Global Fuel Cell Electric Vehicle Market By Vehicle Type (Passenger Vehicles, Light commercial vehicles, Heavy commercial vehicles), By Type (Polymer Electrolyte Membrane Fuel Cell (PEMFC), Proton Exchange Membrane Fuel Cell, Phosphoric acid Fuel Cell, Other Types), By Range (Short Range, Long Range), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: October 2024

- Report ID: 28484

- Number of Pages: 351

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

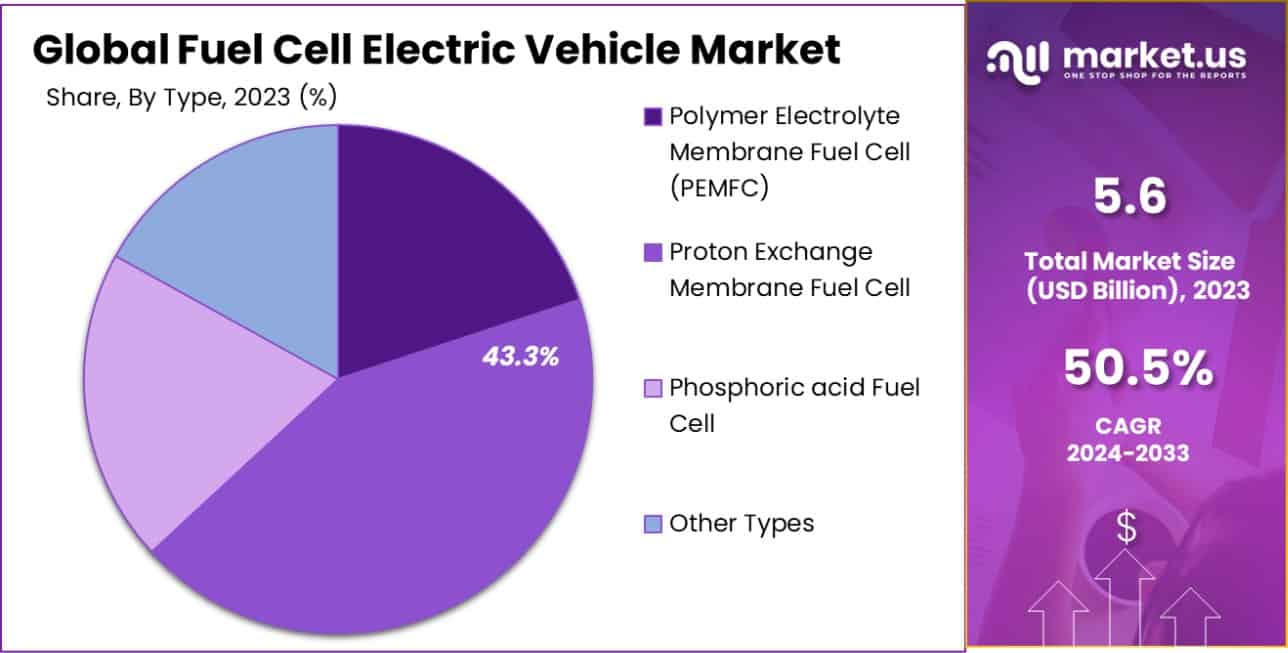

The Global Fuel Cell Electric Vehicle Market is expected to be worth around USD 333.9 billion by 2033, up from USD 5.6 billion in 2023, growing at a CAGR of 50.5% during the forecast period from 2024 to 2033.

A Fuel Cell Electric Vehicle (FCEV) utilizes a fuel cell to generate electricity through a chemical reaction between hydrogen and oxygen, without combustion. This electrically powered vehicle emits only water vapor and warm air, presenting a sustainable alternative to fossil fuel-dependent vehicles.

The fuel cell Electric Vehicle Market is driven by the growing demand for environmentally friendly transportation solutions and stringent global emission regulations. This market comprises manufacturers, infrastructure developers, and technology providers focusing on enhancing fuel cell efficiency and expanding hydrogen refueling infrastructure.

