Global Erythritol Market Size, Share and Future Trends Analysis Report By Form (Powder, Granular, Liquid), By Purity Level (High Purity (Greater-than Equal to 99%), Standard Purity (95-98%), Others), By Application (Food and Beverages, Pharmaceutical, Personal Care and Cosmetics, Others) , Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: May 2025

- Report ID: 148892

- Number of Pages: 251

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

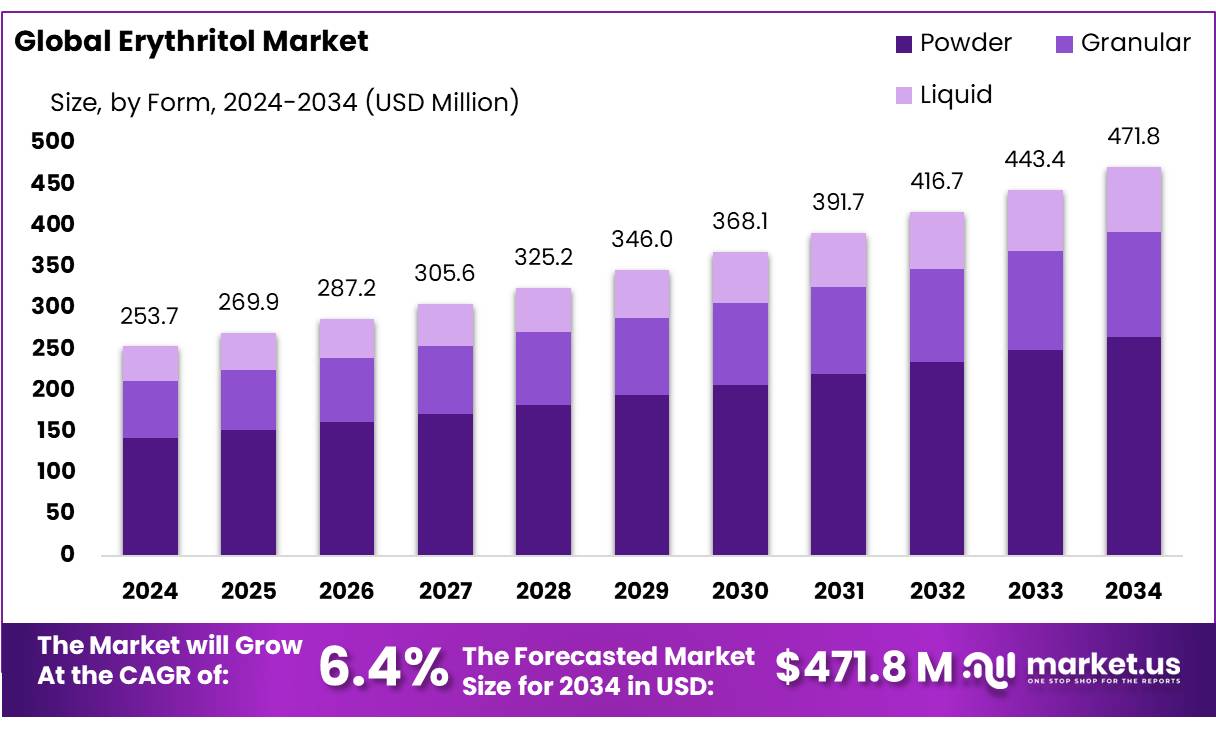

The Global Erythritol Market size is expected to be worth around USD 471.8 Million by 2034, from USD 253.7 Million in 2024, growing at a CAGR of 6.4% during the forecast period from 2025 to 2034.

Erythritol, a naturally occurring sugar alcohol, has gained significant traction in the food and beverage industry as a low-calorie sweetener. With approximately 60–70% of the sweetness of sucrose and minimal caloric content, it offers a favorable profile for health-conscious consumers. Commercially, erythritol is produced via fermentation of glucose derived from corn starch, resulting in a product that is non-cariogenic and has negligible impact on blood glucose levels.

