Fertility Supplements Market By Product (Vitamins, Minerals, Herbal Supplements, Omega 3 Fatty Acids, Amino Acids, Antioxidants, Probiotics, Others), By Form (Capsules, Tablets, Soft gels, Powder, Liquid, Others), By Ingredient Type (Natural, Synthetic, Combination), By Type (OTC, Prescribed), By End-User (Men, Women), By Distribution Channel (Retail Stores, Online Retailers, Pharmacies, Brand Websites, Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: July 2024

- Report ID: 100720

- Number of Pages: 377

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Drug Type Analysis

- Form Analysis

- Ingredient Type Analysis

- Type Analysis

- End-User Analysis

- Distribution Channel Analysis

- Key Market Segments

- Drivers

- Restraints

- Opportunities

- Impact of Macroeconomic / Geopolitical Factors

- Latest Trends

- Regional Analysis

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

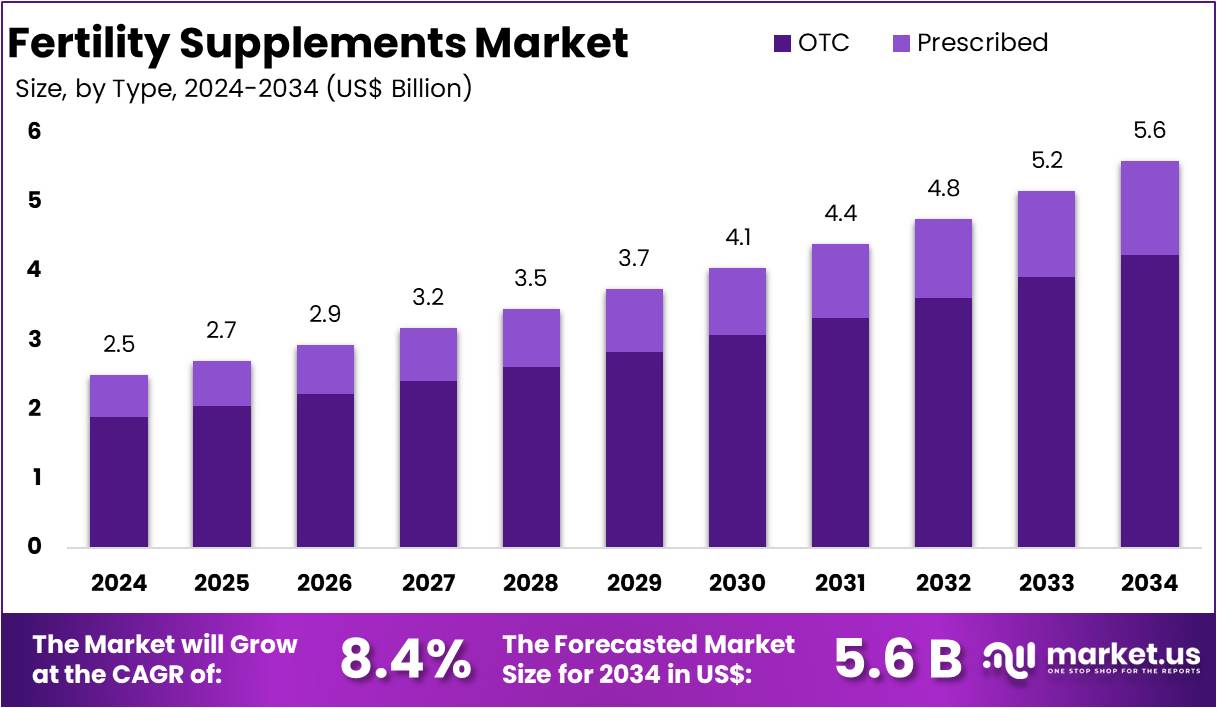

The Fertility Supplements Market size is forecasted to be valued at US$ 5.6 billion by 2034 from US$ 2.5 billion in 2024, growing at a CAGR of 8.4% during the forecast period 2025 to 2034.

The fertility supplements market is experiencing significant growth due to increasing awareness of reproductive health, lifestyle changes, and the rising incidence of infertility. In recent years, more individuals and couples are seeking ways to enhance fertility, driven by factors such as delayed parenthood, stress, poor diet, and environmental influences. The market is being shaped by both men and women looking for natural and safe alternatives to support their reproductive health, which has led to a rise in the consumption of supplements aimed at improving fertility.