The market’s expansion is fueled by technological advancements in fuel cell efficiency and energy density, coupled with reductions in smart manufacturing costs. Governments worldwide are also incentivizing FCEV adoption through subsidies and tax benefits, accelerating market growth.

Increasing awareness of environmental issues and the need to reduce carbon emissions bolster the demand for FCEVs. As urban air quality concerns rise, cities are adopting zero-emission public transportation solutions, including buses and commercial fleets powered by fuel cells.

The FCEV market is poised for growth with the expansion of hydrogen infrastructure and renewable energy sources. Emerging markets in Asia and Europe are rapidly developing hydrogen refueling stations, which, combined with advancements in fuel cell technology, present significant opportunities for market expansion.

The Fuel Cell Electric Vehicle (FCEV) market is positioned at a pivotal juncture, fueled by both technological advancements and substantial governmental support aimed at fostering a sustainable energy transition. A critical driver of this market is the U.S. Department of Energy’s Hydrogen and Fuel Cell Technologies Office (HFTO), which is channeling significant resources into the sector.

The HFTO has earmarked up to $10 million per project for the development and deployment of clean hydrogen technologies, with a focus on enhancing hydrogen fueling infrastructure for medium and heavy-duty vehicles and standardizing hydrogen port equipment.

This initiative requires a cost share of 20% to 50%, depending on the project scope, and mandates a community benefits plan to ensure diversity, equity, inclusion, and accessibility.

Furthermore, the DOE’s recent announcement of $142 million in Phase II Small Business Innovation Research (SBIR) and Small Business Technology Transfer (STTR) awards underlines the strategic investment in clean energy R&D. Out of this, approximately $17.1 million is allocated to 15 projects specifically dedicated to clean hydrogen and fuel cell applications.

Additionally, a notable $46 million funding opportunity aims to accelerate the research, development, and demonstration of affordable hydrogen and fuel cell technologies, emphasizing the government’s commitment to reducing carbon emissions and promoting green technology.

These substantial financial injections not only validate the market’s growth potential but also pave the way for rapid advancements and deployment of FCEVs, signifying a robust trajectory for market expansion and technological maturity.

The amalgamation of governmental fiscal support with emerging technological innovations presents a fertile landscape for stakeholders to cultivate substantial growth in the FCEV sector, thereby driving forward the clean energy agenda.

Key Takeaways

- The Global Fuel Cell Electric Vehicle Market is expected to be worth around USD 333.9 billion by 2033, up from USD 5.6 billion in 2023, growing at a CAGR of 50.5% during the forecast period from 2024 to 2033.

- In 2023, Passenger Vehicles held a dominant market position in the By Vehicle Type segment of Fuel Cell Electric Vehicle Market.

- In 2023, Proton Exchange Membrane Fuel Cells held a dominant market position in the by-type segment of the Fuel Cell Electric Vehicle Market, with a 43.3% share.

- In 2023, Short Range held a dominant market position in the By Range segment of the Fuel Cell Electric Vehicle Market.

By Vehicle Type Analysis

In 2023, Passenger Vehicles held a dominant market position in the “By Vehicle Type” segment of the Fuel Cell Electric Vehicle Market. This segment outstripped others due to heightened consumer interest in sustainable and innovative transportation solutions.

Enhanced governmental incentives, subsidies, and robust investments in hydrogen infrastructure significantly contributed to fostering this segment’s growth. Additionally, technological advancements in fuel cell technology improved vehicle efficiency and reduced costs, making passenger fuel cell electric vehicles (FCEVs) more accessible to a broader consumer base.

Light commercial vehicles (LCVs) also experienced considerable growth, driven by the increasing adoption of eco-friendly vehicles in corporate fleets and small businesses aiming to reduce carbon footprints. The expansion of logistics and e-commerce has particularly propelled the demand for FCEV LCVs, emphasizing the need for sustainable intra-city transport solutions.

