Global Game Publisher Market Size, Share, Statistics Analysis Report By Game Type (Action-Adventure Games, First-person Shooters (FPS), Simulation Games, Sports Games, Fighting Games, Survival Games, eSports Games, Others), By Device Type (Mobile Device, Computer, Console, Online), By Distribution Channel (Digital Distribution, Physical Distribution), By End-user (Casual Gamers, Professional Gamers), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: April 2025

- Report ID: 146922

- Number of Pages: 202

- Format:

-

keyboard_arrow_up

Quick Navigation

- Game Publisher Market Size

- Market Overview

- Key Takeaways

- China Game Publisher Market

- Game Type Analysis

- Device Type Analysis

- Distribution Channel Analysis

- End-user Analysis

- Key Market Segments

- Driver

- Restraint

- Opportunity

- Challenge

- Latest Market Trends

- Business Benefits

- Key Player Analysis

- Top Key Players in the Market

- Top Opportunities for Players

- Industry News

- Report Scope

Game Publisher Market Size

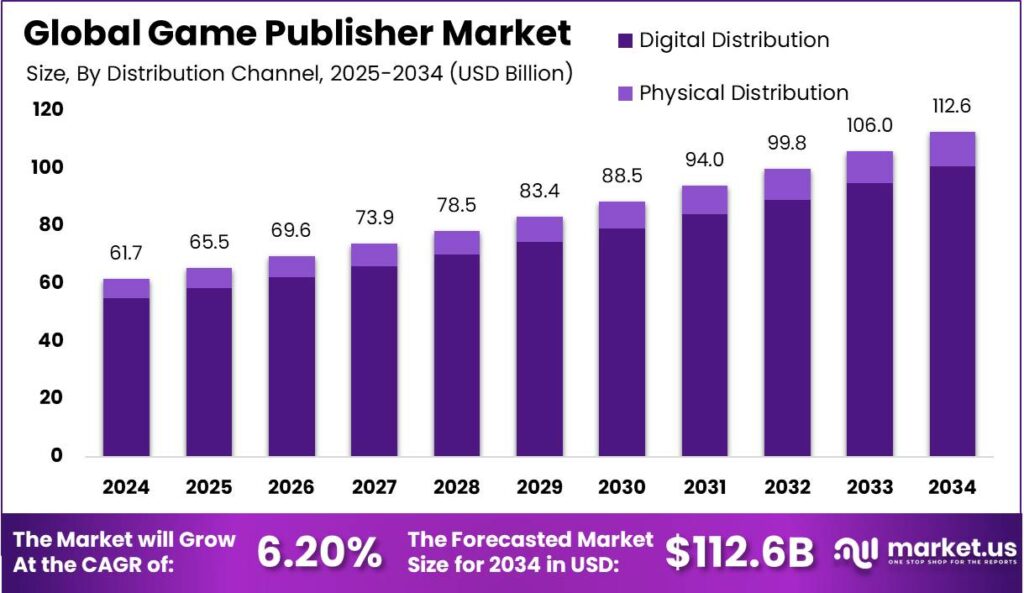

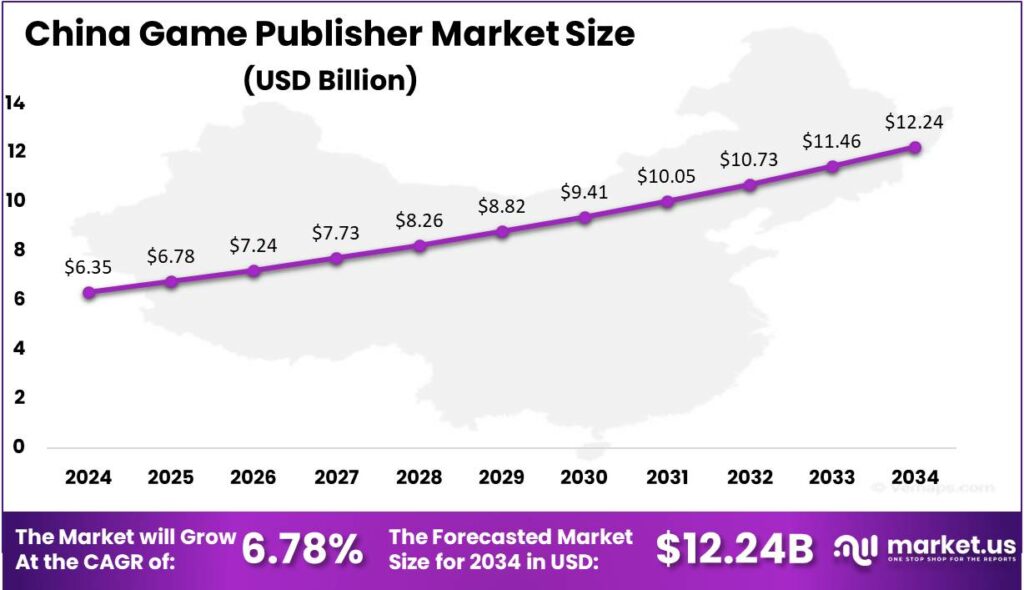

The Global Game Publisher Market size is expected to be worth around USD 112.6 Billion By 2034, from USD 61.7 Billion in 2024, growing at a CAGR of 6.20% during the forecast period from 2025 to 2034. In 2024, Asia-Pacific held a dominant market position in the game publisher market with over a 36.78% share, generating USD 22.6 billion in revenue. Meanwhile, the market for game publishers in China was estimated at USD 6.35 billion, with a CAGR of 6.78%.

A game publisher is responsible for marketing, distribution, and often financing video games developed by others. The publisher market includes managing production timelines, promotion, sales, and distribution across platforms like consoles, PCs, and mobile devices. This market plays a key role in connecting developers with consumers, ensuring games reach their intended audience effectively.

The growth of the game publisher market is driven by key factors, including the global rise in smartphone penetration and internet connectivity, which expands the consumer base, especially in mobile gaming. Additionally, advancements in technology, such as AR and VR, have enhanced gaming experiences, attracting more users.

Market Overview

