Global Face Wash Market By Product Form (Gel, Powder, Foam, Liquid, Collagen Based, Others), By Skin Type (Normal Skin, Dry Skin, Oily Skin, Acne-Prone, Sensitive Skin, Others), By Price Point (Economy, Medium, Premium), By End User (Women, Men, Others), By Distribution Channel (Supermarkets and Hypermarkets, Convenient Stores, Pharmacy and Drug Stores, Online Stores, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Jan 2025

- Report ID: 137382

- Number of Pages: 397

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

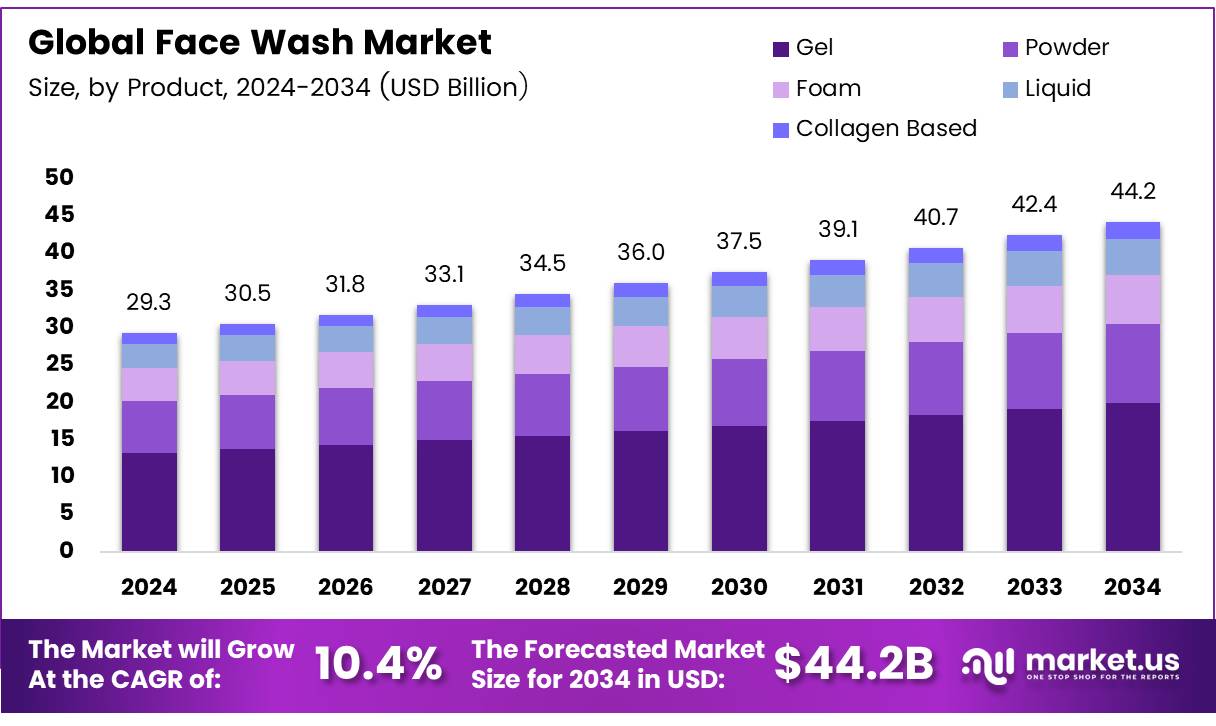

The Global Face Wash Market size is expected to be worth around USD 44.2 Billion by 2034, from USD 29.3 Billion in 2024, growing at a CAGR of 4.2% during the forecast period from 2025 to 2034.

Face wash, as a product, is designed specifically to cleanse the facial skin by removing dirt, oil, dead skin cells, and other pollutants that daily exposure can deposit on the skin. The face wash market, therefore, comprises the manufacturing, marketing, and sales of these cleansing products.

