Generic Injectable Market By Product Type (Monoclonal Antibodies, Vaccines, Small Molecule Antibiotics, Peptide Hormone, Peptide Antibiotics, Insulin, Immunoglobin, Cytokines, Chemotherapy Agents, and Blood Factors), By Molecular Type (Large Molecule, and Small Molecule), By Application (Oncology, Pain Management, Musculoskeletal Disorders, Infectious Diseases, Hormonal Disorders, Diabetes, CNS Diseases, Cardiovascular Diseases, Blood Disorders, and Others), By Distribution Channel (Hospital Pharmacy, Retail Pharmacy, Online Pharmacy, and Drug Stores), By Administration (Intravenous (IV), Subcutaneous (SC), and Intramuscular (IM)), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Oct 2025

- Report ID: 160384

- Number of Pages: 219

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Product Type Analysis

- Molecular Type Analysis

- Application Analysis

- Distribution Channel Analysis

- Administration Analysis

- Key Market Segments

- Drivers

- Restraints

- Opportunities

- Impact of Macroeconomic / Geopolitical Factors

- Latest Trends

- Regional Analysis

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

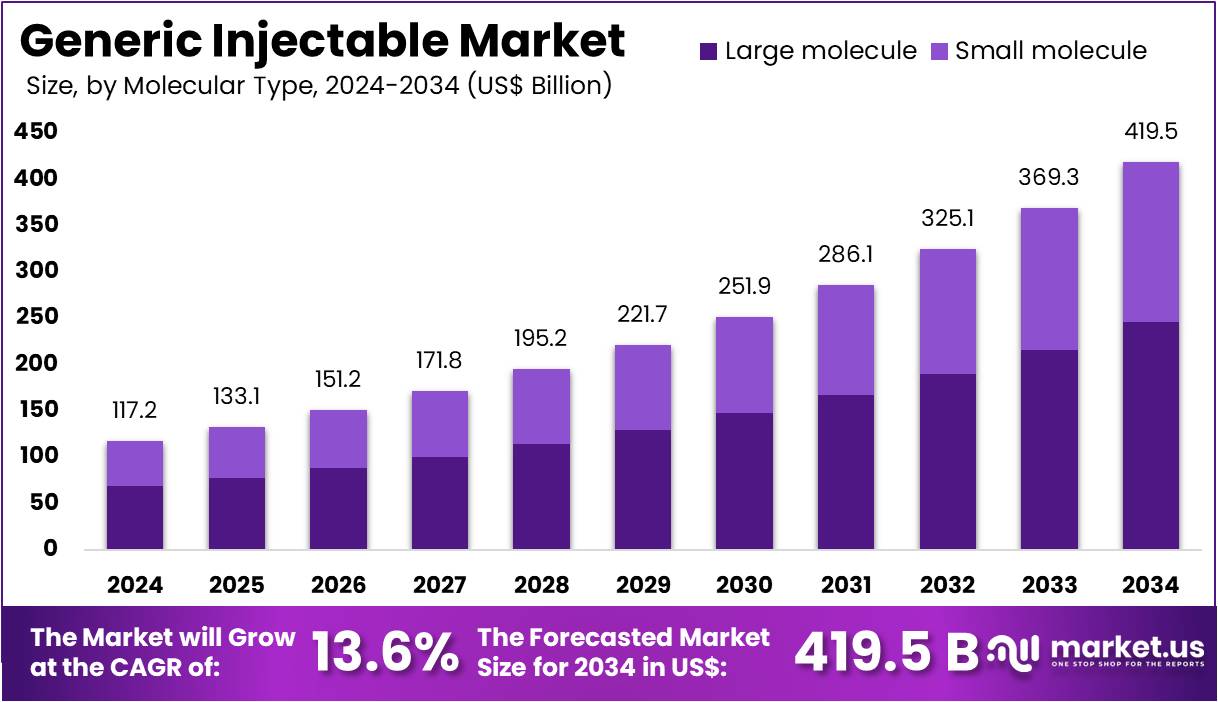

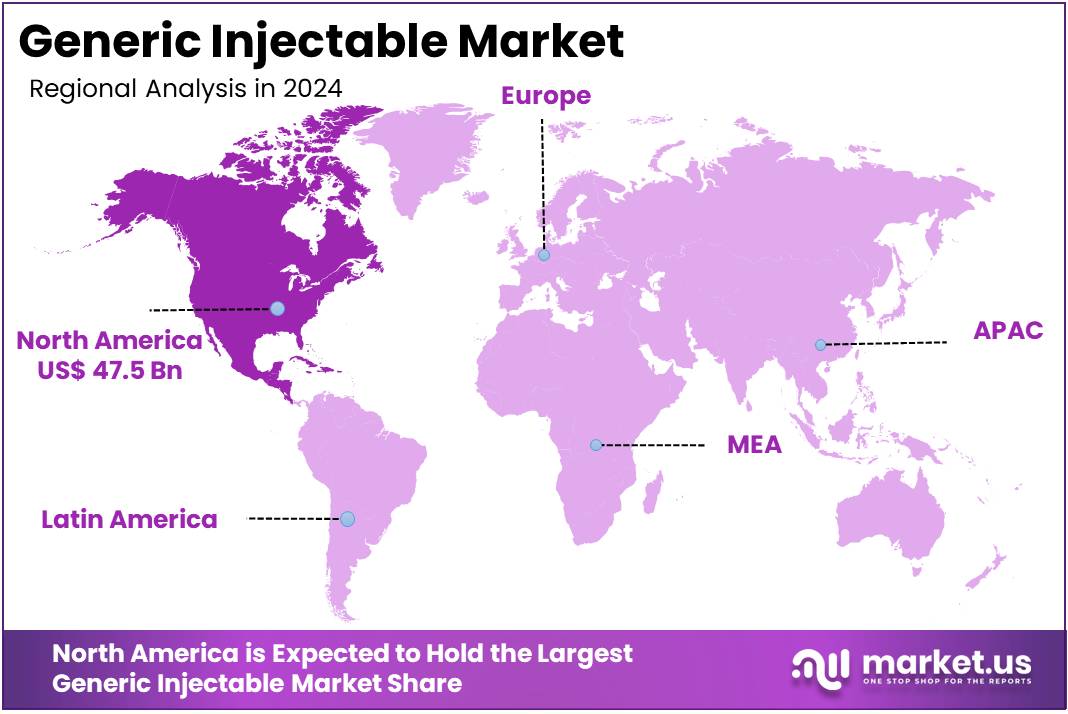

The Generic Injectable Market size is expected to be worth around US$ 419.5 billion by 2034 from US$ 117.2 billion in 2024, growing at a CAGR of 13.6% during the forecast period 2025 to 2034. North America held a dominant market position, capturing more than a 40.7% share and holds US$ 47.5 Billion market value for the year.

Rising demand for cost-effective therapies is driving growth in the generic injectable market, as healthcare providers increasingly prefer affordable alternatives to branded drugs for hospital and critical care settings. The increasing prevalence of chronic diseases such as cardiovascular disorders, diabetes, and cancer