Global Fruits And Vegetables Processing Market Size, Share, And Enhanced Productivity By Fruit and Vegetable Type (Fruits, Vegetables, Others), By Product Type (Fresh, Fresh-cut, Canned, Frozen, Dried and Dehydrated, Convenience), By Equipment Type (Pre-processing, Peeling/Inspection/slicing, Washing and Dewatering, Fillers, Packaging & Handling, Seasoning Systems, Others), By Mode of Operation (Automatic, Semi-automatic), By Processing System (Small Scale, Intermediate Scale), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: January 2026

- Report ID: 174013

- Number of Pages: 273

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- By Fruit and Vegetable Type Analysis

- By Product Type Analysis

- By Equipment Type Analysis

- By Mode of Operation Analysis

- By Processing System Analysis

- Key Market Segments

- Driving Factors

- Restraining Factors

- Growth Opportunity

- Latest Trends

- Regional Analysis

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

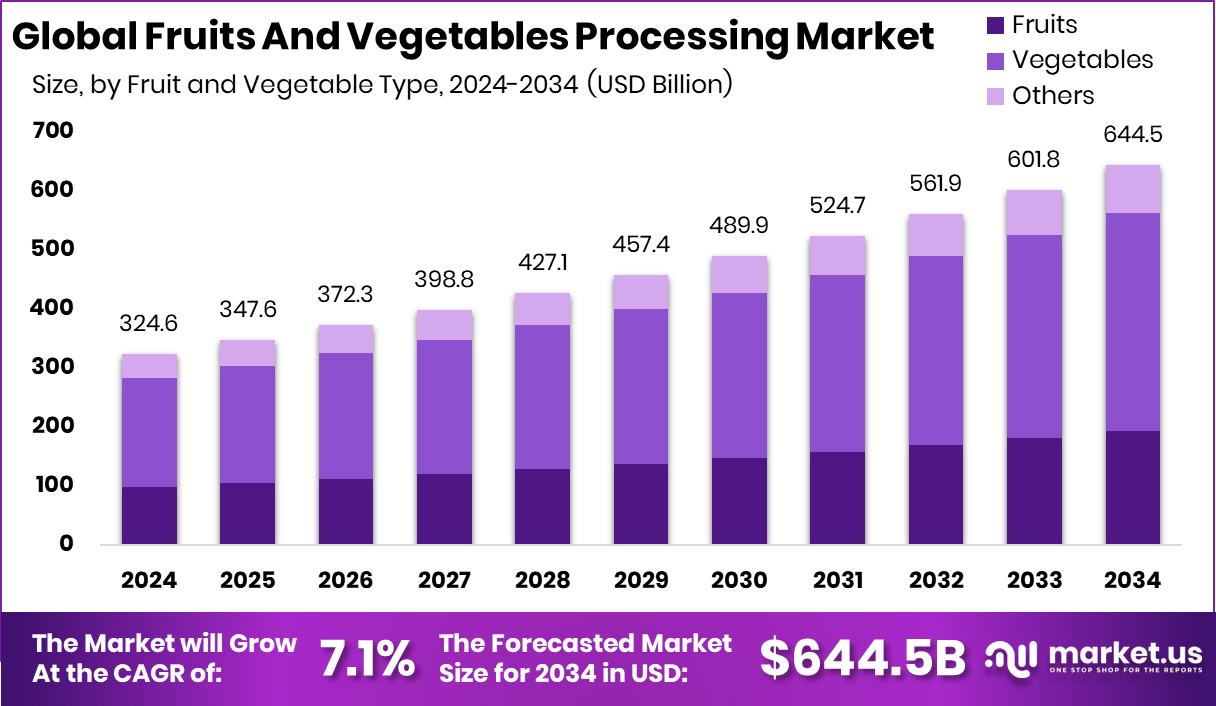

The Global Fruits And Vegetables Processing Market is expected to be worth around USD 644.5 billion by 2034, up from USD 324.6 billion in 2024, and is projected to grow at a CAGR of 7.1% from 2025 to 2034. Fruits and Vegetables Processing Market in Asia Pacific reached 43.6%, USD 142.4 Bn.