The demand within the game publisher market is primarily driven by the global increase in gaming audiences, especially in mobile and online gaming. As devices become more affordable and internet connectivity improves worldwide, more people engage in gaming activities. This trend is particularly strong in emerging markets where mobile devices are the primary means of internet access.

As of 2024, the gaming industry has seen a decisive shift toward digital platforms, with 95% of global game sales now occurring through digital downloads or streaming, leaving physical sales at a minimal 5%, according to Udonis. This transformation underlines the dominance of online distribution in consumer behavior and content delivery.

Mobile gaming continues to lead the sector, generating approximately USD 92 billion, which accounts for 49% of the global gaming revenue. Console gaming ranks second, contributing around USD 51 billion (28% share), followed by PC gaming at roughly USD 43 billion (23% share). This segmentation highlights the rising accessibility of mobile platforms and their growing engagement rates compared to traditional formats.

From a regional perspective, the United States and China remain the top contributors to industry revenue. In 2023, the U.S. generated approximately USD 46.7 billion, marginally surpassing China’s USD 44.6 billion. Other key markets include Japan (USD 18.4 billion), South Korea (USD 7.4 billion), Germany (USD 6.6 billion), and the United Kingdom (USD 5.5 billion).

The integration of cross-platform play has emerged as a major trend, enhancing player engagement by allowing gamers from different platforms to interact and play together. This trend is complemented by the Games-as-a-Service (GaaS) model, where games are continually updated with new content to maintain and grow user bases over time.

Key Takeaways

- The Global Game Publisher Market size is expected to be worth around USD 112.6 Billion by 2034, from USD 61.7 Billion in 2024, growing at a CAGR of 6.20% during the forecast period from 2025 to 2034.

- In 2024, the Action-Adventure Games segment held a dominant market position, capturing more than a 16.7% share in the game publisher market.

- In 2024, the Mobile Device segment held a dominant market position, capturing more than a 52.1% share in the game publisher market.

- In 2024, the Digital Distribution segment held a dominant market position, capturing more than an 89.4% share in the game publisher market.

