Global Furfural Market By Process (Chinese Batch Process, Quaker Batch Process, and Rosenlew Continuous Process), By Raw Material (Sugarcane bagasse, Corn cob, Rice husk, and Sunflower hull), By Application(Furfuryl Alcohol, Solvent, Intermediate, Others), By End-use (Pharmaceuticals, Agriculture, Food & Beverage, Paints & Coatings, and Refineries), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2023-2033

- Published date: Nov 2023

- Report ID: 14818

- Number of Pages: 378

- Format:

-

keyboard_arrow_up

Quick Navigation

Market Overview

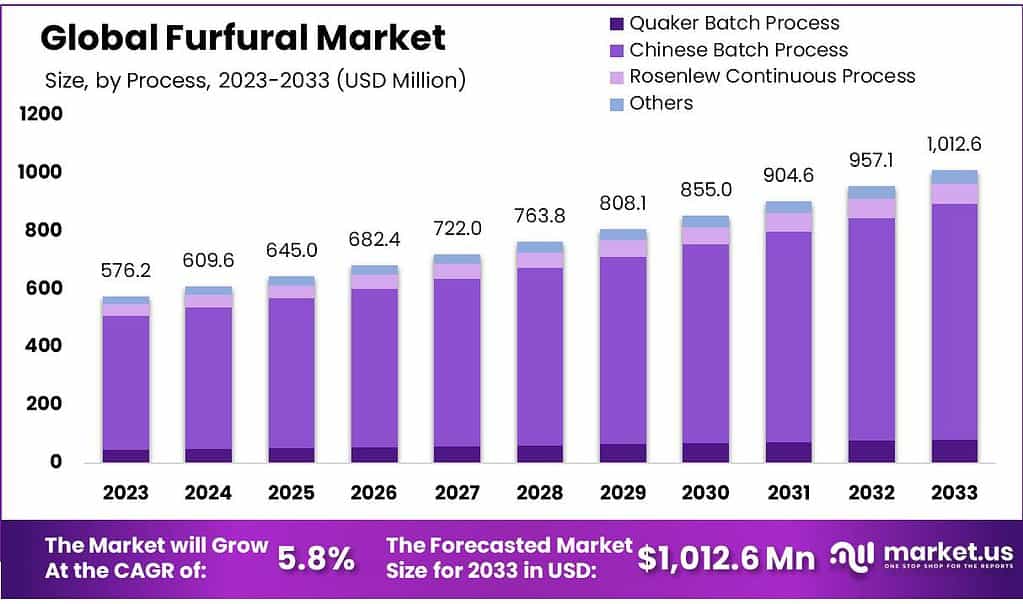

The global Furfural market size is expected to be worth around USD 1012.6 Million by 2033, from USD 576.2 Million in 2023, growing at a CAGR of 5.8% during the forecast period from 2023 to 2033.

Environmental concerns are likely to develop, increasing demand for solvent applications. Due to the COVID-19 pandemic, the market saw a decline in 2020. Due to social distancing and lockdowns, there was a decrease in production. Furfural production was also affected by disruptions in the supply chain and logistic facilities.

Note: Actual Numbers Might Vary In the Final Report

Key Takeaways

- Market Growth Projection: The Furfural market is anticipated to grow significantly, with an expected worth of around USD 1012.6 Million by 2033, marking a substantial increase from USD 576.2 Million in 2023, at a CAGR of 5.8%.

- Process Analysis: The Chinese Batch Process dominates, accounting for 80.3% of global revenue in 2023. Rosenlew Continuous Process is reliable but less preferred due to high production costs. Quaker Batch Process, an older method, remains in use despite modifications.

- Raw Material Influence: Corncob, with over 68.5% market share in 2023, stands out due to its high yield and extensive use in furfural production. Sugarcane bagasse, despite being easily available, faces challenges in storage and transportation, limiting its utilization.