Key ingredients in these supplements include vitamins and minerals like folic acid, zinc, vitamin D, and selenium, which are known to play crucial roles in supporting hormonal balance, improving sperm quality, and enhancing egg health. A study conducted by the National Institutes of Health (NIH) found that 40% of women do not receive enough folate in their diets, further driving the demand for supplements. Zinc, which plays a critical role in hormone production and immune function, is also essential for both male and female fertility.

A deficiency in zinc has been linked to male infertility, and studies suggest that supplementation can improve sperm quality and motility. Omega-3 fatty acids and antioxidants like CoQ10 are also becoming popular in fertility supplements due to their anti-inflammatory and cell-protective properties. It is particularly important for women over 35, as its levels decline with age, impacting fertility. Alongside these, herbal ingredients such as maca root, ashwagandha, and chaste tree berry are gaining traction for their potential to regulate menstrual cycles, balance hormones, and improve overall reproductive function.

The demand for fertility supplements has been boosted by the growing number of individuals turning to assisted reproductive technologies (ART) such as in vitro fertilization (IVF). These technologies often incorporate supplements to improve the success rate of treatments, further driving market growth. Additionally, there has been a shift towards more personalized fertility supplements, with brands offering tailored solutions based on genetic or hormonal testing. This approach addresses specific reproductive health needs, from ovulation support for women with irregular cycles to sperm health for men with low sperm count or motility.

Consumer preferences are also shifting towards natural and organic products, with many people seeking supplements that are free from synthetic chemicals and additives. This demand for natural fertility supplements aligns with the broader health and wellness trend where consumers are increasingly conscious of the ingredients in the products they consume.

Key Takeaways

- In 2024, the market for fertility supplements generated a revenue of US$ 2.5 billion, with a CAGR of 8.4%, and is expected to reach US$ 5.6 billion by the year 2034.

- Among the product segment, Vitamins dominated the market with 35.2% share in 2024.

- By Form, Capsules contributed to the largest revenue share of 33.7% in 2024.

- Natural ingredient segment held significant shares of 39.5% in 2024.

- By Type, OTC-based supplements captured the majority of the market share with 75.8% in 2024.

