Global Enterprise Conversational AI Platform Market Size, Share, Growth Analysis By Component (Solutions/Platforms, Services (Professional and Managed)), By Deployment Mode (On-Premises, Cloud-Based), By Technology (Machine Learning (ML), Natural Language Processing (NLP), Speech Recognition, Deep Learning, Computer Vision (limited integrations)), By Application (Customer Support and Service Automation, Sales and Marketing, Human Resource Management, IT Help-desk Automation, Others (finance, compliance, operations)), By End-Use Industry (BFSI, Retail and E-commerce, Healthcare, IT and Telecom, Manufacturing, Travel and Hospitality, Education, Others (government, logistics, energy)), By Interaction Type (Text-Based, Voice-Based, Multi-Modal (voice + text + vision)), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Nov 2025

- Report ID: 165366

- Number of Pages: 281

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Role Of AI

- AI Industry Adoption

- Emerging Trends

- US Market Size

- By Component

- By Deployment Mode

- By Technology

- By Application

- By End-Use Industry

- By Interaction Type

- Key Market Segments

- Regional Analysis

- Driving Factors

- Restraint Factors

- Growth Opportunities

- Trending Factors

- Competitive Analysis

- Recent Developments

- Report Scope

Report Overview

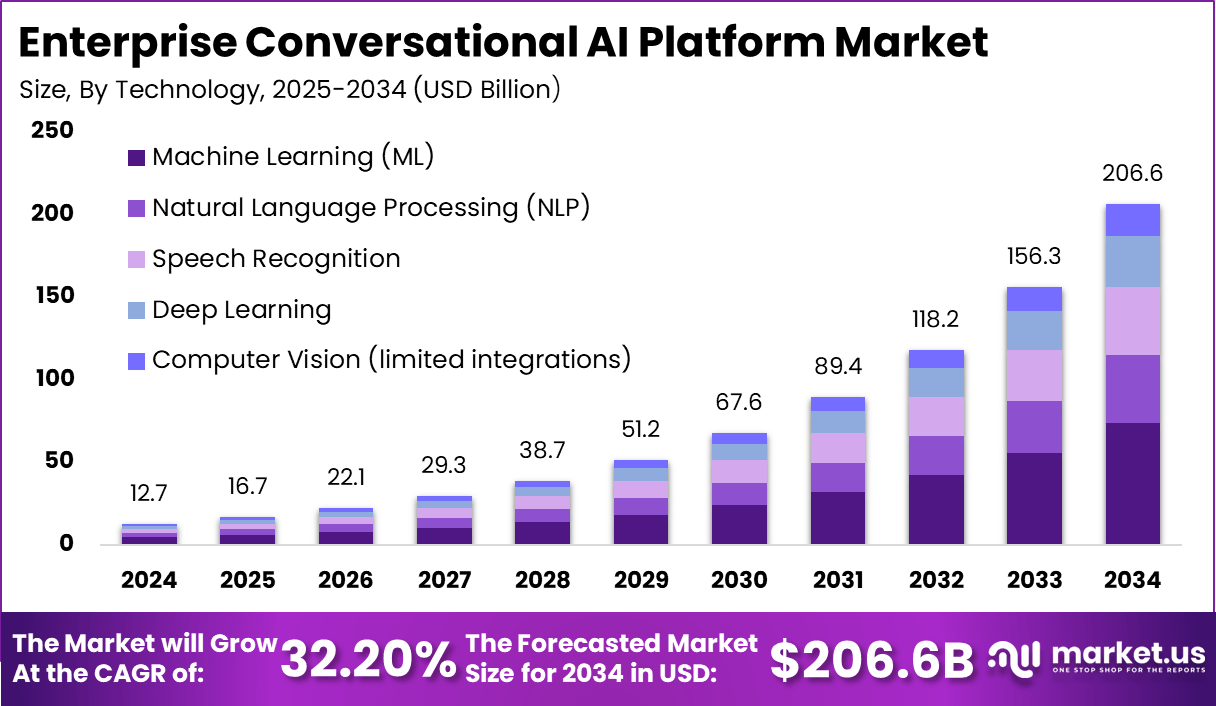

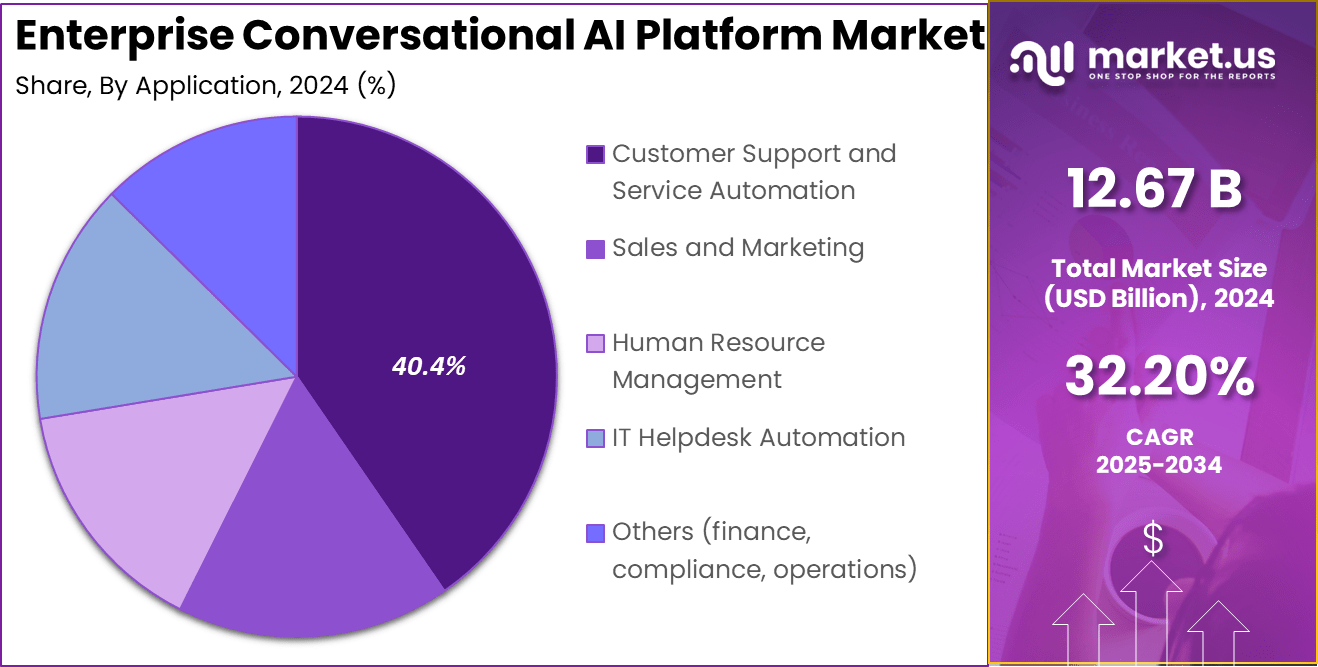

The global Enterprise Conversational AI Platform Market, valued at USD 12.67 billion in 2024, is projected to reach USD 206.6 billion by 2034, expanding at a CAGR of 32.2%. The surge is driven by the widespread adoption of AI-powered conversational systems that automate communication, customer support, and workflow management.

Enterprises are increasingly integrating natural language processing (NLP), generative AI, and machine learning technologies to improve user interaction, enhance productivity, and deliver personalized experiences across multiple digital channels. The growing demand for intelligent virtual assistants and chatbots across industries further strengthens the market outlook.

