Global Garment Steamer Market Size, Share, Growth Analysis By Application (Clothes, Curtains, Carpets, Others), By Distribution Channel (Online, Supermarket/Hypermarket), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: April 2025

- Report ID: 147047

- Number of Pages: 201

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

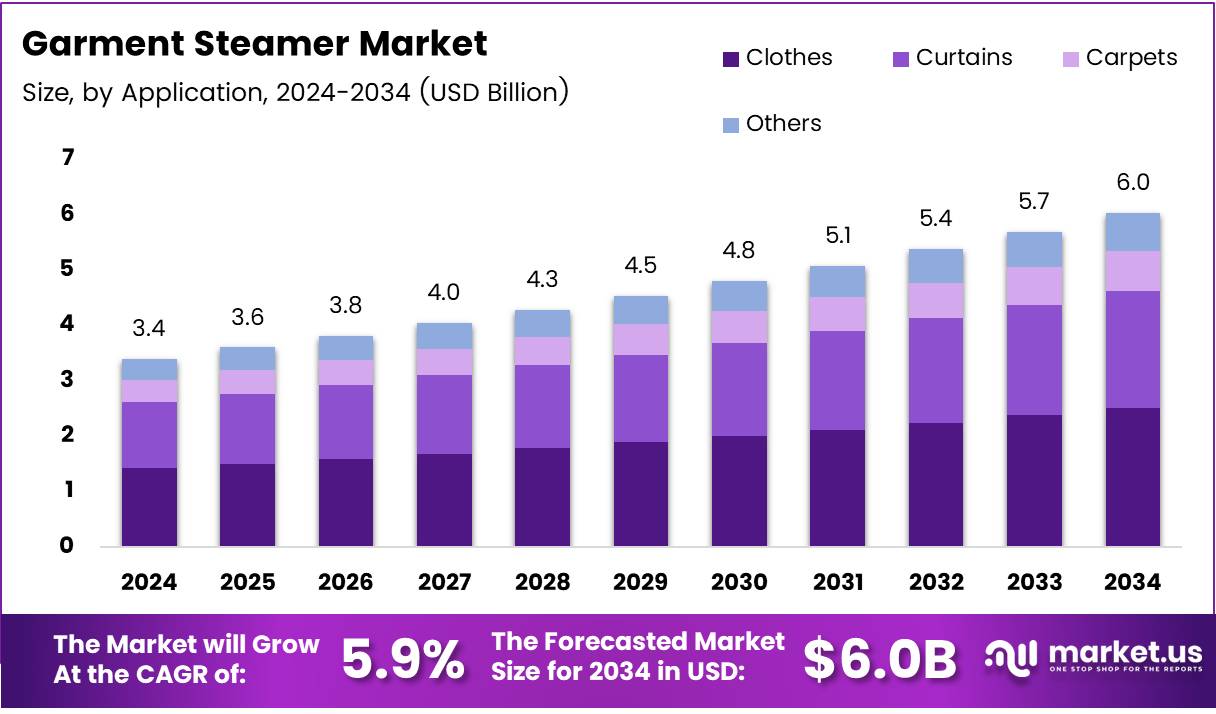

The Global Garment Steamer Market size is expected to be worth around USD 6.0 Billion by 2034, from USD 3.4 Billion in 2024, growing at a CAGR of 5.9% during the forecast period from 2025 to 2034.

The Garment Steamer Market is a burgeoning segment within the consumer appliances sector, catering to an increasing demand for quick and efficient alternatives to traditional ironing. Garment steamers are valued for their ability to remove wrinkles without making direct contact with the fabric, which preserves the clothing’s longevity and appearance. This market caters to both individual consumers and commercial operations, such as laundromats and fashion retail outlets.

From an analyst’s perspective, the market for garment steamers shows promising growth potential. According to Reboutique, the average woman owns 103 pieces of clothing, suggesting a robust target market for garment steamers as consumers seek convenient solutions to maintain their extensive wardrobes.

Furthermore, as per Businessdasher, the average person spends approximately $161 monthly on clothing, indicating a significant ongoing investment in apparel that underscores the need for proper care and maintenance tools like garment steamers.

