Global Flexible Endoscopes Market By Product Type (Gastroscopes, Colonoscopes, Duodenoscopes, Sigmoidoscopes, Bronchoscopes, Nasolaryngoscopes, Rhinopharyngoscopes, Flexible Laryngoscopes, Ureteroscopes, Cystoscopes, Laparoscopes, Arthroscopes, Neuroendoscopes, Hysteroscopes, Otoscopes, Enteroscopes and Others), By Application (Gastroenterology, Respiratory, ENT, Urology, Gynecology and Others), By End-User (Hospitals, Ambulatory Surgical Centers and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 171899

- Number of Pages: 279

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

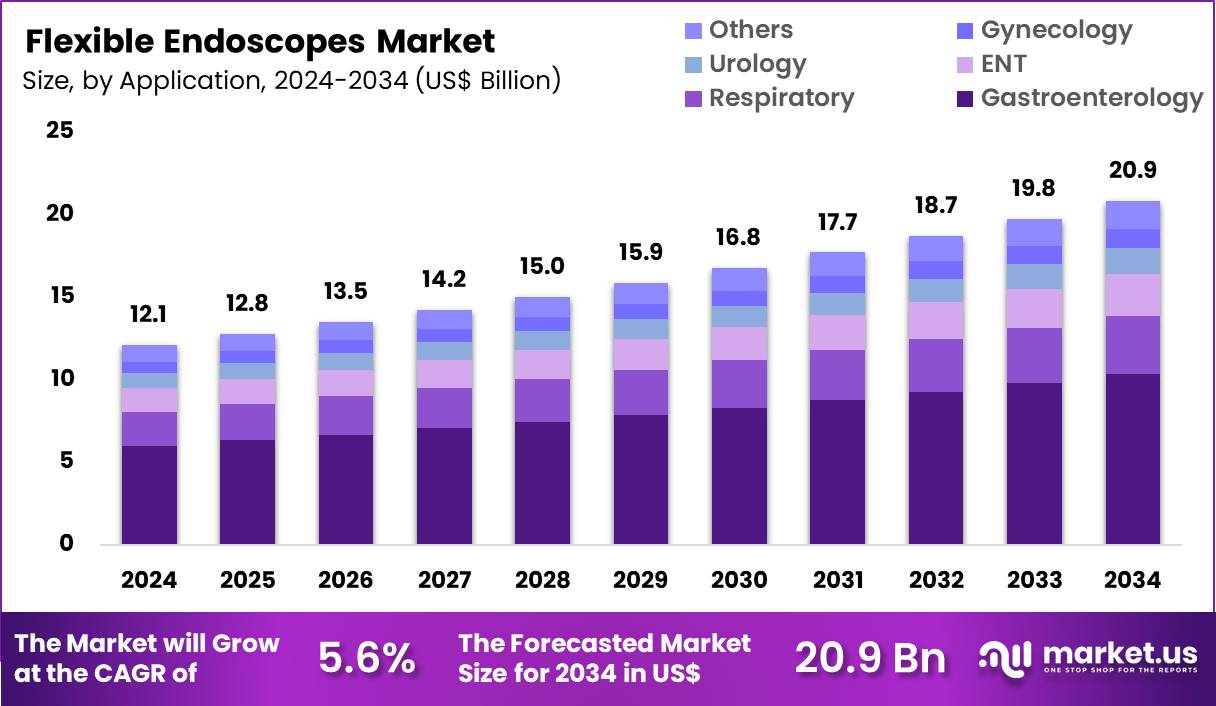

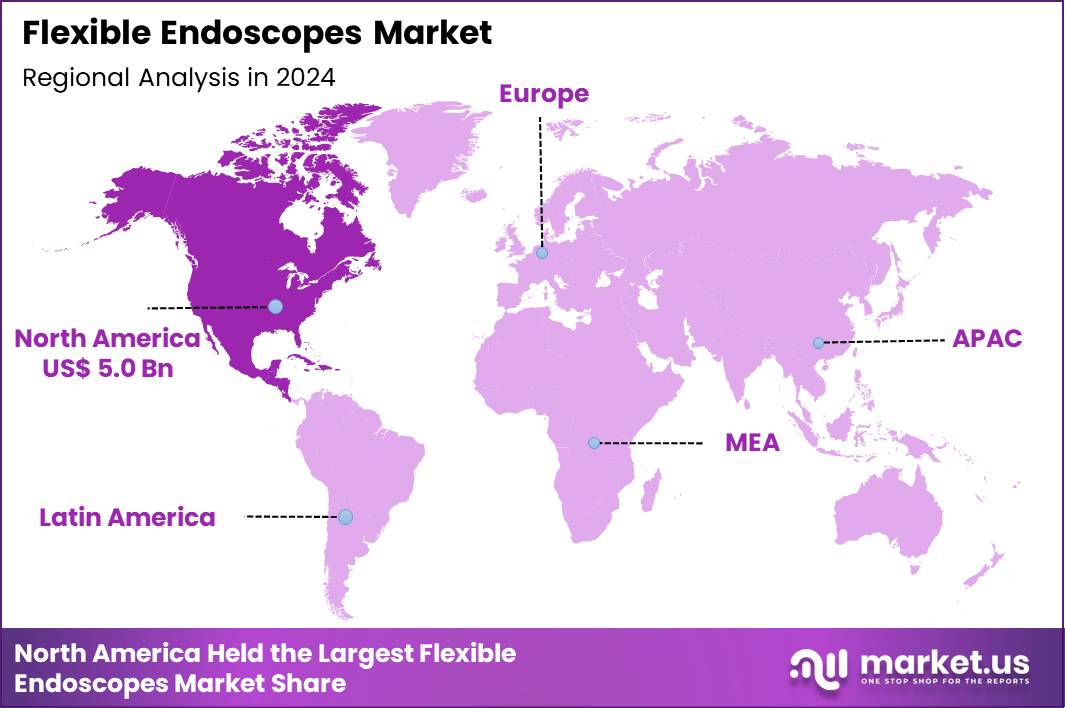

The Global Flexible Endoscopes Market size is expected to be worth around US$ 20.9 Billion by 2034 from US$ 12.1 Billion in 2024, growing at a CAGR of 5.6% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 41.4% share with a revenue of US$ 5.0 Billion.

Growing preference for minimally invasive diagnostic and therapeutic procedures accelerates the adoption of flexible endoscopes that provide superior maneuverability and patient comfort in internal examinations. Gastroenterologists routinely utilize these devices for upper gastrointestinal endoscopy to inspect the esophagus, stomach, and duodenum, identifying ulcers, inflammation, and early malignancies.

