Global Female Stress Urinary Incontinence Treatment Device Market By Product Type (Mid-Urethral Slings, Vaginal Pessaries, Urethral Bulking Agents, Urethral Seal Pads and Others), By Procedure Type (Surgical and Non-Surgical), By End-User (Hospitals and Surgical Centres, Gynaecology Clinics, Specialty Centers and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Jan 2026

- Report ID: 173472

- Number of Pages: 287

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

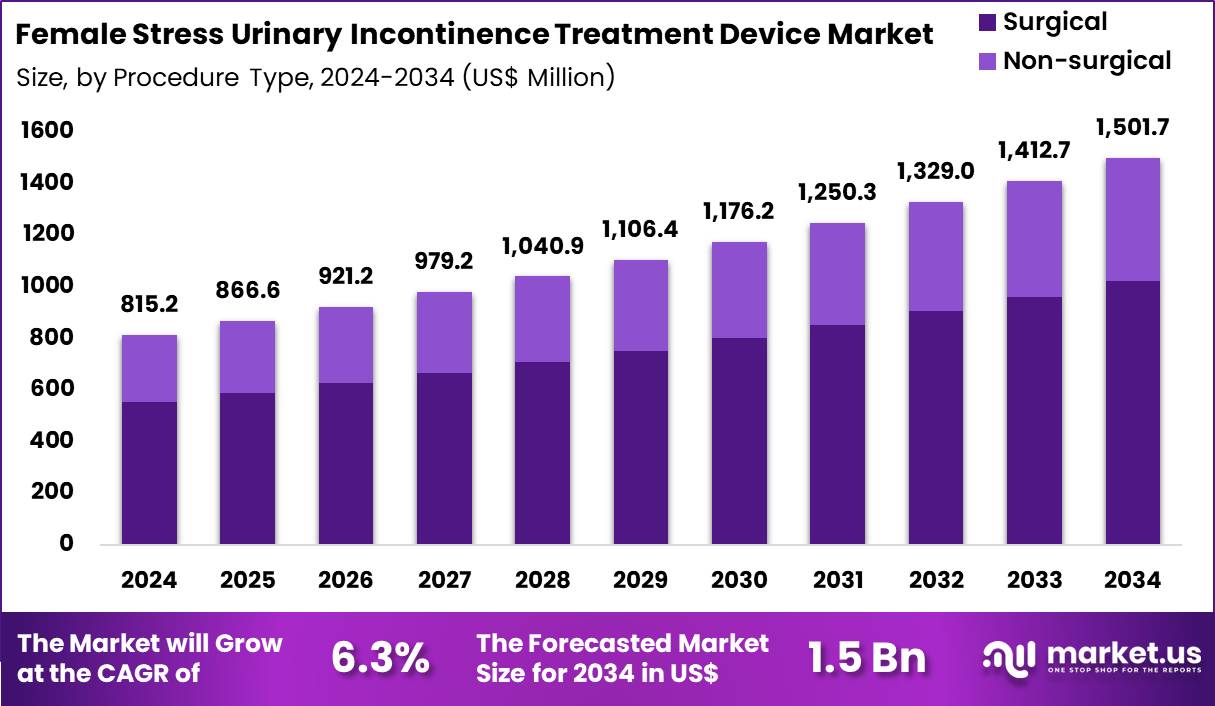

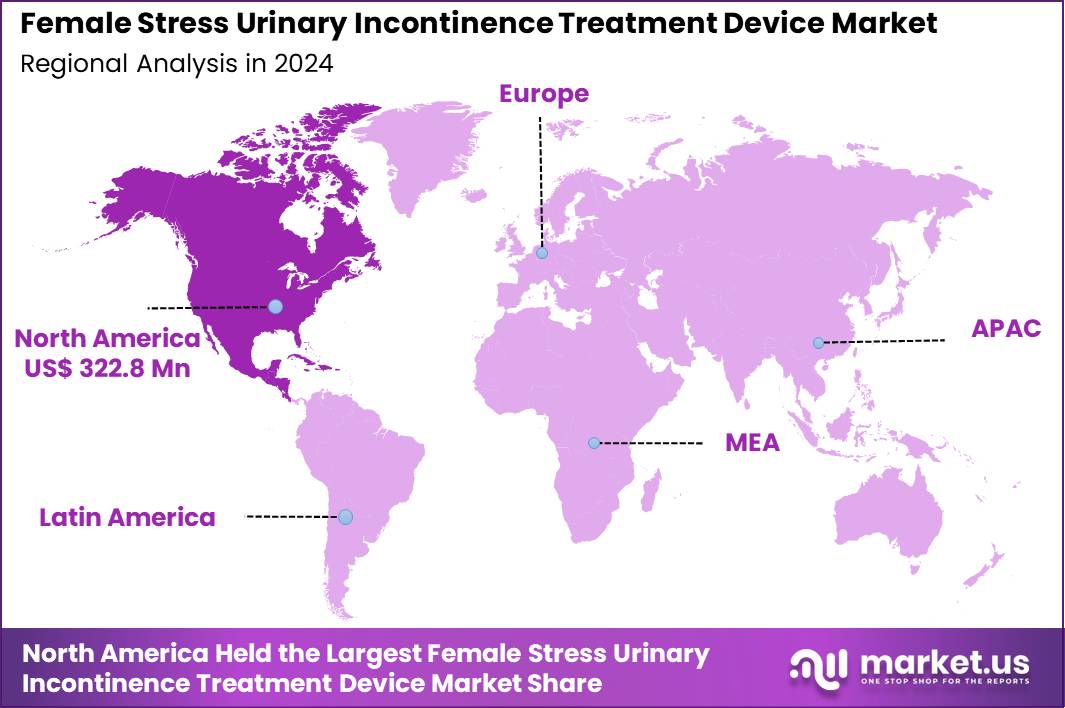

The Global Female Stress Urinary Incontinence Treatment Device Market size is expected to be worth around US$ 1501.7 Million by 2034 from US$ 815.2 Million in 2024, growing at a CAGR of 6.3% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 39.6% share with a revenue of US$ 322.8 Million.

Increasing prevalence of pelvic floor disorders among women propels demand for specialized treatment devices that address stress urinary incontinence through minimally invasive mechanisms. Urogynecologists increasingly recommend mid-urethral slings to support the urethra during activities that elevate intra-abdominal pressure, effectively preventing leakage in cases of urethral hypermobility. These devices support injectable bulking agents that enhance urethral closure by increasing tissue volume, offering relief for mild to moderate stress incontinence.

Clinicians utilize neuromodulation systems to stimulate sacral or tibial nerves, modulating bladder control signals for patients experiencing mixed or refractory symptoms. These treatments facilitate vaginal inserts and pessaries that provide mechanical support to the bladder neck, aiding continence during daily physical exertion.

In September 2025, Medtronic secured regulatory authorization in the United States for Altaviva, a minimally invasive neuromodulation system developed to address urinary incontinence. The therapy offers patients a non-pharmacological option that avoids major surgery, supporting symptom control with shorter recovery periods and reduced procedural burden compared with conventional surgical approaches.

