Global Fried Chicken Market Size, Share, And Industry Analysis Report By Product Type (Bone In, Boneless, Spicy, Non Spicy), By Distribution Channel (Quick Service Restaurants, Full Service Restaurants, Online Delivery, Supermarkets and Hypermarkets, Convenience Stores), By End-User (Commercial, Household), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: December 2025

- Report ID: 169676

- Number of Pages: 335

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

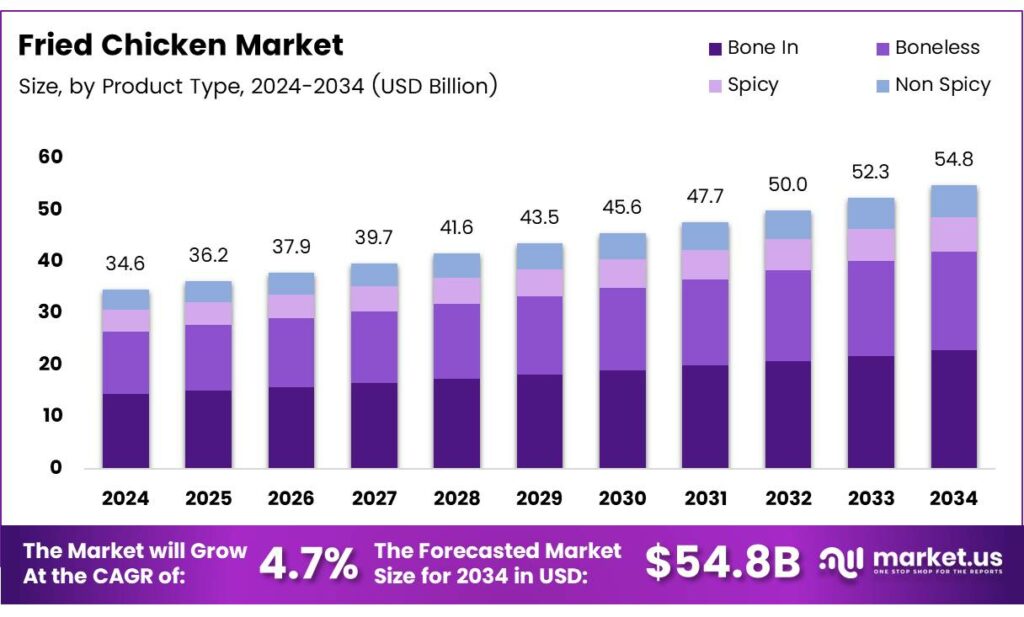

The Global Fried Chicken Market size is expected to be worth around USD 54.8 billion by 2034, from USD 34.6 billion in 2024, growing at a CAGR of 4.7% during the forecast period from 2025 to 2034.

Fried chicken refers to chicken portions coated with seasoned flour or batter and cooked using hot oil. It delivers crisp texture, rich flavor, and high satiety, making it a staple in global foodservice menus. As eating habits diversify, fried chicken remains relevant through portion flexibility and customizable taste profiles.

The Fried Chicken Market represents organized production and sale across restaurants, quick-service outlets, and frozen retail formats. Demand grows steadily due to urban lifestyles, rising protein intake, and preference for indulgent comfort foods. Moreover, convenient formats support both dine-in and delivery-driven consumption cycles worldwide.

Regulatory pressure also accelerates healthier operational practices rather than limiting growth. Guidelines on oil reuse, trans-fat limits, and energy-efficient frying equipment push process upgrades. Consequently, producers adopt improved cooking techniques that optimize texture while managing fat absorption, aligning indulgence with regulatory compliance and cost efficiency.

Processing science plays an important role in market performance and profitability. Pre-cooked frozen chicken parts experienced 20% to 26% weight loss from raw to ready-to-eat states, while non-precooked controls averaged 16% losses, directly impacting yield calculations and pricing strategies.

