Global GCC Pump Market Size, Share, And Industry Analysis Report By Pump Type (Centrifugal, Positive-Displacement), By Drive Technology (Electric Motor, Diesel/Gas Engine, Solar/Renewable, Magnetically-Driven/Sealless), By Position (Surface, Submersible, Vertical In-Line), By Application (Water and Wastewater, Chemical and Petrochemical, HVAC and Building Services, Oil and Gas, Food and Beverage, Power Generation, Pharmaceuticals and Biotech), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: January 2026

- Report ID: 173796

- Number of Pages: 350

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

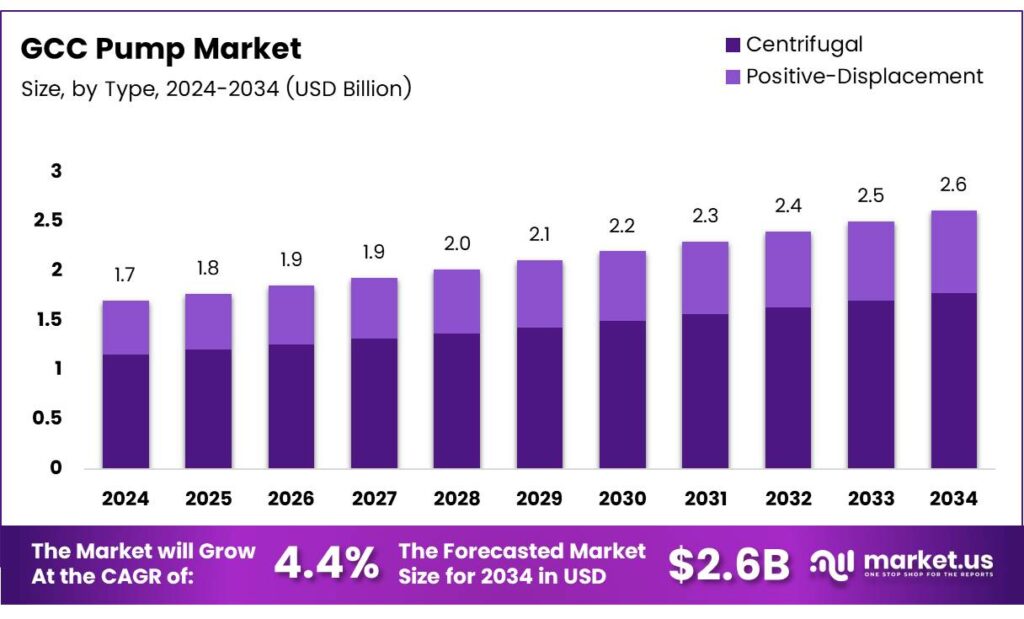

The Global GCC Pump Market size is expected to be worth around USD 2.6 billion by 2034, from USD 1.7 billion in 2024, growing at a CAGR of 4.4% during the forecast period from 2025 to 2034.

The GCC Pump Market is an organized ecosystem of industrial, municipal, and energy-driven pumping solutions across the Gulf Cooperation Council region. It supports water transfer, desalination, oil and gas processing, construction, and building services, while aligning with regional sustainability and infrastructure agendas through energy-efficient pump technologies and localized manufacturing strategies.

The market benefits from continued urban expansion, rising desalination capacity, and industrial diversification programs. Governments increasingly prioritize water security, district cooling, and process efficiency, which accelerates demand for centrifugal, inline, and sealless pumping systems. Procurement decisions increasingly balance lifecycle cost, reliability, and compliance rather than upfront pricing alone.

- Electrical standards also shape purchasing behavior across applications. Small DC-powered magnetic drive pumps commonly operate at 6, 12, 24, or 32 volts, supporting portable and renewable setups. Single-phase motors typically require 100, 115, 200, or 230 volts, while three-phase motors operate from 230 VDC to 460 VDC, and 480 VDC to 690 VDC, ensuring compatibility with industrial grids.

Product-level innovation illustrates how specifications translate into market value. The AV, AVI, AVN, and AVS vertical multistage inline pump series operate with power ranges from 0.5 HP to 100 HP, deliver heads up to 300 m, and achieve flows of 120 m³/hr at 2800 RPM, making such configurations attractive for high-pressure boosting and water transfer projects.

Regulatory alignment and public investment further strengthen market momentum. Energy-efficiency labeling, minimum motor efficiency requirements, and water-use optimization policies encourage adoption of advanced pump designs. Across the region, public infrastructure spending favors equipment that reduces leakage, lowers power consumption, and supports automation, creating steady opportunities for high-performance and specialty pump configurations.