has fueled the need for injectable treatments, particularly in oncology and intensive care units. In March 2024, Alex Oshmyansky, CEO of Mark Cuban Cost Plus Drug Company, announced plans to produce ICU-grade epinephrine and norepinephrine, followed by pediatric chemotherapy drugs, aiming to improve supply stability and reduce treatment costs.

Hospitals report shortages of essential injectables, highlighting the importance of domestic manufacturing to meet clinical demand. Government initiatives, such as the FDA’s Drug Shortage Program, indicate that nearly 130 injectable drugs faced shortages in 2023, emphasizing the need for scalable generic production. Increased adoption of hospital-administered injectables positions the market for sustained expansion over the next several years.

Growing focus on oncology and specialty care is opening opportunities for generic injectable manufacturers to expand their portfolios. In August 2024, Lupin launched Doxorubicin Hydrochloride Liposome Injection in the US, providing a cost-effective alternative for cancer therapy and increasing patient access to essential treatment. Generic injectables targeting chemotherapy, immunotherapy, and anti-infective applications are gaining attention due to high treatment costs and complex dosing regimens.

Hospitals and specialty clinics are increasingly investing in automated infusion systems compatible with multiple injectables, encouraging manufacturers to develop versatile formulations. According to the American Hospital Association, nearly 60% of acute care hospitals reported increased usage of generic injectables in 2023, signaling strong adoption trends. Strategic partnerships between pharmaceutical companies and contract manufacturing organizations further enable efficient production of high-demand injectables, reducing lead times and ensuring consistent supply.