These products vary widely in formulation, catering to different skin types and consumer needs, such as moisturizing, oil control, and acne treatment. Innovations in this sector often reflect broader consumer trends, including the demand for organic and cruelty-free products.

The face wash market itself is a dynamic segment within the broader personal care industry, characterized by its rapid response to evolving dermatological science and consumer preferences. It encompasses a range of products includes that are sold through various channels such as pharmacies, supermarkets, and increasingly, e-commerce platforms.

The face wash market is poised for substantial growth, driven by increasing consumer awareness about skin health and hygiene. This sector is benefitting significantly from the rising trend of personal grooming among both male and female consumers globally.

Government investments in health and wellness campaigns have further bolstered the market by promoting hygiene practices that include skin care routines as a fundamental aspect.

Opportunities within this market are abundant, particularly in the development of products tailored to varying skin care needs and regional preferences. For instance, there is growing demand for products formulated with natural or organic ingredients, driven by consumer preferences shifting towards sustainability and health-consciousness.

The evolving dynamics of the face wash market are supported by compelling consumer behavior statistics. According to Exploding Topics, as of December 2023, 40% of facial skincare users reported an increase in the use of cleansing products compared to pre-pandemic levels, underscoring a heightened focus on hygiene and skin care.

Additionally, YouGov highlights that 60% of women, compared to 39% of men, maintain a consistent skincare routine, indicating a significant market segment that brands can target.

Moreover, eco-conscious consumer behavior is influencing product innovation; Garnier notes that one out of every four beauty and skincare product users prefer eco-friendly brands, a trend that is prompting companies to rethink ingredients and packaging.

This shift is particularly pronounced among female consumers in Asia, where, as per a study, 70% of female respondents in Vietnam use a cleanser in the morning, highlighting the routine nature of face wash use. This routine usage is further supported by data from Statistics, showing that 85% of women use cleansers one to two times daily, suggesting a substantial daily demand for these products.

Key Takeaways

- Global Face Wash Market projected to grow from USD 29.3 billion in 2024 to USD 44.2 billion by 2034, with a CAGR of 4.2%.

- Gel products dominated the Product Form Analysis segment with a 40% market share in 2023, favored for moisture retention.

- Normal Skin products led the Skin Type Analysis segment in 2023, preferred for their versatility and broad appeal.

- Women were the primary consumers in the End User Analysis segment, reflecting a proactive approach to skincare.

