Global Gene Panel Market By Product Type (Test Kits and Testing Services), By Technology (Amplicon-based and Hybridization-based), By Application (Cancer Risk Assessment, Pharmacogenetics, Diagnosis of Congenital Diseases, and Other), By Design (Predesigned Gene Panel and Customized Gene Panel), By End-user (Academic & Research Institutes, Pharmaceutical & Biotechnology Companies, and Hospital & Diagnostic Laboratories), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: May 2025

- Report ID: 65536

- Number of Pages: 296

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

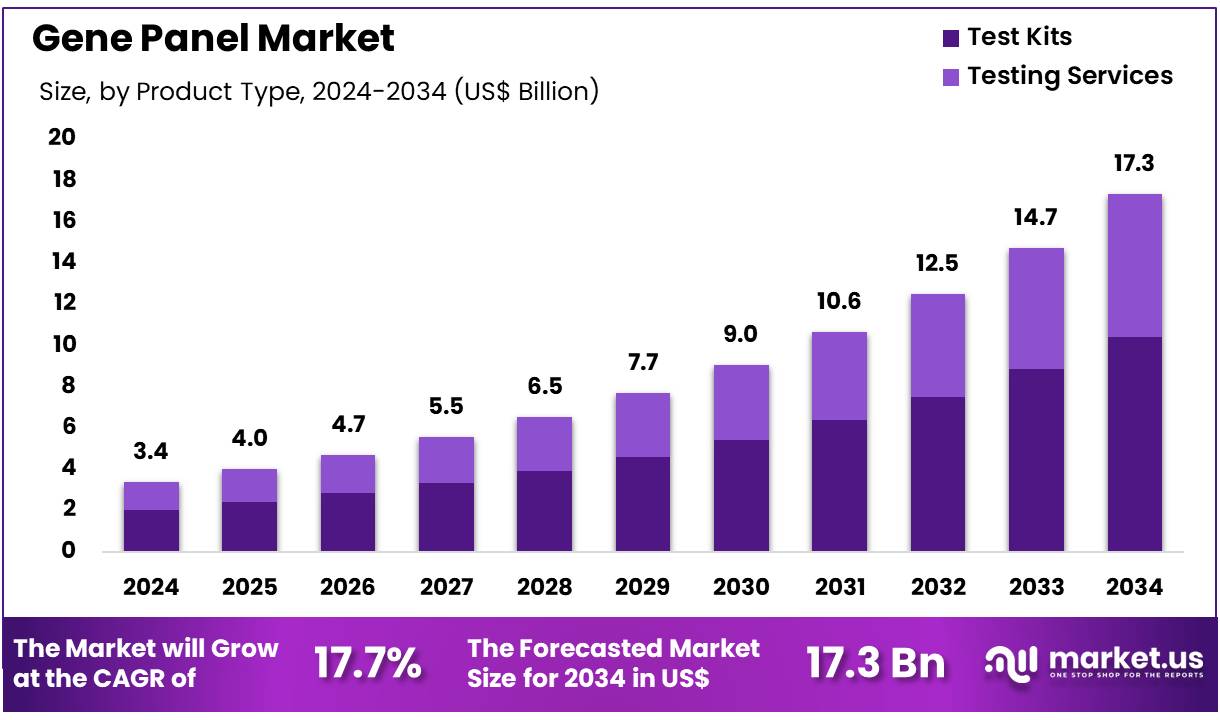

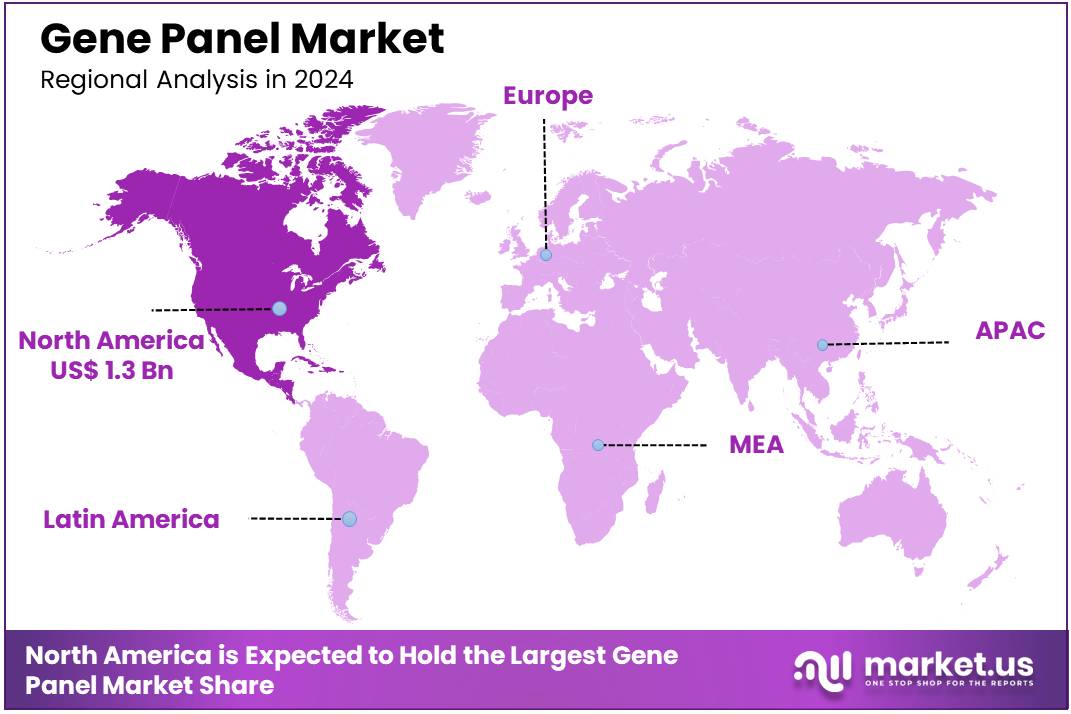

Global Gene Panel Market size is expected to be worth around US$ 17.3 Billion by 2034 from US$ 3.4 Billion in 2024, growing at a CAGR of 17.7% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 38.7% share with a revenue of US$ 1.3 Billion.

Growing emphasis on precision medicine and targeted therapies continues to drive expansion in the gene panel market. Gene panels enable simultaneous analysis of multiple genes, making them highly valuable for applications such as cancer risk assessment, congenital disease diagnosis, pharmacogenomics, and rare disease detection. Rising demand for cost-effective and rapid genomic testing solutions encourages healthcare providers and research institutions to adopt multi-gene panels over traditional sequencing techniques.

In April 2023, Agilent Technologies introduced an advanced NGS assay designed for somatic variant profiling across a wide variety of solid tumors. This tool is anticipated to play a significant role in advancing the field of precision oncology, offering comprehensive genomic profiling (CGP) capabilities to enable more accurate and personalized treatment plans for cancer patients. Ongoing innovations in NGS platforms and bioinformatics tools are streamlining data interpretation, boosting clinical adoption across both diagnostic and therapeutic domains.

Pharmaceutical companies increasingly leverage gene panel data to identify biomarkers, stratify patient populations, and optimize drug development pipelines. Expanding awareness of hereditary conditions and rising consumer interest in personalized health further support market growth. As regulatory frameworks evolve to accommodate genomic technologies, opportunities continue to emerge for developers offering validated and clinically actionable gene panel solutions. Moreover, collaborations between diagnostic firms and healthcare institutions are accelerating clinical integration and expanding test accessibility.

Key Takeaways

- In 2024, the market for Gene Panel generated a revenue of US$ 3. 4 billion, with a CAGR of 17.7%, and is expected to reach US$ 17.3 billion by the year 2033.

- The product type segment is divided into test kits and testing services, with test kits taking the lead in 2023 with a market share of 60.1%.

