Global 1,3-Pentadiene Market Size, Share, And Business Benefits By Type (Below 40% Purity, 40% -65% Purity, Above65% Purity), By Application (Adhesives, Paints, Rubber, Others), By End-User Industry (Automotive, Construction, Healthcare, Packaging, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: February 2025

- Report ID: 139113

- Number of Pages: 356

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

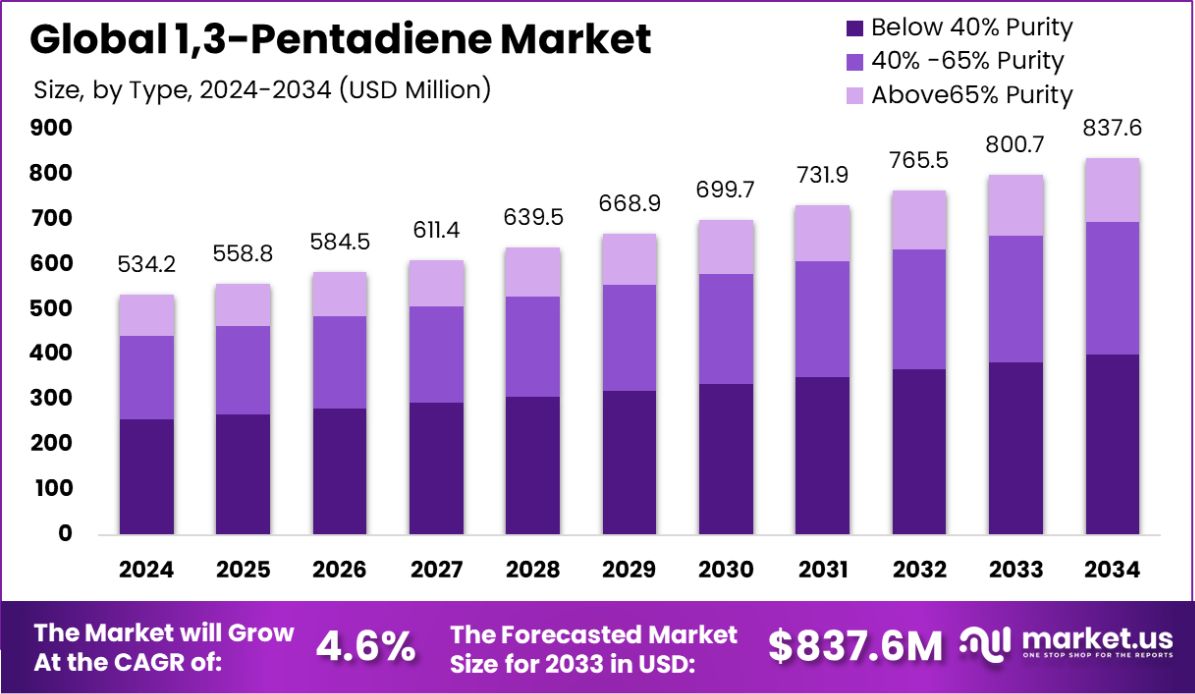

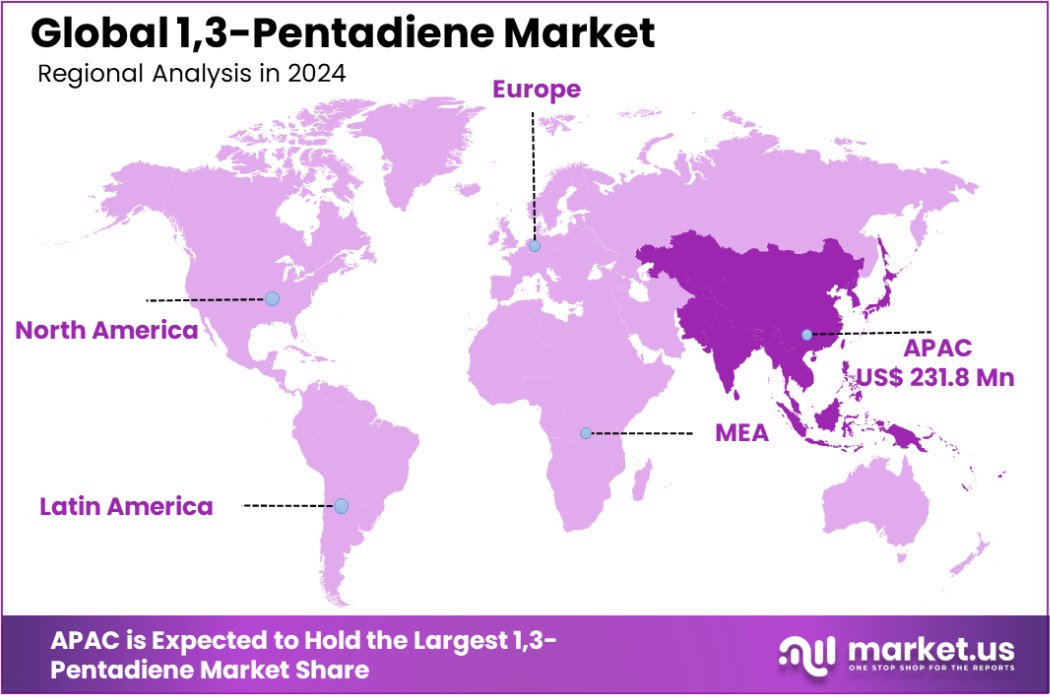

The Global 1,3-pentadiene Market is expected to be worth around USD 837.6 million by 2034, up from USD 534.2 million in 2024, and grow at a CAGR of 4.6% from 2025 to 2034. In 2024, the Asia-Pacific region accounted for 46.2%, USD 231.8 Mn.

1,3-Pentadiene is an organic compound with the chemical formula C5H8, a diene featuring two double bonds at positions 1 and 3 of its five-carbon chain. It is a colorless liquid with a pungent odor and is used primarily in the chemical and petrochemical industries as a precursor to other chemicals. It is produced through the cracking of hydrocarbons or from the pyrolysis of gasoline.

The 1,3-pentadiene market is driven by its wide applications in producing synthetic rubber, adhesives, and resins, as well as in the manufacture of other chemicals like 1,3-butadiene and isoprene. The market benefits from growing demand in industries such as automotive, construction, and consumer goods.

The growing demand for synthetic rubber and resins in the automotive and manufacturing industries is a key driver. Additionally, advancements in petrochemical technologies and expanding industrial applications are propelling the growth of the market. Increased use of 1,3-pentadiene in specialty chemicals and its importance in the production of high-performance materials are pushing demand in the market, especially in emerging economies.

