US Funeral Homes Market Size, Share, Growth Analysis By Service (Traditional Funeral Service, Cremation Services, Green/Environmental Funerals, Pre-planned/Pre-paid Funeral Services), By Payment Model (At-need Funeral Services, Pre-paid Funeral Plans), By Distribution Channel (Offline, Online), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: April 2025

- Report ID: 145474

- Number of Pages: 213

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

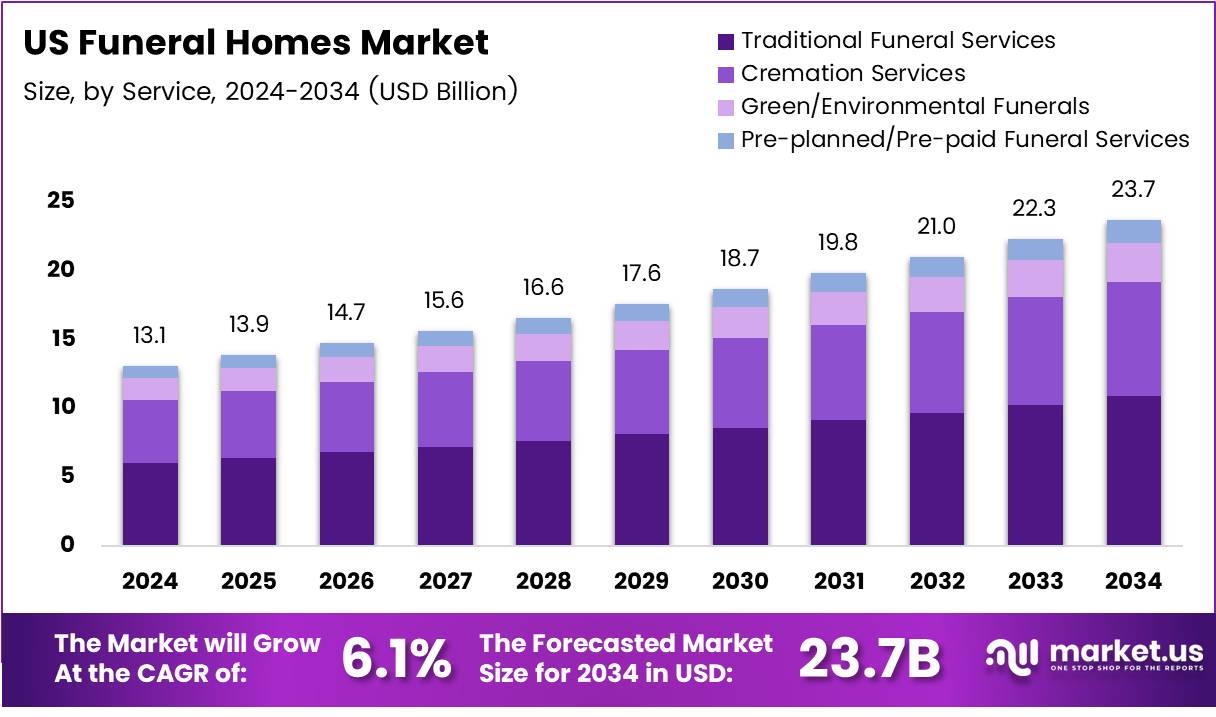

The US Funeral Homes Market size is expected to be worth around USD 23.7 Billion by 2034, from USD 13.1 Billion in 2024, growing at a CAGR of 6.1% during the forecast period from 2025 to 2034.

The US funeral homes market is an essential part of the country’s broader deathcare services industry, providing a range of services such as funeral planning, embalming, cremation, burial, and memorial services. According to the CDC, approximately 3.1 million deaths were recorded in the U.S. in 2023, which directly impacts the demand for funeral services.

Additionally, the average cost of a funeral with burial in the U.S. is reported to be around $7,848, according to carewgarcia. As the population ages and death rates increase, the demand for funeral services is expected to grow.

The market is also witnessing a shift in consumer preferences, with more individuals opting for cremation services, contributing to the evolution of the funeral services landscape.

The funeral homes market in the U.S. presents significant growth opportunities driven by several factors. The increasing number of deaths, with 3.1 million deaths in 2023 according to CDC, is a key driver, alongside changing consumer preferences, such as a rise in cremation rates.

Another opportunity lies in the growing number of women entering the funeral service profession, with 77% of the 7,000 students in funeral service education programs in 2022 being women, according to usatoday. This shift in the workforce could lead to new innovations and approaches in service delivery. On the regulatory side, government regulations, such as mandatory licensing and standards for funeral homes, ensure ethical practices and consumer protection.