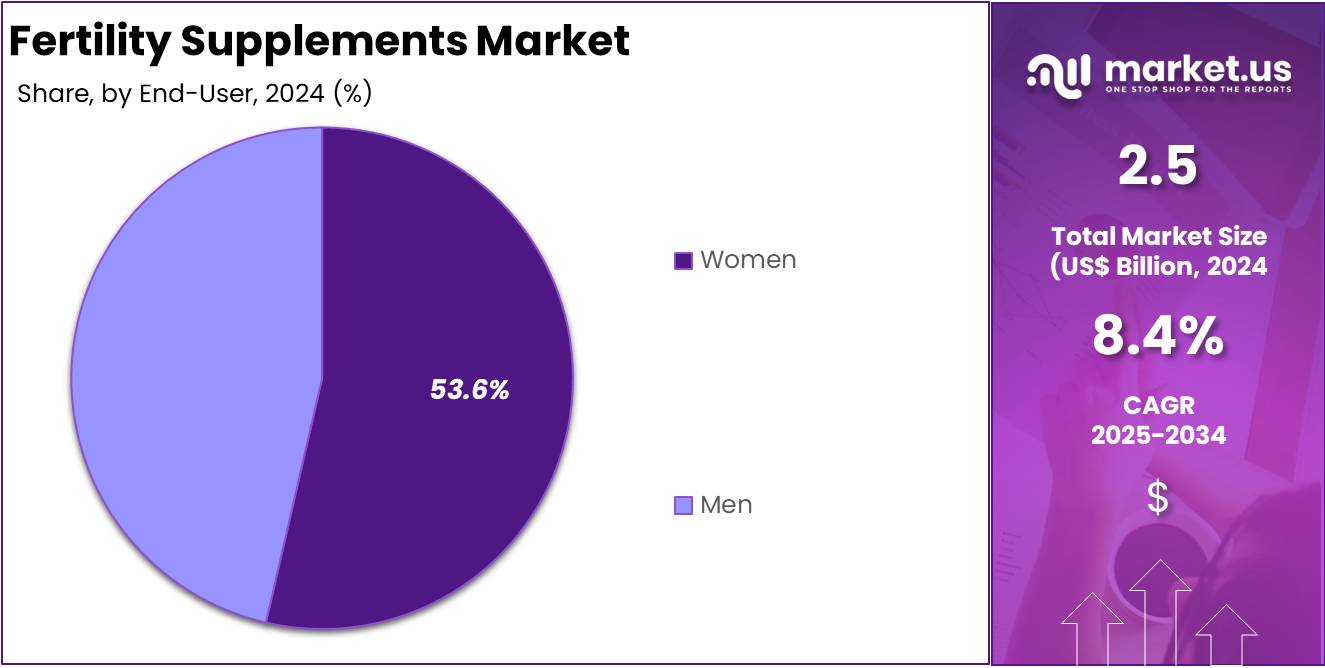

- Women was the largest revenue generating end-user contributing 53.6% market share in 2024.

- Among the distribution channel segment, Pharmacies held the largest segment accounting for 31.0% in 2024.

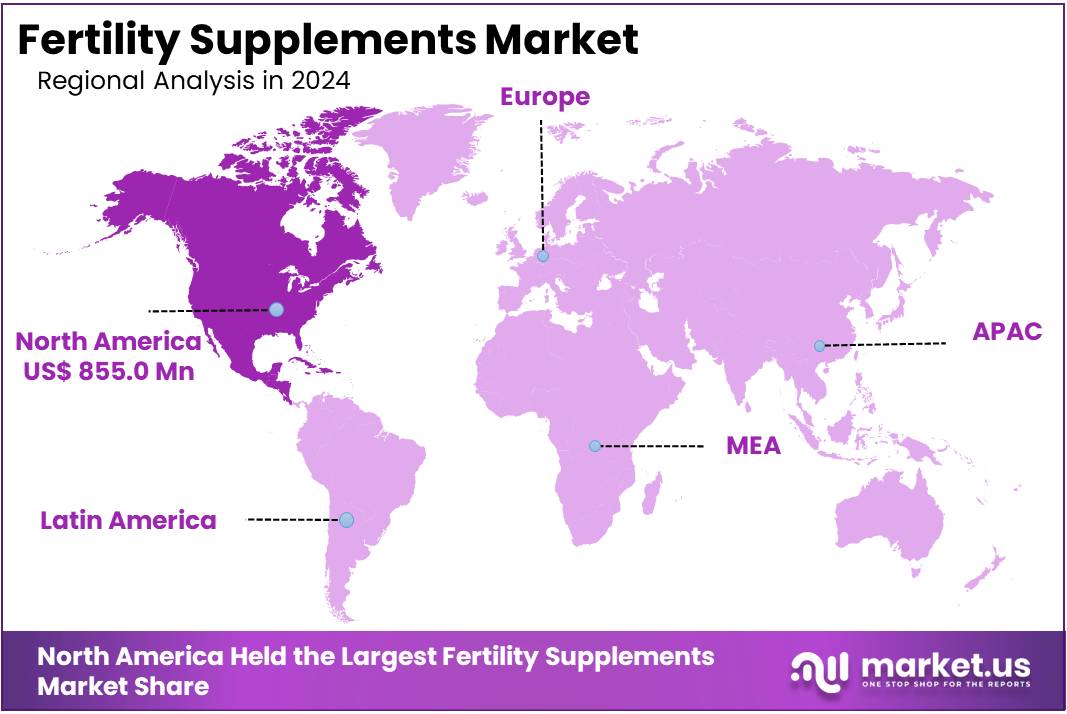

- North America held the maximum share of 34.2% in 2024 in the global market.

Drug Type Analysis

The vitamins segment held the largest share in the fertility supplements market with 35.2% in 2024, driven by their essential role in reproductive health and widespread consumer recognition. Vitamins such as folic acid, vitamin D, vitamin E, and B-vitamins are integral components in supporting fertility, making them key ingredients in many fertility supplement formulations. These vitamins are recognized for their ability to regulate hormone levels, enhance the quality of eggs and sperm, and support overall reproductive health.