Meanwhile, the Heavy commercial vehicles (HCVs) segment is emerging more slowly due to higher initial investments and the nascent stage of supportive infrastructure. However, it holds substantial long-term growth potential as industries are pushed towards reducing environmental impact, which could pivot more significantly towards FCEV adoption in heavy-duty transportation scenarios.

Overall, while passenger vehicles currently lead the market, shifts in commercial transport regulations and sustainability targets may influence future dynamics across all vehicle categories.

By Type Analysis

In 2023, the Proton Exchange Membrane Fuel Cell (PEMFC) held a dominant market position in the “By Type” segment of the Fuel Cell Electric Vehicle Market, capturing a 43.3% share.

This technology, favored for its low operating temperature and quick start-up capabilities, is particularly suited for passenger and light commercial vehicles, which aligns with the automotive industry’s push toward cleaner energy sources.

The PEMFC’s efficiency and durability underpin its widespread adoption, enabling longer driving ranges and shorter refueling times compared to other fuel cell types.

The Phosphoric Acid Fuel Cell (PAFC), known for its reliability and high tolerance to impurities, also plays a crucial role, particularly in heavier transportation applications. However, its higher operational temperature and longer start-up times, compared to PEMFC, limit its suitability primarily to stationary applications or larger vehicles where these characteristics are less of a disadvantage.

Other types, including solid oxide and molten carbonate fuel cells, while important, currently represent a smaller portion of the market. They are often reserved for specific niche applications that can benefit from their particular characteristics, such as high-temperature operation and the capability to utilize various fuels. As the market evolves, these technologies might see growth, driven by advancements and specific use-case requirements.

By Range Analysis

In 2023, Short Range held a dominant market position in the “By Range” segment of the Fuel Cell Electric Vehicle Market. This segment’s prominence is primarily attributed to the current distribution of hydrogen refueling infrastructure, which is more conducive to short-range travel within urban and suburban areas.

Short-range fuel cell electric vehicles (FCEVs) are particularly appealing for daily commutes and smart city driving, where frequent refueling is less of a concern, thereby aligning well with consumer usage patterns and existing infrastructure capabilities.

Conversely, Long Range FCEVs, though they offer extended travel distances and are ideal for long-haul journeys, face limitations due to the sparse hydrogen refueling stations outside metropolitan regions. This segment, while slowly expanding, is driven by ongoing developments in infrastructure and the potential for larger vehicles such as buses and trucks, where long-range capabilities are essential.

The market dynamics are influenced by technological advancements that aim to increase the efficiency and hydrogen storage capacities of FCEVs, potentially shifting future preferences towards longer-range models as refueling infrastructure becomes more widespread. For now, short-range FCEVs continue to dominate, providing a practical and eco-friendly solution for the majority of consumers.

Key Market Segments

By Vehicle Type

- Passenger Vehicles

- Light commercial vehicles

- Heavy commercial vehicles

By Type

- Polymer Electrolyte Membrane Fuel Cell (PEMFC)

- Proton Exchange Membrane Fuel Cell

- Phosphoric acid Fuel Cell

- Other Types

By Range

- Short Range

- Long Range

Drivers

Key Drivers of FCEV Market Growth

The Fuel Cell Electric Vehicle (FCEV) market is driven primarily by global efforts to reduce carbon emissions, prompting a shift from conventional internal combustion engines to cleaner alternatives.

Governments worldwide are supporting this transition through subsidies and incentives, making FCEVs more attractive to consumers and businesses alike.

Additionally, advancements in fuel cell technology have significantly lowered costs and improved the efficiency and range of these vehicles, further boosting their market appeal. The growing infrastructure for hydrogen fueling stations, especially in urban and industrial hubs, also enhances the practicality of FCEVs for everyday use.

These factors collectively fuel the accelerated adoption of FCEVs, aligning with broader environmental goals and innovations in green technology.