The erythritol concentrates is evolving rapidly due to the expanding global focus on reducing sugar consumption. According to the U.S. Department of Agriculture (USDA), per capita sugar intake in the United States has declined by approximately 20% between 2010 and 2020, signaling an increasing preference for sugar substitutes like erythritol. This shift has propelled manufacturers to invest in erythritol production technologies that enhance purity and concentration levels to meet the high-quality standards required by food processors.

Driving factors for erythritol concentrates include the rising prevalence of lifestyle diseases such as diabetes and obesity, which have reached epidemic proportions globally. The International Diabetes Federation (IDF) reported that in 2023, approximately 537 million adults worldwide are living with diabetes, emphasizing the need for sugar alternatives that do not spike blood glucose levels. This demand fuels product innovation and drives erythritol consumption, especially in functional foods, beverages, and pharmaceuticals.

Government initiatives and regulatory frameworks have also influenced the erythritol market. In the United States, erythritol is recognized as Generally Recognized As Safe (GRAS) by the Food and Drug Administration (FDA), facilitating its incorporation into food products. In the European Union, erythritol is approved as a food additive (E 968), with the European Food Safety Authority (EFSA) conducting re-evaluations to ensure its safety and appropriate usage levels.

Key Takeaways

- Erythritol Market size is expected to be worth around USD 471.8 Million by 2034, from USD 253.7 Million in 2024, growing at a CAGR of 6.4%.

- Powder held a dominant market position, capturing more than a 56.3% share of the global erythritol market.

- High Purity (≥99%) held a dominant market position, capturing more than a 65.9% share of the global erythritol market.

