ePrescibing Market By Product Type (Solutions (Standalone Solutions, and Integrated Solutions), and Services (Implementation, Network, Support, and Training)), By Substance (Controlled, and Non-controlled), By Technology (Web/Cloud-Based, and On-premise), By Application (Oncology, Cardiology, Neurology, Sports Medicine, and Others), By Usage (Handheld, and Computer Based Devices), By End-user (Hospital, Pharmacy, and Office-based Physicians), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Oct 2025

- Report ID: 161083

- Number of Pages: 381

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Product Type Analysis

- Substance Analysis

- Technology Analysis

- Application Analysis

- Usage Analysis

- End-User Analysis

- Key Market Segments

- Drivers

- Restraints

- Opportunities

- Impact of Macroeconomic / Geopolitical Factors

- Latest Trends

- Regional Analysis

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

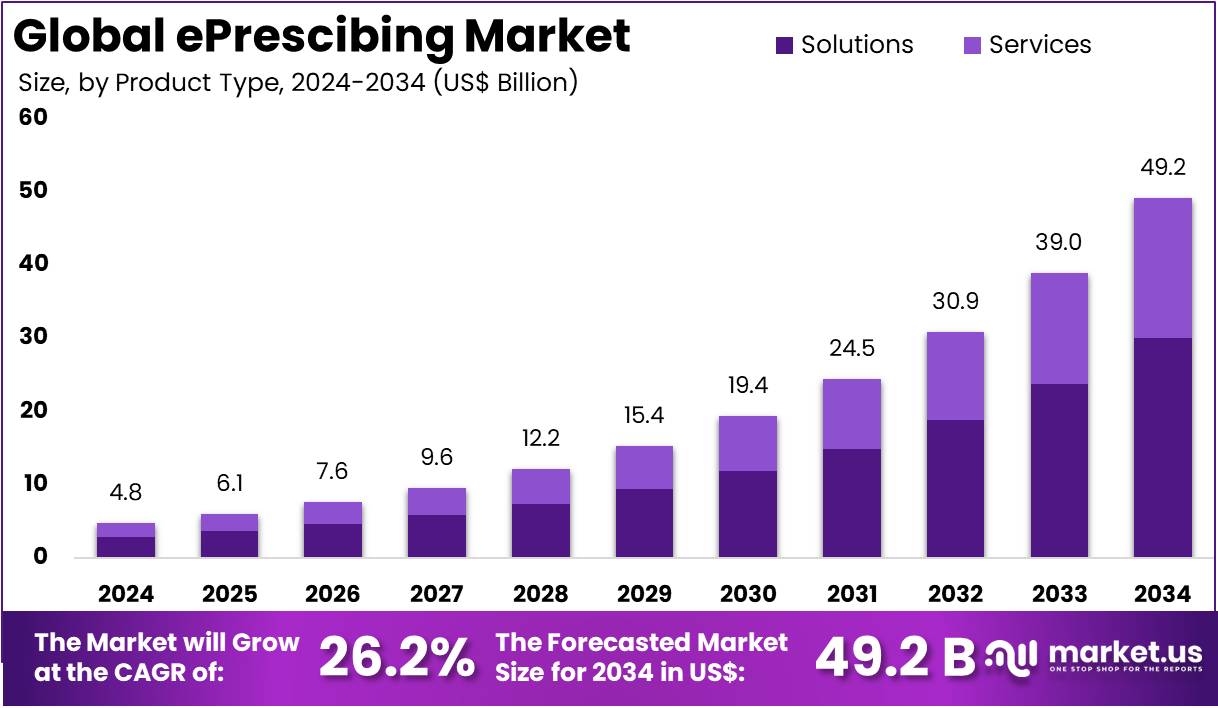

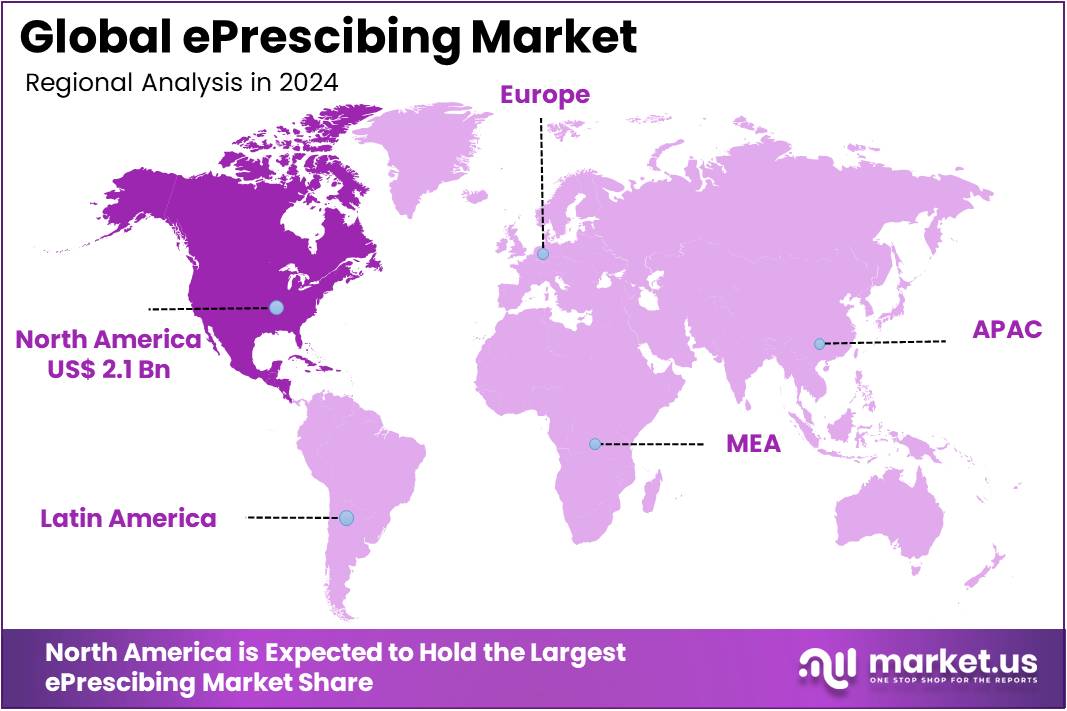

The ePrescibing Market size is expected to be worth around US$ 49.2 billion by 2034 from US$ 4.8 billion in 2024, growing at a CAGR of 26.2% during the forecast period 2025 to 2034. North America held a dominant market position, capturing more than a 43.6% share and holds US$ 2.1 Billion market value for the year.

Rising emphasis on reducing medication errors drives the ePrescribing market as healthcare providers prioritize accurate, streamlined prescription processes. Clinicians increasingly adopt ePrescribing systems for outpatient care, enabling real-time drug interaction checks to enhance patient safety during chronic disease management. The growing need for regulatory compliance fuels demand, with platforms ensuring adherence to controlled substance protocols in pain management clinics.

