Global Gas Nitriding Furnace Market By Type(Vacuum Gas Nitriding Furnace, Well Type Gas Nitriding Furnace, Other Types), By Application(Automotive, Construction Equipment, Aerospace Industry, Industrial Machinery, Other Applications), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2024-2033

- Published date: May 2024

- Report ID: 15854

- Number of Pages: 294

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

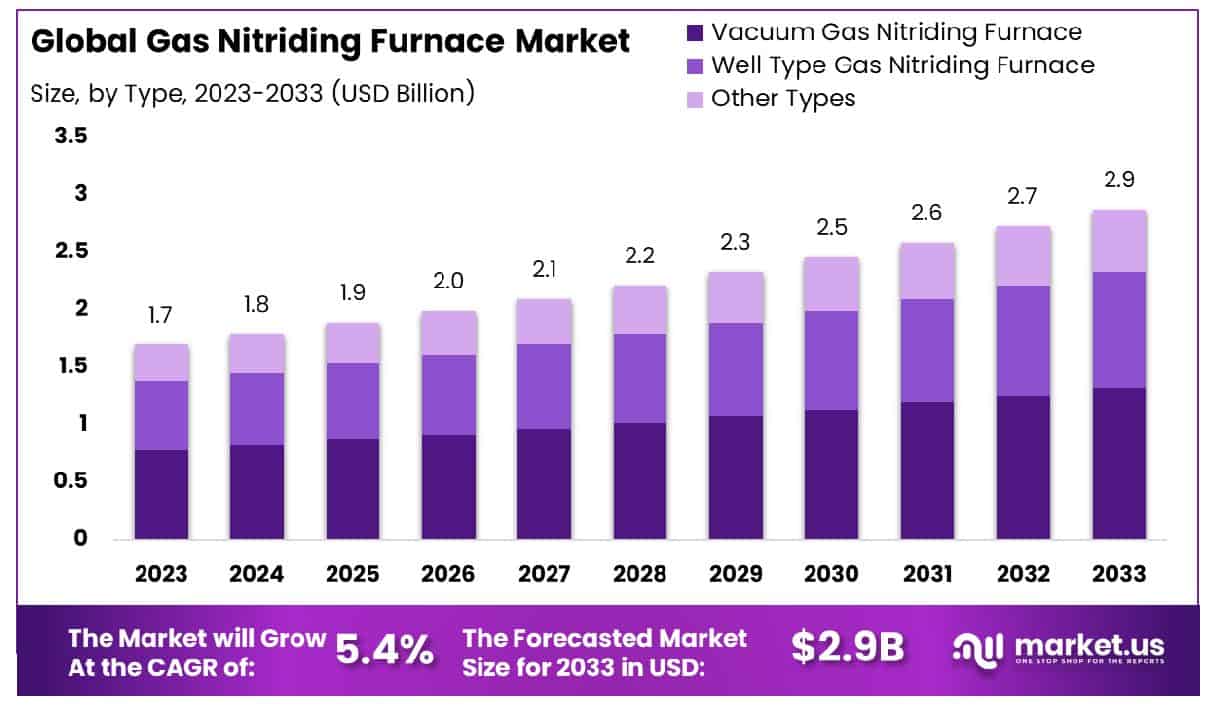

The Global Gas Nitriding Furnace Market size is expected to be worth around USD 2.9 Billion by 2033, From USD 1.7 Billion by 2023, growing at a CAGR of 5.40% during the forecast period from 2024 to 2033.

The Gas Nitriding Furnace Market comprises industries involved in the manufacture and distribution of gas-nitriding furnaces used for the surface hardening of steel. These specialized furnaces utilize ammonia gas to introduce nitrogen into the steel surface, creating a hard, wear-resistant layer. This market is integral to sectors requiring durable metal components, such as automotive, aerospace, and heavy machinery.

As businesses increasingly prioritize longevity and efficiency in their operations, the demand for gas-nitriding furnaces is expected to grow, driven by advancements in furnace technology and the expanding manufacturing capabilities of emerging markets. This market is essential for leaders focused on optimizing product durability and performance.

The Gas Nitriding Furnace Market has exhibited a stable trajectory, influenced predominantly by the inherent complexities and technical limitations associated with the nitriding process. Nitriding time, often extending between 40 to 60 hours, significantly impedes operational efficiency.

This extended duration not only escalates production costs but also limits throughput, affecting the market’s overall productivity and scalability. Moreover, the stability of global gas production in 2022, following a notable 4.3% increase in the previous year, has played a crucial role in shaping the market dynamics.