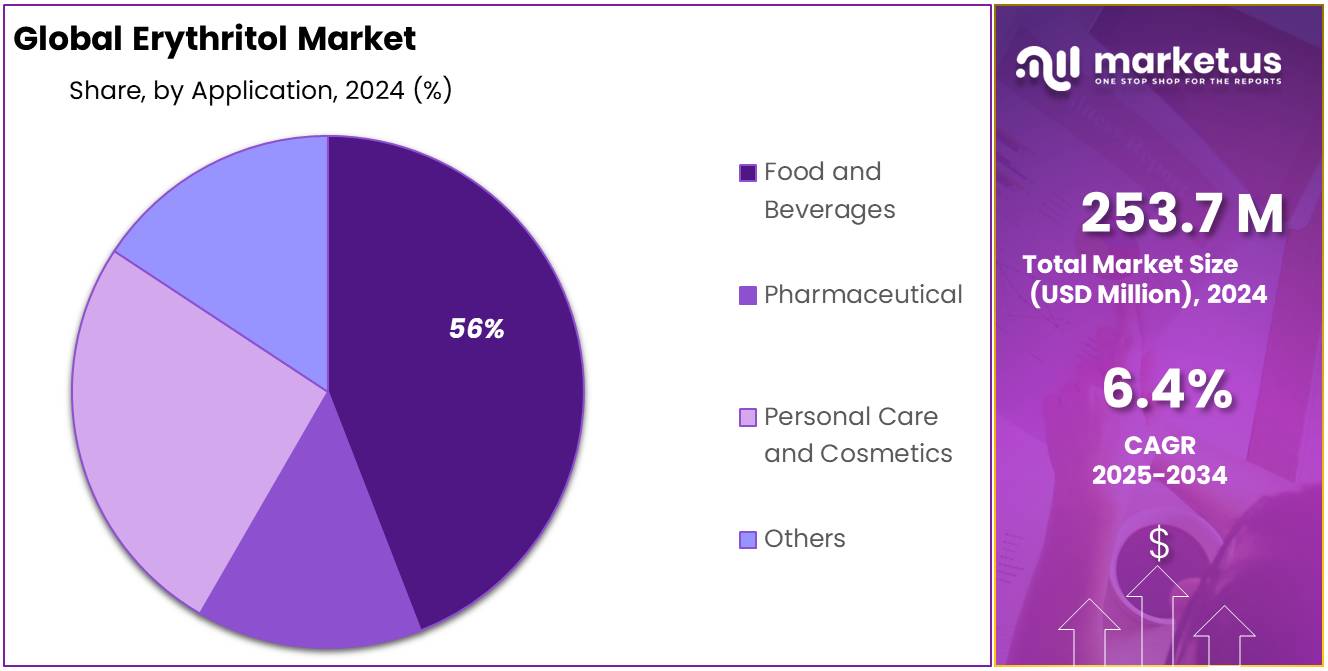

- Food and Beverages held a dominant market position, capturing more than a 56.1% share of the global erythritol market.

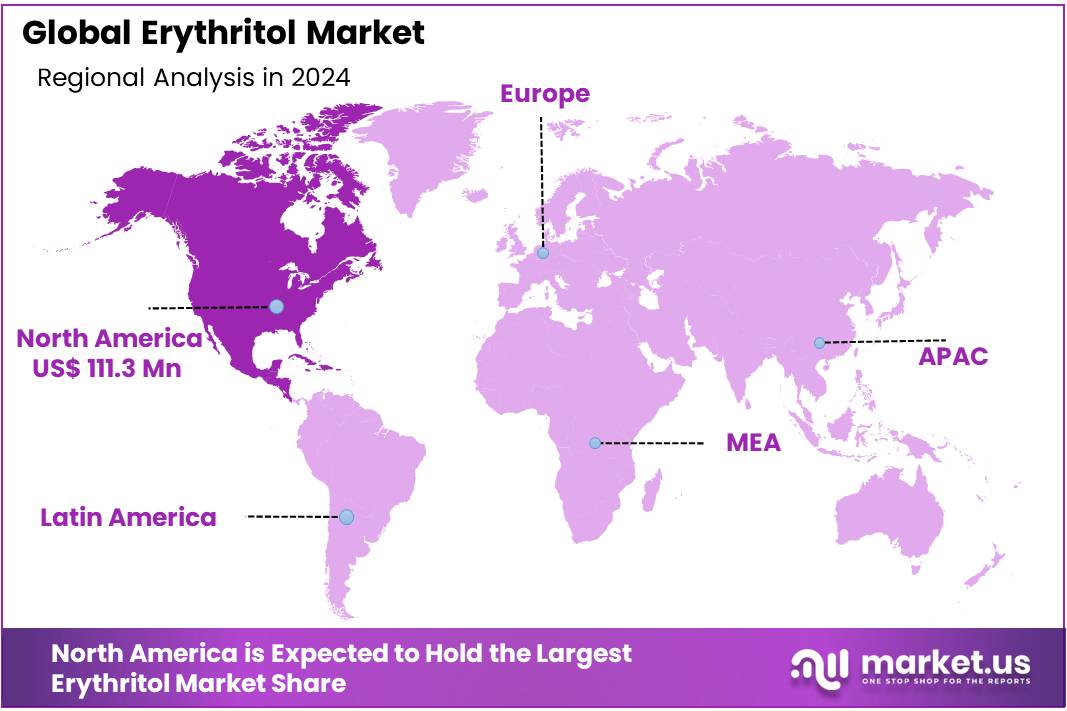

- North America holds a significant position in the global erythritol market, accounting for approximately 43.9% of the market share, valued at USD 111.3 million.

By Form

Powder Form Dominates Erythritol Market with 56.3% Share in 2024, Driven by Ease of Use and Stability

In 2024, Powder held a dominant market position, capturing more than a 56.3% share of the global erythritol market. This strong performance can be attributed to its versatility in food and beverage applications, especially in sugar-free and keto-friendly products. Powdered erythritol is preferred by manufacturers for its easy blending properties, consistent sweetness, and longer shelf life compared to liquid forms. It dissolves well in both hot and cold applications, making it ideal for a wide range of products from baked goods to beverages. In markets such as North America and Europe, where low-calorie and diabetic-friendly alternatives are in strong demand, powdered erythritol has become a staple in health-conscious product formulations.