Fruits and vegetables processing refers to the cleaning, sorting, cutting, freezing, drying, canning, and packaging of fresh produce to extend shelf life and improve usability. This process helps reduce spoilage, ensures food safety, and makes fruits and vegetables available year-round in convenient forms for households and foodservice operators.

The Fruits and Vegetables Processing Market represents the commercial ecosystem that supports these activities, including processing facilities, cold storage, logistics, and distribution. Public support strengthens this system, as seen when Tennessee provided $5 million in emergency food funding during a government shutdown affecting SNAP benefits, helping stabilize food access through processed and preserved produce.

Growth factors for the market are closely linked to food security and infrastructure support. Over $25 million allocated to Iowa projects through USDA funding improved local processing and storage capabilities, while a federal funding cut leaving a Camden pantry with 200,000 fewer pounds of food highlighted the importance of reliable processing systems to manage supply disruptions.

Demand is rising due to changing eating habits and convenience preferences. Investments such as $4.65 million raised by Frizata for flexitarian frozen meals and $10 million secured by Kidfresh, with 75% directed to brand marketing, reflect growing consumer interest in nutritious, ready-to-eat processed options.

Opportunities are expanding through innovation and supply chain upgrades. Del Monte Pacific borrowing $500 million to fund a food business purchase, HUNDY! securing $350K for frozen fruit products, and Pasarnow raising $3.3 million to upgrade Indonesia’s fresh food supply chain show how funding is enabling new products, better distribution, and broader market reach.

Key Takeaways

- The Global Fruits And Vegetables Processing Market is expected to be worth around USD 644.5 billion by 2034, up from USD 324.6 billion in 2024, and is projected to grow at a CAGR of 7.1% from 2025 to 2034.

- Vegetables dominate the fruits and vegetables processing market with 57.3% share due to consumption volumes.

- Frozen products hold 27.5% share in fruits and vegetables processing market driven by convenience demand.

- Washing and dewatering equipment leads with 32.7% share ensuring hygiene and quality compliance standards globally.

- Automatic operation dominates with 67.2% share as processors seek efficiency labor savings consistency and scalability.

