Global Fragrances Market Report By Type (Natural, Synthetic), By Application (Food & Beverages, Cosmetic and Personal Care, Home Care, Fabric Care), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: October 2024

- Report ID: 98231

- Number of Pages: 276

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

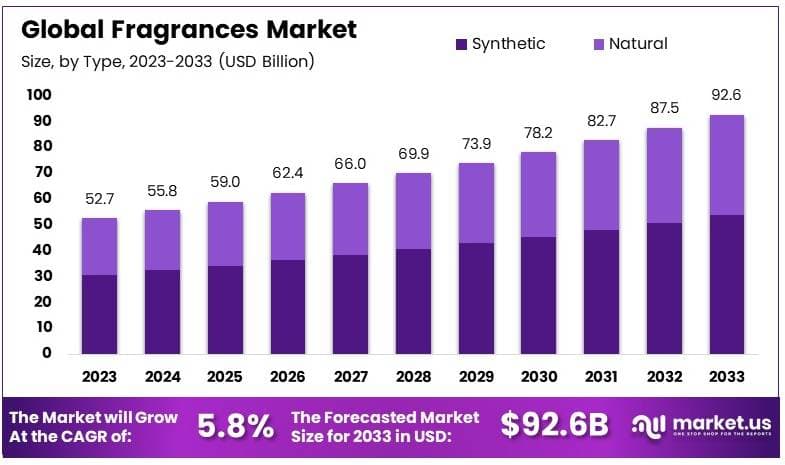

The Global Fragrances Market size is expected to be worth around USD 92.6 Billion by 2033, from USD 52.7 Billion in 2023, growing at a CAGR of 5.8% during the forecast period from 2024 to 2033.

Fragrances refer to aromatic compounds used in personal care products, perfumes, and household items. These scents are crafted from natural or synthetic ingredients and are designed to enhance the sensory experience.

The fragrance market includes the production, distribution, and retail of perfume, cologne, and other scented products. This market encompasses both luxury and mass-market offerings. It is a key segment within the broader beauty and personal care industry.

The growth of the fragrance market is influenced by rising consumer disposable income, increasing awareness of personal grooming, and the expansion of the luxury goods segment. Innovations in natural and eco-friendly ingredients also contribute to market expansion, as sustainability becomes a growing consumer preference.

Demand for fragrances is driven by evolving consumer preferences, with personalized and niche fragrances gaining popularity. The rise of online retail has made luxury goods and unique fragrances more accessible, driving sales. Growth in emerging markets, particularly in Asia-Pacific, also contributes to higher demand.

There are significant opportunities in sustainable and eco-conscious fragrance development. Brands that can offer ethical and environmentally friendly products are likely to see increased demand. Additionally, customization trends present a unique opportunity for companies to offer personalized scent experiences through AI and digital platforms.

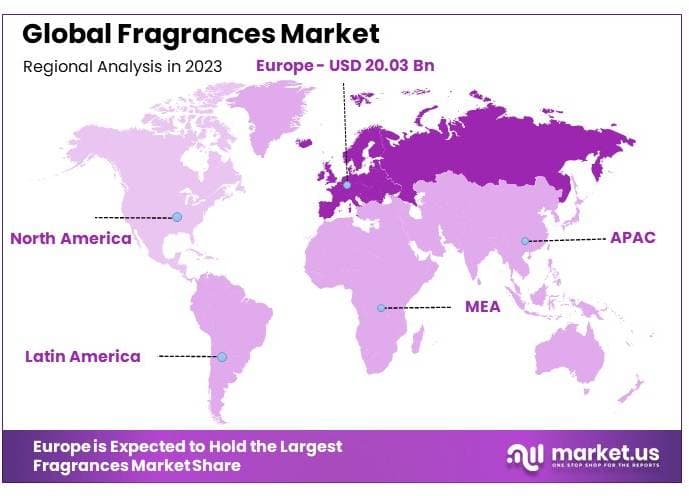

Europe stands out as a pivotal region in this market, with countries like France, Germany, the UK, and Spain driving significant demand. France, in particular, plays a crucial role not only in consumption but also in production, being a global leader in perfume exports valued at $43,375 per ton, according to World’s Top Exports.

The growth of this market is further evidenced by the substantial growth seen in non-traditional markets such as Mauritius and Togo, where perfume exports have surged by over 260,000% and 793%, respectively, indicating burgeoning market segments.

Globally, the perfume sector continues to experience robust expansion, propelled by rising consumer interest across emerging markets in Asia and Latin America. This surge is attributed to increasing disposable incomes and a growing middle class, which are more inclined towards luxury and personal care products.

France’s significant role is underlined by its hefty import of essential oils, worth €253 million in 2021, showcasing its commitment to maintaining a top-tier position in the global fragrance landscape.