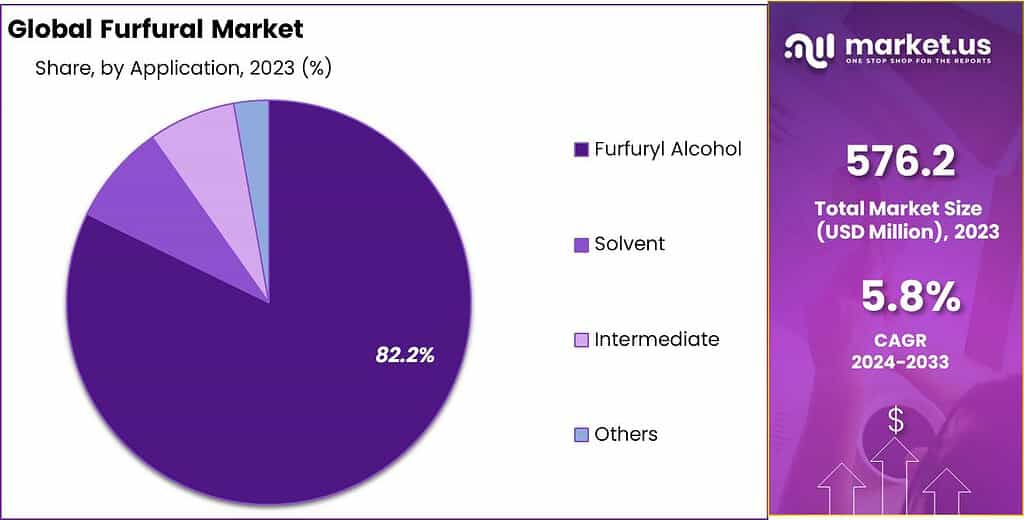

- Application Areas: Furfuryl Alcohol leads with 82.1% market share in 2023, favored for its diverse applications in various industries like automotive and electronics. Solvents find steady demand in paints, coatings, and cleaning products due to their dissolving properties.

- End-Use Significance: Refineries hold a dominant share (48.9% in 2023) due to Furfural’s use as a solvent and agrochemical component. Its role in pharmaceuticals, agriculture, and food & beverage industries continues to expand.

- Market Drivers: Increasing demand for furfuryl alcohol owing to its role in foundry sand binders. Growth in the foundry industry, especially in India, propels the demand for furfuryl alcohol.

- Market Challenges: Competition from cheaper crude oil-based alternatives poses a challenge, particularly in the foundry industry. Furfural’s higher cost compared to alternatives like BDO limits its adoption.

- Opportunities and Advancements: Emerging demand for furfural derivatives, notably in the textile industry for spandex production and PU applications. Research focuses on improving furfural yield from biomass to meet industrial scale requirements.