Pulmonologists employ bronchoscopes to navigate airways, enabling biopsy collection and foreign body removal in respiratory disorders. Urologists apply ureteroscopes to access the urinary tract, facilitating stone fragmentation and tumor resection with minimal tissue disruption. Otolaryngologists leverage nasopharyngoscopes for laryngeal visualization, supporting voice disorder assessments and vocal cord interventions.

In August 2024, KARL STORZ U.S. and FUJIFILM Healthcare Americas Corporation formed a strategic collaboration focused on delivering integrated solutions for endoscopy and surgery. Under the agreement, Fujifilm’s flexible GI endoscopes are being offered alongside KARL STORZ’s operating room integration technologies, enabling clinicians to access coordinated imaging and workflow systems within procedural environments.

Manufacturers target opportunities to develop advanced visualization enhancements in flexible endoscopes, incorporating narrow-band imaging to improve detection of subtle mucosal changes in colorectal screening. Developers engineer smaller-diameter instruments to expand applications in pediatric gastroenterology, allowing safe navigation of delicate anatomies for congenital anomaly evaluations.

These devices create avenues for therapeutic expansions in pulmonology, supporting stent placement and ablation in central airway obstructions. Opportunities emerge in hybrid endoscopic-ultrasound systems that combine flexibility with real-time imaging for guided fine-needle aspirations in pancreatic cysts.