Restraint

Barriers to FCEV Market Adoption

A significant restraint in the Fuel Cell Electric Vehicle (FCEV) market is the limited hydrogen refueling infrastructure. This shortage poses a considerable challenge, especially in less urban areas, deterring potential buyers who worry about fuel availability on longer trips.

Additionally, the high cost of hydrogen production, which often involves energy-intensive processes, further complicates the economic viability of FCEVs compared to battery electric vehicles (BEVs). While technology improvements have reduced costs, these vehicles remain expensive due to the advanced materials required for fuel cells.

Moreover, public awareness and understanding of fuel cell technology are relatively low, slowing consumer acceptance and adoption rates. These factors collectively hinder the widespread uptake of FCEVs, despite their environmental benefits.

Opportunities

Expanding Horizons for FCEVs

The Fuel Cell Electric Vehicle (FCEV) market presents significant opportunities, particularly through technological advancements and expanding hydrogen infrastructure. Innovations in fuel cell efficiency and durability are reducing costs and enhancing vehicle performance, making FCEVs more competitive with traditional and other electric vehicles.

Increasing investment in hydrogen fueling infrastructure by governments and private entities is addressing a range of concerns, making these vehicles more practical for everyday use and long-distance travel. Additionally, FCEVs offer unique advantages in heavy-duty transport sectors, such as trucks and buses, where their longer range and faster refueling capabilities are critical.

The push towards decarbonization in transportation and the integration of renewable energy sources for hydrogen production also position FCEVs as a sustainable solution in the shift away from fossil fuels, tapping into growing environmental consciousness among consumers and businesses.

Challenges

Challenges Facing FCEV Market Growth

The Fuel Cell Electric Vehicle (FCEV) market faces several challenges that could hinder its growth. The most significant is the high initial cost of fuel cell production, largely due to the expensive platinum-based catalysts used in fuel cells. This cost makes FCEVs more expensive than both conventional vehicles and other electric vehicle types.

Another major challenge is the hydrogen supply chain; producing, storing, and transporting hydrogen fuel is complex and costly, limiting the expansion of necessary refueling infrastructure. Moreover, there are safety concerns related to the storage and handling of hydrogen, a highly flammable substance, which requires stringent safety measures and can discourage potential users.

Finally, FCEVs must compete with rapidly advancing battery electric vehicle (BEV) technology, which currently enjoys more consumer acceptance and greater market penetration. These hurdles must be addressed to realize the full potential of FCEVs in the automotive market

Growth Factors

Driving Growth in the FCEV Sector

The growth of the Fuel Cell Electric Vehicle (FCEV) market is propelled by several key factors. First, stringent environmental regulations worldwide are pushing the automotive industry to adopt cleaner technologies, positioning FCEVs as a viable green alternative.

Second, technological advancements in fuel cell efficiency and hydrogen storage are enhancing performance and reducing the costs of FCEVs, making them more appealing to consumers. Additionally, increasing investments in hydrogen infrastructure, including fueling stations, are making it easier for consumers to consider FCEVs as a practical option.

Government incentives, such as tax breaks and grants for both manufacturers and consumers, further encourage the adoption of FCEVs. Lastly, the growing corporate commitment to sustainability is leading more businesses to integrate FCEVs into their fleets, thus driving further market expansion. These factors collectively contribute to the robust growth of the FCEV market.

Emerging Trends

Emerging Trends in the FCEV Market

Emerging trends in the Fuel Cell Electric Vehicle (FCEV) market are shaping its future landscape. A significant trend is the integration of renewable energy sources for hydrogen production, which promotes sustainability and reduces dependency on traditional fossil fuels.

There is also a growing focus on developing multi-fuel stations that offer both hydrogen and electric charging, enhancing convenience for users of different electric vehicles. Additionally, partnerships between automotive manufacturers and technology companies are accelerating the development and deployment of advanced fuel cell technologies.