Despite the stable gas supply, fluctuating demand and regional production variances continue to challenge market stability. This backdrop necessitates advancements in furnace technology and process efficiency to better harness the potential of gas nitriding, particularly in sectors demanding high precision and durability in metal components.

Key Takeaways

- Market Growth: The Global Gas Nitriding Furnace Market size is expected to be worth around USD 2.9 Billion by 2033, From USD 1.7 Billion by 2023, growing at a CAGR of 5.40% during the forecast period from 2024 to 2033.

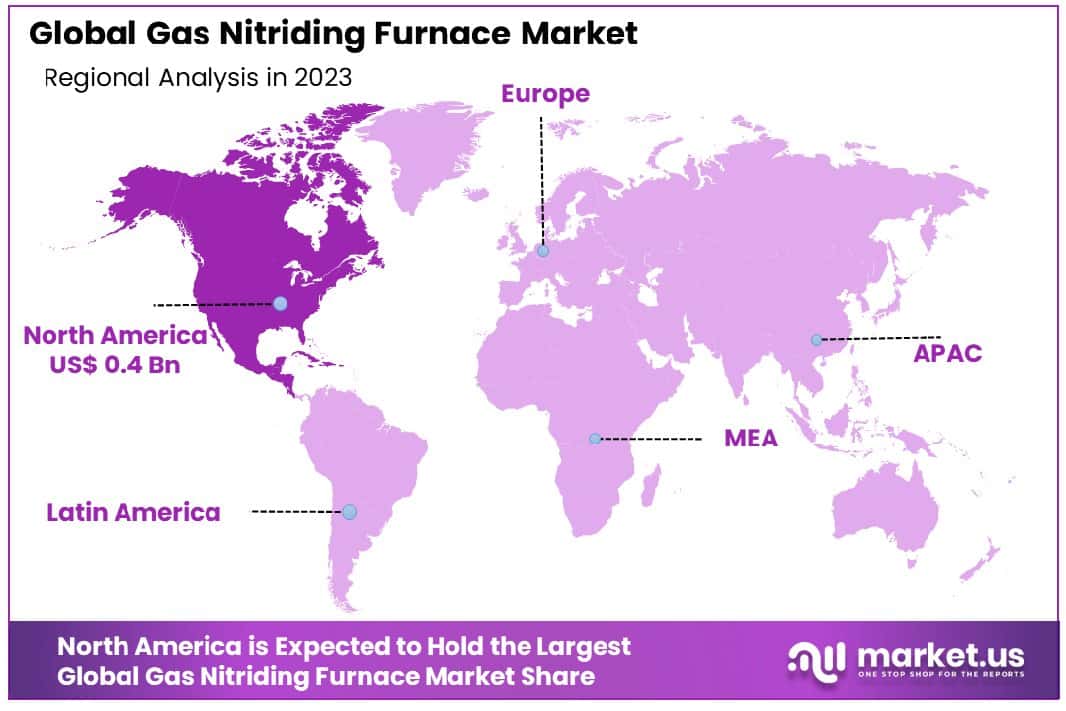

- Regional Dominance: North America holds a 29% share of the global gas nitriding furnace market.

- Segmentation Insights:

- By Type: Vacuum Gas Nitriding Furnace dominates, holding 47% market share.