Folic acid, for instance, is widely recommended for women trying to conceive due to its role in preventing neural tube defects and supporting early pregnancy development. Vitamin D is essential for reproductive health, as it helps regulate menstrual cycles and can improve fertility in both men and women. Vitamin E, an antioxidant, protects eggs and sperm from oxidative damage and improves overall reproductive health. B-vitamins, including B6 and B12, are crucial for hormone regulation and the production of red blood cells, further supporting reproductive health.

The dominance of the vitamins segment is also attributed to the high consumer awareness and trust in these ingredients. Vitamins are commonly included in daily multivitamins and prenatal supplements, making them familiar and accessible to a broad audience. This familiarity contributes to their widespread use in fertility supplements, as consumers often seek products that include ingredients they already recognize and trust. In October 2024, Premom, a leader in women’s fertility technology and the creator of Amazon’s best-selling ovulation tests, unveiled its innovation: a premium supplement line formulated by female doctors, featuring the Premium Prenatal Multivitamin.

Form Analysis

The capsule form has become the largest segment in the fertility supplements market with 33.7% share in 2024, driven by consumer preference for convenience and precise dosage. Capsules are easy to consume, requiring no additional preparation or mixing, which makes them a popular choice for those seeking a simple and effective way to support reproductive health. Unlike powders or liquids, capsules are pre-measured, eliminating the need for consumers to worry about the correct dosage, making them a hassle-free option. This factor is particularly important for individuals already managing complex routines or those who prefer a straightforward method of supplementation.

Capsules also offer significant advantages in terms of ingredient stability. Many vitamins and minerals that are commonly included in fertility supplements, such as folic acid, vitamin D, and Myo-Inositol, are sensitive to light, heat, and air. Capsules protect these nutrients, ensuring they remain effective for longer periods. This protection is especially crucial for fertility products, where consistency in dosage and potency is key to supporting reproductive health.

Additionally, capsules can easily encapsulate a wide range of active ingredients, including those that may have a strong odor or taste, offering a more pleasant user experience. For example, Fairhaven Health offers a range of fertility supplements, including their popular FertilAid capsules, designed for both men and women.

Ingredient Type Analysis

The natural ingredient-based supplements market has gained considerable traction in recent years capturing 39.5% share in 2024, driven by a growing consumer preference for organic and chemical-free products. This shift reflects a broader trend towards holistic health solutions and a heightened awareness of the potential side effects of synthetic ingredients. Many consumers are now opting for natural fertility supplements, which include plant-based extracts, vitamins, and minerals known to support reproductive health.

For instance, a popular natural ingredient, Coenzyme Q10 (CoQ10) is a naturally occurring antioxidant that has been shown to improve ovarian function and egg quality in women, especially those with diminished ovarian reserve. Studies suggest that CoQ10 supplementation can enhance egg quality and embryo development, which is particularly beneficial for women undergoing fertility treatments such as IVF. Another key ingredient gaining attention is Myo-inositol, which has been associated with improved ovarian response and higher fertilization rates, particularly in women with polycystic ovary syndrome (PCOS).

Myo-inositol helps regulate insulin sensitivity, which in turn supports healthy ovarian function and hormonal balance, making it a valuable addition to fertility regimens. The shift towards natural options is particularly notable in the growing use of OTC fertility supplements, which offer consumers easy access to products without requiring prescriptions. As more individuals seek products that align with their health-conscious lifestyles, natural fertility supplements have become a mainstream choice.

Type Analysis

The over-the-counter (OTC) segment has emerged as the dominant force in the fertility supplements market, accounting for 75.8% share in 2024 of global sales. This surge is primarily attributed to the increasing consumer preference for accessible, affordable, and discreet reproductive health solutions. Unlike prescription medications, OTC fertility supplements are readily available in pharmacies, health stores, and online platforms, allowing individuals to manage their fertility health without the need for a doctor’s prescription.

A significant factor contributing to the OTC segment’s growth is the rising awareness among consumers about the role of nutrition and lifestyle in fertility. Supplements containing vitamins such as folic acid, vitamin C, and vitamin E, along with minerals like zinc and selenium, have gained popularity for their potential to enhance reproductive health. The convenience of OTC fertility supplements is another compelling reason for their widespread adoption.

Consumers appreciate the ability to purchase these products without the need for medical consultations, which can be both time-consuming and costly. This ease of access is particularly appealing to individuals seeking to address minor fertility concerns or those in the early stages of family planning. Increasing participation of influencers and celebrities in the fertility supplement space is also driving growth.

