Global Fast Fashion Market Size, Share, Growth Analysis By Product Type (Apparel, Footwear, Accessories), By Consumer Demographics (Men, Women, Children), By Price Range, By Distribution Channel, By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2024-2033

- Published date: Dec 2024

- Report ID: 136209

- Number of Pages: 298

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Business Environment Analysis

- Product Type Analysis

- Consumer Demographics Analysis

- Price Range Analysis

- Distribution Channel Analysis

- Key Market Segments

- Driving Factors

- Restraining Factors

- Growth Opportunities

- Emerging Trends

- Regional Analysis

- Competitive Landscape

- Recent Developments

- Report Scope

Report Overview

The Global Fast Fashion Market size is expected to be worth around USD 254.1 Billion by 2033, from USD 61.2 Billion in 2023, growing at a CAGR of 15.3% during the forecast period from 2024 to 2033.

Fast fashion is a retail strategy focused on quickly producing high volumes of trendy and affordable clothing to meet the latest consumer demands. It emphasizes rapid turnaround from design to store shelves, allowing consumers to purchase current fashion styles at lower prices, often leading to frequent wardrobe updates.

The Fast Fashion Market includes companies and retailers that specialize in the rapid production and distribution of inexpensive, fashionable apparel. This market caters to consumers seeking the latest trends at affordable prices, leveraging efficient supply chains and frequent inventory refreshes to maintain competitiveness and meet high consumer demand.

The fast fashion market is rapidly evolving, with a production of approximately 100 billion garments annually. This high output is driven by consumer demand but is met with challenges such as market saturation and intense competition. Furthermore, there is a noticeable impact on a broader scale, affecting both global supply chains and environmental sustainability.

Moreover, consumer behavior highlights significant trends in the industry. According to Earth.org, clothing is now worn only 7 to 10 times before disposal, a reduction of over 35% in the last 15 years. Similarly, while 94% of Generation Z supports sustainable clothing, a significant portion still frequents fast fashion outlets, with 17% shopping weekly and 62% monthly.

Additionally, the demographic data points out that young women are pivotal consumers of fast fashion, buying 50 to 60 items annually, yet approximately 14% of these purchases remain unworn. In contrast, in March 2022, the European Union’s introduction of the Ecodesign for Sustainable Products Regulation (ESPR) aims to increase product sustainability.

It promotes the production of single-fiber garments to aid in recycling efforts. This regulation represents a significant step towards integrating sustainability within the fast fashion industry, fostering a move towards more environmentally friendly practices.

Key Takeaways

- The Fast Fashion Market was valued at USD 61.2 Billion in 2023 and is expected to reach USD 254.1 Billion by 2033, with a CAGR of 15.3%.

- In 2023, Apparel dominates the Product Type segment with 53.4%, reflecting the high demand for affordable clothing options.

- In 2023, Women lead the Consumer Demographics segment with 64.8%, showcasing their preference for trendy and affordable fashion.

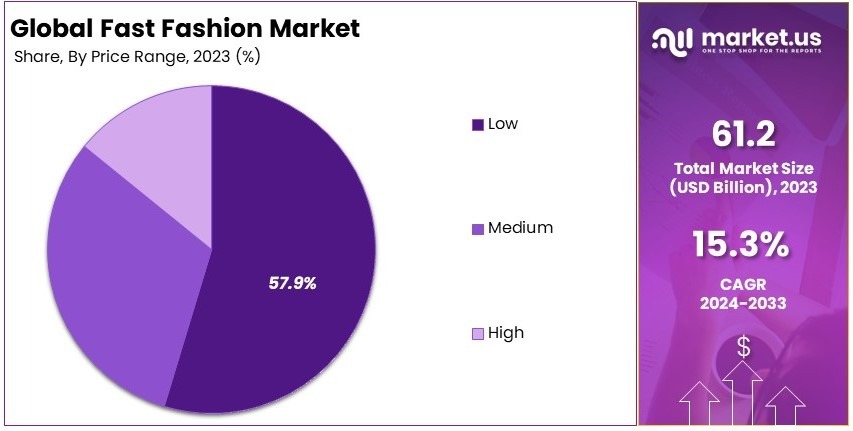

- In 2023, Low-priced items dominate the Price Range with 57.9%, underlining the affordability factor of fast fashion.

- In 2023, Online Sales account for 68.2% of the Distribution Channel, driven by the convenience of online shopping.