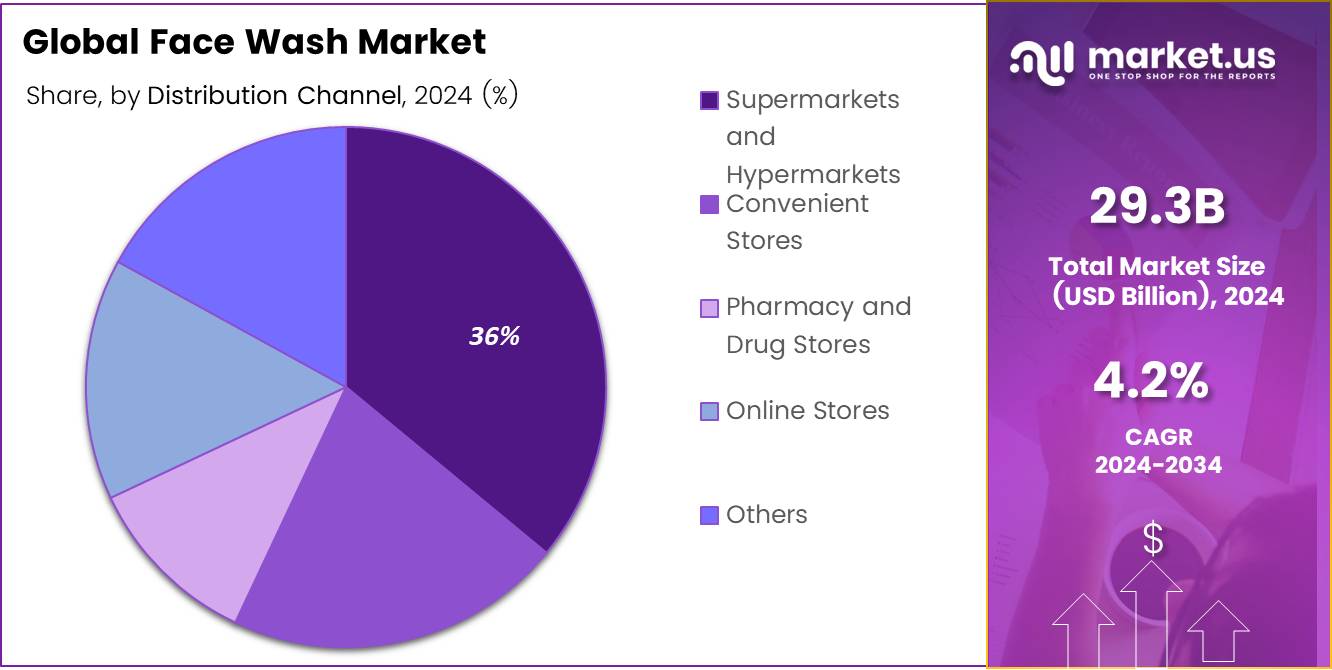

- Supermarkets and Hypermarkets were the leading distribution channels, holding a 36% share in 2023.

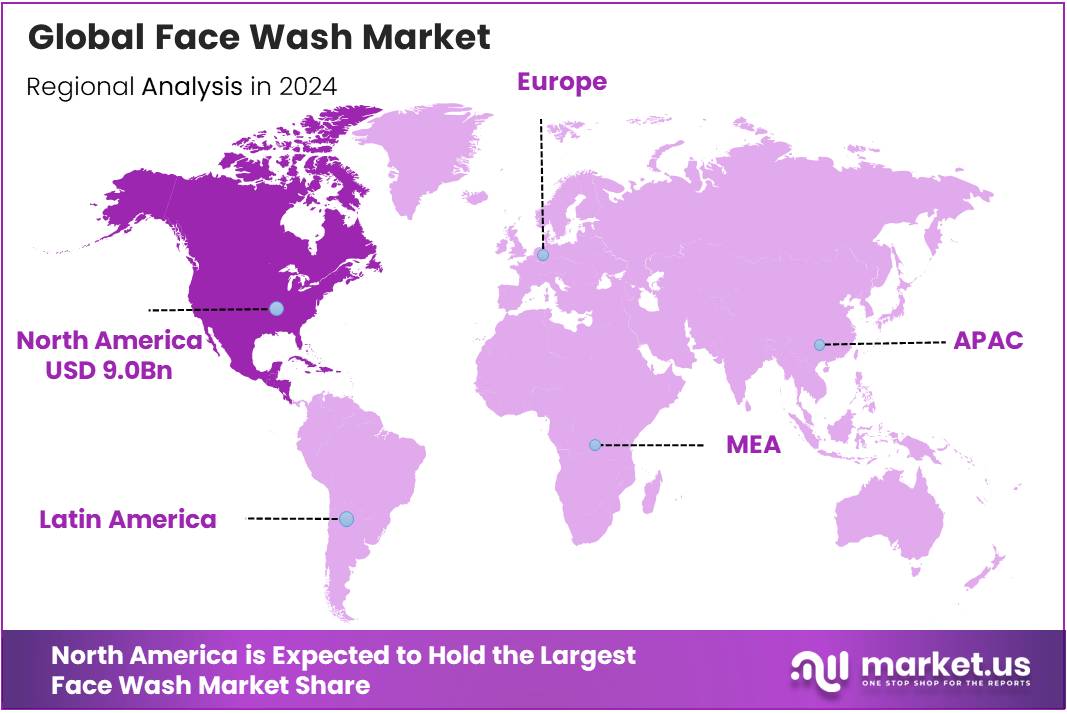

- North America is a major player in the market, accounting for 30% of global sales, valued at USD 9.0 billion.