Key Takeaways

- The Global GCC Pump Market is projected to grow from USD 1.7 billion in 2024 to USD 2.6 billion by 2034, registering a CAGR of 4.4% during 2025–2034.

- Centrifugal pumps dominate the market by pump type, accounting for a leading share of 63.8% due to their efficiency and suitability for large-scale infrastructure applications.

- Electric motor-driven pumps lead by drive technology with a market share of 72.4%, supported by strong grid connectivity and energy optimization initiatives.

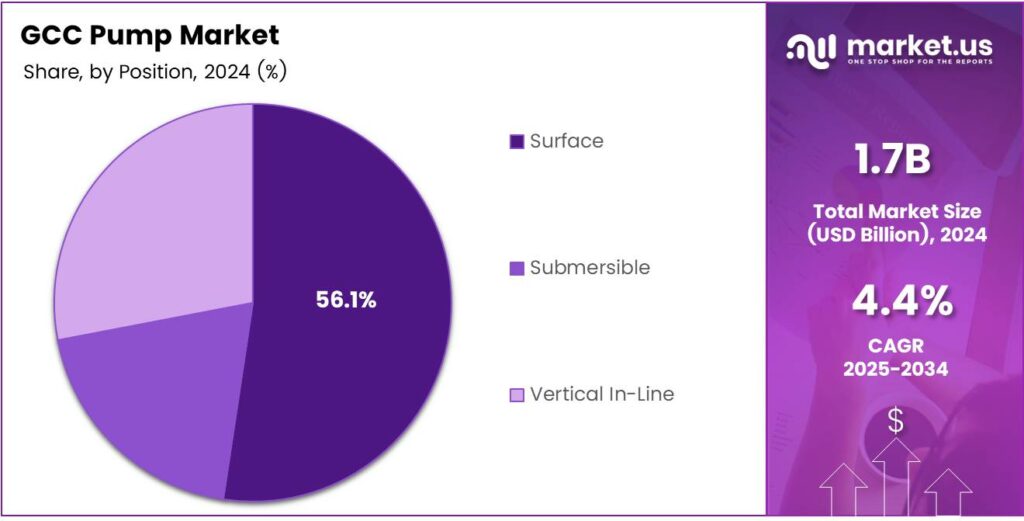

- Surface-mounted pumps hold the largest position-based share at 56.1%, driven by easier installation, accessibility, and maintenance advantages.

- Water and Wastewater applications represent the largest application segment with a share of 38.9%, supported by desalination, sewage treatment, and urban water distribution projects.

By Pump Type Analysis

Centrifugal pumps dominate with 63.8% due to their operational efficiency and broad industrial usability.

In 2024, Centrifugal held a dominant market position in the By Pump Type analysis segment of the GCC Pump Market, with a 63.8% share. This dominance is supported by their ability to handle high flow rates efficiently. Moreover, these pumps suit large-scale infrastructure projects across water, energy, and industrial facilities.

Positive-displacement pumps continue to maintain steady relevance in applications requiring precise flow control. Although their market share remains lower than centrifugal pumps, they are widely used in specialized industrial processes. Gradually, demand is supported by oil handling, chemical dosing, and viscous fluid transfer requirements.

By Drive Technology Analysis

Electric motor-driven pumps lead with 72.4% owing to energy reliability and grid connectivity.

In 2024, Electric Motor held a dominant market position in the By Drive Technology analysis segment of the GCC Pump Market, with a 72.4% share. This leadership is driven by stable electricity infrastructure and ease of automation. Additionally, electric drives support energy optimization initiatives across regional utilities.

Diesel/Gas Engine-driven pumps remain relevant in remote and off-grid environments. They provide operational flexibility where power access is limited. Consequently, these systems are often preferred in temporary construction, oilfield operations, and emergency water management.

Solar/Renewable pump systems are gradually gaining attention due to sustainability goals. Their adoption is supported by renewable energy integration and water conservation projects. However, deployment remains selective, mainly in agriculture and rural water supply initiatives.

Magnetically-driven/Sealless pumps serve niche industrial needs requiring leak-free operations. They are particularly valued in hazardous fluid handling. Over time, demand grows steadily due to safety regulations and process reliability requirements.

By Position Analysis

Surface-mounted pumps lead with 56.1% due to ease of access and maintenance.