Government regulations and international standards also play a crucial role in shaping the fragrance industry. Regulations concerning the safe use of chemicals and the sustainability of sourcing practices ensure product safety and environmental stewardship, aligning with the increasing consumer demand for eco-friendly and ethically produced goods.

Key Takeaways

- The Fragrances Market was valued at USD 52.7 Billion in 2023 and is expected to reach USD 92.6 Billion by 2033, with a CAGR of 5.8%.

- In 2023, Synthetic dominates the type segment with 58% due to cost-effectiveness and variety.

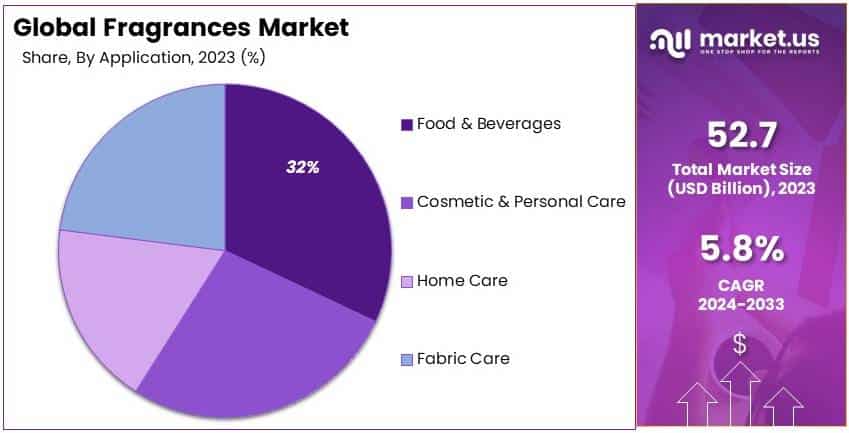

- In 2023, Food & Beverages leads the application segment with 32% owing to the increasing demand for flavored products.

- In 2023, Europe is the dominant region with 38%, highlighting its strong fragrance industry presence.

Type Analysis

Synthetic Fragrances dominate with 58% due to cost-effectiveness and consistent quality.

In the fragrances market, categorized by type, Synthetic Fragrances are the dominant sub-segment, holding a substantial 58% market share. This prominence is mainly due to their cost-effectiveness and ability to ensure consistent quality across various products.

Synthetic fragrances are developed in laboratories using man-made compounds, which allows for greater control over the scent and stability, providing a consistent product experience for consumers. This is particularly important in large-scale production settings where uniformity in fragrance from batch to batch is crucial.

The Natural Fragrances segment, although smaller in market share, caters to a growing niche of consumers who prefer organic and natural products due to rising health consciousness and environmental concerns. These fragrances are derived from natural sources without synthetic additives, aligning with the consumer shift towards more sustainable and eco-friendly products.

Despite the higher cost of production and the variability in scent that natural ingredients may introduce, this segment is experiencing growth driven by the premiumization trend and the clean beauty movement.

The future growth trajectory of the fragrance market is influenced by consumer trends and regulatory changes. With increasing scrutiny on the environmental and health impacts of synthetic ingredients, natural fragrances may see increased demand.

Application Analysis

Food & Beverages dominate with 32% due to widespread use in flavoring and new product innovations.

Segmented by application, the Food & Beverages sector within the fragrances market asserts dominance with a 32% share, driven by its widespread use in flavoring a variety of products from processed foods to beverages.

The use of fragrances in this sector is crucial for enhancing the sensory appeal of consumables, which plays a significant role in consumer purchase decisions. Innovations in food technology and consumer interest in novel flavors fuel continuous demand in this segment.

Other significant segments include Cosmetic and Personal Care, Home Care, and Fabric Care, each serving different functional and aesthetic needs. The Cosmetic and Personal Care segment utilizes fragrances to enhance the consumer experience in products such as perfumes, lotions, and soaps.

Meanwhile, Home Fragrances and Fabric Care segments incorporate fragrances to add a pleasing scent to products, improving the perception of cleanliness and freshness.

The diversity of applications highlights the integral role of fragrances in enhancing the consumer appeal of everyday products. The growth in the Food & Beverages segment is particularly supported by the introduction of new and exotic flavors, catering to the evolving palates of global consumers.

Key Market Segments

By Type

- Natural

- Synthetic

By Application

- Food & Beverages

- Cosmetic and Personal Care

- Home Care

- Fabric Care

Driver

Evolving Consumer Preferences Drive Market Growth

Evolving consumer preferences are a major driver of the fragrances market. As more consumers prioritize personal grooming and self-care, demand for high-quality fragrances continues to grow.