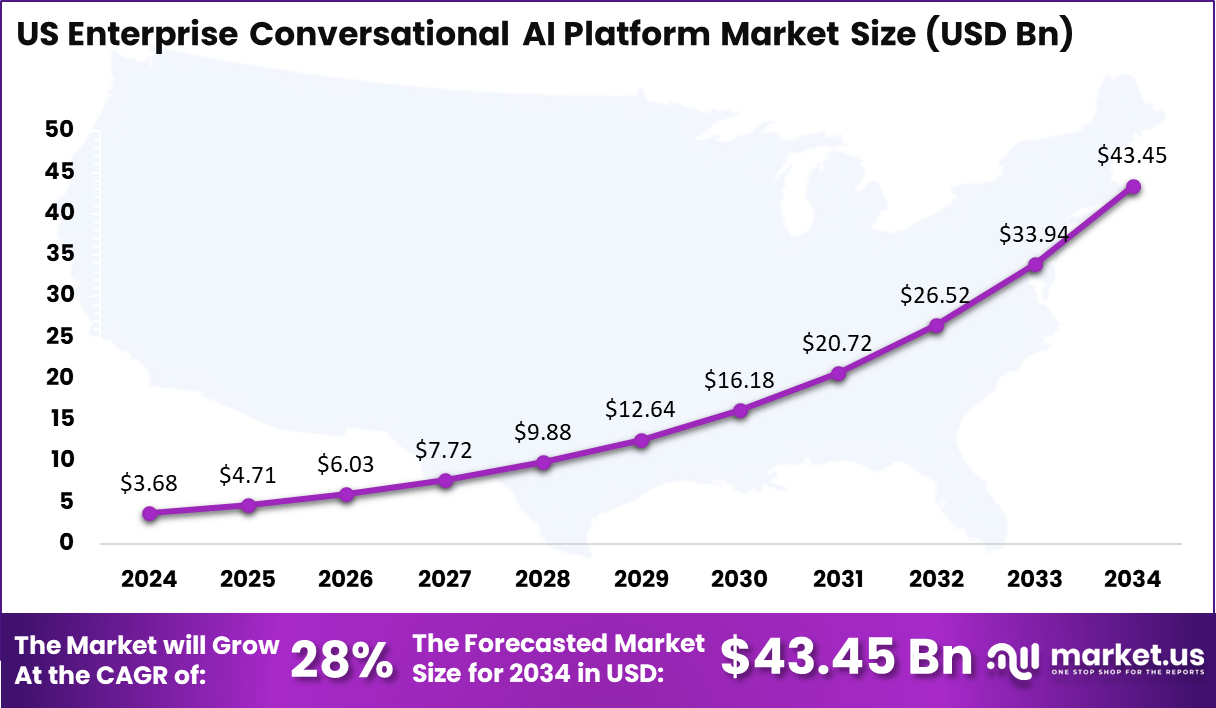

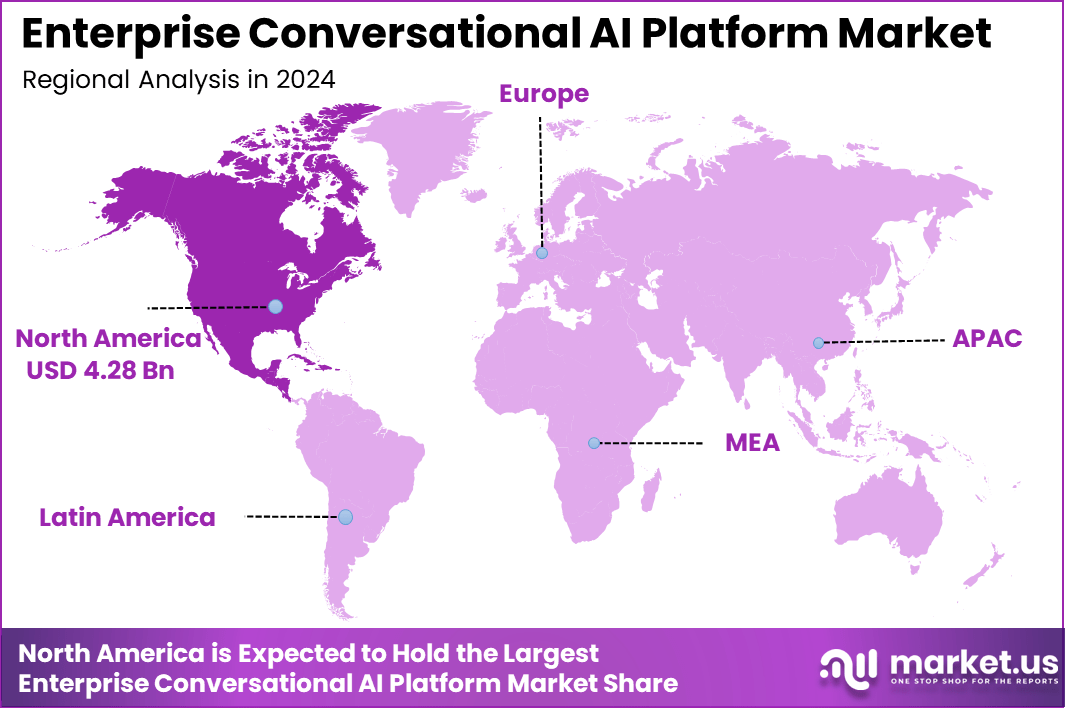

North America dominates the global market, holding a 33.8% share in 2024 with a valuation of USD 4.28 billion. The US leads the regional growth, estimated at USD 3.68 billion in 2024 and projected to reach USD 43.45 billion by 2034 at a CAGR of 28%.

This growth is supported by high enterprise digital transformation, strong AI research infrastructure, and the rapid deployment of cloud-based conversational solutions. Leading technology firms in the region are investing heavily in AI model development and enterprise automation tools, reinforcing North America’s leadership position. Meanwhile, emerging economies are expected to accelerate adoption as businesses pursue AI-driven efficiency and customer engagement.

The Enterprise Conversational AI Platform market is experiencing rapid expansion as enterprises increasingly integrate artificial intelligence into their communication and operational frameworks. These platforms enable organizations to automate conversations, streamline workflows, and enhance customer engagement through natural, human-like interactions.

The growing adoption of natural language processing (NLP), machine learning, and generative AI has transformed how enterprises manage customer support, internal collaboration, and sales functions. Businesses are using conversational AI to improve responsiveness, reduce manual workload, and provide consistent, personalized experiences across multiple communication channels, making it a key component of modern digital transformation strategies.

The market’s growth is further fueled by the rising need for enterprise automation, cloud-based deployment models, and real-time data analytics. Organizations across industries such as BFSI, retail, healthcare, and IT services are deploying AI chatbots and virtual assistants to enhance efficiency and operational intelligence.

North America remains a leading region due to its strong AI research ecosystem and advanced digital infrastructure, while Asia-Pacific is witnessing rapid adoption driven by expanding enterprise digitalization. As conversational AI technologies continue to evolve, enterprises are focusing on integrating context-aware and emotionally intelligent systems to redefine customer interactions and improve decision-making across the organizational landscape.

Recent developments in the enterprise conversational AI platform market in 2025 show strong growth through major acquisitions, funding rounds, and product innovations. One notable acquisition was NiCE’s purchase of Cognigy for approximately $955 million.