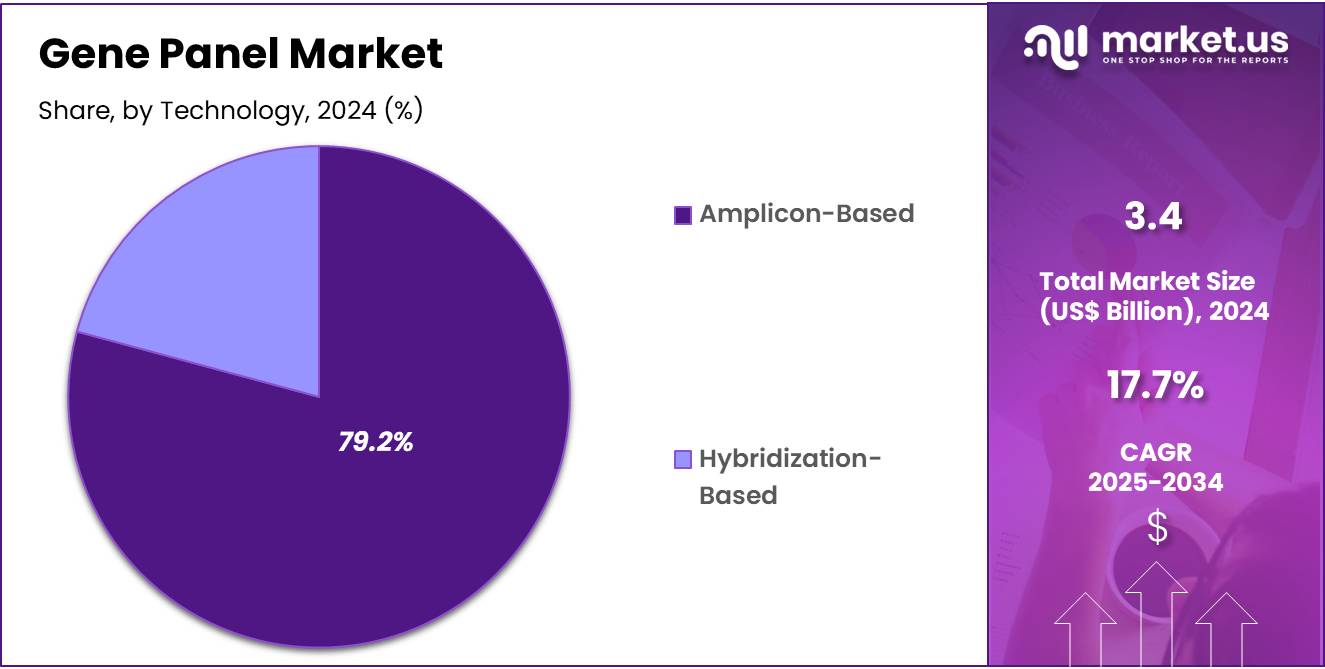

- Considering technology, the market is divided into amplicon-based and hybridization-based. Among these, amplicon-based held a significant share of 79.2%.

- Furthermore, concerning the application segment, the market is segregated into cancer risk assessment, pharmacogenetics, diagnosis of congenital diseases, and other. The cancer risk assessment sector stands out as the dominant player, holding the largest revenue share of 55.1% in the Gene Panel market.

- The design segment is segregated into predesigned gene panel and customized gene panel, with the predesigned gene panel segment leading the market, holding a revenue share of 67.1%.

- Considering end-user, the market is divided into academic & research institutes, pharmaceutical & biotechnology companies, and hospital & diagnostic laboratories. Among these, academic & research institutes held a significant share of 42.3%.

- North America led the market by securing a market share of 38.7% in 2023.

Product Type Analysis

The test kits segment claimed a market share of 60.1% owing to increasing demand for at-home and point-of-care genetic testing. Rising public awareness of early disease detection and prevention is anticipated to fuel the adoption of user-friendly kits. Researchers and clinicians prefer test kits for their ease of use, fast turnaround times, and cost efficiency.

Additionally, expanding direct-to-consumer genetic testing services by companies focusing on personal health insights is likely to accelerate market growth. Advancements in microfluidics and multiplexing technologies are expected to improve test kit performance and accessibility. Regulatory approvals for innovative kits targeting cancer, rare diseases, and carrier screening are also anticipated to support the segment’s expansion. As personalized medicine advances, the utility of test kits in clinical and research applications is projected to rise.

Technology Analysis

The amplicon-based held a significant share of 79.2% due to its ability to provide high coverage with minimal DNA input. Researchers prefer this method for its cost-effectiveness, rapid workflow, and suitability for targeted sequencing of known variants. The technology is expected to gain traction in oncology and inherited disease applications where focused gene coverage is sufficient.