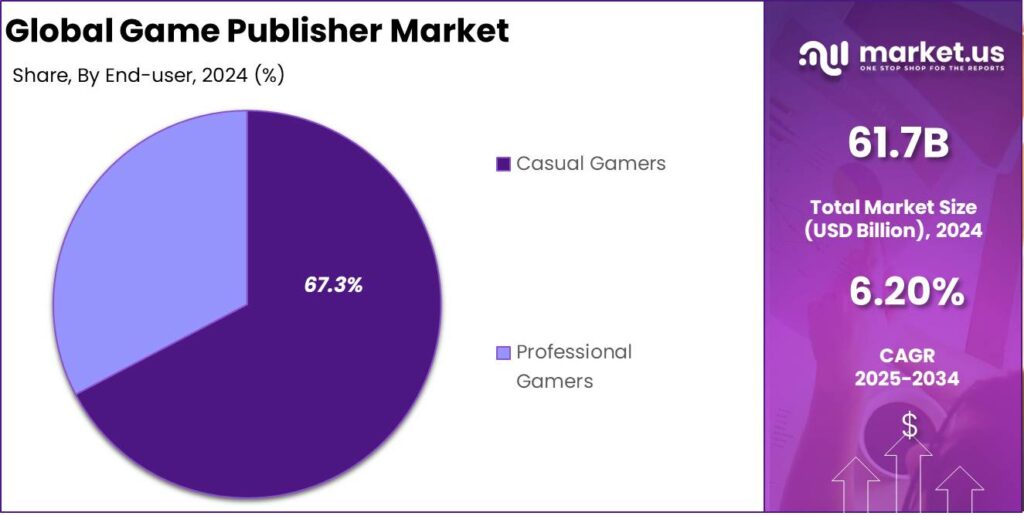

- In 2024, the Casual Gamers segment held a dominant market position within the game publisher market, capturing more than a 67.3% share.

- In 2024, Asia-Pacific held a dominant market position in the game publisher market, capturing more than a 36.78% share and generating revenues amounting to USD 22.6 billion.

- In 2024, the market for game publishers in China was estimated at USD 6.35 billion. This sector is experiencing a steady growth trajectory, with a CAGR of 6.78%.

China Game Publisher Market

In 2024, the market for game publishers in China was estimated at USD 6.35 billion. This sector is experiencing a steady growth trajectory, with a compound annual growth rate (CAGR) of 6.78%. This expansion highlights the dynamic growth of the Chinese gaming industry, fueled by rising consumer demand and advancements in gaming technology.

The sustained growth of the Chinese game publisher market is driven by several factors, including the rising popularity of mobile gaming among China’s large population. Increased internet access and the spread of smartphones have made gaming more accessible, boosting market expansion. Additionally, innovations in game design and the integration of AR and VR are attracting new players while retaining the existing user base.

The Chinese game publisher market is set for continued growth, fueled by advancements in gaming technologies and supportive government policies for digital entertainment. Collaborations between publishers and mobile device manufacturers will create new opportunities for expansion. As the market matures, these factors will propel the industry forward, solidifying China’s role as a global gaming leader.

In 2024, Asia-Pacific held a dominant market position in the game publisher market, capturing more than a 36.78% share and generating revenues amounting to USD 22.6 billion. This significant market share can be largely attributed to the extensive digital transformation across the region, especially in major economies such as China, Japan, and South Korea.

Asia-Pacific benefits from a large, young population that is highly tech-savvy and enthusiastic about gaming. The region’s strong gaming culture, along with substantial local production and consumption, drives growth. In countries like South Korea, government support through subsidies and programs to promote game development has further boosted the industry.

Esports plays a key role in the dominance of the Asia-Pacific game publisher market, with top esports teams fueling enthusiasm for competitive gaming and driving demand for diverse genres. The market is poised to maintain its leadership, supported by innovations in gaming technology, expanding internet and mobile access, and the continued growth of an engaged gaming community.

Game Type Analysis

In 2024, the Action-Adventure Games segment held a dominant market position in the game publisher market, capturing more than a 16.7% share. This genre’s leading status comes from its wide appeal, combining engaging stories, immersive worlds, and interactive gameplay with problem-solving, exploration, and combat, attracting both casual and hardcore gamers.

Action-adventure games have thrived thanks to advancements in gaming hardware, enabling developers to craft more detailed and expansive worlds. These improvements make the games more engaging and visually appealing. The genre’s versatility, blending elements from various genres, also broadens its appeal, attracting a wider audience.