- Mickelberry and Stadelman reported that partially steaming chicken before deep-fat frying reduced overall cooking losses versus traditional frying-only methods. Their research also noted skin fat content reached 40% in deep-fat fried chicken, compared with 31% for oven-fried and 33% for skillet-fried chicken.

The Fried Chicken Market balances indulgence with operational efficiency. Growth is supported by urban demand, regulatory clarity, processing innovation, and protein affordability. As cooking science improves outcomes and governments strengthen food systems, fried chicken remains a resilient, scalable, and commercially attractive segment within global foodservice markets.

Key Takeaways

- The Global Fried Chicken Market is projected to grow from USD 34.6 billion in 2024 to USD 54.8 billion by 2034, registering a 4.7% CAGR during 2025–2034.

- Bone-in products lead the By Product Type segment with a dominant share of 44.2%, driven by strong traditional taste preference.

- Quick Service Restaurants dominate the By Distribution Channel segment, accounting for 49.1% of total market demand.

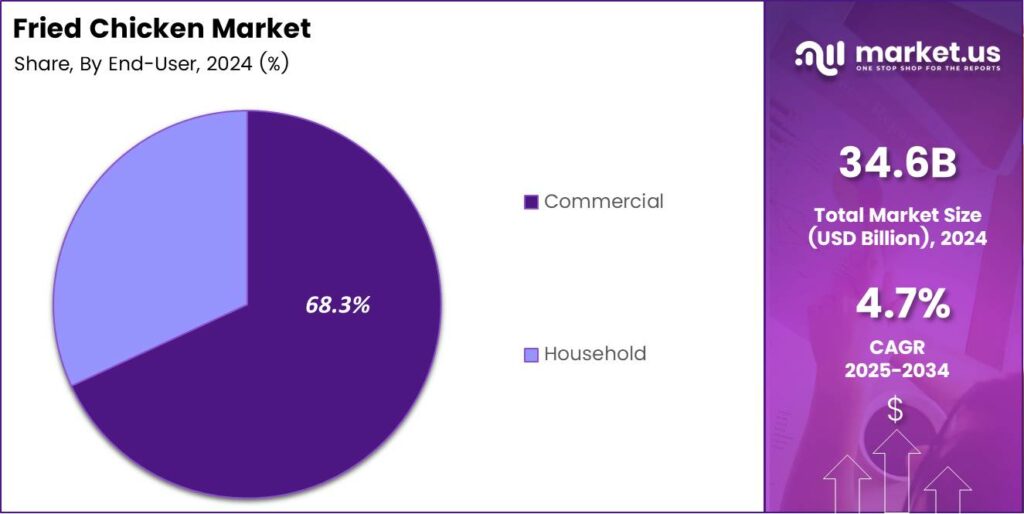

- The Commercial end-user segment holds the largest share at 68.3%, supported by high-volume restaurant and foodservice consumption.