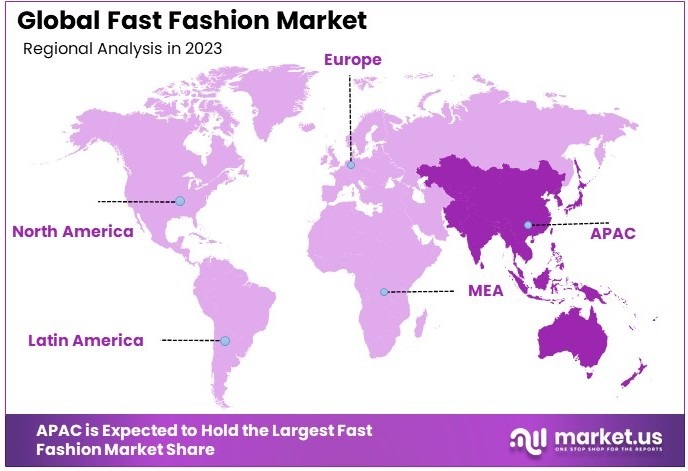

- In 2023, Asia Pacific remains the dominant region, attributed to its robust manufacturing infrastructure and growing consumer base.

Business Environment Analysis

The fast fashion market is reaching a high level of market saturation, with major players continuously expanding their reach. Shein’s strategic re-entry into the Indian market through a partnership with Reliance Retail, as reported in July 2024, exemplifies efforts to capture new consumer bases and enhance market share.

Target demographics for fast fashion primarily include younger consumers who value quick, trendy, and cost-effective clothing options. Newme’s 90-minute delivery service, introduced in July 2024, caters specifically to Gen Z’s preference for instant gratification and could reshape consumer expectations in urban areas.

Product differentiation in fast fashion is increasingly focused on speed and sustainability. Shein’s establishment of a €200 million circularity fund, noted in July 2024, aims to blend rapid fashion cycles with eco-friendlier practices, highlighting efforts to mitigate environmental impacts while maintaining competitive edge.

The value chain in fast fashion is being optimized to support rapid production and distribution. Slikk’s recent $300,000 funding, secured in July 2024, is set to enhance logistics for quicker fashion delivery, demonstrating a shift towards more agile and responsive supply chain solutions.

Investment opportunities in the fast fashion sector are burgeoning, particularly in technologies that streamline operations and expand market reach. Newme’s $18 million Series A funding in July 2024 supports its omnichannel strategy, indicative of a trend where investors are keen on brands that effectively integrate online and offline sales channels.

Adjacent markets like e-commerce and sustainable fashion are becoming increasingly interconnected with fast fashion. Initiatives to incorporate sustainability, such as Shein’s circularity fund, suggest a blending of fast fashion with sustainable practices, aiming to appeal to a broader, more environmentally conscious consumer base.

Product Type Analysis

Apparel dominates with 53.4% due to high consumer demand and rapid turnover of styles.

The fast fashion market, segmented by product type, sees apparel as the leading category, commanding a market share of 53.4%. This dominance is driven by high consumer demand for trendy, affordable clothing that mirrors current fashion trends. Fast fashion brands excel in turning over new styles quickly, meeting consumer expectations for freshness and variety in their wardrobes.

Footwear plays a significant role in complementing the fast-changing apparel trends, with brands frequently updating their offerings to match new clothing lines.

Accessories, although smaller in contribution, are essential for completing fashion looks, offering consumers cost-effective ways to update their style without purchasing new outfits.

Consumer Demographics Analysis

Women lead with 64.8% due to their higher frequency of purchases and interest in fashion trends.

In consumer demographics, women represent the largest segment in the fast fashion market at 64.8%. This significant share is due to women’s higher engagement with fashion trends and greater frequency of purchase compared to men, driven by a wider variety of style options and seasonal changes in women’s fashion.

Men, while less engaged than women, still represent a substantial market segment, driven by growing interest in fashion and increased marketing focus from fast fashion brands.

Children’s fast fashion is increasingly significant, reflecting the rapid growth and frequent need for new clothing in this demographic as well as the trend towards more fashion-forward childrenswear.

Price Range Analysis

Low-priced items dominate with 57.9% due to the core appeal of fast fashion: affordability.

The price range segmentation in fast fashion is dominated by low-priced items, which hold a 57.9% market share. This dominance underscores the core appeal of fast fashion: providing trendy clothes at affordable prices. This pricing strategy is key to attracting and retaining a broad customer base that prioritizes budget over durability.