Pharmacies leverage these solutions for automated refill authorizations, minimizing delays in medication access for hypertension patients. In January 2025, the US DEA introduced rules allowing telemedicine-based prescribing of controlled substances, expanding ePrescribing applications without in-person exams. According to the CDC, 6% of hospital admissions stem from adverse drug events, underscoring the critical role of ePrescribing in improving prescription accuracy.

Growing demand for integrated healthcare systems creates significant opportunities in the ePrescribing market. Innovators develop platforms that sync with telehealth portals, supporting virtual consultations for mental health prescriptions. Healthcare networks explore ePrescribing for population health management, analyzing prescription trends to optimize antibiotic stewardship programs. Opportunities also arise in pediatric care, where systems streamline dosage calculations for weight-based medications.

In October 2023, FDB and Veradigm integrated FDB Vela™ into Veradigm’s EHRs and ePrescribe Enterprise solution, enhancing interoperability for medication data exchange. The Office of the National Coordinator for Health IT reports that 88% of office-based physicians used ePrescribing in 2021, highlighting the potential for broader adoption in diverse clinical workflows.

Recent trends in the ePrescribing market focus on enhanced interoperability and mobile accessibility to optimize prescribing efficiency. Developers incorporate real-time benefit verification into platforms, aiding applications like oncology treatment planning by confirming formulary coverage. Trends also include AI-driven decision support for allergy clinics, flagging potential adverse reactions during antihistamine prescribing.

Mobile apps enable on-the-go prescribing for urgent care providers, streamlining workflows for acute infection treatments. In January 2025, the US DEA’s telemedicine prescribing rules further advanced remote ePrescribing capabilities. These developments, coupled with a reported 15% increase in ePrescribing adoption among small practices in 2023 per recnt surveys, signal a shift toward connected, user-centric prescription ecosystems.