This deal allows NiCE to integrate Cognigy’s conversational AI platform into its customer experience solutions, creating an end-to-end system that can listen, understand, decide, execute, and log customer interactions. The acquisition complements NiCE’s existing offerings by adding the front-end conversational capabilities, while also expanding access to European markets and the over 1,000 enterprise clients Cognigy serves.

Funding for conversational AI startups continues to rise sharply, with over $2.8 billion disclosed in funding rounds during 2024 and the first half of 2025. For example, Uniphore raised $400 million in Series E funding at a $2.5 billion valuation in January 2025, focusing on conversational automation for customer experience.

Other significant rounds include PolyAI’s $50 million Series C and Mistral AI’s $640 million Series B, showing investor confidence across both foundational large language model development and enterprise-focused automation solutions. These funding increases reflect a broader AI investment surge, with conversational AI representing a substantial share of startup funding in early 2025.

Additionally, Automation Anywhere acquired conversational AI firm Aisera in November 2025 to enhance its agentic process automation platform, aiming to streamline IT service management through conversational AI capabilities, marking another key consolidation in the market. Workday’s acquisition of Paradox in October 2025 also added conversational AI-powered recruiting and HR tools to its enterprise AI platform portfolio.

Key Takeaways

- The global Enterprise Conversational AI Platform Market is valued at USD 12.67 billion in 2024 and is projected to reach USD 206.6 billion by 2034, expanding at a CAGR of 32.2%.

- North America dominates the global market, accounting for a 33.8% share with a 2024 valuation of USD 4.28 billion.

- The US leads the regional landscape with a 2024 size of USD 3.68 billion and is expected to grow to USD 43.45 billion by 2034, registering a CAGR of 28%.

- By Component, Solutions/Platforms hold the dominant share of 67.7%, driven by increasing enterprise adoption of AI-integrated communication tools.

- By Deployment Mode, On-Premises accounts for 70.2%, attributed to data privacy, compliance, and security requirements in large organizations.

- By Technology, Machine Learning (ML) leads with 35.6%, reflecting its critical role in enabling adaptive, context-aware conversational experiences.

- By Application, Customer Support and Service Automation capture 40.4%, supported by the growing demand for efficient, round-the-clock interaction systems.

- By End-Use Industry, BFSI represents 30.2%, as financial institutions increasingly deploy AI chatbots and assistants for customer engagement and fraud prevention.

- By Interaction Type, Text-Based communication dominates with 48.5%, owing to widespread integration in customer messaging, live chat, and support interfaces.

Role Of AI

Artificial intelligence plays a central role in shaping the Enterprise Conversational AI Platform market by driving automation, personalization, and scalability in enterprise communication. AI technologies such as natural language processing (NLP), machine learning (ML), and large language models (LLMs) enable systems to understand, interpret, and respond to human language with contextual accuracy.

This capability allows organizations to create seamless, human-like interactions across customer service, HR, sales, and internal collaboration channels. AI enhances efficiency by automating repetitive tasks, reducing human intervention, and improving response times, which collectively boost customer satisfaction and operational productivity.

The integration of AI also empowers enterprises with data-driven insights and adaptive learning capabilities. Machine learning models continuously analyze user behavior and conversation patterns, enabling platforms to deliver personalized responses and predictive assistance. Generative AI further strengthens conversational platforms by enabling dynamic content generation, sentiment analysis, and multi-language support.

As AI algorithms become more advanced, enterprises are transitioning from basic chatbot systems to intelligent virtual agents capable of understanding emotions and intent. Overall, AI acts as the backbone of enterprise conversational systems, facilitating smarter communication, better decision-making, and an enhanced user experience across business functions, thereby redefining the digital interaction landscape for modern enterprises.