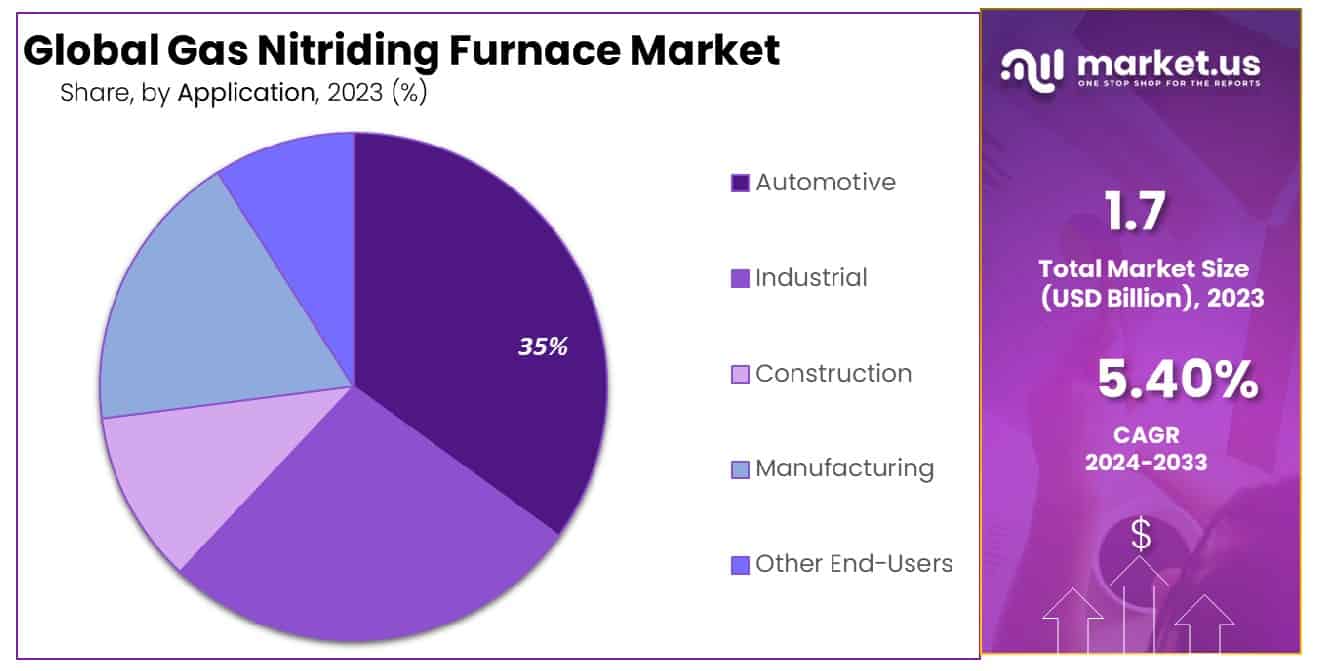

- By Application: Automotive sector leads, representing 35% of applications.

- Growth Opportunities: The global gas nitriding furnace market is expanding due to advancements in post-oxidation technologies and rising demand from the tool and die industry for wear-resistant tools.

Driving Factors

Increasing Demand for Durable and Wear-Resistant Metal Components

The demand for durable and wear-resistant metal components significantly propels the Gas Nitriding Furnace market. Industries such as automotive, aerospace, and machinery are increasingly focusing on extending the lifespan and efficiency of their components. Gas nitriding, a process that enhances surface hardness and fatigue life of metals, directly benefits from these requirements.

For instance, components treated with gas nitriding show reduced wear and greater resistance to fatigue, making this technology indispensable in manufacturing sectors where durability is paramount. The push towards more robust manufacturing standards worldwide amplifies this effect, driving continuous growth in the demand for gas nitriding furnaces.

Expansion in Aerospace and Defense Manufacturing

The expansion of aerospace and defense sectors is a critical driver for the Gas Nitriding Furnace market. As global defense budgets increase and commercial air travel gradually returns to pre-pandemic levels, the demand for aircraft and defense equipment with enhanced material properties escalates.

Gas nitriding furnaces are crucial for treating parts such as landing gear, turbine blades, and other critical components. The technology’s ability to improve the mechanical and wear properties of these parts ensures their operational reliability and longevity, which is essential in high-stakes environments like aerospace and defense.

Stringent Environmental Regulations Driving the Adoption of Cleaner Technologies

Stringent environmental regulations worldwide are compelling industries to adopt cleaner and more sustainable manufacturing technologies. Gas nitriding is perceived as a more environmentally friendly alternative compared to traditional surface hardening processes, as it emits lower quantities of harmful pollutants.

This alignment with global environmental goals not only enhances the market prospects for gas nitriding furnaces but also positions them favorably in regions enforcing strict environmental compliance. As industries pivot towards greener practices, the adoption of gas nitriding technology is expected to surge, bolstered by its compliance with these regulatory frameworks.

Restraining Factors

High Capital Costs: A Barrier to Market Entry and Expansion

High capital costs represent a significant restraining factor for the growth of the Gas Nitriding Furnace Market. The initial expenditure required to purchase and install these furnaces is substantial, posing a barrier to entry for smaller enterprises and startups.

This high cost is attributed to the advanced technology and materials needed to manufacture gas nitriding furnaces that meet industry standards and regulatory requirements. As a result, the market is often dominated by well-established players who can afford these upfront investments.

Additionally, the significant capital requirement may deter existing manufacturers from expanding their operations or upgrading their equipment, thereby slowing the pace of technological innovations and improvements within the sector. This factor limits the overall market growth, as potential new entrants and expansion efforts are curtailed by the financial burdens associated with these high costs.