Key Takeaways

- In 2024, the market generated a revenue of US$ 4.8 billion, with a CAGR of 26.2%, and is expected to reach US$ 49.2 billion by the year 2034.

- The product type segment is divided into solutions and services, with solutions taking the lead in 2024 with a market share of 61.2%.

- Considering substance, the market is divided into controlled and non-controlled. Among these, controlled held a significant share of 55.4%.

- Furthermore, concerning the technology segment, the market is segregated into web/cloud-based and on-premise. The web/cloud-based sector stands out as the dominant player, holding the largest revenue share of 58.7% in the market.

- The application segment is segregated into oncology, cardiology, neurology, sports medicine, and others, with the oncology segment leading the market, holding a revenue share of 28.6%.

- Considering usage, the market is divided into handheld and computer based devices. Among these, handheld held a significant share of 53.8%.

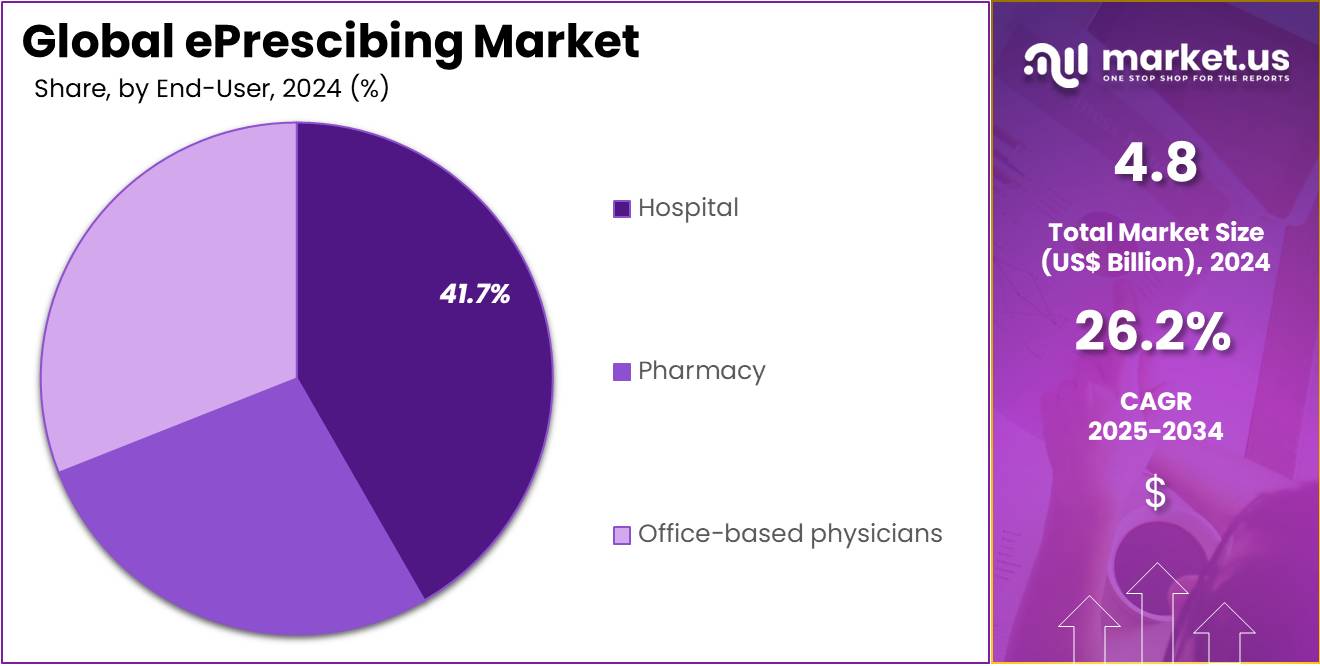

- The end-user segment is segregated into hospital, pharmacy, and office-based physicians, with the hospital segment leading the market, holding a revenue share of 41.7%.

- North America led the market by securing a market share of 43.6% in 2024.

Product Type Analysis

Solutions dominate the ePrescribing market with a 61.2% share and are projected to continue growing due to increasing adoption of integrated prescribing platforms. Solutions provide healthcare providers with real-time access to patient data, prescription history, and drug interaction alerts, enhancing patient safety and reducing errors. The rising prevalence of chronic diseases, coupled with the growing need for streamlined healthcare workflows, is expected to drive the demand for comprehensive ePrescribing solutions.