Companies advance disposable variants to broaden utility in emergency settings, ensuring sterility during urgent bronchoscopies in critically ill patients. Firms invest in ergonomic designs with improved tip deflection, enhancing precision in complex urological procedures like renal pelvis inspections.

Industry leaders incorporate high-definition and 4K resolution cameras into flexible endoscopes, delivering sharper images for detailed lesion characterization in gastrointestinal diagnostics. Developers integrate artificial intelligence-assisted polyp detection algorithms to augment real-time decision-making during colonoscopies. Market participants refine single-use bronchoscope platforms that maintain flexibility while eliminating reprocessing challenges in intensive care environments.

Innovators embed fluorescence imaging capabilities to highlight neoplastic tissues in bladder cancer surveillance via cystoscopy. Companies prioritize wireless data transmission features for seamless integration with electronic health records in otolaryngology clinics. Ongoing advancements emphasize robotic-assisted flexibility controls, improving navigation accuracy in intricate airway and urinary tract explorations.

Key Takeaways

- In 2024, the market generated a revenue of US$ 12.1 billion, with a CAGR of 5.6%, and is expected to reach US$ 20.9 billion by the year 2034.

- The product type segment is divided into gastroscopes, colonoscopes, duodenoscopes, sigmoidoscopes, bronchoscopes, nasolaryngoscopes, rhinopharyngoscopes, flexible laryngoscopes, ureteroscopes, cystoscopes, laparoscopes, arthroscopes, neuroendoscopes, hysteroscopes, otoscopes, enteroscopes and others, with gastroscopes taking the lead in 2024 with a market share of 33.2%.

- Considering application, the market is divided into gastroenterology, respiratory, ENT, urology, gynecology and others. Among these, gastroenterology held a significant share of 49.5%.