Medium-priced items cater to consumers looking for slightly better quality within the fast fashion market, offering a balance between cost and durability.

High-priced items, though less common in fast fashion, are occasionally offered to cater to a segment of consumers willing to pay more for premium designs or limited edition items.

Distribution Channel Analysis

Online sales lead with 68.2% due to the convenience of shopping from home and broader access to global trends.

Distribution channels in the fast fashion industry are led by online sales, which currently hold a 68.2% market share. This dominance is facilitated by the convenience of shopping apps from home and the increasing consumer preference for online purchases. Online platforms allow fast fashion brands to quickly showcase new trends and make them accessible to a global audience.

Offline channels remain vital, particularly for consumers who prefer the in-store shopping experience, allowing for immediate try-ons and the ability to assess fabric quality and fit before purchasing.

Key Market Segments

By Product Type

- Apparel

- Footwear

- Accessories

By Consumer Demographics

- Men

- Women

- Children

By Price Range

- Low

- Medium

- High

By Distribution Channel

- Online

- Offline

Driving Factors

Changing Trends and Pricing Drive Market Growth

Rapidly changing fashion trends are a major driver of the fast fashion market. Consumers are drawn to constantly evolving styles that allow them to keep up with the latest trends. Brands like Zara and H&M capitalize on this by delivering fresh collections in short intervals.

Affordable pricing strategies further fuel this growth. Low-cost production and competitive pricing make fast fashion accessible to a wider audience. For instance, brands like Forever 21 attract price-sensitive consumers by offering trendy designs at budget-friendly prices.

Growing online retail platforms provide another boost. E-commerce platforms, such as Shein and Boohoo, make shopping convenient and expand the market reach. Their digital-first approaches appeal to tech-savvy customers who prefer browsing and purchasing online.

Globalization and supply chain efficiency complete the picture. Optimized supply chains allow brands to produce and distribute products quickly and cost-effectively. The use of global networks helps ensure a consistent supply of the latest designs.

Restraining Factors

Environmental Concerns Restrain Market Growth

Environmental and ethical concerns present significant challenges for the fast fashion market. The industry faces criticism for its contribution to waste and pollution. Brands like Primark and others often deal with backlash over textile waste and unsustainable practices.

Regulatory pressures are also increasing. Governments are introducing stricter policies to address environmental damage caused by the industry. For example, the European Union’s directives on textile recycling are pushing brands to adopt more sustainable practices.

Short product lifecycles add another layer of difficulty. The fast fashion model, built on frequent new collections, leads to inventory challenges and reduced profit margins. Products often become obsolete quickly, creating financial and logistical burdens.

Rising consumer preference for sustainable alternatives further restrains growth. Consumers are shifting toward eco-friendly options offered by brands like Everlane and PACT. This trend challenges traditional fast fashion players to rethink their strategies.

Growth Opportunities

Emerging Markets and Digital Innovations Provide Opportunities

Expansion into emerging markets offers significant opportunities for fast fashion. Regions such as Southeast Asia and Africa are experiencing rising disposable incomes and urbanization. Brands like Shein are tapping into these markets to broaden their consumer base.

Leveraging data analytics for predictive trends is another growth avenue. By analyzing consumer preferences, brands can better anticipate trends and align their collections. For example, ASOS uses data to enhance inventory planning and optimize product launches.

Advanced manufacturing technologies also create opportunities. Automation and 3D Printing Market help brands reduce production time and costs. These technologies allow faster responses to market demand, giving companies a competitive edge.

Collaborations with influencers and social media campaigns further amplify growth potential. Partnerships with figures on platforms like Instagram drive consumer engagement. For instance, Boohoo has successfully utilized influencer marketing to increase brand visibility and sales.

Emerging Trends

Digital Platforms and AI Are Latest Trending Factors

Digital platforms are reshaping the fast fashion market. The rise of digital-only collections by brands like PrettyLittleThing enables faster product launches without the need for physical inventory. This approach appeals to environmentally conscious consumers.

Mobile shopping apps have gained immense popularity. Apps like Shein’s mobile platform provide a seamless shopping experience, allowing users to browse and purchase effortlessly. Mobile-first strategies are essential for reaching younger, tech-savvy audiences.

Artificial intelligence (AI) is another significant trend. AI-driven personalization enhances the shopping experience by offering tailored recommendations. Brands like ASOS use AI tools to predict consumer preferences and improve engagement.