Providers are increasingly adopting these solutions to improve operational efficiency, reduce paperwork, and ensure compliance with regulatory standards. The integration of electronic health records (EHRs) with ePrescribing solutions is likely to enhance workflow efficiency further. Cloud-based solutions offer scalability and remote access, which is anticipated to accelerate adoption across hospitals, clinics, and pharmacies. The focus on reducing medication errors and improving prescription accuracy is expected to strengthen the growth of solutions in this market.

Substance Analysis

Controlled substances account for 55.4% of the market and are expected to maintain strong growth due to the strict regulatory requirements surrounding their prescription. ePrescribing of controlled substances helps providers comply with government regulations, prevent abuse, and ensure accurate tracking of medications. The opioid epidemic and increasing concerns about substance misuse are likely to drive adoption of electronic prescribing for controlled drugs.

Hospitals, clinics, and pharmacies increasingly rely on ePrescribing systems to track controlled medication prescriptions efficiently. These systems provide safeguards, such as real-time validation, reporting, and audit trails, which are expected to enhance regulatory compliance. The growing emphasis on patient safety and secure medication management is likely to further boost demand. Additionally, increasing government initiatives supporting ePrescribing for controlled substances are anticipated to accelerate market growth, making this segment a crucial component of the overall ePrescribing ecosystem.

Technology Analysis

Web/cloud-based ePrescribing technology holds 58.7% of the market and is anticipated to experience significant growth due to its accessibility, scalability, and cost-effectiveness. Cloud-based platforms allow healthcare providers to access prescription data from any location, improving coordination between hospitals, clinics, and pharmacies. The rising adoption of cloud infrastructure in healthcare is projected to facilitate remote prescribing and telemedicine initiatives. Cloud-based systems offer real-time updates, secure data storage, and integration with EHRs, enhancing overall efficiency and compliance.

The ability to support multiple users and locations without significant hardware investment is expected to drive adoption in both small and large healthcare institutions. Additionally, the increasing demand for digital healthcare solutions during the COVID-19 pandemic has accelerated cloud-based adoption, which is likely to continue in the coming years. Cloud technology also enables faster updates and better scalability, ensuring the segment’s sustained growth in the ePrescribing market.

Application Analysis

Oncology accounts for 28.6% of the ePrescribing market and is projected to grow steadily due to the increasing prevalence of cancer and the complexity of oncology treatment protocols. ePrescribing systems help oncologists manage complex chemotherapy regimens, monitor drug interactions, and ensure accurate dosing, which is critical for patient safety. The growing adoption of personalized medicine in oncology, including targeted therapies and immunotherapy, is expected to drive demand for robust ePrescribing systems.

Integration with EHRs enables oncologists to access patient histories, track progress, and adjust treatments efficiently. Additionally, the rising number of cancer centers and outpatient oncology clinics worldwide is likely to expand the market for oncology-focused ePrescribing solutions. Governments and healthcare organizations are increasingly implementing digital solutions to enhance treatment safety, which is anticipated to accelerate adoption. Overall, the combination of rising cancer incidence and advanced treatment requirements supports the growth of this application segment.

Usage Analysis

Handheld devices hold 53.8% of the ePrescribing market and are expected to experience robust growth due to the increasing need for mobility and real-time access to prescription information. Physicians, nurses, and pharmacists increasingly use handheld devices to review patient data, verify prescriptions, and communicate with healthcare teams. The portability of handheld devices allows healthcare professionals to access prescribing information at the point of care, reducing errors and improving workflow efficiency.

Handheld systems are particularly useful in hospital wards, clinics, and remote or home-based care environments. The rising adoption of mobile health technologies and tablets is anticipated to further boost the demand for handheld ePrescribing devices. Additionally, the ability to integrate with cloud-based platforms and EHR systems enhances usability, making handheld devices an essential tool for modern healthcare providers. Continuous innovation in mobile device software and security features is likely to sustain growth in this segment.

End-User Analysis

Hospitals account for 41.7% of the end-user market and are projected to remain a leading segment due to their high volume of prescription activity and need for accurate medication management. Hospitals implement ePrescribing systems to improve patient safety, reduce medication errors, and enhance operational efficiency across multiple departments. The integration of ePrescribing solutions with hospital EHRs enables better coordination between physicians, pharmacists, and nursing staff, which is expected to drive adoption.