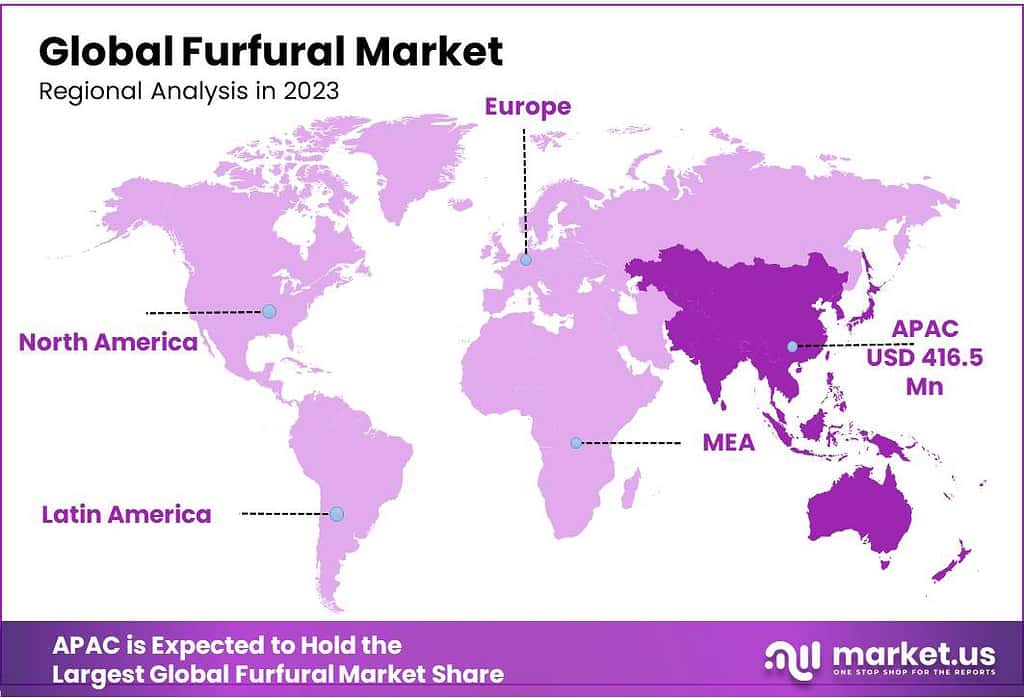

- Regional Insights: Asia Pacific was the dominant region, with a market share of over 72.3% by 2023. Europe’s market growth is attributed to its use in food as a flavoring agent, especially in countries like Austria, Slovenia, and Italy.

- Key Market Players: Fragmented market with small- to mid-sized manufacturers dominating. Major players engage in integrated manufacturing across the value chain and emphasize R&D.

Process analysis

The global market can be further divided by processes into the Quacker batch, Chinese batch, Rosenlew continuous, and Chinese batch processes. The largest process segment, the Chinese batch process, accounted for 80.3% of global revenue in 2023.

This process is a major part of China’s manufacturing sector. While the Quaker batch process may be the oldest, others are modified versions. The main distinction between the Rosenlew continuous process and the Quaker batch process is the employment of sulfuric acid as a catalyst in the former process while not being necessary for the latter.

The Rosenlew continuous process, which is simple and requires little maintenance, is also the most reliable. This process is not recommended for small and medium-sized manufacturers. It uses large quantities of steam and has low production yields, leading to high production costs. Because it is cheap, most Chinese batch processes are preferred by manufacturers.

Raw Material analysis

The global market can be divided into several segments based on raw materials. These include corncob and sugarcane bagasse. With a share of more than 68.5%, the corncob raw material segment led the global market in 2023.

Because of its extensive use in furfural production, it is expected to maintain its dominant position for the next few years. Corncob has the highest yield, making it the most desired raw material for production. Corncob can also be used as a biomass feedstock to create renewable energy.

Sugarcane bagasse can be a significant byproduct of the agro-industrial sector. Sugarcane bagasse is easily available at a low price in many sugarcane-processing facilities, such as sugar mills or independent distilleries.

The high sugarcane production in Brazil, India, China, Thailand, Thailand, Thailand, and Pakistan means a lot of bagasse available in these countries. You can use a gas-fired boiler to increase bagasse production in sugar mills. Bagasse storage is complicated and expensive. A furfural unit should be placed near a sugar mill.

By Application

In 2023, Furfuryl Alcohol was a big deal, ruling the market with over 82.1% of the share. It’s a top choice for making various things like resins, foundry sand binders, and more. The demand for Furfuryl Alcohol comes from industries like automotive, construction, and electronics due to its sturdy and versatile nature.

Solvents are also a key part of this market, finding their place in paints, coatings, and cleaning products. They’re valued for their ability to dissolve other substances and help create different formulations for various applications. Their demand remains steady across multiple industries, especially in manufacturing and construction.

Intermediates, another important segment, play a behind-the-scenes role. They’re like the building blocks used to make other chemicals or products. They contribute to the production of a wide range of goods, from pharmaceuticals to agricultural chemicals.

Other applications of furfural, while not as massive as Furfuryl Alcohol, Solvents, or Intermediates, still hold significance. These might include uses in flavors and fragrances or as raw material for different chemical compounds. They might have smaller market shares individually, but together, they contribute to the diverse landscape of furfural applications.

Note: Actual Numbers Might Vary In the Final Report

End-Use analysis

The global market can be further divided by end uses into paints & coatings and pharmaceuticals. Food & beverages, agriculture, paints and coatings, pharmaceuticals, and food & drink are all examples. Refineries held a dominant market share in revenue, with more than 48.9% in 2023.

Its high use as a solvent in petroleum refineries, specialty adhesives, and Lubricants is responsible for this high market share. Furfural is widely used in the agrochemical sector as an insecticide, nematicide, and fungicide. It is an active ingredient of many nematicides, such as crop protectors and guards. It is also used in horticulture as a weed killer.

