Global Freight Brokerage Market Size, Share, Growth Analysis By Services (Intermodal, Truckload, Less than Truckload), By Customer Type (B2B, B2C), By Mode of Transport (Waterways, Roadways, Others), By Industry Vertical (Manufacturing, Automotive, Healthcare, Retail & E-commerce, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Jun 2025

- Report ID: 151357

- Number of Pages: 287

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

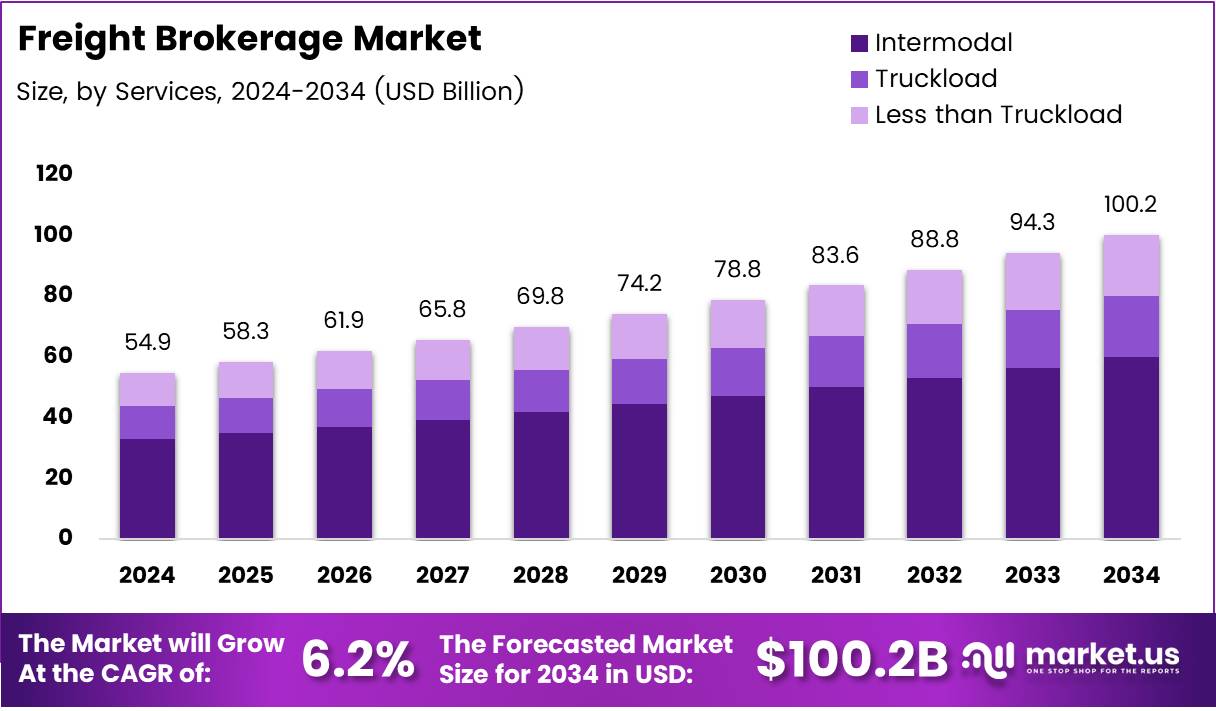

The Global Freight Brokerage Market size is expected to be worth around USD 100.2 Billion by 2034, from USD 54.9 Billion in 2024, growing at a CAGR of 6.2% during the forecast period from 2025 to 2034.

The Freight Brokerage Market plays a crucial role in streamlining the complex logistics and supply chain ecosystem. By acting as intermediaries, freight brokers connect shippers with carriers, optimizing routes and ensuring timely delivery. Their ability to coordinate resources efficiently makes them indispensable in today’s fast-paced transportation landscape.

In recent years, the market has witnessed robust expansion, driven by the surge in e-commerce and globalization. According to Translogisticsinc, by 2023, freight brokers handle over 20% of all transport trucking freight, reflecting their mainstream role in scaling logistics operations. This shift highlights the increasing reliance on brokerage services to manage growing freight volumes.

Simultaneously, technological advancements are transforming brokerage operations. Digital platforms, AI-driven analytics, and real-time tracking tools allow brokers to offer faster, more reliable services. This tech integration not only enhances operational efficiency but also provides data-driven insights that drive competitive advantages for market players.

