Global Food Fortifying Agent Market Size, Share, Report Analysis By Type (Vitamins, Minerals, Proteins and Amino Acids, Carbohydrates, Prebiotics and Probiotics, Lipids, Others), By Process (Drum Drying, Dusting), By Application (Dairy and Dairy-based Products, Infant Formula, Cereals and Cereal-based Products, Beverages, Dietary supplements, Fats and Oils, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Aug 2025

- Report ID: 156474

- Number of Pages: 361

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

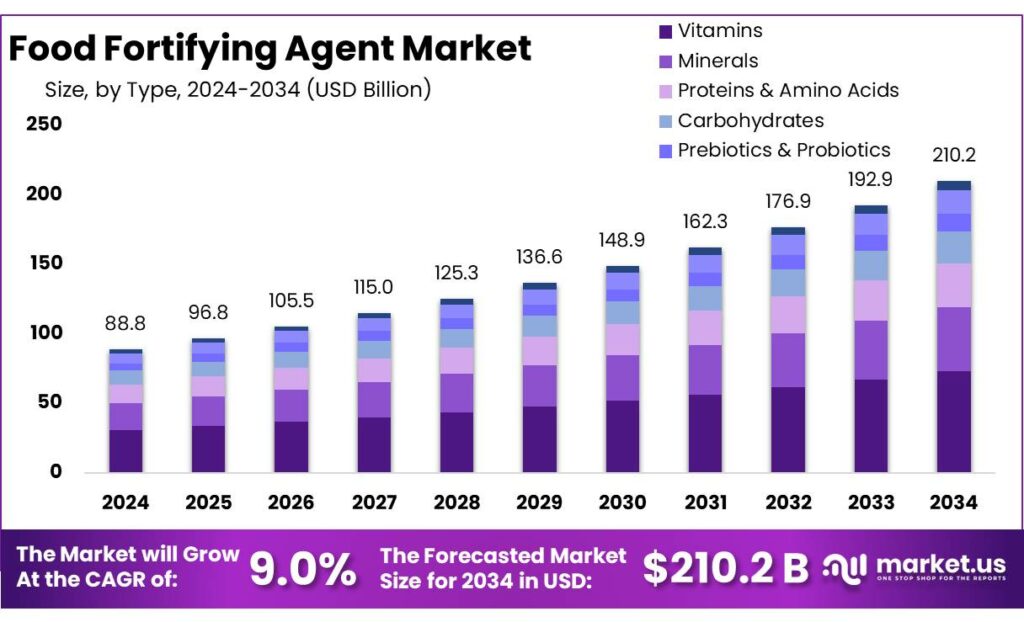

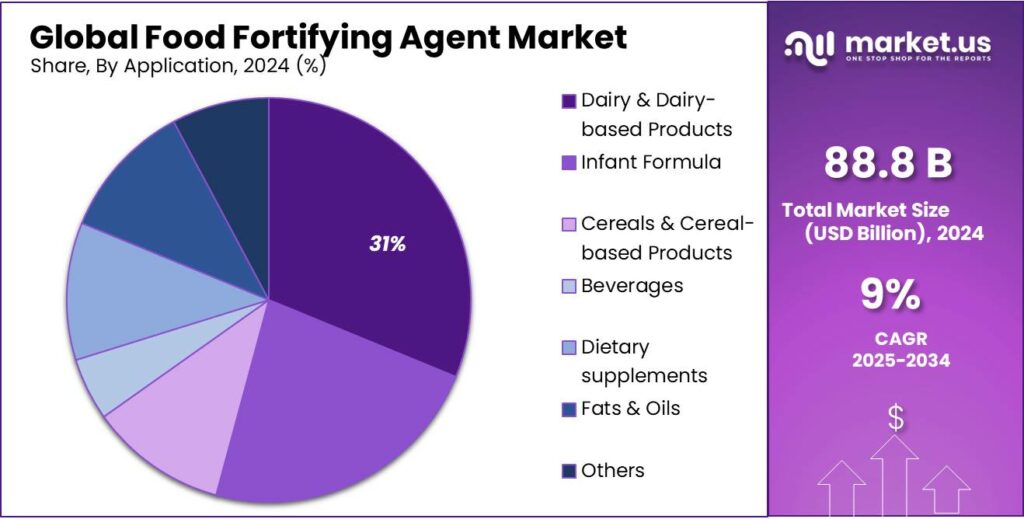

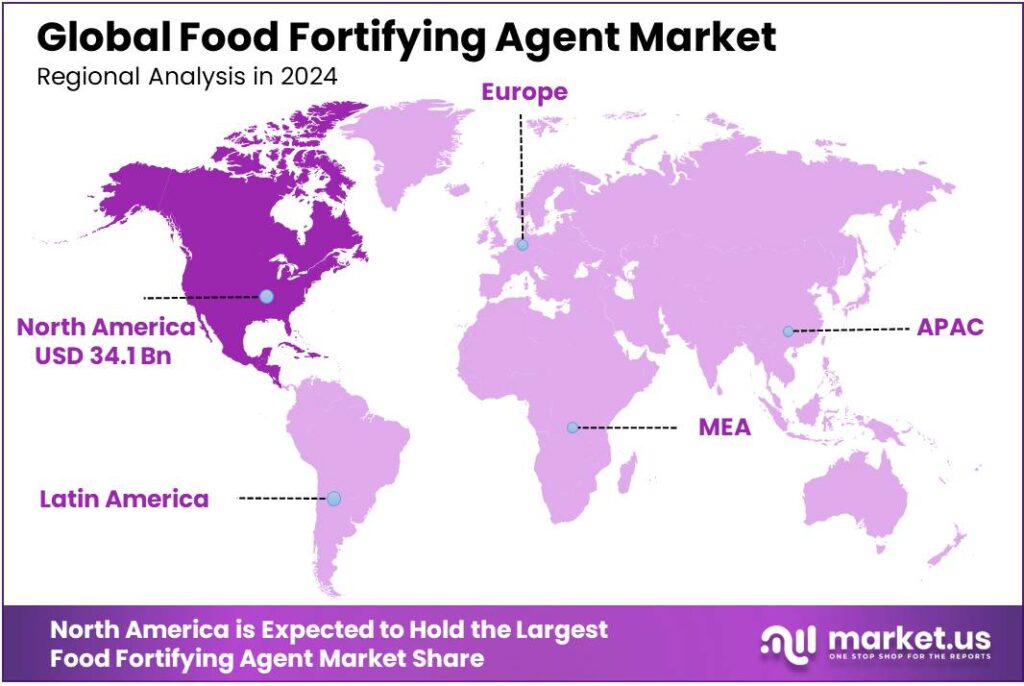

The Global Food Fortifying Agent Market size is expected to be worth around USD 210.2 Billion by 2034, from USD 88.8 Billion in 2024, growing at a CAGR of 9.0% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 38.5% share, holding USD 34.1 Billion revenue.

The food fortifying agents industry plays a pivotal role in enhancing the nutritional quality of staple foods, thereby addressing widespread micronutrient deficiencies globally. These agents, encompassing vitamins, minerals, amino acids, and other bioactive compounds, are integrated into food products to improve public health outcomes.