Increasing emphasis on innovation and regulatory support is shaping trends in the generic injectable market. Companies are focusing on sterile manufacturing technologies, advanced lyophilization methods, and ready-to-use prefilled syringes to enhance drug stability and reduce administration errors. The rise of hospital-acquired infections and the need for intravenous antibiotics have accelerated the development of multi-dose injectable solutions. Market participants are also exploring biosimilar injectables for monoclonal antibodies and hormones, expanding treatment options across various therapeutic areas.

Collaboration between industry players and regulatory bodies facilitates accelerated approval pathways while maintaining safety standards. For example, recent FDA guidelines have streamlined bioequivalence testing for complex generics, helping manufacturers bring injectable alternatives to market faster. These innovations support broader adoption of generic injectables in critical care, oncology, and chronic disease management, reinforcing the market’s long-term growth trajectory.

Key Takeaways

- In 2024, the market generated a revenue of US$ 117.2 billion, with a CAGR of 13.6%, and is expected to reach US$ 419.5 billion by the year 2034.

- The product type segment is divided into monoclonal antibodies, vaccines, small molecule antibiotics, peptide hormone, peptide antibiotics, insulin, immunoglobin, cytokines, chemotherapy agents, and blood factors, with monoclonal antibodies taking the lead in 2023 with a market share of 26.7%.

- Considering molecular type, the market is divided into large molecule and small molecule. Among these, large molecule held a significant share of 58.6%.

- Furthermore, concerning the application segment, the oncology sector stands out as the dominant player, holding the largest revenue share of 29.4% in the market.

- The distribution channel segment is segregated into hospital pharmacy, retail pharmacy, online pharmacy, and drug stores, with the hospital pharmacy segment leading the market, holding a revenue share of 44.7%.

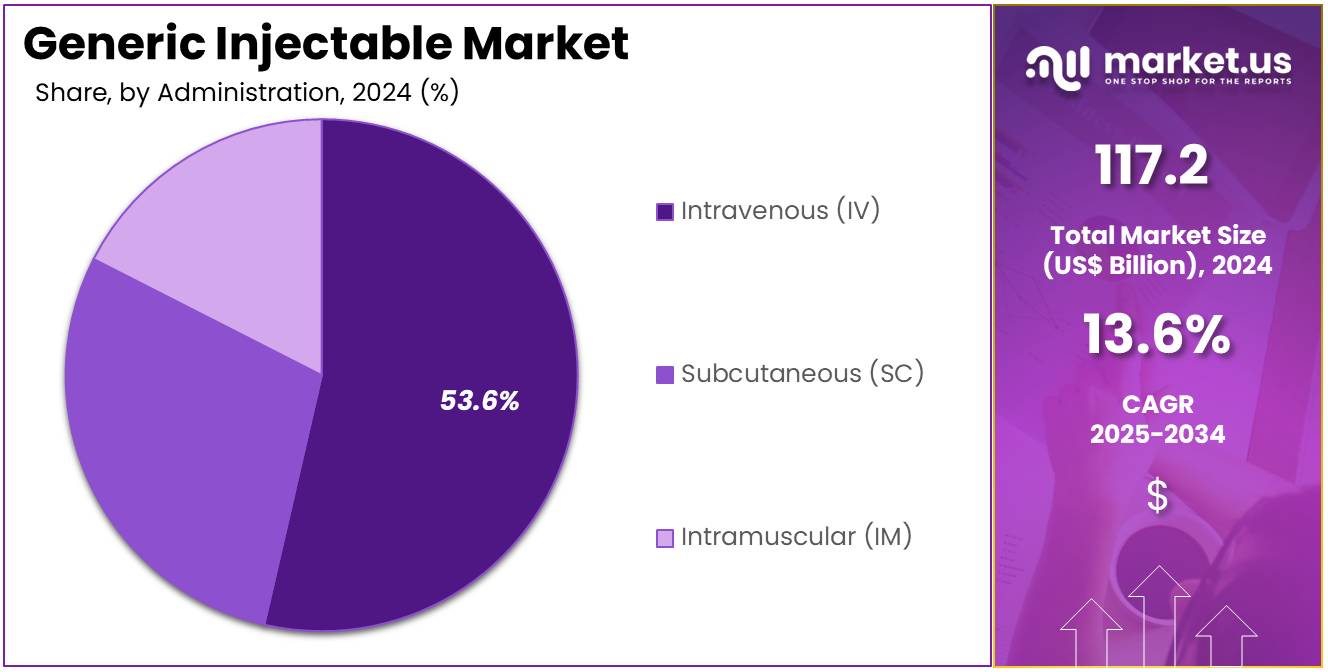

- Considering administration, the market is divided into intravenous (IV), subcutaneous (SC), and intramuscular (IM). Among these, intravenous (IV) held a significant share of 53.6%.