Their personal experiences and endorsements lend credibility to these products, encouraging a broader audience to consider OTC supplements as a viable option for enhancing fertility. This trend not only amplifies the visibility of OTC fertility supplements but also fosters a sense of community and support among individuals navigating their fertility journeys.

End-User Analysis

The women’s segment in the fertility supplements market is the largest and continues to drive substantial growth, accounting for 53.6% share in 2024. This shift can be attributed to a variety of factors, including lifestyle changes, delayed childbearing, and increasing rates of infertility. Many women are now seeking proactive solutions to enhance their reproductive health, as they become more aware of the role that nutrition and supplements can play in supporting fertility. As women face challenges related to hormonal imbalance, ovulation issues, and other reproductive health concerns, fertility supplements tailored to their needs have gained popularity.

One of the key conditions contributing to the growing demand for fertility supplements in women is PCOS. Between 5% and 10% of women of childbearing age, have PCOS. Anovulation is diagnosed in 30% of couples seeking fertility treatment, with 90% of these cases attributed to PCOS. This hormonal disorder, which affects a substantial number of women, can impair ovulation and lead to infertility. As a result, women with PCOS are turning to fertility supplements containing Myo-inositol, which has been shown to improve ovarian function and regulate insulin sensitivity.

Studies indicate that Myo-inositol supplementation can increase the chances of follicle maturation and successful ovulation, helping women with PCOS improve their fertility outcomes. A study published on ScienceDirect on herbal supplement use among reproductive-aged women revealed that more than two-thirds of women seeking infertility treatment had previously used herbal medicine, and over half reported using it currently.

The World Health Organization (WHO) conducted a large multinational study to assess the gender distribution and causes of infertility. The study found that female infertility was the primary cause in 37% of infertile couples, while both male and female factors contributed in 35% of cases. Male infertility was identified in 8% of the couples. Among the most common identifiable causes of female infertility were:

- Ovulatory disorders: 25%

- Endometriosis: 15%

- Pelvic adhesions: 12%

- Tubal blockage: 11%

- Other tubal/uterine abnormalities: 11%

- Hyperprolactinemia: 7%

Distribution Channel Analysis

The pharmacies segment has become the largest distribution channel in the fertility supplements market with 31.0% share in 2024, driven by several key factors, including convenience, trust, and accessibility. Pharmacies, both retail and hospital-based, play a crucial role in making fertility supplements widely available to consumers, allowing them to purchase products designed to support reproductive health with ease. This widespread accessibility makes pharmacies the preferred choice for many individuals looking to address fertility concerns, as they offer a convenient one-stop location where consumers can find a variety of health-related products, including fertility supplements.

One of the main reasons pharmacies dominate in this space is the trust that consumers place in them. Pharmacies are regulated establishments, and people generally perceive them as reliable sources for health products. This trust is especially important when it comes to fertility supplements, where consumers often seek assurances regarding the safety and effectiveness of the products they are considering. The presence of trained pharmacists who can provide guidance and advice also adds to this sense of security, making pharmacies a go-to option for people unsure about which supplement is most suitable for their needs.

Key Market Segments

By Product

- Vitamins

- Minerals

- Herbal Supplements

- Omega 3 Fatty Acids

- Amino Acids

- Antioxidants

- Probiotics

- Others

By Form

- Capsules

- Tablets

- Soft gels

- Powder

- Liquid

- Others

By Ingredient Type

- Natural

- Synthetic

- Combination

By Type

- OTC

- Prescribed

By End-User

- Men

- Women

By Distribution Channel

- Retail Stores

- Online Retailers

- Pharmacies

- Brand Websites

- Others

Drivers

Increasing Infertility Rates

The increasing global infertility rates have significantly influenced the demand for fertility supplements, positioning them as a vital component in reproductive health management. According to the WHO, approximately 17.5% of the adult population, or about 1 in 6 people globally, experience infertility, highlighting the critical need to expand access to affordable, high-quality fertility care. The lifetime prevalence of infertility is 17.8% in high-income countries and 16.5% in low- and middle-income countries. These statistics underscore the urgent need for accessible and effective solutions to support fertility.