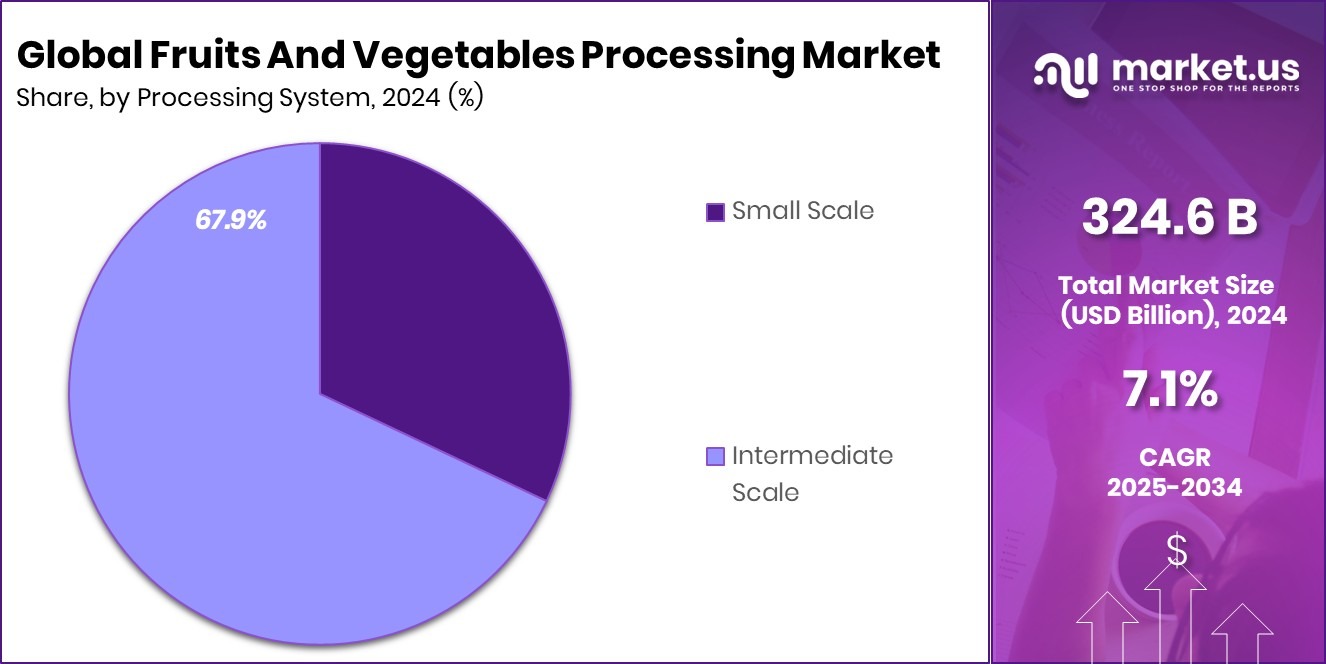

- Intermediate scale processing systems account for 67.9% share balancing capacity investment flexibility for growing processors.

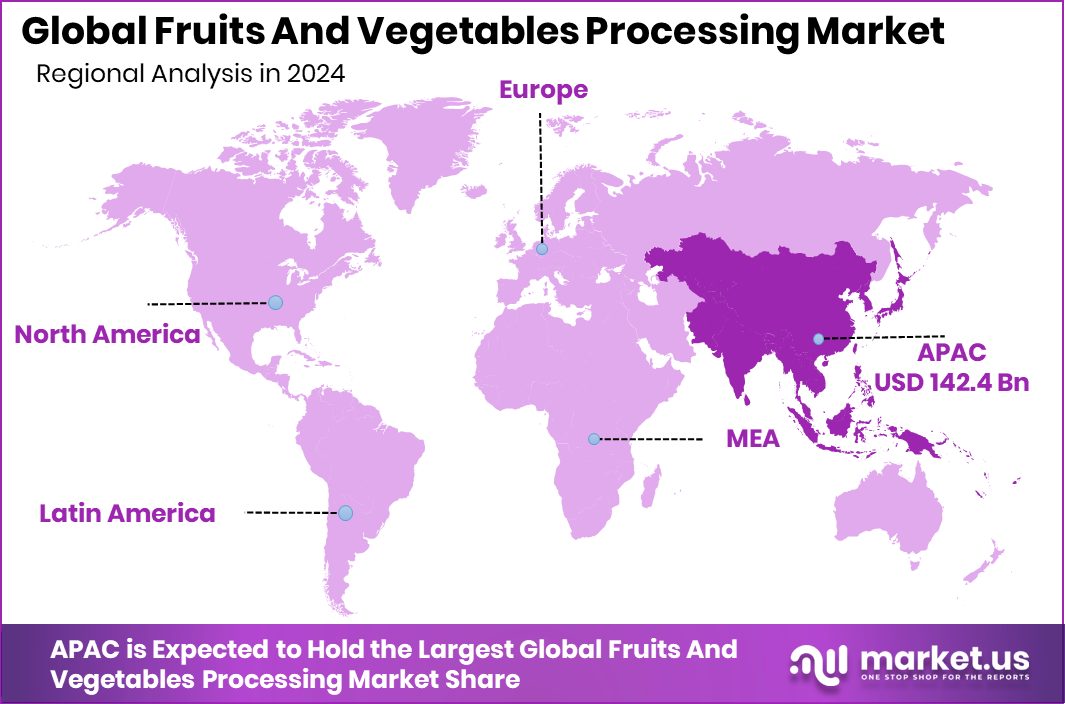

- Asia Pacific dominated Fruits Vegetables Processing Market with 43.6% share USD 142.4 Bn.

By Fruit and Vegetable Type Analysis

Vegetables dominate the Fruits and Vegetables Processing Market, holding 57.3% share globally today.