Manufacturers pursue opportunities to develop patient-activated neuromodulation devices that empower individuals to adjust therapy parameters, broadening applications in long-term management of stress urinary incontinence. Developers engineer adjustable sling systems that allow intraoperative fine-tuning, improving outcomes in complex cases involving prior pelvic surgery. These innovations expand utility in postpartum rehabilitation, where devices assist recovery from pregnancy-related pelvic floor weakening.

Opportunities arise in combining bulking agents with regenerative biomaterials, targeting durable urethral reinforcement for women with intrinsic sphincter deficiency. Companies advance non-absorbable and bioresorbable options that minimize complications while maintaining efficacy in recurrent incontinence scenarios. Firms invest in ergonomic vaginal supports for daily use, facilitating active lifestyles among women with moderate stress symptoms.

Industry leaders refine implantable tibial neuromodulation technologies that deliver consistent nerve stimulation, reducing the need for frequent office visits in stress urinary incontinence care. Developers incorporate wireless programming features into devices, enabling remote adjustments for personalized symptom control.

Market participants prioritize minimally invasive delivery tools that shorten procedure times and enhance precision in sling placements. Innovators explore hybrid approaches combining pelvic floor stimulation with supportive inserts, addressing multifaceted incontinence presentations.

Companies emphasize biocompatibility advancements to lower erosion risks in long-term device applications. Ongoing refinements focus on integrated monitoring capabilities that track continence improvements, guiding evidence-based progression in female stress urinary incontinence treatment protocols.