The rise of digital distribution platforms has further fueled the growth of the action-adventure games segment. Platforms like Steam, PlayStation Network, and Xbox Live provide developers with direct access to vast audiences globally, reducing barriers to entry and enabling more frequent updates and enhancements to existing games, which helps maintain player interest over longer periods.

The action-adventure games segment is set for sustained growth, driven by innovations like virtual reality (VR) and augmented reality (AR), which open new possibilities for player immersion. As technology and gameplay evolve, the market is expected to remain dominant, captivating gamers with engaging and innovative experiences.

Device Type Analysis

In 2024, the Mobile Device segment held a dominant market position in the game publisher market, capturing more than a 52.1% share. This dominance is driven by the global adoption of smartphones and the convenience of mobile gaming, allowing users to play on-the-go with games designed for quick, engaging sessions that suit busy lifestyles.

Furthermore, the mobile platform has seen an increase in the sophistication of games available, attracting a broader audience that includes both casual and hardcore gamers. Developers and publishers have leveraged this trend by focusing on mobile-first strategies, often releasing games exclusively for mobile devices before other platforms.

The economic model of mobile gaming also supports rapid growth. Many mobile games are free to play and monetize through in-app purchases and advertising, making them accessible to a larger demographic compared to traditionally priced PC and console games.

Technological advancements in mobile devices, like enhanced graphics and processing power, have led to more complex and visually appealing games. This progression is narrowing the gap in gaming quality between mobile devices and traditional consoles or PCs, further driving the growth of the mobile gaming market.

Distribution Channel Analysis

In 2024, the Digital Distribution segment held a dominant market position, capturing more than an 89.4% share. This substantial market share can be attributed to several pivotal factors that highlight the segment’s robust appeal and its alignment with contemporary consumer preferences and technological advancements.

Digital distribution platforms have revolutionized how consumers access and purchase games, offering 24/7 worldwide availability. Unlike physical stores, these platforms provide instant content delivery, eliminating the need for travel. This convenience appeals to consumers who prioritize ease and immediacy, which traditional retail outlets can’t match.

Digital distribution lowers costs by removing the need for manufacturing, shipping, and storage, allowing publishers to maintain higher margins. These savings can be reinvested into game development or marketing, boosting the overall quality and competitiveness of their products.

These platforms give publishers direct access to consumer behavior data, offering insights into market trends, preferences, and purchasing patterns. By using this data, publishers can refine marketing strategies and game development to better align with audience demands, leading to higher engagement and customer satisfaction.

The growth of digital distribution is further fueled by the rise of mobile gaming and cloud gaming technologies. These trends broaden the gaming market, attracting casual gamers who favor the accessibility of mobile devices. The integration of games into mobile and cloud platforms strengthens the dominance of digital distribution in the gaming industry.

End-user Analysis

In 2024, the Casual Gamers segment held a dominant market position within the game publisher market, capturing more than a 67.3% share. The significant market share can be attributed to the accessibility of gaming platforms and the wide variety of games that appeal to casual gamers’ diverse interests and skill levels, making gaming an attractive leisure activity for a broad audience. This inclusivity has driven the segment’s growth.

The rise of mobile gaming has played a key role in expanding the casual gamer base. With games designed to be intuitive and engaging, mobile gaming appeals to users seeking entertainment during commutes or short breaks. This accessibility and playability have attracted a large number of casual gamers.

Game publishers’ marketing strategies, including ads, social media campaigns, and brand collaborations, have effectively targeted casual gamers, boosting the visibility of casual-friendly games and driving growth. Additionally, the evolution of casual games, with more competition and social interaction elements, has kept players engaged and encouraged frequent play, helping the segment remain strong and influential in the broader gaming market.

Key Market Segments

By Game Type

- Action-Adventure Games

- First-person Shooters (FPS)

- Simulation Games

- Sports Games

- Fighting Games

- Survival Games

- eSports Games

- Others

By Device Type

- Mobile Device

- Computer

- Console

- Online

By Distribution Channel

- Digital Distribution

- Physical Distribution

By End-user

- Casual Gamers

- Professional Gamers

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver

Expansion of Mobile Gaming and Digital Distribution

The proliferation of smartphones and the widespread availability of affordable internet have significantly propelled the growth of mobile gaming. This segment has become a dominant force in the game publishing industry, driven by the accessibility of games on various devices and the convenience of digital distribution platforms.