In 2024, vegetables held a 57.3% share within the Fruits and Vegetables Processing Market, reflecting their strong role in daily food consumption and industrial demand. Vegetables are widely processed for frozen foods, ready meals, soups, sauces, and institutional catering because of their shorter shelf life in fresh form. Urban lifestyles and rising working populations increased demand for cleaned, cut, blanched, and packaged vegetables.

Food processors focused on minimizing post-harvest losses by adopting efficient processing lines for potatoes, peas, carrots, onions, and leafy greens. Additionally, government support for cold-chain infrastructure and food parks encouraged higher vegetable processing volumes. The dominance of vegetables also reflects growing consumer interest in affordable nutrition, year-round availability, and convenience-driven food choices.

By Product Type Analysis

Frozen products account for 27.5% within the Fruits and Vegetables Processing Market segment.

In 2024, frozen products accounted for 27.5% of the Fruits and Vegetables Processing Market, making frozen the leading product type. Freezing preserves texture, color, and nutritional value while extending shelf life without chemical preservatives. This method gained traction among households, restaurants, and foodservice operators due to easy storage and reduced food waste.

Quick-service restaurants and cloud kitchens increasingly relied on frozen vegetables and fruits for consistency and cost control. Advances in individual quick freezing technology improved product quality and reduced freezer burn. Moreover, rising exports of frozen produce supported processing investments. Consumers viewed frozen products as reliable alternatives to fresh produce, especially in urban areas with limited daily access to fresh markets.

By Equipment Type Analysis

Washing and dewatering equipment leads with 32.7% share in Fruits Vegetables Processing Market.

In 2024, washing and dewatering equipment dominated with a 32.7% share in the Fruits and Vegetables Processing Market by equipment type. This stage is critical because it directly impacts food safety, hygiene, and product quality. Processors prioritized efficient removal of soil, pesticides, and surface contaminants before cutting or further processing. Automated washers, bubble washers, and centrifugal dewatering systems reduced water usage and labor costs.

Stricter food safety regulations pushed manufacturers to upgrade sanitation standards across processing lines. Small and mid-sized processors also invested in modular washing systems to meet compliance needs. The strong share highlights how proper cleaning and moisture control remain foundational steps for reducing spoilage and extending shelf life.

By Mode of Operation Analysis

Automatic operations dominate at 67.2%, boosting efficiency across Fruits Vegetables Processing Market globally.

In 2024, automatic mode of operation led the Fruits and Vegetables Processing Market with a 67.2% share, driven by labor shortages and efficiency goals. Automation improved throughput, consistency, and traceability across processing plants. Automatic systems minimized human contact, supporting hygiene standards and reducing contamination risks. Processors adopted automated sorting, washing, cutting, and packaging to manage large volumes with lower operational errors.

Although initial costs were higher, long-term savings from reduced labor dependency and waste justified investments. Automation also enabled better integration with digital monitoring and quality control systems. This shift reflected the industry’s focus on scalable operations capable of meeting rising domestic and export demand.

By Processing System Analysis

Intermediate-scale processing systems command 67.9% share, reflecting scalable demand in Fruits Vegetables Market.

In 2024, intermediate-scale processing systems captured a 67.9% share of the Fruits and Vegetables Processing Market, highlighting the strength of mid-sized processors. These systems balance capacity, flexibility, and cost, making them suitable for regional suppliers, cooperatives, and contract processors. Intermediate-scale units supported diversified product portfolios, including frozen, dried, and minimally processed produce.

Governments and financial institutions favored this scale for food processing clusters and rural value addition programs. These systems allowed faster market entry without the complexity of large industrial plants. Their dominance reflects a market structure where scalable, adaptable processing solutions meet growing demand while supporting local sourcing and regional distribution networks.

