Europe Laundry Detergent Pods Market Size, Share, Growth Analysis By Product Type (Non-Biological, Biological), By Form (Liquid, Powder, Pods, Others), By End Use (Household, Commercial), By Distribution Channel (Hypermarkets & Supermarkets, Convenience Stores, Online, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: March 2025

- Report ID: 80798

- Number of Pages: 256

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

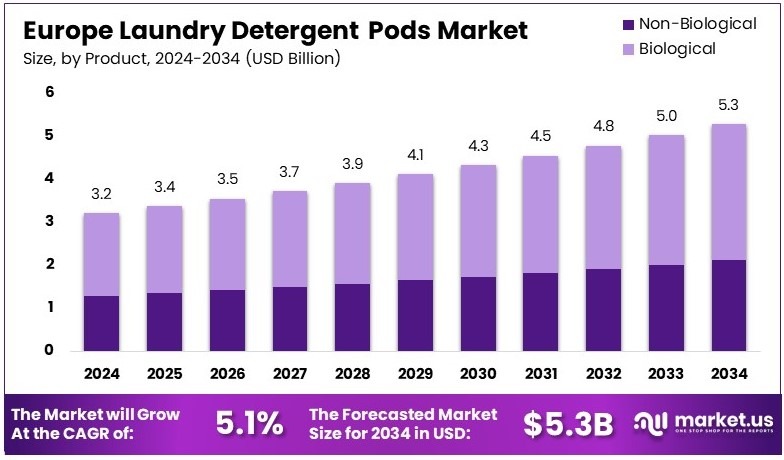

The Europe Laundry Detergent Pods Market size is expected to be worth around USD 5.3 Billion by 2034, from USD 3.2 Billion in 2024, growing at a CAGR of 5.1% during the forecast period from 2025 to 2034.

Europe Laundry Detergent Pods are pre-measured, single-use capsules that contain concentrated cleaning detergent for washing machines. They are designed to simplify the laundry process and ensure accurate dosage. These pods are manufactured to meet strict quality standards and are widely available for household use across European markets with reliable performance.

The Europe Laundry Detergent Pods Market refers to the commercial network that oversees the production, distribution, and sale of these cleaning capsules in Europe. It comprises manufacturers, distributors, and retailers that adhere to regulatory standards. The market ensures standardized quality and consistent product availability across various retail channels for end consumers.

In Europe, the laundry detergent pods market is evolving, driven by a shift towards eco-friendly products. As sustainability becomes a priority, 70% of new detergent launches in 2024 are expected to be eco-friendly. The demand for these products is particularly high among younger consumers, with 64% of Gen Z and 67% of Millennials favoring sustainable brands.

Furthermore, the market’s growth is supported by increased accessibility to washing machines. In developed European countries, about 90% of households have a washing machine, enhancing the potential consumer base for laundry care. This accessibility, combined with the environmental push, is reshaping the market dynamics, presenting opportunities for innovation and expansion.

However, this growth also brings challenges, such as market saturation and intense competition among brands. To stay competitive, companies are focusing on unique selling propositions like plant-based ingredients and cost-efficiency, with some pods costing about 21 cents per load and capable of cleaning up to 100 loads. These factors are crucial in maintaining a strong market position and responding effectively to consumer preferences and regulatory standards.

Key Takeaways

- The Europe Laundry Detergent Pods Market was valued at USD 3.2 billion in 2024 and is expected to reach USD 5.3 billion by 2034, with a CAGR of 5.1%.

- In 2024, Biological detergents dominated the product type segment with 59.4% due to their superior stain removal properties.

- In 2024, Pods led the form segment with 48.5%, driven by convenience and pre-measured doses reducing wastage.