Key Takeaways

- In 2024, the market generated a revenue of US$ 815.2 Million, with a CAGR of 6.3%, and is expected to reach US$ 1501.7 Million by the year 2034.

- The product type segment is divided into mid-urethral slings, vaginal pessaries, urethral bulking agents, urethral seal pads and others, with mid-urethral slings taking the lead in 2024 with a market share of 44.7%.

- Considering procedure type, the market is divided into surgical and non-surgical. Among these, surgical held a significant share of 68.1%.

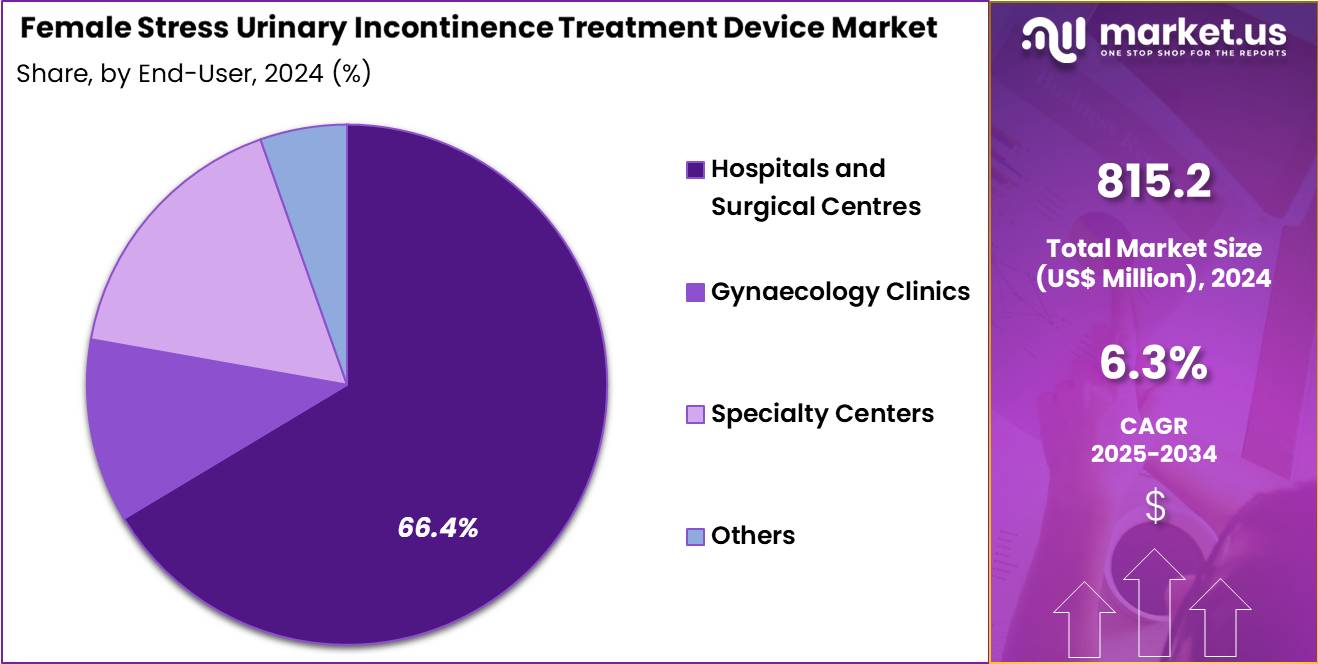

- Furthermore, concerning the end-user segment, the market is segregated into hospitals and surgical centres, gynaecology clinics, specialty centers and others. The hospitals and surgical centres sector stands out as the dominant player, holding the largest revenue share of 66.4% in the market.

- North America led the market by securing a market share of 39.6% in 2024.

Product Type Analysis

Mid-urethral slings accounted for 44.7% of the female stress urinary incontinence treatment device market, reflecting their strong clinical effectiveness and long-term success rates. Gynecologists and urologists widely adopt these devices due to durable symptom relief and high patient satisfaction. Sling procedures provide reliable urethral support, which directly addresses the underlying cause of stress incontinence.

Growing prevalence of childbirth-related pelvic floor weakness increases demand for definitive treatment options. Advancements in sling materials improve biocompatibility and reduce complication rates. Shorter recovery times compared to traditional surgeries support wider acceptance.