By Purity Level

High Purity Erythritol Leads with 65.9% Share in 2024 as Demand for Premium-Grade Sweeteners Rises

In 2024, High Purity (≥99%) held a dominant market position, capturing more than a 65.9% share of the global erythritol market. This high-purity grade is favored by manufacturers due to its superior taste profile, minimal aftertaste, and high performance in sensitive formulations like pharmaceuticals, premium food products, and nutraceuticals. With increasing awareness around food safety and product quality, food and beverage producers are leaning heavily toward ≥99% pure erythritol to meet strict regulatory and consumer standards. Its stability, non-hygroscopic nature, and compatibility with other ingredients make it a go-to choice for clean-label and zero-calorie product launches. Looking ahead into 2025, the demand for high-purity erythritol is expected to grow steadily as health-conscious buyers seek reliable sugar alternatives, especially in diabetic, keto, and weight-management food categories.

By Application

Food and Beverages Take the Lead with 56.1% Share in 2024 as Sugar-Free Trends Drive Demand

In 2024, Food and Beverages held a dominant market position, capturing more than a 56.1% share of the global erythritol market. This strong foothold is mainly due to the rising consumer shift toward low-calorie, sugar-free, and diabetic-friendly diets. Erythritol is widely used in a variety of food and drink products including baked goods, candies, soft drinks, and dairy alternatives, where it provides sweetness without the calories or blood sugar spikes associated with regular sugar. Its clean taste and natural origin make it especially appealing in health-focused products.

Key Market Segments

By Form

- Powder

- Granular

- Liquid

By Purity Level

- High Purity (≥99%)

- Standard Purity (95-98%)

- Others

By Application

- Food and Beverages

- Bakery & Confectionery

- Beverages

- Dairy Products

- Frozen Desserts

- Others

- Pharmaceutical

- Tablets & Capsules

- Syrups & Suspensions

- Others

- Personal Care and Cosmetics

- Oral Care Products

- Skin Care Products

- Others

- Others

Drivers

Government-Led Sugar Reduction Initiatives Fuel Erythritol Market Growth

One of the key drivers propelling the erythritol market is the global push to reduce sugar consumption, led by government initiatives and public health campaigns. The World Health Organization (WHO) recommends that both adults and children limit their intake of free sugars to less than 10% of total energy intake, with a further reduction to below 5% suggested for additional health benefits.

In India, the Central Board of Secondary Education (CBSE) has mandated the establishment of ‘sugar boards’ in schools to educate students about the health risks associated with excessive sugar consumption. These boards display information on recommended sugar intake, sugar content in common foods, and healthier alternatives. Schools are also required to conduct awareness workshops and submit progress reports to ensure compliance.

Similarly, Chandigarh’s education department has initiated a citywide program to reduce sugar consumption among schoolchildren. Starting July 1, 2025, all schools are required to install ‘Sugar Boards’ and ban the sale of high-fat, sugar, and salt (HFSS) foods within their premises. This initiative aims to address the rising cases of childhood obesity and diabetes by fostering healthier school environments.

These government-led initiatives are creating a favorable environment for the growth of the erythritol market. As awareness about the health risks of excessive sugar consumption increases, consumers are seeking healthier alternatives, leading to a surge in demand for sugar substitutes like erythritol. Manufacturers are responding by incorporating erythritol into a wide range of products, from beverages to baked goods, to meet the growing demand for low-calorie, sugar-free options.