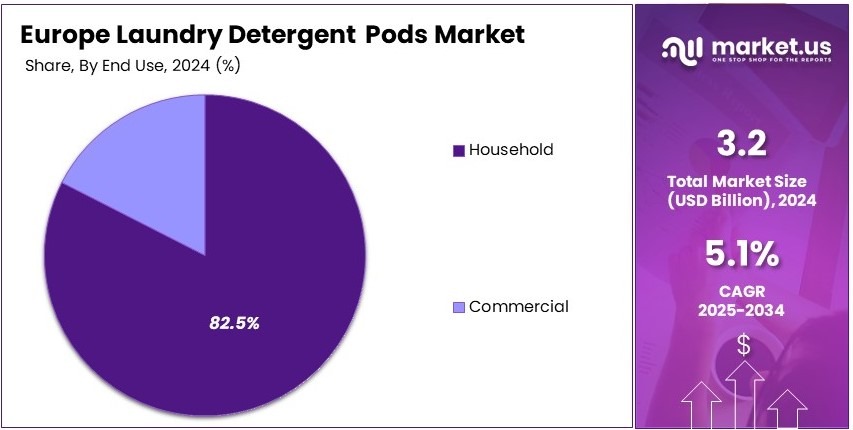

- In 2024, Household dominated the end-use segment with 82.5%, attributed to the increasing adoption of convenient laundry solutions.

- In 2024, Hypermarkets & Supermarkets led the distribution channel with 53.4%, benefiting from widespread availability and promotional offers.

Type Analysis

Biological dominates with 59.4% due to its enhanced cleaning efficacy and consumer preference for effective stain removal.

The biological segment of the laundry detergent pods market in Europe holds a dominant position with a 59.4% share, primarily because these products contain enzymes that are highly effective at breaking down stains even at lower temperatures.

This attribute makes biological pods especially popular among consumers dealing with diverse and stubborn stains, offering a compelling selling point over non-biological alternatives. The effectiveness of biological detergents in cold wash cycles also appeals to energy-conscious consumers, who seek to reduce their energy consumption while achieving high cleaning performance.

Non-biological pods, while significant, do not contain these enzymes and are often perceived as less effective on difficult stains, though they are preferable for sensitive skin. Their role in the market caters primarily to consumers who have allergies or sensitivities to the enzymes used in biological detergents, underscoring the importance of this sub-segment in addressing the needs of a niche market.

Form Analysis

Pods dominate with 48.5% due to their convenience and precision in dosage.

Pods have carved out the largest share in the detergent form segment, holding 48.5%, driven by their convenience and ease of use. The pre-measured pods prevent overdosing, reducing waste and ensuring optimal detergent use, which resonates with the modern consumer’s desire for efficiency and minimal environmental impact.

This format’s popularity is further supported by the growing trend towards compact living and minimal storage space, which favors the small and non-messy nature of pods.

Liquid and powder forms, although still widely used, do not offer the same level of convenience and mess-free application as pods. Liquid detergents are prone to spillage and overdosing, while powders can be cumbersome to measure and store. Despite these drawbacks, they remain integral to the market, serving consumers who prioritize cost over convenience or have specific washing preferences that pods cannot meet.

End Use Analysis

Household dominates with 82.5% due to the high volume of laundry generated by residential consumers.

The household segment significantly leads in the end use category of the market, with an 82.5% share, predominantly because residential settings naturally generate a steady demand for laundry detergents as a daily necessity. The convenience and ease-of-use associated with detergent pods make them highly attractive to busy families and individuals seeking effective, time-saving laundry solutions.

The commercial sector, while smaller, is nonetheless vital for the overall market. It encompasses a variety of industries including hospitality, healthcare, and education, where large volumes of laundry are processed regularly. Although commercial usage is less frequent compared to household, its demand for high-efficiency and industrial-strength products sustains a steady market segment that complements the dominant household usage.

Distribution Channel Analysis

Hypermarkets & Supermarkets dominate with 53.4% due to their extensive reach and consumer trust in physical retail.

Hypermarkets and supermarkets hold the largest share in the distribution channels segment with 53.4%, attributed to their wide geographical footprint and the trust consumers place in purchasing from established retail environments. These venues offer the advantage of immediate product availability and the option for consumers to physically evaluate products before purchase.

Other distribution channels, including convenience stores and online platforms, play crucial roles despite their smaller shares. Convenience stores serve the demand for immediate or emergency purchases, typically in urban settings, whereas online sales channels are growing rapidly, driven by the rise in e-commerce and consumer convenience. These channels are crucial for reaching different consumer segments and adapting to evolving shopping behaviors.

Key Market Segments

By Product Type

- Non-Biological

- Biological

By Form

- Liquid

- Powder

- Pods

- Others

By End Use

- Household

- Commercial

By Distribution Channel

- Hypermarkets & Supermarkets

- Convenience Stores

- Online

- Others

Driving Factors

Convenience and Sustainability Drive Market Growth

Consumers are increasingly choosing laundry detergent pods due to their ease of use. These pre-measured pods eliminate the need for measuring liquid or powder, reducing spills and waste. This convenience appeals to busy households and working professionals.