Opportunities lie in expanding production capacities, especially in Asia-Pacific, where industrial growth is driving the need for raw materials. Additionally, innovations in sustainable production processes present significant market opportunities.

The 1,3-pentadiene market is poised for growth, driven by increasing industrial applications in the production of synthetic rubber, resins, and specialty chemicals. Key growth factors include the expanding automotive and construction industries, both of which rely on high-performance materials derived from 1,3-pentadiene, such as rubber and adhesives.

The compound is primarily produced from C₅ hydrocarbon fractions obtained during the steam cracking of naphtha at 900°C to produce ethylene, positioning the market within the broader petrochemical sector. Additionally, the National Science Foundation’s recent award of $287,000 for research in physical organic chemistry, potentially including studies on 1,3-pentadiene, underscores the compound’s scientific relevance and potential for future innovations.

As demand increases, particularly in emerging markets, there is a growing opportunity for manufacturers to expand production capacities, especially in Asia-Pacific, where industrialization continues to drive chemical consumption. Furthermore, advancements in sustainable production methods present opportunities for market players to position themselves as leaders in an evolving, environmentally-conscious market.

Key Takeaways

- The Global 1,3-pentadiene Market is expected to be worth around USD 837.6 million by 2034, up from USD 534.2 million in 2024, and grow at a CAGR of 4.6% from 2025 to 2034.

- The 1,3-pentadiene market predominantly consists of products with above 65% purity, accounting for 48.5%.