In 2024, Surface pumps held a dominant market position in the By Position analysis segment of the GCC Pump Market, with a 56.1% share. Their widespread use is supported by simplified installation and operational visibility. As a result, they are favored in municipal and industrial facilities.

Submersible pumps play a vital role in groundwater extraction and wastewater handling. Their ability to operate underwater makes them essential for deep-well and drainage applications. Demand remains stable due to expanding urban infrastructure requirements.

Vertical In-Line pumps are increasingly used where space optimization is critical. These systems support compact mechanical room designs. Consequently, adoption is notable in high-rise buildings and integrated HVAC installations.

By Application Analysis

Water and wastewater applications dominate with 38.9% driven by infrastructure expansion.

In 2024, Water and Wastewater held a dominant market position in the By Application analysis segment of the GCC Pump Market, with a 38.9% share. Growth is supported by desalination plants, sewage treatment, and water distribution projects. Moreover, urban population growth sustains long-term demand.

Chemical and Petrochemical applications rely on pumps for safe fluid transfer and processing operations. These sectors emphasize durability and corrosion resistance. Gradually, process optimization continues to support consistent pump replacement demand.

HVAC and Building Services utilize pumps for cooling, heating, and circulation needs. Their role is essential in commercial and residential developments. Expansion of smart buildings further strengthens usage across the region. Oil and Gas applications depend on pumps for upstream and downstream operations.

Reliability remains a key requirement. Meanwhile, operational efficiency improvements drive steady equipment upgrades. Food and Beverage pumps support hygienic processing and fluid handling. Compliance with safety standards sustains adoption. Similarly, production scaling contributes to replacement demand.

Key Market Segments

By Pump Type

- Centrifugal

- Positive-Displacement

By Drive Technology

- Electric Motor

- Diesel/Gas Engine

- Solar/Renewable

- Magnetically-Driven / Sealless

By Position

- Surface

- Submersible

- Vertical In-Line

By Application

- Water and Wastewater

- Chemical and Petrochemical

- HVAC and Building Services

- Oil and Gas

- Food and Beverage

- Mining and Metals

- Power Generation

- Pharmaceuticals and Biotech

- Others

Emerging Trends

Digitalization and Sustainable Design Trends Shape the GCC Pump Market

A major trend shaping the GCC pump market is the adoption of digital pump management systems. End users increasingly prefer pumps integrated with real-time performance monitoring, predictive maintenance alerts, and data analytics. These features help reduce unplanned downtime and improve operational efficiency in critical applications.

- The U.S. International Trade Administration notes an ongoing capital projects portfolio of USD 6.28 billion, mainly across water distribution, water treatment, wastewater collection, and wastewater treatment—areas that directly require high-reliability pumps and pumping stations.

Sustainability-focused pump design is also gaining importance. Pumps with corrosion-resistant materials, longer service life, and lower energy consumption are being favored in desalination and wastewater projects. This aligns with regional goals to reduce environmental impact while maintaining high operational reliability.

Drivers

Rising Infrastructure and Water Security Investments Drive GCC Pump Market Growth

The GCC pump market is strongly driven by rising investments in water infrastructure across Gulf countries. Rapid urban population growth and limited natural freshwater resources are pushing governments to expand desalination plants, water transmission pipelines, and wastewater treatment facilities.

- Pumps are essential in moving large volumes of water across long distances in harsh desert conditions, making them critical equipment in national water security plans. Tabreed, one of the region’s largest district cooling players, reports it delivers 1.325 million refrigeration tons of cooling across 92 plants in the GCC footprint.

Oil and gas activity also remains a major growth driver for pumps in the GCC. Exploration, refining, and petrochemical operations rely heavily on centrifugal and positive displacement pumps for fluid handling, cooling, and chemical injection. Even as energy diversification progresses, upstream maintenance and downstream capacity expansions continue to support steady pump demand.

Restraints

High Operating Costs and Harsh Operating Conditions Restrain Market Expansion

One of the key restraints in the GCC pump market is the high operating and maintenance costs of pump systems. Extreme heat, sand, and saline water conditions accelerate wear on seals, bearings, and impellers. This increases downtime and replacement frequency, raising lifecycle costs for industrial and municipal users.

Energy consumption is another challenge, as pumps account for a significant share of electricity use in desalination plants, water networks, and industrial facilities. Rising power tariffs in some GCC countries make inefficient pump systems less attractive, especially for small utilities and private operators with limited budgets.