In addition, the shift towards eco-friendly products has boosted demand for pods with water-soluble films and biodegradable ingredients. Many consumers now prefer detergents with minimal packaging, aligning with sustainability goals.

Online shopping has further fueled market expansion. E-commerce platforms provide easy access to a variety of pod options, along with discounts and subscription services. This has widened the customer base, especially among younger consumers who prefer digital shopping.

Urbanization is another key factor. With more people living in compact apartments, space-saving products like detergent pods are gaining popularity. Unlike bulky liquid detergent bottles, pods are easy to store and transport. As European cities grow, more consumers are likely to adopt these efficient solutions.

Restraining Factors

Safety and Cost Restrain Market Growth

Despite the advantages, safety concerns limit the market’s expansion. Laundry pods can be mistaken for candy by children, leading to accidental ingestion. Reports of poisoning incidents have prompted regulatory scrutiny and warnings from health authorities. As a result, some parents avoid buying pods, choosing traditional detergents instead.

Additionally, the higher price of pods compared to liquid or powder alternatives discourages budget-conscious consumers. While pods offer convenience, many shoppers see them as an unnecessary expense.

Another challenge is skepticism about cleaning performance. Some consumers believe liquid detergents provide better stain removal, especially for tough stains like grease or wine. This perception affects adoption rates, particularly among households with heavy laundry needs.

Environmental concerns also play a role. While some brands use biodegradable materials, many pods still contain non-recyclable polymer films. This raises sustainability issues, discouraging eco-conscious buyers from making the switch.

Growth Opportunities

Product Innovation and Strategic Partnerships Provide Opportunities

Developing new features can attract more consumers to detergent pods. Fragrance-infused pods, fabric-softening formulas, and stain-specific solutions cater to different customer needs. For example, some brands offer pods designed for sportswear, while others focus on delicate fabrics. Expanding these options increases market appeal.

Partnering with appliance manufacturers is another growth strategy. Washing machine brands can promote pods as the ideal detergent for their machines, enhancing brand trust and encouraging usage.

Moreover, improving sustainability features can draw eco-conscious buyers. Biodegradable packaging, plant-based ingredients, and reduced plastic content address environmental concerns. Companies investing in these innovations gain a competitive edge.

Additionally, targeted marketing campaigns play a vital role. Many consumers are still unfamiliar with the benefits of pods. Educating them through online ads, social media influencers, and in-store promotions can increase adoption.

Emerging Trends

Multi-functional Pods and Subscription Models Are Latest Trending Factors

The trend of multi-functional pods is gaining traction. Consumers now seek products that offer more than just cleaning. Pods with built-in fabric softeners, scent boosters, or antibacterial agents provide added value. These all-in-one solutions simplify laundry routines, making them highly attractive.

Subscription-based models are another rising trend. Many brands now offer detergent pods through auto-delivery services, ensuring customers never run out of detergent. This model increases customer retention and provides convenience.

Advances in pod dissolution technology also enhance market demand. Improved water-soluble films ensure that pods dissolve completely in cold and hot water, reducing residue issues. This makes them more effective and eliminates consumer doubts about their performance.

Regulatory changes also influence the market. European policies favor sustainable household products, encouraging companies to develop eco-friendly detergent pods. As environmental concerns rise, brands that align with these regulations will gain a stronger foothold.

Regional Analysis

Germany and UK Lead Europe Laundry Detergent Pods Market with Strong Market Presence

Germany and the UK are at the forefront of the European laundry detergent pods market, capitalizing on their advanced manufacturing processes and high consumer adoption rates. These countries have established a strong market presence through effective marketing strategies and widespread retail distribution.

Key factors driving their dominance include environmental awareness among consumers preferring eco-friendly and convenient cleaning solutions, and the presence of leading global brands that innovate consistently. High standards of living and consumer preference for premium products also play significant roles.

The future impact of Germany and the UK on the laundry detergent pods market looks promising. With ongoing trends towards sustainability and convenience, these markets are expected to expand further. Regulatory support for environmentally friendly products will likely bolster their continued market leadership.