Restraints

High Production Costs and Price Sensitivity

One of the main challenges restraining the growth of the erythritol market is its relatively high production cost compared to traditional sweeteners like sugar or high-fructose corn syrup. Erythritol is produced mainly through fermentation processes involving specific yeasts or fungi, which require advanced technology and strict quality control. These factors contribute to higher manufacturing expenses, which are often passed on to consumers through elevated product prices. This price difference can make erythritol less attractive, especially in price-sensitive markets or among low-income consumer segments.

According to data from the U.S. Department of Agriculture (USDA), sugar prices have remained relatively low and stable over the past decade, averaging about US$0.30 to US$0.40 per pound in 2023. In contrast, erythritol prices are significantly higher, sometimes costing several times more than conventional sweeteners. This disparity limits erythritol’s ability to compete in bulk food production and mass-market products where cost efficiency is crucial.

Moreover, government programs that subsidize sugar production in various countries further support lower sugar prices. For example, the U.S. Sugar Program provides price support and import quotas to domestic sugar producers, which keeps sugar prices artificially low and makes it difficult for erythritol to gain price parity. Such subsidies create a market environment where switching to erythritol involves higher costs for manufacturers, which can discourage adoption despite the health benefits.

Opportunity

Rising Demand for Low-Calorie and Diabetic-Friendly Sweeteners

The growing global focus on health and wellness has significantly increased the demand for low-calorie and diabetic-friendly sweeteners, positioning erythritol as a key player in this market. Erythritol, a sugar alcohol derived from natural sources, offers a sweet taste without the associated calories and glycemic impact of traditional sugars. This makes it particularly appealing to health-conscious consumers, individuals managing diabetes, and those seeking to reduce their sugar intake.

In the United States, per capita consumption of caloric sweeteners has declined, with 123.5 pounds per person available in 2023, down from a peak of 153.6 pounds in 1999. This trend reflects a broader shift towards healthier eating habits and the adoption of sugar alternatives like erythritol.

Government initiatives also support this transition. For instance, the U.S. Department of Agriculture’s Specialty Crop Block Grant Program (SCBGP) funds projects that enhance the competitiveness of specialty crops, including those used in natural sweeteners. This program encourages innovation and research in the cultivation of crops suitable for erythritol production.

Additionally, the U.S. Food and Drug Administration (FDA) has recognized erythritol as a Generally Recognized As Safe (GRAS) substance, facilitating its use in a wide range of food products. Such regulatory support bolsters consumer confidence and promotes the inclusion of erythritol in various food and beverage offerings.

Trends

Integration of Erythritol in Functional and Clean-Label Products

A notable trend in the erythritol market is its increasing incorporation into functional and clean-label food products. Consumers are becoming more health-conscious, seeking products with fewer artificial ingredients and more natural components. Erythritol, being a naturally occurring sugar alcohol with minimal calories and a low glycemic index, aligns well with these consumer preferences.

In the United States, the Food and Drug Administration (FDA) recognizes erythritol as a Generally Recognized As Safe (GRAS) substance, allowing its use in various food products without the need for premarket approval. This regulatory support has facilitated its adoption in a wide range of applications, including beverages, confectioneries, and baked goods.

The trend is also supported by government initiatives aimed at promoting healthier eating habits. Programs such as the U.S. Department of Agriculture’s (USDA) Dietary Guidelines for Americans encourage the reduction of added sugars in the diet, indirectly boosting the demand for sugar substitutes like erythritol.

Regional Analysis

North America holds a significant position in the global erythritol market, accounting for approximately 43.9% of the market share, valued at USD 111.3 million. This dominance is primarily driven by the United States, which leads in both consumption and production of erythritol. The region’s strong foothold is attributed to several factors, including a high prevalence of lifestyle-related health issues such as obesity and diabetes, which have spurred demand for low-calorie and sugar-free alternatives. According to the Centers for Disease Control and Prevention (CDC), nearly 40% of U.S. adults are obese, underscoring the growing need for healthier dietary options.