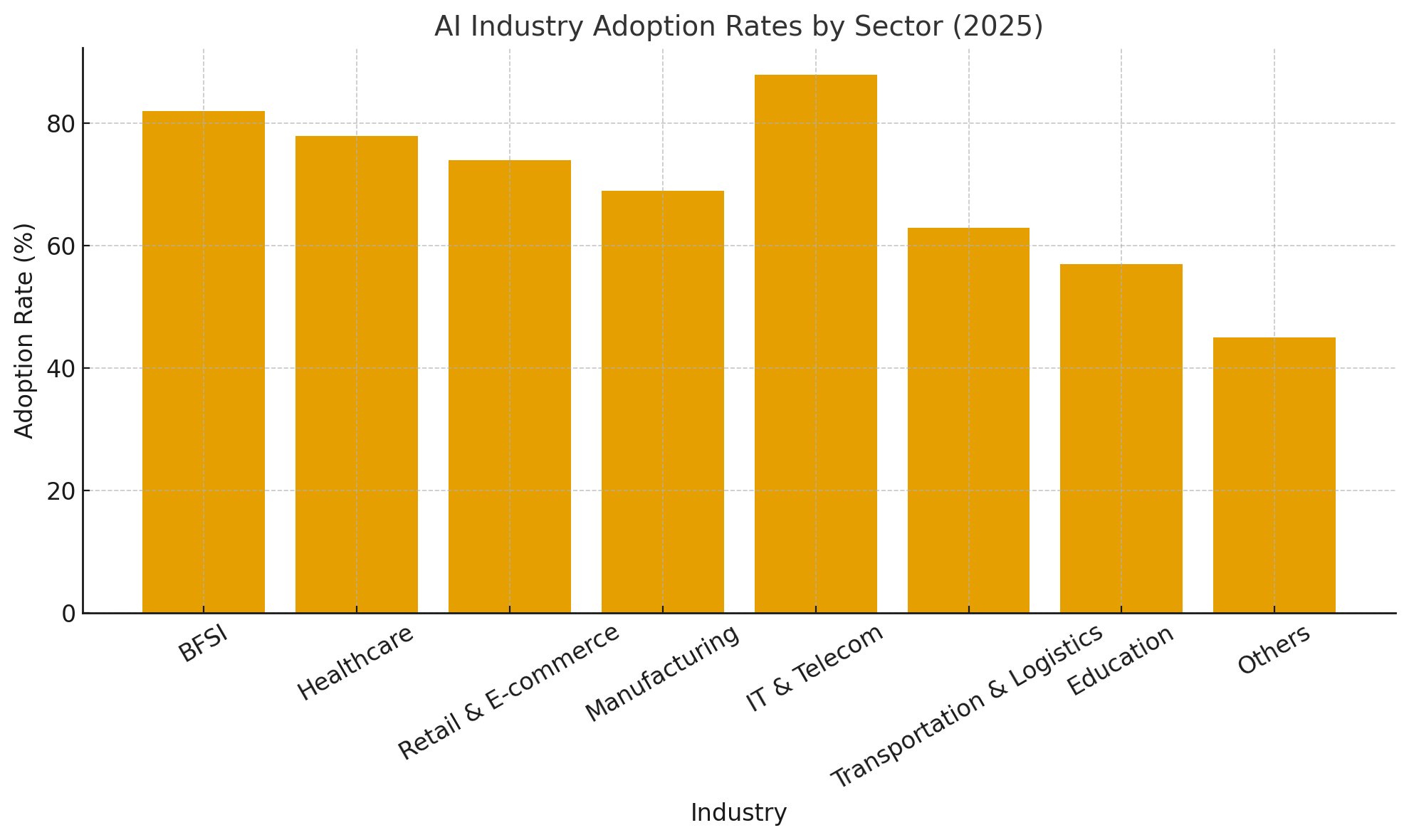

AI Industry Adoption

The adoption of AI across industries has moved beyond experimentation to steady integration, with 88% of organizations reporting regular use of AI in at least one business function, up from 78% a year earlier. However, only 23% of respondents say they are scaling agentic AI systems across multiple functions. In the context of conversational AI specifically, organizations are rapidly embracing platforms to improve customer engagement and operational efficiency.

The use of conversational analytics, AI, and automation is forecast to rise steeply—from 17% to as much as 76%—as more enterprises invest in these technologies. Industries such as BFSI, healthcare, retail, and IT services are leading this adoption, leveraging conversational AI for customer support, virtual assistants, and internal workflow automation.

Despite strong momentum, adoption varies by region and firm size: larger enterprises and tech-intensive firms lead, whereas many small firms and firms in less AI-mature geography remain in pilot phases. The trend suggests that while AI adoption is widespread, scaling across business functions and achieving enterprise-wide integration remain key challenges.

Emerging Trends

- Conversational AI is moving from rule-based chatbots to intelligent agents that use context, memory, and real-time data to deliver personalised interactions.

- Multimodal experiences combining text, voice, and visual inputs (e.g., voice assistants, video chatbots, AR-enabled agents) are becoming more common, enhancing user engagement and accessibility.

- Multilingual and cross-region support is gaining significance as enterprises serve global audiences, driving conversational AI systems to handle language variants, local dialects, and translation in real time.

- Integration with enterprise systems (CRM, knowledge bases, workflow tools) is deepening, enabling conversational platforms to fetch data, trigger actions, and provide seamless hand-offs between bot and human.

- Adoption of low-code/no-code platforms is rising, enabling business users to configure conversational agents without heavy developer dependency, thereby accelerating deployment and reducing time-to-value.

- Enhanced analytics, sentiment detection, emotional intelligence, and adaptive learning are enabling conversational agents to improve over time, recognize tone or mood, and refine responses based on user behaviour.

- Privacy, governance, and compliance are becoming integral, particularly for regulated industries; conversational platforms are being built with audit trails, secure data pipelines, and domain-specific controls.

US Market Size

The US enterprise conversational AI platform market is witnessing exceptional growth, driven by rapid advancements in artificial intelligence, natural language processing (NLP), and generative AI technologies. Valued at USD 3.68 billion in 2024, the market is projected to surge to USD 43.45 billion by 2034, expanding at a CAGR of 28%.