The rising prevalence of chronic and complex diseases increases the demand for accurate prescription tracking and management in hospitals. Additionally, hospitals are increasingly investing in digital health infrastructure and technology-driven patient care solutions, which is likely to further expand ePrescribing adoption. Government regulations and incentives supporting electronic prescribing in hospitals are anticipated to accelerate growth. The combination of regulatory support, patient safety concerns, and operational efficiency needs ensures hospitals remain a dominant end-user segment in the market.

Key Market Segments

By Product Type

- Solutions

- Standalone Solutions

- Integrated Solutions

- Services

- Implementation

- Network

- Support

- Training

By Substance

- Controlled

- Non-controlled

By Technology

- Web/Cloud-Based

- On-premise

By Application

- Oncology

- Cardiology

- Neurology

- Sports Medicine

- Others

By Usage

- Handheld

- Computer Based Devices

By End-user

- Hospital

- Pharmacy

- Office-based Physicians

Drivers

Regulatory Mandates for Controlled Substances is driving the market

The ePrescribing market is heavily driven by the increasing number of regulatory mandates, particularly those focusing on the electronic prescribing of controlled substances (EPCS). These government-level requirements force prescribers to transition from traditional paper-based methods to secure, electronic systems to combat the national opioid epidemic, reduce prescription fraud, and improve overall public safety.

As states enact laws to mandate EPCS, healthcare organizations must quickly adopt compatible ePrescribing solutions, providing a significant and non-optional catalyst for market growth. This regulatory push shifts the purchase decision from a value-based choice to a compliance-based necessity, ensuring market penetration across various healthcare settings, including hospitals, clinics, and pharmacies. The Centers for Medicare & Medicaid Services (CMS) also actively updates its standards to ensure full compliance across federal healthcare programs.

A verifiable example of this national-level mandate driving adoption is the requirement by CMS that entities must exclusively use the newest version of the NCPDP SCRIPT standard (version 2023011) for Part D ePrescribing starting January 1, 2028, with a transition period beginning in July 2024. This compliance deadline forces all providers and technology vendors supporting Medicare Part D to upgrade their systems, thereby driving innovation and market activity in the near term.

Restraints

High Initial Cost of Implementation and Maintenance is restraining the market

A major restraint on the ePrescribing market is the significant cost associated with the initial deployment and long-term maintenance of the required IT infrastructure, which often proves prohibitive for smaller, independent practices and organizations in emerging economies.

The capital investment involves not just the purchase of the ePrescribing software license but also the expenses for hardware, system integration with existing Electronic Health Records (EHRs), and initial training and education for clinical and administrative staff. These financial barriers are especially pronounced in ambulatory settings, where the return on investment may be less immediate compared to large hospital systems.

Furthermore, the reliance on subscription-based models and the need for continuous IT support add to the ongoing operational expenditure. This cost factor significantly limits the rate of global adoption. While specific government-cited annual costs are scarce, industry reports frequently point to this being a major financial hurdle, estimating that the average annual cost for an ePrescribing system can range from US$500 to US$800 per prescriber. This recurrent fee, when multiplied across a practice’s staff, creates a substantial, continuous budget line item that smaller and low-resource facilities often cannot justify, thereby slowing down market expansion outside of large, well-funded healthcare networks.

Opportunities

Expansion of Pharmacist-Initiated Prescribing is creating growth opportunities

The evolving scope of practice for pharmacists, specifically their increasing authority to initiate or modify prescriptions in various states, presents a significant growth opportunity for the ePrescribing market. This shift recognizes pharmacists as accessible care providers and extends the patient’s point of care beyond the traditional physician’s office, especially in community settings for issues like minor ailments or emergency contraception.

For pharmacists to manage these expanded responsibilities efficiently and safely, they require robust ePrescribing capabilities integrated directly into their pharmacy management systems. This creates a large new segment of professional users demanding advanced ePrescribing solutions that support their clinical decision-making.

The opportunity is numerically validated by the growth witnessed in this segment. According to key industry data provider Surescripts, the total number of e-prescriptions issued by a pharmacist increased by 13% between 2022 and 2023, with the number of pharmacists actively e-prescribing increasing by 28.8% in the same timeframe. This rapid growth confirms that the regulatory and professional recognition of pharmacists as prescribers is not just a theoretical shift but a quantifiable expansion of the ePrescribing user base, driving demand for tailored software solutions.