Product Form Analysis

Gel Leads Face Wash Market with 40% Share Due to Its Moisture-Preserving Properties

In 2023, Gel held a dominant market position in the By Product Form Analysis segment of the Face Wash Market, commanding a 40% share. This substantial market presence can be attributed to the consumer preference for gel-based cleansers, which are perceived to offer effective cleansing without stripping the skin of essential moisture.

Following gel, the foam type captured a significant portion of the market, favored for its light texture and deep-cleaning properties. Liquid face washes also maintained a steady demand, appreciated for their versatility and ease of use across various skin types.

Powder form, while lesser-known, has begun to carve out a niche for its eco-friendly attributes and customizable usage, appealing particularly to environmentally conscious consumers. Collagen-based face washes are gaining traction as they promise anti-aging benefits, thus attracting a demographic that prioritizes skincare products with added functionalities.

The ‘Others’ category, which includes unique formulations like cream and oil-based face washes, caters to specific consumer needs, offering targeted solutions for sensitive or problematic skin types. Each form factor continues to innovate, striving to meet the evolving preferences and concerns of today’s skincare consumers.

Skin Type Analysis

Normal Skin leads the Face Wash Market in 2023, favored for its universal appeal and gentle formulations.

In 2023, Normal Skin held a dominant market position in the By Skin Type Analysis segment of the Face Wash Market. This segment’s preference is attributed to the versatility and broad consumer acceptance of products suitable for this skin type. Normal skin products often emphasize maintaining natural skin balance without specific targeting of issues, making them universally appealing.

Following closely, Dry Skin products captured a substantial market share, driven by an increasing consumer focus on hydration and nourishing formulations. These products are enriched with moisturizing agents like hyaluronic acid and ceramides, catering to consumers experiencing dryness and irritation.

Oily Skin solutions also marked significant presence, offering formulations aimed at controlling excess sebum and minimizing pores. The demand for these products is fueled by the need for matte and clear skin finishes, particularly in humid climates.

Acne-Prone skin care products focused on addressing breakouts and blemishes through ingredients like salicylic acid and tea tree oil. Their market share reflects ongoing concerns about acne among teenagers and adults alike.

Sensitive Skin options were tailored to minimize allergic reactions and skin irritations, featuring gentle and hypoallergenic ingredients. This segment is growing due to heightened awareness of skin health and sensitivity.

The ‘Others’ category, which includes products for combination and mature skin types, catered to niche but growing demographics seeking specific skincare solutions, illustrating the market’s diversification.

End User Analysis

Women Lead Face Wash Market Usage, Capturing Major Share in 2023 Due to Increased Skincare Awareness and Tailored Products

In 2023, women held a dominant market position in the By End User Analysis segment of the Face Wash Market, accounting for a significant share of market consumption. The prominence of female consumers in this market segment can be attributed to heightened awareness and a proactive approach towards skincare routines among women.

Brands have responded by diversifying their product lines to include face washes tailored to various skin types and concerns prevalent among women, such as dry skin, acne, and anti-aging formulations.

Marketing strategies have also evolved, with companies increasingly leveraging digital platforms and social media influencers to reach their target demographic effectively. The result has been a robust growth in market engagement and customer loyalty within this group.

The Men segment of the Face Wash Market has shown considerable growth, driven by changing perceptions of male grooming. As societal norms evolve, more men are embracing skincare as an essential part of their daily regimen.

Companies have recognized this shift, introducing products specifically designed for men’s skin, which tends to be thicker and more prone to oiliness and breakouts. This targeted approach has successfully expanded the market base, making men a rapidly growing consumer segment in the face wash industry.