Key Market Segments

By Fruit and Vegetable Type

- Fruits

- Vegetables

- Others

By Product Type

- Fresh

- Fresh-cut

- Canned

- Frozen

- Dried and Dehydrated

- Convenience

By Equipment Type

- Pre-processing

- Peeling/Inspection/slicing

- Washing and Dewatering

- Fillers

- Packaging & Handling

- Seasoning Systems

- Others

By Mode of Operation

- Automatic

- Semi-automatic

By Processing System

- Small Scale

- Intermediate Scale

Driving Factors

Public Grants Strengthen Specialty Crop Processing Capacity

Government support is a major driving factor for the Fruits and Vegetables Processing Market, as it improves raw material quality and processing readiness. In Virginia, the state awarded $610,350 in specialty crop grants, helping growers invest in better harvesting, handling, and post-harvest practices. These improvements directly support processors by ensuring steady supply and consistent quality.

Similarly, Michigan awarded $2.08M for 22 specialty crop projects statewide, strengthening crop production, storage, and processing linkages. Such funding reduces supply risks for processors and encourages farmers to grow higher-value fruits and vegetables suitable for freezing, drying, and packaging.

As production becomes more reliable, processors can scale operations with confidence. These grants improve coordination between farms and processing units, driving long-term market growth through stable sourcing and improved crop utilization.

Restraining Factors

High Capital Needs Slow Processing Expansion Pace

One key restraining factor in the Fruits and Vegetables Processing Market is the high cost of scaling operations amid uneven funding distribution. While private deals like Helios entering a $40m food deal show investor interest, such large investments are not accessible to most small and mid-sized processors. At the same time, although the USDA announced $99MM in grant funding through two programs, competition for these grants remains intense.

Many processors face delays or partial funding, limiting equipment upgrades and automation plans. Rising costs for energy, labor, and compliance further strain budgets. As a result, some processors struggle to modernize facilities or expand capacity. This funding gap slows processing efficiency improvements, creating barriers for regional players trying to meet growing demand consistently.

Growth Opportunity

Automation Funding Unlocks Scalable Processing Opportunities

Automation-focused funding creates strong growth opportunities in the Fruits and Vegetables Processing Market. USDA agencies funded $287.7 million for specialty crop automation or mechanization projects, enabling processors to adopt advanced sorting, washing, cutting, and packaging systems. Automation helps reduce labor dependency while improving speed, hygiene, and yield.

In addition, 19 grants totaling $36.5 million supporting specialty crop research encourage innovation in processing methods and equipment design. These initiatives allow processors to test new technologies before large-scale adoption. Together, these funds help build scalable, efficient processing systems suited for rising demand. Automation also supports consistent quality, making processed fruits and vegetables more competitive in retail and foodservice channels. This creates long-term opportunities for processors to expand output sustainably.

Latest Trends

Public Nutrition Programs Shape Processing Demand Trends

Public food programs are shaping the latest trends in the Fruits and Vegetables Processing Market by influencing demand patterns. The USDA redirected $11.3M to purchase Iowa meat, dairy, fruits, and vegetables for schools and day care programs, increasing demand for processed and packaged produce suitable for institutional use.

At the consumer level, the Colorado program reimbursing SNAP recipients up to $60 per month for fruits and vegetables encourages higher consumption, indirectly boosting processing volumes. Additionally, the USDA awarded $2 million in grants to help Michigan farms grow specialty crops, strengthening future raw material supply. These programs push processors to focus on affordable, nutritious, and ready-to-use products. The trend reflects stronger links between public nutrition policies and processing strategies.

Regional Analysis

Asia Pacific Fruits Vegetables Processing Market held 43.6% share, valued USD 142.4 Bn.

Asia Pacific dominated the Fruits and Vegetables Processing Market with a 43.6% share, valued at USD 142.4 Bn, making it the leading regional contributor. This dominance reflects high population density, strong agricultural output, and rising consumption of processed food products across urban and semi-urban areas. Expanding cold storage capacity and growing demand for frozen and minimally processed fruits and vegetables further strengthened the region’s position.

In comparison, North America represents a mature market driven by established processing infrastructure, high food safety standards, and steady demand from foodservice and retail sectors. Europe follows closely, supported by organized supply chains, emphasis on quality processing, and consistent consumption of packaged fruits and vegetables.