Key Regions and Countries Covered in the Report

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Competitive Landscape

The Europe Laundry Detergent Pods Market is dominated by several key players, each contributing significantly to the regional market dynamics. Among these, Procter & Gamble, Henkel AG & Co. KGaA, Unilever, and Reckitt Benckiser Group Plc stand out due to their substantial market share, product innovation, and strong distribution networks.

Procter & Gamble (P&G) is a leading force with its globally recognized brands, such as Tide Pods. P&G’s strength lies in its extensive R&D capabilities and aggressive marketing strategies. The company’s commitment to sustainability and the introduction of eco-friendly products have helped it maintain a strong position in the European market.

Henkel AG & Co. KGaA is renowned for its Purex brand among others. Henkel’s strategy focuses on combining innovation with sustainability, offering products that are both effective and environmentally friendly. This approach has resonated well with European consumers who are increasingly environmentally conscious.

Unilever is another major player with a diverse product portfolio that includes popular brands like Persil. Unilever’s strength is its ability to understand local consumer preferences and adapt its products accordingly. This consumer-centric approach, coupled with strong marketing campaigns, has enabled Unilever to capture a significant share of the market.

Reckitt Benckiser Group Plc, with its Woolite brand, focuses on specialty products that cater to the needs of consumers looking for gentle yet effective cleaning solutions. Reckitt Benckiser has leveraged its global presence to enhance brand recognition and trust, making it a preferred choice among European households.

These top companies drive the laundry detergent pods market in Europe through continuous product innovation, focusing on sustainability and adapting to changing consumer preferences. Their efforts are supported by robust marketing strategies and broad distribution networks, ensuring widespread availability across Europe. As the market continues to evolve, these players are expected to remain at the forefront, shaping industry trends and consumer behaviors in the region.

Major Companies in the Market

- Sainsbury’s

- ASDA

- Church & Dwight Co. Inc.

- Colgate-Palmolive Company

- Ecozone

- Gel Caps

- Hema

- Henkel AG & Co. KGaA (Purex)

- Morrison’s Ltd.

- Procter & Gamble

- Procter & Gamble Co. (Tide)

- Reckitt Benckiser Group Plc (Woolite)

- Seventh Generation, Inc.

- Tesco.com

- The Clorox Company

- Unilever

- Waitrose & Partners

- Wilko

Recent Developments

- Unilever: On July 2022, Unilever announced the global launch of its most sustainable laundry capsule to date. These capsules are designed for optimal performance in cold (20°C and below) short cycles, enabling consumers to save up to 60% energy per use. Packaged in plastic‐free, recyclable cardboard containers, this innovation is set to prevent over 6,000 tonnes of plastic waste annually.

- Tide, Gain, Ace, and Ariel: On April 2024, a recall was issued for approximately 8.2 million packets of liquid laundry detergent pods from brands including Tide, Gain, Ace, and Ariel due to faulty packaging that could pose risks to consumers. This recall underscores the importance of stringent quality control measures in consumer product packaging.

Report Scope

Report Features Description Market Value (2024) USD 3.2 Billion Forecast Revenue (2034) USD 5.3 Billion CAGR (2025-2034) 5.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Non-Biological, Biological), By Form (Liquid, Powder, Pods, Others), By End Use (Household, Commercial), By Distribution Channel (Hypermarkets & Supermarkets, Convenience Stores, Online, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Ainbury’s, ASDA, Church & Dwight Co. Inc., Colgate-Palmolive Company, Ecozone, Gel Caps, Hema., Henkel AG & Co. KGaA (Purex), Morrison’s Ltd., Procter & Gamble, Procter & Gamble Co. (Tide), Reckitt Benckiser Group Plc (Woolite), Seventh Generation, Inc., Tesco.com, The Clorox Company, Unilever, Waitrose & Partners, Wilko Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Europe Laundry Detergent Pods MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample

Europe Laundry Detergent Pods MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Ainbury's

- ASDA

- Church & Dwight Co. Inc.

- Colgate-Palmolive Company

- Ecozone

- Gel Caps

- Hema

- Henkel AG & Co. KGaA (Purex)

- Morrison's Ltd.

- Procter & Gamble

- Procter & Gamble Co. (Tide)

- Reckitt Benckiser Group Plc (Woolite)

- Seventh Generation, Inc.

- Tesco.com

- The Clorox Company

- Unilever

- Waitrose & Partners

- Wilko