The market also faces reliance on imported components and skilled labor. Specialized pumps and spare parts are often sourced from outside the region, leading to longer lead times and higher procurement costs. In addition, the shortage of trained pump technicians limits optimal system operation, reducing efficiency gains and slowing the adoption of advanced pump technologies.

Growth Factors

Smart Water Projects and Energy-Efficient Pumps Create New Growth Opportunities

Growth opportunities in the GCC pump market are expanding with the rise of smart water management projects. Governments are adopting digital monitoring, leakage control, and automated pumping stations to reduce water losses. This creates strong demand for intelligent pumps with sensors, variable speed drives, and remote monitoring capabilities.

Energy-efficient pump solutions also offer significant opportunities. Utilities and industries are increasingly replacing old systems with high-efficiency pumps to reduce electricity consumption and meet sustainability targets. Demand is growing for pumps designed specifically for desalination, treated wastewater reuse, and district cooling applications.

Local manufacturing and service localization present another opportunity. GCC countries are encouraging local assembly, maintenance hubs, and technology partnerships to reduce import dependency. Suppliers that invest in regional production, training centers, and after-sales support are well-positioned to benefit from long-term infrastructure spending cycles.

Key Players Analysis

Grundfos continues to be viewed as a dependable benchmark player for GCC pump buyers that prioritize lifecycle cost, high efficiency, and predictable performance in water, building services, and industrial circulation duties. Its strength in engineered packages and service-backed uptime aligns well with GCC operators that run asset-heavy infrastructure and cannot afford unplanned shutdowns.

Flowserve stands out for mission-critical pumping where reliability, sealing systems, and engineered customization matter—especially across oil & gas, petrochemical, and power applications common in the GCC. Its position with the ability to support complex specifications, turnaround schedules, and aftermarket demand that grows as plants seek longer operating cycles and tighter maintenance planning.

Sulzer remains a strong reference name for high-duty applications where energy optimization and hydraulic performance improvements can deliver measurable operating savings. Its relevance in water transport, desalination-related systems, and process industries supports GCC modernization programs, particularly where operators are upgrading legacy fleets and targeting efficiency gains without compromising reliability.

Xylem is commonly linked with smart water, wastewater, and network efficiency themes that are increasingly important as GCC cities expand and utilities digitize operations. Its positioning benefits from demand for monitoring, control, and reduced non-revenue water, where pumps are integrated into broader systems aimed at performance transparency and proactive maintenance.

Top Key Players in the Market

- Grundfos

- Flowserve

- Sulzer

- Xylem

- KSB

- Wilo

- ITT Inc.

- Ebara

- Kirloskar Brothers

- SPX FLOW

Recent Developments

- In 2025, Grundfos announced plans to expand its retrofit programs across the GCC and Africa, including standardizing service tiers and accelerating the adoption of aftermarket solutions to enhance maintenance value and efficiency. Grundfos unveiled next-generation self-controlling pump units for commercial buildings, designed to simplify installation, commissioning, and operation while addressing pressure-related issues in GCC projects

- In 2025, Flowserve developments center on facility expansions, partnerships, and ongoing supply chain activities in the GCC, particularly in oil and gas-related pump repairs and spares. Flowserve and Petrotec celebrated the grand opening of a dry gas seal repair and testing facility in Doha, Qatar, enhancing local service capabilities for GCC customers in the pump and seal sector.

Report Scope

Report Features Description Market Value (2024) USD 1.7 Billion Forecast Revenue (2034) USD 2.6 Billion CAGR (2025-2034) 4.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Pump Type (Centrifugal, Positive-Displacement), By Drive Technology (Electric Motor, Diesel/Gas Engine, Solar/Renewable, Magnetically-Driven/Sealless), By Position (Surface, Submersible, Vertical In-Line), By Application (Water and Wastewater, Chemical and Petrochemical, HVAC and Building Services, Oil and Gas, Food and Beverage, Mining and Metals, Power Generation, Pharmaceuticals and Biotech, Others) Competitive Landscape Grundfos, Flowserve, Sulzer, Xylem, KSB, Wilo, ITT Inc., Ebara, Kirloskar Brothers, SPX FLOW Customization Scope Customisation for segments, region/country-level will be provided. Moreover, additional customisation can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)

-

-

- Grundfos

- Flowserve

- Sulzer

- Xylem

- KSB

- Wilo

- ITT Inc.

- Ebara

- Kirloskar Brothers

- SPX FLOW