Additionally, the rising popularity of premium and niche perfumes has expanded the market, catering to a more sophisticated and discerning customer base. The increasing awareness of natural and organic ingredients also fuels growth, as health-conscious consumers seek products free from synthetic additives.

Furthermore, growing disposable incomes, particularly in emerging markets, have enabled more people to spend on luxury fragrances, contributing to the expansion of the market. These factors collectively enhance the global fragrances market by increasing demand across multiple customer segments and price ranges.

Restraint

Regulatory Restrictions Restraints Market Growth

Regulatory restrictions present significant barriers to the growth of the fragrances market. Strict regulations around the use of certain synthetic chemicals limit product development and add compliance costs for manufacturers.

Additionally, varying international standards complicate global distribution, as brands must adapt formulations for different markets. Rising concerns about allergies and health risks associated with fragrance ingredients also create challenges.

Consumers are becoming more aware of potential allergens in perfumes, leading to demand for hypoallergenic or sensitive-skin-friendly products. Furthermore, fluctuating raw material prices, particularly for natural ingredients, contribute to increased production costs. These restraining factors hinder the market’s ability to innovate and expand as quickly as consumer demand might suggest.

Opportunity

Emerging Markets Provide Opportunities

Emerging markets, particularly in Asia-Pacific and Latin America, provide significant growth opportunities for the fragrances market. As disposable incomes rise in these regions, consumers are increasingly willing to invest in luxury and premium fragrances.

Additionally, growing urbanization and changing lifestyles contribute to higher demand for personal care products, including perfumes. The expansion of e-commerce platforms in these markets also provides an opportunity for fragrance brands to reach a broader audience, offering a convenient shopping experience.

Furthermore, the rise of unisex fragrances represents another opportunity, as gender-neutral products appeal to a wide demographic. These factors create a fertile ground for the fragrance industry to expand and capitalize on new consumer bases.

Challenge

Safety Concerns Challenge Market Growth

Safety concerns present ongoing challenges to the fragrance market’s growth. Consumers are becoming more cautious about the safety of synthetic ingredients used in perfumes, leading to a growing demand for transparency in product formulations.

The potential for skin irritations or allergic reactions adds to these concerns, driving the need for hypoallergenic alternatives. Another challenge is the increasing complexity of supply chains, which can result in inconsistent ingredient sourcing and potential contamination.

Furthermore, counterfeit products entering the market pose a serious risk to both consumer safety and brand reputation. These challenges require the fragrance industry to invest in more stringent quality control measures and consumer education initiatives to maintain trust.

Growth Factors

Rising Disposable Incomes Are Growth Factors

Rising disposable incomes are a significant growth factor in the global fragrances market. As consumers have more spending power, particularly in emerging markets, they are more likely to purchase premium and luxury fragrances.

This trend is further supported by the growing culture of self-care and grooming, where people are investing in personal luxury products. Another important factor is the increasing influence of social media and celebrity endorsements, which drives brand awareness and aspirational purchases.

Additionally, innovation in product packaging and marketing strategies, particularly for gift items, helps brands capture a larger share of the market. These factors together fuel the ongoing growth of the fragrance industry.

Emerging Trends

Natural Ingredients Are Latest Trending Factor

The use of natural ingredients in fragrances is one of the latest trending factors in the market. With consumers becoming more conscious of their health and environmental impact, there is a growing demand for natural and organic perfumes.

This trend aligns with the broader clean beauty movement, where consumers seek products made with sustainably sourced, eco-friendly ingredients. The rise of artisanal and niche fragrance brands, which often emphasize natural ingredients, also contributes to this trend.

Additionally, personalization in fragrances is gaining popularity, as consumers look for scents tailored to their unique preferences. These trends reflect a shift towards authenticity and sustainability in the fragrance market.

Regional Analysis

Europe Dominates with 38% Market Share

Europe leads the global Fragrances Market with a 38% share, valued at USD 20.03 billion. This dominance is driven by the region’s rich heritage in perfumery, strong consumer preference for premium and natural products, and the presence of world-renowned fragrance brands. European consumers’ demand for high-quality, organic ingredients further boosts market growth.

The fragrance industry in Europe benefits from stringent regulations on ingredient transparency and sustainability, which align with consumer trends toward natural and eco-friendly products. The market is also supported by innovation in luxury and niche fragrances, catering to diverse consumer preferences across different countries.

In the coming years, Europe is expected to maintain its leadership in the fragrance market, with growing interest in personalized and sustainable perfumes. The region’s commitment to eco-conscious practices will further drive demand for organic and natural fragrances, ensuring continued market growth.

Regional Mentions:

- North America: North America holds a solid position in the fragrances market, driven by a growing demand for premium and personalized scents. Consumers in the U.S. are increasingly inclined towards natural and organic ingredients.