Global-scale initiatives also drive industry growth. The Global Alliance for Improved Nutrition (GAIN) has, since 2009, facilitated the procurement of premix micronutrients worth US$79 million, supplying quality fortificant blends across 53 countries. Meanwhile, the Food Fortification Initiative (FFI) supports large-scale fortification programs in around 30 countries, monitoring progress in 196 countries, and backing cereal fortification efforts globally.

At a quantitative impact level, current data show that among countries with mandatory fortification policies (around 125 nations), 94% of households consume any form of salt and 96% consume fortifiable salt—highlighting both the reach and the remaining implementation gaps in coverage. However, surveys from 22 national fortification programs indicate that less than half of households consume adequately fortified foods, and only about 45% of product samples meet national standards, underscoring the challenges in quality assurance and regulatory monitoring.

Key Takeaways

- Food Fortifying Agent Market size is expected to be worth around USD 210.2 Billion by 2034, from USD 88.8 Billion in 2024, growing at a CAGR of 9.0%.

- Vitamins held a dominant market position, capturing more than a 34.8% share in the Food Fortifying Agent Market.

- Drum Drying held a dominant market position, capturing more than a 68.9% share in the Food Fortifying Agent Market.

- Dairy & Dairy-based Products held a dominant market position, capturing more than a 31.2% share in the Food Fortifying Agent Market.