- North America led the market by securing a market share of 40.5% in 2023.

Product Type Analysis

Monoclonal antibodies held 26.7% share and are expected to remain dominant due to their expanding use in oncology, autoimmune diseases, and rare genetic conditions. Rising approvals of biosimilars are anticipated to reduce treatment costs and improve accessibility for patients in both developed and emerging markets. Pharmaceutical companies are investing heavily in clinical trials, expanding therapeutic pipelines, and securing faster regulatory approvals. Partnerships between biotech innovators and large pharma players are driving innovation and market expansion.

Governments are also providing funding support to accelerate biologics production capacity. Increasing adoption of personalized medicine is projected to push monoclonal antibodies further into mainstream care. The ability to deliver targeted therapies with fewer side effects is enhancing their preference among physicians. Growth in manufacturing facilities, especially in Asia, is likely to strengthen global supply networks. Rising patient awareness of advanced biologics is fueling broader acceptance. This convergence of affordability, accessibility, and innovation is sustaining strong growth.

Molecular Type Analysis

Large molecules accounted for 58.6% share and are projected to dominate the molecular type segment. Their effectiveness in complex disease management such as oncology, cardiovascular, and autoimmune disorders is driving widespread adoption. Increasing approvals of biosimilars and biologic generics are anticipated to expand market reach and affordability. Manufacturing investments in biopharmaceutical facilities across North America, Europe, and Asia are boosting production capacity. Large molecules’ targeted therapeutic action with improved safety profiles is supporting strong clinical demand.

Governments and healthcare institutions are prioritizing biologics in treatment guidelines, reinforcing their importance. Strategic collaborations for large molecule R&D pipelines are advancing rapidly. Growing patient demand for effective long-term therapies is expected to strengthen adoption. Enhanced distribution through hospital pharmacies is improving accessibility. Collectively, these factors are ensuring sustained market leadership for large molecules.

Application Analysis

Oncology, with 29.4% share, remains the leading application in the generic injectable market. Rising global cancer prevalence is fueling demand for accessible and affordable treatment options. Generic oncology injectables are anticipated to reduce treatment costs significantly, improving patient access in developing nations. Governments are expanding cancer treatment programs and reimbursement policies, which are projected to strengthen this segment. Increasing approvals of biosimilar oncology drugs are driving adoption across healthcare systems.

Pharmaceutical companies are scaling production capacities to meet growing oncology demand. Clinical advancements are expanding therapeutic uses of oncology injectables, enhancing their treatment scope. Rising collaborations between manufacturers and hospitals are boosting supply efficiency. Oncology injectables are also benefiting from heightened patient awareness of advanced care solutions. These combined dynamics are solidifying oncology’s leadership in the application segment.

Distribution Channel Analysis

Hospital pharmacies, capturing 44.7% share, are expected to lead distribution due to their central role in injectable drug administration. They serve as the primary point for managing acute and chronic disease patients requiring immediate therapies. Rising hospitalization rates and increasing surgical procedures are fueling injectable demand. Governments are investing in hospital infrastructure, reinforcing their supply and storage capacities. Bulk procurement by hospital systems is driving affordability and accessibility of injectables.

Growth in oncology and critical care cases is anticipated to strengthen hospital pharmacy reliance. Pharmaceutical companies are aligning distribution strategies to meet hospital demand effectively. Advanced supply chain integration is ensuring timely delivery of essential injectables. Patient preference for hospital-based treatments further supports this dominance. Collectively, these factors are positioning hospital pharmacies as the backbone of the generic injectable market.

Administration Analysis

Intravenous administration accounted for 53.6% share and is anticipated to sustain dominance as the primary route of injectable drug delivery. IV delivery is critical for oncology, emergency care, and chronic therapies where immediate drug action is required. Its superior bioavailability compared to other methods supports strong physician preference. The growing prevalence of cancer, diabetes, and cardiovascular diseases is driving infusion therapies.