The Others category within the Face Wash Market, though smaller, is expanding as brands increasingly cater to diverse consumer needs, including gender-neutral and inclusive products.

This segment captures individuals seeking specialized products that defy traditional gender binaries. The growth in this niche market segment is supported by a broader cultural movement towards inclusivity and personalization in beauty and personal care products.

Distribution Channel Analysis

Supermarkets and Hypermarkets lead with 36% share, favored for their broad product selections and hands-on buying experience

In 2023, Supermarkets and Hypermarkets held a dominant market position in the By Distribution Channel Analysis segment of the Face Wash Market, with a 36% share. These venues are preferred for their extensive product ranges and the ability to physically assess product quality before purchase.

Convenient Stores provide quick access to face wash products, especially valued in urban and suburban locales. Pharmacy and Drug Stores are pivotal, trusted for their selection of dermatologically approved skincare products, appealing to health-conscious consumers. Online Stores, marked by the convenience of home delivery and abundant online reviews, continue to grow in influence.

Other sales channels, including direct sales and boutique stores, cater to niche markets seeking specialized or premium products, highlighting the varied consumer preferences and shopping behaviors that shape the face wash market landscape.

Key Market Segments

By Product Form

- Gel

- Powder

- Foam

- Liquid

- Collagen Based

- Others

By Skin Type

- Normal Skin

- Dry Skin

- Oily Skin

- Acne-Prone

- Sensitive Skin

- Others

By Price Point

- Economy

- Medium

- Premium

By End User

- Women

- Men

- Others

By Distribution Channel

- Supermarkets and Hypermarkets

- Convenient Stores

- Pharmacy and Drug Stores

- Online Stores

- Others

Drivers

Increasing Awareness and Spending Drive Face Wash Market Growth with Innovation and Male Grooming Trends

In the current market landscape, several key drivers are significantly propelling the demand for face wash products. Firstly, the growing consumer consciousness regarding the benefits of maintaining a thorough skin care regimen is instrumental in boosting the sales of face washes. This surge in awareness is largely due to increased educational efforts and marketing by skin care companies.

Secondly, a global increase in personal care spending reflects rising disposable incomes, enabling consumers to allocate more resources towards enhancing their personal care routines.

Additionally, there is a noticeable trend towards innovative product formulations. Manufacturers are continually integrating natural and organic ingredients into their products, responding to the consumer demand for safer and more environmentally friendly options.

Lastly, the expansion of the male grooming market has also contributed significantly to the market’s growth. More men are now investing in specialized face care routines, including the use of face wash products designed specifically for their skin types and concerns.

These factors collectively underscore a robust expansion trajectory for the face wash market, driven by evolving consumer preferences and increased financial capacity for personal care expenditures.

Restraints

Facing Growth Challenges with Harmful Ingredients and Rising Competition from Substitutes

The face wash market faces several restraints that could slow its growth. One of the significant factors is the increasing consumer awareness about the presence of harmful chemicals in some face wash products.

As more people become conscious of the ingredients in their skincare routines, there is rising concern over the potential adverse effects of certain chemicals, such as parabens, sulfates, and artificial fragrances. This has led to a preference for natural and organic products, which are perceived to be safer and healthier.

Brands that fail to meet these expectations may struggle to attract health-conscious consumers, limiting their market share. Another restraint is the competition posed by substitute products like facial cleansing wipes and micellar water. These alternatives are often marketed as more convenient and effective, offering consumers an easier, on-the-go solution for skincare.

Micellar water, in particular, has gained popularity due to its ability to remove makeup and cleanse the skin in one step, which is seen as a time-saving option compared to traditional face washes.

The rise in the availability of such substitutes may therefore impact the demand for traditional face wash products, particularly among younger consumers who prioritize convenience and multi-functional products. This combination of consumer concerns over product ingredients and the growing preference for alternative skincare solutions may present challenges to the face wash market’s expansion.