Several factors contribute to the rising infertility rates, including lifestyle choices, environmental exposures, and delayed childbearing. In many high-income countries, the average age of first-time mothers has increased, leading to a natural decline in fertility due to age-related factors. Additionally, lifestyle factors such as poor diet, lack of physical activity, smoking, and excessive alcohol consumption have been linked to decreased fertility in both men and women. Environmental factors, including exposure to endocrine-disrupting chemicals found in plastics and pesticides, have also been implicated in declining reproductive health.

The increasing awareness of infertility and the availability of fertility supplements have led to a surge in their use. Individuals seeking to conceive are turning to these supplements as a natural and accessible option to support their reproductive health. The growing market for fertility supplements reflects the broader societal recognition of infertility as a significant health issue and the desire for effective solutions.

Restraints

Limited Scientific Evidence

The fertility supplements market faces a significant restraint due to the limited scientific evidence supporting the efficacy of many products. Despite the growing popularity of supplements marketed to enhance reproductive health, a substantial number lack rigorous clinical validation. A notable investigation by the Center for Science in the Public Interest analyzed 39 fertility supplements available in the market, including products like FertilHerb for Women and OvaBoost. The findings revealed that none of these supplements provided credible scientific evidence demonstrating their effectiveness in improving fertility or increasing the chances of conception.

Further scrutiny into male fertility supplements highlights similar concerns. A comprehensive review of over-the-counter antioxidant supplements intended for male fertility found that less than half had been subjected to clinical trials. Among those that were studied, the majority of clinical trials exhibited poor quality, with only a few meeting acceptable standards for scientific research. This lack of robust evidence raises questions about the reliability and effectiveness of such supplements. The absence of high-quality clinical trials is a critical issue. Many fertility supplements are not subjected to the rigorous testing required for pharmaceutical drugs, leading to a market flooded with products that may not deliver the promised benefits.

Moreover, the regulatory landscape for dietary supplements is less stringent compared to prescription medications. In the United States, for example, the Food and Drug Administration (FDA) does not require supplements to undergo clinical trials before reaching the market. This regulatory gap allows products to be sold with claims of fertility benefits without the necessary scientific backing, potentially misleading consumers. The limited scientific evidence not only hampers consumer trust but also poses risks to individuals seeking to improve their reproductive health. Without conclusive data, it’s challenging for healthcare providers to recommend specific supplements confidently. This uncertainty underscores the need for more rigorous research and clinical trials to substantiate the claims made by fertility supplement manufacturers.

Opportunities

Emergence of Personalized Fertility Supplements

The emergence of personalized fertility supplements represents a significant opportunity in the reproductive health sector, addressing the growing demand for tailored health solutions. Traditional fertility supplements often adopt a one-size-fits-all approach, which may not effectively meet the unique needs of every individual. Personalized supplements, however, are designed based on an individual’s specific health profile, lifestyle, and reproductive goals, offering a more targeted approach to fertility support.

Companies like Bioniq and Shaklee have pioneered this personalized approach by utilizing data-driven methods to create customized nutrient plans. Bioniq, for instance, employs a comprehensive analysis of biochemical data to formulate supplements tailored to an individual’s health requirements. Similarly, Shaklee’s Meology platform offers personalized vitamin packs based on a detailed assessment of an individual’s health status, goals, and lifestyle, ensuring that each supplement regimen is uniquely suited to the user.

This trend is further exemplified by brands like Molo, co-founded by influencer Rebecca Zamolo, which offers fertility supplements in convenient powder forms. These products are designed to support various stages of the fertility journey, from conception to postpartum, and are formulated based on insights from fertility experts. Molo’s approach underscores the growing recognition of the need for personalized fertility solutions that align with individual health profiles and preferences.

The rise of personalized fertility supplements is also supported by advancements in technology, such as artificial intelligence and genetic testing. These technologies enable a more precise understanding of an individual’s nutritional needs and reproductive health, facilitating the development of supplements that are specifically tailored to enhance fertility outcomes. As consumers become more informed and proactive about their reproductive health, the demand for personalized supplements is expected to continue its upward trajectory.