Impact of Macroeconomic / Geopolitical Factors

Elevated borrowing costs and inflationary pressures challenge developers in the digital prescription platform sector, forcing them to trim feature rollouts and heighten scrutiny on vendor contracts. Ongoing Russia-Ukraine hostilities and broader supply disruptions in Eastern Europe impede deliveries of server-grade processors, extending deployment horizons for integrated EHR systems and inflating integration fees for regional health networks. Astute providers, however, accelerate cloud-native architectures with domestic data centers, fortifying compliance and slashing latency for point-of-care decisions.

Expanding telehealth mandates inject vigor into interoperability standards, elevating adoption rates among ambulatory practices. Moreover, the US universal baseline 10% tariff on imports, effective April 5, 2025, escalates outlays for foreign-sourced APIs and middleware, denting ROI for startup entrants and complicating scalability for enterprise licenses. This policy engenders hesitancy in cross-border tech acquisitions, sporadically hampering API enrichments tied to global formularies. Forward-thinking entities capitalize on innovation tax credits to nurture in-house algorithm teams, pioneering blockchain-secured transmission protocols and enriching talent pools in cybersecurity.

Latest Trends

Focus on Real-Time Benefit and Price Transparency is a recent trend

A dominant and recent trend in the ePrescribing market is the intense focus on integrating Real-Time Prescription Benefit (RTPB) and price transparency data directly into the prescriber’s workflow at the point of care. This goes beyond basic formulary checks and actively shows the patient’s out-of-pocket cost and lower-cost therapeutic alternatives before the prescription is sent to the pharmacy. This trend is driven by the growing issue of prescription abandonment due to high costs, which directly impacts medication adherence and patient outcomes.

By providing immediate financial information, prescribers can select an affordable option, increasing the likelihood that the patient will fill the prescription. This functionality is being rapidly adopted and improved by major industry players. In its 2024 annual report, Surescripts, a leading health information network, noted that when prescribers used their Real-Time Prescription Benefit tool to find a lower-cost alternative medication, they saved patients an average of US$82 per prescription in 2024, marking a significant increase from the US$37 average savings reported in 2023. This jump in savings demonstrates the tangible value and market-shifting impact of real-time price transparency in the ePrescribing workflow.

Regional Analysis

North America is leading the ePrescibing Market

In 2024, North America held a 43.6% share of the global ePrescribing market, driven by stringent federal mandates for secure electronic prescribing and the integration of seamless digital workflows to curb medication errors amid rising opioid oversight. Clinicians embraced these platforms to mitigate transcription errors, achieving up to 50% reductions in adverse drug events through built-in formulary checks and patient allergy alerts during ambulatory encounters.

The Centers for Medicare & Medicaid Services’ enforcement of electronic prescribing for Medicare Part D further accelerated uptake, aligning with broader interoperability goals under the 21st Century Cures Initiative to enhance care transitions in fragmented delivery models. Pharmaceutical stakeholders collaborated with software developers to embed real-time prior authorization workflows, streamlining approvals for high-cost specialties and alleviating administrative delays in oncology protocols.

Heightened cybersecurity protocols addressed data breach concerns, bolstering institutional confidence in cloud-hosted solutions for multi-site practices. Fiscal analyses from federal audits revealed appreciable savings in operational efficiencies, prompting widespread retrofitting of legacy systems in community health centers. These progressive measures exemplified the region’s dedication to fortified digital prescribing infrastructures. Surescripts documented 1.34 million prescribers utilizing ePrescribing in 2024, marking a 3.9% rise from 2023 levels. This expansion builds on 2022 figures of 1.23 million prescribers, reflecting a 7.9% year-over-year increment.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Policymakers in Asia Pacific anticipate the ePrescribing sector to intensify during the forecast period, as sovereign investments fortify national digital health architectures to counter medication discrepancies in overburdened primary care settings. Regulators in Indonesia and Malaysia direct allocations toward subsidized interfaces, enabling rural dispensaries to interface with central repositories for instantaneous verification amid escalating antibiotic stewardship imperatives.

Technology consortia engage indigenous coders to refine multilingual validation engines, projecting diminished forgery incidents in cross-border migrant consultations. Administrative bodies in New Zealand and Taiwan pioneer biometric authentication layers, positioning outpatient hubs to expedite renewals for chronic regimens without physical validations. Authorities estimate amplifying open-access portals for expatriate populations, alleviating bottlenecks in urban polyclinics through API-driven integrations.