- North America clearly stood out as the dominant region in the Food Fortifying Agent Market, capturing 38.5% of global share, which corresponds to about USD 34.1 billion.

By Type Analysis

Vitamins Dominate with 34.8% Share in 2024

In 2024, Vitamins held a dominant market position, capturing more than a 34.8% share in the Food Fortifying Agent Market. Their leadership comes from the essential role vitamins play in addressing widespread nutritional gaps, particularly deficiencies in vitamin D, A, and B-complex groups. Food and beverage manufacturers commonly add vitamins to dairy, cereals, juices, and infant formulas to enhance daily nutrition, making them the most widely accepted fortification agents. Consumers trust vitamin fortification because it is both effective and scientifically validated.

By 2025, vitamins are expected to continue leading the market as health awareness rises globally and governments expand food fortification programs to combat malnutrition. Initiatives such as mandatory vitamin D fortification in dairy or vitamin A fortification in edible oils further strengthen their dominance. The adaptability of vitamins across processed foods and beverages, along with growing demand for preventive healthcare, ensures steady growth. Overall, the vitamin segment remains the backbone of food fortification, ensuring accessible nutrition for both developed and emerging markets.

By Process Analysis

Drum Drying Dominates with 68.9% Share in 2024

In 2024, Drum Drying held a dominant market position, capturing more than a 68.9% share in the Food Fortifying Agent Market. This process is widely chosen because it allows sensitive nutrients like vitamins, proteins, and minerals to be preserved while creating a stable, easy-to-handle powdered form. Food producers favor drum drying for its cost efficiency, scalability, and ability to maintain high nutritional value, making it especially suitable for fortified cereals, baby foods, and instant meal products.

By 2025, the dominance of drum drying is expected to continue as demand for fortified convenience foods grows globally. The technique supports mass production and ensures uniformity, which is critical for manufacturers focused on nutritional accuracy and shelf-life stability. Additionally, its adaptability for both large- and small-scale operations makes it a versatile solution across diverse markets. Overall, the drum drying process remains the backbone of fortification technologies, helping ensure that fortified foods retain their health benefits while meeting the rising demand for quick and nutritious meal options.

By Application Analysis

Dairy & Dairy-based Products Dominate with 31.2% Share in 2024

In 2024, Dairy & Dairy-based Products held a dominant market position, capturing more than a 31.2% share in the Food Fortifying Agent Market. The segment’s strength comes from the daily consumption of milk, cheese, yogurt, and other dairy items, which are ideal carriers for vitamins, minerals, and probiotics. Fortification of dairy with vitamin D, calcium, and iron has become a standard practice to address nutritional deficiencies, especially in children and elderly populations who rely heavily on these foods for essential nutrients.

By 2025, this category is expected to sustain its lead, supported by government-backed fortification initiatives and rising consumer preference for nutrient-rich functional foods. Dairy companies continue to highlight the added value of fortified products, positioning them as everyday health boosters. With the growing popularity of flavored and ready-to-drink fortified milk, alongside fortified yogurt products, the segment is widening its consumer base. Overall, the dairy and dairy-based products segment remains the most trusted application for fortification, ensuring its stable leadership in the global market.

Key Market Segments

By Type

- Vitamins

- Minerals

- Proteins & Amino Acids

- Carbohydrates

- Prebiotics & Probiotics

- Lipids

- Others

By Process

- Drum Drying

- Dusting

By Application

- Dairy & Dairy-based Products

- Infant Formula

- Cereals & Cereal-based Products

- Beverages

- Dietary supplements

- Fats & Oils

- Others

Emerging Trends

The Revolutionary Approach Transforming Global Food Security

The world of food fortification has witnessed a remarkable shift toward biofortification, a natural approach that enhances the nutritional content of crops during their growth rather than adding nutrients after harvest. This sustainable strategy is gaining unprecedented momentum across the globe, addressing the pressing nutritional needs of billions who struggle with micronutrient deficiencies.

According to the World Health Organization, deficiencies in vitamin and mineral status, particularly of folate, iron, vitamin A, and zinc, affect 50% of all preschool aged children and 67% of all women of reproductive age worldwide. These staggering numbers have prompted a global response that positions biofortification as a game-changing solution. The World Health Assembly adopted a groundbreaking resolution in May 2023, calling for accelerated efforts to prevent micronutrient deficiencies through safe and effective food fortification methods.