As diagnostic laboratories seek scalable solutions for high-throughput screening, amplicon-based techniques are likely to become the method of choice. Reduced sequencing errors and simplified data analysis also contribute to its growing adoption. Increasing R&D investments in next-generation sequencing and companion diagnostics are projected to bolster demand. The method’s compatibility with automated workflows further supports its integration into routine clinical testing.

Application Analysis

The cancer risk assessment segment had a tremendous growth rate, with a revenue share of 55.1% owing to the rising prevalence of hereditary cancers and growing demand for preventive genetic screening. Clinicians are increasingly recommending multi-gene panels to identify mutations linked to breast, ovarian, colorectal, and prostate cancers. Advances in genomics and expanded insurance coverage for genetic testing are anticipated to drive adoption.

Early detection initiatives by public health agencies and private organizations are likely to increase awareness and access. As personalized oncology treatments evolve, oncologists are expected to rely more on risk assessment tools for therapy decisions. Pharmaceutical companies also utilize such panels to stratify patients in clinical trials. Expanding partnerships between genetic labs and cancer care centers are projected to further accelerate growth.

Design Analysis

The predesigned gene panel segment grew at a substantial rate, generating a revenue portion of 67.1% due to the convenience and reliability it offers for clinical and research use. Laboratories prefer predesigned panels as they reduce assay development time, ensure consistent performance, and comply with regulatory standards. Manufacturers have expanded offerings that cover common mutation profiles across various diseases, making them suitable for routine diagnostics.

As demand for standardization in genetic testing rises, predesigned options are anticipated to gain wider acceptance. Moreover, cost savings and scalability associated with mass production of standardized kits are likely to support market penetration. Rapid turnaround time and validated data outputs make predesigned panels appealing for large-scale studies and hospital diagnostics. The trend toward precision medicine further increases their relevance.

End-User Analysis

The academic & research institutes held a significant share of 42.3% due to increasing investments in genomics research and the global rise in academic collaborations. Universities and research centers are likely to expand their use of gene panels to study disease mechanisms, identify novel biomarkers, and validate genetic associations. Government grants supporting life sciences and molecular biology projects are expected to drive demand.

The accessibility of high-throughput sequencing tools and bioinformatics platforms also enables academic institutions to adopt gene panels more widely. Institutes play a critical role in technology validation and pilot studies, encouraging early-stage adoption of new panels. Moreover, their non-commercial nature allows them to conduct extensive comparative research, enhancing the market’s knowledge base. Collaborations with biotech firms further amplify the segment’s influence.

Key Market Segments

By Product Type

- Test Kits

- Testing Services

By Technology

- Amplicon-based

- Hybridization-based

By Application

- Cancer Risk Assessment

- Pharmacogenetics

- Diagnosis of Congenital Diseases

- Other

By Design

- Predesigned Gene Panel

- Customized Gene Panel

By End-user

- Academic & Research Institutes

- Pharmaceutical & Biotechnology Companies

- Hospital & Diagnostic Laboratories

Drivers

The increasing incidence of cancer and genetic diseases is driving the market

The increasing incidence of cancer and genetic diseases is a significant driver for the gene panel market. Gene panels allow for the simultaneous testing of multiple genes associated with specific diseases, providing comprehensive genetic information that aids in diagnosis, prognosis, and personalized treatment planning. As the global burden of cancer and the identification of genes linked to various inherited conditions continue to rise, the demand for efficient and targeted genetic testing solutions like gene panels increases.

Healthcare providers increasingly utilize these panels to identify actionable genetic alterations in tumors or to confirm diagnoses in patients with suspected genetic disorders. The scale of this health challenge underscores the need for advanced diagnostic tools; for example, the National Cancer Institute estimated that in 2023, there were approximately 1,958,310 new cases of cancer diagnosed in the US.

Restraints

Challenges in reimbursement and coverage are restraining the market

Challenges in obtaining consistent reimbursement and broad insurance coverage are restraining the gene panel market. The cost of developing, performing, and interpreting gene panel tests can be substantial, and securing adequate reimbursement from public and private payors remains a complex hurdle for diagnostic laboratories and manufacturers. Policies regarding which genes or panels are considered medically necessary, the specific clinical indications for testing, and the level of evidence required for coverage vary significantly, creating uncertainty and administrative burdens.