Limited Gas Flow Control: Impeding Process Efficiency and Output Quality

Limited gas flow control in gas nitriding furnaces critically impacts the quality and efficiency of the nitriding process, thus restraining the market’s growth. Precise control over the gas flow is essential for achieving uniform case hardening, which is crucial for the desired properties of wear resistance and fatigue strength in treated metals.

Inadequate control can lead to inconsistencies in the nitriding results, affecting the reliability and performance of the end products. This limitation not only reduces the operational efficiency of these furnaces but also affects the manufacturers’ ability to meet the stringent quality standards demanded by industries such as aerospace and automotive.

The inability to consistently produce high-quality outputs can lead to reduced customer satisfaction and a lower market share, as users seek out alternative solutions with better control technologies. Consequently, advancements in control mechanisms and technologies are vital for overcoming this challenge and unlocking further growth in the Gas Nitriding Furnace Market.

By Type Analysis

Vacuum Gas Nitriding Furnaces command a 47% market share due to their advanced capabilities.

In 2023, the Gas Nitriding Furnace Market was characterized by three primary segments: Vacuum Gas Nitriding Furnace, Well Type Gas Nitriding Furnace, and Other Types. Among these, the Vacuum Gas Nitriding Furnace segment held a dominant position in the market, capturing more than a 47% share. This dominance can be attributed to several key factors, including the superior control over nitriding parameters such as temperature and gas flow, which are critical for achieving desired surface hardness and case depth in treated materials.

The preference for Vacuum Gas Nitriding Furnaces is driven by their ability to provide uniform nitriding effects and minimal distortion, making them highly suitable for high-precision applications in aerospace, automotive, and tool & die industries. The growing demand for durable and wear-resistant components in these sectors has further propelled the adoption of this technology.

Conversely, the Well Type Gas Nitriding Furnace segment also holds a significant market share, favored for its cost-effectiveness and capacity to treat large batches of components, which is particularly advantageous in high-volume manufacturing settings. However, its market share is slightly lesser compared to the vacuum variant due to the higher precision and control offered by the latter.

The segment categorized as ‘Other Types’ encompasses a variety of less common furnace designs that cater to specific niche applications. While these types constitute a smaller fraction of the market, they are integral in applications where standard furnace types are not feasible.

Overall, the Gas Nitriding Furnace Market’s dynamics are largely influenced by technological advancements in furnace design and control systems, which enhance the process efficiency and outcome quality, thereby driving their adoption across various industrial sectors.

By Application Analysis

The automotive sector utilizes 35% of Vacuum Gas Nitriding Furnaces for enhanced component durability.

In 2023, the Gas Nitriding Furnace Market by Application was segmented into Automotive, Construction Equipment, Aerospace Industry, Industrial Machinery, and Other Applications. Among these, Automotive held a dominant market position, capturing more than a 35% share. This significant market share can be attributed to the critical role of gas nitriding in enhancing the wear resistance and fatigue life of automotive components such as gears, crankshafts, and camshafts.

The demand within the automotive sector is primarily driven by the industry’s stringent requirements for parts that can withstand extreme conditions and extended usage, which gas nitriding furnaces provide efficiently. The process imparts high surface hardness and improved mechanical properties through the diffusion of nitrogen into the alloy, making it ideal for automotive applications.

The Construction Equipment segment also represents a substantial portion of the market, leveraging gas nitriding for the treatment of heavy-duty equipment parts that require enhanced strength and durability against harsh environmental conditions. However, it holds a smaller share compared to the automotive sector due to the latter’s larger scale of operations and higher volume of components processed.

The Aerospace Industry and Industrial Machinery segments follow closely, utilizing gas nitriding to meet the high-quality standards required for aerospace components and industrial tools. These sectors value the precise control over case depth and hardness that gas nitriding furnaces offer.

Lastly, Other Applications include various smaller and niche markets that utilize gas nitriding for specific requirements, contributing to the overall diversity and resilience of the market. The continued growth in these segments is fueled by innovation in nitriding technologies and expanding applications across different industries.

Key Market Segments

By Type

- Vacuum Gas Nitriding Furnace

- Well Type Gas Nitriding Furnace

- Other Types

By Application

- Automotive

- Construction Equipment

- Aerospace Industry

- Industrial Machinery

- Other Applications

Growth Opportunities

Advancements in Post-Oxidation Technologies

The global gas nitriding furnace market is poised for growth, primarily driven by significant advancements in post-oxidation technologies. These innovations are pivotal in enhancing the corrosion resistance of nitrided parts, thereby extending their operational life and reliability in various industrial applications. A notable development in this area is the integration of accelerated post-oxidation processes that effectively reduce the overall time required for gas nitriding.