This growth is primarily attributed to the increasing demand for AI-powered virtual assistants, chatbots, and voice-based systems that enhance customer interaction, streamline enterprise workflows, and reduce operational costs. Enterprises across industries, particularly BFSI, healthcare, retail, and IT services, are adopting conversational AI to automate service delivery and improve engagement efficiency.

The US remains at the forefront of technological innovation due to its robust AI ecosystem, extensive R&D investments, and strong presence of leading tech companies such as Google, Microsoft, IBM, and Amazon. The adoption of large language models (LLMs) in enterprise systems has further accelerated market expansion by enabling more natural, context-aware conversations.

The growing emphasis on omnichannel communication, personalized customer experiences, and compliance with privacy regulations is also shaping market evolution. As enterprises continue their digital transformation journeys, conversational AI platforms are expected to become integral to business operations, driving smarter communication and enhanced decision-making across sectors.

By Component

Solutions and platforms account for 67.7% of the enterprise conversational AI platform market, underscoring the strong enterprise preference for scalable, ready-to-deploy systems that combine natural language processing, machine learning, and automation capabilities. These platforms enable organizations to build, train, and deploy intelligent virtual assistants and chatbots seamlessly across multiple communication channels, improving response times and enhancing customer engagement.

The growing emphasis on digital transformation and self-service models has further accelerated adoption, as enterprises seek unified solutions that integrate easily with CRM, ERP, and workflow management systems to deliver consistent, efficient, and data-driven interactions.

Services, including professional and managed offerings, hold a smaller share but play a vital supporting role in the ecosystem. These services are essential for implementing, customizing, and maintaining AI platforms according to enterprise-specific needs, ensuring alignment with compliance and data governance standards.

Managed service providers also help enterprises optimize conversational AI performance, update models, and monitor analytics to improve system accuracy and customer satisfaction. While solutions dominate the market, the demand for services is anticipated to grow steadily as companies pursue long-term operational efficiency and require expert support for integration, continuous learning, and AI lifecycle management within their digital communication infrastructure.

By Deployment Mode

The deployment mode segment of the enterprise conversational AI platform market shows that on-premises deployment accounts for 70.2% of the total, reflecting strong enterprise preference for control, data sovereignty, and integration with existing infrastructure.

Organizations in highly regulated industries such as banking, healthcare, and government often favour on-premises models because they enable tighter oversight of security, data residency, and compliance requirements. On-premises platforms also provide opportunities for deep customization, optimized performance for internal workflows, and lower long-term ownership costs for large-scale stable workloads.

In contrast, cloud-based deployment modes, while offering speed of implementation, elasticity, and lower upfront costs, hold a smaller share of the market. Enterprises adopting cloud deployments typically prioritise agility, global reach, and rapid scalability over full control of infrastructure.

Cloud models are especially suitable for pilot projects, innovation-use cases, and organisations without extensive in-house IT infrastructure. Despite their advantages, concerns around vendor lock-in, data privacy, and latency remain relevant. The dominance of on-premises deployment, therefore, underscores the current maturity of enterprise conversational AI, with large organisations opting for proven, controlled models while cloud deployments continue to grow for more dynamic use cases.

By Technology

The technology segment of the enterprise conversational AI platform market indicates that machine learning (ML) holds a leading share of 35.6%, demonstrating its critical role in enabling conversational systems to learn from data and improve over time. ML algorithms are foundational to conversational AI, powering tasks such as intent detection, dialogue management, and response generation.

Alongside ML, natural language processing (NLP) plays a vital part by enabling these systems to interpret user inputs, extract meaning, and generate human-like responses. The integration of NLP with ML creates a feedback loop where learning continuously refines language understanding and system performance.

Speech recognition technology supports voice-enabled conversational agents by converting spoken language into textual input, which is then processed by NLP and ML. Deep learning techniques further enhance these capabilities by improving model accuracy, enabling more nuanced language understanding, and supporting complex tasks such as sentiment detection and context tracking.

Computer vision, though currently limited in adoption within this market, is increasingly being integrated to support multimodal interactions—combining text, voice, and visual inputs—to deliver richer conversational experiences.

By Application

The application segment shows that customer support and service automation account for 40.4% of the enterprise conversational AI platform market, which highlights its position as the primary use case driving demand. This dominance reflects the urgent need for enterprises to automate high-volume, repetitive customer interactions and to improve responsiveness across digital channels.

By leveraging conversational AI, organizations can reduce wait times, support 24/7 service, and allow human agents to focus on more complex tasks. Beyond customer support and service, the market is expanding into sales and marketing, human resource management, IT helpdesk automation, and other functions such as finance, compliance, and operations.

Sales and marketing applications are gaining traction as conversational AI platforms help with lead qualification, personalized outreach, and customer engagement. In HR and IT helpdesks, these platforms facilitate employee self-service, onboarding, and incident resolution, enabling internal workflow efficiencies.

Enterprises in finance and operations are gradually incorporating conversational agents to support compliance checks, invoice processing, and internal communication. This diversification suggests that while customer support is the dominant application today, the breadth of conversational AI deployment across business functions is expanding rapidly.