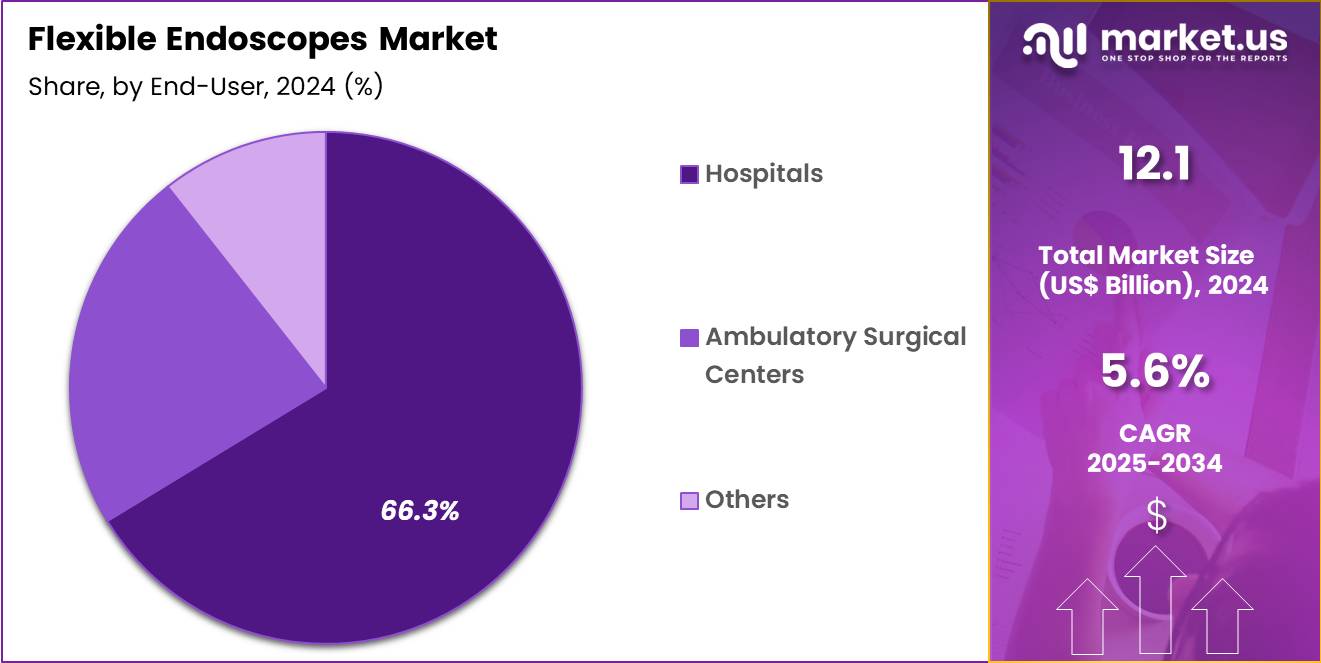

- Furthermore, concerning the end-user segment, the market is segregated into hospitals, ambulatory surgical centers and others. The hospitals sector stands out as the dominant player, holding the largest revenue share of 66.3% in the market.

- North America led the market by securing a market share of 41.4% in 2024.

Product Type Analysis

Gastroscopes, holding 33.2%, are expected to dominate because upper gastrointestinal disorders continue to rise globally due to lifestyle changes, dietary habits, and increasing prevalence of acid-related diseases. Physicians frequently rely on gastroscopy for early diagnosis of gastritis, ulcers, gastrointestinal bleeding, and gastric cancer. Preventive screening programs and growing awareness of digestive health strengthen procedural volumes.

Technological advancements improve image resolution, maneuverability, and patient comfort, encouraging wider clinical adoption. Aging populations increase demand for routine upper GI evaluations, especially in hospital settings. Training standardization around gastroscopy further reinforces its routine use. High procedure frequency compared with other flexible endoscopes supports sustained replacement and procurement cycles. These factors keep gastroscopes anticipated to remain the leading product type in the flexible endoscopes market.

Application Analysis

Gastroenterology, holding 49.5%, is projected to dominate because it represents the most procedure-intensive specialty using flexible endoscopy. Rising incidence of colorectal cancer, inflammatory bowel disease, and upper GI disorders drives continuous diagnostic and therapeutic demand. Early detection initiatives emphasize endoscopic evaluation as a first-line diagnostic tool.

Advances in endoscopic interventions reduce the need for invasive surgery, increasing reliance on flexible scopes. Gastroenterologists adopt endoscopy for both diagnosis and minimally invasive treatment, expanding usage scope. Improved sedation techniques enhance patient acceptance and procedure throughput. Growing outpatient and inpatient GI care volumes strengthen procedural frequency. These drivers keep gastroenterology expected to remain the dominant application segment.

End-User Analysis

Hospitals, holding 66.3%, are expected to dominate because they manage the highest volume of complex diagnostic and therapeutic endoscopic procedures. Hospitals maintain advanced infrastructure, infection control systems, and specialized endoscopy suites required for flexible endoscope usage. Emergency gastrointestinal bleeding cases and cancer evaluations concentrate demand within hospital environments.

Multidisciplinary support enables safe management of high-risk patients undergoing endoscopy. Capital investment capacity allows hospitals to procure and maintain advanced endoscopic equipment. Teaching and tertiary care hospitals also serve as training centers, reinforcing equipment utilization. Regulatory oversight and quality standards further centralize procedures in hospitals. These factors keep hospitals anticipated to remain the dominant end-user segment in the flexible endoscopes market.

Key Market Segments

By Product Type

- Gastroscopes

- Colonoscopes

- Duodenoscopes

- Sigmoidoscopes

- Bronchoscopes

- Nasolaryngoscopes

- Rhinopharyngoscopes

- Flexible laryngoscopes

- Ureteroscopes

- Cystoscopes

- Laparoscopes

- Arthroscopes

- Neuroendoscopes

- Hysteroscopes

- Otoscopes

- Enteroscopes

- Others

By Application

- Gastroenterology

- Respiratory

- ENT

- Urology

- Gynecology

- Others

By End-User

- Hospitals

- Ambulatory Surgical Centers

- Others

Drivers

Rising prevalence of colorectal cancer is driving the market

The flexible endoscopes market is substantially driven by the rising prevalence of colorectal cancer, which necessitates frequent use of colonoscopes and other gastrointestinal flexible devices for screening, diagnosis, and surveillance procedures. Early detection through routine colonoscopy significantly improves patient outcomes, prompting healthcare systems to expand endoscopic services. Flexible colonoscopes provide high-resolution visualization and biopsy capabilities essential for identifying precancerous polyps and malignant lesions.