Moreover, regulatory frameworks are evolving to support sustainable growth. Government bodies are investing in infrastructure modernization and setting policies that promote transparency and safety. These measures encourage compliance, foster trust among stakeholders, and ensure long-term market stability.

The rise in freight volumes creates immense opportunities for both new entrants and established firms. Small and mid-sized businesses, in particular, are increasingly leveraging brokerage services to access competitive shipping rates and flexible solutions. This democratization of logistics services fuels market diversification.

Furthermore, the employment landscape reflects the sector’s dynamism. According to the U.S. Bureau of Labor Statistics (BLS), jobs for logisticians, including freight brokers, are projected to increase by 18% through 2032. This growth indicates sustained demand for skilled professionals who can navigate the evolving logistics landscape.

Financially, the profession offers steady income potential. As reported by the Bureau of Labor Statistics, freight brokers earn an average of $45,000 annually. While entry-level salaries may be modest, experienced brokers and firms managing larger accounts can achieve significantly higher earnings.

Additionally, cross-border trade liberalization and free trade agreements open new corridors for freight brokerage. Brokers specializing in international logistics can capitalize on these trends by offering value-added services like customs brokerage, documentation handling, and regulatory compliance support.

Despite the promising outlook, the market faces challenges such as fluctuating fuel prices, capacity constraints, and geopolitical tensions. However, agile brokers who invest in technology, diversify services, and foster strong carrier relationships can mitigate these risks effectively.

Key Takeaways

- The Global Freight Brokerage Market is projected to reach USD 100.2 Billion by 2034, growing from USD 54.9 Billion in 2024 at a 6.2% CAGR.

- In 2024, Intermodal services dominated the By Services segment due to their flexibility, cost-effectiveness, and optimized delivery capabilities.

- In 2024, B2B transactions led the By Customer Type segment with a 59.2% share, driven by industrial manufacturing and wholesale distribution demand.

- In 2024, Waterways held the top position in the By Mode of Transport segment, offering cost-effective solutions for bulk commodity transportation over long distances.

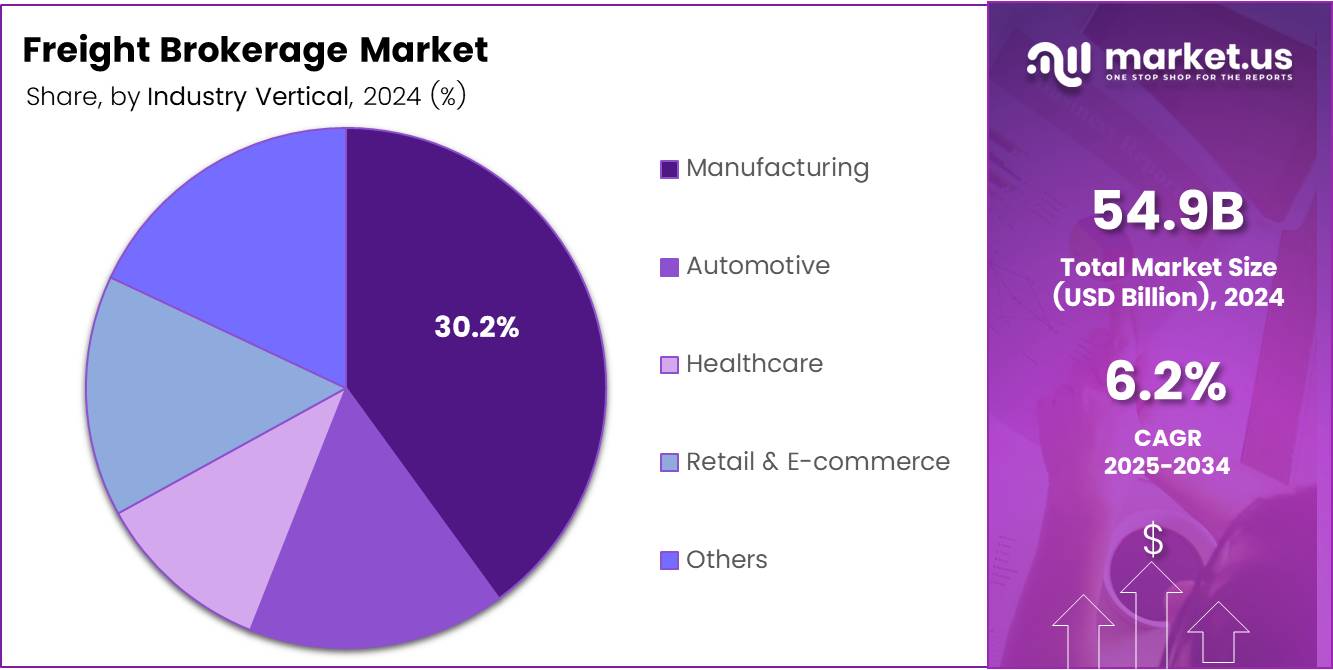

- In 2024, Manufacturing dominated the By Industry Vertical segment with a 30.2% share, supported by its reliance on timely logistics for raw materials and product distribution.