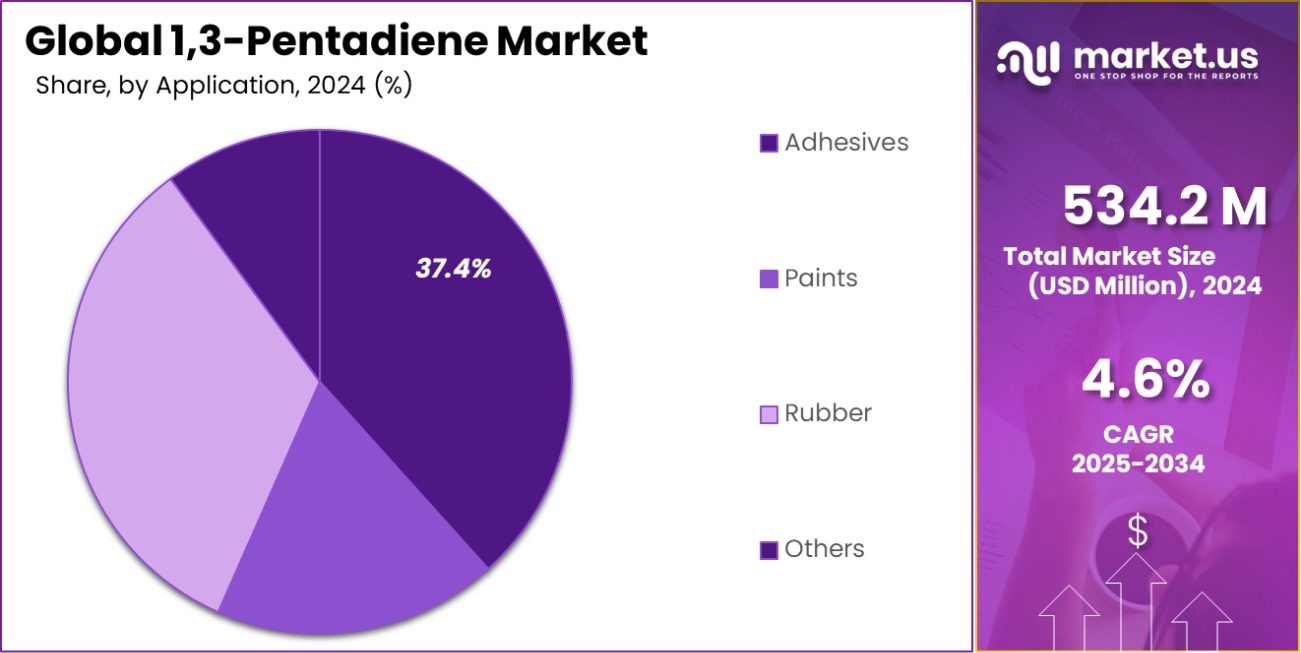

- Adhesives are a major application of 1,3-pentadiene, making up 37.4% of the market share.

- The automotive sector is the largest end-user, driving 39.3% of 1,3-pentadiene demand.

- In the Asia-Pacific region, the 1,3-Pentadiene market holds a 46.2% share, valued at USD 231.8 million.

By Type Analysis

The 1,3-pentadiene market’s above 65% purity segment holds a 48.5% share.

In 2024, the Above 65% Purity segment held a dominant market position in the 1,3-Pentadiene market, with a 48.5% share. This high-purity grade is extensively utilized in industrial applications, particularly in the production of high-performance chemicals such as synthetic rubber, adhesives, and specialty resins, which require consistent quality and purity for optimal performance. The significant demand for above 65% purity 1,3-pentadiene can be attributed to its superior quality and wide applicability in the automotive, construction, and chemical industries.

The 40%–65% Purity segment follows with a substantial market share, driven by its cost-effectiveness and adequate performance for medium-grade chemical applications. These grades of 1,3-pentadiene are typically used in applications where high purity is not as critical but where chemical consistency and adequate reactivity are necessary.

Meanwhile, the Below 40% Purity segment remains the smallest, comprising a minor portion of the market. This lower purity grade is typically used in more industrial-scale applications, where price sensitivity is more crucial than purity. While its use is limited, it plays a role in some specialized manufacturing processes where performance requirements are less stringent. As the market for 1,3-pentadiene continues to grow, demand for higher purity grades is expected to dominate, driven by industrial advancements and product quality needs.

By Application Analysis

Adhesives account for 37.4% of the 1,3-pentadiene market’s total demand.