Increased guideline recommendations for screening starting at younger ages contribute to higher procedural volumes. Risk factors such as dietary patterns, obesity, and genetic predispositions sustain elevated incidence rates across populations. Oncologists integrate endoscopic interventions into multidisciplinary treatment plans for staging and follow-up. Public awareness campaigns promote adherence to screening protocols, further elevating demand.

Technological compatibility with therapeutic accessories enhances utility in tumor resection. According to the American Cancer Society, an estimated 152,810 new cases of colorectal cancer were projected in the United States for 2024. This epidemiological trend directly supports sustained investment in advanced flexible endoscopy systems. Global variations in incidence reinforce market growth in high-burden regions. Regulatory emphasis on cancer prevention aligns with expanded device deployment. Overall, this driver maintains strong momentum for flexible endoscopes in preventive oncology.

Restraints

Challenges in reprocessing and infection prevention are restraining the market

The flexible endoscopes market faces significant restraints from persistent challenges in reprocessing reusable devices, which involve intricate cleaning protocols to eliminate microbial contaminants from complex internal channels. Inadequate reprocessing can lead to patient-to-patient transmission of pathogens, undermining confidence in device safety. Facilities must adhere to detailed manufacturer instructions and validation testing, adding operational complexity.

Human errors in manual steps contribute to variability in outcomes. Regulatory scrutiny has intensified following reports of post-endoscopic infections. High-level disinfection processes require specialized equipment and trained personnel. Monitoring compliance through quality assurance programs imposes additional resource demands. Replacement of damaged scopes due to wear from repeated cycles increases long-term costs.

Transition barriers include staff retraining and workflow adjustments. In 2024, the U.S. Food and Drug Administration issued letters to manufacturers concerning validation data deficiencies for certain reusable flexible endoscopes. These issues collectively slow adoption rates for traditional reusable models. Healthcare administrators weigh risks against benefits in procurement decisions. Ongoing investigations highlight the need for robust mitigation strategies. Such restraints necessitate careful management to preserve market stability.

Opportunities

Development of single-use flexible endoscopes is creating growth opportunities

The flexible endoscopes market offers considerable growth opportunities through the ongoing development and commercialization of single-use devices, which eliminate reprocessing requirements and associated infection risks. These disposable systems ensure sterility for each procedure, enhancing patient safety in high-volume settings. Manufacturers innovate materials and optics to match performance metrics of reusable counterparts.

Clinical adoption expands in specialties prone to contamination concerns, such as bronchoscopy and urology. Regulatory pathways support rapid clearance of validated single-use designs. Cost models evolve to demonstrate economic advantages in certain usage scenarios. Partnerships between device companies and healthcare providers facilitate real-world evidence generation. Global supply chains adapt to meet rising production demands. Integration with existing ancillary equipment broadens compatibility.

Momentum from initial launches in gastrointestinal applications extends to additional modalities. These opportunities enable market participants to address safety gaps while capturing new segments. Feedback from early adopters informs iterative enhancements in ergonomics and functionality. Institutional policies increasingly favor single-use options for outbreak prevention. This progression diversifies the competitive landscape and promotes broader accessibility.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic dynamics energize the flexible endoscopes market as escalating healthcare investments and surging demand for minimally invasive procedures worldwide drive gastroenterology and pulmonology centers to integrate high-resolution video and fiber-optic systems for superior diagnostics. Leading manufacturers strategically launch disposable and reusable hybrid models, capitalizing on aging populations and outpatient surgery trends to expand adoption across developed and emerging healthcare systems.

Lingering inflation and economic headwinds, however, elevate costs for precision optics and electronic components, prompting hospitals to postpone fleet upgrades and constrain procedure volumes in budget-limited settings. Geopolitical frictions, particularly U.S.-China trade disputes and regional supply disruptions, routinely interrupt deliveries of critical sensors and sterilization materials, creating manufacturing bottlenecks and sourcing challenges for globally oriented producers.