In terms of investment, the U.S. government’s focus on healthcare and eldercare could indirectly impact the funeral homes market, as the aging population demands greater death care services. The market’s growth is also supported by evolving consumer preferences for sustainable practices, driving opportunities for eco-friendly funeral options.

Key Takeaways

- The US Funeral Homes Market is projected to reach USD 23.7 billion by 2034, growing at a 6.1% CAGR from 2025 to 2034.

- Traditional Funeral Services dominate the market, with a 45.8% share in 2024.

- At-need Funeral Services lead the market in 2024, driven by immediate consumer needs and flexible payment options.

Service Analysis

Traditional Funeral Services Lead the US Funeral Homes Market with 45.8% Share in 2024

In 2024, Traditional Funeral Services held a dominant market position in the By Service Analysis segment of the US Funeral Homes Market, commanding a 45.8% share.

These services, which include embalming, casketed burials, and traditional funeral rituals, remain the most commonly chosen option for families seeking a conventional and formal farewell for their loved ones. The strong preference for these services is driven by cultural norms and long-standing traditions, positioning them as the most widely accepted funeral service option in the US.

In contrast, Cremation Services continue to gain popularity, holding a significant share of the market due to their lower costs, flexibility, and growing acceptance across diverse demographics. Green and Environmental Funerals are also emerging as an alternative, with an increasing focus on sustainability and eco-friendly burial practices.

Although still a niche segment, it is projected to grow as environmental awareness rises. Meanwhile, Pre-planned and Pre-paid Funeral Services are gaining traction as individuals seek to alleviate the financial burden on their families, providing a sense of control and peace of mind for the future. These shifts in consumer preferences are reshaping the funeral services landscape, indicating diversification in consumer choices.

Payment Model Analysis

At-Need Funeral Services Lead the US Funeral Homes Market Due to Immediate Demand and Flexibility

In 2024, At-need Funeral Services held a dominant market position in the By Payment Model Analysis segment of the US Funeral Homes Market, driven by its responsiveness to immediate consumer needs and flexible payment options.

At-need services are primarily used by families seeking funeral arrangements in response to the passing of a loved one, making them highly relevant to those who require fast and convenient solutions. This segment’s strong performance is supported by the emotional and urgent nature of the service, where families prioritize services that can be arranged promptly without the complexity of pre-planning.

On the other hand, Pre-paid Funeral Plans, though growing, account for a smaller portion of the market. These plans are more popular among individuals planning for their future, but their growth is slower compared to At-need services due to the longer commitment and financial planning involved.

However, with rising awareness and demographic trends toward aging populations, pre-paid plans are projected to gain momentum. Despite this, At-need Funeral Services remain the dominant force in the market due to the immediate nature of demand, with families preferring to settle funeral arrangements without the upfront commitment of a pre-paid plan.