Opportunities within this market are expansive, particularly in regions experiencing rising consumer spending and urbanization. The convenience of garment steamers makes them appealing to the growing middle-class population, which prioritizes efficiency and time-saving appliances. Additionally, the increasing presence of fashion-conscious consumers who require quick outfit changes also propels demand for this appliance.

Government investment and regulations play a crucial role in shaping the garment steamer market. In several countries, initiatives to promote energy-efficient appliances have led to the adoption of more eco-friendly garment steamers. Regulations that mandate lower energy consumption standards for household appliances encourage manufacturers to innovate and improve product efficiency, thus fostering market growth.

Key Takeaways

- Global Garment Steamer Market Size is expected to reach USD 6.0 Billion by 2034, growing at a CAGR of 5.9% from 2025 to 2034.

- Clothes held a dominant market share of 54.9% in the By Application segment in 2024 due to the rising adoption for wrinkle removal.

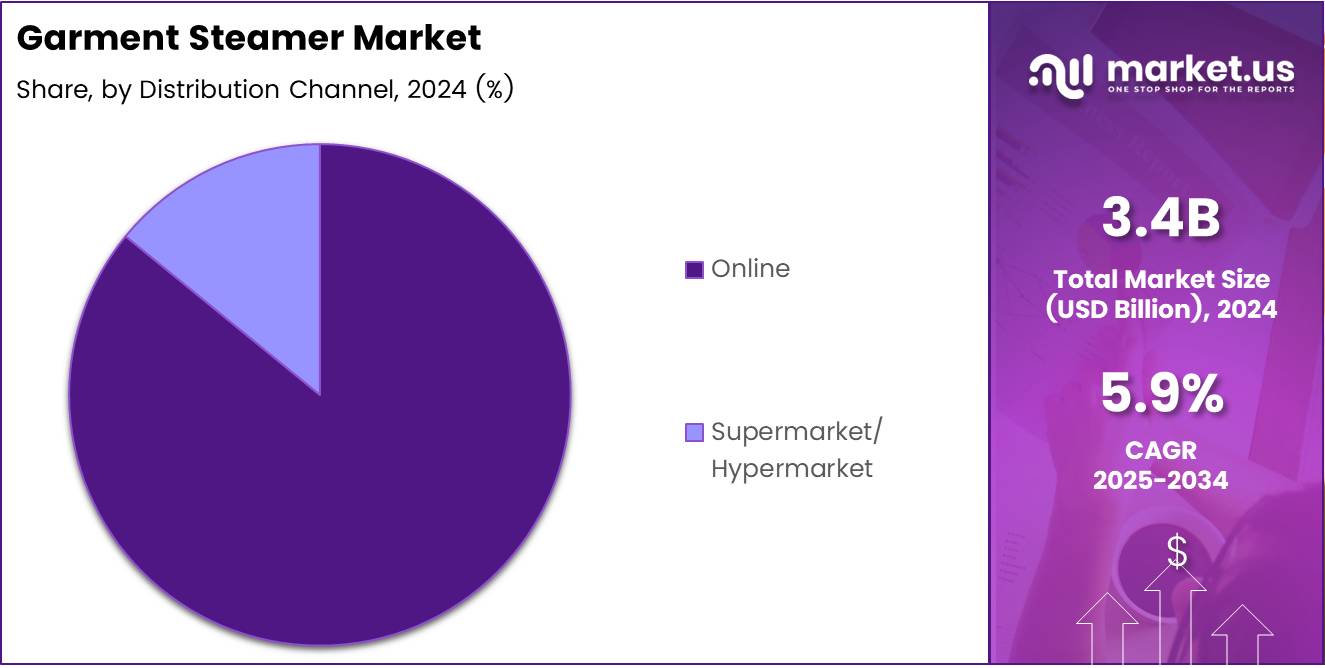

- Online held a dominant share of 85.9% in the By Distribution Channel segment in 2024, driven by e-commerce growth and convenience.

- Europe dominates the market with 34.6% of the total share, valued at USD 1.2 Billion, supported by consumer preferences for eco-friendly solutions.