Growth Factors

Growth Opportunities in the Face Wash Market Driven by Consumer Demand and Innovation

The face wash market is set for growth, particularly through expansion into emerging markets like Asia-Pacific and Latin America, where rising middle-class populations are driving demand for skincare products.

As disposable incomes increase, consumers are more inclined to invest in quality personal care. Another significant opportunity lies in customization, with consumers increasingly seeking personalized face washes tailored to specific skin types and concerns, such as acne or dryness.

Sustainability is also a major trend, with eco-conscious consumers favoring biodegradable products, natural ingredients, and recyclable packaging. Brands that emphasize eco-friendly practices can appeal to this growing segment.

Additionally, technological advancements in product testing, such as AI-driven skin simulations, are enhancing product efficacy and safety, which helps meet diverse consumer needs. These factors combined suggest strong growth prospects for the face wash market, driven by shifting consumer preferences and technological innovation.

Emerging Trends

Trending Values in the Face Wash Market Driven by Consumer Demand for Natural Ingredients and Personalization

The face wash market is evolving rapidly, driven by several emerging trends. One of the key factors influencing this growth is the increasing preference for natural and organic ingredients.

Consumers are becoming more aware of the potential harms of synthetic chemicals, leading to a demand for face washes that use plant-based, cruelty-free, and environmentally friendly ingredients.

Alongside this, anti-pollution skincare products are gaining popularity as urban pollution levels rise, with consumers seeking face washes that not only cleanse the skin but also protect it from harmful environmental pollutants.

Additionally, the growing trend of men’s skincare is driving the development of specialized face washes designed to meet the unique needs of men’s skin, which tends to be thicker and oilier. This shift towards gender-specific products is fostering innovation in the skincare space.

Lastly, the focus on microbiome skincare has gained traction, with an increasing number of face washes designed to support and maintain the skin’s natural microbiome. These products promote healthy bacteria balance, essential for overall skin health.

Collectively, these trends reflect a broader consumer shift toward more targeted, sustainable, and scientifically advanced skincare solutions. As these factors continue to gain momentum, they are likely to shape the future of the face wash market, with an increasing emphasis on natural ingredients, environmental protection, and personalized care.

Regional Analysis

North America leads the Face Wash Market with a 30% share valued at USD 9.0 Billion

The global face wash market is segmented by region into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America, with each region contributing distinctively to the market dynamics.

North America holds a dominant position in the global face wash market, accounting for approximately 30% of the total market share, valued at USD 9.0 billion. This significant market share can be attributed to high consumer awareness regarding skincare, the growing trend of self-care, and the presence of major skincare brands and retailers.

The rising demand for natural and organic face washes, especially among millennials and Gen Z, is expected to drive further growth in this region. Additionally, the increasing inclination toward premium and personalized skincare products contributes to the robust performance of the market in North America.

Regional Mentions:

Europe is the second-largest market for face washes, driven by growing awareness around skincare routines and an increased preference for eco-friendly and organic beauty products. The market in Europe is projected to maintain steady growth, with countries like Germany, France, and the UK leading the demand for premium skincare items. The increasing focus on sustainability and skin health among European consumers plays a pivotal role in shaping the regional market.

Asia Pacific is expected to experience the highest growth rate in the face wash market, attributed to the rapidly expanding middle-class population, increased disposable income, and a strong inclination toward beauty and personal care routines, particularly in countries such as China, India, and Japan. With the rise of e-commerce platforms and growing penetration of skincare products among younger consumers, the market in Asia Pacific is set to continue its upward trajectory.

Middle East & Africa and Latin America represent smaller, yet promising markets. In these regions, rising urbanization and increasing disposable income, especially in countries like Brazil, Saudi Arabia, and South Africa, are contributing to the growing demand for face wash products. The market is expected to expand steadily, albeit at a slower pace compared to more mature regions.