Key Market Segments

By Service

- Traditional Funeral Service

- Cremation Services

- Green/Environmental Funerals

- Pre-planned/Pre-paid Funeral Services

By Payment Model

- At-need Funeral Services

- Pre-paid Funeral Plans

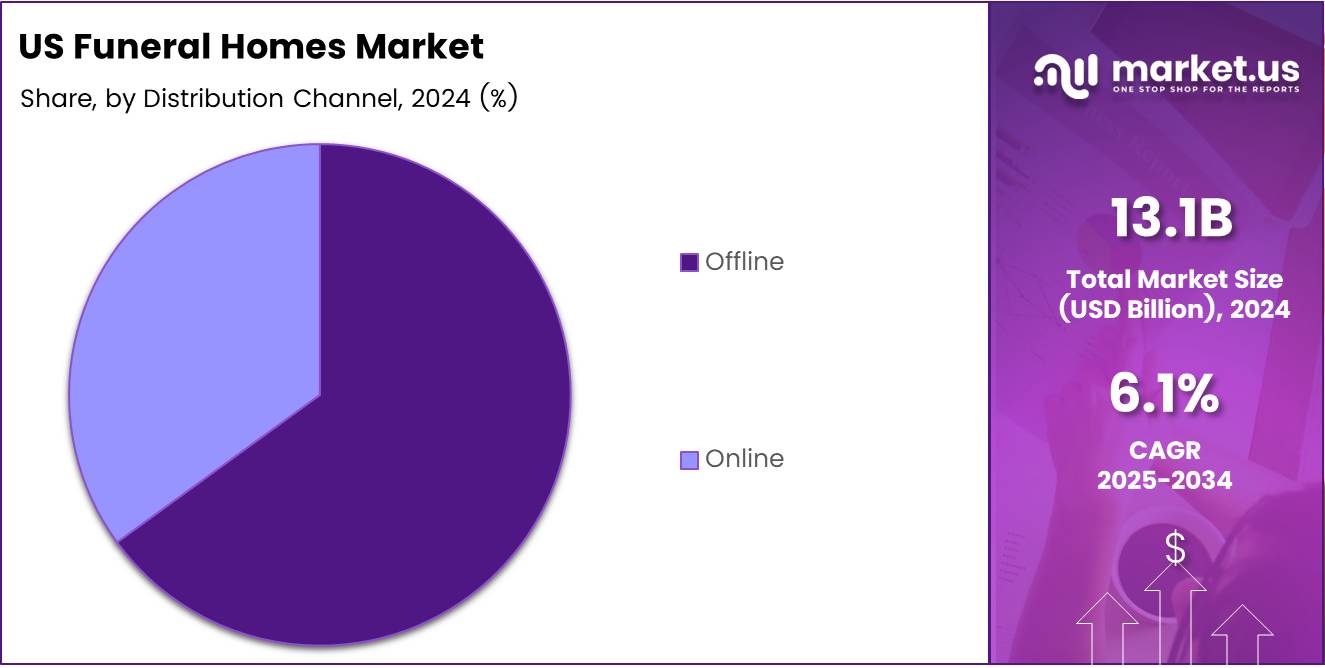

By Distribution Channel

- Offline

- Online

Drivers

Aging Population Drives Increased Demand for Funeral Services

The aging population in the United States is one of the key drivers behind the growing demand for funeral homes. As the elderly population continues to increase, there is a higher need for funeral and end-of-life services. This demographic shift has led to a greater requirement for funeral homes to provide services such as memorial planning, burial, cremation, and other end-of-life arrangements.

Additionally, the rise in pre-planning funeral services has become more common, as individuals look to ease the burden on their families by organizing funeral details in advance. This trend is not only providing funeral homes with a more stable client base, but it also helps ensure predictable revenue streams.

Furthermore, there has been a cultural shift toward celebrating life instead of focusing solely on mourning death, leading to an increase in memorial services that reflect the personality and accomplishments of the deceased. This shift has prompted funeral homes to offer more personalized, celebration-of-life services, catering to the evolving preferences of families. As a result, funeral homes are adapting to these changes by diversifying their offerings to meet the demands of the aging population and changing cultural expectations.

Restraints

Cultural Shifts Toward Cremation Pose Challenges for Traditional Funeral Homes

The growing popularity of cremation is creating significant challenges for funeral homes that primarily focus on burial services. As more people opt for cremation due to its lower cost, environmental considerations, and flexibility, traditional funeral homes are finding it difficult to adapt to changing consumer preferences.

Funeral homes that have built their businesses around burial services may struggle to attract and retain customers who are now looking for cremation services, which often come with fewer logistical requirements and lower overall expenses. This shift is especially evident in regions where cremation rates have rapidly increased, leaving traditional funeral providers at a disadvantage unless they diversify their service offerings.

Additionally, funeral homes that do not evolve to meet this trend may face declining market share, as families are more likely to choose providers that cater to their modern needs. For many funeral homes, transitioning to offer both cremation and burial services requires significant investment in new equipment, staff training, and marketing to shift public perception and accommodate the growing demand for cremation-related services. This cultural shift is reshaping the competitive landscape of the funeral services market and pushing businesses to rethink their strategies.

Growth Factors

Growing Demand for Green Funerals and Eco-Friendly Services Drives Market Growth

The US funeral homes market is experiencing an exciting shift toward sustainability and eco-conscious practices. More families are seeking environmentally friendly funeral options, such as biodegradable caskets and green burial alternatives, as awareness of environmental issues rises. Funeral homes that offer these green services can appeal to this growing demographic, attracting clients who prefer a more natural and low-impact approach to end-of-life services.

Moreover, the expansion of online and remote services presents a huge growth opportunity for funeral homes. Offering virtual funeral services, such as live-streamed memorials or online condolence platforms, allows funeral homes to reach a broader audience, including those who cannot attend in person.

Additionally, partnerships with health and hospice care providers are a valuable avenue for growth. By collaborating with these organizations, funeral homes can offer integrated services, helping families navigate the end-of-life process more smoothly.