Strong clinical evidence reinforces physician confidence in recommending slings. Favorable outcomes reduce repeat intervention rates, strengthening adoption. Training familiarity among surgeons accelerates procedural volume growth. This segment is projected to expand steadily due to proven efficacy and standardized surgical practice.

Procedure Type Analysis

Surgical procedures represented 68.1% of the female stress urinary incontinence treatment device market, driven by demand for long-lasting and definitive symptom resolution. Patients with moderate to severe incontinence increasingly prefer surgical intervention after conservative therapies fail.

Surgical approaches deliver higher continence rates compared to non-surgical alternatives. Rising awareness of treatment availability encourages earlier clinical consultation. Improvements in minimally invasive surgical techniques enhance safety and recovery outcomes. Standardized procedural guidelines support consistent adoption across care settings.

Surgeon expertise continues to improve through specialized training programs. Healthcare systems prioritize interventions that reduce long-term management costs. High procedural success strengthens patient and clinician confidence. This segment is anticipated to maintain dominance due to durable outcomes and established clinical protocols.

End-User Analysis

Hospitals and surgical centres held 66.4% of the female stress urinary incontinence treatment device market, reflecting their role as primary providers of surgical care. These facilities manage high volumes of gynecological and urological procedures requiring specialized infrastructure. Access to operating theatres and trained surgical teams supports procedural efficiency. Hospitals integrate diagnostic evaluation, treatment, and postoperative care within a single setting.

Institutional protocols emphasize evidence-based surgical management of incontinence. Reimbursement structures often favor hospital-based procedures, improving patient access. Surgical centres focus on minimally invasive approaches that enhance throughput. Centralized procurement ensures availability of approved devices. Patient preference for comprehensive care supports utilization. Consequently, this end-user segment is expected to remain dominant due to procedural concentration and clinical capability.

Key Market Segments

By Product Type

- Mid-urethral slings

- Vaginal Pessaries

- Urethral bulking agents

- Urethral seal pads

- Others

By Procedure Type

- Surgical

- Non-surgical

By End-User

- Hospitals and Surgical Centres

- Gynaecology Clinics

- Specialty Centers

- Others

Drivers

Rising prevalence of female stress urinary incontinence is driving the market

The female stress urinary incontinence treatment device market is significantly driven by the rising prevalence of the condition, which necessitates advanced devices for effective management and improved quality of life. Healthcare providers increasingly recommend treatment devices to address symptoms in affected women, supporting early intervention and long-term care.

Regulatory bodies emphasize the need for reliable devices to handle the growing patient population experiencing involuntary urine leakage during physical activities. Pharmaceutical and device companies invest in innovations to meet the demands of this expanding demographic, focusing on user-friendly solutions. Clinical guidelines advocate for device use in conservative management, contributing to market expansion. Global health organizations track prevalence trends to inform policy on device accessibility.

Academic research on etiology highlights the role of aging and childbirth in prevalence increases, driving demand for tailored devices. Patient awareness campaigns promote seeking treatment, boosting utilization of sling systems and pessaries. Economic impacts from untreated incontinence further justify investment in device technologies. According to a 2023 study published by the National Institutes of Health, the prevalence of stress urinary incontinence among women ranges from 10% to 40%, with higher rates in postmenopausal groups.

Restraints

High costs and limited reimbursement are restraining the market

The female stress urinary incontinence treatment device market is restrained by high costs and limited reimbursement, which limit access for many patients requiring surgical or implantable solutions. Manufacturers face challenges in pricing devices like urethral slings, as production and materials expenses elevate overall costs. Healthcare systems in certain regions struggle with budget constraints, deterring widespread adoption of premium devices.

Regulatory requirements for safety testing add to financial burdens, slowing innovation cycles. Clinical practices may opt for conservative therapies over devices due to reimbursement inconsistencies. Global disparities in insurance coverage exacerbate market limitations in low-income areas. Academic analyses highlight the impact of cost on treatment disparities among socioeconomic groups.

Patient decisions are influenced by out-of-pocket expenses, reducing device utilization. Economic models project slower growth without reimbursement reforms. These factors collectively hinder market penetration and scalability for treatment devices.

Opportunities

Increasing FDA approvals for innovative devices is creating growth opportunities

The female stress urinary incontinence treatment device market offers growth opportunities through increasing FDA approvals for innovative devices, which expand treatment options and attract investment in R&D. Developers can introduce advanced sling systems and bulking agents with enhanced safety profiles, targeting unmet needs in minimally invasive care.