This lack of uniform and predictable reimbursement can limit patient access to testing and slow market adoption, particularly for newly developed or broader panels. Despite the clinical value gene panels offer, navigating the complex landscape of payor policies presents a significant financial challenge for the market. US hospital expenditures grew by 10.4% to reach US$1.5197 trillion in 2023, illustrating the increasing financial demands on healthcare providers that influence their technology adoption and service utilization decisions, including decisions related to reimbursable genetic tests.

Opportunities

The growing focus on precision medicine is creating growth opportunities

The growing focus on precision medicine is creating significant growth opportunities for the market. Precision medicine aims to tailor medical treatment to the individual characteristics of each patient, and genetic information obtained from tests like gene panels is fundamental to this approach. By identifying specific genetic mutations or biomarkers, these panels help clinicians select the most effective therapies, predict patient responses to treatment, and avoid adverse drug reactions.

As research expands understanding of the genetic underpinnings of various diseases, particularly in oncology, pharmacogenomics, and rare diseases, the utility and demand for comprehensive gene profiling are increasing. The growth experienced by companies specializing in this area highlights this opportunity. Guardant Health, a company focused on precision oncology, reported total revenue of US$739.0 million in fiscal year 2024, a 31% increase from US$563.9 million in fiscal year 2023, reflecting the expanding application of advanced genomic testing in cancer care.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic and geopolitical factors influence the market. Economic conditions impact healthcare budgets at national and institutional levels, affecting investment in advanced diagnostic infrastructure and the ability of healthcare systems and patients to afford genetic testing; during economic downturns, discretionary spending on diagnostic technologies might decrease, potentially slowing the adoption of newer or broader gene panels, while economic stability supports greater investment in precision medicine initiatives.

Geopolitical events and trade policies can disrupt the global supply chains for reagents, consumables, and specialized equipment necessary for performing genetic tests, potentially leading to increased costs or delays in test processing. Reports in early 2025 indicated that geopolitical risks were contributing to disruptions across various global supply chains, impacting sectors including medical diagnostics.

Despite potential negative impacts from economic fluctuations and supply chain vulnerabilities, the undeniable value of genetic information in improving diagnosis and guiding treatment for serious diseases maintains a fundamental demand for testing, driving continued innovation and efforts to ensure access to these essential diagnostic tools globally.

Current US tariff policies can indirectly impact the market by affecting the cost of imported reagents, consumables, and instrumentation used in the testing process. The manufacturing and processing of gene panels often rely on specialized chemical reagents, enzymes, and laboratory equipment sourced from international suppliers, and tariffs imposed on these imported goods can increase operational costs for diagnostic laboratories and manufacturers operating in the US.

According to the US International Trade Commission DataWeb, in 2023, the US imported instruments and appliances used in medical or surgical sciences (under HTS 9018.90), a category that includes equipment relevant to gene panels, with a Customs Value of approximately US$19.52 billion, indicating the scale of imports in this broad category which includes equipment used for genetic testing.

These increased input costs present a financial challenge for testing providers and could potentially lead to higher prices for genetic tests, impacting affordability and accessibility for patients and healthcare systems. However, the significant clinical utility of gene panels in guiding personalized medicine decisions provides a strong incentive for their continued use, encouraging stakeholders to mitigate cost increases and optimize supply chains to ensure patient access to this critical diagnostic technology.

Latest Trends

Technological advancements are a recent trend

Technological advancements are a recent trend in the market. Companies are continuously investing in research and development to improve the capabilities, accuracy, and efficiency of genetic sequencing and analysis technologies used in gene panels. This includes developing faster and more cost-effective sequencing platforms, improving bioinformatics tools for interpreting complex genomic data, and creating integrated software solutions that streamline the testing workflow from sample to report.

These advancements enhance the performance and clinical utility of gene panels, making them more accessible and valuable for both researchers and clinicians. The substantial investments made by key players in this area demonstrate this ongoing trend. Illumina, a leading provider of sequencing technology, reported GAAP research and development expenses of US$1,169 million in fiscal year 2024, indicating significant ongoing efforts to drive innovation in genomics technology.