- Asia Pacific: Asia Pacific is rapidly growing, with increasing consumer spending on personal care and luxury products. Urbanization and rising incomes in countries like China and India drive demand for high-quality fragrances.

- Middle East & Africa: The Middle East and Africa are emerging markets, with a focus on premium and traditional scents like oud. High disposable incomes in the GCC region are fueling demand for luxury perfumes.

- Latin America: Latin America is seeing steady growth, particularly in Brazil and Mexico. Consumers are showing increasing interest in locally sourced and affordable fragrances, contributing to the market’s expansion.

Key Regions and Countries covered іn thе rероrt

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The Fragrances Market is primarily driven by Givaudan International SA, Firmenich SA, and Symrise AG, three global leaders in the fragrance and flavor industry. These companies have established a strong foothold through innovation, sustainability, and strategic partnerships.

Givaudan International SA is the largest fragrance producer globally, known for its expertise in crafting high-quality fragrances for personal care and consumer products. Givaudan focuses heavily on innovation, blending traditional perfumery with sustainable sourcing of natural ingredients. The company’s extensive global network and investment in research and development keep it at the forefront of the market.

Firmenich SA is another dominant player, renowned for its commitment to sustainability and natural ingredients. Firmenich is known for its collaborations with leading brands to create unique fragrance experiences. The company’s focus on environmental and social responsibility sets it apart, helping to align its business strategies with consumer demand for eco-friendly products.

Symrise AG has made significant contributions to the fragrance industry by combining technology and creativity. The company’s ability to innovate and deliver personalized, high-quality fragrance solutions has strengthened its market position. Symrise is also recognized for its focus on sustainability and ethical sourcing, which resonate with global consumers.

Together, these companies dominate the global fragrance market through their continuous innovation, commitment to sustainability, and ability to meet evolving consumer preferences.

Top Key Players in the Market

- Firmenich SA

- Frutarom Industries Ltd.

- Givaudan International SA

- Huabao International Holdings Limited

- Kerry Group PLC

- Robertet SA

- S H Kelkar and Company Limited

- Sensient Technologies Corporation

- Symrise AG

- International Flavors & Fragrances, Inc.

- Other Key Players

Recent Developments

- Titan’s SKINN: In September 2024, Titan’s SKINN fragrance brand launched a new line called 24Seven, offering affordable yet premium scents with variants such as Aqua, Woody, and Floral, priced at Rs 1,745. The brand aims to reach 2.5 million customers by the end of FY25, targeting younger consumers with accessible luxury fragrances. SKINN is also introducing Fastrack Perfumes and plans to open kiosks in major cities to enhance its direct sales strategy.

- Liberty’s LBTY: In October 2024, Liberty’s LBTY fragrance brand expanded with three new scents— Ianthe Oud, Hera Reigns, and Vine Thief—drawing inspiration from the company’s iconic prints. Launched in 2023, LBTY has become a top-seller both in-store and online, thanks to its art-inspired fragrances crafted by renowned perfumers. The brand plans to continue expanding globally, with special editions to celebrate Liberty’s 150th anniversary in 2025.

- Kylie Cosmetics: In October 2024, Kylie Cosmetics launched its first fragrance in India, marking the brand’s expansion into the perfume sector. This move reflects Kylie Jenner’s strategy to diversify her brand’s offerings and appeal to the Indian market, aligning with the increasing demand for celebrity-endorsed products in the region.

- Bottega Veneta: In October 2024, Bottega Veneta reentered the fragrance market with a new line of five perfumes, inspired by Venice and crafted using only natural ingredients. The collection, under Matthieu Blazy’s direction, includes unique scents that reflect the city’s cultural heritage, featuring elements like orange blossom and oud. Each fragrance is housed in hand-blown glass bottles, emphasizing craftsmanship and luxury.

Report Scope

Report Features Description Market Value (2023) USD 52.7 Billion Forecast Revenue (2033) USD 92.6 Billion CAGR (2024-2033) 5.8% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Natural, Synthetic), By Application (Food & Beverages, Cosmetic and Personal Care, Home Care, Fabric Care) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Firmenich SA, Frutarom Industries Ltd., Givaudan International SA, Huabao International Holdings Limited, Kerry Group PLC, Robertet SA, S H Kelkar and Company Limited, Sensient Technologies Corporation, Symrise AG, International Flavors & Fragrances, Inc., Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Firmenich SA

- Frutarom Industries Ltd.

- Givaudan International SA

- Huabao International Holdings Limited

- Kerry Group PLC

- Robertet SA

- S H Kelkar and Company Limited

- Sensient Technologies Corporation

- Symrise AG

- International Flavors & Fragrances, Inc.