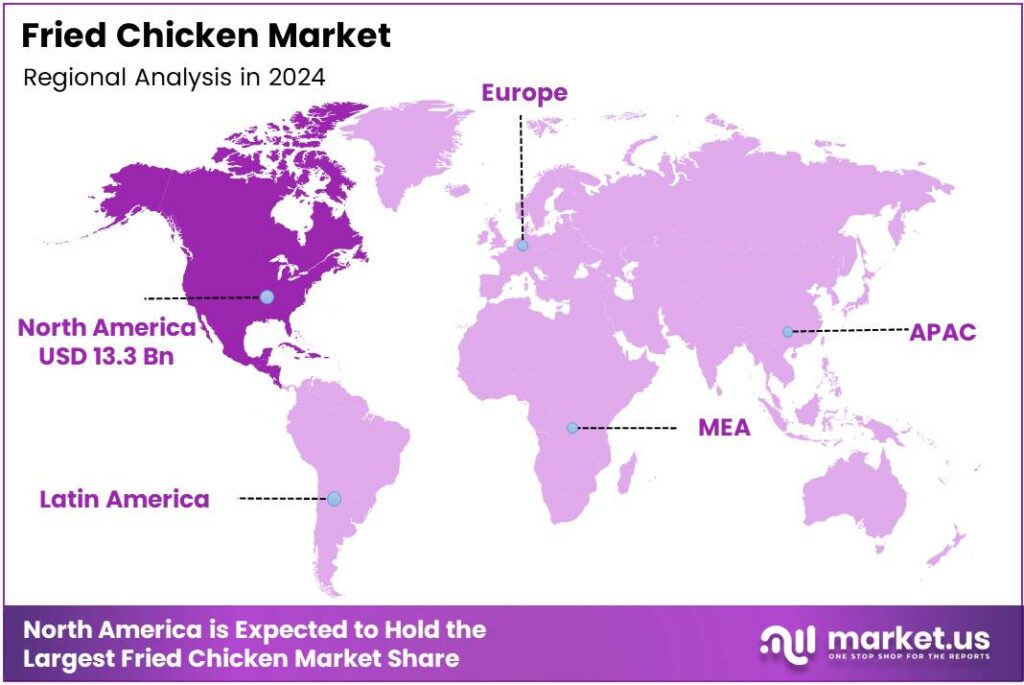

- North America remains the leading region, capturing 38.5% of the global market and reaching a value of USD 13.3 billion.

By Product Type Analysis

Bone-in dominates with 44.2% due to traditional taste preference and higher perceived value.

In 2024, Bone In held a dominant market position in the By Product Type Analysis segment of the Fried Chicken Market, with a 44.2% share. Consumers consistently associate bone-in chicken with richer flavor and juiciness. As a result, restaurants frequently promote it as a signature offering.

Boneless products continue to gain traction because they are easier to eat and faster to prepare. This segment appeals strongly to younger consumers and urban buyers. Moreover, boneless formats support portion control and encourage experimentation with sauces and coatings.

Spicy fried chicken benefits from growing interest in bold and regional flavors. Many consumers actively seek heat-driven experiences, especially in quick dining formats. Consequently, spicy variants often appear in limited-time offers, helping brands drive repeat visits.

Non-spicy options remain relevant for family dining and conservative taste profiles. They serve consumers who prefer mild flavors, including children and older demographics. Thus, non-spicy products support broad menu balance across multiple restaurant formats.

By Distribution Channel Analysis

Quick Service Restaurants dominate with 49.1% driven by speed, affordability, and consistent taste.

In 2024, Quick Service Restaurants held a dominant market position in the By Distribution Channel Analysis segment of the Fried Chicken Market, with a 49.1% share. These outlets focus on fast service and standardized flavors, which encourage frequent consumer visits.

Full-service restaurants play a steady role by offering plated meals and dine-in experiences. They often emphasize premium presentation and ambiance. As a result, this channel attracts consumers seeking social dining rather than speed-centric consumption.

Online Delivery continues to expand as digital ordering becomes routine. Convenience strongly influences this segment’s growth. Many consumers now prioritize doorstep delivery, especially during peak hours or busy weekdays. Supermarkets and Hypermarkets support at-home consumption through ready-to-eat or frozen options.

By End-User Analysis

Commercial dominates with 68.3% supported by restaurant volume sales and foodservice demand.

In 2024, Commercial held a dominant market position in the By End-User Analysis segment of the Fried Chicken Market, with a 68.3% share. Restaurants and food outlets drive bulk demand, ensuring consistent sales cycles throughout the year.

Household consumption continues to grow as consumers prepare fried chicken at home. This segment benefits from the increased availability of marinated and ready-to-cook products. Accordingly, households value convenience while maintaining control over ingredients and spice levels.

Key Market Segments

By Product Type

- Bone In

- Boneless

- Spicy

- Non Spicy

By Distribution Channel

- Quick Service Restaurants

- Full Service Restaurants

- Online Delivery

- Supermarkets and Hypermarkets

- Convenience Stores

- Others

By End-User

- Commercial

- Household

Emerging Trends

Rising Demand for Customized Flavors and Digital Ordering Shapes Market Trends

One key trend in the fried chicken market is the growing demand for customized flavors. Consumers enjoy choosing spice levels, sauces, and coatings that match their personal preferences. This trend increases customer satisfaction and brand engagement.