Current U.S. tariffs substantially increase landed costs on imported endoscopes and accessories, especially from Asian suppliers, pressuring margins for American distributors and limiting accessibility for cost-conscious providers. These measures also trigger reciprocal barriers overseas that hinder U.S. exports of advanced endoscopic technologies and slow multinational clinical partnerships. Still, the tariff environment galvanizes meaningful commitments to North American assembly lines and diversified supply networks, forging resilient foundations that promise enhanced technological progress and sustained market leadership ahead.

Latest Trends

Expanding availability of single-use gastrointestinal endoscopes is a recent trend

In 2024, the flexible endoscopes market has exhibited a notable trend toward expanding availability and clinical integration of single-use gastrointestinal devices, marking a shift from predominantly reusable systems. These products address longstanding reprocessing challenges by providing sterile, ready-to-use options for upper and lower GI procedures. Gastroenterologists report improved workflow efficiency and reduced turnaround times between cases.

Initial market entries focused on duodenoscopes have extended to gastroscopes and related platforms. Hospitals incorporate single-use models into infection control protocols amid heightened vigilance. Manufacturers scale manufacturing to support wider distribution networks. Procedural data demonstrate comparable diagnostic yield and maneuverability. Professional guidelines begin acknowledging single-use alternatives in risk-stratified recommendations. Training simulations prepare endoscopists for device-specific handling characteristics.

Environmental assessments explore sustainable disposal solutions alongside adoption growth. This trend reflects collaborative efforts between regulators and industry to enhance procedural safety. Reimbursement discussions evolve to accommodate innovative disposable technologies. User preferences increasingly favor options minimizing cross-contamination potential. Overall, this development signals a transformative phase in gastrointestinal flexible endoscopy practices.

Regional Analysis

North America is leading the Flexible Endoscopes Market

In 2024, North America secured a 41.4% share of the global flexible endoscopes market, advanced by surging adoption of minimally invasive visualization tools in gastrointestinal and respiratory diagnostics. Clinicians increasingly utilize high-definition and ultrathin scopes to conduct precise examinations for inflammatory bowel diseases and Barrett’s esophagus, supported by reimbursement policies favoring ambulatory procedures.

Innovations in disposable sheath systems and enhanced reprocessing protocols address infection control concerns, encouraging broader deployment in community hospitals and surgical centers. Aging populations drive higher volumes of screening colonoscopies and bronchoscopies, complemented by integrated artificial intelligence for real-time anomaly detection.

Multidisciplinary oncology programs incorporate endoscopic ultrasound-guided fine-needle aspiration for pancreatic and mediastinal lesion sampling. Supply chain resiliencies ensure availability of ergonomic, multi-channel instruments tailored for therapeutic interventions like submucosal dissections.

Guideline expansions from professional societies promote early detection strategies, amplifying procedural frequencies across diverse patient cohorts. These elements underscore a commitment to procedural excellence and reduced invasiveness. A comprehensive burden report estimates that 23.5 million gastrointestinal endoscopies occurred in the United States in 2022.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Stakeholders project robust progression in flexible endoscopic instrumentation throughout Asia Pacific over the forecast period, as demographic transitions and lifestyle shifts heighten digestive disorder prevalences. Tertiary institutions acquire advanced therapeutic platforms for endoscopic retrograde cholangiopancreatography, managing choledocholithiasis and ampullary tumors in expanding elderly demographics.

National health initiatives roll out population-based gastric cancer surveillance, leveraging chromoendoscopy enhancements for precancerous lesion identification. Medical device innovators customize pediatric-sized bronchosopes, supporting rising asthma and foreign body retrieval cases in urban pediatric wards. Cross-regional collaborations standardize training on peroral endoscopic myotomy for achalasia, elevating expertise in motility disorder resolutions.