By End-Use Industry

The end-use industry segment shows that the BFSI industry holds a 30.2% share of the market, underscoring its leading role in adopting enterprise conversational AI platforms. BFSI firms are projected to continue driving demand as they increasingly deploy chatbots and virtual assistants for customer service automation, fraud detection, account management, and advisory services.

The adoption is driven by heightened customer expectations for instant, personalized service and the imperative to reduce cost-to-serve while improving scalability and operational resilience. Research highlights that conversational AI in banking facilitates 24/7 service, richer personalization, and smarter automation of routine interactions.

Beyond BFSI, other industries such as retail & e-commerce, healthcare, IT & telecom, manufacturing, travel & hospitality, education, and government/logistics/energy are also embracing conversational AI. These sectors leverage the technology for functions ranging from customer engagement and virtual sales assistants to patient support, internal IT helpdesks, and regulatory compliance.

The diversification of end-use industries indicates growing maturity of conversational AI across enterprise functions and sectors, reflecting broader enterprise digital transformation beyond the traditional BFSI stronghold.

By Interaction Type

The Text-Based interaction type holds the 48.5% share in the interaction-type segmentation of the enterprise conversational AI platform market, underscoring its dominant role in how users currently engage with AI-driven systems. Text-based interfaces remain preferred in enterprise environments due to their ease of deployment, integration into existing digital channels (such as websites, chatbots, and messaging apps), and relatively lower complexity compared to voice or multimodal systems.

Many organisations prioritise typed chats and messaging-based virtual assistants because they are cost-effective, scalable across geographies, and well aligned with asynchronous workflows typical in customer service and internal support. Voice-based interaction and multi-modal (voice + text + vision) approaches occupy the remaining share of the market, reflecting growing interest but comparatively slower adoption.

Voice-based systems offer hands-free, natural conversational experiences, yet require investment in automatic speech recognition (ASR), speech-to-text, and noise-robust models, which present additional implementation complexity.

Multi-modal interaction—with a combination of text, voice, and visual cues—represents the next frontier, enabling richer user experiences (for example, via screen sharing, image recognition, video, or augmented reality). While this segment is expected to grow more rapidly in the coming years, the prevailing preference remains for text-only interaction owing to enterprise maturity, channel familiarity, and deployment pragmatics.

Key Market Segments

By Component

- Solutions/Platforms

- Services (Professional and Managed)

By Deployment Mode

- On-Premises

- Cloud-Based

By Technology

- Machine Learning (ML)

- Natural Language Processing (NLP)

- Speech Recognition

- Deep Learning

- Computer Vision (limited integrations)

By Application

- Customer Support and Service Automation

- Sales and Marketing

- Human Resource Management

- IT Helpdesk Automation

- Others (finance, compliance, operations)

By End-Use Industry

- BFSI

- Retail and E-commerce

- Healthcare

- IT and Telecom

- Manufacturing

- Travel and Hospitality

- Education

- Others (government, logistics, energy)

By Interaction Type

- Text-Based

- Voice-Based

- Multi-Modal (voice + text + vision)

Regional Analysis

North America accounts for 33.8% of the global enterprise conversational AI platform market, with a 2024 valuation of USD 4.28 billion, positioning it as the leading regional market. The region’s dominance is attributed to its strong technological ecosystem, high enterprise digital maturity, and early adoption of AI-driven communication systems.

Enterprises across industries such as BFSI, IT & telecom, retail, and healthcare are increasingly implementing conversational AI to enhance customer engagement, automate workflows, and improve operational efficiency. The region’s well-established infrastructure, availability of advanced AI models, and widespread integration of natural language processing (NLP) and machine learning (ML) technologies have accelerated platform deployment across both large enterprises and mid-sized firms.

The US remains the core contributor to regional growth, supported by robust investments in AI research, cloud infrastructure, and enterprise automation solutions. Leading technology providers, including Google, IBM, Microsoft, and Amazon, are continuously innovating in conversational AI, offering platforms with enhanced contextual understanding and real-time analytics.

The growing trend toward omnichannel communication, remote collaboration, and customer self-service is further fueling adoption. Moreover, regulatory emphasis on data security and ethical AI use has strengthened enterprise trust in on-premises and hybrid conversational systems. North America is projected to maintain its leadership, with expanding enterprise use cases and strong innovation momentum.

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driving Factors

The market is driven by the growing shift toward enhancing consumer experience through 24/7 personalised engagement via conversational agents, which enables organisations to deliver immediate responses and more human-like interactions.

Technological advancements such as NLP, ML, deeper integration with enterprise workflows, and large-language-model-driven agents are enhancing system capabilities and accelerating deployment across industries.

The strong focus on cost optimisation, operational efficiency, and omnichannel support across digital touchpoints is motivating enterprises to adopt conversational AI platforms.

Restraint Factors

One major restraint is the concern around data privacy, security, and regulatory compliance, particularly when enterprise systems handle sensitive customer or internal information; breaches or non-compliance present significant risk.