- Digital ordering has made fried chicken more accessible, especially in urban areas. Convenience and quick delivery have increased consumption frequency. Global poultry output was estimated at around 142 million tonnes, and by 2025, this is projected to reach roughly 151.4 million tonnes.

Sustainability is also influencing trends. Some brands are focusing on responsibly sourced chicken and eco-friendly packaging, which appeals to environmentally aware customers. Limited-time offers and regional special menus are gaining popularity, creating excitement and urgency among consumers.

Drivers

Growing Preference for Convenient and Ready-to-Eat Foods Drives Market Growth

The fried chicken market is strongly driven by the rising demand for convenient and ready-to-eat food options. Modern consumers have busy lifestyles and often prefer meals that save time without compromising taste. Fried chicken fits this need well, as it is quick to serve and easy to consume.

- Fried chicken outlets offer consistent taste, affordable pricing, and quick service, making them a reliable choice. Global meat production in 2024 is being driven largely by poultry: meat output reached about 365 million tonnes, with poultry meat contributing a significant portion to that increase.

Changing food habits among younger consumers also plays a role. They are more open to global food trends and flavors, and fried chicken is widely accepted across cultures. Its availability in different spice levels and formats adds to its appeal. In addition, promotional offers, meal combos, and delivery services have increased consumption frequency.

Restraints

Health Concerns Related to High Fat and Calorie Content Limit Market Expansion

One major restraint for the fried chicken market is growing health awareness among consumers. Fried foods are often linked with high fat, oil, and calorie intake, which raises concerns about obesity and heart-related issues. This has made some consumers reduce their fast-food consumption.

Nutrition-focused diets and clean eating trends are influencing food choices, especially among urban and health-conscious populations. Many people now prefer grilled, baked, or air-fried options instead of deep-fried products. This shift can slow demand growth.

Government regulations and public health campaigns also add pressure. Some regions promote reduced oil usage and better nutritional labeling, which can increase compliance costs for fried chicken sellers. In addition, rising prices of cooking oil and quality poultry can impact profit margins.

Growth Factors

Product Innovation and Healthier Cooking Methods Create New Growth Opportunities

The fried chicken market has strong growth opportunities through product innovation. Brands are experimenting with new flavors, spice blends, and regional recipes to attract diverse customer groups. This helps increase repeat purchases and customer loyalty.

Health-focused innovations are another major opportunity. Air-fried, baked, and low-oil fried chicken options address health concerns while keeping the taste familiar. These alternatives can bring back consumers who avoid traditional fried foods. Expansion into new formats such as ready-to-cook, frozen, and packaged fried chicken products also opens new revenue streams.

Digital ordering, mobile apps, and improved delivery services further support market expansion. From an analyst perspective, companies that balance taste, convenience, and health will be well-positioned to capture long-term growth in the fried chicken market.

Regional Analysis

North America Dominates the Fried Chicken Market with a Market Share of 38.5%, Valued at USD 13.3 Billion

North America held the leading position in the fried chicken market, accounting for a dominant share of 38.5% and reaching a market value of USD 13.3 billion. This dominance is supported by high consumption frequency of quick-service meals and well-established foodservice infrastructure. Strong demand from urban populations and continuous menu innovations further reinforced regional growth.

The European fried chicken market demonstrated steady expansion, driven by rising preference for convenient and affordable protein-rich meals. Changing eating habits, especially among younger consumers, supported the adoption of fried chicken across casual dining and takeaway formats. Growth was further supported by increased availability across both urban and semi-urban areas.

Asia Pacific emerged as a fast-growing region in the fried chicken market due to rapid urbanization and rising disposable incomes. Increasing exposure to Western-style fast food and expanding food delivery platforms accelerated regional adoption. Strong population growth and a growing working-class consumer base enhanced consumption levels. The region continues to present long-term growth potential supported by evolving dietary preferences.