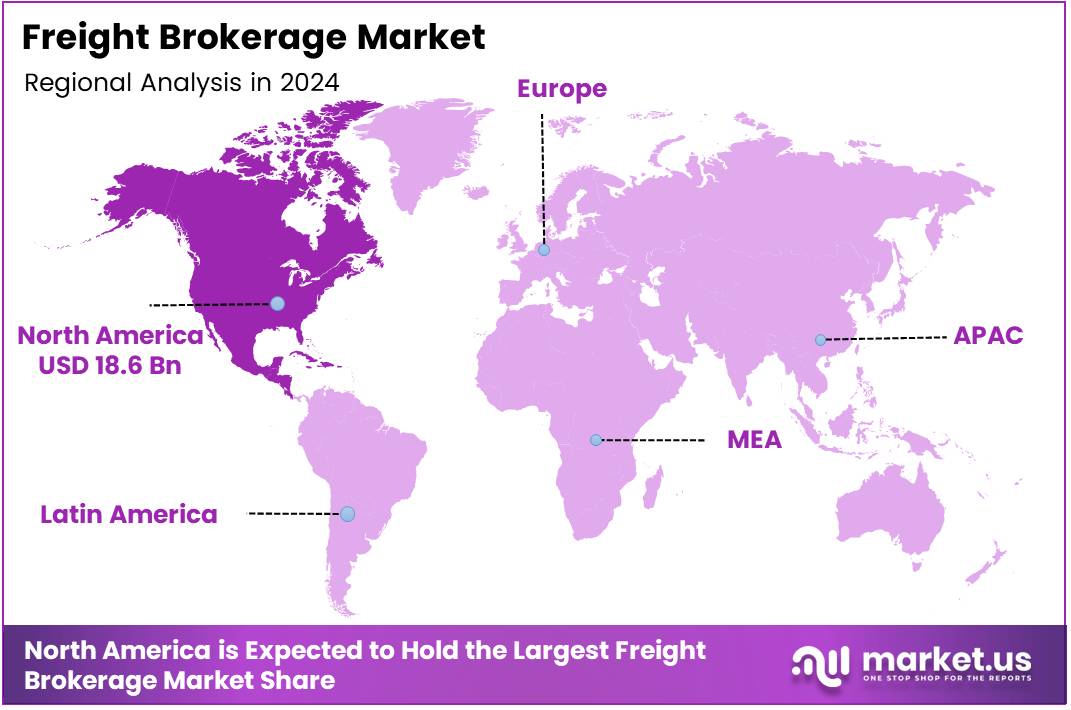

- North America led the regional market in 2024, accounting for a 34.2% share valued at USD 18.6 Billion, supported by advanced logistics infrastructure and strong cross-border trade.

Services Analysis

Intermodal dominates due to its cost efficiency and multimodal flexibility.

In 2024, Intermodal held a dominant market position in By Services Analysis segment of Freight Brokerage Market. Intermodal services have gained significant traction due to their ability to combine multiple modes of transportation, offering flexibility and cost-effectiveness. This approach allows businesses to optimize logistics operations, reduce fuel consumption, and improve delivery times, making it a preferred choice for many large-scale shippers.

Truckload services follow closely, benefiting from their capacity to handle full loads with minimal handling, thus ensuring the safety of goods during transit. The simplicity and direct point-to-point service make Truckload highly attractive for industries dealing with large volumes of homogeneous products.

Less than Truckload (LTL) services cater to businesses that do not require a full truck’s capacity, providing a cost-effective solution for smaller shipments. LTL’s networked operations enable shippers to distribute products more economically while still maintaining reasonable delivery timelines. The growing e-commerce sector and increasing demand for frequent, smaller shipments have further fueled the demand for LTL services.

Customer Type Analysis

B2B dominates with 59.2% due to strong industrial and commercial demand.

