemical testing are critical for clients aiming to expedite their project development timelines.

ALS Limited and Bureau Veritas Group maintain their positions as industry leaders due to their global footprints and extensive service offerings that extend beyond geochemical analysis to include environmental and quality assurance solutions. This broad service portfolio enables them to serve a diverse client base from mining to environmental sectors.

SGS SA and Intertek Group plc are notable for their stringent quality control measures and data processing capabilities. Their commitment to delivering reliable and actionable insights makes them preferred partners for major mining companies and environmental agencies.

FLSmidth, Schlumberger Limited, and Weatherford International are distinguished by their integration of geochemical services with drilling and geological data analysis, offering a more comprehensive view of subsurface conditions. This integration is particularly valued in oil and gas industries where precise data is crucial for operational decisions.

Saudi Aramco shows strategic involvement in geochemical services to bolster its exploration capabilities, particularly in challenging and frontier markets. Their investments in advanced geochemical technologies are indicative of a broader industry trend toward innovation and efficiency.

Fugro remains a leader in providing geochemical survey data, crucial for offshore and remote projects. Their advanced remote sensing and data analytics capabilities are instrumental in reducing exploratory risks and enhancing resource evaluation.

Emerging players like Nexus Gold and GeoMark Research are carving niches by focusing on specialized services and regional markets, offering tailored solutions that appeal to small to mid-sized exploration firms.

The landscape suggests that these key players are not only expanding their technological capabilities but also forming strategic alliances to leverage their respective strengths in a highly competitive market. The overarching trend is towards embracing advanced technologies and expanding service scopes to meet the increasing demands of a dynamic global market.

Market Key Players

- Actlabs Group

- ALS Limited

- Bureau Veritas Group

- Capital Limited

- Chinook Consulting Services Ltd.

- Enviros

- FLSmidth

- Fugro

- Intertek Group plc

- Saudi Aramco

- Schlumberger Limited

- SGS SA

- Shiva Analyticals& Testing Laboratories India

- Geochemic Ltd.

- Activation Laboratories Ltd.

- ACZ Laboratories Inc.

- Alex Stewart International

- AGAT Laboratories Ltd.

- Nexus Gold

- Premier Oilfield Group

- GeoMark Research

- Weatherford International

Recent Development

- In February 2024, this company reported outcomes from prospecting and soil sampling studies conducted on the Olympic Claims of its Reliance Gold Project in southern British Columbia. This development is a part of the ongoing efforts to explore and evaluate the gold prospects in the region.

- In 2023, SGS SA further developed its geochemical service facilities to include more advanced analytical technologies. This development aims to provide more precise and faster analysis to support mining operations and environmental compliance.

Report Scope

Report Features Description Market Value (2023) USD 1.3 Billion Forecast Revenue (2033) USD 2.0 Billion CAGR (2024-2032) 4.8% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type (Laboratory-based, Infiled-based), By Service Type (Sample Preparation, Mixed Acid Digest, Hydrogeochemistry, Fire Assay, X-ray Fluorescence, Aqua Regia Digest, Others), By Technology (Machine Learning, Natural Language Processing (NLP), Data Analytics, Others), By End-user (Mineral & Mining, Oil & Gas, Archaeological Survey, Others) Regional Analysis North America – The US, Canada, Rest of North America, Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America – Brazil, Mexico, Rest of Latin America, Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape Actlabs Group, ALS Limited, Bureau Veritas Group, Capital Limited, Chinook Consulting Services Ltd., Enviros, FLSmidth, Fugro, Intertek Group plc, Saudi Aramco, Schlumberger Limited, SGS SA, Shiva Analyticals& Testing Laboratories India, Geochemic Ltd., Activation Laboratories Ltd., ACZ Laboratories Inc., Alex Stewart International, AGAT Laboratories Ltd., Nexus Gold, Premier Oilfield Group, GeoMark Research, Weatherford International Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Geochemical Services marketPublished date: Oct 2024add_shopping_cartBuy Now get_appDownload Sample

Geochemical Services marketPublished date: Oct 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Actlabs Group

- ALS Limited

- Bureau Veritas Group

- Capital Limited

- Chinook Consulting Services Ltd.

- Enviros

- FLSmidth

- Fugro

- Intertek Group plc

- Saudi Aramco

- Schlumberger Limited

- SGS SA

- Shiva Analyticals& Testing Laboratories India

- Geochemic Ltd.

- Activation Laboratories Ltd.

- ACZ Laboratories Inc.

- Alex Stewart International

- AGAT Laboratories Ltd.

- Nexus Gold

- Premier Oilfield Group

- GeoMark Research

- Weatherford International