The Middle East and Africa region recorded moderate growth in the fried chicken market, supported by expanding foodservice outlets in urban centers. The growing youth population and rising acceptance of quick-service dining formats contributed to steady demand. Increased tourism and changing lifestyles further influenced consumption patterns. However, growth varied significantly across countries within the region.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

KFC remains the benchmark brand in the global fried chicken market, leveraging its massive store count, standardized recipes, and aggressive franchising model. Its menu localization strategy in Asia-Pacific and emerging markets helps capture diverse taste preferences while sustaining premium positioning. Continued investment in digital ordering, delivery tie-ups, and limited-time flavors supports traffic growth and safeguards its leadership in 2024.

Popeyes Louisiana Kitchen builds its competitive edge around bold Cajun flavor profiles and differentiated chicken sandwiches, which have strengthened its brand identity worldwide. Strategic expansion through master franchise agreements in Europe, the Middle East, and Asia is helping it narrow the gap with the market leader. Its focus on high-margin combo meals and efficient kitchen operations adds resilience to margins despite inflationary pressures.

Chick-fil-A dominates the U.S. premium fast-food chicken space with a strong service culture, streamlined menu, and high unit volumes. Its emphasis on drive-thru optimization, mobile app loyalty, and family-friendly positioning translates into exceptional same-store sales productivity. While international presence is still limited, careful market selection in Canada and Europe could create substantial long-term upside for the brand.

Bojangles’ Famous Chicken ‘n Biscuits differentiates itself through a Southern-inspired menu, breakfast biscuits, and strong regional brand loyalty across the U.S. Southeast. The company is increasingly leaning on franchising, new store formats, and drive-thru efficiency to unlock growth beyond its core footprint. Its balance of value offerings and indulgent products positions Bojangles to capture both everyday traffic and occasion-based spending in 2024.

Top Key Players in the Market

- KFC

- Popeyes Louisiana Kitchen

- Chick-fil-A

- Bojangles’ Famous Chicken ‘n Biscuits

- Church’s Chicken

- Raising Cane’s Chicken Fingers

- Wingstop

- Zaxby’s

- Jollibee

- El Pollo Loco

Recent Developments

- In 2025, KFC launched its “Kentucky Fried Comeback” campaign, featuring a free bucket offer, the return of the Colonel in ads as a “Chefpreneur,” and limited-time items like fried pickles to re-engage fans. This was built on Q3 fiscal 2025 U.S. sales growth of 2%, driven by spicy wings and potato wedges.

- In 2025, Chick-fil-A launched its first U.K. restaurant in London, with a Leeds opening confirmed for autumn and plans for five total U.K. sites in two years. The brand announced permanent expansions into Europe and Asia, starting with Singapore, adapting to local tastes while maintaining its service model.

Report Scope

Report Features Description Market Value (2024) USD 34.6 Billion Forecast Revenue (2034) USD 54.8 Billion CAGR (2025-2034) 4.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Bone In, Boneless, Spicy, Non Spicy), By Distribution Channel (Quick Service Restaurants, Full Service Restaurants, Online Delivery, Supermarkets and Hypermarkets, Convenience Stores, Others), By End-User (Commercial, Household) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape KFC, Popeyes Louisiana Kitchen, Chick-fil-A, Bojangles’ Famous Chicken ‘n Biscuits, Church’s Chicken, Raising Cane’s Chicken Fingers, Wingstop, Zaxby’s, Jollibee, El Pollo Loco Customization Scope Customisation for segments, region/country-level will be provided. Moreover, additional customisation can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)

-

-

- KFC

- Popeyes Louisiana Kitchen

- Chick-fil-A

- Bojangles' Famous Chicken 'n Biscuits

- Church's Chicken

- Raising Cane's Chicken Fingers

- Wingstop

- Zaxby's

- Jollibee

- El Pollo Loco