In 2024, B2B held a dominant market position in By Customer Type Analysis segment of Freight Brokerage Market, with a 59.2% share. The strong growth in industrial manufacturing, automotive production, and wholesale distribution has driven the dominance of B2B transactions. Large-scale enterprises rely on freight brokerage services to streamline their complex supply chains and ensure timely delivery of raw materials and finished goods.

The B2C segment, while smaller in comparison, has witnessed steady growth fueled by the booming e-commerce industry. The increasing consumer demand for fast and reliable home deliveries has pushed freight brokers to optimize last-mile delivery services and offer flexible shipment options. While B2C presents unique challenges in terms of smaller, more frequent deliveries, it continues to be an area of strategic focus for market players seeking long-term growth.

Mode of Transport Analysis

Waterways dominates due to its cost-efficiency for bulk shipments over long distances.

In 2024, Waterways held a dominant market position in By Mode of Transport Analysis segment of Freight Brokerage Market. Waterways offer a highly economical solution for transporting large volumes of goods, particularly bulk commodities such as raw materials, oil, and agricultural products, over extensive distances. The lower cost per ton-mile compared to other modes makes it highly attractive for cross-border and intercontinental trade.

Roadways remain an essential mode of transport, particularly for short to medium distances. Their flexibility in accessing remote locations and providing door-to-door service makes road freight indispensable in the overall logistics ecosystem. Road freight plays a crucial role in the first and last-mile delivery network.

The Others segment, encompassing rail and air transport, provides niche advantages such as speed or specialized handling for certain commodities. Rail is often used for heavy and long-haul inland transportation, while air freight offers unparalleled speed for high-value or perishable goods, though at a significantly higher cost.

Industry Vertical Analysis

Manufacturing dominates with 30.2% due to its extensive and complex supply chain needs.

In 2024, Manufacturing held a dominant market position in By Industry Vertical Analysis segment of Freight Brokerage Market, with a 30.2% share. The manufacturing sector’s dependence on timely procurement of raw materials and distribution of finished products has driven the demand for efficient freight brokerage services. Manufacturers increasingly rely on brokers to manage diverse logistics networks and ensure smooth operations across global supply chains.

The Automotive segment follows closely, driven by the industry’s just-in-time production models and global component sourcing requirements. Freight brokers play a pivotal role in coordinating shipments of automotive parts and finished vehicles across borders efficiently.

The Healthcare sector demands specialized freight solutions for transporting sensitive and time-critical medical equipment, pharmaceuticals, and biological samples. The need for temperature control, compliance, and security adds complexity to healthcare logistics, making freight brokers essential partners.

Retail & E-commerce continues to expand rapidly, with consumer expectations for faster deliveries pushing brokers to innovate and optimize distribution strategies. Finally, the Others category includes industries with niche logistical needs, contributing to the diverse freight brokerage market landscape.

Key Market Segments

By Services

- Intermodal

- Truckload

- Less than Truckload

By Customer Type

- B2B

- B2C

By Mode of Transport

- Waterways

- Roadways

- Others

By Industry Vertical

- Manufacturing

- Automotive

- Healthcare

- Retail & E-commerce

- Others

Drivers

Increasing Adoption of Digital Freight Platforms Drives Market Growth

The freight brokerage market is experiencing strong growth due to the rising adoption of digital freight platforms. These platforms simplify the process of matching shippers with carriers, reducing manual paperwork and speeding up transactions. Shippers and carriers now benefit from real-time data, better pricing transparency, and automated booking processes.

Cross-border e-commerce trade is also fueling market expansion. As consumers buy products from international sellers, there is a growing need for efficient freight services to handle the movement of goods across countries. Freight brokers play a key role in coordinating these complex shipments and ensuring timely deliveries.

Another major driver is the rising demand for just-in-time inventory models. Companies aim to reduce inventory holding costs by receiving goods exactly when needed. This creates pressure on logistics networks to deliver shipments quickly and reliably, increasing demand for skilled freight brokers who can optimize transportation routes and schedules.

The expansion of third-party logistics (3PL) services is further contributing to market growth. Many businesses are outsourcing their logistics functions to 3PL providers, who often work closely with freight brokers to ensure cost-effective and flexible transportation solutions. This collaboration helps companies manage their supply chains more efficiently while focusing on their core business operations.