Impact of Macroeconomic / Geopolitical Factors

One key macroeconomic factor is the rising healthcare costs worldwide, particularly in developed markets. In 2023, National Health Expenditures (NHE) grew by 7.5% to reach $4.9 trillion, or $14,570 per person, representing 17.6% of the Gross Domestic Product (GDP). As fertility treatments such as IVF become more expensive, many individuals and couples are turning to more affordable, OTC fertility supplements as an alternative or complementary solution. This trend has been particularly evident in countries where the costs of ART are high, leading to a growing reliance on natural fertility products as a cost-effective solution.

In addition, economic instability or political unrest in certain regions can affect consumer spending patterns, including spending on fertility-related products. For example, the median annual disposable income per person in the EU was €19,955 (US$ 23371.70) in Purchasing Power Standards (PPS) in 2023. Geopolitical factors also have a direct impact on the fertility supplements market. For instance, trade policies and tariffs can affect the global supply chain for raw materials used in the production of these supplements. Changes in international trade agreements or the imposition of tariffs on key ingredients could result in higher production costs, which may ultimately affect product pricing and availability.

Additionally, the regulatory environment surrounding fertility supplements varies significantly across regions, with some countries having more stringent guidelines for the approval and marketing of these products, while others have less oversight. This disparity in regulations can influence market access and growth potential for companies operating globally.

Latest Trends

Integration with Assisted Reproductive Technologies (ART)

The integration of fertility supplements with assisted reproductive technologies (ART) has become a significant trend, reflecting a holistic approach to enhancing reproductive health outcomes. While ART procedures like IVF and intracytoplasmic sperm injection (ICSI) have advanced reproductive medicine, the addition of targeted nutritional support aims to optimize the body’s environment for conception and embryo development.

Research indicates that certain nutrients can positively influence ART success rates. For instance, higher intake of supplemental folate has been associated with increased live birth rates in women undergoing ART. A study involving 232 women found that those in the highest quartile of folate intake had a 20% higher likelihood of achieving a live birth compared to those in the lowest quartile. Similarly, adequate levels of vitamin D have been linked to improved ovarian reserve markers and higher clinical pregnancy rates in women undergoing IVF or ICSI.

The growing awareness of the potential benefits of fertility supplements has led to their incorporation into ART treatment plans. Clinics and healthcare providers are increasingly recommending specific supplements to patients undergoing ART, aiming to improve the chances of successful conception and pregnancy. This trend reflects a shift towards personalized and comprehensive fertility care, addressing both medical and nutritional aspects to support reproductive health.

Regional Analysis

North America is leading the Fertility Supplements Market

North America was the largest revenue-generating region with 34.2% share in 2024. In North America, particularly the United States, the fertility supplements market benefits from high consumer awareness, advanced healthcare infrastructure, and widespread access to OTC products. In the U.S., fertility supplements have become increasingly popular as more individuals face challenges related to delayed childbearing, lifestyle factors, and environmental influences on fertility.

The high prevalence of conditions such as PCOS and endometriosis, coupled with a growing awareness of the role of nutrition in fertility, has contributed to a steady demand for fertility supplements. In the US, an estimated 5 to 6 million women are affected by PCOS. North American consumers often seek natural and organic solutions, supported by a regulatory environment that ensures product safety and efficacy.

As a result, OTC fertility supplements have seen significant growth, as consumers prefer easy access to products without requiring prescriptions or specialized healthcare visits. Additionally, consumer preferences in the region are shifting towards personalized fertility solutions that cater to individual health needs, further boosting the market for fertility supplements.

According to CDC data, the infertility rate among married women aged 15–49 is 8.5%. When broken down by parity, the infertility rate is 19.4% for women with no children and 6.0% for women with one or more children. Additionally, 12.2% of women aged 15–49 have used infertility services at some point.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is experiencing rapid growth in the fertility supplements market, driven by an increase in infertility rates, rising awareness of reproductive health, and changing lifestyles. Countries such as China and India are witnessing a surge in demand for fertility supplements as infertility becomes a more recognized issue. Factors like urbanization, stress, dietary changes, and environmental pollution are impacting reproductive health in these regions.

In India, approximately 22 to 33 million couples of reproductive age face lifetime infertility, with 40-50% of cases attributed to female factors, while the remaining 30-40% are linked to male infertility. As more people turn to fertility supplements to improve their reproductive health, the market is expanding, particularly in countries where healthcare systems are evolving, and access to supplements is increasing.