Economic growth facilitates private clinic expansions stocking hybrid video-fiberoptic hybrids for cost-effective outpatient services. Policy reforms expedite imports of narrow-band imaging-equipped models, sharpening vascular pattern recognition in colitis assessments. These developments fortify diagnostic and interventional capacities, countering escalating oncological and functional gastrointestinal challenges. Estimates from GLOBOCAN reveal approximately 966,400 new colorectal cancer cases across Asia in 2022.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the flexible endoscopes market accelerate growth by advancing imaging resolution, maneuverability, and ergonomic design to improve diagnostic accuracy and procedural efficiency across GI, pulmonary, and urology applications. Companies strengthen demand by embedding infection-prevention features, including improved reprocessing compatibility and single-use components, to align with hospital safety priorities.

Commercial teams expand adoption through bundled offerings that combine scopes, processors, accessories, training, and service contracts to reduce lifecycle costs for providers. Innovation strategies emphasize digital integration, AI-assisted visualization, and workflow connectivity to support faster decisions and higher throughput.

Geographic expansion targets emerging healthcare systems with rising endoscopy volumes and improving reimbursement environments. Olympus Corporation anchors its leadership with a comprehensive endoscopy portfolio, global manufacturing and service infrastructure, and sustained investment in visualization technologies that support high-volume clinical use and long-term customer relationships worldwide.

Top Key Players

- Olympus Corporation

- Karl Storz SE & Co. KG

- FUJIFILM Holdings Corporation

- PENTAX Medical

- Ambu A/S

- Boston Scientific Corporation

- Medtronic plc

- Richard Wolf GmbH

- CONMED Corporation

- Cook Medical

- Johnson & Johnson

- Stryker Corporation

- Smith & Nephew Inc.

- Machida Endoscope Co., Ltd.

- Becton, Dickinson and Company

Recent Developments

- In May 2025, FUJIFILM Healthcare Europe expanded its endoscopy portfolio with the introduction of the ELUXEO EG-840T and the slimmer EG-840TP as part of the ELUXEO 800 Series. These devices represent the next step in the company’s “WELCOME, FUTURE” strategy and build on the earlier ELUXEO 8000 platform. Designed for both diagnostic imaging and complex therapeutic interventions, the endoscopes support advanced gastrointestinal procedures such as EMR and ESD, which are increasingly used for the treatment of early-stage GI malignancies.

- In October 2024, Lumicell disclosed progress on a flexible endoscopic system under development for identifying precancerous changes and early esophageal adenocarcinoma in individuals with Barrett’s esophagus. The project is being supported through a Phase I SBIR award from the National Cancer Institute, reflecting federal backing for technologies aimed at earlier cancer detection and improved screening accuracy.

Report Scope

Report Features Description Market Value (2024) US$ 12.1 Billion Forecast Revenue (2034) US$ 20.9 Billion CAGR (2025-2034) 5.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Gastroscopes, Colonoscopes, Duodenoscopes, Sigmoidoscopes, Bronchoscopes, Nasolaryngoscopes, Rhinopharyngoscopes, Flexible Laryngoscopes, Ureteroscopes, Cystoscopes, Laparoscopes, Arthroscopes, Neuroendoscopes, Hysteroscopes, Otoscopes, Enteroscopes and Others), By Application (Gastroenterology, Respiratory, ENT, Urology, Gynecology and Others), By End-User (Hospitals, Ambulatory Surgical Centers and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Olympus Corporation, Karl Storz SE & Co. KG, FUJIFILM Holdings Corporation, PENTAX Medical, Ambu A/S, Boston Scientific Corporation, Medtronic plc, Richard Wolf GmbH, CONMED Corporation, Cook Medical, Johnson & Johnson, Stryker Corporation, Smith & Nephew Inc., Machida Endoscope Co., Ltd., Becton, Dickinson and Company Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Olympus Corporation

- Karl Storz SE & Co. KG

- FUJIFILM Holdings Corporation

- PENTAX Medical

- Ambu A/S

- Boston Scientific Corporation

- Medtronic plc

- Richard Wolf GmbH

- CONMED Corporation

- Cook Medical

- Johnson & Johnson

- Stryker Corporation

- Smith & Nephew Inc.

- Machida Endoscope Co., Ltd.

- Becton, Dickinson and Company