In 2024, Adhesives held a dominant market position in the By Application segment of the 1,3-Pentadiene market, with a 37.4% share. This segment’s dominance is primarily driven by the growing demand for high-performance adhesives used in the automotive, construction, and packaging industries. 1,3-Pentadiene plays a crucial role in enhancing the strength, flexibility, and durability of adhesives, making it a key raw material in these applications.

The Rubber segment follows closely, accounting for a significant portion of the market. The automotive and manufacturing industries are the primary drivers of 1,3-pentadiene consumption in rubber production. It is used as a precursor in synthetic rubber manufacturing, particularly in the production of high-performance elastomers, which are essential for automotive tires, seals, and other rubber products. As the demand for durable, high-quality rubber products increases globally, so does the need for 1,3-pentadiene in the sector.

The Paints segment, while smaller, remains an important application for 1,3-pentadiene, contributing to the overall growth of the market. It is utilized in the formulation of specialized coatings and paints, particularly in industrial and automotive applications where enhanced durability and resistance are required. As the demand for durable, eco-friendly paints rises, the role of 1,3-pentadiene in improving performance is expected to grow.

By End-User Industry Analysis

The automotive industry drives 39.3% of the 1,3-Pentadiene market’s.

In 2024, Automotive held a dominant market position in the By End-User Industry segment of the 1,3-Pentadiene market, with a 39.3% share. The automotive industry’s reliance on high-performance materials such as synthetic rubber and adhesives, which incorporate 1,3-pentadiene, has significantly contributed to this segment’s market leadership.

As global automotive production continues to rise, especially with the increasing demand for durable components like tires, seals, and gaskets, the consumption of 1,3-pentadiene is expected to remain robust.

The Construction segment follows closely, driven by the need for adhesives, resins, and coatings used in building materials and infrastructure projects. 1,3-Pentadiene’s role in producing durable and flexible materials used in construction is expanding, as the sector demands more high-performance products for long-lasting structures. This growth is particularly noticeable in emerging markets with rapid urbanization.

In the Healthcare sector, 1,3-pentadiene is used in the production of specialty chemicals and pharmaceutical intermediates, although it holds a smaller share of the market. As the demand for medical-grade adhesives and high-quality polymers increases, this segment is poised for steady growth.

The Packaging industry, while not as large as automotive or construction, also contributes to the market. The use of 1,3-pentadiene in packaging materials, especially in coatings and adhesives, is increasing with the rise of eco-friendly and durable packaging solutions.

Key Market Segments

By Type

- Below 40% Purity

- 40% – 65% Purity

- Above 65% Purity

By Application

- Adhesives

- Paints

- Rubber

- Others

By End-User Industry

- Automotive

- Construction

- Healthcare

- Packaging

- Others

Driving Factors

Growing Demand for Synthetic Rubber in the Automotive Industry

The automotive industry’s increasing demand for high-performance tires and rubber components is one of the key drivers for the 1,3-pentadiene market. Synthetic rubber, primarily produced from 1,3-pentadiene, is essential for manufacturing durable and long-lasting tires, seals, gaskets, and other components. As global automotive production expands and consumer demand for quality vehicles rises, the need for synthetic rubber, and consequently 1,3-pentadiene, continues to grow.

Expanding Construction Sector Driving Adhesives Demand

The construction industry’s steady growth, especially in emerging economies, is significantly contributing to the 1,3-pentadiene market. 1,3-pentadiene is an important raw material in the production of adhesives and resins used in building materials. With the increasing demand for high-performance and long-lasting construction materials, driven by urbanization and infrastructure development, the demand for adhesives containing 1,3-pentadiene is expected to rise.

Advancements in Chemical Applications and Innovations

The ongoing research and development in the chemical sector are driving new applications for 1,3-pentadiene. Its versatility in producing specialty chemicals, coatings, and resins is increasing its demand in various industries, from automotive to healthcare. As chemical innovations continue, particularly in the areas of sustainable materials and eco-friendly products, the role of 1,3-pentadiene in formulating high-performance chemicals will become even more critical.

Restraining Factors

Volatility in Raw Material Prices Affects Production Costs

Fluctuations in the prices of raw materials, especially naphtha, which is used to produce 1,3-pentadiene, can significantly impact the market. Since 1,3-pentadiene is derived from naphtha during the steam cracking process, any volatility in oil prices or supply chain disruptions can increase production costs. This unpredictability makes it challenging for manufacturers to maintain consistent pricing, affecting market stability and growth.