The growth is further fueled by the increasing availability of fertility supplements through retail outlets and e-commerce platforms, making them more accessible to a broader consumer base.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The global fertility supplements market is characterized by a competitive landscape with a mix of established brands and emerging players. Major companies such as Fairhaven Health, Coast Science, and LENUS Pharma have significant presence in the market, offering a broad range of products. These brands have a strong presence in North America and Europe, where consumer awareness of fertility issues is high and demand for natural fertility solutions is increasing. These established players benefit from their ability to offer clinically supported products, making them trusted names in the market.

However, the market is also witnessing an influx of new entrants that focus on innovative, personalized approaches to fertility care. The global competition is also fueled by the increasing trend of e-commerce, which has made fertility supplements more accessible across the world. Online platforms allow consumers to compare products, read reviews, and purchase fertility supplements with ease, which has intensified the competition among both established and new players.

Top Key Players in the Fertility Supplements Market

- Vitabiotics Ltd

- Fairhaven Health

- Exeltis USA Inc.

- Zenith Nutrition

- Bionova

- Theralogix

- Eu Natural

- LENUS Pharma GesmbH

- Active Bio Life Science GmbH

- Orthomol Pharmazeutische Vertriebs GmbH

- NutraBlast

- Nestlé

- Jamieson Wellness

- Fertility Nutraceuticals LLC (Ovaterra)

- Coast Science

- OLLY Nutrition

- Fertility Nutraceuticals LLC

- Nutrafol

- InnovaMed Ltd.

Recent Developments

- In June 2025: Phytaphix, a botanical supplement company based in Ireland, has introduced a comprehensive fertility product aimed at supporting reproductive health for both men and women. The product, Fertility Phix, includes 27 essential ingredients—such as a blend of vitamins, minerals, and probiotics—all carefully chosen based on the latest clinical research, as explained by Dr. Conor Kerley, founder and chief scientific officer at Phytaphix.

- In late 2024: Theralogix launched a targeted consumer marketing campaign in collaboration with Exverus Media to expand its supplement brand beyond its established provider network. The campaign aimed to reach individuals seeking health information through platforms such as Google, Facebook, Instagram, and Reddit. Creative content included visuals like a Theralogix container with the search query “how to manage PCOS symptoms” and positive user testimonials for their inositol supplement, Ovasitol.

- In November 2024: Nestlé introduced two new nutritional solutions, Materna Pre and Materna Nausea, aimed at supporting women’s fertility and alleviating pregnancy-related symptoms such as nausea and vomiting.

Report Scope

Report Features Description Market Value (2024) US$ 2.5 billion Forecast Revenue (2034) US$ 5.6 billion CAGR (2025-2034) 8.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product (Vitamins, Minerals, Herbal Supplements, Omega 3 Fatty Acids, Amino Acids, Antioxidants, Probiotics, Others), By Form (Capsules, Tablets, Soft gels, Powder, Liquid, Others), By Ingredient Type (Natural, Synthetic, Combination), By Type (OTC, Prescribed), By End-User (Men, Women), By Distribution Channel (Retail Stores, Online Retailers, Pharmacies, Brand Websites, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Vitabiotics Ltd, Fairhaven Health, Exeltis USA Inc., Zenith Nutrition, Bionova, Theralogix, Eu Natural, LENUS Pharma GesmbH, Active Bio Life Science GmbH, Orthomol Pharmazeutische Vertriebs GmbH, NutraBlast, Nestlé, Jamieson Wellness, Fertility Nutraceuticals LLC (Ovaterra), Coast Science, OLLY Nutrition, Fertility Nutraceuticals LLC, Nutrafol, InnovaMed Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Fertility Supplements MarketPublished date: July 2024add_shopping_cartBuy Now get_appDownload Sample

Fertility Supplements MarketPublished date: July 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Vitabiotics Ltd

- Fairhaven Health

- Exeltis USA Inc.

- Zenith Nutrition

- Bionova

- Theralogix

- Eu Natural

- LENUS Pharma GesmbH

- Active Bio Life Science GmbH

- Orthomol Pharmazeutische Vertriebs GmbH

- NutraBlast

- Nestlé

- Jamieson Wellness

- Fertility Nutraceuticals LLC (Ovaterra)

- Coast Science

- OLLY Nutrition

- Fertility Nutraceuticals LLC

- Nutrafol

- InnovaMed Ltd.