Regulatory pathways facilitate faster market entry for devices demonstrating improved efficacy in clinical trials. Healthcare providers gain tools for personalized treatments, improving outcomes in diverse patient cohorts. Pharmaceutical partnerships focus on combining devices with pharmacotherapy for comprehensive solutions.

Clinical research explores device applications in combination with physical therapy for better results. Global adoption in emerging markets aligns with approvals promoting equitable access to care. Academic collaborations refine device designs to address specific demographic needs. Patient care advances with devices enabling shorter recovery times and reduced complications. The U.S. Food and Drug Administration cleared the Pelvital Stress Urinary Incontinence Training Device in 2024, providing a non-invasive option for treatment

Impact of Macroeconomic / Geopolitical Factors

Robust economic expansions worldwide direct substantial funds toward women’s health initiatives, accelerating adoption of female stress urinary incontinence treatment devices in mature markets. Businesses exploit advancements in minimally invasive technologies to meet surging needs from aging female demographics. However, unrelenting global inflation amplifies expenses for device components, compelling providers to adjust budgets in resource-limited areas.

Escalating geopolitical conflicts in key trade corridors hinder timely access to specialized materials, straining production timelines for global operators. Managers address these issues through strategic inventory stockpiling and alternative vendor explorations, which enhances adaptability and reduces dependency risks.

Existing US tariffs, charging 25-60% on medical imports from nations like China, heighten procurement expenditures for overseas-sourced incontinence solutions. American companies leverage this environment to expand in-house fabrication, promoting innovation hubs and economic multipliers locally. Progressive strides in bio-compatible implants continually energize the industry, forecasting resilient progress and improved patient outcomes globally.

Latest Trends

Development of smart implantable devices is a recent trend

In 2025, the female stress urinary incontinence treatment device market has shown a prominent trend toward the development of smart implantable devices, which offer adjustable and automated control for better symptom management. Manufacturers are focusing on electromechanical artificial urinary sphincters to provide dynamic support tailored to patient needs.

Healthcare professionals are incorporating these devices into surgical options for severe cases, improving long-term efficacy. Regulatory evaluations are adapting to validate smart features for clinical use. Clinical trials are assessing implant performance in female patients, demonstrating feasibility for widespread adoption.

Academic studies are exploring integration with digital monitoring for real-time adjustments. Global collaborations are advancing implant technologies to address diverse anatomical variations. Patient feedback is guiding designs to minimize discomfort and enhance usability. Ethical protocols are ensuring safe deployment in vulnerable populations. The UroActive smart implant by UroMems completed its first-ever female clinical feasibility study in 2025, marking a key milestone in smart device innovation.

Regional Analysis

North America is leading the Female Stress Urinary Incontinence Treatment Device Market

In 2024, North America held a 39.6% share of the global female stress urinary incontinence treatment device market, fueled by heightened awareness of pelvic health issues and advancements in minimally invasive solutions that offer improved efficacy and patient comfort for women experiencing leakage during physical activities. Gynecologists and urologists expanded adoption of urethral slings and bulking agents to address post-childbirth and menopausal symptoms, supported by reimbursement policies that encouraged outpatient procedures amid rising healthcare access.

Innovations in bioabsorbable materials and adjustable tension systems reduced complication rates, aligning with clinical guidelines prioritizing durable, low-risk interventions for active lifestyles. Demographic trends toward delayed motherhood amplified procedural volumes for corrective devices, while educational campaigns empowered patients to seek early treatments for quality-of-life improvements. Hospital networks integrated these tools into multidisciplinary continence clinics, optimizing recovery times for surgical and non-surgical options.

Collaborative research validated long-term outcomes for injectable therapies, bridging gaps in underserved communities. Supply enhancements ensured sterile, user-friendly kits compliant with safety norms in high-demand settings. A 2022 study in Female Pelvic Medicine & Reconstructive Surgery reported that stress urinary incontinence was the most common type, affecting 31.9% of adult U.S. women.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Healthcare authorities foresee notable escalation in female stress urinary incontinence treatment device deployment across Asia Pacific throughout the forecast period, driven by urbanization-induced lifestyle changes that exacerbate pelvic floor weaknesses among working women. Specialists incorporate mid-urethral slings into routine care protocols, tailoring approaches to postpartum recovery in high-fertility nations.