This efficiency not only optimizes production cycles but also contributes to cost reduction, making the technology increasingly accessible and appealing to manufacturers. The enhanced processing capabilities can be attributed to improved control systems and material handling techniques, which ensure uniform treatment and quality. As industries continue to demand higher durability and performance from machinery and components, these technological enhancements will likely fuel the expansion of the gas nitriding furnace market.

Rising Demand in the Tool and Die Industry

Concurrently, the gas nitriding furnace market is experiencing robust demand from the tool and die industry. This sector relies heavily on the exceptional wear resistance imparted by gas nitriding processes to produce tools and dies that can withstand rigorous use. The ability of gas nitriding to enhance the surface hardness and fatigue resistance of steel components makes it indispensable for manufacturing high-precision and durable tools.

As the global manufacturing sector expands, driven by automotive, aerospace, and heavy machinery industries, the demand for such enhanced tools and dies is expected to surge. This trend underscores the market’s potential for growth as tool and die makers increasingly adopt gas nitriding to meet the stringent quality and longevity requirements of modern manufacturing environments.

Latest Trends

Rising Demand in the Tool and Die Industry

In 2023, the global gas nitriding furnace market is witnessing a substantial rise in demand within the tool and die industry. This trend is driven by the industry’s need for tools and dies that exhibit superior wear resistance, a critical factor in maintaining productivity and reducing downtime in manufacturing processes.

Gas nitriding, known for its ability to harden the surface of steel parts, is increasingly sought after for its efficacy in extending the lifespan and durability of tools used in high-precision sectors such as automotive and aerospace manufacturing. As these sectors continue to grow and evolve, the demand for reliable and efficient manufacturing tools underscores the expansion of the gas nitriding furnace market, highlighting its pivotal role in modern industrial applications.

Advancements in Gas Nitriding Technologies

Parallel to the rising demand, 2023 also marks significant technological advancements in the gas nitriding process. These advancements are focused on enhancing the surface quality and fatigue strength of metal alloys, which are essential attributes for components exposed to cyclic stress and harsh environments. Innovations in gas nitriding technologies have led to more precise control over the nitriding parameters, resulting in improved uniformity and consistency in the nitriding layers.

Such enhancements not only increase the performance of the treated metals but also contribute to the overall reliability and efficiency of the process. This progress is crucial for industries that depend on the strength and durability of metal components, further propelling the growth of the global gas nitriding furnace market.

Regional Analysis

The North American market holds a 29% share in the global gas nitriding furnace industry.

The Gas Nitriding Furnace Market exhibits nuanced growth patterns and opportunities across various regions, including North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America. Dominating the market with a 29% share, North America stands as a leader due to robust manufacturing sectors and the increasing adoption of advanced heat treatment technologies by the automotive and aerospace industries. The market here is driven by stringent standards requiring enhanced material properties, fueling demand for nitriding furnaces.

In Europe, the market is propelled by a strong presence of automotive manufacturers and significant investments in research and development, aiming to enhance material durability and performance. The region’s stringent environmental regulations also push for the adoption of technologies that offer cleaner and more energy-efficient processes, supporting the growth of the gas nitriding furnace market.

Asia Pacific is anticipated to witness rapid growth, influenced by expanding manufacturing bases, particularly in China, India, and Southeast Asia. The region benefits from lower production costs, increasing industrialization, and the rising automotive metal sector, which extensively utilizes nitriding processes to improve the lifespan and quality of automotive components.

Meanwhile, the Middle East & Africa, and Latin America are emerging markets where growth is driven by gradual industrial growth and increasing foreign investments in manufacturing. Although these regions hold smaller shares of the global market, they present significant growth opportunities due to expanding industrial sectors and increasing awareness about the benefits of controlled nitriding processes.

Overall, while North America currently leads the market, Asia Pacific is expected to grow at the highest rate due to rapid industrialization and manufacturing activities in the automotive sector, bolstering the demand for gas nitriding furnaces.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

The global Gas Nitriding Furnace Market in 2023 features a competitive landscape with several key players driving innovation and growth. Bodycote plc stands out with its extensive service offerings and geographical footprint, enabling it to cater to diverse industries globally. The company’s commitment to technology and sustainability is likely to strengthen its market position further.