The Middle East & Africa region shows gradual growth, influenced by increasing reliance on processed food to manage climatic limitations affecting fresh produce availability. Latin America contributes through strong raw material availability and export-oriented processing activities, particularly for frozen and preserved products.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

GEA Group AG played a critical role in the global Fruits and Vegetables Processing Market in 2024 by focusing on integrated processing solutions. The company’s strength lies in offering end-to-end systems covering washing, cutting, freezing, drying, and packaging. Its emphasis on hygienic design, automation, and energy-efficient equipment aligned well with processors aiming to reduce waste and improve throughput. GEA’s modular approach allowed processors of different scales to upgrade operations gradually, making it especially relevant for intermediate-scale facilities seeking long-term operational efficiency.

Bühler continued to demonstrate strong positioning through advanced processing and sorting technologies tailored for fruits and vegetables. The company focused on precision processing, digital monitoring, and quality consistency, which are increasingly important for meeting food safety and export requirements. Bühler’s engineering expertise supported processors looking to improve yield while maintaining product integrity. Its solutions helped address challenges such as raw material variability and process optimization, reinforcing its role as a technology-driven partner rather than just an equipment supplier.

Meanwhile, Alfa Laval remained influential through its specialization in separation, heat transfer, and fluid handling systems. In fruits and vegetables processing, Alfa Laval’s equipment supported critical operations like washing, dewatering, pasteurization, and thermal treatment. The company’s focus on reliability, hygiene, and reduced water and energy usage resonated with processors under pressure to improve sustainability while maintaining consistent output quality.

Top Key Players in the Market

- GEA Group AG

- Bühler

- Alfa Laval

- JBT Corporation

- Syntegon Technology GmbH

- Krones AG

- Marel

- Bigtem Makine A.S.

- FENCO Food Machinery S.R. L.

- ANKO FOOD MACHINE CO.LTD

- Heat and Control, Inc.

Recent Developments

- In July 2025, Alfa Laval, a leader in heat transfer, separation, and fluid handling equipment, completed the acquisition of the cryogenics business unit from French group Fives. This move strengthens Alfa Laval’s technology portfolio in cryogenic heat exchangers and pumps, helping the company support efficient liquefaction and handling of industrial gases, including applications in energy and processing sectors.

- In September 2024, Bühler acquired Esau & Hueber, a German process and fermentation technology specialist. This acquisition strengthens Bühler’s ability to serve food and beverage sectors, especially in hygienic processing and fermentation solutions.

- In March 2024, GEA launched a real-time monitoring solution called GEA InsightPartner at the Anuga FoodTec trade show. This cloud-based tool helps food processing plants monitor equipment performance, reduce downtime, and improve efficiency by providing historic and live machine data. It supports processors in maximizing productivity on their production lines.

Report Scope

Report Features Description Market Value (2024) USD 324.6 Billion Forecast Revenue (2034) USD 644.5 Billion CAGR (2025-2034) 7.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Fruit and Vegetable Type (Fruits, Vegetables, Others), By Product Type (Fresh, Fresh-cut, Canned, Frozen, Dried and Dehydrated, Convenience), By Equipment Type (Pre-processing, Peeling/Inspection/slicing, Washing and Dewatering, Fillers, Packaging & Handling, Seasoning Systems, Others), By Mode of Operation (Automatic, Semi-automatic), By Processing System (Small Scale, Intermediate Scale) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape GEA Group AG, Bühler, Alfa Laval, JBT Corporation, Syntegon Technology GmbH, Krones AG, Marel, Bigtem Makine A.S., FENCO Food Machinery S.R. L., ANKO FOOD MACHINE CO.LTD, Heat and Control, Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Fruits And Vegetables Processing MarketPublished date: January 2026add_shopping_cartBuy Now get_appDownload Sample

Fruits And Vegetables Processing MarketPublished date: January 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- GEA Group AG

- Bühler

- Alfa Laval

- JBT Corporation

- Syntegon Technology GmbH

- Krones AG

- Marel

- Bigtem Makine A.S.

- FENCO Food Machinery S.R. L.

- ANKO FOOD MACHINE CO.LTD

- Heat and Control, Inc.