The rise of app stores and online marketplaces has enabled publishers to reach a global audience without the constraints of physical distribution. Moreover, the adoption of cloud gaming services has further facilitated access to high-quality games across different platforms.

These developments have not only expanded the consumer base but have also opened new revenue streams through in-app purchases and subscription models. The continuous innovation in mobile technology and the increasing engagement of users with mobile games underscore the significance of this driver in the industry’s growth trajectory.

Restraint

Escalating Development Costs

The game publishing industry is currently grappling with the challenge of rising development costs, particularly for AAA titles. The demand for high-fidelity graphics, expansive open-world environments, and sophisticated gameplay mechanics necessitates substantial investment in technology and talent.

The rising cost of developing AAA games, often exceeding budgets, is putting financial pressure on publishers, who also face the need for costly marketing campaigns. As a result, many are becoming more risk-averse, prioritizing established franchises over innovative but unproven concepts. This trend may hinder creativity and reduce the diversity of games available to players.

Opportunity

Growth of Emerging Markets

Emerging markets, particularly in regions like Africa, present a significant opportunity for game publishers. The increasing penetration of smartphones and improvements in internet infrastructure have led to a growing gaming audience in these areas.

Local developers are creating culturally relevant content that resonates with regional audiences, while international publishers are exploring partnerships to tap into these markets. The potential for growth is substantial, as these markets are relatively untapped and offer a new consumer base eager for diverse gaming experiences. By investing in localized content and understanding regional preferences, publishers can establish a strong foothold and drive revenue growth in these burgeoning markets.

Challenge

Market Saturation and Visibility Issues

The game publishing industry faces the challenge of market saturation, with an overwhelming number of titles released annually. This abundance makes it increasingly difficult for individual games, especially from independent developers, to gain visibility and attract a substantial player base.

The competition for consumer attention is intense, and without significant marketing budgets, many quality games fail to achieve commercial success. This environment favors established publishers with the resources to promote their titles extensively, potentially marginalizing innovative projects from smaller studios. Addressing this challenge requires strategic marketing, community engagement, and leveraging alternative distribution channels to enhance discoverability.

Latest Market Trends

The game publishing landscape is shifting due to technological advancements and changing player expectations. A key trend is the rise of cross-platform development, which allows games to be accessible on PCs, consoles, and mobile devices. This expands the audience and boosts player engagement by offering flexible gaming experiences.

Cloud gaming is transforming the industry by enabling players to stream high-quality games without costly hardware, with services like Xbox Cloud Gaming and NVIDIA GeForce NOW leading the way. Additionally, ethical monetization practices are on the rise, with publishers moving away from loot boxes and pay-to-win models in favor of fairer strategies like cosmetic purchases and battle passes to maintain player trust.

AI is playing a larger role in game development, aiding in content creation, user acquisition, and data analytics for personalized gaming experiences. Additionally, there’s a growing focus on supporting indie developers, with companies like Pocketpair launching publishing divisions to fund and assist smaller studios, promoting innovation and diversity in game content.

Business Benefits

Game publishers provide essential funding to developers, particularly indie developers, allowing them to bring their creative visions to life without the burden of financial risk. This funding is often tied to development milestones, helping structure the development process and ensuring ongoing financial support.

Publishers play a critical role in marketing games, utilizing various channels such as social media, online advertising, and event promotions to increase visibility. Marketing support plays a vital role in a game’s success, helping it stand out in a crowded market. Strong strategies boost visibility, spark anticipation, and keep players engaged before and after launch.

Publishers provide valuable expertise in both game development and market strategies. This involves handling licensing, localizing for global markets, and ensuring quality. For smaller dev teams, this expertise helps tackle technical hurdles and improve game design for wider reach.

Key Player Analysis

The gaming industry is one of the most dynamic sectors globally, and its success relies heavily on a few key players who dominate the market.

Tencent Holdings is a Chinese multinational conglomerate that has become one of the largest and most powerful forces in the gaming industry. The company’s strength lies in its vast portfolio, which includes some of the world’s most popular games and gaming platforms. Additionally, Tencent is a key player in the mobile gaming market, which has seen rapid growth in recent years.