Restraints

Fluctuating Fuel Prices Impacting Profit Margins Restrains Market Growth

The freight brokerage market faces challenges due to fluctuating fuel prices. Fuel is a major operating cost for transportation, and sudden price increases can reduce profit margins for both carriers and brokers. This unpredictability makes it difficult to set stable pricing agreements, leading to potential disputes and financial pressure.

Complex regulatory compliance across regions further restrains market growth. Freight brokers must navigate a web of regulations related to customs, safety, emissions, and labor laws that vary by country and even by region. Keeping up with changing rules requires significant administrative effort and can lead to delays or penalties if not managed properly.

These regulatory challenges can especially impact small and medium-sized brokerage firms that may lack the resources to maintain specialized compliance teams. This adds operational complexity and limits the ability of some players to expand internationally, reducing the overall market growth potential.

The combination of rising fuel costs and complicated regulations creates uncertainty in the freight brokerage market. Brokers must constantly adjust their strategies and pricing models to remain competitive, which can slow their ability to scale and innovate in a rapidly evolving logistics landscape.

Growth Factors

Integration of Artificial Intelligence for Route Optimization Creates Growth Opportunities

The freight brokerage market holds significant growth opportunities through the integration of artificial intelligence (AI) for route optimization. AI-powered tools can analyze traffic patterns, weather conditions, and delivery schedules in real-time to suggest the most efficient routes. This not only reduces fuel consumption but also enhances delivery speed and reliability.

Growing demand for green and sustainable logistics solutions is opening new doors for freight brokers. Shippers and customers are increasingly prioritizing eco-friendly practices, such as reducing carbon emissions and utilizing cleaner transportation modes. Freight brokers who offer sustainable logistics options are likely to attract environmentally conscious clients, strengthening their market position.

Expansion in emerging markets with untapped logistics potential also offers promising opportunities. Regions in Asia, Africa, and South America are experiencing rapid economic growth, increasing trade volumes and infrastructure development. As these markets open up, freight brokers have the chance to establish new partnerships and expand their global networks, tapping into fresh revenue streams.

These opportunities encourage freight brokerage companies to invest in advanced technologies and strategic market entries, which can enhance their competitiveness and support long-term growth in an increasingly dynamic global trade environment.

Emerging Trends

Blockchain Adoption for Enhanced Freight Transparency Shapes Market Trends

The freight brokerage market is witnessing a trend toward blockchain adoption for enhanced freight transparency. Blockchain technology offers secure, real-time tracking of shipments, reducing the risk of fraud and improving trust among all parties involved in the supply chain. This transparency helps brokers build stronger relationships with clients and carriers.

Rising use of predictive analytics in freight forecasting is also transforming the market. By analyzing historical data and current market conditions, brokers can better predict demand patterns, optimize pricing, and manage capacity more efficiently. This data-driven approach allows for proactive decision-making, minimizing delays and maximizing profits.

Increased venture capital investments in freight tech startups reflect growing confidence in the market’s potential. Startups are developing innovative solutions such as automated matching platforms, smart contracts, and AI-powered analytics. These new technologies attract funding and drive competition, pushing the entire industry toward digital transformation.

Adoption of Internet of Things (IoT) in fleet management systems is another significant trend. IoT devices provide real-time data on vehicle performance, location, and cargo conditions, allowing brokers and carriers to monitor shipments closely and respond quickly to any issues. This level of visibility improves service quality and customer satisfaction, setting new standards for the industry.

Regional Analysis

North America Dominates the Freight Brokerage Market with a Market Share of 34.2%, Valued at USD 18.6 Billion

The freight brokerage market in North America holds a dominant position, accounting for a 34.2% share and valued at USD 18.6 Billion. This leadership is driven by the region’s highly developed logistics infrastructure, robust intermodal transportation networks, and advanced digital freight matching technologies. Strong cross-border trade between the U.S., Canada, and Mexico, combined with continuous investments in supply chain modernization, further strengthen market growth.

Europe Freight Brokerage Market Dynamics

Europe demonstrates a mature freight brokerage landscape supported by well-established road, rail, and inland waterway systems. The region benefits from regulatory frameworks like the EU Mobility Package that promote cross-border freight efficiency. Additionally, growing e-commerce volumes and sustainable transport initiatives contribute to the rising demand for flexible and technology-driven brokerage services.

Asia Pacific Freight Brokerage Market Insights

Asia Pacific showcases rapid expansion in the freight brokerage sector, fueled by booming manufacturing hubs, export-oriented economies, and rising intra-regional trade. Growing urbanization and the evolution of e-commerce platforms are accelerating the need for agile logistics solutions. Governments across the region are actively investing in transportation infrastructure, which further enhances the brokerage ecosystem.