Application Analysis

Clothes dominate with 54.9% due to high household and commercial usage

In 2024, Clothes held a dominant market position in the By Application Analysis segment of the Garment Steamer Market, with a 54.9% share. The rising adoption of garment steamers for quick and effective wrinkle removal from clothes has been a key driver. Increasing urbanization and fast-paced lifestyles have heightened the need for convenient clothing care solutions, further strengthening demand in this segment.

Curtains emerged as another significant application area for garment steamers. Growing consumer awareness regarding home aesthetics and hygiene standards has led to a greater emphasis on maintaining fabric furnishings like curtains. Garment steamers provide an effective solution for refreshing and deodorizing curtains without the need for traditional laundering, enhancing their popularity.

Carpets also presented a niche but growing opportunity in the market. Although not a primary application, the use of steamers for spot cleaning and rejuvenating carpets has gained attention, particularly among households seeking multi-functional appliances for compact living spaces.

The Others segment, encompassing uses such as steaming upholstered furniture and delicate fabric items, has seen gradual growth. Consumers increasingly value the versatility offered by garment steamers, promoting adoption beyond conventional clothing care needs.

Distribution Channel Analysis

Online dominates with 85.9% due to digital shopping convenience and product variety

In 2024, Online held a dominant market position in the By Distribution Channel Analysis segment of the Garment Steamer Market, with a 85.9% share. The surge in e-commerce platforms offering a wide range of garment steamers, combined with the convenience of home delivery, has made online purchasing the preferred choice for many consumers. Competitive pricing, product comparisons, and extensive customer reviews have also bolstered online sales.

Supermarkets and hypermarkets, though a secondary channel, continued to attract customers who prefer a hands-on evaluation of the product before purchasing. Physical stores provide opportunities for consumers to experience product demonstrations, which can influence buying decisions, especially for those unfamiliar with garment steamers.

Key Market Segments

By Application

- Clothes

- Curtains

- Carpets

- Others

By Distribution Channel

- Online

- Supermarket/Hypermarket

Drivers

Convenience and Time-Saving Solutions Drive the Garment Steamer Market

The garment steamer market is witnessing strong growth mainly because of the convenience it offers. Consumers today are looking for faster and easier ways to keep their clothes wrinkle-free without the hassle of traditional ironing. Garment steamers are seen as a quicker and simpler solution, especially for delicate fabrics and quick touch-ups.

Another strong driver is the rising preference for easy-to-use home appliances. People now want products that are not complicated and save time, and garment steamers fit perfectly into this lifestyle. With simple controls and flexible designs, they are becoming a favorite in modern households.

Additionally, increasing urbanization and the fast-paced life in cities are boosting demand. Busy schedules leave little time for traditional ironing, making garment steamers a go-to option for working professionals, students, and frequent travelers. Overall, the combination of time-saving, simplicity, and urban lifestyle needs is pushing the garment steamer market forward.

Restraints

High Initial Cost Restricts Wider Adoption of Garment Steamers

Despite their growing popularity, garment steamers face some key restraints. One of the biggest challenges is the high initial cost compared to regular irons. Many budget-conscious consumers find it hard to justify the extra expense, especially when traditional irons still do the basic job at a much lower price.

Another limitation is their reduced effectiveness on heavy fabrics like thick cotton or denim. Garment steamers are excellent for light and delicate materials, but when it comes to heavier garments, they often struggle to deliver crisp, wrinkle-free results. This performance gap limits their appeal to consumers who own a diverse wardrobe.

Some users still prefer traditional ironing for that sharper, professional finish. As a result, both price sensitivity and performance concerns are slowing down the wider adoption of garment steamers across different market segments.

Growth Factors

Expansion in Emerging Markets Opens New Avenues for Garment Steamer Growth

The garment steamer market holds strong growth opportunities, especially in emerging economies. The growing middle-class population in countries across Asia, Africa, and Latin America is creating a bigger customer base that seeks modern, easy-to-use home appliances. As incomes rise, more households are willing to invest in products like garment steamers that offer convenience and time-saving benefits.

Another major opportunity lies in the integration of smart features. Manufacturers introducing garment steamers with app control, voice commands, and automated settings are likely to attract tech-savvy consumers who seek smarter living solutions. In addition, the hospitality industry is increasingly adopting garment steamers.