The adoption of buy-now-pay-later (BNPL) payment models is transforming purchasing behavior. Services like Klarna and Afterpay allow consumers to spread payments, making fast fashion more affordable and accessible. These models cater to budget-conscious shoppers.

Regional Analysis

Asia Pacific Dominates the Fast Fashion Market

Asia Pacific leads the Fast Fashion Market, driven by its expansive consumer base and rapid urbanization. The region’s dominance is supported by strong manufacturing capabilities and the quick adoption of trends that cater to a diverse, style-conscious population.

The area benefits from economies of scale in manufacturing, allowing for lower production costs and quicker turnaround times. Cultural trends towards frequent wardrobe updates also fuel demand in this sector.

Looking forward, the Asia Pacific region is expected to continue its dominance in the fast fashion industry. Increasing internet penetration and e-commerce growth will likely further boost consumer access and demand for fast fashion, reinforcing the region’s market leadership.

Regional Mentions:

- North America: North America’s fast fashion market is driven by a combination of aggressive marketing, a diverse consumer base, and a strong retail infrastructure, supporting steady growth.

- Europe: Europe’s market is marked by a balance of demand for fast fashion and growing consumer advocacy for sustainable practices, influencing both market dynamics and industry responses.

- Middle East & Africa: The Middle East and Africa are experiencing growing demand for fast fashion, supported by increasing urbanization and youth population, though the market is still developing.

- Latin America: Latin America is seeing an uptick in fast fashion consumption, spurred by economic improvements and the rising influence of Western fashion trends among its youthful demographics.

Key Regions and Countries Covered in the Report

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Competitive Landscape

In the Fast Fashion Market, Zara (Inditex), H&M, Shein, and Uniqlo (Fast Retailing) stand out as the top players, each with a distinctive approach to dominating the global market.

Zara excels through its sophisticated supply chain that allows for rapid production and turnover of new styles, reflecting current fashion trends directly from the runway to the stores. This agility ensures high customer footfall and sales volume, reinforcing Zara’s market position.

H&M focuses on offering a wide range of fashion-forward and affordable apparel, appealing to a broad demographic. Their global presence and strong brand recognition enable them to capture significant market share. H&M also invests in sustainability initiatives, aiming to improve the perception of fast fashion.

Shein has revolutionized the fast fashion industry with its ultra-fast manufacturing processes and online-only business model. It targets the younger demographic with trendy, low-cost apparel, leveraging powerful social media marketing strategies to engage customers and drive sales.

These key players are shaping the fast fashion industry by adapting quickly to fashion trends and consumer preferences, using advanced technologies and marketing strategies. Their ability to efficiently manage vast global supply chains allows them to meet and drive consumer demand effectively.

Major Companies in the Market

- Zara (Inditex)

- H&M

- Shein

- Uniqlo (Fast Retailing)

- Forever 21

- Boohoo

- Fashion Nova

- Primark

- Mango

- ASOS

- Topshop (ASOS)

- Missguided

- River Island

Recent Developments

- Shein and Forever 21: In August 2023, Shein, a leading online fast fashion retailer, entered into a joint venture with SPARC Group, the owner of Forever 21. This strategic partnership involves each company acquiring a minority stake in the other, aiming to expand their market reach and leverage combined strengths in the fast fashion sector.

- Gap Inc.: In November 2024, Gap Inc., the operator of Old Navy and Athleta, revised its sales outlook upward, now anticipating a 1.5% to 2% increase for the fiscal year, compared to the previous estimate of less than 1% growth. This adjustment reflects improved performance and strategic initiatives aimed at revitalizing the brand in a competitive retail environment.

Report Scope

Report Features Description Market Value (2023) USD 61.2 Billion Forecast Revenue (2033) USD 254.1 Billion CAGR (2024-2033) 15.3% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Apparel, Footwear, Accessories), By Consumer Demographics (Men, Women, Children), By Price Range (Low, Medium, High), By Distribution Channel (Online, Offline) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Zara (Inditex), H&M, Shein, Uniqlo (Fast Retailing), Forever 21, Boohoo, Fashion Nova, Primark, Mango, ASOS, Topshop (ASOS), Missguided, River Island Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Zara (Inditex)

- H&M

- Shein

- Uniqlo (Fast Retailing)

- Forever 21

- Boohoo

- Fashion Nova

- Primark

- Mango

- ASOS

- Topshop (ASOS)

- Missguided

- River Island