Key Regions and Countries covered іn thе rероrt

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In 2023, the global face wash market is dominated by a range of established players, each leveraging unique strategies to maintain or expand their market share.

Companies such as Unilever, L’Oréal, and Procter & Gamble have consolidated their leadership through robust product portfolios, global distribution networks, and strong brand equity. These corporations have been quick to integrate emerging consumer trends, such as natural ingredients and sustainability, which appeal to increasingly eco-conscious consumers.

Amorepacific Corporation and Shiseido, major players from Asia, have capitalized on growing demand for high-end skincare products, particularly in the luxury segment. Their extensive research and development efforts have driven innovation in both product formulations and packaging, aligning with shifting consumer preferences for premium, effective, and eco-friendly skincare solutions.

Kao Corporation and Beiersdorf AG, with brands like Nivea and Bioré, have focused on offering a wide range of face washes catering to different skin types and concerns, from sensitive skin to oily or acne-prone skin. This segmentation allows them to target a diverse consumer base while maintaining significant market share.

Meanwhile, The Body Shop International Limited and Mary Kay Inc. continue to benefit from their strong ties to ethical beauty and direct-selling models, respectively. Both brands are capitalizing on the growing demand for socially responsible and cruelty-free skincare.

Overall, the competition within the face wash market remains intense, driven by innovation, sustainability, and the ability to adapt to ever-changing consumer demands. In this dynamic landscape, major brands are focusing on product differentiation, digital engagement, and sustainability to retain and expand their market position.

Top Key Players in the Market

- Amorepacific Corporation

- Shiseido Company

- The Body Shop International Limited

- Unilever

- Avon Products, Inc.

- Kao Corporation

- L’Oréal

- Estée Lauder Companies

- Mary Kay Inc.

- Beiersdorf AG

- Coty Inc.

- Johnson & Johnson

- Neutrogena Corporation

- Olay

- Procter & Gamble

Recent Developments

- In January 2025, RAS Luxury Skincare, a premium beauty brand, secured $5 million in funding, with a significant contribution from Unilever Ventures, aiming to expand its innovative skincare line and global reach. The investment highlights growing interest in luxury skincare brands backed by major investors.

- In February 2024, Stockholm-based skincare start-up Mantle raised £2.4 million in a funding round, focusing on its mission to create sustainable and high-performance skincare products. The investment is set to support Mantle’s product development and market expansion in the competitive beauty sector.

- In February 2023, UK-based Skin + Me secured over €11 million to scale its personalized prescription-based skincare platform, which customizes treatments based on individual skin needs. This funding round will support the expansion of Skin + Me’s digital health solutions and personalized skincare offerings across Europe.

Report Scope

Report Features Description Market Value (2023) USD 29.3 Billion Forecast Revenue (2033) USD 44.2 Billion CAGR (2024-2033) 4.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Form (Gel, Powder, Foam, Liquid, Collagen Based, Others), By Skin Type (Normal Skin, Dry Skin, Oily Skin, Acne-Prone, Sensitive Skin, Others), By Price Point (Economy, Medium, Premium), By End User (Women, Men, Others), By Distribution Channel (Supermarkets and Hypermarkets, Convenient Stores, Pharmacy and Drug Stores, Online Stores, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Amorepacific Corporation, Shiseido Company, The Body Shop International Limited, Unilever, Avon Products, Inc., Kao Corporation, L’Oréal, Estée Lauder Companies, Mary Kay Inc., Beiersdorf AG, Coty Inc., Johnson & Johnson, Neutrogena Corporation, Olay, Procter & Gamble Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Amorepacific Corporation

- Shiseido Company

- The Body Shop International Limited

- Unilever

- Avon Products, Inc.

- Kao Corporation

- L'Oréal

- Estée Lauder Companies

- Mary Kay Inc.

- Beiersdorf AG

- Coty Inc.

- Johnson & Johnson

- Neutrogena Corporation

- Olay

- Procter & Gamble