Sony Group Corporation is a well-known name in the entertainment world, and its gaming division, Sony Interactive Entertainment, plays a pivotal role in the video game market. Sony’s focus on providing high-quality gaming experiences, both in terms of hardware and software, has earned it a loyal customer base worldwide.

Microsoft Corporation is another major player that has made significant strides in the gaming sector, particularly with its Xbox consoles and its growing portfolio of game studios. Microsoft’s commitment to game subscription services like Xbox Game Pass has also revolutionized how players access and enjoy games, offering a wide variety of titles for a monthly fee.

Top Key Players in the Market

- Tencent Holdings Limited

- Sony Group Corporation

- Microsoft Corporation

- Sea Limited

- NetEase, Inc.

- Nintendo Co., Ltd.

- Electronic Arts Inc.

- Bandai Namco Holdings Inc.

- Entain plc

- Epic Games

- CyberAgent, Inc.

- Embracer Group AB

- Sega Sammy Holdings Inc.

- Nexon Co., Ltd.

- Playtika Holding Corp.

- Other Major Players

Top Opportunities for Players

The game publishing market is poised for dynamic growth with several key opportunities emerging from technological advancements and evolving market conditions.

- Cross-Platform Development: There’s a growing demand for games that offer a seamless experience across multiple platforms, including PC, consoles, and mobile devices. With over three billion active gamers worldwide, the ability to publish games that are accessible on various devices can significantly expand a game’s reach and revenue potential.

- Enhanced Monetization Strategies: Game publishers are increasingly exploring sophisticated monetization strategies beyond traditional sales, such as microtransactions, season passes, and in-game advertising. The key is to balance monetization with user experience to maintain player engagement and satisfaction.

- Indie Game Support: The barriers to game development are lowering, thanks to intuitive game engines and digital distribution platforms like Steam and the Epic Games Store. This trend presents a lucrative opportunity for publishers to partner with indie developers, who are now capable of creating hit titles without extensive budgets, and help them navigate the crowded marketplace.

- Global Expansion: Emerging markets present significant growth opportunities. Regions such as Asia-Pacific are rapidly growing in terms of gamer population and revenue, offering game publishers the chance to capitalize on new customer bases and diversified gaming preferences.

- Adoption of Latest Technologies: Incorporating advanced technologies such as AI, cloud computing, and virtual reality can lead to innovative game features and experiences. These technologies not only enhance gameplay but also provide new ways to engage users and stand out in a competitive market.

Industry News

- In January 2025, CyberAgent, Inc. took a step to expand its creative frontier by launching a brand-new anime production studio, CA Soa Inc., a move aimed at supercharging its presence and capabilities in the world of anime.

- In April 2024, Epic Games acquired Loci, an AI platform for automated tagging of 3D assets, to enhance its digital asset offerings.

Report Scope

Report Features Description Market Value (2024) USD 61.7 Bn Forecast Revenue (2034) USD 112.6 Bn CAGR (2025-2034) 6.20% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Game Type (Action-Adventure Games, First-person Shooters (FPS), Simulation Games, Sports Games, Fighting Games, Survival Games, eSports Games, Others), By Device Type (Mobile Device, Computer, Console, Online), By Distribution Channel (Digital Distribution, Physical Distribution), By End-user (Casual Gamers, Professional Gamers) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Tencent Holdings Limited, Sony Group Corporation, Microsoft Corporation, Sea Limited, NetEase, Inc., Nintendo Co., Ltd., Electronic Arts Inc., Bandai Namco Holdings Inc., Entain plc, Epic Games, CyberAgent, Inc., Embracer Group AB , Sega Sammy Holdings Inc., Nexon Co., Ltd., Playtika Holding Corp., Other Major Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Tencent Holdings Limited

- Sony Group Corporation

- Microsoft Corporation

- Sea Limited

- NetEase, Inc.

- Nintendo Co., Ltd.

- Electronic Arts Inc.

- Bandai Namco Holdings Inc.

- Entain plc

- Epic Games

- CyberAgent, Inc.

- Embracer Group AB

- Sega Sammy Holdings Inc.

- Nexon Co., Ltd.

- Playtika Holding Corp.

- Other Major Players