Hotels, spas, and resorts see them as a way to provide better guest services while maintaining eco-friendly standards. This creates a strong commercial demand alongside residential buyers. Together, these factors indicate a promising future for garment steamer brands that innovate and expand into new territories.

Emerging Trends

Portable and Travel-Friendly Garment Steamers are Shaping Market Trends

One of the biggest trends in the garment steamer market is the rising popularity of portable and travel-friendly models. Consumers today travel more and want lightweight, easy-to-carry steamers that can fit into their luggage and deliver quick results anywhere.

Another emerging trend is multi-functionality. New garment steamers now come with extra features, allowing them to sanitize fabrics, clean upholstery, and even freshen up curtains. This added versatility makes them more attractive to buyers looking for products that can handle multiple tasks.

Finally, eco-friendly garment steamers are becoming more important. Models with energy-saving modes, water filtration systems, and minimal chemical use are drawing attention from environmentally conscious consumers. These trending factors are shaping how brands design and market their products, focusing more on portability, multiple uses, and sustainability to stay competitive in the evolving market.

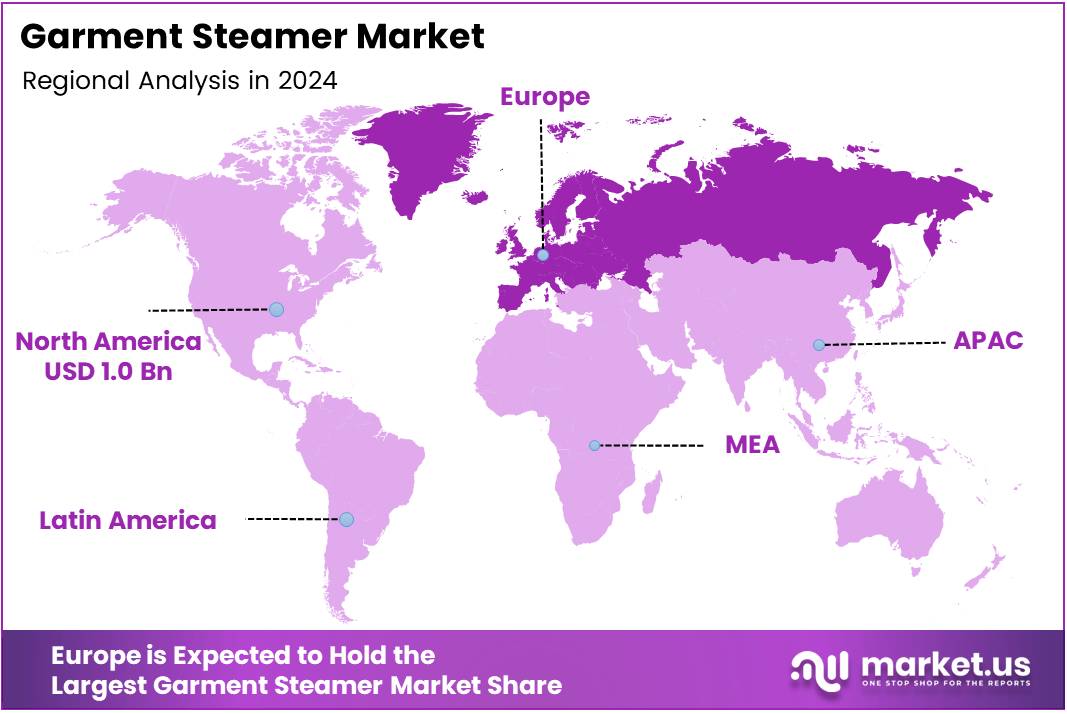

Regional Analysis

Europe Leads Global Garment Steamer Market with 34.6% Share, Valued at USD 1.2 Billion

Europe dominates the global garment steamer market, capturing 34.6% of the total share and reaching a valuation of USD 1.2 billion. The region’s growth is driven by a high preference for efficient, eco-friendly garment care solutions, supported by strong purchasing power and evolving consumer lifestyles. Additionally, an increasing focus on premium home appliances continues to boost demand across key European markets.