Regional Analysis

North America is leading the Gene Panel Market

North America dominated the market with the highest revenue share of 38.7% owing to the increasing use of next-generation sequencing (NGS) technologies, which enhance the efficiency of analyzing multiple genes. A strong inclination towards advanced genetic testing methods is evident. The rising prevalence of chronic diseases, including cancer and cardiovascular conditions, has also increased the demand for early and accurate diagnostic tools like gene panels. The American Heart Association projects that clinical CVD will affect 45 million adults in the US, highlighting the necessity for advanced genetic testing.

The well-established healthcare infrastructure in North America supports the integration of sophisticated diagnostic tests into clinical practice, further contributing to market growth. The FDA has issued guidances to facilitate the development of reliable NGS-based tests, promoting innovation in genetic diagnostics. This integration accelerates the identification of genetic variants associated with various diseases, enhancing diagnostic capabilities.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is expected to grow with the fastest CAGR owing to several reasons. Increasing investments in healthcare infrastructure across the region will enhance the accessibility of advanced diagnostic technologies. A rising awareness of genetic testing and its benefits in managing various diseases is likely to propel market growth.

Government initiatives focused on genomics research and precision medicine, such as India’s GenomeIndia Project aiming to sequence 10,000 genomes, are expected to boost the adoption of genetic analysis, including the use of panels. The growing prevalence of genetic disorders and cancer in the Asia Pacific region will necessitate more sophisticated diagnostic approaches. The increasing research on chronic diseases and the presence of key players in the region are significant drivers.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the gene panel market pursue growth through strategies such as expanding their product offerings, forging strategic partnerships, and investing in cutting-edge sequencing technologies. They customize solutions to address clinical and research demands in areas like oncology, rare diseases, and pharmacogenomics. Collaborations with hospitals and research organizations help these companies enhance distribution and promote wider clinical use. Many also focus on obtaining regulatory approvals and entering new geographic markets to boost their presence.

Illumina Inc., a leading company in this sector, designs and manufactures advanced sequencing systems and genomic tools that empower researchers and clinicians worldwide. The company’s innovation-driven approach and broad product portfolio make it a key player supporting diverse applications across diagnostics and life sciences research.

Gene Panel Market

- Unipath Specialty Laboratory

- Twist Bioscience

- Thermo Fisher Scientific

- Personalis

- Eurofins Genomics

- Cepheid

- Bio-Rad Laboratories

- Agilent Technologies

Recent Developments

- In May 2023, Unipath Specialty Laboratory in India unveiled the HRD Gene Panel, powered by SOPHiA GENETICS technology. This innovative tool is poised to support the progression of cancer genomics by identifying key genetic markers associated with hereditary cancer risk, providing insights for early diagnosis and targeted therapeutic strategies.

- In January 2023, Twist Bioscience and Centogene launched new NGS panels aimed at detecting specific genetic sequences with enhanced sensitivity. These panels are expected to be instrumental in advancing research into hereditary cancers, enabling better identification of genetic mutations that influence cancer development and response to treatment.

Report Scope

Report Features Description Market Value (2024) US$ 3.4 Billion Forecast Revenue (2034) US$ 17.3 Billion CAGR (2025-2034) 17.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Test Kits and Testing Services), By Technology (Amplicon-based and Hybridization-based), By Application (Cancer Risk Assessment, Pharmacogenetics, Diagnosis of Congenital Diseases, and Other), By Design (Predesigned Gene Panel and Customized Gene Panel), By End-user (Academic & Research Institutes, Pharmaceutical & Biotechnology Companies, and Hospital & Diagnostic Laboratories) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Unipath Specialty Laboratory, Twist Bioscience, Thermo Fisher Scientific, Personalis, Eurofins Genomics, Cepheid, Bio-Rad Laboratories, Agilent Technologies. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Unipath Specialty Laboratory

- Twist Bioscience

- Thermo Fisher Scientific

- Personalis

- Eurofins Genomics

- Cepheid

- Bio-Rad Laboratories

- Agilent Technologies