This collaboration extends to governments and international bodies promoting FCEVs through supportive policies and global climate agreements. Furthermore, the application of FCEVs in public transportation and commercial fleets is increasing, showcasing their viability and efficiency in high-utilization scenarios.

These trends highlight a dynamic and evolving market, poised for significant expansion as technologies mature and adoption increases.

Regional Analysis

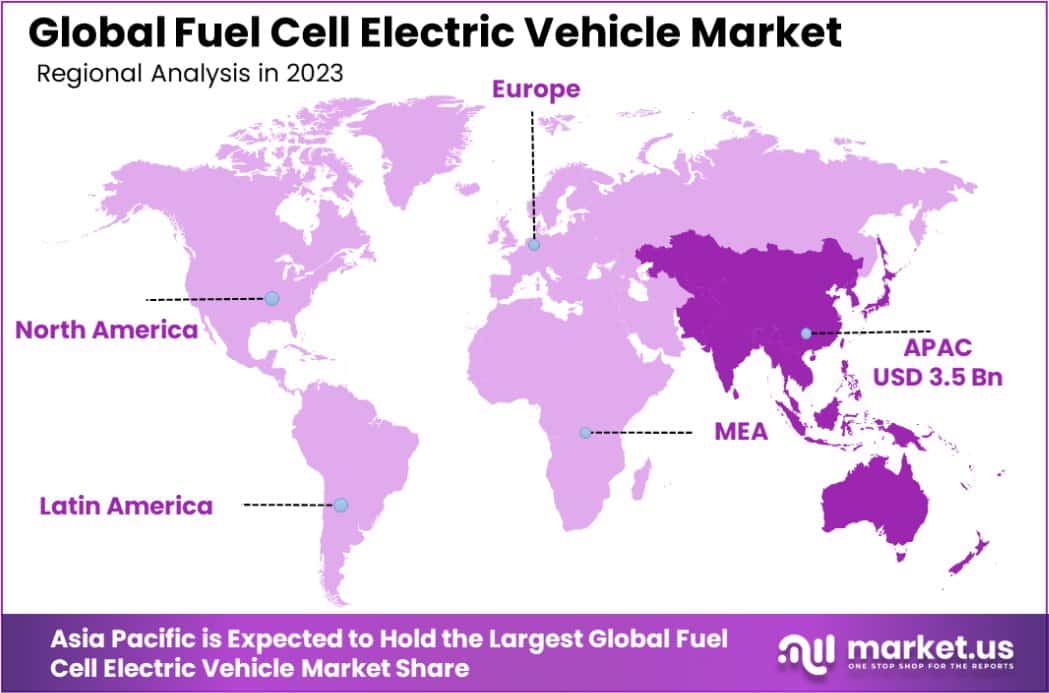

The Fuel Cell Electric Vehicle (FCEV) market exhibits varied growth dynamics across global regions, influenced by regulatory environments, technological advancements, and infrastructure development.

Asia Pacific leads the market with a commanding 63.6% share, valued at USD 3.5 billion, primarily driven by aggressive environmental policies and investments in hydrogen infrastructure, particularly in countries like Japan, South Korea, and China.

These nations have implemented substantial governmental funding and incentives that support both the development of FCEV technologies and the expansion of hydrogen refueling stations.

In Europe, the market is propelled by strong policy support from the European Union, aimed at reducing carbon emissions. Countries such as Germany and Norway are at the forefront, offering various incentives to accelerate FCEV adoption. This region focuses heavily on integrating renewable energy sources with hydrogen production, enhancing the sustainability of FCEVs.

North America, led by the United States, is rapidly catching up, supported by both state and federal policies encouraging renewable energy and clean transportation solutions. The development of hydrogen fuel infrastructure is pivotal in this growth, alongside initiatives like California’s Zero-Emission Vehicle Program.