Middle East and Africa Freight Brokerage Market Overview

The Middle East and Africa region is witnessing steady growth in the freight brokerage market, driven by the development of major logistics hubs in countries such as the UAE and Saudi Arabia. Expanding trade routes, diversification of economies beyond oil, and increased focus on digital transformation in logistics operations are contributing to market expansion.

Latin America Freight Brokerage Market Outlook

In Latin America, the freight brokerage market is gradually growing, supported by the strengthening of regional trade agreements and rising demand for cost-effective supply chain solutions. Economic reforms and infrastructure improvements in key markets like Brazil and Mexico are enhancing freight mobility and creating new opportunities for brokerage services.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Freight Brokerage Company Insights

The global Freight Brokerage Market continues to evolve rapidly in 2024, driven by technological advancements, shifting trade patterns, and the growing demand for integrated logistics solutions.

Kuehne+Nagel, a global logistics leader, continues to leverage its advanced digital platforms and comprehensive service portfolio to maintain a strong position in the market. Their focus on end-to-end visibility, real-time tracking, and sustainable logistics solutions has positioned them as a preferred partner for many multinational clients.

Hoyer Group remains a dominant force in the niche market of liquid goods transportation. Its specialization in chemical, food, gas, and petroleum logistics, combined with a robust fleet and safety-first approach, allows it to cater to highly regulated industries where precision and compliance are critical.

Sinotrans, benefiting from its strategic positioning within China’s Belt and Road Initiative, has expanded its international freight brokerage capabilities. Its strong domestic network, coupled with increasing global partnerships, has enabled it to serve as a key gateway for cross-border trade, particularly between Asia and Europe.

DB Schenker continues to strengthen its market share by investing heavily in digital transformation and sustainable logistics solutions. Its integrated multimodal offerings, combined with AI-driven optimization tools, have enhanced operational efficiencies, enabling the company to provide cost-effective and timely solutions to a diverse client base.

As global trade becomes increasingly complex, these key players are well-positioned to capitalize on emerging opportunities while addressing the evolving needs of their customers in the dynamic freight brokerage landscape.

Top Key Players in the Market

- Kuehne+Nagel

- Hoyer Group

- Sinotrans

- DB Schenker

- BDP International

- XPO Logistics

- DSV

- Expeditors International

- Markline

- Flexport

- Hellmann Worldwide Logistics

- Nippon Express

- H. Robinson Worldwide

- Kerry Logistics

Recent Developments

- In May 2025, Flock Freight successfully secured $60 million in Series E funding to support its rapid growth. The investment aims to strengthen its innovative shared truckload model, enhancing operational efficiencies and expanding its market reach.

- In May 2025, Flock Freight announced closing a $60 million Series E round, allowing the company to continue scaling its unique shared truckload solution. This funding will help optimize freight utilization and reduce environmental impact across its expanding network.

- In July 2024, digital freight brokerage platform Lobb raised $2.9 million to accelerate its disruption of the $100 billion logistics market. The funds will support technology enhancements and customer acquisition to challenge traditional freight brokerage models.

- In December 2024, Vooma secured $16.6 million in fresh funding as freight brokers brace for potential shifts in market dynamics. The capital infusion will enable the company to expand its platform capabilities and better serve shippers amid evolving industry conditions.

Report Scope

Report Features Description Market Value (2024) USD 54.9 Billion Forecast Revenue (2034) USD 100.2 Billion CAGR (2025-2034) 6.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Services (Intermodal, Truckload, Less than Truckload), By Customer Type (B2B, B2C), By Mode of Transport (Waterways, Roadways, Others), By Industry Vertical (Manufacturing, Automotive, Healthcare, Retail & E-commerce, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Kuehne+Nagel, Hoyer Group, Sinotrans, DB Schenker, BDP International, XPO Logistics, DSV, Expeditors International, Markline, Flexport, Hellmann Worldwide Logistics, Nippon Express, H. Robinson Worldwide, Kerry Logistics Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Kuehne+Nagel

- Hoyer Group

- Sinotrans

- DB Schenker

- BDP International

- XPO Logistics

- DSV

- Expeditors International

- Markline

- Flexport

- Hellmann Worldwide Logistics

- Nippon Express

- H. Robinson Worldwide

- Kerry Logistics