Expansion of outpatient infusion centers is projected to improve patient access. Technological advancements in infusion systems are enhancing safety and precision. Rising demand for rapid-acting treatments in critical care supports IV growth. Governments are expanding healthcare infrastructure, boosting infusion therapy capacity. Hospitals remain the largest consumer base due to reliance on IV administration. This widespread clinical necessity ensures IV’s continued leadership in the administration segment.

Key Market Segments

By Product Type

- Monoclonal Antibodies

- Vaccines

- Small molecule antibiotics

- Peptide hormone

- Peptide antibiotics

- Insulin

- Immunoglobin

- Cytokines

- Chemotherapy agents

- Blood factors

By Molecular Type

- Large Molecule

- Small Molecule

By Application

- Oncology

- Pain Management

- Musculoskeletal Disorders

- Infectious Diseases

- Hormonal Disorders

- Diabetes

- CNS Diseases

- Cardiovascular Diseases

- Blood Disorders

- Others

By Distribution Channel

- Hospital pharmacy

- Retail pharmacy

- Online pharmacy

- Drug stores

By Administration

- Intravenous (IV)

- Subcutaneous (SC)

- Intramuscular (IM)

Drivers

Impending Patent Expirations is driving the market

The imminent wave of patent expirations for numerous high-revenue, branded injectable drugs serves as the primary and most powerful driver for the generic injectable market’s expansion. Once exclusivity ends, generic manufacturers are legally permitted to introduce bioequivalent, lower-cost versions, which fundamentally transforms the market dynamics and creates immediate opportunities for significant revenue capture. This phenomenon, often termed the “patent cliff,” is crucial for healthcare systems as it facilitates massive cost savings and increases patient access to essential treatments.

The financial impact is profound: generic drugs already account for over 90% of all prescriptions filled in the United States, yet they represent only about 13.1% of the nation’s total prescription drug spending as of 2023, showcasing the immense value proposition. Analysts project that between 2025 and 2030, nearly 70 high-revenue pharmaceutical products will lose patent protection, collectively placing an estimated colossal US$236 billion in annual revenue at risk for originator companies. The strategic entry of generic sterile injectables into these newly available therapeutic areas, such as oncology and cardiovascular health, allows for significant market share capture almost instantly, fueling a robust growth cycle.

Restraints

High Regulatory and Manufacturing Complexity is restraining the market

The stringent and complex regulatory requirements for sterile injectable products, coupled with high manufacturing barriers, act as a significant restraint on the market. Unlike oral tablets, sterile injectables require impeccable aseptic conditions, specialized “fill-finish” capabilities, and rigorous quality control to prevent contamination, which substantially increases the capital investment and operational cost for generic manufacturers. These complexities contribute directly to the persistent problem of drug shortages, particularly for critical care generic injectables.

Data from analyses of drug shortages from 2018 to 2023 indicated that injectable drug products accounted for approximately 50% of all drug shortages, compared to 42.3% for oral products. Furthermore, the analysis highlighted the fragility of the injectable supply chain, finding that shortages for injectable products last roughly twice as long, with a median duration of 4.6 years, compared to a median of 1.6 years for oral products. This difficulty in maintaining a stable, high-quality supply chain limits the number of manufacturers willing to enter the market, creating a less resilient environment and constraining overall market growth and competition.

Opportunities

The Rise of Biosimilars for Large Molecule Injectables is creating growth opportunities

The ongoing maturation of the biosimilar market, particularly for complex biologic injectable drugs, represents a pivotal growth opportunity for generic manufacturers. Biosimilars are highly similar, interchangeable versions of approved biologic medicines, many of which are administered via injection for complex conditions like cancer and autoimmune disorders. As these high-value biologics begin to lose exclusivity, generic companies are leveraging advanced manufacturing and regulatory expertise to bring biosimilars to market, significantly driving down the cost of therapy.

The US Food and Drug Administration (FDA) has consistently supported this development, and this is evidenced by the continuous pipeline of approvals. For example, in the period covering the 2022 Fiscal Year, the FDA’s Center for Drug Evaluation and Research (CDER) approved or tentatively approved a total of 694 Abbreviated New Drug Applications (ANDAs), with a focus on first-time generic equivalents that often include complex injectable formats. This trend is further illustrated by the fact that the monoclonal antibodies segment of the generic sterile injectable market held the largest revenue share in 2023.