Latin America and the Middle East & Africa are still nascent markets for FCEVs. However, they show potential with gradual investments in clean transportation technologies and infrastructure, albeit at a slower pace compared to other regions. These markets are expected to gain momentum as global efforts towards decarbonization intensify and technology transfer increases.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In 2023, the global Fuel Cell Electric Vehicle (FCEV) market is significantly shaped by the strategic maneuvers of key players such as Hyundai Motor Group, Daimler AG, and Ballard Power Systems. Each company contributes uniquely to the market’s dynamics, underscoring diverse strategies in technology development, market penetration, and regional expansion.

Hyundai Motor Group stands out as a pioneer in FCEV technology, having introduced one of the world’s first commercial hydrogen-powered vehicles. In 2023, Hyundai continues to lead with aggressive expansion plans in Asia and North America, focusing on enhancing its hydrogen infrastructure and launching next-generation FCEV models.

The company’s commitment to FCEV technology is evident in its substantial investments in fuel cell production capabilities, aiming to lower costs and improve efficiency, thereby making FCEVs more accessible to a broader market.

Daimler AG, known for its luxury and commercial vehicles, has made significant strides in integrating fuel cell technology into its product lineup. The company focuses on high-performance FCEVs, leveraging its extensive experience in automotive engineering to enhance vehicle reliability and appeal.

Daimler’s strategy involves collaborative ventures, such as with Volvo Group, to scale hydrogen-based technology for heavy-duty vehicles, indicating a targeted approach to capture specific segments of the transportation sector.

Ballard Power Systems, a leader in proton exchange membrane fuel cell technology, plays a crucial role in providing the core technology that powers FCEVs. In 2023, Ballard continues to innovate in fuel cell performance and durability, partnering with several automotive manufacturers to supply fuel cell stacks and modules.

Their strategy emphasizes reducing the platinum content in fuel cells to decrease costs and increase the appeal of FCEV solutions in commercial and public transportation.

Together, these companies are driving the FCEV market forward through technological innovation, strategic alliances, and a deep commitment to sustainable transportation solutions, positioning the FCEV as a viable competitor in the green vehicle market.

Top Key Players in the Market

- Hyundai Motor Group

- Daimler AG

- Ballard Power Systems

- Volvo AB

- General Motors

- Honda Motor Co.

- Nikola Corporation

- Toyota Motor Corporation

- BMW AG

- Volkswagen AG

- Audi AG

- Other Key Players

Recent Developments

- In September 2024, Volkswagen’s new fuel cell technology contains a ceramic membrane as opposed to standard polymer membranes favored by the Asia-based automobile giants. The membrane is key to the cell generating electricity and a novel ceramic membrane means a cheaper manufacturing process.

- In July 2024, Hyundai Motor advances hydrogen technology, showcasing a Hydrogen Fuel Cell Support Bus in Jeju and achieving 10 million km with the XCIENT Fuel Cell truck in Switzerland.

Report Scope

Report Features Description Market Value (2023) USD 5.6 Billion Forecast Revenue (2033) USD 333.9 Billion CAGR (2024-2033) 50.5% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Vehicle Type (Passenger Vehicles, Light commercial vehicles, Heavy commercial vehicles), By Type (Polymer Electrolyte Membrane Fuel Cell (PEMFC), Proton Exchange Membrane Fuel Cell, Phosphoric acid Fuel Cell, Other Types), By Range (Short Range, Long Range) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Hyundai Motor Group, Daimler AG, Ballard Power Systems, Volvo AB, General Motors, Honda Motor Co., Nikola Corporation, Toyota Motor Corporation, BMW AG, Volkswagen AG, Audi AG, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Fuel Cell Electric Vehicle MarketPublished date: October 2024add_shopping_cartBuy Now get_appDownload Sample

Fuel Cell Electric Vehicle MarketPublished date: October 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Hyundai Motor Group

- Daimler AG

- Ballard Power Systems

- Volvo AB

- General Motors

- Honda Motor Co.

- Nikola Corporation

- Toyota Motor Corporation

- BMW AG

- Volkswagen AG

- Audi AG

- Other Key Players