The beauty of biofortification lies in its simplicity and long-term impact. Unlike traditional fortification methods that require ongoing processing and additional costs, biofortified crops carry their enhanced nutritional value naturally. Research published in Nature Food reveals that mandatory large-scale food fortification programmes can reduce the estimated prevalence of inadequate zinc intake by up to 50% globally

Drivers

Government Initiatives Driving the Growth of Food Fortifying Agents in India

India is grappling with a significant public health challenge: micronutrient deficiencies, often referred to as “hidden hunger.” Despite adequate caloric intake, many individuals lack essential vitamins and minerals, leading to various health issues. To address this, the Indian government has implemented several initiatives to promote the use of food fortifying agents, aiming to enhance the nutritional quality of staple foods and improve public health outcomes.

The National Family Health Survey (NFHS-5) revealed alarming statistics about micronutrient deficiencies in India. Iron deficiency anemia affects 57% of women aged 15–49, and 69% of children aged 6–59 months are anemic. Additionally, 53% of children aged 6–59 months suffer from vitamin D deficiency, and 38% of children aged 6–11 years are deficient in vitamin B12. These deficiencies contribute to compromised immune systems, impaired cognitive development, and increased susceptibility to infections and diseases.

The Pradhan Mantri Poshan Shakti Nirman (PM POSHAN) Scheme, formerly known as the Mid-Day Meal Scheme, has been instrumental in implementing food fortification in schools. Under this scheme, fortified rice and wheat flour are provided to schoolchildren, ensuring they receive essential nutrients during their formative years. This initiative not only addresses nutritional deficiencies but also promotes health and well-being among the youth.

Restraints

Cold Storage Infrastructure Deficits Impacting Food Fortification in India

A significant challenge hindering the effective implementation of food fortification in India is the inadequate cold storage infrastructure. Despite being a global leader in agricultural production, India faces substantial post-harvest losses due to insufficient and outdated cold storage facilities. This deficiency not only affects the shelf life of perishable foods but also impedes the distribution of fortified products to consumers, particularly in rural and remote areas.

India’s existing cold storage capacity is limited, with many facilities being outdated and inefficient. According to the National Centre for Cold-chain Development (NCCD), there are approximately 8,653 cold storage units in the country with a capacity of 394.17 lakh metric tonnes. However, only about 60% of this capacity is being utilized, indicating a significant underutilization of existing infrastructure.

Moreover, the cold storage facilities are unevenly distributed across the country, with states like Uttar Pradesh, Gujarat, West Bengal, and Punjab accounting for a substantial portion of the total capacity. This geographical disparity leads to logistical challenges in transporting perishable goods, including fortified foods, to areas lacking adequate storage facilities.

The lack of modern cold storage infrastructure results in significant post-harvest losses. Studies indicate that a substantial portion of India’s horticultural produce, including fruits and vegetables, is lost due to inadequate storage facilities. This not only leads to financial losses for farmers but also affects the supply chain for processed food industries, including those involved in food fortification . Additionally, the absence of proper cold storage facilities hampers the shelf life of fortified foods, reducing their effectiveness in combating micronutrient deficiencies.

Opportunity

Government-Led Fortification: A Path to Nutritional Equity

Food fortification is a powerful tool in the fight against malnutrition, especially in countries like India, where micronutrient deficiencies are widespread. By enriching staple foods with essential vitamins and minerals, fortification ensures that even the most vulnerable populations receive the nutrients they need for healthy development. One of the most promising avenues for fortification in India is through rice, a staple consumed daily by approximately 65% of the population.

The Government of India has launched an ambitious rice fortification program to combat iron deficiency anemia, a condition affecting a significant portion of the population. Under the Pradhan Mantri Garib Kalyan Anna Yojana (PMGKAY), the government aims to procure 520 Lakh Metric Tons (LMT) of fortified rice annually. This initiative is supported by a robust infrastructure, including over 1,023 Fortified Rice Kernel (FRK) manufacturers with an annual production capacity of 111 LMT, and 232 premix suppliers capable of producing 75 LMT per annum. This capacity far exceeds the program’s requirements, ensuring a steady supply of fortified rice.

The fortification process involves blending rice with micronutrient-rich kernels, which are produced by specialized manufacturers. These fortified kernels are then mixed with regular rice at blending units, many of which are installed in over 21,000 operational rice mills across the country. This widespread adoption of fortification technology ensures that fortified rice reaches even the most remote areas.