Another restraint is deployment complexity: integrating conversational AI with existing enterprise systems, legacy infrastructure, and ensuring scalability remains challenging for many organisations.

Additionally, the lack of human touch in overly automated interactions and the risk of biased or inaccurate responses from AI models may hamper user acceptance and adoption.

Growth Opportunities

Significant growth opportunities exist as conversational AI expands into industry-specific verticals—such as healthcare, finance, education, and government—where domain knowledge and regulatory compliance are crucial and current tooling remains underdeveloped.

The shift toward multilingual, multimodal, and contextual agents opens new possibilities in global markets and across diverse user populations, enabling broader deployment beyond traditional English-text chatbots.

Emerging models like agentic AI (autonomous task-capable agents) and hybrid human-AI workflows allow enterprises to extend conversational platforms from support to sales, HR, and internal workflows, unlocking higher value.

Trending Factors

A key trend is the evolution from simple rule-based chatbots to advanced conversational agents powered by generative AI and retrieval-augmented generation, which offer richer, more dynamic conversations and decision support.

Multimodal interaction—including voice, text, and vision inputs—is gaining traction, enabling interfaces that mimic human-like communication across channels and devices.

The growing adoption of low-code/no-code platforms and integrations with enterprise systems (CRM, knowledge base, workflows) is accelerating deployment speed and reducing dependency on heavy IT effort.

Competitive Analysis

The competitive landscape of the enterprise conversational AI platform market is marked by strong participation from global technology titans and agile specialist vendors. Key players such as Microsoft, Google, IBM (via Watson Assistant), Amazon Web Services (AWS), Oracle, SAP SE, and Nuance Communications dominate the market through broad platform offerings, cloud integration, multi-channel capabilities, and enterprise-grade governance.

These incumbents benefit from large installed bases, deep AI research, and extensive ecosystem partnerships. At the same time, specialist players such as Rasa Technologies Inc., Kore.ai, Inc., Yellow.ai, and Haptik provide highly focused solutions tailored for verticals, multilingual support, and innovation in conversational workflows.

Competitive differentiation is increasingly driven by the following factors: deep domain knowledge (e.g., financial services, healthcare), integration with enterprise systems (CRM, ERP, knowledge bases), strong data-governance capabilities (critical for on-premises deployment), and advanced AI features such as large language model (LLM) support, conversational memory, and multimodal interaction. With rising M&A activity, ecosystem consolidation, and strategic partnerships, vendors are racing to capture market share rapidly ahead of new entrants and regional challengers.

Top Key Players in the Market

- Microsoft

- Amazon Web Services

- IBM Watson Assistant

- Rasa

- LivePerson

- Genesys

- Twilio

- Cognigy

- Kore.ai

- Ada (Ada Support)

- Yellow.ai

- ServiceNow (Virtual Agent)

- Nuance

- Inbenta

- Recent De

- Others

Recent Developments

- August 18, 2025: Google LLC was named a Leader and placed furthest in vision in the 2025 Gartner® Magic Quadrant™ for Conversational AI Platforms report.

- July 24, 2025: Gupshup Inc. raised over USD 60 million in a combined equity and debt financing round to accelerate global expansion and enhance its AI-driven messaging and conversational-agent capabilities.

- June 25, 2025: Synthflow AI, a Berlin-based startup focused on enterprise voice agents, secured USD 20 million in a Series A led by Accel Partners. The funding will support an upcoming U.S. office and further development of its no-code voice agent platform for customer support.

Report Scope

Report Features Description Market Value (2024) USD 12.67 Billion Forecast Revenue (2034) USD 206.6 Billion CAGR(2025-2034) 32.20% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics, and Emerging Trends Segments Covered By Component (Solutions/Platforms, Services (Professional and Managed)), By Deployment Mode (On-Premises, Cloud-Based), By Technology (Machine Learning (ML), Natural Language Processing (NLP), Speech Recognition, Deep Learning, Computer Vision (limited integrations)), By Application (Customer Support and Service Automation, Sales and Marketing, Human Resource Management, IT Helpdesk Automation, Others (finance, compliance, operations)), By End-Use Industry (BFSI, Retail and E-commerce, Healthcare, IT and Telecom, Manufacturing, Travel and Hospitality, Education, Others (government, logistics, energy)), By Interaction Type (Text-Based, Voice-Based, Multi-Modal (voice + text + vision)) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Microsoft, Google, Amazon Web Services, IBM Watson Assistant, Rasa, LivePerson, Genesys, Twilio, Cognigy, Kore.ai, Ada (Ada Support), Yellow.ai, ServiceNow (Virtual Agent), Nuance, Inbenta, Recent De, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)  Enterprise Conversational AI Platform MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample

Enterprise Conversational AI Platform MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Microsoft

- Amazon Web Services

- IBM Watson Assistant

- Rasa

- LivePerson

- Genesys

- Twilio

- Cognigy

- Kore.ai

- Ada (Ada Support)

- Yellow.ai

- ServiceNow (Virtual Agent)

- Nuance

- Inbenta

- Recent De

- Others