Environmental Regulations on Chemical Manufacturing Processes

Stricter environmental regulations are a growing concern for the 1,3-pentadiene market. As governments around the world enforce stricter emissions standards and sustainability goals, chemical producers are under pressure to adopt cleaner and more environmentally friendly manufacturing processes. Compliance with these regulations often involves costly investments in technology, which can restrain the market by increasing production expenses and limiting available production capacity.

Competition from Alternative Raw Materials in Chemical Production

The 1,3-pentadiene market faces increasing competition from alternative raw materials, such as bio-based feedstocks and other petrochemical derivatives. As industries search for more sustainable and cost-effective materials, the demand for 1,3-pentadiene may be challenged by these alternatives. Innovations in green chemistry and renewable feedstocks could limit 1,3-pentadiene’s market share in certain applications, hindering its long-term growth potential.

Growth Opportunity

Expansion of Electric Vehicle (EV) Industry Boosting Demand for Rubber

The rise of electric vehicles (EVs) presents a significant growth opportunity for the 1,3-pentadiene market. As EV adoption increases globally, the demand for high-performance synthetic rubber in tire production also grows. 1,3-pentadiene is a crucial raw material for manufacturing these rubbers, especially for tires that require superior durability and performance.

Growing Demand for Eco-Friendly Construction Materials

As the construction industry shifts toward sustainable building materials, 1,3-pentadiene has a strong opportunity to be incorporated into eco-friendly adhesives, resins, and coatings. Green building practices are gaining popularity, and 1,3-pentadiene is essential in creating durable, high-performance materials that meet environmental standards. As the demand for sustainable and low-emission construction materials grows, the role of 1,3-pentadiene in this sector will expand, driving market growth.

Increasing R&D in Bio-based Chemical Alternatives

Advancements in bio-based and renewable feedstocks present a promising growth opportunity for the 1,3-pentadiene market. Ongoing research into sustainable production methods and bio-based chemicals could reduce the environmental impact of 1,3-pentadiene production. By incorporating bio-based processes, manufacturers can offer greener alternatives that appeal to eco-conscious industries.

Latest Trends

Growing Focus on Sustainable Production Methods for 1,3-Pentadiene

Sustainability has become a key trend in the 1,3-pentadiene market. Manufacturers are increasingly adopting eco-friendly production processes, such as bio-based feedstocks and energy-efficient technologies. With growing concerns about climate change and environmental impact, companies are focusing on reducing carbon footprints and improving waste management.

Rising Demand for High-Performance Elastomers in Automotive Applications

As the automotive industry evolves, the demand for high-performance materials like synthetic rubbers is increasing. 1,3-pentadiene plays a critical role in the production of elastomers used in tires, seals, and gaskets. With the growth of electric vehicles (EVs) and the need for durable, lightweight materials, there is a noticeable increase in the consumption of 1,3-pentadiene for automotive applications. This trend is expected to continue as automotive technology advances.

Innovations in Chemical Recycling Enhancing Market Potential

The 1,3-pentadiene market is benefiting from innovations in chemical recycling. New technologies that allow the recycling of plastics and other materials are creating new opportunities for 1,3-pentadiene in the production of recycled chemicals. As the chemical industry focuses on reducing waste and improving the circular economy, 1,3-pentadiene’s role in sustainable materials is expanding, making it a crucial part of the recycling process and boosting demand.

Regional Analysis

In 2024, the Asia-Pacific region dominated the 1,3-Pentadiene market, holding a 46.2% share, valued at USD 231.8 Mn.

In 2024, the Asia-Pacific region dominated the global 1,3-Pentadiene market, accounting for 46.2% of the market share, valued at USD 231.8 million. The region’s stronghold can be attributed to the growing demand from key industries such as automotive, construction, and chemicals. Rapid industrialization, urbanization, and expanding manufacturing sectors in countries like China, India, and Japan are driving this significant demand, especially for synthetic rubber and adhesives.

North America holds a notable share of the market, supported by the robust automotive and chemicals industries, particularly in the United States. The increasing focus on electric vehicles and high-performance materials is expected to drive future growth in the region.