Governments subsidize bulking agent programs for public hospitals, enabling affordable access amid economic disparities. Biotech innovators customize adjustable implants with enhanced biocompatibility, optimizing outcomes for menopausal cohorts in humid climates. Regional task forces conduct efficacy trials on injectable therapies through multicenter collaborations, fostering standardized practices for diverse ethnic groups.

Pharmaceutical partnerships promote non-surgical options with minimal downtime, addressing adherence barriers in rural settings. Community health drives educate on preventive exercises alongside device usage, extending reach to underserved provinces. A 2024 study in the International Journal of Environmental Research and Public Health documented that the overall rate of female stress urinary incontinence in mainland China stood at 24.5%.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the Female Stress Urinary Incontinence Treatment Device market drive growth by developing minimally invasive and patient-friendly devices that improve continence outcomes while reducing recovery time and procedural complexity. Companies expand adoption by working closely with urogynecologists and pelvic floor specialists to integrate device-based therapies into standardized treatment algorithms.

Commercial strategies emphasize clinician training, evidence-backed performance data, and reimbursement alignment to increase confidence in device-based interventions over surgical options. Innovation priorities focus on adjustable designs, biocompatible materials, and improved durability that support long-term symptom control and patient comfort.

Market expansion targets regions with rising awareness of women’s pelvic health and increasing access to outpatient urogynecology services. Boston Scientific represents a leading participant by leveraging its strong pelvic health portfolio, global clinical presence, and continuous device innovation to support effective and scalable solutions for female stress urinary incontinence management.

Top Key Players

- Boston Scientific Corporation

- Coloplast A/S

- Johnson & Johnson (Ethicon)

- CooperSurgical Inc.

- MedGyn Products, Inc.

- Becton, Dickinson and Company (BD)

- Milex Products, Inc.

- Cousin Biotech

- FEG Textiltechnik mbH

- Bioteque America, Inc.

- Caldera Medical

- Canada Pessary Inc.

- Betatech Medical

- Advin Health Care

- C.R. Bard

Recent Developments

- In January 2024, Boston Scientific Corporation completed the acquisition of Axonics, Inc., strengthening its position in neuromodulation-based bladder therapies. The transaction expanded Boston Scientific’s offerings in minimally invasive sacral neuromodulation, supporting treatment of overactive bladder and related chronic conditions while reinforcing long-term growth in device-based urology solutions.

- In September 2023, Caldera Medical, Inc. finalized the acquisition of Atlantic Therapeutics, adding the FDA-cleared Innovo system to its women’s health portfolio. The integration broadened Caldera’s capabilities in non-invasive treatment options for female stress urinary incontinence, enabling the company to address patient demand for conservative, device-driven alternatives to surgical intervention.

Report Scope

Report Features Description Market Value (2024) US$ 815.2 Million Forecast Revenue (2034) US$ 1501.7 Million CAGR (2025-2034) 6.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Mid-Urethral Slings, Vaginal Pessaries, Urethral Bulking Agents, Urethral Seal Pads and Others), By Procedure Type (Surgical and Non-Surgical), By End-User (Hospitals and Surgical Centres, Gynaecology Clinics, Specialty Centers and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Boston Scientific Corporation, Coloplast A/S, Johnson & Johnson, CooperSurgical Inc., MedGyn Products, Inc., BD, Milex Products, Inc., Cousin Biotech, FEG Textiltechnik mbH, Bioteque America, Inc., Caldera Medical, Canada Pessary Inc., Betatech Medical, Advin Health Care, C.R. Bard Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Female Stress Urinary Incontinence Treatment Device MarketPublished date: Jan 2026add_shopping_cartBuy Now get_appDownload Sample

Female Stress Urinary Incontinence Treatment Device MarketPublished date: Jan 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Boston Scientific Corporation

- Coloplast A/S

- Johnson & Johnson (Ethicon)

- CooperSurgical Inc.

- MedGyn Products, Inc.

- Becton, Dickinson and Company (BD)

- Milex Products, Inc.

- Cousin Biotech

- FEG Textiltechnik mbH

- Bioteque America, Inc.

- Caldera Medical

- Canada Pessary Inc.

- Betatech Medical

- Advin Health Care

- C.R. Bard