Impact of Macroeconomic / Geopolitical Factors

Rising inflation and interest rates drive up raw material costs for sterile injectables, compressing manufacturers’ margins and slowing expansion plans, while boosting demand for affordable alternatives as consumer budgets tighten. Geopolitical conflicts, particularly in Eastern Europe and Asia-Pacific, disrupt supplies of active pharmaceutical ingredients, causing shortages and increasing compliance risks for exporters.

However, companies counter these challenges by forming strategic alliances with suppliers in Latin America and Eastern Europe, enhancing supply chain resilience. Strong economic recovery in key markets fuels healthcare investments, increasing hospital procurements and outpatient procedures, which drives volume growth and supports a positive outlook for the sector.

The US imposition of a 100% tariff on imported branded pharmaceuticals, effective October 1, 2025, indirectly raises costs for generic parenteral drugs by inflating prices of shared intermediates from countries like India and China, straining hospital budgets and risking supply gaps. Conversely, the tariff spurs manufacturers to build US-based facilities to bypass import costs, creating high-skill jobs and reducing reliance on foreign supplies. It also encourages innovation in localized production techniques, potentially lowering costs over time. Industry leaders seize this opportunity to diversify into biosimilars and advanced delivery systems, positioning the market for long-term stability and growth.

Latest Trends

Shift Toward Ready-to-Use (RTU) and Pre-filled Formats is a recent trend

A dominant trend in the generic injectable market for 2024 is the accelerated shift from traditional glass vials to Ready-to-Use (RTU) and pre-filled syringe (PFS) formats. This transition is being heavily driven by hospitals and clinical settings seeking to enhance patient safety, minimize medication errors, and improve operational efficiency. RTU formats eliminate the need for manual reconstitution or dilution by pharmacy staff, which drastically reduces the risk of contamination and dosing inaccuracies—a critical benefit in high-pressure care environments.

The demand for these advanced delivery systems is evidenced by major industry investments, such as a prominent manufacturer announcing a US$1 billion investment over five years in the US to expand manufacturing and R&D, a key part of which is aimed at boosting production of ready-to-administer presentations. This move aligns with a broader industry preference for formats that require less preparation time, with pre-filled injectables consistently gaining favor among healthcare professionals for being more hygienic and offering greater stability for complex generic formulations.

Regional Analysis

North America is leading the Generic Injectable Market

In 2024, North America captured a 40.5% share of the global generic injectable market, sustained by accelerated patent expirations on high-volume biologics and escalating hospital demands for cost-effective alternatives amid inflationary pressures on branded therapies. Pharmaceutical manufacturers ramped up production of biosimilar versions for oncology and anti-infective treatments, enabling seamless substitutions that lowered acquisition costs by up to 30% in outpatient infusion centers.

The FDA’s efficient review processes expedited market entry for complex sterile formulations, fostering competition that stabilized supply chains disrupted by prior shortages. Collaborative efforts between generic firms and health systems refined cold-chain logistics, ensuring reliable delivery for time-sensitive vaccines and monoclonal antibodies. Regulatory incentives under the Biosimilar User Fee Act further catalyzed approvals, aligning with national priorities for equitable access in rural clinics.

Economic analyses underscored substantial savings for payers, prompting Medicare expansions in coverage for interchangeable injectables to combat rising chronic disease burdens. Venture investments targeted advanced aseptic filling technologies, enhancing scalability for emergency stockpiles. These elements reinforced the region’s pivotal role in affordable parenteral drug ecosystems. The FDA approved 14 first generic injectable drugs in 2024, including formulations such as Ephedrine Sulfate Injection and Cyclophosphamide Injection.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Analysts project the Asia Pacific generic injectable sector to expand dynamically during the forecast period, propelled by government-backed manufacturing incentives that bolster domestic production capacities in emerging economies. National regulators in India and China streamline approval pathways for sterile formulations, equipping public hospitals with affordable oncology and antibiotic options to address surging infectious disease caseloads.

Pharmaceutical enterprises collaborate with state-owned facilities to scale biosimilar outputs, anticipating reductions in import dependencies through localized fill-finish operations. Innovation clusters in Hyderabad and Shanghai pioneer nanotechnology-enhanced delivery systems, positioning mid-tier providers to penetrate export markets with high-potency payloads. Regional health ministries allocate subsidies for cold-storage infrastructure, enabling rural dispensaries to stock essential parenteral therapies without spoilage risks.