The distribution of fortified rice through government schemes like PMGKAY has shown promising results. In states such as Jharkhand and Maharashtra, over 2.64 lakh beneficiaries have received fortified rice, contributing to improved nutritional outcomes. Moreover, pilot projects have demonstrated a significant reduction in anemia rates among schoolchildren, highlighting the effectiveness of fortified rice in addressing micronutrient deficiencies.

Regional Insights

North America commands with 38.5% share (USD 34.1 billion) in the 2024 Food Fortifying Agent Market

In 2024, North America clearly stood out as the dominant region in the Food Fortifying Agent Market, capturing 38.5% of global share, which corresponds to about USD 34.1 billion in regional revenue. This leadership reflects a combination of strong consumer awareness around nutrition, a robust food processing industry, and supportive government fortification policies that promote the addition of essential nutrients—such as vitamins A, D, and folic acid—to staple products like dairy, cereals, and oils.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Archer Daniels Midland (ADM), a U.S.-based agribusiness giant, plays a leading role in food fortification with vitamins, minerals, and protein fortifiers. In 2024, ADM generated revenues of USD 93.9 billion, supported by its Nutrition segment, which focuses on functional ingredients for fortified foods and beverages. The company leverages advanced R&D and global sourcing to deliver tailored fortification solutions. With a strong presence across North America, Europe, and Asia, ADM continues to be a trusted supplier of high-quality fortifying agents.

Arla Foods Ingredients, a Denmark-based subsidiary of Arla Foods, focuses on dairy-derived fortification solutions such as whey proteins, caseinates, and hydrolyzed proteins. In 2024, the company posted revenues of €1,015 million, up 5.4% year-on-year, with strong growth in nutrition applications. Its clinical-backed products are widely used in infant formula, sports nutrition, and fortified dairy. Arla stands out by combining innovation and sustainability, helping food producers create nutrient-rich products that support global health and wellness needs.

BASF SE, headquartered in Germany, is a global chemical leader supplying vitamins, carotenoids, and omega-3 fatty acids as food fortifying agents. In 2024, BASF reported revenues of €68.9 billion, with its Nutrition & Care segment contributing significantly. The company is known for delivering science-driven solutions to combat micronutrient deficiencies. Its fortification ingredients are used across dairy, infant formula, and functional foods. BASF’s scale, innovation, and commitment to health programs reinforce its strong role in the global food fortification landscape.

Top Key Players Outlook

- ADM

- Advanced Organic Materials, S.A.

- Arla Foods Ingredients Group PS

- BASF SE

- DSM

- Evonik Industries AG

- Ingredion Inc.

- Kellogg Co.

- Nestle SA

- Omya International AG

Recent Industry Developments

In 2024, ADM’s Nutrition segment—home to fortifying agents like vitamins, minerals, and amino acids—generated USD 5.6 billion in revenue, marking a modest 2% increase year-over-year.

In 2024, BASF SE’s Nutrition & Care segment—which includes ingredients like vitamins A, E, B2, carotenoids, and plant sterols used for fortifying food and feed—achieved sales of €6.729 billion, down slightly by 1.9% from the previous year.

Report Scope

Report Features Description Market Value (2024) USD 88.8 Bn Forecast Revenue (2034) USD 210.2 Bn CAGR (2025-2034) 9.0% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Vitamins, Minerals, Proteins and Amino Acids, Carbohydrates, Prebiotics and Probiotics, Lipids, Others), By Process (Drum Drying, Dusting), By Application (Dairy and Dairy-based Products, Infant Formula, Cereals and Cereal-based Products, Beverages, Dietary supplements, Fats and Oils, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape ADM, Advanced Organic Materials, S.A., Arla Foods Ingredients Group PS, BASF SE, DSM, Evonik Industries AG, Ingredion Inc., Kellogg Co., Nestle SA, Omya International AG Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Food Fortifying Agent MarketPublished date: Aug 2025add_shopping_cartBuy Now get_appDownload Sample

Food Fortifying Agent MarketPublished date: Aug 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- ADM

- Advanced Organic Materials, S.A.

- Arla Foods Ingredients Group PS

- BASF SE

- DSM

- Evonik Industries AG

- Ingredion Inc.

- Kellogg Co.

- Nestle SA

- Omya International AG