It is a contact insecticide that is mechanically incorporated into the soil or moved during irrigation. It can be used in relatively low concentrations. It is an agrochemical and relatively harmless. Furfural is used in the synthesis and construction of pharmaceutical building blocks.

The Drug Products Database lists Furfural as an active ingredient in veterinary medicines. Due to high investment and growing production, the demand for many health products will increase.

Кеу Маrkеt Ѕеgmеntѕ

By Process

- Chinese Batch Process

- Quaker Batch Process

- Rosenlew Continuous Process

- Other Process

By Raw Material

- Sugarcane bagasse

- Corn cob

- Rice husk

- Sunflower hull

- Other Raw Materials

By Application

- Furfuryl Alcohol

- Solvent

- Intermediate

- Others

By End-Use

- Pharmaceuticals

- Agriculture

- Food & Beverage

- Paints & Coatings

- Refineries

- Other End-uses

Drivers

Growing demand for furfuryl alcohol

Furfuryl alcohol, derived from furfural, plays a crucial role in making foundry sand binders due to its high reactivity. For decades, it has been a go-to substance for crafting cores and molds in metal production. Additionally, it’s a key ingredient in creating tetrahydrofurfuryl alcohol (THFA), widely utilized in pharmaceuticals.

The World Foundry Organization forecasts a substantial 13.0-14.0% growth in India’s foundry industry until 2025, positioning it as the world’s second-largest foundry market after China. This burgeoning industry is a driving force behind the escalating demand for furfuryl alcohol, consequently fueling the furfural market.

Restraints

Availability of crude oil-based alternatives

Cheaper alternatives derived from crude oil are posing a challenge to the furfural market. In the foundry industry, furan resin serves as a binder, but it faces competition from the more cost-effective phenolic resin sourced from crude oil, a fact highlighted by industry experts.

Additionally, butanediol (BDO) plays a role in producing spandex via polytetramethylene ether glycol (PTMEG) for the textile industry. While THF, a furfural derivative, could be used for spandex production, its higher cost due to furfural processing makes it less favorable compared to BDO.

Opportunity

Emerging demand for furfural derivatives (apart from furfuryl alcohol) in various applications

The textile and apparel industry’s growing appetite for spandex, prized for its strength and elasticity, is on the rise. Changes in the textile landscape and a heightened focus on health considerations have propelled the spandex fibers market in recent times. This surge is poised to propel the PTMEG market, a derivative of THF. THF, derived from furfural, serves as a building block for various applications.

Polyurethane (PU), another product stemming from PTMEG, finds extensive use across diverse sectors like apparel, appliances, automotive, construction, flooring, furnishing, marine, and medical. PU foam, especially valued for automotive interiors and building insulation due to its energy-efficient qualities, enjoys significant preference.

China stands out as both a major consumer and producer of PU globally, setting the stage for a buoyant market in the Asia-Pacific region. This optimistic scenario forecasts increased demand for PU, thereby offering opportunities for furfural manufacturers in the forecast period.

Challenges

Low yield of furfural from traditional technology

Furfural, derived from biomass, serves as a base for various chemical compounds and fuels, commonly produced through methods like the Quaker Oats process. Numerous technologies aim to extract value from agricultural resources or wood remnants to create furfural.

One such method, the Supra Yield technology, showed promising results with a 70.0% yield in small-scale trials. However, its application at a commercial level fell short in delivering similar returns.

Multiple research endeavors have delved into comprehending the reaction mechanisms involved in generating furfural from agricultural and wood sources. Present efforts concentrate on upscaling these studies to enhance furfural yield at an industrial scale.

Regional Analysis

The Asia Pacific was the dominant region, with a market share of over 72.3% by 2023. This is due to high furfural production in the region, particularly in China, and growth in many end-use industries such as agriculture, food & drink, pharmaceutical, and refinery.

Due to the growing product demand from the chemical and foundry sectors, Asia Pacific will see the highest CAGR between 2023 to 2033. China was the Asia Pacific’s dominant market in 2023. China’s high demand for furfuryl alcohol and its growing production drive product consumption. Many small-scale producers dominate China’s market.

Key manufacturers use corncobs in China as a primary feedstock. They also use the Chinese batch process to produce their products. China accounts for over 81.1% of global production. The development of the pharmaceutical and food industries over the past decade has contributed to Europe’s market growth. Furfural is mainly produced in Austria, Slovenia, and Italy.