Europe also remains an important market for 1,3-Pentadiene, with demand stemming from automotive, construction, and industrial applications. Stringent environmental regulations in Europe have led to innovations in sustainable chemical production, which could propel further growth in the coming years.

The Middle East & Africa and Latin America regions represent smaller portions of the market, with growth primarily driven by demand in petrochemicals and construction. However, the adoption of 1,3-Pentadiene in these regions remains relatively limited due to economic challenges and lower industrialization levels compared to other regions.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In 2024, the global 1,3-Pentadiene market is significantly influenced by key players spanning various sectors, including petrochemicals, specialty chemicals, and materials manufacturing. Braskem, Eastman, Formosa Chemicals, and Shell remain central to the market’s development, with their extensive production capabilities in petrochemicals and strong supply chains, making them leading contributors to 1,3-pentadiene production.

These companies benefit from integrated operations and established market presence, enabling them to meet the growing demand for 1,3-pentadiene used in synthetic rubber, adhesives, and other critical industrial applications.

LANXESS AG, LyondellBasell, and Mitsui also play a major role in expanding the 1,3-pentadiene market. Their technological innovations and strong focus on specialty chemicals support demand across the automotive, construction, and healthcare sectors. Furthermore, Zeon Corporation and Sinopec have strengthened their market positions by expanding their product portfolios and exploring new production technologies, which enhances the overall availability and application scope of 1,3-pentadiene.

Smaller players, including Penta Manufacturing Company, Nanjing Yuangang, and Angene International Limited, contribute to the competitive dynamics by focusing on niche markets, particularly in the chemical and pharmaceutical industries. Despite having a relatively smaller market share, these companies’ flexible production methods and localized supply chains enable them to cater to specific regional demands, adding to the market’s diversification.

Top Key Players in the Market

- 3B Scientific (Wuhan) Corp.

- Acros Organics

- AK Scientific Inc.

- Angene International Limited.

- BOC Sciences

- Braskem

- Eastman

- Formosa Chemical

- LANXESS AG

- LOTTE Chemical

- LyondellBasell

- Mitsui

- Nanjing Yuangang

- Ningbo Jinhai Chenguang Chemical

- Penta Manufacturing Company

- Shandong Yuhuang Chemical

- Shell

- Sinopec

- TCI America

- Wanko Chemical Co.

- Yancheng Shunxiang Chemical Co.

- YNCC

- Zeon Corporation

Recent Developments

- In 2023, YNCC showed strong development in the 1,3-Pentadiene sector, boosting production capacity and enhancing technology use. The company saw revenue growth and funding improvements, with a focus on market expansion and sustainability.

- In 2023, Zeon Corporation’s development 2023 included expanded production, securing funding for growth, and a steady revenue increase, positioning itself to capture a larger market share in the 1,3-pentadiene sector.

Report Scope

Report Features Description Market Value (2024) USD 534.2 Million Forecast Revenue (2034) USD 837.6 Million CAGR (2025-2034) 4.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Below 40% Purity, 40% -65% Purity, Above65% Purity), By Application (Adhesives, Paints, Rubber, Others), By End-User Industry (Automotive, Construction, Healthcare, Packaging, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape 3B Scientific (Wuhan) Corp., Acros Organics, AK Scientific Inc., Angene International Limited., BOC Sciences, Braskem, Eastman, Formosa Chemical, LANXESS AG, LOTTE Chemical, LyondellBasell, Mitsui, Nanjing Yuangang, Ningbo Jinhai Chenguang Chemical, Penta Manufacturing Company, Shandong Yuhuang Chemical, Shell, Sinopec, TCI America, Wanko Chemical Co., Yancheng Shunxiang Chemical Co., YNCC, Zeon Corporation Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- 3B Scientific (Wuhan) Corp.

- Acros Organics

- AK Scientific Inc.

- Angene International Limited.

- BOC Sciences

- Braskem

- Eastman

- Formosa Chemical

- LANXESS AG

- LOTTE Chemical

- LyondellBasell

- Mitsui

- Nanjing Yuangang

- Ningbo Jinhai Chenguang Chemical

- Penta Manufacturing Company

- Shandong Yuhuang Chemical

- Shell

- Sinopec

- TCI America

- Wanko Chemical Co.

- Yancheng Shunxiang Chemical Co.

- YNCC

- Zeon Corporation