This strategic collaboration can enhance the overall client experience, creating a seamless transition from healthcare to funeral services, thus positioning funeral homes as trusted, one-stop providers for families during difficult times.

Emerging Trends

Personalized Memorial Services Gain Popularity in US Funeral Homes Market

The US funeral homes market is witnessing significant shifts, driven by evolving consumer preferences. One of the key trends is the growing demand for personalized memorial services, where families seek to create ceremonies that reflect the individuality of their loved ones. This includes custom music, unique themes, and even the option to design memorial items like caskets or urns.

Alongside this, technology is reshaping how funeral services are offered. Digital memorials, virtual funerals, and 3D-printed urns are becoming increasingly common, making it easier for families to honor their loved ones in innovative ways.

Moreover, cremation continues to outpace traditional burial, with many funeral homes offering alternatives like water cremation and biodegradable urns, aligning with environmentally conscious choices. As these trends gain traction, funeral homes are adapting to meet consumer demands for more meaningful and tech-savvy services.

Key Players Analysis

The global U.S. funeral homes market in 2024 is shaped by several influential key players, each with distinct strategic approaches to maintaining and expanding their market presence. Service Corporation International (SCI) stands out as the largest funeral service provider in the U.S., benefiting from its expansive network of funeral homes and cemeteries. Its emphasis on acquisitions and vertical integration positions it as a dominant force in the industry, focusing on both traditional and cremation services.

Dignity Memorial, part of SCI, also plays a significant role, leveraging a strong brand reputation for premium funeral services and innovative pre-planning solutions. Their focus on customer experience and strategic partnerships further strengthens their market foothold.

Wilbert Funeral Services and Neptune Society are crucial players in the cremation and memorial space. Wilbert’s leadership in burial vault manufacturing complements its funeral home operations, while Neptune Society capitalizes on the growing trend of cremation services, positioning itself as a low-cost yet high-quality alternative to traditional burial.

StoneMor and Everstory Partners are expanding rapidly through both organic growth and acquisitions, appealing to diverse consumer preferences by offering personalized and affordable funeral services. Similarly, Carriage Services continues to grow its market share through a combination of acquisitions and the expansion of its service offerings, focusing heavily on customer-centric services.

Foundation Partners Group and Sollon Funeral and Cremation Services Ltd. demonstrate a niche focus, with Foundation Partners investing in innovative funeral solutions and Sollon emphasizing personalized, local services. These players are poised for growth as consumer preferences continue to evolve toward more customized and cost-effective funeral options.

The competitive landscape remains dynamic, with a growing shift toward cremation services, innovative pre-planning, and the increasing importance of customer experience.

Top Key Players in the Market

- Wilbert Funeral Services

- NorthStar Memorial Group

- Foundation Partners Group, LLC

- Carriage Services, Inc.

- Dignity Memorial

- StoneMor

- Everstory Partners

- Sollon Funeral and Cremation Services Ltd.

- Neptune Society

- Service Corporation International

Recent Developments

- In April 2024, Milestone Funeral Partners was acquired by Rosewood Private Investments, marking a strategic move to strengthen Rosewood’s position in the funeral services sector.

- In September 2024, Aura Life, a provider of funeral services and plan sales, secured a £350,000 equity investment from the Coast to Capital Growth Fund, managed by The FSE Group, to support its growth and development.

- In June 2024, Alpha Club Musashino launched a Corporate Venture Capital (CVC) initiative aimed at seeking innovative opportunities in the funeraltech space to drive technological advancement in the funeral services industry.

Report Scope

Report Features Description Market Value (2024) USD 13.1 Billion Forecast Revenue (2034) USD 23.7 Billion CAGR (2025-2034) 6.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Service (Traditional Funeral Service, Cremation Services, Green/Environmental Funerals, Pre-planned/Pre-paid Funeral Services), By Payment Model (At-need Funeral Services, Pre-paid Funeral Plans), By Distribution Channel (Offline, Online) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Wilbert Funeral Services, NorthStar Memorial Group, Foundation Partners Group, LLC, Carriage Services, Inc., Dignity Memorial, StoneMor, Everstory Partners, Sollon Funeral and Cremation Services Ltd., Neptune Society, Service Corporation International Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Wilbert Funeral Services

- NorthStar Memorial Group

- Foundation Partners Group, LLC

- Carriage Services, Inc.

- Dignity Memorial

- StoneMor

- Everstory Partners

- Sollon Funeral and Cremation Services Ltd.

- Neptune Society

- Service Corporation International