Regional Mentions:

North America maintains a significant presence in the garment steamer market, propelled by widespread urbanization and a busy lifestyle that favors quick and convenient garment care solutions. The rising adoption of advanced household appliances in the United States and Canada is further enhancing regional market growth. Increasing awareness of home-care innovations is expected to fuel continuous demand in the coming years.

The Asia Pacific region is experiencing the fastest growth in the garment steamer market, backed by a surge in disposable incomes and a growing urban population. Countries like China, India, and Japan are seeing a rapid increase in demand for efficient garment care appliances. Moreover, the expansion of the regional textile and apparel industry continues to support the positive outlook for garment steamers.

The Middle East & Africa is gradually emerging as a promising market for garment steamers, supported by rising living standards and a growing inclination toward modern lifestyle products. Increased household income and a shift toward energy-efficient appliances are positively influencing market expansion. The steady rise of tourism and hospitality sectors in the region also supports the growth of garment care solutions.

Latin America shows steady development in the garment steamer market, fueled by increasing urbanization and a shift toward convenient home appliance solutions. Consumers in countries such as Brazil, Argentina, and Chile are showing greater interest in modern garment care methods. Improvements in the retail distribution network are further aiding market accessibility across the region.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The global garment steamer market in 2024 is shaped by a diverse and competitive landscape, with key players continuously driving innovation and shaping consumer demand.

Rowenta leads the market with a strong focus on high-performance steamers, offering models that cater to both home users and professional environments. Their products are known for their efficiency, durability, and design, making Rowenta a trusted brand for premium steamers.

Panasonic is another significant player, offering advanced garment steamers with features such as 360° steaming and precise temperature controls. The brand appeals to a broad consumer base with versatile and easy-to-use products that provide convenience and superior performance.

Pursteam has garnered attention for its affordable yet effective steamers. By providing high-quality products at competitive prices, Pursteam has built a strong following among budget-conscious consumers who do not want to compromise on performance.

Midea Group brings its extensive manufacturing capabilities to the garment steamer market, focusing on incorporating smart technologies and energy-efficient features into its products. This resonates particularly well with tech-savvy users looking for modern solutions to garment care.

Electrolux, through its brands like AEG, continues to position itself in the high-end segment, with an emphasis on design, functionality, and sustainability. Their steamers are favored by consumers who prioritize premium features and environmental impact.

Haier Group adds to the market with its smart garment steamers, catering to the growing trend of connected home appliances. Haier’s integration of advanced technology offers users a seamless experience.

Top Key Players in the Market

- Rowenta

- Panasonic Marketing Middle East & Africa FZE

- Pursteam

- Midea Group

- AB Electrolux

- Haier Group

- Conair LLC

- FLYCO

- CHIGO

- Jiffy Steamer Company, LLC

- Koninklijke Philips N.V.

Recent Developments

- In January 2024, Versuni inaugurated a state-of-the-art factory in Ahmedabad dedicated to the production of air fryers and garment steamers, boosting its manufacturing capacity in India. This new facility is set to cater to both domestic and international markets with advanced product innovations.

- In March 2025, Kent launched its premium range of steam irons and the Swift Garment Steamer under the brand “Crisp N Sharp Clothing,” aiming to redefine fabric care. These high-performance appliances are designed to deliver professional-quality results for modern households.

Report Scope

Report Features Description Market Value (2024) USD 3.4 Billion Forecast Revenue (2034) USD 6.0 Billion CAGR (2025-2034) 5.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Application (Clothes, Curtains, Carpets, Others), By Distribution Channel (Online, Supermarket/Hypermarket) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Rowenta, Panasonic Marketing Middle East & Africa FZE, Pursteam, Midea Group, AB Electrolux, Haier Group, Conair LLC, FLYCO, CHIGO, Jiffy Steamer Company, LLC, Koninklijke Philips N.V. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Rowenta

- Panasonic Marketing Middle East & Africa FZE

- Pursteam

- Midea Group

- AB Electrolux

- Haier Group

- Conair LLC

- FLYCO

- CHIGO

- Jiffy Steamer Company, LLC

- Koninklijke Philips N.V.