The U.S. Food and Drug Administration (FDA) has recognized erythritol as a Generally Recognized As Safe (GRAS) substance, further bolstering its acceptance in the food and beverage industry. This regulatory support has facilitated its widespread use in products ranging from beverages and baked goods to dairy items and confectionery. Additionally, the region’s robust infrastructure and technological advancements in food processing have enabled efficient production and distribution of erythritol, meeting the growing consumer demand.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Archer Daniels Midland is a global leader in agricultural processing and food ingredients, including erythritol production. With extensive fermentation capabilities and supply chain infrastructure, ADM supplies high-quality erythritol concentrates for food and beverage applications worldwide. The company’s strong R&D focus drives product innovation, meeting the rising demand for natural, low-calorie sweeteners. ADM’s strategic partnerships and global footprint enable efficient distribution, positioning it as a prominent player in the erythritol market.

Baolingbao Biology is a key Chinese manufacturer specializing in natural sweeteners such as erythritol. Leveraging advanced fermentation technology, Baolingbao produces high-purity erythritol tailored for food, pharmaceutical, and beverage industries. The company focuses on quality assurance and sustainable practices, aiming to meet increasing domestic and international demand. Baolingbao’s commitment to innovation and expanding production capacity supports its growing presence in the global erythritol market.

Buxtrade GmbH is a European-based supplier and distributor of specialty ingredients including erythritol. The company emphasizes sourcing high-quality, clean-label sweeteners to serve food manufacturers seeking sugar alternatives. Buxtrade offers customized supply chain solutions and strong customer support, catering to diverse market needs. With its focus on sustainable sourcing and regulatory compliance, Buxtrade plays an essential role in connecting producers and end-users in the erythritol supply chain across Europe and beyond.

Top Key Players in the Market

- Archer Daniels Midland (ADM)

- Baolingbao Biology Co., Ltd.

- Buxtrade GmbH

- Foodchem International Corporation

- Futaste Co., Ltd.

- Jungbunzlauer Suisse AG

- Mitsubishi Corporation

- ProAgro GmbH

- Shandong Sanyuan Biotechnology Co., Ltd.

- Tate & Lyle

- Zhucheng Xingmao Corn Developing Co., Ltd.

Recent Developments

In 2024, ADM’s Carbohydrate Solutions segment, encompassing starches and sweeteners, reported a segment operating profit of $248 million in the first quarter, reflecting a 11% decrease compared to the previous year.

In 2024, Buxtrade GmbH reported a revenue of $400,000, reflecting its strong presence in the European market. The company operates with a team of approximately 10 employees and is strategically located near Hamburg, facilitating efficient logistics and distribution. Buxtrade’s commitment to quality and customer satisfaction has solidified its position as a reputable supplier in the erythritol market.

Report Scope

Report Features Description Market Value (2024) USD 253.7 Mn Forecast Revenue (2034) USD 471.8 Mn CAGR (2025-2034) 6.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Form (Powder, Granular, Liquid), By Purity Level (High Purity (Greater-than Equal to 99%), Standard Purity (95-98%), Others), By Application (Food and Beverages, Pharmaceutical, Personal Care and Cosmetics, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Archer Daniels Midland (ADM), Baolingbao Biology Co., Ltd., Buxtrade GmbH, Foodchem International Corporation, Futaste Co., Ltd., Jungbunzlauer Suisse AG, Mitsubishi Corporation, ProAgro GmbH, Shandong Sanyuan Biotechnology Co., Ltd., Tate & Lyle, Zhucheng Xingmao Corn Developing Co., Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Archer Daniels Midland (ADM)

- Baolingbao Biology Co., Ltd.

- Buxtrade GmbH

- Foodchem International Corporation

- Futaste Co., Ltd.

- Jungbunzlauer Suisse AG

- Mitsubishi Corporation

- ProAgro GmbH

- Shandong Sanyuan Biotechnology Co., Ltd.

- Tate & Lyle

- Zhucheng Xingmao Corn Developing Co., Ltd.