Ipsen International GmbH is another significant competitor, renowned for its advanced engineering and manufacturing capabilities. Its focus on R&D and customer-centric solutions positions it well to capitalize on emerging market opportunities, particularly in high-precision industries.

Seco/Warwick S.A. continues to make strides with its bespoke thermal processing solutions. The company’s focus on continuous improvement and global expansion strategy enhances its ability to meet evolving market demands effectively.

Solar Manufacturing Inc. has been pivotal in advancing gas nitriding technology through innovation. Its dedication to quality and performance in furnace design sets it apart, potentially boosting its market share in specialized sectors.

Surface Combustion Inc. brings a legacy of reliability and excellence, with a strong emphasis on energy efficiency and operational flexibility in its furnace designs. This approach likely attracts a broad base of clients seeking cost-effective and environmentally sustainable solutions.

Nitrex Metal Inc., known for its proprietary technologies in nitriding and nitrocarburizing, offers unique value propositions that could see increased adoption as industries seek more specialized treatment processes.

Tenova S.p.A leverages its global network to deliver high-quality, scalable solutions that cater to the needs of large-scale industrial operations, enhancing its competitive edge.

Solar Atmospheres continues to excel in providing custom-tailored solutions with a focus on client-specific requirements, thereby ensuring high satisfaction and repeat business.

Nabertherm GmbH maintains a strong focus on innovation and flexibility, which supports its ability to adapt quickly to changing market conditions and technological advancements.

Overall, these companies are well-positioned to leverage their technological, operational, and strategic strengths to capitalize on the growing demand within the global Gas Nitriding Furnace Market.

Market Key Players

- Bodycote plc

- Ipsen International GmbH

- Seco/Warwick S.A.

- Solar Manufacturing Inc.

- Surface Combustion Inc.

- Nitrex Metal Inc.

- Tenova S.p.A

- Solar Atmospheres

- Nabertherm GmbH

Recent Development

- In March 2024, Taiyo Nippon Sanso Corp developed a system for delivering high-purity hydrazine gas, enhancing safety and efficiency in semiconductor manufacturing processes.

- In March 2024, General Motors enhanced brake rotor durability and reduced corrosion through the adoption of ferritic nitrocarburizing technology, significantly extending rotor lifespan.

Report Scope

Report Features Description Market Value (2023) USD 1.7 Billion Forecast Revenue (2033) USD 2.9 Billion CAGR (2024-2033) 5.40% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type(Vacuum Gas Nitriding Furnace, Well Type Gas Nitriding Furnace, Other Types), By Application(Automotive, Construction Equipment, Aerospace Industry, Industrial Machinery, Other Applications) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Bodycote plc, Ipsen International GmbH, Seco/Warwick S.A., Solar Manufacturing Inc., Surface Combustion Inc., Nitrex Metal Inc., Tenova S.p.A, Solar Atmospheres, Nabertherm GmbH Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the size of the Global Gas Nitriding Furnace Market Size in 2023?The Global Gas Nitriding Furnace Market Size is USD 1.7 Billion in 2023.

What is the projected CAGR at which the Global Gas Nitriding Furnace Market is expected to grow at?The Global Gas Nitriding Furnace Market is expected to grow at a CAGR of 5.40% (2024-2033).

List the segments encompassed in this report on the Global Gas Nitriding Furnace Market?Market.US has segmented the Global Gas Nitriding Furnace Market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Type(Vacuum Gas Nitriding Furnace, Well Type Gas Nitriding Furnace, Other Types), By Application(Automotive, Construction Equipment, Aerospace Industry, Industrial Machinery, Other Applications)

List the key industry players of the Global Gas Nitriding Furnace Market?Bodycote plc, Ipsen International GmbH, Seco/Warwick S.A., Solar Manufacturing Inc., Surface Combustion Inc., Nitrex Metal Inc., Tenova S.p.A, Solar Atmospheres, Nabertherm GmbH

Name the key areas of business for Global Gas Nitriding Furnace Market?The US, Canada, Mexico are leading key areas of operation for Global Gas Nitriding Furnace Market.

Gas Nitriding Furnace MarketPublished date: May 2024add_shopping_cartBuy Now get_appDownload Sample

Gas Nitriding Furnace MarketPublished date: May 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Bodycote plc

- Ipsen International GmbH

- Seco/Warwick S.A.

- Solar Manufacturing Inc.

- Surface Combustion Inc.

- Nitrex Metal Inc.

- Tenova S.p.A

- Solar Atmospheres

- Nabertherm GmbH