It is also imported from other countries in the region. The product is used in Europe as a flavoring agent in various foods, such as frozen dairy, baked goods and gravies, candies and meat products, beverages, and desserts. Shortly, the market will be driven by the increasing use of furfural in meat products, baking, and the expanding bakery sector in France and Italy.

Note: Actual Numbers Might Vary In the Final Report

Key Regions and Countries

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Key Players Analysis

This market is somewhat fragmented, with many small- and mid-sized manufacturers accounting for most of the global share. The market is characterized by integrated manufacturing across the entire value chain. Large manufacturing facilities are a hallmark of top companies.

They also engage in research and development. Illovo Sugar Africa (Pty.) Ltd. is integrated throughout the value chain. The sugarcane bagasse is used for production. The company also manufactures furfuryl alcohol.

Маrkеt Кеу Рlауеrѕ

- Central Romana Corporation

- ILLOVO SUGAR AFRICA (PTY) LTD

- KRBL Ltd.

- LENZING AG

- Pennakem, LLC

- Hongye Holding Group Corporation Limited

- Silvateam SpA

- Tanin d.d.

- TransFurans Chemicals bvba

- Xingtai Chunlei Furfuryl Alcohol Co. Ltd (hebeichem)

- Zibo Xinye Chemical Co. Ltd

- Arcoy Industries Pvt. Ltd.

- GoodRich Sugar

- Zibo Huaao Chemical

- Tieling North Furfural (Group) Co. Ltd.

Recent Development

In 2022, Numaligarh refinery planed to set up a USD 212 million bio refinery to produce bioethanol for 5MT of bamboo per annum. Also, these units will supply chipped bamboo for the refinery to form 49 metric tonnes of ethanol, 19 MT of furfural and 11 MT of acetic acid and other associated products.

Report Scope

Report Features Description Market Value (2023) USD 576.2 Million Forecast Revenue (2033) USD 1012.6 Million CAGR (2023-2032) 5.8% Base Year for Estimation 2023 Historic Period 2017-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Process (Chinese Batch Process, Quaker Batch Process, and Rosenlew Continuous Process), By Raw Material (Sugarcane bagasse, Corn cob, Rice husk, and Sunflower hull), By Application(Furfuryl Alcohol, Solvent, Intermediate, Others), By End-use (Pharmaceuticals, Agriculture, Food & Beverage, Paints & Coatings, and Refineries) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Central Romana Corporation, ILLOVO SUGAR AFRICA (PTY) LTD, KRBL Ltd., LENZING AG, Pennakem, LLC, Hongye Holding Group Corporation Limited, Silvateam SpA, Tanin d.d., TransFurans Chemicals bvba, Xingtai Chunlei Furfuryl Alcohol Co. Ltd (hebeichem), Zibo Xinye Chemical Co. Ltd, Arcoy Industries Pvt. Ltd., GoodRich Sugar, Zibo Huaao Chemical, Tieling North Furfural (Group) Co. Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is furfural, and how is it obtained?Furfural is a chemical compound derived from biomass, often obtained through processes that involve the dehydration of agricultural feedstocks or wood residues. This conversion process, commonly known as the Quaker Oats method among others, extracts furfural from these organic sources.

What are the primary applications of furfural?Furfural serves as a versatile compound with various applications. It's extensively used in industries such as foundry for sand binders, in the production of chemicals like furfuryl alcohol and tetrahydrofurfuryl alcohol (THFA), and as a precursor in creating polymers like polyurethane (PU) and spandex.

What are the current trends or advancements in the furfural market?

-

-

- Central Romana Corporation

- ILLOVO SUGAR AFRICA (PTY) LTD

- KRBL Ltd.

- LENZING AG

- Pennakem, LLC

- Hongye Holding Group Corporation Limited

- Silvateam SpA

- Tanin d.d.

- TransFurans Chemicals bvba

- Xingtai Chunlei Furfuryl Alcohol Co. Ltd (hebeichem)

- Zibo Xinye Chemical Co. Ltd

- Arcoy Industries Pvt. Ltd.

- GoodRich Sugar

- Zibo Huaao Chemical Tieling North Furfural (Group) Co. Ltd.