Local consortia focus on regulatory harmonization with international standards, facilitating cross-border trials for autoimmune injectables. These measures establish the region as a resilient hub for volume-driven parenteral innovations. Under India’s Pradhan Mantri Bhartiya Janaushadhi Pariyojana, sales of quality generic medicines, including injectables, reached Rs. 1,000 crore in fiscal year 2023-24.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Leading companies in the generic injectables sector advance their position by launching new formulations that target oncology and cardiology needs, addressing shortages and meeting rising demand for cost-effective treatments. They pursue mergers and acquisitions to integrate advanced manufacturing capabilities, expanding their therapeutic portfolios and accelerating regulatory approvals. Firms establish partnerships with contract manufacturers and global distributors to streamline supply chains and enhance market access in diverse regions.

Executives allocate significant resources to R&D for complex sterile products, incorporating innovative delivery systems like pre-filled syringes to improve efficiency. They focus on capacity expansions in emerging markets such as Asia-Pacific and Latin America, adapting to local compliance standards for broader penetration. Additionally, leaders implement subscription-like service models for ongoing supply assurance, building reliable client networks and sustained profitability.

Dr. Reddy’s Laboratories, founded in 1984 and headquartered in Hyderabad, India, specializes in affordable pharmaceuticals across generics, biosimilars, and innovative therapies for global markets. The company produces a wide array of injectables, including recent generics for HIV prevention like lenacapavir, to support chronic disease management and public health initiatives.

Dr. Reddy’s invests heavily in R&D to develop complex formulations, ensuring high-quality standards and rapid market entry through strategic collaborations. CEO Erez Israeli directs operations in over 60 countries, emphasizing innovation in sterile manufacturing and supply chain resilience. The firm partners with organizations like Unitaid and the Gates Foundation to deliver accessible solutions in low-income regions. Dr. Reddy’s maintains its competitive stature by prioritizing patient-centric advancements and robust regulatory compliance.

Top Key Players in the Generic Injectable Market

- Teva Pharmaceuticals

- Sun Pharmaceutical Industries Ltd

- Sanofi S.A

- Pfizer Inc

- Novartis AG

- Mylan N.A

- Merck & Co. Inc

- Fresenius Kabi

- Reddys Laboratries Ltd

- Cipla Ltd

- Baxter International

- Astra Zeneca Plc

Recent Developments

- In July 2024: Sun Pharmaceutical Industries received approval for Octreoscan™, a kit used to prepare Indium In 111 Pentetreotide Injection, a radioactive diagnostic agent. By offering a generic preparation solution for this specialized injectable, the company supports broader clinical adoption and reduces dependence on brand-name products, stimulating growth in the generic injectable sector.

- In June 2024: Teva Pharmaceuticals announced the US launch of an authorized generic version of Victoza® (liraglutide injection 1.8mg). This launch provides a lower-cost alternative for diabetes management, expanding patient access and increasing market penetration for authorized generics within the injectable therapeutics segment.

Report Scope

Report Features Description Market Value (2024) US$ 117.2 Billion Forecast Revenue (2034) US$ 419.5 Billion CAGR (2025-2034) 13.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Monoclonal Antibodies, Vaccines, Small Molecule Antibiotics, Peptide Hormone, Peptide Antibiotics, Insulin, Immunoglobin, Cytokines, Chemotherapy Agents, and Blood Factors), By Molecular Type (Large Molecule, and Small Molecule), By Application (Oncology, Pain Management, Musculoskeletal Disorders, Infectious Diseases, Hormonal Disorders, Diabetes, CNS Diseases, Cardiovascular Diseases, Blood Disorders, and Others), By Distribution Channel (Hospital Pharmacy, Retail Pharmacy, Online Pharmacy, and Drug Stores), By Administration (Intravenous (IV), Subcutaneous (SC), and Intramuscular (IM)) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Teva Pharmaceuticals, Sun Pharmaceutical Industries Ltd, Sanofi S.A, Pfizer Inc, Novartis AG, Mylan N.A, Merck & Co. Inc, Fresenius Kabi, DR. Reddys Laboratries Ltd, Cipla Ltd, Baxter International, Astra Zeneca Plc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Teva Pharmaceuticals

- Sun Pharmaceutical Industries Ltd

- Sanofi S.A

- Pfizer Inc

- Novartis AG

- Mylan N.A

- Merck & Co. Inc

- Fresenius Kabi

- Reddys Laboratries Ltd

- Cipla Ltd

- Baxter International

- Astra Zeneca Plc