Domestic innovators cultivate predictive refill algorithms, harmonizing with public insurance ledgers to preempt stockouts for essential antihypertensives. These configurations underpin a cohesive continuum for prescribant oversight. A 2024 survey revealed 98% of Australian community pharmacies employing ePrescribing systems, underscoring entrenched operational reliance.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Prominent enterprises in the digital prescription arena propel advancement by embedding AI capabilities for error detection and dosage optimization, enabling prescribers to access real-time formulary checks during consultations. They negotiate licensing deals with pharmacy benefit managers to synchronize prior authorization processes, minimizing delays and elevating compliance in specialty drug handling. Innovators allocate budgets to interoperability upgrades that link platforms with lab results and patient portals, fostering holistic care coordination.

Executives scout acquisitions of compliance-focused startups to embed controlled substance safeguards, aligning with federal mandates for secure transmissions. They intensify campaigns in underserved urban and rural pockets, deploying mobile-first interfaces to bridge access gaps for independent practices. Moreover, they craft hybrid revenue structures blending licensing fees with usage analytics, incentivizing sustained adoption among mid-sized clinics.

Surescripts LLC, formed in 2003 through a collaboration between pharmacy and payer networks and based in Arlington, Virginia, operates the nation’s largest health information network dedicated to secure medication data exchange. The organization facilitates billions of transactions annually, connecting over 3,000 EHR vendors and 2,000 pharmacies to streamline clinical messaging and reduce fraud.

Surescripts invests in foundational protocols like RouteSmart for intelligent routing, enhancing efficiency in prescription fulfillment. CEO Kevin Brandt oversees a mission-driven entity that prioritizes data neutrality and collaborative governance among stakeholders. The firm engages with federal agencies to shape standards for electronic prior authorizations, bolstering public health safeguards. Surescripts anchors its pivotal role by championing transparent, equitable systems that underpin safer prescribing practices nationwide.

Top Key Players in the ePrescibing Market

- Surescripts

- Practice Fusion, Inc

- NXGN Management, LLC

- McKesson Corporation

- Epic Systems Corporation

- DrFirst

- Change Healthcare

- Cerner Corporation (Oracle)

- Athenahealth

- Allscripts Healthcare, LLC

Recent Developments

- In October 2025: New policy changes in the US took effect, allowing healthcare providers using certified health IT systems to e-Prescribe, check drug coverage and pricing, and submit prior authorization requests with real-time information. Though this is a regulatory mandate, it directly impacts and is supported by key ePrescribing vendors like Epic and Cerner. This development drives the market by mandating the use of advanced functionality like electronic prior authorization (ePA) and real-time benefit checks (RTBC), making these features an essential part of ePrescribing solutions and accelerating their integration and use across the healthcare system.

- In April 2025: Surescripts, a leading health intelligence network that processes a vast majority of US electronic prescriptions, was designated as a Qualified Health Information Network (QHIN) under the US federal government’s Trusted Exchange Framework and Common Agreement (TEFCA). This designation is a critical step in nationwide interoperability, allowing Surescripts’ network to more seamlessly transfer comprehensive patient health data, beyond just prescription information, with other major health information networks. This cross-industry collaboration ensures that prescribers, pharmacies, and other healthcare entities can exchange information securely, enhancing the accuracy and safety of e-prescribing and medication management.

Report Scope

Report Features Description Market Value (2024) US$ 4.8 billion Forecast Revenue (2034) US$ 49.2 billion CAGR (2025-2034) 26.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Solutions (Standalone Solutions, and Integrated Solutions), and Services (Implementation, Network, Support, and Training)), By Substance (Controlled, and Non-controlled), By Technology (Web/Cloud-Based, and On-premise), By Application (Oncology, Cardiology, Neurology, Sports Medicine, and Others), By Usage (Handheld, and Computer Based Devices), By End-user (Hospital, Pharmacy, and Office-based Physicians) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Surescripts, Practice Fusion, Inc, NXGN Management, LLC, McKesson Corporation, Epic Systems Corporation, DrFirst, Change Healthcare, Cerner Corporation (Oracle), Athenahealth, Allscripts Healthcare, LLC Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Surescripts

- Practice Fusion, Inc

- NXGN Management, LLC

- McKesson Corporation

- Epic Systems Corporation

- DrFirst

- Change Healthcare

- Cerner Corporation (Oracle)

- Athenahealth

- Allscripts Healthcare, LLC